Annual Report 2012/13

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Escort Paris, Sexy, Paris, France Verkäuferinformationen Name: Escort Paris

SEX BOMB - Escort ads from Female Escort, Male Escort, Shemale Escort, Adult search https://www.sex-bomb.com/de/france/ Escort paris, sexy, Paris, France Verkäuferinformationen Name: Escort paris Anzeigendetails Titel hinzufügen: sexy Über mich Name: Escort paris Alter: 25 Haarfarbe: Blonde Höhe: 169 cm Sprachkenntnisse Sprache: English Über mich: Paris Escort, Paris, Escorts Paris, Erotic, Massage, Charles de Gaulle Airport, Paris Escort, Orly Airport.Muscat Escort Quebec City Escort Antalya Escort Edmonton Escort Mississauga Escort North York Escort Scarborough Escort Adelaide Escort Gold Coast Escort Canberra Escort Wollongong page 1 / 6 SEX BOMB - Escort ads from Female Escort, Male Escort, Shemale Escort, Adult search https://www.sex-bomb.com/de/france/ Escort Logan City Escort Brisbane Escort Reims Escort Ibiza Escort Mykonos Escort Marbella Escort Courchevel Escort Nantes Escort Montpellier Escort Lille Escort Bordeaux Escort Seville Escort Bilbao Escort Malaga Escort Las Palmas Escort Zaragoza Escort Granada Escort Palma Escort Almere Escort Rotterdam Escort Utrecht Escort Groningen Escort Tilburg Escort Patras Escort Heraklion Escort Larissa Escort Volos Escort Rhodes Escort Thessaloniki Escort Nice Escort Monaco Escort Athens Escort São Paulo Escort Rio de Janeiro Escort Salvador Escort Brasília Escort Fortaleza Escort Belo Horizonte Escort Manaus Escort Curitiba Escort Recife Escort Porto Alegre Escort Belém Escort Goiânia Escort Guarulhos Escort Campinas Escort São Luís Escort São Gonçalo Escort Maceió Escort Toulouse Escort -

Maps -- by Region Or Country -- Eastern Hemisphere -- Europe

G5702 EUROPE. REGIONS, NATURAL FEATURES, ETC. G5702 Alps see G6035+ .B3 Baltic Sea .B4 Baltic Shield .C3 Carpathian Mountains .C6 Coasts/Continental shelf .G4 Genoa, Gulf of .G7 Great Alföld .P9 Pyrenees .R5 Rhine River .S3 Scheldt River .T5 Tisza River 1971 G5722 WESTERN EUROPE. REGIONS, NATURAL G5722 FEATURES, ETC. .A7 Ardennes .A9 Autoroute E10 .F5 Flanders .G3 Gaul .M3 Meuse River 1972 G5741.S BRITISH ISLES. HISTORY G5741.S .S1 General .S2 To 1066 .S3 Medieval period, 1066-1485 .S33 Norman period, 1066-1154 .S35 Plantagenets, 1154-1399 .S37 15th century .S4 Modern period, 1485- .S45 16th century: Tudors, 1485-1603 .S5 17th century: Stuarts, 1603-1714 .S53 Commonwealth and protectorate, 1660-1688 .S54 18th century .S55 19th century .S6 20th century .S65 World War I .S7 World War II 1973 G5742 BRITISH ISLES. GREAT BRITAIN. REGIONS, G5742 NATURAL FEATURES, ETC. .C6 Continental shelf .I6 Irish Sea .N3 National Cycle Network 1974 G5752 ENGLAND. REGIONS, NATURAL FEATURES, ETC. G5752 .A3 Aire River .A42 Akeman Street .A43 Alde River .A7 Arun River .A75 Ashby Canal .A77 Ashdown Forest .A83 Avon, River [Gloucestershire-Avon] .A85 Avon, River [Leicestershire-Gloucestershire] .A87 Axholme, Isle of .A9 Aylesbury, Vale of .B3 Barnstaple Bay .B35 Basingstoke Canal .B36 Bassenthwaite Lake .B38 Baugh Fell .B385 Beachy Head .B386 Belvoir, Vale of .B387 Bere, Forest of .B39 Berkeley, Vale of .B4 Berkshire Downs .B42 Beult, River .B43 Bignor Hill .B44 Birmingham and Fazeley Canal .B45 Black Country .B48 Black Hill .B49 Blackdown Hills .B493 Blackmoor [Moor] .B495 Blackmoor Vale .B5 Bleaklow Hill .B54 Blenheim Park .B6 Bodmin Moor .B64 Border Forest Park .B66 Bourne Valley .B68 Bowland, Forest of .B7 Breckland .B715 Bredon Hill .B717 Brendon Hills .B72 Bridgewater Canal .B723 Bridgwater Bay .B724 Bridlington Bay .B725 Bristol Channel .B73 Broads, The .B76 Brown Clee Hill .B8 Burnham Beeches .B84 Burntwick Island .C34 Cam, River .C37 Cannock Chase .C38 Canvey Island [Island] 1975 G5752 ENGLAND. -

Til Andreas Keil, MB E-Mail

KØBENHAVNS KOMMUNE Beskæftigelses- og Integrationsforvaltningen Direktionen Til 30. januar 2019 Andreas Keil, MB Sagsnr. E-mail: [email protected] 2019-0000199 Dokumentnr. 2019-0000199-14 Kære Andreas Keil Tak for din henvendelse af d. 16. januar 2019, hvor du har stillet spørgsmål til Beskæftigelses- og Integrationsforvaltningen vedr. virk- somhedspraktikker. De spørgsmål, du har stillet, er oplistet nedenfor med forvaltningens svar angivet efter hvert spørgsmål. Vi har notatet igennem behandlet dine spørgsmål ud fra en forudsæt- ning om, at du spørger til alle virksomhedspraktikker. Vi har således ikke opdelt opgørelserne i målgrupper (jobparate borgere, aktivitetspa- rate borgere mv.), men i stedet udarbejdet opgørelser for alle borgere samlet set. Virksomhedspraktikker gives ofte med forskelligt formål, da borgerne i de forskellige målgrupper har forskellige behov. Spørgsmål 1 Hvilke virksomheder ansætter ledige i ordinære job efter virksomheds- praktik, og hvilke virksomheder ansætter ikke virksomhedspraktikan- ter efter endt praktik? Der ønskes en oversigt. Beskæftigelses- og Integrationsforvaltningens svar Beskæftigelses- og Integrationsforvaltningen kan ikke se, hvilke virk- somheder der ansætter ledige efter virksomhedspraktik. Det vil kræve et manuelt opslag i e-indkomst i hver enkelt borgersag. Forvaltningen har i stedet udarbejdet en oversigt, der viser de virk- somheder, der har haft borger(e) i virksomhedspraktik, som er blevet ordinært ansat i samme branche i 2. måned efter endt virksomheds- praktik. Oversigten er opgjort for alle borgere samlet og altså ikke op- delt på målgrupper. Oversigten er afgrænset til virksomhedspraktikker i perioden juli 2017-juni 2018. Oversigten siger således ikke noget om, hvorvidt borgeren er blevet ansat i et ordinært job i samme virk- somhed, som han/hun var i virksomhedspraktik i. -

Management Commentary Annual Report 2017/18 — Ic

MANAGEMENT COMMENTARY ANNUAL REPORT 2017/18 — IC GROUP A/S 1 CONTENTS CONTENTS MANAGEMENT COMMENTARY PARENT COMPANY FINANCIAL STATEMENTS 3 The Group in short 3 Financial facts 2017/18 83 Income statement 5 Financial highlights and key ratios 84 Statement of financial position 6 Management letter 85 Statement of changes in equity 8 Outlook 86 Statement of cash flows 10 Strategy and Group structure 87 Notes to the parent company 12 Business segments financial statements 25 Financial review 27 Risk management 29 Corporate responsibility STATEMENTS 30 Corporate governance 31 Executives and Board of Directors 96 Statement by the Management 34 Shareholder information 96 The independent auditor’s report CONSOLIDATED FINANCIAL STATEMENTS GROUP STRUCTURE AND KEY RATIOS 36 Consolidated income statement 99 Group structure 36 Consolidated statement of 100 Definition of key ratios comprehensive income 101 Information on the Group 37 Consolidated statement of financial position 38 Consolidated statement of changes in equity 39 Consolidated statement of cash flows 40 Notes to the consolidated financial statements ANNUAL REPORT 2017/18 — IC GROUP A/S 2 MANAGEMENT COMMENTARY – OVERVIEW IC GROUP THE GROUP IN SHORT FINANCIAL FACTS 2017/18 - CONTINUING OPERATIONS Revenue per business unit IC Group operates in the apparel and fashion industry and owns a portfolio of brands 5% consisting of the three Premium brands; Tiger of Sweden, By Malene Birger and Designers 17% Remix (equity share of 51%) as well as the fast fashion brand Saint Tropez. As a portfolio 1,535 57 company, we create value through an active Revenue, DKK million EBIT, DKK million ownership of the Group brands, and we will 56% develop and invest in these brands in order to 22% maximize their future values. -

Detailhandelsanalyse

Svendborg Kommune Detailhandelsanalyse Maj 2017 INDHOLDSFORTEGNELSE Metode, begreber og definitioner 3 1. Konklusioner og vurderinger 7 2. Detailhandelen i Svendborg kommune 31 3. Befolknings- og forbrugsforhold 51 4. Handelsbalancen 61 5. Den nuværende og fremtidige konkurrencesituation 63 6. Interviews i Svendborg bymidte 67 Bilag 1: Branchefortegnelse detailhandel Bilag 2: Branchefortegnelse kundeorienterede servicefunktioner Metode, begreber og definitioner Nedenfor gives en kort introduktion om metoden, herunder dataindsam- lingen og definitioner i detailhandelsanalysen. Geografisk opdeling af Svendborg kommune Detailhandelen i Svendborg kommune er overordnet opdelt i 8 lokalom- råder, der fremgår af nedenstående kort: Svendborg by, Gudbjerg- Gudme-Hesselager, Skårup-Oure, Stenstrup-Kirkeby, Ollerup-V. Sker- ninge, Thurø, Vindeby-Troense samt Tåsinge inklusiv øerne. Herudover afrapporteres antallet af butikker og bruttoarealet i den gæl- dende centerstruktur, afgrænset jf. Kommuneplan 2013. Figur 0.1 Områder i Svendborg kommune 3 Metode, begreber og definitioner Antal butikker Alle butikker i kommunen er registreret i forbindelse med en rekogno- scering, der blev foretaget i februar 2017. Butikkerne er registreret med navn, adresse og branchegruppe. Branchegrupper Alle butikker er overordnet kategoriseret inden for dagligvarer og ud- valgsvarer samt butikker, der forhandler særligt pladskrævende va- regrupper. Dagligvarebutikkerne er discountbutikker (Netto, Fakta, Aldi, Rema 1000 m.fl.), supermarkeder (SuperBrugsen, Meny m.fl.) -

INTERIM REPORT Q1 2013/14 Table of Contents

ILLUSTRATION: BARKARBY GATE, RETAIL PARK Stockholm, Sweden TK DEVELopment A/S | CVR NO. 24256782 COMPANY ANNOUNCEMENT NO. 16/2013 | 21 JUNE 2013 INTERIM REPORT Q1 2013/14 TABLE OF contents Page 3 Summary 5 Consolidated financial highlights and key ratios 6 Results in Q1 2013/14 and outlook for 2013/14 12 Market conditions 13 Property development 17 Asset management 22 Discontinuing activities 23 Other matters 24 Statement by the Board of Directors and Executive Board on the Interim Report 25 Consolidated financial statements 34 Company information 2 /34 | TK DEVELOPMENT A/S | INTERIM REPORT Q1 2013/14 | TABLE OF CONTENTS Summary RESUltS FOR THE FIRST QUarter OF 2013/14 PHOTO: TK Development’s results for the first quarter of 2013/14 FASHION ARENA OUTLET CENTER amounted to DKK -19.0 million before tax, compared to DKK PRAGUE, CZECH REPUBLIC -6.9 million in the same period the year before. The results after tax amounted to DKK -16.2 million against DKK -154.9 million in the same period the year before. The balance sheet total amounted to DKK 3,957.9 million at 30 April 2013 against DKK 4,009.3 million at 31 January 2013. Consolidated equity totalled DKK 1,370.9 million, and the solvency ratio stood at 34.6 %. ASSET MANageMENT The total portfolio of own properties under asset manage- Cash flows for the period amounted to DKK -4.5 million ment, which thus generates cash flow, comprised 138,250 against DKK -12.9 million in the same period the year before. m² and amounted to DKK 1,938.7 million at 30 April 2013, Net interest-bearing debt amounted to DKK 2,195.7 million of which investment properties accounted for DKK 314.0 at 30 April 2013 against DKK 2,206.1 million at 31 January million. -

List of National and International Assignments in Frequency Order

COM3- List of national and international assignments in Frequency order Rwy DME MLS SAFIRE VHF DME VHF Channel CTY Location Service Designat Id Co-ordinates TRD VHFDOC DMEDOC MLSDOC MaxFL Remarks Channel Channel Ref EIRP EIRP or 000.000 0 RUS MINERALNYE VODY 3223 VOR/DME @441500N 430000E 250/500 250/500 500 17 37 RUS NOVOSIBIRSK 3651 ILS IKT 550400N 830500E 25/62.5 62 3652 ILS LLZ 550100N 824000E 25/62.5 62 KHABAROVSK 3648 ILS IUF 483100N1351100E 25/62.5 62 3649 ILS IBD 483100N1351100E 25/62.5 62 3650 ILS IHI 483100N1351100E 25/62.5 62 IRKUTSK 3646 ILS CN 521600N1042400E 25/62.5 62 3647 ILS IIR 521600N1042400E 25/62.5 62 EDINKA 3645 VOR DE 471000N1383900E 300/450 450 17 CHITA 3642 ILS 520200N1131800E 25/62.5 62 SERVICE = NIS 3643 ILS IDG 520200N1131800E 25/62.5 62 3644 ILS IZM 520200N1131800E 25/62.5 62 SUKHOTINO 3263 VOR 543600N 372000E 200/500 500 17 !DOC=200E-SE/100 PETROVSKOYE 3245 VOR 514300N 401100E 200/500 500 17 !DOC=200NW&S/60 BRYANSK 3219 VOR 532000N 341600E 200/500 500 17 !DOC=200SW&N-NE/80 BELYOZYORSK 3218 VOR 600200N 374500E 150/500 500 17 !DOC=150W&S/80 BELY 3217 VOR @555100N 325600E 150/500 500 17 TJK DUSHANBE 3654 ILS IFN 382900N 684800E 25/62.5 62 108.000 17X TUR USAK 4320 VOR/DME USK 384101N 292831E 80/250 80/250 250 17 37 D ALL GERMANY 4420 VOR TST ALL GERMANY(LAND) 25/100 100 19 TEST + NIS (DGNSS) 108.050 17Y MRC TANGER/IBN BATOUTA 31807 VOR/DME TNR 354403N 055509W 150/500 200/500 500 20 37 364654N 055234E 108.100 18X ALG JIJEL/FERHAT ABBAS 72186 ILS/DME 17 JL 364812N 055224E 25/62.5 25/100 100 29 TRD 313745N 021540W -

New Edition All Inclusive 2020 Cruises

Sail from just Save over Love your first pp cruise or your £795 money back! £3000 all inclusive per cabin Cruise Calendar 2020 Spirit of Discovery all-inclusive cruises Departure date Cruise Offer Nights Departure port Cruise code Page Jan 9, 2020 Pure Canaries SAVE OVER £3000 PER CABIN 13 Southampton SD016 20 Jan 22 An Italian Premiere SAVE OVER £4100 PER CABIN 21 Southampton SD017 22 Feb 12 Rendezvous in Rouen SAVE OVER £1100 PER CABIN 4 Southampton SD018 24 Feb 16 Norway’s Night Skies SAVE OVER £2800 PER CABIN 15 Southampton SD019 26 Mar 2 The Glorious Canary Islands SAVE OVER £3400 PER CABIN 13 Southampton SD020 28 Mar 15 Sounds of Spain SAVE OVER £4100 PER CABIN 14 Southampton SD021 30 Mar 29 Scandinavian Cities SAVE OVER £3100 PER CABIN 12 Southampton SD022 32 Apr 10 In the Footsteps of St James SAVE OVER £2400 PER CABIN 9 Southampton SD023 34 Apr 19 Escape to the Continent SAVE OVER £1300 PER CABIN 4 Dover SD024 36 NEW EDITION Apr 23 Hidden Adriatic SAVE OVER £5900 PER CABIN 26 Dover SD025 38 May 19 Scenes of Dunkirk SAVE OVER £2200 PER CABIN 7 Southampton SD026 39 May 26 Norway’s Ancient Fjords SAVE OVER £1600 PER CABIN 7 Dover SD027 40 Jun 2 Splendour of the Baltic SAVE OVER £3400 PER CABIN 14 Dover SD028 42 All inclusive 2020 Cruises Jun 16 Greenland Explorer SAVE OVER £8000 PER CABIN 21 Dover SD029 43 Jul 7 Arctic Expedition SAVE OVER £4000 PER CABIN 16 Dover SD030 44 Jul 23 Western France and the Costa Verde SAVE OVER £4700 PER CABIN 15 Dover SD031 46 Spirit of Discovery & Spirit of Adventure Aug 7 A Baltic Fable SAVE OVER -

Denmark Is One of the Most Prosperous Countries in Europe

Cushman & Wakefield Global Cities Retail Guide Denmark is one of the most prosperous countries in Europe. Furthermore, Denmark is also a gateway to the Scandinavia or the Nordic region. Danish consumers have a relatively affluent lifestyle. The majority is well in informed with an eye for quality and good design. The population is mainly urban, with some 30% living in Copenhagen. Danes have access to excellent public services in health, education, and transport. A survey by OECD (Organisation for Economic Co- operation and Development) showed that Danes have one of the highest scores in terms of life satisfaction of the countries surveyed. This suggests that Danish consumers shows trust in the market and are content with their way of life. Denmark has proved to be an attractive destination for investment from several international retailers. Furthermore, there are also many strong domestic retailers in the market, including Bestseller with its many trading facias at home and abroad. Other Danish companies with international operations include Ecco, IC DENMARK Companys, Pandora, Flying Tiger Copenhagen, Bang & Olufsen, Søstrene Grene, and Lego. OVERVIEW Cushman & Wakefield | Denmark | 2019 1 DENMARK ECONOMIC OVERVIEW ECONOMIC SUMMARY ECONOMIC INDICATORS* 2018 2019F 2020F 2021F 2022F GDP growth 1.4 1.9 1.8 1.8 1.9 Consumer spending 2.3 1.8 2.0 1.8 2.2 Industrial production 2.1 3.3 1.9 2.0 1.8 Investment 5.1 -4.3 2.0 2.2 2.3 Unemployment rate (%) 3.9 3.7 3.8 3.8 3.8 Inflation 0.8 1.2 1.5 1.8 1.9 Kroner/€ (average) 7.5 7.5 7.5 7.5 7.5 Kroner/US$ -

The Ownership of Europe's Airports

THE OWNERSHIP OF EUROPE’S AIRPORTS 2016 TABLE OF Contents ForeworD 1 Iceland 17 Definitions 2 Ireland 17 OVerView 3 Israel 17 EU Versus Non-EU 4 Italy 17 Fully Publically Owned Airports 5 Kosovo 20 Mixed Ownership Airports 5 Latvia 20 Fully Privately Owned Airports 6 Lithuania 20 Type of Ownership by Country 6 Luxembourg 20 Operational Arrangements – Land Ownership & Malta 20 Concession Agreements 6 Moldavia 21 DetaiLED Data BY CountrY 8 Monaco 21 Albania 8 Montenegro 21 Austria 8 Netherlands 21 Belarus 8 Norway 21 Belgium 8 Poland 21 Bosnia and Herzegovina 8 Portugal 22 Bulgaria 9 Romania 22 Croatia 9 Russian Federation 23 Cyprus 10 Serbia 24 Czech Republic 10 Slovakia 24 Denmark 10 Slovenia 24 Estonia 10 Spain 24 Finland 10 Sweden 24 France 11 Switzerland 26 FYROM 14 Turkey 26 Georgia 14 Ukraine 27 Germany 15 United Kingdom 27 Greece 16 Scope & MethoDOLOGY 29 Hungary 16 ANNEX: Airport Ownership Report Questionnaire 30 The Ownership of Europe’s Airports 2016 is an updated version of the previous 2010 Report, and provides detailed information on and analysis of the ownership structure of airports across Europe in 2016. As well as providing the name and percentage holding of shareholders in European airports, the Report also examines the degree and nature of private involvement in European airport operators. are ‘corporatised’ – structured as independent commercial entities. Indeed, the distinction between public and private airports is perhaps beginning to blur and lose significance - with some of the most active investors in airports actually being themselves airport operators with some degree of public ownership. -

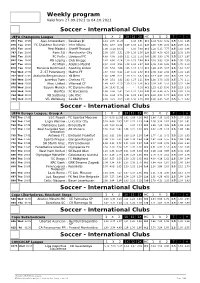

Weekly Program Soccer

Weekly program Valid from 27.09.2021 to 04.10.2021 Soccer - International Clubs UEFA Champions League 1 X 2 1X 12 2X HC 1 X 2 T - + 871 Tue 17:45 Ajax Amsterdam : Besiktas JK 1,11 9,76 21,28 - 1,03 6,51 0:1 1,34 5,02 6,39 3.5 1,82 1,95 875 Tue 17:45 FC Shakhtar Donetsk : Inter Milano 5,84 4,57 1,52 2,49 1,17 1,11 1:0 2,45 3,86 2,31 2.5 2,28 1,61 872 Tue 20:00 Real Madrid : Sheriff Tiraspol 1,08 11,28 29,21 - 1,01 7,90 0:1 1,28 5,35 7,77 3.5 1,82 1,96 787 Tue 20:00 Paris SG : Manchester City 2,99 3,55 2,31 1,58 1,26 1,36 1:0 1,55 4,56 4,25 2.5 2,31 1,60 866 Tue 20:00 FC Porto : Liverpool FC 4,69 4,06 1,69 2,12 1,21 1,16 1:0 2,08 3,90 2,76 2.5 2,17 1,67 822 Tue 20:00 RB Leipzig : Club Brugge 1,47 4,86 6,14 1,10 1,15 2,64 0:1 2,18 3,93 2,59 3.5 1,56 2,39 867 Tue 20:00 AC Milan : Atletico Madrid 2,94 3,18 2,53 1,48 1,32 1,37 1:0 1,46 4,38 5,38 2.5 1,70 2,13 870 Tue 20:00 Borussia Dortmund : Sporting Lisbon 1,35 5,54 7,69 1,06 1,12 3,13 0:1 1,89 4,05 3,07 3.5 1,64 2,22 794 Wed 17:45 Z. -

Denmark Country and Sector Analysis Report

NOVEMBER 2014 DENMARK COUNTRY AND SECTOR ANALYSIS REPORT Rosenborg Castle, DK SECTOR ANALYSIS OVERVIEW Diners Club International® is owned by Discover We realize our customers, especially those in Financial Services® (NYSE: DFS), a direct the corporate sector, desire ease of card use banking and payment services company with when traveling globally. In recognition of this one of the most recognized brands in U.S. need, Diners Club continues to increase card financial services. Established in 1950, Diners acceptance in the travel and entertainment Club International became the first multi-purpose (T&E) sector. Additionally, we are optimizing charge card in the world, launching a financial geographical and sector penetration within revolution in how consumers and companies select markets. pay for products and services. Today, Diners This Country and Sector Analysis report serves as Club® is a globally recognized brand serving the an annual guide to merchant acceptance within payment needs of select and affluent consumers, select countries. This report provides a snapshot offering access to more than 558 airport lounges of acceptance at travel and entertainment worldwide, and providing corporations and (T&E) merchants which had a minimum of one small business owners with a complete array of transaction over a rolling 12 month period. expense management solutions. With acceptance Additionally, we have added an external source, in more than 185 countries and territories, millions Lanyon1, as a source for the hotel sector. of merchant locations and access to over 1M cash access locations and ATMs, Diners Club is uniquely qualified to serve its cardmembers all over the world. 1.