Metro Vital Signs Report June 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Downloaded and Analyzed the Vehicle Monitoring Data for This Event

WMSC Commissioner Brief: W-0034 – Fatality at Farragut West Station December 9, February201 2019 Prepared for Washington Metrorail Safety Commission meeting on August 4, 2020 Safety event summary: A customer jumped from the Farragut West platform to the track bed as outbound Blue Line Train 406 entered the station on Track 2 on December 9, 2019 at approximately 12:53 p.m. Upon report of the collision, Metro Transit Police and D.C. Fire EMS were called and third rail power was de- energized on Track 2 at 12:55 p.m. Power was de-energized to Track 1 at 1:07 p.m. Service resumed after 3 p.m. Probable Cause: The customer intentionally placed themselves in front of oncoming train. Corrective Actions: None planned in specific response to this event. Train 3166 broken TWC antenna repaired. Staff recommendation: Adopt final report. Washington Metropolitan Area Transit Authority Department of Safety & Environmental Management FINAL REPORT OF INVESTIGATION A&I E19675 SMS 20191209#84904 Date of Event: 12/09/2019 Type of Event: Collision (Fatality) Incident Time: 12:54 hrs. Location: Farragut West Station, Track 2 Time and How received by SAFE: 12/09/2019 - 12:55 hrs. - SAFE on-call phone WMSC Notification: 12/09/2019 - 13:09 hrs. WMSC on-call phone Responding Safety officers: WMATA SAFE: Yes, SAFE 203 WMSC: No Other: N/A Rail Vehicle: (L) 3166.3167 x 3114.3115 x 3156.3157 Injuries: Fatal Injury Damage: Car 3166 Broken TWC Antenna Emergency Responders: Metro Transit Police Department (MTPD), Office of Car Maintenance (CMNT), Office of Rail Transportation (RTRA), DC Fire and EMS (DCFD), Safety and Environmental Management (SAFE), Track and Structure (TRST). -

Capitol Hill Element

Comprehensive Plan Capitol Hill Area Element Proposed Amendments DELETIONS ADDITIONS April 2020 Page 1 of 40 Comprehensive Plan Capitol Hill Area Element Proposed Amendments 1500 OVERVIEW Overview 1500.1 The Capitol Hill Planning Area encompasses the 3.1 square miles loCated east of the U.S. Capitol, north of I-695, and south of Florida Avenue NE and Benning Road NE. Boundaries of the Planning Area are shown on the Capitol Hill map. Map at left. Most of this area has historiCally been Ward 6 and is now partially in Ward 7, although in past deCades parts have been included in Wards 2 and 5. 1500.1 1500.2 The Planning Area is bounded on the west by Central Washington and on the south by the Lower AnaCostia Waterfront/Near Southwest Planning Area. BeCause plans for these twothis area areas is are of partiCular concern to Capitol Hill residents, this chapter includes cross-references to relevant seCtions of the Central Washington and Lower AnaCostia Waterfront /Near Southwest Planning Area Elements. Changes along the waterfront—partiCularly at Reservation 13 and in the Near Southeast—are extremely important to the future of Capitol Hill. The Planning Area is bounded to the north by Florida Avenue NE and Benning Road NE. To the south, the area is bounded by Southeast Boulevard. To the west, the area is bounded generally by 1st Street NE. The Anacostia River provides a natural border to the east. 1500.2 1500.3 In many respeCts, Capitol Hill is a “City within the city.” The community has well- defined physiCal boundaries that enhance its sense of identity. -

Anchor Mental Health…………………………………………………………………

District of Columbia Department of Mental Health Directory of Mental Health Rehabilitation Services Agencies 2008 - 2009 Revised Feb. 2009 1 Table of Contents: Access HelpLine (AHL)............................................................................................Pg. 5 CSA Directory: Anchor Mental Health…………………………………………………………………..... Pg. 6 Community Action Group…………………………………………………………………Pg. 7 Community Connections, Inc………………………………………………………........ Pg. 8 D.C. Community Services Agency (DCCSA)………………………………………….. Pg. 9 Family and Child Services of WDC, Inc…………………………………………………Pg. 10 Family Preservation……………………………………………………………….…….... Pg. 11 Fihankra Place, Inc……………………………………………………………….……..... Pg. 12 First Home Care Corporation……………………………………………………….…… Pg. 13 Georgetown Kids Medical Mobile Clinic (KMMC) …………………………………...Pg. 14 Green Door…………………………………………………………………………….……Pg. 15 Hillcrest Children’s Center………………………………………………………….….... Pg. 16 Latin American Youth Center…………………………………………………….………Pg. 17 Launch, LLC. ………………………………………………………………………………Pg. 18 Life Stride……………………………………………………………..………….……….. Pg. 19 Mary’s Center……………………………………………………………..……………..... Pg. 20 McClendon Center……………………………………………………………………..… Pg. 21 MD/DC Family Center ..........……………………………………………….…..……... Pg. 22 Neighbors Conseijo…………………………………………………………………....…. Pg. 23 Progressive Life…………………………………………………………………………….Pg. 24 PSI…………………………………………………………………………………...…...... Pg. 25 Psychiatric Center Chartered…………………………………………………….…........ Pg. 26 RCI Counseling Center……………………………………………………………………Pg. -

FTA WMATA Safety Oversight Inspection Reports June 2018

Inspection Form FOIA Exemption: All (b)(6) Form FTA-IR-1 United States Department of Transportation Federal Transit Administration Agency/Department Information YYYY MM DD Inspection Date Report Number 20180601-WMATA-WP-1 2018 06 01 Washington Metropolitan Area Transit Rail Agency Rail Agency Name TRPM Sub- Department Authority Department Name Email Office Phone Mobile Phone Rail Agency Department Contact Information Inspection Location B-Line, Track 1, between Union Station (B03) and Metro Center (A01) Inspection Summary Inspection Activity # 1 2 3 4 5 6 Activity Code TP-JSB-OBS TP-WI-OBS Inspection Units 1 1 Inspection Subunits 1 1 Defects (Number) 0 11 Recommended Finding No No Remedial Action Required1 No Yes Recommended Reinspection No Yes Activity Summaries Inspection Activity # 1 Inspection Subject Job Safety Briefing Activity Code TP JSB OBS Job Briefing Accompanied Out Brief 1000- Outside Employee WMATA RWIC Yes Yes Time No Inspector? Conducted 1400 Shift Name/Title Related Reports N/A Related CAPS / Findings N/A Ref Rule or SOP Standard Other / Title Checklist Reference Related Rules, SOPs, RWPM R-17-02 Standards, or Other MSRPH R-17-03 Main RTA FTA Yard Station OCC At-grade Tunnel Elevated N/A Track Facility Office Inspection Location Track Type X X Track Chain Marker From To Line(s) B-Line N/A Number and/or Station(s) Union Station (B03) Union Station (B03) Head Car Number Number of Cars Vehicles Equipment N/A N/A N/A 1 The rail transit agency must provide FTA with the necessary evidence (e.g. maintenance work order system records, photos, documentation, records, data, or other evidence) to close out the Remedial Action. -

Approval of the Staff Report and Recommendations on The

Finance, Administration and Oversight Committee Action Item III-A May 8, 2008 Approval of the Staff Report and Recommendations on the Proposed Restructuring of Metrobus Routes 30, 32, 34, 35, 36 Washington Metropolitan Area Transportation Authority Board Action/Information Summary Action MEAD Number: Resolution: Information 99997 Yes No PURPOSE To request Board approval of the staff report and recommendations on the proposed restructuring of regional Metrobus Routes 30, 32, 34, 35, 36, which comprise the Pennsylvania Avenue Line. DESCRIPTION The proposed changes to routes and service in Docket No. B08-1 are described below: • Maintain local Routes 32 and 36 between Friendship Heights and Southern Avenue stations (Route 32) and Naylor Road Station (Route 36) serving all stops and operating seven days a week. • Implement new peak period limited-stop services on Route 37 between Friendship Heights and Archives stations via Massachusetts Avenue and 22nd/23rd Streets, and on Route 39 between Naylor Road and Foggy Bottom- GWU Stations via Southern and Pennsylvania Avenues. • Implement new seven-day-a-week neighborhood connectors on Route 31 between Friendship Heights and Foggy Bottom stations and on Route M5 between Naylor Road and Eastern Market stations. • Eliminate Routes 30, 34 and 35. Two public hearings were conducted in the District of Columbia on March 17 and 19, 2008, concerning the proposed route restructuring. Twenty-one persons attended each of the public hearings and a total of 23 witnesses testified for the record. In addition, 12 persons submitted written testimony for the record. The most often mentioned comments from witnesses were general support for the proposals, especially Routes 31 and 37; concerns about the effectiveness of the supervision and monitoring plan to reduce bus bunching and delays; concerns about maintaining adequate frequency of service and capacity in critical areas; and suggestions to speed the boarding process on limited-stop routes by restricting use of cash. -

SBT Mezz Final PDF.Indd

p n e y h A e s g K6 i T17 TB11 TB15 Ln a e kvi d Z13 Z29 Dr 20 24 C7 TB11 L e 13 Long Rd 89 on Av W Cedar Ln J5 A 8 9 13 TB15x TB16 H 89M hns Broo 4 v Silver Spring: Branch C2 E C7 UM Ivy UM Ewin Jo Southampton Dr J3 70 J1 J2 e 19 d J2 14 21 22 S Park C4 Springhill Dr m J1 J5 Rock 70 71 79 F4 F6 J1 J2 R1 R1 C8 e Stephen l J3 J7 ig Three Oaks UM University o v Ln 3 14 n A J3 J4 J5 Q2 S2 S4 o UM UM Baltimore Greenbelt K6 Edwards Wy s Arylawn J9 30 2 4 J5 Q2 13 of t UM 4 C UM TB11 o h S9 Y5 Y7 Y8 Y9 Z2 20 t Park National Robert Grant Av 5 re 19 M Maryland n r Crescent Rd R12 T16 34 46 4 Research Dr Y5 Y7 e R2 TB16 o T17 Medical North Z6 Z8 Z9 Z11 Z13 Z29 a R Bradmoor Dr W d k n 24 Oakmont 70 NNMC Y8 Y9 c Metzerott Rd R1 Rhode Island Av 81 C2 d lw 30 n R h R5 C8 UM i e o P C ter Center: Chevy Chase 1 2 3 4 5 8 University n e o l D Rockville Pike Hospital k r l 19 etzerot C9 R3 Greenbelt Lake Naval 29 s t R Warren G i w M d d Recreation Georgia Ave UM J1 J2 J3 9 11 12 13 14 15 t R1 UM UM Courtyard Ke y e n M 3 R12 T16 R12 Magnuson R r J4 12 L Park 7 G 30 33 34 Area Creek 16 17 18 19 20 21 d W J4 Apartments r d ee s Z2 Z6 Z8 UM l ntr 2 R R R3 CherrywoodT17 LnTB11 l R12 UM ClinicalC Center i ee Medical e 13 19 12 UM T16 R 46 70 Porter Rd 22 28 UM 915 929 d h d o n 4 Z9 Z11 K6 20 24 Archives II 13 TB15 TB15x g TB11 r n o UM Blvd T17 33 J 2nd Ave 13 ity n D ers i Greenbelt v 16th St e niv Z13 Z29 Silver Building U R3 UM r 47 l 19 UM H C e Ride-On l TB16 e S i Schuyler Rd UM p G Lake r Greenbe n Center p 24 d e 2 v S J1 33 ri 8 9 13 81 83 81 C2 -

Building a World Class Streetcar System for a World Class City

BUILDING A WORLD-CLASS STREETCAR SYSTEM FOR A WORLD-CLASS CITY System Recommendations and Route Assessment A Report to the Mayor and Council of the District of Columbia Prepared by the Streetcar Working Group of the Subcommittee on Transportation Committee of 100 on the Federal City Meg Maguire, Dorn McGrath, Monte Edwards, Dick Wolf With assistance from Alec Stewart, Graduate Student, Department of Geography, George Washington University January 2011 Also available on our web site: <http://www.committeeof100.net> Table of Contents Executive Summary and Recommendations ................................................................................................. 1 Introduction and Methodology........................................................................................................................ 9 Route Diagrams .............................................................................................................................................. 11 Historic and Economic Development Districts Affected by Streetcars ............................................. 11 Route Diagrams ........................................................................................................................................... 15 Route Summary and Conclusions ................................................................................................................. 22 Detailed Route Segment Analysis .................................................................................................................. 27 Route -

Capitol Hill Guide

Local Guide to Capitol Hill/Eastern Market There’s a lot more to Capitol Hill than a marble dome and the House and Senate Buildings. I work and live on Capitol Hill in an area now known as “Hill East.” Capitol Hill is one of the largest neighborhoods in Washington, stretching east from the Capitol all the way to the Anacostia River. There’s a lot to do—especially on the weekends. Enjoy! ——Compiled by Megan Halsband, Library of Congress and Program Committee Co-Chair Getting there: Hop on the blue/orange line from Metro Center and get off at either the Capitol South station or the Eastern Market Station. The 30’s bus lines (32/34/36) run east along Pennsylvania Avenue past the US Capitol and right down to Eastern Market—or grab the 96 Bus or the Circulator from Union Station. 1. Coffee and breakfast/brunch: Getting breakfast on the weekend at Market Lunch at Eastern Market is a Capitol Hill tradition—but be prepared to wait in line and bring cash! I like to go to Pound, which not only has great coffee, but also serves breakfast, lunch, and dinner. Many of the restaurants in the area also serve brunch on the weekends as well (see my recommendations below). 2. Shop: I go to the Flea Market at Eastern Market to get presents (for myself and others)—you can find everything from vintage maps and postcards to furniture. I also regularly stop by Hill's Kitchen to get fun kitchen/food stuff. Labyrinth, a game store for adults and children, is a fun place to browse as is Capitol Hill Books—plan to stop at the book store before shopping elsewhere as the aisles are crowded. -

Pennsylvania Avenue Line Find the Stop at Or Nearest the Point Where You Will Get on the Bus

How to use this timetable Effective 6-6-21 ➤ Use the map to find the stops closest to where you will get on and off the bus. ➤ Select the schedule (Weekday, Saturday, Sunday) for when you will 32,36 travel. Along the top of the schedule, Pennsylvania Avenue Line find the stop at or nearest the point where you will get on the bus. Follow that column down to the time you want to leave. ➤ Use the same method to find the times the bus is scheduled to arrive at the stop where you will get off the bus. Serves these locations- ➤ If the bus stop is not listed, use the Brinda servicio a estas ubicaciones time shown for the bus stop before it as the time to wait at the stop. l Southern Ave station (32) ➤ The end-of-the-line or last stop is listed l Naylor Road station (36) in ALL CAPS on the schedule. l Naylor and Good Hope Roads, SE (32) l Hillcrest (36) Cómo Usar este Horario L’Enfant Square ➤ Use este mapa para localizar las l paradas más cercanas a donde se l Potomac Ave station subirá y bajará del autobús. l Eastern Market station ➤ Seleccione el horario (Entre semana, l Capitol Hill sábado, domingo) de cuando viajará. A lo largo de la parte superior del l The National Mall horario, localice la parada o el punto l Federal Triangle más cercano a la parada en la que se l White House subirá al autobús. Siga esa columna hacia abajo hasta la hora en la que l Foggy Bottom-GWU station desee salir. -

Driving Directions

Directions to Calvary Women’s Services 1217 Good Hope Road SE Washington, DC 20020 Public Transportation Anacostia Station (Green Line) is the closest metro stop to Calvary, but we are also near Eastern Market Station (Blue/Orange/Silver Lines). From Anacostia Station (Green Line): Walk from the Anacostia Metro Station (approximately 10 minutes) Exit station using main exit. Walk towards Martin Luther King, Jr. Ave., SE. Turn left on Martin Luther King, Jr. Ave., SE. Walk approximately 5 blocks on Martin Luther King, Jr. Ave., SE. Turn right on Good Hope Rd SE. Calvary Women’s Services will be on your right. Bus from the Anacostia Metro Station (approximately 5 minutes) Take either the 90 bus (towards Ellington Bridge) or the P6 bus (towards Rhode Island Ave): o Get off at Good Hope Road, SE and Martin Luther King, Jr. Ave., SE. o Turn right onto Good Hope Road, SE. o Calvary Women’s Services will be on your right. Take the Circulator bus: o Potomac-Skyland (DCPOTSKY) Circulator, towards Potomac Ave. o Get off after turning right onto Good Hope Road, SE. o Calvary Women’s Services is one building to the right. From Eastern Market Station (Blue/Orange/Silver Line): Bus from the Eastern Market Metro (approximately 7-14 minutes) Walk to 8th and D Street, SE (just outside of the metro station) Take the 90 bus (towards Anacostia Station) or the 92 bus (towards Congress Heights Station) o Get off at Good Hope Road, SE and Martin Luther King Jr. Ave, SE. o Turn right onto Good Hope Road, SE. -

Building a World-Class Streetcar System for a World-Class City: System

BUILDING A WORLD-CLASS STREETCAR SYSTEM FOR A WORLD-CLASS CITY System Recommendations and Route Assessment A Report to the Mayor and Council of the District of Columbia Prepared by the Streetcar Working Group of the Subcommittee on Transportation Committee of 100 on the Federal City Meg Maguire, Dorn McGrath, Monte Edwards, Dick Wolf With assistance from Alec Stewart, Graduate Student, Department of Geography, George Washington University January 2011 Also available on our web site: <http://www.committeeof100.net> Table of Contents Executive Summary and Recommendations..................................................................................................1 Introduction and Methodology........................................................................................................................9 Route Diagrams...............................................................................................................................................11 Historic and Economic Development Districts Affected by Streetcars .............................................11 Route Diagrams............................................................................................................................................15 Route Summary and Conclusions..................................................................................................................22 Detailed Route Segment Analysis ..................................................................................................................27 Route # -

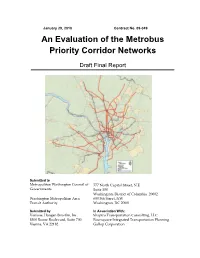

Standard VHB Memo Template

January 29, 2010 Contract No. 09-049 An Evaluation of the Metrobus Priority Corridor Networks Draft Final Report Submitted to Metropolitan Washington Council of 777 North Capitol Street, N.E Governments Suite 300 Washington, District of Columbia 20002 Washington Metropolitan Area 600 5th Street, NW Transit Authority Washington, DC 20001 Submitted by In Association With: Vanasse Hangen Brustlin, Inc. Shapiro Transportation Consulting, LLC 8300 Boone Boulevard, Suite 700 Foursquare Integrated Transportation Planning Vienna, VA 22182 Gallop Corporation Contents Overview of Priority Corridor Network (PCN) Concept ...................................................... 1 PCN Concept ............................................................................................................................ 1 Current PCN Status ................................................................................................................. 1 PCN Evaluation Project .......................................................................................................... 4 PCN Evaluation Overall Findings ......................................................................................... 5 Overall Results of PCN Alternatives .................................................................................... 5 Results of Key Measures of Effectiveness in PCN Corridors ............................................ 7 PCN Impact on Regional Transit Ridership ...................................................................... 14 PCN Relationship