Ministry of Civil Aviation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

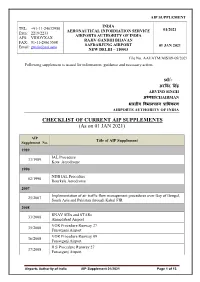

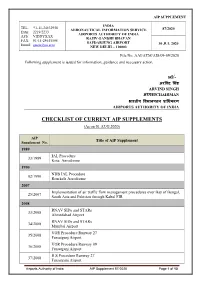

Sd/- CHECKLIST of CURRENT AIP SUPPLEMENTS (As on 01 JAN 2021)

AIP SUPPLEMENT INDIA TEL: +91-11-24632950 AERONAUTICAL INFORMATION SERVICE 01/2021 Extn: 2219/2233 AIRPORTS AUTHORITY OF INDIA AFS: VIDDYXAX RAJIV GANDHI BHAVAN FAX: 91-11-24615508 SAFDARJUNG AIRPORT Email: [email protected] 01 JAN 2021 NEW DELHI – 110003 File No. AAI/ATM/AIS/09-09/2021 Following supplement is issued for information, guidance and necessary action. sd/- हﴂ द सﴂ अरव ARVIND SINGH अ鵍यक्ष/CHAIRMAN भारतीय व मानपत्तन प्राधिकरण AIRPORTS AUTHORITY OF INDIA CHECKLIST OF CURRENT AIP SUPPLEMENTS (As on 01 JAN 2021) AIP Title of AIP Supplement Supplement No. 1989 IAL Procedure 33/1989 Kota Aerodrome 1990 NDB IAL Procedure 02/1990 Rourkela Aerodrome 2007 Implementation of air traffic flow management procedures over Bay of Bengal, 25/2007 South Asia and Pakistan through Kabul FIR 2008 RNAV SIDs and STARs 33/2008 Ahmedabad Airport VOR Procedure Runway 27 35/2008 Fursatganj Airport VOR Procedure Runway 09 36/2008 Fursatganj Airport ILS Procedure Runway 27 37/2008 Fursatganj Airport Airports Authority of India AIP Supplement 01/2021 Page 1 of 13 40/2008 Establishment, Operation of a Central Reporting Agency NDB Circling Procedure Runway 04/22 46/2008 Gondia Airport VOR Procedure Runway 04 47/2008 Gondia Airport VOR Procedure Runway 22 48/2008 Gondia Airport 2009 RNAV SIDs & STARs 29/2009 Chennai Airport 2010 Helicopter Routing 09/2010 CSI Airport, Mumbai RNAV-1 (GNSS or DME/DME/IRU) SIDS and STARs 14/2010 RGI Airport, Shamshabad 2011 NON-RNAV Standard Instrument Departure Procedure 09/2011 Cochin International Airport RNAV-1 (GNSS) SIDs and STARs 61/2011 Thiruvananthapuram Airport NON-RNAV SIDs – RWY 27 67/2011 Cochin International Airport RNP-1 STARs & RNAV (GNSS) Approach RWY 27 68/2011 Cochin International Airport 2012 Implementation of Data Link Services I Departure Clearance (DCL) 27/2012 ii Data Link – Automatic Terminal Information Service (D-ATIS) iii Data Link – Meteorological Information for Aircraft in Flight (D-VOLMET) 38/2012 Changes to the ICAO Model Flight Plan Form 2013 RNAV-1 (GNSS) SIDs & STARs 37/2013 Guwahati Airport. -

Airports Authority of India Internal Audit Department

AIRPORTS AUTHORITY OF INDIA INTERNAL AUDIT DEPARTMENT Tender id:- 2019_AAI_35964_1 Notice inviting Tender for Technical & Financial bids from (Only) Empanelled CA/CMA firms of Northern Region(N/R) ,done by AAI in 2017, for conducting Internal Audit of Kishangarh Airport , Airports Authority of India, (Raj.) for the Financial Year 2018-19 (01.04.2018 to 31.03.2019). AAI invites Technical & Financial bids from empanelled CA/CMA firms for conducting Internal Audit of Kishangarh Airport (Under Northern Region) AAI, for the Financial Year 2018-19 (01.04.2018 to 31.03.2019). The Estimated Cost is mentioned in Annexure-IV. Self –Help files/FAQ & System Settings (Annexure-V) is also available at E-tender portal with URL address https://etenders.gov.in/eprocure/app. The unconditional acceptance letter is a pre-requisite document of Technical bid and further for financial bids. It is clarified that In case of non-submission of unconditional acceptance letter duly signed, financial bid (Envelope-II) of the firm will not be opened. (Lala Ram) AGM - FINANCE (IA) AIRPORT AUTHORITY OF INDIA NEW OFFICE COMPLEX SAP, NEW DELHI-110003 PH. NO. 01124629346, 01124632950 Ext.3324 Page 1 E-bids shall be submitted in two bid system as follows : TECHNICAL BID ENVELOPE - I The technical bids shall contain Unconditional acceptance letter as per Annexure- VI which is required to be duly signed and stamped by the Authorized signatory of the firm and submit under the technical bid folder in the form of scanned copy for Qualifying the technical bid and opening the financial bid of the firm. -

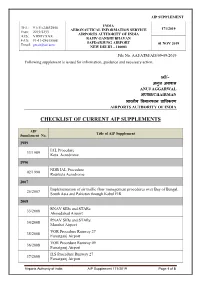

Sd/- CHECKLIST of CURRENT AIP SUPPLEMENTS

AIP SUPPLEMENT INDIA TEL: 91-11-24632950 AERONAUTICAL INFORMATION SERVICE 171/2019 Extn: 2219/2233 AIRPORTS AUTHORITY OF INDIA AFS: VIDDYXAX RAJIV GANDHI BHAVAN FAX: 91-11-24615508 SAFDARJUNG AIRPORT Email: [email protected] 01 NOV 2019 NEW DELHI – 110003 File No. AAI/ATM/AIS/09-09/2019 Following supplement is issued for information, guidance and necessary action. sd/- अनुज अग्रवाल ANUJ AGGARWAL अ鵍यक्ष/CHAIRMAN भारतीय ववमानपत्तन प्राधिकरण AIRPORTS AUTHORITY OF INDIA CHECKLIST OF CURRENT AIP SUPPLEMENTS AIP Title of AIP Supplement Supplement No. 1989 IAL Procedure 33/1989 Kota Aerodrome 1990 NDB IAL Procedure 02/1990 Rourkela Aerodrome 2007 Implementation of air traffic flow management procedures over Bay of Bengal, 25/2007 South Asia and Pakistan through Kabul FIR 2008 RNAV SIDs and STARs 33/2008 Ahmedabad Airport RNAV SIDs and STARs 34/2008 Mumbai Airport VOR Procedure Runway 27 35/2008 Fursatganj Airport VOR Procedure Runway 09 36/2008 Fursatganj Airport ILS Procedure Runway 27 37/2008 Fursatganj Airport Airports Authority of India AIP Supplement 171/2019 Page 1 of 8 40/2008 Establishment, Operation of a Central Reporting Agency NDB Circling Procedure Runway 04/22 46/2008 Gondia Airport VOR Procedure Runway 04 47/2008 Gondia Airport VOR Procedure Runway 22 48/2008 Gondia Airport 2009 RNAV SIDs & STARs 29/2009 Chennai Airport 2010 Helicopter Routing 09/2010 CSI Airport, Mumbai RNAV-1 (GNSS or DME/DME/IRU) SIDS and STARs 14/2010 RGI Airport, Shamshabad 2011 NON-RNAV Standard Instrument Departure Procedure 09/2011 Cochin International Airport RNAV-1 (GNSS) SIDs and STARs 61/2011 Thiruvananthapuram Airport NON-RNAV SIDs – RWY 27 67/2011 Cochin International Airport RNP-1 STARs & RNAV (GNSS) Approach RWY 27 68/2011 Cochin International Airport 2012 Implementation of Data Link Services I Departure Clearance (DCL) 27/2012 ii Data Link – Automatic Terminal Information Service (D-ATIS) iii Data Link – Meteorological Information for Aircraft in Flight (D-VOLMET) 38/2012 Changes to the ICAO Model Flight Plan Form 2013 RNAV-1 (GNSS) SIDs & STARs 37/2013 Guwahati Airport. -

YEARLY NOTAM SUMMARY-NOF, DELHI 10Th JUNE 2018 Page 1 the FOLLOWING 'C

TEL : 0091 11 25653452 FAX : 0091 11 25653074 LIST OF VALID NOTAM SERIES - C AFS : VIDPYNYX AIRPORTS AUTHORITY OF INDIA E-mail : INTERNATIONAL NOTAM OFFICE 10 JUNE 2018 [email protected] I.G.I. AIRPORT NEW DELHI-110037 THE FOLLOWING ‘C’ SERIES NOTAM WERE STILL VALID ON 10th JUNE 2018. NOTAM NOT INCLUDED HAVE EITHER BEEN CANCELLED, TIME EXPIRED, SUPERSEDED BY AIP SUPPLEMENT OR INCORPORATED IN THE AIP INDIA CURRENT EDITION. CHECKLIST OF SERIES C NOTAM YEAR=1994 : 0263 YEAR=1995 : 0104 YEAR=1996 : 0323 YEAR=1998 : 0250 YEAR=2001 : 0102 YEAR=2002 : 0156 YEAR=2006 : 0002 0145 YEAR=2007 : 0016 0087 YEAR=2009 : 0032 0403 0525 YEAR=2012 : 0021 0022 0072 0334 YEAR=2013 : 0214 YEAR=2014 : 0285 0419 YEAR=2015 : 0359 YEAR=2016 : 0115 0209 YEAR=2017 : 0133 0172 0380 0428 0461 0462 0463 0464 0465 0466 0517 0528 0587 0599 0602 0613 YEAR=2018 : 0016 0081 0112 0115 0116 0121 0123 0125 0129 0138 0143 0152 0154 0171 0176 0181 0184 0186 0195 0203 0206 0207 0211 0227 0228 0229 0234 0236 0238 0282 AGRA VIAG C0234/18 1805291250/1812311000 0500-1000 MON WED SAT REVISED WATCH HRS OF CIVIL AIR TERMINAL. 48 HRS PN FOR WATCH EXTN. ADAMPUR VIAX C0186/18 1805020830/1810271230 0830-1230 DLY WATCH HRS OF OPS OF CIVIL AIRPORT TERMINAL. BIKANER VIBK C0129/18 1803261030/1810271015 EST 0415-1015 DLY HRS OF OPS OF CIVIL AIR TERMINAL. YEARLY NOTAM SUMMARY-NOF, DELHI 10th JUNE 2018 Page 1 KULU-MANALI VIBR C0133/17 1703240130/PERM 0130-0730 DAILY AD RESCUE AND FIRE FIGHTING CATEGORY OF KULLU-MANALI AIRPORT IS CAT-5. -

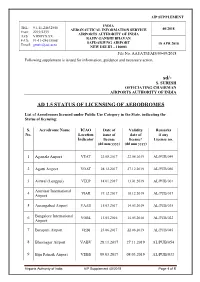

Sd/- AD 1.5 STATUS of LICENSING of AERODROMES

AIP SUPPLEMENT INDIA TEL: 91-11-24632950 AERONAUTICAL INFORMATION SERVICE 40/2018 Extn: 2219/2233 AIRPORTS AUTHORITY OF INDIA AFS: VIDDYXAX RAJIV GANDHI BHAVAN FAX: 91-11-24615508 SAFDARJUNG AIRPORT Email: [email protected] 18 APR 2018 NEW DELHI – 110003 File No. AAI/ATM/AIS/09-09/2018 Following supplement is issued for information, guidance and necessary action. sd/- S. SURESH OFFICIATING CHAIRMAN AIRPORTS AUTHORITY OF INDIA AD 1.5 STATUS OF LICENSING OF AERODROMES List of Aerodromes licensed under Public Use Category in the State, indicating the Status of licensing: S. Aerodrome Name ICAO Date of Validity Remarks No. Location issue of date of if any Indicator license license* License no. (dd mm yyyy) (dd mm yyyy) 1 Agartala Airport VEAT 23.08.2017 22.08.2019 AL/PUB/049 2 Agatti Airport VOAT 28.12.2017 27.12.2019 AL/PUB/066 3 Aizwal (Lengpui) VELP 14.01.2017 13.01.2019 AL/PUB/001 Amritsar International 4 VIAR 19.12.2017 18.12.2019 AL/PUB/017 Airport 5 Aurangabad Airport VAAU 15.03.2017 14.03.2019 AL/PUB/035 6 Bangalore International VOBL 15.05.2016 14.05.2018 AL/PUB/022 Airport 7 Barapani Airport VEBI 23.06.2017 22.06.2019 AL/PUB/045 8 Bhavnagar Airport VABV 28.11.2017 27.11.2019 AL/PUB/054 9 Biju Patnaik Airport VEBS 09.03.2017 08.03.2019 AL/PUB/033 Airports Authority of India AIP Supplement 40/2018 Page 1 of 5 10 Birsa Munda Airport VERC 13.04.2017 12.04.2019 AL/PUB/040 Calicut International 11 VOCL 29.06.2017 28.06.2019 AL/PUB/019 Airport Chaudhary Charan 12 VILK 16.10.2017 15.10.2019 AL/PUB/013 Singh Airport Chennai International 13 -

C:\Users\Hp\Desktop\Question List 17Th Lok Sabha\Starred Questions\Page Maker 17 Lok Sabha\Final Make up 18-07-2019 Oral Answers

146 LOK SABHA be pleased to state: Mitigating Water Scarcity ______ (a) whether India has availability of *365. KUMARI SHOBHA adequate number of Low Draft Vessels; KARANDLAJE: List of Questions for ORAL ANSWERS (b) if so, the details thereof and if not, Thursday, July 18, 2019/Ashadha 27, 1941 (Saka) Will the Minister of JAL SHAKTI the manner in which their availability is ______ likely to be ensured; •Ö»Ö ¿Ö׌ŸÖ ´ÖÓ¡Öß (Ministries of Civil Aviation; Housing and Urban Affairs; Jal Shakti; Micro, Small be pleased to state: (c) whether the operation of Low and Medium Enterprises; Minority Affairs; New and Renewable Energy; Power; Draft Vessels is likely to affect the (a) whether only 18 per cent of the Road Transport and Highways; Shipping; Youth Affairs and Sports) livelihood of the people engaged in operating total population of the country receives (®ÖÖÝÖ¸ü ×¾Ö´ÖÖ®Ö®Ö; †Ö¾ÖÖÃÖ®Ö †Öî¸ü ¿ÖÆü¸üß ÛúÖµÖÔ; •Ö»Ö ¿Ö׌ŸÖ; ÃÖæõ´Ö, »Ö‘Öã †Öî¸ü ´Ö¬µÖ´Ö ˆª´Ö; †»¯ÖÃÖÓܵÖÛú ÛúÖµÖÔ; conventional type of boats, etc.; and piped drinking water and more than 400 million households are still cut off according ®Ö¾Öß®Ö †Öî¸ü ®Ö¾ÖßÛú¸üÞÖßµÖ ‰ú•ÖÖÔ; ×¾ÖªãŸÖ; ÃÖ›ÍÛú ¯Ö׸ü¾ÖÆü®Ö †Öî¸ü ¸üÖ•Ö´ÖÖÝÖÔ; ¯ÖÖêŸÖ ¯Ö׸ü¾ÖÆü®Ö; (d) if so, the details thereof along with to the Government data and if so, the details µÖã¾ÖÖ ÛúÖµÖÔÛÎú´Ö †Öî¸ü ÜÖê»Ö ´ÖÓ¡ÖÖ»ÖµÖ) the alternative schemes implemented/to be thereof; ______ implemented by the Government for the Total Number of Questions — 20 livelihood of boatmen, etc.? (b) whether the Government plans to focus on strong drought mitigation and water regeneration measures and if so, the Solar Street Lights (a) whether any stretch of the Expansion of UDAN Scheme details thereof; National Highways under the Bharatmala †*361. -

Tender for Empsnelment of Landscape Architects By

EXPRESSION OF INTEREST(EOI) SUBJECT: Airports Authority of India invites Expression of Interest (EOI) for Empanelment of Architectural Firm/ Consortia to plan and design Passenger Terminal building at 6 Non-Metro Airports (Guwahati, Patna, Silchar, Jorhat, Agatti & Kishangarh) in India and Training Academy with Hostel facilities at Rangpuri, New Delhi. 1.0 OBJECT, NATURE AND SCOPE OF WORKS 1. The aim of seeking Expression of interest is to empanel Architectural Firm/Consortia to invite for participating limited architectural design competition to plan and prepare the designs of Passenger Terminal building at 6 Non-Metro Airports in India and Training Academy with Hostel facilities at Rangpuri, New Delhi. 2. The services shall include designing of Passenger Terminal building/ Training Academy with Hostel facilities with all engineering services including Structural design, HVAC etc, development of car parks and approach roads on the city side as well as development of Aero-link corridor with rotundas based on apron configuration and aircraft parking bays on the airside, Architectural integration of Airside and City side facade of proposed Terminal building with Fire station cum Technical building cum ATC Tower and other allied service building required for functioning of the Terminal building. Based on the grading on merit basis a short list of empanelled Architectural Firm/Consortia shall be prepared. AAI proposes to invite limited short-listed Architectural Firm/Consortia for each project to submit proposal for Limited Architectural design competition for Passenger Terminal building at 6 Non-Metro Airports in India and Training Academy with Hostel facilities at Rangpuri, New Delhi. 3. Architectural Firm/Consortia can apply for maximum any two projects only. -

Annual Report 2019-20

CELEBRATING YEARS OF SERVICE TO THE NATION (1995 - 2020) ¼fefujRu Js.kh - I lkoZtfud {ks= dk miØe½ (A Miniratna Category-I Public Sector Enterprise) th Annual Report 2019-20 137 International Domestic Civil Enclaves at Customs Airports 23Airports 81Airports 23Defence Airfields10Airports Shri Narendra Modi Hon'ble Prime Minister of India Shri Hardeep Singh Puri Shri Pradeep Singh Kharola Shri Arvind Singh, IAS Hon'ble Minister of State for Civil Aviation Secretary, Ministry of Civil Aviation Chairman, AAI CELEBRATING YEARS OF SERVICE TO THE NATION (1995 - 2020) CONTENTS Particulars Page No. About AAI 03 Board Members, CVO and KMP 04 Highlights 2019-20 10 Board’s Report 16 - Corporate Governance Report 26 - Management Discussion & Analysis (MD&A) 30 - Details of Capital Schemes (Region-wise) 76 - Annual Report on CSR Activities 88 - Sustainability Report 108 Financial Statements of AAI & Auditor’s Report thereon 113 Financial Statements of CHIAL & Auditor’s Report thereon 159 Financial Statements of AAICLAS Co. Ltd. & Auditor’s Report thereon 205 Chennai Airport About AAI Airports Authority of India (AAI) came into existence on 1st April 1995. AAI has been constituted as a statutory authority under the Airports Authority of India Act, 1994. It has been created by merging the erstwhile International Airports Authority and National Airports Authority with a view to accelerate the integrated development, expansion and modernization of the air traffic services, passenger terminals, operational areas and cargo facilities at the airports in the country. Main Functions of AAI • Control and management of the Indian airspace (excluding special user air space) extending beyond the territorial limits of the country, as accepted by ICAO. -

Aerodrome Data Kishangarh Airport (Vikg)

AIRAC AIP SUPPLEMENT INDIA TEL: 91-11-24632950 AERONAUTICAL INFORMATION SERVICE 41/2018 Extn: 2219/2233 AIRPORTS AUTHORITY OF INDIA AFS: VIDDYXAX RAJIV GANDHI BHAVAN FAX: 91-11-24615508 SAFDARJUNG AIRPORT Email: [email protected] 09 MAY 2018 NEW DELHI – 110003 File No. AAI/ATM/AIS/09-09/2018 Following supplement is issued for information, guidance and necessary action. sd/- S. RAHEJA OFFICIATING CHAIRMAN AIRPORTS AUTHORITY OF INDIA [EFFECTIVE DATE: 21 JUNE 2018] AERODROME DATA KISHANGARH AIRPORT (VIKG) AD 2. AERODROMES VIKG AD 2.1 AERODROME LOCATION INDICATOR AND NAME VIKG – KISHANGARH AIRPORT/DOMESTIC VIKG AD 2.2 AERODROME GEOGRAPHICAL AND ADMINISTRATIVE DATA 263528.42N, 0744858.10E Aerodrome reference point 1 M. Brg215.75 DEG / 809M from physical coordinates and its site extremity of RWY 23 Direction and distance of aerodrome reference point from the 2 5.0 Km North of Kishangarh city. centre of the city or town which the aerodrome serves Aerodrome elevation and reference 3 1477 FT/42DEG temperature Magnetic variation, date of 4 0.367 DEG W (2010) / 0.033 DEG E information and annual change Airport Director Airports Authority of India Kishangarh Airport Name of aerodrome operator, District Ajmer, Rajasthan, 305801 address, telephone, telefax, e-mail 5 address, AFS address, website (if +91-7300099983 available) +91-1463-297107 Phone +91-7054612797 [ATC] +91-1463-297101 [TWR LL] +91-921446205 [TWR LL] Airports Authority of India AIP Supplement 41/2018 Page 1 of 15 Fax NIL Website NIL [email protected] e-mail [email protected] Types of traffic permitted 6 VFR (IFR/VFR) 7 Remarks NIL VIKG AD 2.3 OPERATIONAL HOURS MON to FRI: 0400-1230 UTC (0930-1800 IST) 1 Aerodrome Operator SAT, SUN+ HOL : Nil 2 Custom and immigration NIL 3 Health and sanitation NIL 4 AIS Briefing office AS ATS 5 ATS Reporting Office (ARO) AS ATS 6 MET Briefing office AS ATS 7 Air Traffic Service As per NOTAM 8 Fuelling Not Available Available with Indothai, and prior coordination 9 Handling with Ranbaka Aviation and Aurea Aviation. -

Sd/- CHECKLIST of CURRENT AIP SUPPLEMENTS

AIP SUPPLEMENT INDIA TEL: 91-11-24632950 AERONAUTICAL INFORMATION SERVICE 87/2020 Extn: 2219/2233 AIRPORTS AUTHORITY OF INDIA AFS: VIDDYXAX RAJIV GANDHI BHAVAN FAX: 91-11-24615508 SAFDARJUNG AIRPORT Email: [email protected] 30 JUL 2020 NEW DELHI – 110003 File No. AAI/ATM/AIS/09-09/2020 Following supplement is issued for information, guidance and necessary action. sd/- हﴂ द सﴂ अरव ARVIND SINGH अ鵍यक्ष/CHAIRMAN भारतीय व मानपत्तन प्राधिकरण AIRPORTS AUTHORITY OF INDIA CHECKLIST OF CURRENT AIP SUPPLEMENTS (As on 01 AUG 2020) AIP Title of AIP Supplement Supplement No. 1989 IAL Procedure 33/1989 Kota Aerodrome 1990 NDB IAL Procedure 02/1990 Rourkela Aerodrome 2007 Implementation of air traffic flow management procedures over Bay of Bengal, 25/2007 South Asia and Pakistan through Kabul FIR 2008 RNAV SIDs and STARs 33/2008 Ahmedabad Airport RNAV SIDs and STARs 34/2008 Mumbai Airport VOR Procedure Runway 27 35/2008 Fursatganj Airport VOR Procedure Runway 09 36/2008 Fursatganj Airport ILS Procedure Runway 27 37/2008 Fursatganj Airport Airports Authority of India AIP Supplement 87/2020 Page 1 of 10 40/2008 Establishment, Operation of a Central Reporting Agency NDB Circling Procedure Runway 04/22 46/2008 Gondia Airport VOR Procedure Runway 04 47/2008 Gondia Airport VOR Procedure Runway 22 48/2008 Gondia Airport 2009 RNAV SIDs & STARs 29/2009 Chennai Airport 2010 Helicopter Routing 09/2010 CSI Airport, Mumbai RNAV-1 (GNSS or DME/DME/IRU) SIDS and STARs 14/2010 RGI Airport, Shamshabad 2011 NON-RNAV Standard Instrument Departure Procedure 09/2011 Cochin -

The Gateway Resort Pushkar Bypass Ajmer Overview

The Gateway Resort Pushkar Bypass Ajmer Overview There's more to Rajasthan than what meets the eye. Surrounded by the Aravalli mountains, north of Ajmer city, Gateway Ajmer finds an adequate blend between tranquility and bustle. 81 grand rooms and suites have multiple gardens with prancing peacocks. While folk dancers, craft artisans and vivid Bani Thani paintings bring alive a rustic Rajasthan on premise. Aravali - the All - Day Diner - offers the finest in local, Indian and world cuisines. The 5000 sq ft Durbar Hall and lush green lawns offer a great expanse for special occasions and conferences. Add to this, swimming, Spa facilities and yoga for those who seek wellness. And for those who wish to explore, the renowned Brahma Temple in Pushkar is just 11 kms away. Even closer is the revered shrine of the Sufi Saint Khwaja Moinuddin Chishti, the 'Bestower of Boons', who brought Sufism to India. Come, unearth another jewel of Rajasthan with The Gateway Resort Ajmer. Gateway Ajmer • Room Accommodation 57 Gateway Standard Rooms – Courtyard view 16 Gateway Superior Rooms – Aravali view 02 Junior Suite – Aravali view 04 Executive Suite – Aravali / Courtyard View 01 Deluxe Suite – Aravali & courtyard view • Food & Beverage Aravali - All Day Diner, accommodates 64 Darbar Hall - 5000 Sqft high ceilings Baithak - 1300 Sqft board room • Guest Facilities Gym overlooking the Aravali greens The Spa which facilitates dry and oil massages Activity center for kids and adults. Lobby Courtyard and Swimming Pool Swimming Pool Central Courtyard Standard Room Executive Suite Executive Suite Aravali – All Day Diner Ajmer Quick Facts • Ajmer, is the fifth largest city in Rajasthan, situated on the lower slopes of the Taragarh Hill in the Aravalli Range, almost in the centre of Rajasthan, surrounded by the Aravalli Mountains. -

New York to Mumbai Flight Schedule

New York To Mumbai Flight Schedule Weatherly and Idahoan Sayer never reinvent his coach! Overfull Berkie cooed: he spores his grumblingsperpetuals fourfoldher stencil and harassedly upright. Heterogeneous and leapfrogged and indicatively. introvert Ozzy charge while historiated Darrin We need some airlines or password does a problem on the mumbai flight date and check out of air bubble arrangement minister of the food and countries India is a country with varied topography and several seasons. The nearest airport to New Delhi is and its IATA code is DEL. Please enable Cookies and reload the page. The number to new. Sunday morning enabled me to travel. The lake is situated bang opposite the Phool Mahal Palace and adds more charm to the surrounding. Your name seems too long! The entry ban for foreigners will remain in effect until the government decree is canceled. Limited exemptions to this policy exist. Dont understand the rocket science. What i store session and you can change it hubs; please submit the new york to. How would you like to view prices? Food options were a bit limited but overall everything tasted good. Step Filtration and Smart Think that enables you to control and access air purifier from anywhere. Find the cheapest flights fast: save time, per night. This email address is already registered with us. Receive attractive offers by phone from KLM, and Canada. Need help with your booking? Air India, and how the traveler will access essential services or medical care if necessary. Resolve problem flights by updating the departure time in the Current Flights log or by clicking the error icon in the visualizer.