Malaysia Daybreak | 2 September 2021 FBMKLCI Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

With Israel? Malaysiakini.Com 14 Februari 2018 Has Malaysia

Harapan MP: Is Malaysia having ‘an affair’ with Israel? MalaysiaKini.com 14 Februari 2018 Has Malaysia softened its stance on Israel by allowing the latter's high- ranking officials to enter the country, questioned an Amanah lawmaker today. Kuala Terengganu MP Raja Kamarul Bahrin Shah Raja Ahmad in a statement said the government's "unannounced" move had caused shock and sadness amongst many Muslims in the country. "Have we pawned the pride of Muslims in matters concerning Israel just for the sake of money and trade? “Just days after the deputy prime minister sent home 12 Uighur Muslims back to China on the pretext of maintaining "good relations" between the two countries what has become of Muslim dignity and pride in the country?" he asked. Kamarul Bahrin was responding to news reports that a delegation of Israeli diplomats had attended the recent week-long ninth Urban World Forum in Kuala Lumpur. The delegation was reportedly led by David Roet who was formerly Israel's deputy ambassador to the United Nations. Kamarul Bahrin urged Malaysia to state clearly, its current position on Israel. "Is this a product of the wasatiyah concept practised by (Prime Minister) Najib (Abdul Razak) or upon the advice of the 'Global Movement of Moderates' led by Nasaruddin Mat Isa and which had caused the government's change in attitude and policy? The rakyat wants to know. "Or is Najib so eager to follow in the footsteps of the Saudi Arabian government which reportedly has close ties to Israel? Is Malaysia having an 'affair' with Israel'?" he asked. -

JFKL Publication 11-01.Eps

Past, Present and Future: The 30th Anniversary of the Japan Foundation, Kuala Lumpur Greetings from the Director The Japan Foundation was established in 1972 with the main goal of cultivating friendship and ties between Japan and the world through culture, language, and dialogue. The Kuala Lumpur ofice known as The Japan Foundation Kuala Lumpur Liaison Ofice was established at Wisma Nusantara, off Jalan P. Ramlee on 3 October 1989 as the third liaison ofice in SEA countries, following Jakarta and Bangkok. The liaison ofice was upgraded to Japan Cultural Centre Kuala Lumpur with Prince Takamado attending the opening ceremony on 14 February 1992. Japanese Language Centre Kuala Lumpur was then opened at Wisma Nusantara on 20 April 1995. In July 1998, the ofice moved to Menara Citibank, Jalan Ampang and then once more to our current ofice in Northpoint, Mid-Valley in September 2008. Since the establishment, the Japan Foundation, Kuala Lumpur (JFKL) has been working on various projects such as introducing Japanese arts and culture to Malaysia and vice versa. JFKL has also closely worked with the Ministry of Education to form a solid foundation of Japanese Language Education especially in Malaysian secondary schools and conducted various seminars and trainings for local Japanese teachers. We have also been supporting Japanese studies and promoting dialogues on common international issues. The past 30 years have deinitely been a long yet memorable journey in bringing the cultures of the two countries together. The cultural exchange with Malaysia has become more signiicant and crucial as Japan heads towards a multi-cultural society and there is a lot to learn from Malaysia. -

Annual Report 2012

1 2 3 FIRST PRINTING, 2013 © Copyright Human Rights Commission of Malaysia (SUHAKAM) The copyright of this report belongs to the Commission. All or any part of this report may be reproduced provided acknowledgement of source is made or with the Commission’s permission. The Commission assumes no responsibility, warranty and liability, expressed or implied by the reproduction of this publication done without the Commission’s permission. Notification of such use is required. All rights reserved. Published in Malaysia by HUMAN RIGHTS COMMISSION OF MALAYSIA 11th Floor, Menara TH Perdana 1001 Jalan Sultan Ismail, 50250 Kuala Lumpur Email: [email protected] URL: http://www.suhakam.org.my Designed & Printed in Malaysia by SALZ-TERACHI DESIGN SDN BHD 36-01-10, Block 36, Kemuncak Shah Alam Jalan Tengku Ampuan Rahimah 9/20 40100 Shah Alam Selangor Darul Ehsan National Library of Malaysia Cataloguing-in-Publication Data ISSBN: 1675-1159 4 MEMBERS OF THE COMMISSION 2012 6 5 3 4 2 1 1. Prof Emeritus Dato’ Dr Mahmood Zuhdi Hj Ab Majid 2. Ms Jannie Lasimbang Tan Sri Hasmy Agam 3. Mr James Nayagam Chairman 4. Mr Detta Samen (now Datuk) 5. Mr Muhammad Sha’ani Abdullah 6. Ms Rodziah Abdul (Secretary) Datuk Dr Khaw Lake Tee (Vice-Chairman) 5 HUMAN RIGHTS COMMISSION OF MALAYSIA ANNUAL REPORT 2012 CONTENTS CHAIRMAN’S MESSAGE 1 EXECUTIVE SUMMARY 7 KEY ISSUES 11 CHAPTER 1 REPORT OF THE EDUCATION AND PUBLIC RELATIONS 25 GROUP I. EDUCATION AND PROMOTION DIVISION 26 II. PUBLIC RELATIONS DIVISION 39 CHAPTER 2 REPORT OF THE COMPLAINTS, MONITORING AND 51 INQUIRIES GROUP I. -

Umno Kidnap Charge Attempt Against PKR Fails Malaysiakini.Com March 24, 2012 by Leven Woon

Umno kidnap charge attempt against PKR fails MalaysiaKini.com March 24, 2012 By Leven Woon Another attempt at fixing PKR volunteers on a house-to-house survey, this time on a child kidnapping charge, blew up in the face of Umno when police unconditionally released them for lack of evidence. NONESix of them were at the Sri Pahang Flats in Lembah Pantai at around 11.30am today when three Umno members showed up, according to Fahmi Fadzil (left), the political secretary to the constituency's MP Nurul Izzah Anwar. "Despite the volunteers having showed their tags and documents to prove that they are from Nurul Izzah's office, the Umno members cornered them and accused them of trying to kidnap young children. "Four volunteers were then picked up by the police who arrived at the scene later," he said, adding that the other two managed to slip away. The four, identified as Nanthakumar Panisalbon, 24; Gopal Dass Manoharan, 26; Shamsudin Yusof, 30; and Gurmit Singh, 31, were then detained at the Jalan Travers Police Station, Kuala Lumpur. Long wait finally ends Nurul Izzah and Batu MP Tian Chua arrived at the police station in the afternoon and got the volunteers released at 6.16pm, according to an SMS from Fahmi. NONEUpset by the second of such arrests within a week, Nurul Izzah (right) decried the Umno's members' behaviour as "acts of intimidation". "It handicaps an MP's work. I must be given space to do my work. "It is very unbecoming. We condemn the various allegations from Umno members that are baseless and malicious in nature," she said. -

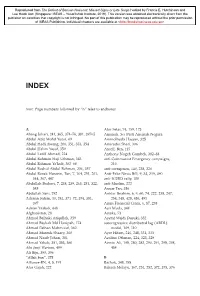

Page Numbers Followed by “N” Refer to Endnotes. a Abang Johari, 241, 365

INDEX Note: Page numbers followed by “n” refer to endnotes. A Alor Setar, 74, 159, 173 Abang Johari, 241, 365, 374–76, 381, 397n5 Amanah. See Parti Amanah Negara Abdul Aziz Mohd Yusof, 69 Aminolhuda Hassan, 325 Abdul Hadi Awang, 206, 351, 353, 354 Amirudin Shari, 306 Abdul Halim Yusof, 359 Ansell, Ben, 115 Abdul Latiff Ahmad, 224 Anthony Nogeh Gumbek, 382–83 Abdul Rahman Haji Uthman, 343 anti-Communist Emergency campaigns, Abdul Rahman Ya’kub, 367–68 210 Abdul Rashid Abdul Rahman, 356, 357 anti-corruption, 140, 238, 326 Abdul Razak Hussein, Tun, 7, 164, 251, 261, Anti-Fake News Bill, 9, 34, 319, 490 344, 367, 447 anti-ICERD rally, 180 Abdullah Badawi, 7, 238, 239, 263, 281, 322, anti-Muslim, 222 348 Anuar Tan, 356 Abdullah Sani, 292 Anwar Ibrahim, 6, 9, 60, 74, 222, 238, 247, Adenan Satem, 10, 241, 371–72, 374, 381, 254, 348, 428, 486, 491 397 Asian Financial Crisis, 6, 87, 238 Adnan Yaakob, 448 Asri Muda, 344 Afghanistan, 28 Astaka, 73 Ahmad Baihaki Atiqullah, 359 Asyraf Wajdi Dusuki, 352 Ahmad Bashah Md Hanipah, 174 autoregressive distributed lag (ARDL) Ahmad Fathan Mahmood, 360 model, 109, 110 Ahmad Marzuk Shaary, 360 Ayer Hitam, 246, 248, 331, 333 Ahmad Nazib Johari, 381 Azalina Othman, 224, 323, 329 Ahmad Yakob, 351, 353, 360 Azmin Ali, 195, 280, 283, 290, 291, 295, 298, Aku Janji Warisan, 409 454 Ali Biju, 390, 396 “Allah ban”, 375 B Alliance-BN, 4, 5, 191 Bachok, 348, 355 Alor Gajah, 222 Bahasa Melayu, 167, 251, 252, 372, 375, 376 19-J06064 24 The Defeat of Barisan Nasional.indd 493 28/11/19 11:31 AM 494 Index Bakun Dam, 375, 381 parliamentary seats, 115, 116 Balakong, 296, 305 police and military votes, 74 Balakrishna, Jay, 267 redelineation exercise, 49, 61, 285–90 Bandar Kuching, 59, 379–81, 390 in Sabah, 402, 403 Bangi, 69, 296 in Sarawak, 238, 246, 364, 374–78 Bangsa Johor, 439–41 Sarawak BN. -

The COVID-19 Pandemic and Its Subsequent Economic Recession

COVID-19 ECONOMIC RESPONSE ASEAN PARLIAMENTARIANS’ MANIFESTO The COVID-19 pandemic and its subsequent economic recession revealed the failure and fragility of our current economic system that prioritized business interests over the well-being of people and the environment, deepened inequalities and failed to protect the most vulnerable. It is therefore crucial that we use measures aimed at economic recovery from the COVID-19 pandemic to break away from the past and instead shift towards a just, sustainable and resilient economy that protects the human rights of all. Shifting towards a greener economy that boosts decent employment, offers social protection to all, and sustainable food supplies, will not only help the region to more rapidly absorb the immediate impact of the recession, but also to avoid and be more resilient to future similar shocks and crises. Parliamentarians can play a significant role in ensuring that measures aimed at economic recovery from the COVID-19 pandemic advance a just, sustainable and resilient economy that promotes, protects and respects the human rights of all. We, parliamentarians from Southeast Asia, therefore commit to using our position to: 1. Advance an economy that keeps the increase in the world’s temperatures to less than 1.5°C at the end of the century, where all, including future generations, are able to enjoy their human rights without harm from climate change, pollution, deforestation, waste and environmental degradation by: 1.1 Ensuring that measures adopted to tackle COVID-19 and the associated -

Election Offenses Listing 5 3 May 2018 Treating and Gifts No. Date

Election Offenses Listing 5 3 May 2018 Treating and gifts No. Date Place Incident Summary 1. 03.04.2018 P137 Hang Tuah In a walkabout in Taman Ayer Keroh Heights, Mohd Jaya, Melaka Ali Rustam gave out cooking oil and rice to voters 2. 06.04.2018 P161 Pulai, Johor Free spectacles giveaway, organised by Puteri Peduli and Puteri UMNO Bahagian Pulai 3. 07.04.2018 P200 Batang Nancy Shukri holds Program Jualan Sentuhan Sadong, Sarawak Rakyat in her constituency, selling goods at heavily discounted prices. 4. 07.04.2018 P136 Tangga Batu, Chief Minister and BN Chairman of Melaka, Idris Melaka Haron giving out free spectacles to voters. 5. 08.04.2018 P75 Bagan Datok, “Jualan Sentuhan Rakyat” event organized by Perak Zahid Hamidi. Food items sold at heavily discounted prices. 6. 08.04.2018 P201 Batang Rohani Abdul Karim holds Program Jualan Lupar, Sarawak Sentuhan Rakyat in her constituency, selling goods at heavily discounted prices. 7. 02/04/2018 P115 BATU, Kuala Gerakan candidate for Batu Dominic Lau gives out Lumpur rice to the elderly 8. 03/04/2018 P160 JOHOR MIC members gave a voter a box full of groceries BAHRU, Johor 9. 07/04/2018 P044 Permatang Dr. Afif Bahardin bersama-sama 30 anggota Pauh, Pulau jenteranya turun menemui pengunjung serta Pinang penjaja Pasar Awam Seberang Jaya. Lebih 400 goodie bag diedarkan oleh jentera Afif kepada orang awam 10. 07/04/2018 P115 BATU, Kuala Gerakan candidate for Batu Dominic Lau gives out Lumpur free spectacles and goodie bags while also handing out campaign leaflets 11. -

The Great Musician SD Burman

JUNE 2018 www.Asia Times.US PAGE 1 www.Asia Times.US Globally Recognized Editor-in-Chief: Azeem A. Quadeer, M.S., P.E. JUNE 2018 Vol 9, Issue 6 Punjab govt backs agitating farmers, Sidhu slams Centre The Punjab government came out in support of the state’s agitating farmers as minister ises, the farmers would not have been in Navjot Singh Sidhu slammed the Centre for ignoring the agriculture sector. such a sorry state of affairs. Sidhu assured the protesting farmers that A 10-day long nationwide agitation against the alleged anti-farmer practices of the Union the Punjab government was sympathetic government began today and as part of the protest, the supply of vegetables, fruits, milk to their demands and stood shoulder to and other items to various parts of Punjab and Haryana was stopped. shoulder with them. The Punjab local bodies and tourism In his unique way, the cricketer-turned-politician visited village Patto along with Con- minister stressed that the Swamina- gress MLAs Kuljit Singh Nagra and Gurpreet Singh and bought milk and vegetables from than Commission report was not being farmers to highlight their significant contribution in the development of the nation. implemented and farmers were not getting adequate price for their crops, leading to “If the country is to be saved then saving farm sector ought to be a priority,” Sidhu said escalation in farmer suicides. adding that if the ruling NDA government at the Centre had fulfilled their pre-poll prom- Suggesting linkage of Minimum Support Price (MSP) of crops with oil prices, the min- ister went on to say that in the last 25 years, oil prices increased twelve fold whereas the MSP increased by only five per cent. -

P11-12 Layout 1

INTERNATIONAL TUESDAY, MARCH 17, 2015 Hong Kong tycoon Kwok’s plea for bail rejected HONG KONG: A Hong Kong court rejected property lion) given to former city deputy leader Rafael Hui. Yeung Chun-kuen. The court bars publication of any and ears” in government for Sun Hung Kai, while he tycoon Thomas Kwok’s plea for bail yesterday as he The high-profile case shocked the city and deep- detail on the reasoning for the ruling. enjoyed an extravagant standard of living. appeals a five-year prison sentence for bribing a senior ened anger over cosy ties between officialdom and big Hui, the city’s former Chief Secretary for Hong Kong is seen as relatively corruption-free-it official in a corruption case which shocked the city. business. Administration, was jailed for seven and a half years on a was ranked the joint 15th cleanest country or territory in The 63-year-old, who was the joint chairman of Kwok, who is serving his sentence at the city’s maxi- total of five graft charges, making him the highest-rank- 2013 by watchdog Transparency International. But the Hong Kong’s biggest property company Sun Hung Kai, mum security Stanley Prison, has appealed the ruling ing official in the city’s history to be found guilty of tak- case fuelled anger at what locals call “collusion” between was jailed in December after he was found guilty of con- and asked the court to grant him bail as he awaits the ing bribes. government and businesses, with many young Hong spiracy to commit misconduct in a public office over a outcome. -

Nurul Izzah to Be Freed After Statement Taken, Says IGP the Malaysian Insider March 17, 2015

Nurul Izzah to be freed after statement taken, says IGP The Malaysian Insider March 17, 2015 Lembah Pantai MP Nurul Izzah Anwar will be released after her statement is recorded over remarks she made at the #KitaLawan rally on March 7, police said tonight. Inspector-General of Police Tan Sri Khalid Abu Bakar said the PKR vice-president had been arrested under the Sedition Act for her remarks at the rally, and not for a speech made in Parliament. "Lembah Pantai MP Nurul Izzah Anwar has been arrested under the Sedition Act to assist the police into the investigation of the Kita Lawan rally and for making contemptuous remarks that those in the judiciary system had sold their souls to the devil. "She will be released once her statement has been recorded," he said in a two-paragraph statement posted on the police Facebook page. Nurul Izzah is a two-term lawmaker and the eldest daughter of opposition leader Datuk Seri Anwar Ibrahim, who is serving a five-year jail sentence for sodomy. Her mother is PKR president Datuk Seri Dr Wan Azizah Wan Ismail. She had gone to the Dang Wangi police station this afternoon to have her statement recorded when police arrested her under the colonial-era sedition law. The mother-of-two is being held at the Jinjang police station lock-up where more than 300 people have gathered tonight against her overnight detention over the past few hours. In an immediate response, PKR Youth deputy chief Fahmi Fadzil disputed Khalid's statement, saying that Nurul Izzah's arrest sheet did not contain references to the #KitaLawan rally on March 7. -

Deepening the Culture of Fear the Criminalization of Peaceful Expression in Malaysia

Deepening the Culture of Fear The Criminalization of Peaceful Expression in Malaysia Copyright © 2016 Human Rights Watch All rights reserved. Printed in the United States of America ISBN: 978-1-6231-34112 Cover design by Rafael Jimenez Human Rights Watch defends the rights of people worldwide. We scrupulously investigate abuses, expose the facts widely, and pressure those with power to respect rights and secure justice. Human Rights Watch is an independent, international organization that works as part of a vibrant movement to uphold human dignity and advance the cause of human rights for all. Human Rights Watch is an international organization with staff in more than 40 countries, and offices in Amsterdam, Beirut, Berlin, Brussels, Chicago, Geneva, Goma, Johannesburg, London, Los Angeles, Moscow, Nairobi, New York, Paris, San Francisco, Sydney, Tokyo, Toronto, Tunis, Washington DC, and Zurich. For more information, please visit our website: http://www.hrw.org OCTOBER 2016 ISBN: 978-1-6231-34112 Deepening the Culture of Fear The Criminalization of Peaceful Expression in Malaysia Map .................................................................................................................................... i Glossary of Terms and Acronyms ........................................................................................ ii Summary ........................................................................................................................... 1 Communications and Multimedia Act ................................................................................. -

Sektor Pelancongan Anggar Rugi RM105 Juta, Sektor Perniagaan

Fahmi: Khairy’s call for Mahathir, Anwar, Kit Siang to quit is flawed Free Malaysia Today July 9, 2017 The PKR communications director says benchmark for continuing to be in politics should be ability of one to serve the best interests of the people. PETALING JAYA: The reasoning behind Umno Youth leader Khairy Jamaluddin’s call for three “old” leaders to retire is flawed, says PKR communications director Fahmi Fadzil. He said in a maturing democracy, the benchmark for continuing to be in politics should be the ability of the person to serve the best interests of the people and the nation. He said if a person is doing the nation a great disservice, then that person must retire. “That’s why I think Khairy has trained his ‘guns’ on the wrong side of the political aisle.” He said members and leaders of the federal opposition were not the ones to connected to financial scandals or alleged to have siphoned out a lot of money from the Sabah Water Department. At a function earlier today, Khairy had asked PPBM chairman Dr Mahathir Mohamad, former PKR leader Anwar Ibrahim and DAP adviser Lim Kit Siang to retire and pave the way for younger leaders to take over. “I do not mean that when we want the people to unite, they all should support Barisan Nasional, but we do not want a situation like today where politics in the country is filled with animosity, hatred and incitement, all created by these three politicians.” Khairy, who is also youth and sports minister, said Mahathir and Anwar, both former Umno leaders, were seen attempting to divide the Malays to achieve their own vested interests, while Lim, was trying to create a rift between the Malays and Chinese.