Exd Company Profile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2013 22 23

Operating as an Open-end Equity Fund Since 1962, NI(U)T is the flagship carrier of a diversified portfolio of collective Investment Schemes managed by NITL. With net assets of over PKR 47.297 billion and 55,109 unit holders, it is the first and largest mutual fund in Pakistan. 20 21 NATIONAL INVESTMENT (UNIT) TRUST FUND MANAGER REPORT 2012-2013 NI(U)T Objective The core objective of NI(U)T is to maximize return for Unit holders, provide a regular stream of current income through dividends, while long term growth is achieved by the management of diversified portfolio and investments into growth and high yielding equity securities. CORPORATE INFORMATION Profile of Investment Manager National Investment Trust Ltd. (NITL) is the first Asset Management Company of Pakistan, formed in 1962. NITL is the largest asset management company of Pakistan with approximately Rs. 81 billion assets under management. The family of Funds of NIT comprises of five funds including 3 equity Funds and 2 fixed income nature Funds. NIT’s distribution network comprises of 24 NIT branches and various Authorized bank branches all over Pakistan. To cater the matters relating to investments in NIT and day to day inquiries / issues of NIT’s unit holders, state of the art Investors’ Facilitation Centre is also in place. The Board of Directors of NITL consists of top executives from leading financial institutions, prominent industrialists and nominee of Govt. of Pakistan. The Company has been assigned an Asset Manager rating of “AM2-” by Pakistan Credit Rating Agency, which FUND NAME reflects the company’s very strong capacity to manage the risks inherent in the asset management business and the asset manager meets very high investment management industry standards and benchmarks. -

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings As of September, 2018

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings as of September, 2018 Parent / Holding Company Website Adamjee Insurance Co. Ltd http://www.adamjeeinsurance.com/ Associated Companies Website Hollard Life Assurance Company Limited/ IVM Intersurer B.V. https://www.hollard.co.za/ D.G.Khan Cement Co. Ltd. http://www.dgcement.com/ Din Leather Pvt Ltd. http://www.dinleather.dingroup.com.pk/ Din Textile Mills Ltd. http://www.dinleather.dingroup.com.pk/ Euronet Pakistan (Pvt.) Limited https://www.euronetpakistan.com/ Gulf Nishat Apparel Limited https://www.nishatpak.com/gna.html Hyundai Nishat Motor (Pvt) Limited http://www.nishatmillsltd.com/ Lalpir Power Limited (Formerly AES Lalpir (Pvt.) Ltd.) http://www.lalpir.com/ MCB Arif Habib Saving & Investment Ltd. http://www.mcbah.com/ MCB Bank Ltd. https://www.mcb.com.pk/ MCB Financial Services Ltd. https://www.mcb.com.pk/ MCB Foundation http://www.mcbef.com.pk/ MCB Islamic Bank Limited https://www.mcbislamicbank.com/ MNET Services (Pvt) Ltd. https://www.mcb.com.pk/about-mcb/group-companies Nishat Agriculture Farming (Pvt.) Limited (Common Directorship) http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Chunian Power Limited. http://www.nishat.net/ Nishat Dairy Pvt Ltd (Common Directorship) http://www.nishatdairy.com/ Nishat Developers (Private) Limited http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Farm Supplies (Pvt.) Limited http://www.nishatmillsltd.com/ Nishat Hospitality Pvt. Ltd. http://nishathospitality.com/ Nishat Hotels & Properties Ltd. https://nishathotels.com/ Nishat Linen https://www.nishatlinen.com/ Nishat Mills Ltd. http://www.nishatmillsltd.com/ Nishat Paper Products Co Ltd. http://www.nishatpaper.com/ Nishat Power Ltd. http://www.nishatpower.com/ Pakgen Power Limited (Formerly AES Pak Gen (Pvt) Co) http://pakgenpower.com/ Security General Insurance Co. -

1 (31St Session) NATIONAL ASSEMBLY SECRETARIAT

1 (31st Session) NATIONAL ASSEMBLY SECRETARIAT ———— “QUESTIONS FOR ORAL ANSWERS AND THEIR REPLIES” to be asked at a sitting of the National Assembly to be held on Thursday, the 1st April, 2021 33. *Mr. Muhammad Afzal Khokhar: (Deferred during 28th Session) Will the Minister for National Health Services, Regulations and Coordination be pleased to state: (a) whether Government has taken notice that buying power of public at large of medicines is significantly decreased since the inception of the incumbent Government; if so, the details thereof; (b) what steps are being taken by the Government to decrease the prices of medicines forthwith; and (c) average prices of essential / life saving medicines as on May, 2018 and detail of prices at present? Minister for National Health Services, Regulations and Coordination: (a) Federal Government and Drug Regulatory Authority of Pakistan are cognizant of the impact of increase in prices of drugs and it has been tried at best to allow increase at minimum level as compared to increase in manufacturing/import cost of drugs. Its impact is much lesser than non availability of drugs. Prices of drugs are mostly lower in Pakistan as compared to average prices in the region i.e. Bangladesh, Srilanka and India. (b) Following steps have been taken to reduce prices of medicines:— 2 (i) Regulation imposed: Drug Regulatory Authority of Pakistan, with the approval of Federal Cabinet notified a Drug Pricing Policy2018 which provides a transparent mechanism for fixation, decrease & increase in MRPs of drugs. (ii) Reduction in MRPs of drugs: Maximum Retail Prices (MRPs) of 562 drugs have been reduced and notified after approval by the Federal Government. -

Nishat Chunian Limited Nishat (Chunian) Limited 1 2020 2020 2 Nishat (Chunian) Limited BRIEF PROFILE

ANNUAL REPORT 2020 Nishat Chunian Limited Nishat (Chunian) Limited 1 2020 2020 2 Nishat (Chunian) Limited BRIEF PROFILE Diversified into Retail Business 2016 The Linen Company (TLC) Diversified into Cinema Business 2015 NC Entertainment Private Limited 2014 46 MW Coal Based Power Plant Established a subsidiary company in 2013 USA 2 Spinning Mills acquired & a new Spin- 2013 ning Mill started 2010 IPP commercial operations 2006 Diversified into Home Textiles Acquisition of 2 Spinning Mills & 5th 2005 Spinning Mill Started 2000 2nd Spinning Mill started production 1998 Diversified into Weaving 1st Spinning Mill Setup 1991 Nishat (Chunian) Limited 2020 1 2020 2 Nishat (Chunian) Limited CONTENTS Company Information 04 Notice of Annual General Meeting 05 Chairperson’s Review Report 14 Director’s Report 17 Financial Highlights 26 Statement of Compliance with the Code of Corporate Governance 28 Review Report to the Members on Statement of Compliance with Best Practices of Code of Corporate Governance 30 Independent Auditor’s Report 31 Nishat (Chunian) Limited – Financial Statements Statement of Financial Position 36 Statement of Profit or Loss 38 Statement of Comprehensive Income 39 Statement of Cash Flows 40 Statement of Changes in Equity 41 Notes to the Financial Statements 42 Pattern of Shareholding 93 Categories of Shareholders 96 Consolidated Financial Statements Independent Auditor’s Report 98 Statement of Financial Position 102 Statement of Profit or Loss 104 Statement of Comprehensive Income 105 Statement of Cash Flows 106 Statement of Changes in Equity 107 Notes to the Consolidated Financial Statements 108 Forms 172 Nishat (Chunian) Limited 3 2020 COMPANY INFORMATION Board of Directors: Bankers to the Company: Mrs. -

894) 3552/2017 Const. P. Master Motor Corp

IN THE HIGH COURT OF SINDH AT KARACHI Before: Muhammad Ali Mazhar and Agha Faisal, JJ. C P D - 3552 of 2017 Master Motor Corporation (Pvt.) Limited vs. Federation of Pakistan & Others C P D - 1264 of 2018 Master Motor Corporation (Pvt.) Limited vs. Federation of Pakistan & Others For the Petitioner: Barrister Abid Shahid Zuberi Barrister Ayan Mustafa Memon (in CP D-1264 of 2018) Barrister Ravi R. Pinjani (in CP D-3552 of 2017) For the Respondent No. 1: Sheikh Liaquat Hussain Assistant Attorney General (in both petitions) For the Respondent No. 2: Mr. Asim Ayaz Deputy General Manager Incharge (Policy) Engineering Development Board (in both petitions) For the Respondent No. 3: Mr. Mukesh Kumar G. Karara Advocate (in both petitions) Dates of Hearing: 31.10.2018, 13.11.2018 & 23.11.2018. Date of Announcement: 12.02.2019 JUDGMENT Agha Faisal, J: The subject petitions filed by the common petitioner, being a company engaged in the assembling and manufacturing of motor vehicles, have assailed the conferment of greenfield status upon 2 the respondent No.3 (“FJW”) herein, being a company incorporated with the objective of assembling / manufacturing motor vehicles, on the ground that the award of such status was not in consonance with the Automotive Development Policy 2016-21 (“Auto Policy”). Since similar questions of law and fact are agitated vide the subject connected petitions, hence, both the petitions shall be decided through this common judgment. 2. Barrister Abid Shahid Zuberi set forth the case of the petitioner (“MMC”), which arguments were also adopted by Barrister Ravi Pinjani, and argued that greenfield status could only be conferred upon assemblers who introduced a new brand into the market, hitherto alien to the public at large. -

Daily Call REP- 300 March 9, 2018 Millat Tractors Limited Automobile Assemblers Ploughing the Future

Daily Call REP- 300 March 9, 2018 Millat Tractors Limited Automobile Assemblers Ploughing the Future 1 BUY MTL: Target Price revised upward by 9.1% to PKR 1,604/share We revise upwards our DCF-based Dec’18 TP of Millat Tractors Limited to PKR Target Price 1,604.4 1,604/share (earlier 1,470/share). Our review thesis is hinged upon i) Higher than Last Closing 1,375.1 expected volumetric growth convinced us to review our volumetric assumption to 39,015 Upside (%) 16.7 units including exports units (previous assumption was 37,635 units), ii) Increase in 1-2% PSX Code MTL of selling prices of all the variants from Dec’17, iii) Low dependency on imported raw Bloomberg Code MTL PA material which allows gross margins to remain firm; currently localization level is between Shares 85% to 90% depending on different variants, and iv) We expect the budget to be farmer focused, agriculture and rural oriented which will allow the company to continue growth at Market Cap (USD m) 554 the same pace. Based on our thesis, a 17% upside potential is available based on the Outstanding Shares (m) 44.3 scrip’s last closing and we recommend a “BUY”. Currently the stock is trading at a FY18E Free Float (%) 50.0 PE multiple of 12.2x. 12M Avg. Daily Turnover (m) 0.1 12M High | Low (PKR) 1,475.8 | 1,019.9 Exhibit: Old & New Estimates Major Shareholders Directors FY18E FY19F FY20F Dec-18 Old 1,470 Key Matrics Target Price New 1,604 FY17A FY18E FY19F (PKR/Share) Change 9.12% Total Equity (PKRbn) 5.7 5.9 5.9 Old 98.6 87.2 98.2 Total Assets (PKRbn) 17.1 17.8 17.5 PAT -

<< Nishat (Chunian) Limited

<< Nishat (Chunian) Limited 1 2 Nishat (Chunian) Limited >> BRIEF PROFILE 2014 46 MW Coal Based Power Plant 2013 Established a subsidiary company in USA 2 Spinning Mills acquired & a new spin- 2013 ning mill started 2010 IPP commercial operations 2006 Diversified into Home Textiles Acquisition of 2 spinning Mills & 5th 2005 Spinning Mill Started 2000 2nd Spinning mill started production 1998 Diversified into Weaving 1991 1st Spinning Mill Setup << Nishat (Chunian) Limited 1 2 Nishat (Chunian) Limited >> >> Contents Company Information 04 Notice of Annual General Meeting 05 Directors Report 09 CONTENTS Financial Highlights 16 Statement of Compliance with the Code of Corporate Governance 18 Review Report to the Members on Statement of Compliance with Best Practices of Code of Corporate Governance 20 Nishat (Chunian) Limited – Financial Statements Auditors’ Report 21 Balance Sheet 22 Profit and Loss Account 24 Statement of Comprehensive Income 25 Cash Flow Statement 26 Statement of Changes in Equity 27 Notes to the Financial Statements 28 Pattern of Shareholding 67 Consolidated Financial Statements Directors’ Report 72 Auditors’ Report 73 Balance Sheet 74 Profit and Loss Account 76 Statement of Comprehensive Income 77 Cash Flow Statement 78 Statement of Changes in Equity 79 Notes to the Consolidated Financial Statements 80 Proxy Form 128 << Nishat (Chunian) Limited 3 >> Company Information Board of Directors: Bankers to the Company: Mr. Shahzad Saleem (Chief Executive/Chairman) Allied Bank Limited Ms. Farhat Saleem Askari Bank Limited Mr. Yahya Saleem Al Barka Bank (Pakistan) Limited Mr. M. Imran Rafiq (Nominee NIT) Bank Alfalah Limited Mr. Aftab Ahmad Khan Barclays Bank plc, Pakistan Mr. Shahid A. -

Pakistan Investment Strategy 2018 Best Equity Advisor Chance for a Home Run; Target 47,199 Best Domestic Equity House

Best Brokerage House Pakistan Investment Strategy 2018 Best Equity Advisor Chance for a Home Run; Target 47,199 Best Domestic Equity House Top 25 Companies Corporate Finance House of the Year REP-300 www.jamapunji.pk Market Strategy Synopsis Total Return: Pakistan equity market is expected to generate a total return of 20% during 2018. Exhibit: KSE100 Index Target Estimates 2018 Valuation Basis Target Attractive Valuations: PSX is expected to provide strong returns in CY18 as KSE-100 is trading at Target Price Based 49,611 a 5 year low PER of 8.5x, cheaper than its past 5 years’ average of 10.3x. PSX is presently trading Earnings Growth 44,160 at a 46% discount to its regional peers as compared to an average of 36% during last 12 years. Justified PE 47,824 Key Reasons for Upside: Average Target 2018 47,199 Diluting political noise Index Closing 22-Dec-17 39,471 Commencement of a high Economic Growth period (FY18-20 average GDP growth expected at Expected Return 2018 19.6% 6.0% compared to past 5 year average of 4.4%) Low interest rates (FY18-20 average discount rate is expected at 6.75%, compared to past 5-yr Source: AHL Research average of 8.64%) Exhibit: KSE100 - Price to Earning Multiple Attractive valuations compared to historic average and regional peers Strong domestic liquidity P/E Average P/E 14.0 Index Target: Based on index methodology of earnings growth, justified PER and target price 12.0 mapping, we view the Dec’18 index target for KSE-100 index at 47,199 points, portraying an upside 12.1 of 19.6%. -

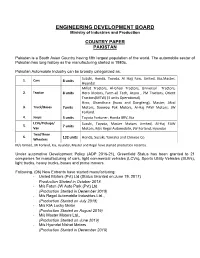

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production COUNTRY PAPER PAKISTAN Pakistan is a South Asian Country having fifth largest population of the world. The automobile sector of Pakistan has long history as the manufacturing started in 1980s. Pakistan Automobile Industry can be broadly categorized as: Suzuki, Honda, Toyota, Al Hajj Faw, United, Kia,Master, 1. Cars 8 units Hyundai Millat Tractors, Al-Ghazi Tractors, Universal Tractors, 2. Tractor 8 units Hero Motors, Farm-all Tech, Arzoo , PM Tractors, Orient Tractors(MTW) (3 units Operational). Hino, Ghandhara (Isuzu and Dongfeng), Master, Afzal 3. Truck/Buses 7units Motors, Daewoo Pak Motors, Al-Haj FAW Motors, JW Forland. 4. Jeeps 3 units Toyota Fortuner, Honda BRV, Kia LCVs/Pickups/ Suzuki, Toyota, Master Motors Limited, Al-Haj FAW 5. 7 units Van Motors, M/s Regal Automobile, JW Forland, Hyundai Two/Three 6. 132 units Honda, Suzuki, Yamaha and Chinese Co. Wheelers M/s United, JW Forland, Kia, Hyundai, Master and Regal have started production recently. Under automotive Development Policy (ADP 2016-21), Greenfield Status has been granted to 21 companies for manufacturing of cars, light commercial vehicles (LCVs), Sports Utility Vehicles (SUVs), light trucks, heavy trucks, buses and prime movers. Following, (06) New Entrants have started manufacturing; - United Motors (Pvt) Ltd (Status Granted on:June 19, 2017) Production Started in October 2018 - M/s Foton JW Auto Park (Pvt) Ltd (Production Started in December 2018) - M/s Regal Automobile Industries Ltd.,, (Production Started on July 2018) - M/s KIA Lucky Motor (Production Started on August 2019) - M/s Master Motors Ltd., (Production Started on June 2019) - M/s Hyundai Nishat Motors (Production Started in December 2019) Most of other companies are in the process of establishing their manufacturing facilities. -

ANNUAL REPORT 2019 Nishat Chunian Limited Nishat (Chunian) Limited 1 2019 2019 2 Nishat (Chunian) Limited BRIEF PROFILE

ANNUAL REPORT 2019 Nishat Chunian Limited Nishat (Chunian) Limited 1 2019 2019 2 Nishat (Chunian) Limited BRIEF PROFILE Diversification into Retail Business 2016 The Linen Company (TLC) Diversified into Cinema Business 2015 NC Entertainment Private Limited 2014 46 MW Coal Based Power Plant Established a subsidiary company in 2013 USA 2 Spinning Mills acquired & a new spin- 2013 ning mill started 2010 IPP commercial operations 2006 Diversified into Home Textiles Acquisition of 2 spinning Mills & 5th 2005 Spinning Mill Started 2000 2nd Spinning mill started production 1998 Diversified into Weaving 1st Spinning Mill Setup 1991 Nishat (Chunian) Limited 2019 1 2019 2 Nishat (Chunian) Limited CONTENTS Company Information 04 Notice of Annual General Meeting 05 Chairperson’s Review Report 13 Director’s Report 16 Financial Highlights 25 Statement of Compliance with the Code of Corporate Governance 27 Review Report to the Members on Statement of Compliance with Best Practices of Code of Corporate Governance 29 Independent Auditor’s Report 30 Nishat (Chunian) Limited – Financial Statements Statement of Financial Position 34 Statement of Profit or Loss 36 Statement of Comprehensive Income 37 Statement of Cash Flows 38 Statement of Changes in Equity 39 Notes to the Financial Statements 40 Pattern of Shareholding 89 Categories of Shareholders 92 Consolidated Financial Statements Independent Auditor’s Report 94 Statement of Financial Position 98 Statement of Profit or Loss 100 Statement of Comprehensive Income 101 Statement of Cash Flows 102 Statement of Changes in Equity 103 Notes to the Consolidated Financial Statements 104 Forms 166 Nishat (Chunian) Limited 3 2019 COMPANY INFORMATION Board of Directors: Bankers to the Company: Mrs. -

Nishat Chunian Power Ninth Month Report 2021

Condensed Interim Financial Information For the Quarter and Nine Month Ended March 31, (Unaudited) 21 Contents Company Information 02 Directors’ Report 03 Condensed Interim Statement of Financial Position 08 Condensed Interim Statement of Profit or Loss Account 10 Condensed Interim Statement of Comprehensive Income 11 Condensed Interim Statement of Changes in Equity 12 Condensed Interim Statement of Cash Flows 13 Selected Notes to the Condensed Interim Financial Statements 14 Nishat Chunian Power Limited 1 Company Information Board of Directors: Faysal Bank Limited Mrs. Farhat Saleem Habib Bank Limited Chairperson Habib Metropolitan Bank Limited Mrs. Ayesha Shahzad MCB Bank Limited Director MCB Islamic Bank Limited Mr. Farrukh Ifzal Meezan Bank Limited Chief Executive Officer National Bank of Pakistan Mr. Aftab Ahmad Khan Pak Oman Investment Company Director Limited Mr. Muhammad Azam Pak Libya Holding Company Limited Director Mr. Muhammad Ashraf Sindh Bank Limited Director Summit Bank Limited Mr. Babar Ali Khan The Bank of Punjab Director United Bank Limited Mr. Rehmat Naveed Elahi Director AUDITORS: Riaz Ahmad & Company AUDIT COMMITTEE AND Chartered Accountants HR & R COMMITTEE: Mr. Muhammad Azam LEGAL ADVISERS: Chairman Ahmad & Pansota Mr. Aftab Ahmad Khan Advocates & Solicitors Member Mr. Rehmat Naveed Elahi REGISTERED & HEAD OFFICE: Member 31-Q, Gulberg-II, Lahore, Pakistan. Phone : 042-35761730-37 CHIEF EXECUTIVE OFFICER: Fax : 042-35878696-97 Mr. Farrukh Ifzal Web : www.nishat.net CHIEF FINANCIAL OFFICER: Mr. Muhammad Bilal SHARE REGISTRAR: Hameed Majeed Associates (Pvt) Limited COMPANY SECRETARY: Mr. Syed Tasawar Hussain 1st Floor, H.M. House 7-Bank Square, Lahore BANKERS TO THE COMPANY: Ph: 042-37235081-2 Al Baraka Bank (Pakistan) Limited Fax: 042-37358817 Allied Bank Limited Askari Bank Limited PLANT: Bank Alfalah Limited 66-Km, Multan Road, Pattoki BankIslami Pakistan Limited Kasur. -

136Feea1-A2da-4B4e-B

Academic Case Study HOSTILE TAKEOVER OF ADAMJEE INSURANCE COMPANY LIMITED (AICL) Submitted to; Dr. Irum Saba Submitted by; Naveed Aslam (15187) Muhammad Daniyal (18195) Hafiz Syed Muhmmad Ubaid (15188) Aiman Shaikh (18197) INSTITUTE OF BUSINESS ADMINISTRATION, KARACHI Ethics and Corporate Governance –Case Study CASE SYNOPSIS This case presents a chronological review of the first and the largest hostile Takeover in Pakistan. Mian Muhammad Mansha of Nishat group was able to accumulate significant shareholding in a company with a weak stock performance but with a strong future potential. This case highlights how Mian Masha worked around the regulations and legal framework to get hold of the largest general insurance company of Pakistan. At that time, Adamjee Insurance Company Limited (AICL) was marred by poor operating performance due to weak management of the company. The Adamjee family was not able to keep the company on track which had a high free float. Mian Mansha gained a huge stake in the companies with the help of his bank, MCB Bank and the MCB Employees funds in addition to his other companies and allegedly manipulated the share price. By the time the Adamjee family became aware that they have lost their control, it was too late… PROFILE OF MIAN MUHAMMAD MANSHA Mian Muhammad Mansha is a business tycoon. He is the founder Nishat Group. Mansha is the highest tax payer in Pakistan. Nishat Textiles Mills was begun in 1951 by his dad and uncles. He joined his family company in 1969. The family split and the companies held by Mansha were named as Nishat Group.