Annual Report 2019 Directors’ Profile Accelerating Focussed Growth Focussed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings As of September, 2018

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings as of September, 2018 Parent / Holding Company Website Adamjee Insurance Co. Ltd http://www.adamjeeinsurance.com/ Associated Companies Website Hollard Life Assurance Company Limited/ IVM Intersurer B.V. https://www.hollard.co.za/ D.G.Khan Cement Co. Ltd. http://www.dgcement.com/ Din Leather Pvt Ltd. http://www.dinleather.dingroup.com.pk/ Din Textile Mills Ltd. http://www.dinleather.dingroup.com.pk/ Euronet Pakistan (Pvt.) Limited https://www.euronetpakistan.com/ Gulf Nishat Apparel Limited https://www.nishatpak.com/gna.html Hyundai Nishat Motor (Pvt) Limited http://www.nishatmillsltd.com/ Lalpir Power Limited (Formerly AES Lalpir (Pvt.) Ltd.) http://www.lalpir.com/ MCB Arif Habib Saving & Investment Ltd. http://www.mcbah.com/ MCB Bank Ltd. https://www.mcb.com.pk/ MCB Financial Services Ltd. https://www.mcb.com.pk/ MCB Foundation http://www.mcbef.com.pk/ MCB Islamic Bank Limited https://www.mcbislamicbank.com/ MNET Services (Pvt) Ltd. https://www.mcb.com.pk/about-mcb/group-companies Nishat Agriculture Farming (Pvt.) Limited (Common Directorship) http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Chunian Power Limited. http://www.nishat.net/ Nishat Dairy Pvt Ltd (Common Directorship) http://www.nishatdairy.com/ Nishat Developers (Private) Limited http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Farm Supplies (Pvt.) Limited http://www.nishatmillsltd.com/ Nishat Hospitality Pvt. Ltd. http://nishathospitality.com/ Nishat Hotels & Properties Ltd. https://nishathotels.com/ Nishat Linen https://www.nishatlinen.com/ Nishat Mills Ltd. http://www.nishatmillsltd.com/ Nishat Paper Products Co Ltd. http://www.nishatpaper.com/ Nishat Power Ltd. http://www.nishatpower.com/ Pakgen Power Limited (Formerly AES Pak Gen (Pvt) Co) http://pakgenpower.com/ Security General Insurance Co. -

1 (31St Session) NATIONAL ASSEMBLY SECRETARIAT

1 (31st Session) NATIONAL ASSEMBLY SECRETARIAT ———— “QUESTIONS FOR ORAL ANSWERS AND THEIR REPLIES” to be asked at a sitting of the National Assembly to be held on Thursday, the 1st April, 2021 33. *Mr. Muhammad Afzal Khokhar: (Deferred during 28th Session) Will the Minister for National Health Services, Regulations and Coordination be pleased to state: (a) whether Government has taken notice that buying power of public at large of medicines is significantly decreased since the inception of the incumbent Government; if so, the details thereof; (b) what steps are being taken by the Government to decrease the prices of medicines forthwith; and (c) average prices of essential / life saving medicines as on May, 2018 and detail of prices at present? Minister for National Health Services, Regulations and Coordination: (a) Federal Government and Drug Regulatory Authority of Pakistan are cognizant of the impact of increase in prices of drugs and it has been tried at best to allow increase at minimum level as compared to increase in manufacturing/import cost of drugs. Its impact is much lesser than non availability of drugs. Prices of drugs are mostly lower in Pakistan as compared to average prices in the region i.e. Bangladesh, Srilanka and India. (b) Following steps have been taken to reduce prices of medicines:— 2 (i) Regulation imposed: Drug Regulatory Authority of Pakistan, with the approval of Federal Cabinet notified a Drug Pricing Policy2018 which provides a transparent mechanism for fixation, decrease & increase in MRPs of drugs. (ii) Reduction in MRPs of drugs: Maximum Retail Prices (MRPs) of 562 drugs have been reduced and notified after approval by the Federal Government. -

Exd Company Profile

Company Profile AGENDA 01Su ExD - At a Glance 02Su SAP 03Su Oracle 04Su Digital 05Su Outsourcing 06Su Optimisation 07Su Core Values At a Glance Technology Services Outsourcing Services Optimization Services ■ ERP ■ IT Outsourcing ■ Technology Selection • SAP S/4HANA • IT/HR/Finance Organization ■ Business Process Reengineering • SAP Business One • IT Support Helpdesk ■ Change Management • SAP Business By Design • Software Development ■ System Audit & Review • SAP C/4HANA • Infrastructure Management ■ IT Organization Design • SAP Ariba • E-commerce ■ Development of IT Strategy • SAP SuccessFactors • Digital Media Marketing ■ IT Procurement Services • SAP Fiori • SAP Analytics ■ Accounting ■ IT Contract Negotiation • Oracle EBS • Back office services ■ TCO Reduction • Oracle Cloud ■ Training ■ Offsite Support • IFS • Help Desk (http://support.exdnow.com/) ■ Digital ■ Onsite Support • Secondary Sales Solution • Dedicated Resources • Big Data Analytics • E-commerce (Shopify/Magento) • On call basis • AI Chatbot Office Locations Office Locations Offices Opening Soon Karachi Lahore Toronto Islamabad Melbourne Denver Kuala Lumpur Dubai Riyadh Doha Awards FASTEST GROWING PARTNER 2011 Awards Recognitions INFORMATION ECONOMY REPORT The Software Industry & 2012 Developing Countries ExD was highlighted in the UNCTAD Information Economy Report 2012 from United Nations. Partners Our Customers Nishat Chunian Group Wateen Telecom Our Customers – List ▪ WASCO, Saudi Arabia ▪ Ghani group ▪ Saudi Electric Services Polytechnic, Dammam, Saudi Arabia ▪ Pepsico -

894) 3552/2017 Const. P. Master Motor Corp

IN THE HIGH COURT OF SINDH AT KARACHI Before: Muhammad Ali Mazhar and Agha Faisal, JJ. C P D - 3552 of 2017 Master Motor Corporation (Pvt.) Limited vs. Federation of Pakistan & Others C P D - 1264 of 2018 Master Motor Corporation (Pvt.) Limited vs. Federation of Pakistan & Others For the Petitioner: Barrister Abid Shahid Zuberi Barrister Ayan Mustafa Memon (in CP D-1264 of 2018) Barrister Ravi R. Pinjani (in CP D-3552 of 2017) For the Respondent No. 1: Sheikh Liaquat Hussain Assistant Attorney General (in both petitions) For the Respondent No. 2: Mr. Asim Ayaz Deputy General Manager Incharge (Policy) Engineering Development Board (in both petitions) For the Respondent No. 3: Mr. Mukesh Kumar G. Karara Advocate (in both petitions) Dates of Hearing: 31.10.2018, 13.11.2018 & 23.11.2018. Date of Announcement: 12.02.2019 JUDGMENT Agha Faisal, J: The subject petitions filed by the common petitioner, being a company engaged in the assembling and manufacturing of motor vehicles, have assailed the conferment of greenfield status upon 2 the respondent No.3 (“FJW”) herein, being a company incorporated with the objective of assembling / manufacturing motor vehicles, on the ground that the award of such status was not in consonance with the Automotive Development Policy 2016-21 (“Auto Policy”). Since similar questions of law and fact are agitated vide the subject connected petitions, hence, both the petitions shall be decided through this common judgment. 2. Barrister Abid Shahid Zuberi set forth the case of the petitioner (“MMC”), which arguments were also adopted by Barrister Ravi Pinjani, and argued that greenfield status could only be conferred upon assemblers who introduced a new brand into the market, hitherto alien to the public at large. -

Daily Call REP- 300 March 9, 2018 Millat Tractors Limited Automobile Assemblers Ploughing the Future

Daily Call REP- 300 March 9, 2018 Millat Tractors Limited Automobile Assemblers Ploughing the Future 1 BUY MTL: Target Price revised upward by 9.1% to PKR 1,604/share We revise upwards our DCF-based Dec’18 TP of Millat Tractors Limited to PKR Target Price 1,604.4 1,604/share (earlier 1,470/share). Our review thesis is hinged upon i) Higher than Last Closing 1,375.1 expected volumetric growth convinced us to review our volumetric assumption to 39,015 Upside (%) 16.7 units including exports units (previous assumption was 37,635 units), ii) Increase in 1-2% PSX Code MTL of selling prices of all the variants from Dec’17, iii) Low dependency on imported raw Bloomberg Code MTL PA material which allows gross margins to remain firm; currently localization level is between Shares 85% to 90% depending on different variants, and iv) We expect the budget to be farmer focused, agriculture and rural oriented which will allow the company to continue growth at Market Cap (USD m) 554 the same pace. Based on our thesis, a 17% upside potential is available based on the Outstanding Shares (m) 44.3 scrip’s last closing and we recommend a “BUY”. Currently the stock is trading at a FY18E Free Float (%) 50.0 PE multiple of 12.2x. 12M Avg. Daily Turnover (m) 0.1 12M High | Low (PKR) 1,475.8 | 1,019.9 Exhibit: Old & New Estimates Major Shareholders Directors FY18E FY19F FY20F Dec-18 Old 1,470 Key Matrics Target Price New 1,604 FY17A FY18E FY19F (PKR/Share) Change 9.12% Total Equity (PKRbn) 5.7 5.9 5.9 Old 98.6 87.2 98.2 Total Assets (PKRbn) 17.1 17.8 17.5 PAT -

Pakistan Investment Strategy 2018 Best Equity Advisor Chance for a Home Run; Target 47,199 Best Domestic Equity House

Best Brokerage House Pakistan Investment Strategy 2018 Best Equity Advisor Chance for a Home Run; Target 47,199 Best Domestic Equity House Top 25 Companies Corporate Finance House of the Year REP-300 www.jamapunji.pk Market Strategy Synopsis Total Return: Pakistan equity market is expected to generate a total return of 20% during 2018. Exhibit: KSE100 Index Target Estimates 2018 Valuation Basis Target Attractive Valuations: PSX is expected to provide strong returns in CY18 as KSE-100 is trading at Target Price Based 49,611 a 5 year low PER of 8.5x, cheaper than its past 5 years’ average of 10.3x. PSX is presently trading Earnings Growth 44,160 at a 46% discount to its regional peers as compared to an average of 36% during last 12 years. Justified PE 47,824 Key Reasons for Upside: Average Target 2018 47,199 Diluting political noise Index Closing 22-Dec-17 39,471 Commencement of a high Economic Growth period (FY18-20 average GDP growth expected at Expected Return 2018 19.6% 6.0% compared to past 5 year average of 4.4%) Low interest rates (FY18-20 average discount rate is expected at 6.75%, compared to past 5-yr Source: AHL Research average of 8.64%) Exhibit: KSE100 - Price to Earning Multiple Attractive valuations compared to historic average and regional peers Strong domestic liquidity P/E Average P/E 14.0 Index Target: Based on index methodology of earnings growth, justified PER and target price 12.0 mapping, we view the Dec’18 index target for KSE-100 index at 47,199 points, portraying an upside 12.1 of 19.6%. -

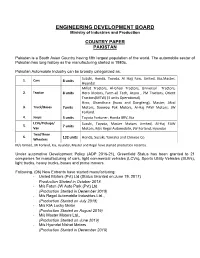

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production COUNTRY PAPER PAKISTAN Pakistan is a South Asian Country having fifth largest population of the world. The automobile sector of Pakistan has long history as the manufacturing started in 1980s. Pakistan Automobile Industry can be broadly categorized as: Suzuki, Honda, Toyota, Al Hajj Faw, United, Kia,Master, 1. Cars 8 units Hyundai Millat Tractors, Al-Ghazi Tractors, Universal Tractors, 2. Tractor 8 units Hero Motors, Farm-all Tech, Arzoo , PM Tractors, Orient Tractors(MTW) (3 units Operational). Hino, Ghandhara (Isuzu and Dongfeng), Master, Afzal 3. Truck/Buses 7units Motors, Daewoo Pak Motors, Al-Haj FAW Motors, JW Forland. 4. Jeeps 3 units Toyota Fortuner, Honda BRV, Kia LCVs/Pickups/ Suzuki, Toyota, Master Motors Limited, Al-Haj FAW 5. 7 units Van Motors, M/s Regal Automobile, JW Forland, Hyundai Two/Three 6. 132 units Honda, Suzuki, Yamaha and Chinese Co. Wheelers M/s United, JW Forland, Kia, Hyundai, Master and Regal have started production recently. Under automotive Development Policy (ADP 2016-21), Greenfield Status has been granted to 21 companies for manufacturing of cars, light commercial vehicles (LCVs), Sports Utility Vehicles (SUVs), light trucks, heavy trucks, buses and prime movers. Following, (06) New Entrants have started manufacturing; - United Motors (Pvt) Ltd (Status Granted on:June 19, 2017) Production Started in October 2018 - M/s Foton JW Auto Park (Pvt) Ltd (Production Started in December 2018) - M/s Regal Automobile Industries Ltd.,, (Production Started on July 2018) - M/s KIA Lucky Motor (Production Started on August 2019) - M/s Master Motors Ltd., (Production Started on June 2019) - M/s Hyundai Nishat Motors (Production Started in December 2019) Most of other companies are in the process of establishing their manufacturing facilities. -

Adamjee Life Assurance Co. Ltd A- Details of Related Parties and Shareholding Therein As of 30Th June 2019

Adamjee Life Assurance Co. Ltd A- Details of Related Parties and Shareholding Therein As of 30th June 2019 Nature of reporting insurer's relationship with related party (mention if Nature of the business of related Sr. No. Name of related party related party is a Parent, party (i.e. Sector of Economy) Subsidiary, Other Group Entity, Associate or Other Related Party)* 1 ADAMJEE INSURANCE COMPANY LIMITED Insurance Parent 2 IVM INTERSURER B.V. Financial Services Associate 3 MR. MUHAMMAD UMER MANSHA CEO 4 MR. IMRAN MAQBOOL Director 5 MR. S.M. JAWED Director 6 MR. MUHAMMAD ALI ZEB Director 7 MR. AQEEL AHMAD Director 8 MR.SAMIR IQBAL SAIGOL Director 9 MR. RAZA MANSHA Director 10 NISHAT MILLS LIMITED Textile Sector Common Directorship 11 DG KHAN CEMENT COMPANY LTD Cement Sector Common Directorship 12 MCB BANK LTD Financial Services Common Directorship 13 NISHAT POWER LTD Energy & Power Common Directorship 14 NISHAT HOTELS & PROPERTIES LTD Construction & Development Common Directorship 15 NISHAT DAIRY PVT LTD Agriculture Sector Common Directorship 16 NISHAT AGRICULTURE FARMING (PVT.) LIMITED Agriculture Sector Common Directorship 17 LALPIR POWER LIMITED (FORMERLY AES LALPIR (PRIVATE) LIMITED) Energy & Power Group Entity 18 MCB BANK LTD - PROVIDENT FUND Financial Services Group Entity 19 NISHAT PAPER PRODUCTS CO LTD. Paper Common Directorship 20 SECURITY GENERAL INSURANCE CO. LTD. Insurance Group Entity 21 NISHAT CHUNIAN LIMITED. Textile Sector Common Directorship 22 NISHAT CHUNIAN POWER LIMITED. Energy & Power Group Entity 23 NISHAT HOTELS & PROPERTIES LTD. Hopitalitality Industry Common Directorship 24 NISHAT (Aziz Avenue) HOTELS & PROPERTIES LTD. Hopitalitality Industry Group Entity 25 NISHAT (Gulberg) HOTELS & PROPERTIES LTD. -

AUTOMOBILE SECTOR August, 2020 2

SECTOR UPDATE AUTOMOBILE SECTOR August, 2020 2 Global Automobile Industry Global car sales trend • Global auto industry expects ~20% year-on-year (YoY) decline in sales in 2020. Prior to advent of Covid-19 90 80 79 78 80 75 pandemic, car sales were projected to reach 80m which 70 60 has now been revised downwards to 60m. 60 55 • Pandemic and the economic recession that was triggered 50 39 Million Units 40 by lockdowns led to an unprecedented turmoil in 2Q’2020. 30 Going forward, recovery in sales is dependent on duration 20 and breadth of the pandemic. (1990-1999)*(2000-2015)* 2016 2017 2018 2019 2020** *Annual Averages • Amidst the outbreak, many factories were also temporarily **Forecast shutdown to curb the spread of virus and contain losses. Top six countries - Sales & market share in 2019 • Governments around the globe have supported their domestic automobile sector by incentivizing car buyers with 30 35% subsidies and tax breaks to offset decreased auto sales. 25 30% 25 17 • On the flip side, global pandemic has accelerated the 20 25% development of both electric and autonomous vehicles. 20% 15 15% • Given the global initiatives on stricter emission controls, 10 10% automakers are beginning to expand their business into Million Units 4 3 3 3 5 5% electric mobility sector. By 2025, every third new car sold is 0 0% anticipated to be propelled or assisted by an electric China USA Germany India Japan Brazil battery. Car Sales - LHS Market Share - RHS VIS Credit Rating Company Limited 3 Global Automobile Industry Global light vehicles (Cars + LCVs) sales by top 10 manufacturer groups in 2019 12 16% 10 10 9 14% 10 12% 8 7 8 10% 5 6 5 8% 4 6% Million Units 3 3 4 4% 2 2% Volkswagen Toyota Renault General Hyundai-Kia Ford Group Honda FIAT Chrysler Peugeot Mercedes - Group Group Nissan Motors Motors (PSA Group) Daimler Alliance Car Sales - LHS Market Share - RHS • Global automobile industry is expected to witness consolidation as weaker OEMs will not be able survive on their own in this competitive environment after bearing significant losses. -

Presentation for the Year 2020

Nishat Mills Limited CORPORATE BRIEFING 2020 26 NOVEMBER 2020 Contents ▪Group Profile ▪Company Profile ▪Financial Review ▪Future Outlook Nishat Group •One of the largest and leading business house in Pakistan •Presence in Textile, Cement, Banking, Insurance, Power Generation, Hotel Business, Agriculture, Dairy, Real Estate, Aviation, Paper Products, and automobile •Assets over Rupees 2,100 billion •Provides direct employment to around 43,000 persons •Seven Companies are listed on Pakistan Stock Exchange •Has played an important role in the industrial development of Pakistan Nishat Group • Nishat Mills Limited • Nishat Power Limited • Nishat Linen (Pvt) Limited Textile Energy • Lalpir Power Limited • Nishat Linen Trading LLC • Pakgen Power Limited • Nishat International FZE • Nishat USA Inc. • Nishat Global China Company Limited • MCB Bank Limited Cement Banking • DG Khan Cement Company Limited • MCB Islamic Bank Limited • Nishat Developers (Pvt) Limited • Nishat Real Estate Development Co. (Pvt) Nishat Limited • Nishat Paper Products Company Limited Paper Real Estate Products • Emporium Properties (Pvt) Limited Group • Golf View Land (Pvt) Limited • Nishat Dairy (Private) Limited • Adamjee Insurance Co. Limited • Nishat Sutas Dairy Limited Agriculture • Security General Insurance Co. Limited • Nishat Agriculture Farming (Pvt) Limited Insurance & Dairy • Adamjee Life Assurance Company Limited • Nishat Agrotech (Pvt) Limited • Nishat Commodities (Pvt) Limited Automobile • Nishat Hotels and Properties Limited • Nishat Hospitality (Pvt) Limited -

Notes to the Financial Statements for the Year Ended June 30, 2017

Notes to the Financial Statements For the year ended June 30, 2017 1 THE COMPANY AND ITS OPERATIONS Nishat Mills Limited is a public limited Company incorporated in Pakistan under the Companies Act, 1913 (Now Companies Act, 2017) and listed on Pakistan Stock Exchange Limited. Its registered office is situated at 53-A, Lawrence Road, Lahore. The Company is engaged in the business of textile manufacturing and of spinning, combing, weaving, bleaching, dyeing, printing, stitching, apparel, buying, selling and otherwise dealing in yarn, linen, cloth and other goods and fabrics made from raw cotton, synthetic fibre and cloth and to generate, accumulate, distribute, supply and sell electricity. 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES The significant accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated: 2.1 Basis of preparation a) Statement of compliance These financial statements have been prepared in accordance with approved accounting standards as applicable in Pakistan. Approved accounting standards comprise of such International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board as are notified under the repealed Companies Ordinance, 1984, provisions of and directives issued under the repealed Companies Ordinance, 1984. In case requirements differ, the provisions or directives of the repealed Companies Ordinance, 1984 shall prevail. The Companies Ordinance, 1984 has been repealed after the enactment of the Companies Act, 2017 on 30 May 2017. SECP vide its Circular 17 of 2017 and its press release dated 20 July 2017 has clarified that the companies whose financial year, including quarterly and other interim period, closes on or before 30 June 2017 shall prepare their financial statements in accordance with the provisions of the repealed Companies Ordinance, 1984. -

NML Annual Report Color Pages

Annual Report 2018 A great y, Nishat Mills Limited a great future Corporate Company Information ............................................ 1 Directors’ Profile..................................................... 2 Vision and Mission ................................................ 4 Chairman’s Review Report..................................... 5 Directors’ Report ................................................... 6 Financial Highlights ............................................. 20 Statement of Compliance with Listed Companies (Code of Corporate Consolidated Financial Statements Governance) Regulations, 2017 ........................ 22 of Nishat Mills Limited and its Independent Auditors’ Review Report to the Subsidiaries Members on the Statement of Compliance contained in Listed Companies (Code of Directors’ Report ................................................ 115 Corporate Governance) Regulations, 2017....... 24 Independent Auditor’s Report to the members .. 116 Notice of Annual General Meeting ...................... 25 Consolidated Statement of Financial Position ... 122 Jama Punji Ad ..................................................... 35 Consolidated Statement of Profit or Loss .......... 124 Consolidated Statement of Financial Statements of Comprehensive Income .................................... 125 Nishat Mills Limited Consolidated Statement of Changes in Equity ............................................. 126 Independent Auditor’s Report to the members ... 38 Consolidated Statement of Cash Flows ............. 127 Statement