Annual Report T-Mobile Czech Republic A.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mergers & Acquisitions

Mergers & Acquisitions Fifth Edition Editors: Michael E. Hatchard & Scott V. Simpson Published by Global Legal Group CONTENTS Preface Michael E. Hatchard & Scott V. Simpson, Skadden, Arps, Slate, Meagher & Flom (UK) LLP General chapter Renewable Energy: Cross-Border M&A John P. Cook, Anthony S. Riley, George T. Rigo & Kerstin Henrich, Orrick, Herrington & Sutcliffe LLP 1 Austria Markus Fellner & Irena Gogl-Hassanin, Fellner Wratzfeld & Partner Rechtsanwälte GmbH 13 Bulgaria Yordan Naydenov & Dr. Nikolay Kolev, Boyanov & Co, Attorneys at Law 21 Canada Kurt Sarno, Shlomi Feiner & Matthew Mundy, Blake, Cassels & Graydon LLP 30 Cayman Islands Ramesh Maharaj, Rob Jackson & Melissa Lim, Walkers 41 Chile Carlos Urzúa, Pablo Bravo & Sebastián Garrido, Larraín, Rencoret & Urzúa Abogados 49 China Will Fung, Yu Xie & Jean Zhang, Grandall Law Firm (Beijing) 53 Croatia Tarja Krehić, Law Offi ce Krehić 59 France Coralie Oger, FTPA 68 Germany Kolja Petrovicki & Sebastian Graf von Wallwitz, SKW Schwarz 76 Hong Kong Joshua Cole, Ashurst 86 India Apoorva Agrawal, Sanjeev Jain & Premnath Rai, PRA Law Offi ces 94 Indonesia Theodoor Bakker, Herry N. Kurniawan & Ms. Hilda, Ali Budiardjo, Nugroho, Reksodiputro 103 Ireland Alan Fuller, Aidan Lawlor & William Dillon-Leetch, McCann FitzGerald 109 Ivory Coast Annick Imboua-Niava, Osther Tella & Hermann Kouao Imboua-Kouao-Tella & Associés 118 Japan Yuto Matsumura & Hideaki Roy Umetsu, Mori Hamada & Matsumoto 124 Macedonia Kristijan Polenak & Tatjana Shishkovska , Polenak Law Firm 132 Malta David Zahra, David Zahra & Associates Advocates 139 Mexico Daniel Del Río & Jesus Colunga, Basham, Ringe y Correa, S.C. 148 Netherlands Alexander J. Kaarls, Johan W. Kasper & Willem J.T. Liedenbaum, Houthoff Buruma 158 Nigeria Busayo Adedeji & Kelvina Ifejika, Bloomfi eld Law Practice 167 Norway Ole K. -

Statement of Investment Holdings Dec. 31, 2016

1 DEUTSCHE TELEKOM AG STATEMENT OF INVESTMENT HOLDINGS IN ACCORDANCE WITH § 285 HGB AS OF DECEMBER 31, 2016 1. Subsidiaries Shareholders’ equity Indirectly Directly Total thousands of Net income/net loss Reporting No. Name and registered office Via % % nominal value Currency reporting currency thousands of € currency Note 1. 3.T-Venture Beteiligungsgesellschaft mbH (3. TVB), Bonn 1.93. 100.00 25,000 EUR 6,382 764 EUR e) 2. Antel Germany GmbH, Karben 1.105. 100.00 25,000 EUR (119) (48) EUR i) 3. Arbeitgeberverband comunity, Arbeitgeberverband für EUR - - EUR Telekommunikation und IT e.V., Bonn 4. Assessment Point (Proprietary) Limited, Johannesburg 1.125. 100.00 100 ZAR (3,192) (6) ZAR e) 5. Atrada GmbH, Nuremberg 100.00 150,000 EUR 3,220 (2,210) EUR e) 6. Atrada Trading Network Limited, Manchester 1.5. 100.00 1 GBP 0 0 GBP e) 7. BENOCS GmbH, Bonn 1.327. 100.00 25,000 EUR 94 (765) EUR e) 8. Benocs, Inc., Wilmington, DE 1.7. 100.00 100 USD - - USD 9. CA INTERNET d.o.o., Zagreb 1.129. 100.00 20,000 HRK 228 11 HRK e) 10. CBS GmbH, Cologne 1.19. 100.00 838,710 EUR 18,055 0 EUR a) e) 11. CE Colo Czech, s.r.o., Prague 1.232. 100.00 711,991,857 CZK 854,466 88,237 CZK e) 12. COMBIS - IT Usluge d.o.o., Belgrade 1.14. 100.00 49,136 RSD (112,300) (9,378) EUR e) 13. COMBIS d.o.o. Sarajevo, Sarajevo 1.14. 100.00 2,000 BAM 5,297 969 BAM e) 14. -

Macedonia-Volume-3-Telekom-English.Pdf

Market Makedonski Telekom offers voice and data services on fixed and mobile network with many years of experience and market leadership. The company constantly introduces international expertise, innovative solutions and state-of-the-art technology trends. According to the results of the first three months of 2016, Makedonski Telecom has 221 thousand customers of fixed voice services, 1.218 thousand of mobile customers, 189 thousand broadband internet subscribers and 104.2 thousand MaxTV customers. Makedonski Telekom is part of Deutsche Telekom Group – one of the world’s leading telecommunications company with over 156 million mobile customers, 29 million fixed customers and more than 18 million broadband service customers. Achievements The company is aiming to provide excellent customer experience through superior technology in the simplest In 2008 Makedonski Telekom also Product manner. became part of Deutsche Telekom Group, Makedonski Telekom offers voice and According to the customer survey whereupon both companies for fixed and data services on fixed and mobile conducted by the “BRIMA” Agency, most mobile telephony worked as separate legal network. of the citizens of the Republic of entities until June, 2016 when both product The Company is focused on integrated Macedonia think that the mobile and fixed brands, T-Home and T-Mobile, ceased to services for consumers and business network of Makedonski Telekom is the exist and one Telekom brand was customers, provided from one place, as best network in the country and justifies introduced under whose umbrella the well as Cloud and ICT solutions for the their expectations. company continued to offer its entire purpose of providing the best customer In 2016 Makedonski Telekom won the portfolio of services for consumers and experience. -

Tsb Bureau De La Normalisation Des Télécommunications De L'uit

Annexe au Bulletin d'exploitation de l'UIT No 979 – 1.V.2011 UNION INTERNATIONALE DES TÉLÉCOMMUNICATIONS TSB BUREAU DE LA NORMALISATION DES TÉLÉCOMMUNICATIONS DE L'UIT _______________________________________________________________ LISTE DES CODES DE POINTS SÉMAPHORES INTERNATIONAUX (ISPC) (SELON LA RECOMMANDATION UIT-T Q.708 (03/99)) (SITUATION AU 1 MAI 2011) _______________________________________________________________ Genève, 2011 Liste des codes de points sémaphores internationaux (ISPC) Note du TSB 1. Cette Liste des codes de points sémaphores internationaux (ISPC) (international signalling point codes) remplace celle qui avait été publiée dans l’Annexe du Bulletin d'exploitation No 956 du 15.V.2010. Depuis ce jour, différentes notifications ont été reçues au TSB et ont été publiées séparément dans différents numéros du Bulletin d'exploitation de l'UIT. La présente Liste récapitule tous les différents amendements qui ont été publiés jusqu'au Bulletin d'exploitation No 979 du 1.V.2011. 2. La Recommandation Q.708 mentionne que l'attribution des codes de zone/réseau sémaphore (SANC) (signalling area network code) doit être régie par le TSB. L'attribution des codes de points sémaphores internationaux (ISPC) sera faite par chaque pays qui en avisera le TSB. 3. Le plan de numérotage de la Recommandation Q.708 contient 2 048 codes SANC permettant de disposer de 16 384 points sémaphores internationaux. Parmi ces codes, 1 536 sont disponibles pour assignation, donnant 12 288 points sémaphores internationaux. A l'heure actuelle, 937 codes SANC sont attribués, et selon les indications reçues, 5 417 points sémaphores internationaux sont en service. 4. Pour que la Liste puisse être tenue à jour, les Administrations sont priées d'aviser le TSB, au moyen du formulaire de notification ci-joint, de toute attribution ou de retrait de code ISPC, www.itu.int/itu-t/inr/forms/ispc.html. -

§ 313 HGB Version 1 Final EN 20210201 Pohler.Xlsx

Summary of share property according to § 313 (2) HGB, consolidated financial statements of Deutschen Telekom AG at date December 31, 2020 Seq. No. Name and place of Business Via Indirectly Directly Total nominal value Currency Note 1. Included companies 1. ALDA Wireless Holdings LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 2. APC Realty and Equipment Co., LLC, Overland Park, Kansas City 1.306. 100,00% 1 USD 3. ATI Sub, LLC, Overland Park, Kansas City 1.38. 100,00% 1 USD 4. American Telecasting Development, LLC, Overland Park, Kansas City 1.38. 100,00% 1 USD 5. American Telecasting of Anchorage, LLC, Overland Park, Kansas City 1.312. 100,00% 1 USD 6. American Telecasting of Columbus, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 7. American Telecasting of Denver, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 8. American Telecasting of Fort Collins, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 9. American Telecasting of Fort Myers, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 10. American Telecasting of Green Bay, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 11. American Telecasting of Lansing, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 12. American Telecasting of Lincoln, LLC, Overland Park, Kansas City 1.46. 100,00% 1 USD 13. American Telecasting of Little Rock, LLC, Overland Park, Kansas City 1.312. 100,00% 1 USD 14. American Telecasting of Louisville, LLC, Overland Park, Kansas City 1.46. -

Commonwealth of Kentucky Before the Public Service

COMMONWEALTH OF KENTUCKY BEFORE THE PUBLIC SERVICE COMMISSION In the Matter of: PETITION OF GEARHEART ) COMMUNICATIONS INC. D/B/A COALFIELDS ) CASE NO. TELEPHONE COMPANY, FOR ARBITRATION ) 2006-00294 OF CERTAIN TERMS AND CONDITIONS OF ) PROPOSED INTERCONNECTION ) AGREEMENT WITH CELLCO PARTNERSHIP ) D/B/A VERIZON WIRELESS, GTE WIRELESS ) OF THE MIDWEST INCORPORATED D/B/A ) VERIZON WIRELESS, AND KENTUCKY RSA ) NO. 1 PARTNERSHIP D/B/A VERIZON ) WIRELESS, PURSUANT TO THE ) COMMUNICATIONS ACT OF 1934, AS ) AMENDED BY THE TELECOMMUNICATIONS ) ACT OF 1996 ) O R D E R Between May 30, 2006 and June 9, 2006, 12 incumbent local exchange carriers (“ILECs”) filed with the Commission 49 separate requests for arbitration of interconnection agreements with eight different commercial radio service providers (collectively “CMRS Providers”),1 pursuant to 47 U.S.C. § 252(b). The Commission initially assigned each case a separate docket number. On July 25, 2007, the 1 Alltel Communications, Inc. (“Alltel”); New Cingular Wireless PCS, LLC, successor to BellSouth Mobility LLC, BellSouth Personal Communications LLC and Cincinnati SMSA Limited Partnership d/b/a Cingular Wireless (collectively, “AT&T Mobility”); Sprint Spectrum L.P., on behalf of itself and SprintCom, Inc., d/b/a Sprint PCS; T-Mobile USA, Inc., Powertel/Memphis, Inc., and T-Mobile Central LLC, (collectively “T-Mobile”); ComScape Telecommunications, Inc.; NTCH-West, Inc.; American Cellular Corporation f/k/a ACC Kentucky License, LLC; and Cellco Partnership d/b/a Verizon Wireless, GTE Wireless of the Midwest Incorporated (collectively, “Verizon Wireless”) and Kentucky RSA No. 1 Partnership. Commission issued an Order in Case No. 2006-00215 that consolidated the petitions to 12 separate proceedings, one for each ILEC. -

Ad Makedonski Telekomunikacii

Makedonski Telekom AD Skopje „Kej 13-ti Noemvri” br.6, 1000 Skopje, Republika Makedonija To: Macedonian Stock Exchange Orce Nikolov 75, 1000 Skopje Date: November 2013 Subject: Explanation on the operation of Makedonski Telekom AD - Skopje Group for the period from 01.01.2013 until 30.09.2013 The following analysis refers to the unaudited consolidated Income statement and analysis on the operating profit of Makedonski Telekom AD – Skopje Group, which includes Makedonski Telekom AD - Skopje, T-Mobile Macedonia AD Skopje and the e-Makedonija – Skopje Foundation for the period 01.01.2013 - 30.09.2013, prepared in accordance with International Financial Reporting Standards (IFRSs). The operating income at Group level in the first nine months of 2013 amounted to MKD 9,556,493 thousand, which represents decrease of 20.3% compared to the same period in 2012. The voice revenues in the fixed segment services decreased due to the decreased number of fixed line customers by 8.2% compared to the same period of the previous year, resulting in a customer base of 270 thousand at the end of September 2013 and a decrease of the outgoing traffic by 15.9% amounting to 434,027 thousand minutes in the first nine months of 2013. However, Makedonski Telekom has managed to maintain its leading market position with a market share of 69.9% (internal estimation) in the fixed line segment and with internet broadband market share of 52.6% (internal estimation). The revenues from internet and digital television via Internet protocol (“IPTV”) increased by 7.3% compared to the same period of the previous year. -

Deutsche Telekom Services Europe Czech Republic Company Presentation OVERVIEW

Deutsche telekom services Europe Czech republic Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 2 DEUTSCHE TELEKOM PROFILE German telecommunication company Headquarters in Bonn By revenue the largest telecommunications provider in Europe – 73 bn. € (2016) Formed in 1996 - the former state-owned monopoly Deutsche Bundespost was privatized Active in 36 countries worldwide More than 218.000 employees DEUTSCHE TELEKOM figures Customers & Markets Facts & Figures Customers Markets Telekom in figures, 2018 Employees & responsibility Employeesworldwide: 215,675 178.4 mnmobile customers Presentin > 50 countries Revenue € 75.7 bn 5,713 trainees and cooperative 27.9 mnfixed-network lines/ Germany, Europe and the USA: Adjusted EBITDA € 23.3 bn degree students in Germany 20.2 mnbroadband lines with own infrastructure Free Cash-Flow € 6.2 bn Pioneer of social issues Approx. 8.2 m TV customers T-Systems: global presence& (climate protection, data privacy, alliances via partners diversity, etc.) Source: DT 2018 annual report 4 Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 5 Where does dtse stand in the deutsche telekom group? operating model Future target operating Headquarters give an explicit Group model -

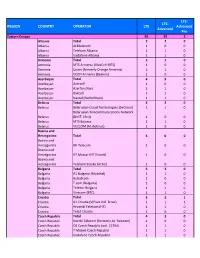

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

View Annual Report

U7 Deutsche Telekom worldwide. Deutsche Telekom at a glance. U2 !"§======= Deutsche Telekom. Bonn (Deutsche Telekom Group Net revenue EBITDA* Headquarters) (billions of €) (billions of €) % Modern teams. of net revenue Country offices, regional offices Selected subsidiaries and The 2001 financial year. 50 and representative offices associated companies 48.3 America 40 20 60 20.7 Europe Europe USA – VoiceStream 40.9 The 2001 financial year. 35.5 18.1 Brussels Austria – T-Mobile Austria – T-Systems 30 34.5 35.1 15 17.2 17.4 50 Kiev – T-Online.at – T-Venture of America 14.5 London – T-Systems 20 10 40 Madrid Belgium – T-Systems Canada – T-Systems Milan Croatia – Hrvatske telekomunikacije 10 5 30 Moscow Czech – RadioMobil/T-Mobile South America Paris Republic – Pragonet Brazil – T-Systems 0 0 20 – T-Systems America Denmark – T-Systems Asia 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 New York France – T-Online France Hong Kong – T-Systems Washington – T-Systems Indonesia – Satelindo I EBITDA margin (% of net revenue)* Hungary – MATÁV Japan – T-Systems 49.8 49.6 41.0 50.6 37.4 Asia – Westel Malaysia – TRI/Celcom Beijing – T-Systems Philippines – Globe Telecom *Calculated on the basis of more precise million figures. Singapore Italy – T-Systems – T-Systems Tokyo Netherlands – BEN Singapore – T-Systems – T-Systems Net income/loss Net cash provided by operating activities Poland – PTC Middle East (billions of €) (billions of €) – T-Systems Israel – Barak I.T.C. Portugal – Terravista – VocalTec 6 Russia – MTS 5.9 – T-Systems Africa 4 12 13.5 -

Magyar Telekom Investor Release

Magyar Telekom Investor Release Contacts Krisztina Förhécz Magyar Telekom IR +36 1 457 6029 Linda László Magyar Telekom IR +36 1 457 6084 [email protected] T-Mobile Makedonija wins UMTS (3G) license BUDAPEST – December 23, 2008 – Magyar Telekom (Reuters: NYSE: MTA.N, BÉT: MTEL.BU and Bloomberg: NYSE: MTA US, BÉT: MTELEKOM HB), the leading Hungarian telecommunications service provider, today announced that the Office of the Macedonian Agency for Electronic Communication granted a UMTS license to T-Mobile Makedonija AD Skopje on December 17, 2008. T-Mobile Makedonija AD Skopje, the leading mobile operator in Macedonia and a fully owned subsidiary of Makedonski Telekom AD, is granted the right to use Macedonian UMTS frequency blocks for 10 years. The one-off license fee is EUR 10 million, which was paid in December 2008. Obligations include the launch of the service within 6 months, 50% population coverage within 1 year and 80% population coverage within 3 years from the date of granting the license. This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom