Canaccord Genuity's U.S. Investment Banking Team Completes 135

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

ES River and Mercantile UK Recovery Fund

ES River and Mercantile UK Recovery Fund Quarterly Report to 30 September 2020 UK Equity Unconstrained Fund I Monthly Report Month 2008 UK Recovery For unitholders only0 ES R&M UK Recovery Fund Quarter 3, 2020 Fund Objective The investment objective of the Fund is to grow the value of your investment (known as “capital growth”) in excess of the MSCI United Kingdom Investable Market Index (IMI) Net Total Return (the “Benchmark”) over a rolling 5 year period, after the deduction of fees. Performance (net of fees) B share class Benchmark Difference 3 Months -1.4% -3.6% 2.2% 1 Year -17.1% -18.5% 1.4% 3 Years p.a. -5.9% -4.1% -1.8% 5 Years p.a. 3.8% 3.0% 0.8% 10 Years p.a. 7.8% 4.6% 3.1% Since Inception p.a. 12.6% 7.9% 4.7% 20% 10% 0% -10% -20% -30% 3 Months 1 Year 3 Years 5 Years 10 Years Since Inception p.a. p.a. p.a. p.a. ES R&M UK Recovery Fund B Shares MSCI UK IM Index Performance (gross of fees) Z class Z share class Benchmark Difference 3 Months -1.2% -3.6% 2.4% 1 Year -16.2% -18.5% 2.3% 3 Years p.a. -5.0% -4.1% -0.9% 5 Years p.a. 4.8% 3.0% 1.9% 10 Years p.a. 8.9% 4.6% 4.2% Source: River and Mercantile Asset Management LLP. Benchmark is the MSCI UK Investable Market index, net GBP. -

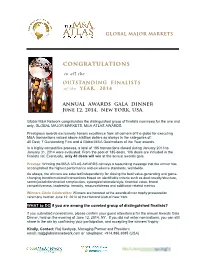

Announcing: Finalists Circle for the Prestigious M&A

GLOBAL MAJOR MARKETS CONGRATULATIONS to all the OUTSTANDING FINALISTS of the YEAR, 2014 ANNUAL AWARDS GALA DINNER June 12, 2014, New YORK, USA. Global M&A Network congratulates the distinguished group of finalists nominees for the one and only, GLOBAL MAJOR MARKETS, M&A ATLAS AWARDS. Prestigious awards exclusively honors excellence from all corners of the globe for executing M&A transactions valued above a billion dollars as always in the categories of: 40 Deal, 7 Outstanding Firm and 4 Global M&A Dealmakers of the Year awards. In a highly competitive process, a total of 185 transactions closed during January 2013 to January 31, 2014 were evaluated. From the pool of 185 deals, 106 deals are included in the finalists list. Eventually, only 40 deals will win at the annual awards gala. Prestige: Winning the M&A ATLAS AWARDS conveys a resounding message that the winner has accomplished the highest performance and excellence standards, worldwide. As always, the winners are selected independently for closing the best value-generating and game- changing transformational transactions based on identifiable criteria such as deal novelty/structure, sector/jurisdiction/market complexities, synergies/rationale/style, financial value, brand competitiveness, leadership, tenacity, resourcefulness and additional related metrics. Winners Circle Celebration: Winners are honored at the awards dinner trophy presentation ceremony held on June 12, 2014 at the Harvard Club of New York. WHAT to DO if you are among the coveted group of distinguished finalists? If you submitted nominations, please confirm your guest attendance for the annual Awards Gala Dinner, held on the evening of June 12, 2014, NY. -

Investment Banking and Capital Markets Sector

Financial Institutions Group Investment Banking and Capital Markets Sector U.S. MARKET UPDATE SUMMER 2021 Introduction: U.S. Investment Banking and Capital Markets Sector Houlihan Lokey’s Financial Institutions Group (FIG) is excited to release the inaugural edition of a new report on the U.S. investment banking and capital markets sector. Our report comes during a particularly dynamic period in the industry. While the volatility and turbulence of 2020 created a polarized environment of “winners and losers,” virtually all segments of the market are now experiencing strong performance. For the first time in years, M&A fee pools are up Y/Y in every sector. Growth has been fueled by pent-up 2020 demand now being unleashed, the specter of capital gains tax increases and a generally bullish backdrop of record stock prices and inexpensive debt financing. SPACs completely transformed the investment banking landscape, providing a boon to bulge-bracket underwriting desks and emerging as a buyer of choice for private assets. 571 SPACs launched IPOs in the last year, representing 60% of all IPO capital raised, and steered by everyone from Bill Ackman to Colin Kaepernick. Regardless of whether proposed regulatory reform materializes, hundreds of SPACs will be seeking and consummating transactions over the next couple of years. Just as pandemic-driven volatility was unwinding and trading volumes were beginning to decelerate, retail traders reasserted themselves as forces in the secondary market. As GameStop stock topped $400 in late January, market-wide daily equity trading volumes overtook records set at the height of the 2008 financial crisis. Volumes have once again begun settling, but new product origination and new ways for traders to access the market should create a longer-term lift for brokers, market-makers, exchanges, and technology providers. -

Investment Banking and Secondary Markets

Lecture 17: Investment Banking and Secondary Markets Economics 252, Spring 2008 Prof. Robert Shiller, Yale University Glass-Steagall Act 1933 • The modern concept of “Investment Bank” was created in the Glass-Steagall act (Banking Act of 1933). Glass Steagall separated commercial banks, investment banks, and insurance companies. • Carter Glass, Senator from Virginia, believed that commercial banks securities operations had contributed to the crash of 1929, that banks failed because of their securities operations, and that commercial banks used their knowledge as lenders to do insider trading of securities. Henry Paulson’s Proposal • Objectives-Based Regulation • Market stabililization Regulator • Prudential Financial Regulator • Business Conduct Regulator Paulson Continued • Federal Charter for insurance • Mortgage Origination Commission • SEC and CFTC merge • Merge OTS with OCC • Equip fed to monitor risks Investment Banks • Bulge bracket firms: First Boston, Goldman Sachs, Merrill Lynch, Morgan Stanley, Salomon Brothers, Lehman Brothers. • Traditionally were often partnerships, but partnership form is disappearing. Graham-Leach Act 1999 • President Clinton November 1999 signs Graham-Leach Bill which rescinded the Glass-Steagall Act of 1933. • Consumer groups fought repeal of Glass- Steagall saying it would reduce privacy. Graham-Leach calls for a study of the issues of financial privacy Mergers among Commercial Banks, Investment Banks & Insurance Companies • Travelers’ Group (insurance) and Citicorp (commercial bank) 1998 to produce Citigroup, on anticipation that Glass-Steagall would be rescinded. Brokerage Smith Barney • Chase Manhattan Bank (commercial bank) acquires JP Morgan (investment bank) (2000) for $34.5 billion • UBS Switzerland buys Paine Webber (brokerage) 2000 • Credit Suisse buys Donaldson Lufkin Jenrette (investment bank) 2000 Lehman Brothers • Founded 1850, by Henry Lehman, a young German immigrant, and his brothers • Investment banking, private equity, private banking, etc. -

Bofa and Merrill Together, Forever Changed

Reprinted from Blog: BofA and Merrill together, forever changed By Joe Mantone November 01, 2017 The unlikely marriage of Bank of America Corp. and Merrill BofA announced it would buy Merrill. Regulators trying to Lynch & Co. Inc. brought with it the specter of a major cul- quell the crisis essentially compelled the Charlotte, N.C.- ture clash, but the companies have managed to successfully based commercial bank to purchase the New York-based transform each other. bulge bracket firm. Ten years ago, Merrill Lynch found itself on the path toward “The marriage of Merrill with Bank of America was a peculiar a sale when Stanley O’Neal resigned as chairman and CEO. one to put it mildly,” said investment banker and Whalen The Oct. 30, 2007, resignation came less than a week after Global Advisors LLC Chairman Chris Whalen. Merrill reported a $2.3 billion quarterly loss and a $7.9 billion write-down related to subprime exposure. The transaction got off to a slow start as reports soon surfaced about financial adviser dissatisfaction at Merrill More losses and write-downs followed, and on Sept. 15, Lynch. Meanwhile, investor backlash about Merrill losses 2008, the day Lehman Brothers Inc. filed for bankruptcy, Net income for Bank of America by business segment ($B) Consumer banking* Global banking and markets** Global wealth and investment management All other 25 20 15 10 5 0 -5 2006 2007 2016 2017^ Data compiled Oct. 30, 2017. Data manually compiled from company released financial supplements and annual reports. * For 2006 and 2007, the figures shown are for the segment titled “Global Consumer and Small Business Banking.” ** For 2016 and 2017, figures represent the sum of segments titled “Global Banking” and “Global Markets.” For 2006 and 2007, the figures shown are for the segment titled “Global Corporate and Investment Banking.” ^ Figures shown are for the nine months ended Sept. -

Foreign Penetration of Japan's Investment-Banking

Foreign Penetration of Japan’s Investment-Banking Market: Will Japan Experience the “Wimbledon Effect”? Nicole Pohl July 2002 1 The Asia/Pacific Research Center (A/PARC) is an important Stanford venue where faculty and students, visiting scholars, and distinguished business and government leaders meet and exchange views on contemporary Asia and U.S. involvement in the region. A/PARC research results in seminars and conferences, published studies, occasional and discussion papers, special reports, and books. A/PARC maintains an active industrial affiliates and training program, involving more than twenty-five U.S. and Asian companies and public agencies. Members of A/PARC’s faculty have held high-level posts in government and business. Their interdisciplinary expertise generates research of lasting significance on economic, political, technological, strategic, and social issues. Asia/Pacific Research Center Encina Hall, Room E301 Stanford University Stanford, CA 94306-6055 http://APARC.stanford.edu 2 About the Author Nicole Pohl was a visiting scholar at the Asia/Pacific Research Center in 2001–2002. An assistant professor of economics at Franklin & Marshall College, she received her doctorate in economics from Gerhard Mercator University Duisburg in 2000. Her major research field is the economic geography of the financial sector. 3 4 Contents 1 Background 9 2 The Environment for Foreign Financial Institutions in Japan 13 2.1 Relationship Banking As a Barrier to Entry for Foreign Banks 13 2.2 The Role of Bureaucracy 14 3 Market-Entry Strategies -

The United States Dominates Global Investment Banking: Does It Matter for Europe?

BRUEGEL POLICY CONTRIBUTION ISSUE 2016/06 MARCH 2016 THE UNITED STATES DOMINATES GLOBAL INVESTMENT BANKING: DOES IT MATTER FOR EUROPE? CHARLES GOODHART AND DIRK SCHOENMAKER Highlights • In the aftermath of the global financial crisis, the market share of US investment banks is increasing, while that of their European counterparts is declining. We present evidence that US investment banks are on the verge of taking over pole position in European investment banking. Meanwhile, since 2015, Chinese investment banks have overtaken American and European investment banks in the Asia-Pacific market. • Credit rating agencies and investment banks are the gatekeepers of the capital markets. The European supervisory institutions can effectively supervise the European operations of these US-managed players. On the political side, we suggest that the European Commission should continue to view its, albeit declining, banking industry as a strategic sector. The Commission, the European Central Bank and the Bank of England should jointly develop a strategic agenda for the EU-US Regulatory Dialogue. • Finally, corporates rely on investment banks to issue new securities. We recommend that the big European corporates should cherish the (few) remaining European Telephone investment banks, by giving them at least one place in otherwise US- +32 2 227 4210 dominated banking syndicates. That could help to avoid complete dependence on US [email protected] investment banks. www.bruegel.org Charles Goodhart is Emeritus Professor at the Financial Markets Group, London School of Economics. Dirk Schoenmaker ([email protected]) is a Senior Fellow at Bruegel and Professor of Banking and Finance at Rotterdam School of Management, Erasmus University. -

The Decline of Investment Banking: Preliminary Thoughts on the Evolution of the Industry 1996-2008, 5 J

University of Florida Levin College of Law UF Law Scholarship Repository Faculty Publications Faculty Scholarship 2010 The eclineD of Investment Banking: Preliminary Thoughts on the Evolution of the Industry 1996-2008 Robert J. Rhee University of Florida Levin College of Law, [email protected] Follow this and additional works at: http://scholarship.law.ufl.edu/facultypub Part of the Banking and Finance Commons Recommended Citation Robert J. Rhee, The Decline of Investment Banking: Preliminary Thoughts on the Evolution of the Industry 1996-2008, 5 J. Bus. & Tech. L. 75 (2010), available at http://scholarship.law.ufl.edu/facultypub/482 This Article is brought to you for free and open access by the Faculty Scholarship at UF Law Scholarship Repository. It has been accepted for inclusion in Faculty Publications by an authorized administrator of UF Law Scholarship Repository. For more information, please contact [email protected]. ROBERT J. RHEE* The Decline of Investment Banking: Preliminary Thoughts on the Evolution of the Industry 1996-2008 DURING THE ROUNDTABLE DISCUSSION ON THE financial crisis,' I noted that it was important to understand finance and the financial industry as a part of legal dis- course and education. This paper is a continuation of that thought. The financial crisis of 2008-2009 was shocking in many ways. For me, a major shock was the sudden collapse of three "bulge bracket" investment banks from the competitive landscape in an industry that was already starting to look like an oligopoly. From time to time, investment banks implode due to poor risk management and/or mal- feasance. -

Investment Banking Demystified

BANKING AT MICHIGAN: Investment Banking Demystified Decoding the Investment Banking recruitment process www.bankingatmichigan.org M I C H G A N B A N K I G T BANKING AT MICHIGAN Website 1 Agenda ● What is investment banking (IB)? ● What are the different types of IBs? ● Why start a career in IB? ● What does an IB analyst do on the job? ● What is the recruitment process like? ● What does Banking at Michigan (BAM) do and how can the club help me? ● How can I get more involved with BAM? M I C H G A N B A N K I G T BANKING AT MICHIGAN Website 2 TEAM M I C H G A N B A N K I G T BANKING AT MICHIGAN Website 3 Our Team ● Directors ○ Rishi Prasad (Investment Banking @ Goldman Sachs) ○ Matthew Balsei (Investment Banking @ Goldman Sachs) ○ Deven Bhatt (Investment Banking @ Morgan Stanley) ○ Ethan Tuckman (Investment Banking @ Rothschild & Co.) ○ Ally Gillman (Investment Banking @ Jefferies) ● Vice Presidents (Juniors) M I C H G A N ○ Will Tso ○ Ryan Haggerty ● Analysts (Freshman & Sophomores, past Juniors) ○ 8 in our first cohort (looking to expand to 15-20+ this semester) B A N K I G T BANKING AT MICHIGAN Website 4 INVESTMENT BANKING OVERVIEW M I C H G A N B A N K I G T BANKING AT MICHIGAN Website 5 What are Investment Banks? ● Trusted advisors and financiers to a diverse client base ● Investments banks provide advisory services (e.g. Mergers & Acquisitions or Restructuring) ● Investment banks help clients raise capital (through debt or equity) M I C H G A N B A N K I G T BANKING AT MICHIGAN Website 6 What are Investment Banks? ● Investment banks -

Challenger Exploration Limited 22 April 2021 COLTS - Metals and Mining

Initiation of Coverage Challenger Exploration Limited 22 April 2021 COLTS - Metals and Mining Paul Howard | Analyst | Canaccord Genuity (Australia) Ltd. | [email protected] | +61.8.9263.1155 Rating Price Target Reg Spencer | Analyst | Canaccord Genuity (Australia) Ltd. | [email protected] | +61.2.9263.2701 SPECULATIVE BUY A$0.55 Price Tango & Cash: High-grade gold in Argentina CEL-ASX A$0.31 Challenger Exploration (CEL-ASX) is a gold exploration company with two key assets in South America. It is earning 75% of the Hualilan Gold Project in the prolific San Market Data Juan Province of western Argentina and has just commenced a new 30,000m (recently 52-Week Range (A$) : 0.09 - 0.40 completed 45,000m), five drill rig resource confirmation and expansion program. Avg Daily Vol (M) : 0.5 Hualilan already hosts a high-grade, foreign resource (NI43-101) of 627koz @ 13.7g/ Market Cap (A$M) : 204.0 t AuEq dating back to La Mancha’s ownership in 2003, which remains open and may Shares Out. (M) : 658.2 present significant growth upside, in our view. The resource ranks among the highest Dividend /Shr (A$) : 0.00 Dividend Yield (%) : 0.0 grade ASX deposits in our extensive database. In our view, San Juan is an attractive Enterprise Value (A$M) : 190 mining destination with majors such as Barrick (GOLD-NYSE), Shandong (1787-SEHK) NAV /Shr (A$) : 0.53 and Glencore (GLEN-LSE) all active in the region. CEL is also exploring the El Guayabo/ NAV /Shr (5%) (A$) : 1.00 Colorado V Gold-Copper Project in Ecuador through an earn-in of up to 100%. -

Investment Banking (Bulge Bracket)

Investment Banking (Bulge Investment Banking (Middle Sales & Trading Research Banking Corporate Finance (Fortune Investment Management Investment Advisory/ Wealth Government/Non- Management Consulting Bracket) Market) 500) Management Profit/Other Representative Firms Goldman Sachs, JP Morgan, Harris Williams, Wells Bulge Bracket + ABN, Bulge Bracket + Most Sales Bank of America, JP Morgan GE, Altria, CapitalOne, BNY Mellon, Dreyfus, Bulge Bracket, Many Federal, State, Local Bain, McKinsey, Boston Morgan Stanley, Citi, Fargo, Cowen, Stifel DKW, BMO, CIBC, Mizuho, & Trading, Boutiques Chase, Citibank, Wells IBM, Proctor & Gamble, Edward Jones, Fidelity, Commercial Banks, Government; Consulting Group, Booz Deutsche Bank, Credit Nicolaus, Jefferies, Houlihan SocGen, Nomura, some Fargo, HSBC, US Bancorp, Johnson & Johnson, Franklin Templeton, Insurance Companies, SEC, FBI, IRS, FannieMae, Allen Hamilton, Mercer, Suisse, Bank of Lokey, BB&T, William Commercial Banks, Others PNC, BNY Mellon, Microsoft, United Hartford, Janus, Legg Independents SallieMae; Deloitte, Monitor, America/Merrill Lynch, Blair, RW Baird, SunTrust, BB&T, Citizens, Technologies, PepsiCo, Mason, MFS, New York Non-Profits Accenture, UBS, Barclays, Lazard, RBS, Oppenheimer, Thomas KeyBank, M&T, Regions Caterpillar, Honeywell, etc. Life, Northern Trust, Boutiques BNP Wiesel, Raymond James, Bank, other smaller banks PIMCO, Prudential, T. Rowe Morgan Joseph, Evercore, Price, Vanguard, Wellington, Greenhill, Moelis, multiple large insurance companies others Competition for Job