Mergers & Acquisitions

Fifth Edition

Editors: Michael E. Hatchard & Scott V. Simpson

Published by Global Legal Group

CONTENTS

Preface

Michael E. Hatchard & Scott V. Simpson,

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

General chapter Renewable Energy: Cross-Border M&A

John P. Cook, Anthony S. Riley, George T. Rigo & Kerstin Henrich,

Orrick, Herrington & Sutcliffe LLP

1

Austria

Markus Fellner & Irena Gogl-Hassanin,

Fellner Wratzfeld & Partner Rechtsanwälte GmbH

13

Bulgaria Canada

Yordan Naydenov & Dr. Nikolay Kolev, Boyanov & Co, Attorneys at Law 21

Kurt Sarno, Shlomi Feiner & Matthew Mundy, Blake, Cassels & Graydon LLP 30

Cayman Islands Ramesh Maharaj, Rob Jackson & Melissa Lim, W a lkers

41

Chile

Carlos Urzúa, Pablo Bravo & Sebastián Garrido,

Larraín, Rencoret & Urzúa Abogados

49 53 59 68 76 86 94

China

Will Fung, Yu Xie & Jean Zhang, Grandall Law Firm (Beijing) Tarja Krehić, Law Of fi ce Krehi ć

Croatia France

Coralie Oger, FT P A

Germany Hong Kong India

Kolja Petrovicki & Sebastian Graf von Wallwitz, SKW Schwarz

Joshua Cole, Ashurst

Apoorva Agrawal, Sanjeev Jain & Premnath Rai, PRA Law Of fi ces Theodoor Bakker, Herry N. Kurniawan & Ms. Hilda,

Ali Budiardjo, Nugroho, Reksodiputro

Indonesia

103

Ireland

Alan Fuller, Aidan Lawlor & William Dillon-Leetch, McCann FitzGerald 109

Ivory Coast

Annick Imboua-Niava, Osther Tella & Hermann Kouao

Imboua-Kouao- T e lla & Associés

118 124 132 139 148

Japan

Yuto Matsumura & Hideaki Roy Umetsu, Mori Hamada & Matsumoto Kristijan Polenak & Tatjana Shishkovska, Polenak Law Firm

David Zahra, David Zahra & Associates Advocates Daniel Del Río & Jesus Colunga, Basham, Ringe y Correa, S.C.

Alexander J. Kaarls, Johan W. Kasper & Willem J.T. Liedenbaum,

Houthoff Buruma

Macedonia Malta Mexico Netherlands

158 167 171

Nigeria Norway Romania

Busayo Adedeji & Kelvina Ifejika, Bloom fi eld Law Practice Ole K. Aabø-Evensen, Aabø-Evensen & Co Advokat fi rma

Lucian Cumpănașu, Alina Movileanu & Cristina Mihălăchioiu,

Cump ă na ș u & Partners

190 197

Russia Serbia

Maria Miroshnikova, Sergei Kushnarenko and Anna Shirokova,

Ivanyan & Partners Radivoje Petrikić, Petriki ć & Partneri AOD in cooperation with CMS Reich-Rohrwig Hainz

207 215 224 232

Singapore Spain

Farhana Siddiqui & Sandy Foo, Drew & Napier LLC

Marta Gil de Biedma, V e ntura Garcés & López-Ibo r , A bogados

Dr. Mariel Hoch & Dr. Christoph Neeracher, Bär & Karrer AG Dr. Umut Kolcuoğlu, Begüm İnceçam & Aslı Tamer,

Kolcuo ğ lu Demirkan Koçakl ı Attorneys at Law

Switzerland Turkey

238 244

United Kingdom Adam Bogdanor & Tessa Hastie, Berwin Leighton Paisner LLP USA

Eric L. Cochran & Robert Banerjea,

Skadden, Arps, Slate, Meagher & Flom LLP

255

Macedonia

Kristijan Polenak & Tatjana Shishkovska

Polenak Law Firm

Overview

The legal framework governing mergers and acquisitions (M&A) in the Republic of Macedonia comprises several laws defining the corporate and contractual steps, and reporting obligations of companies participating in mergers and acquisitions, as well as the legal consequences that occur on the basis of mergers and acquisitions.

The Law on Trade Companies, published in 2004 (Company Law), and the Takeover Law, published in 2013 (Takeover Law), are recognised as primary sources of law relating to M&A.

The Company Law stipulates the general conditions, processes and procedures for M&A and other forms of company reorganisation, applicable to all the companies.

Under the Company Law, M&A are carried out either as a share purchase deal, on the basis of notarised share purchase agreement, or as regulated reorganisation of the companies, on the basis of the merger agreement entered in a form of notarial deed, following strict corporate steps and disclosure requirements by the companies involved. M&A transactions are subject to registration in the trade registry maintained by the Central Registry of the Republic of Macedonia.

A revised Takeover Law was passed in May 2013, regulating the takeover procedure applicable to companies that issue securities listed on the Macedonian Stock Exchange and securities issued by joint stock companies with special reporting requirements pursuant to the Law on Securities. The provisions of the Takeover Law apply for a period of one year after a company ceases to meet these criteria. The control takeover threshold that triggers a mandatory takeover bid is acquisition of more than 25% of the voting shares in a company. The additional takeover thresholds are acquisition of an additional 5% of the voting shares of the target company within a period of two years of the successful takeover, and the highest takeover threshold is 75% of the voting shares.

The provisions of the Takeover Law do not apply to purchase of shares owned by the Republic of Macedonia, including shares owned by beneficiaries of funds from the State Budget, agencies, funds and public companies and other institutions and legal entities performing activities of public interest established by state-owned assets.

In addition, the Securities Law, passed in 2005, regulates the manner and conditions for issuance and trading in shares, and sets the general legal framework of the capital market and the licensed market participants, disclosure obligations of joint-stock companies with special reporting obligations, and other issues with regard to shares.

The Macedonian Security and Exchange Commission (SEC) and the Commission for Protection of Competition (CPC) are the principal regulators related to M&A transactions.

GLI - Mergers & Acquisitions Fifth Edition © Published and reproduced with kind permission by Global Legal Group Ltd, London www.globallegalinsights.com

132

- Polenak Law Firm

- Macedonia

The SEC is established as an autonomous and independent regulatory body with public authorisations prescribed by the Securities Law, the Law on Investment Funds and the Takeover Law. It extends the regulatory framework with secondary legislation relative to M&A, and in particular the acquisitions of listed and reporting companies, to which Takeover Law applies. The CPC is a state body with the status of a legal entity, independent of its work and decision-making process within the competencies provided by the Law on Protection of Competition. It controls the application of the provisions stipulated in the Law on Protection of Competition, and monitors and analyses the conditions on the market to the extent necessary for the development of free and efficient competition. The CPC, inter alia, gives clearance in cases of mergers and acquisitions that meet the regulatory thresholds. The CPC records show the following statistics:

- •

- 37 merger notifications were reviewed and approved by the Commission for Protection

of Competition in 2015, of which:

- •

- 8 transactions involved Macedonian companies directly, and the relevant M&As

were performed in the Republic of Macedonia; and

- •

- 29 M&As were performed outside of the Republic of Macedonia and between

foreign companies.

TheCPCclearancesinvolvedvarioussectors,includingbutnotlimitedtotelecommunications, construction, production and sale of pharmaceutical products, mining and extraction of minerals, entertainment services, etc. Most of the transactions performed in the Republic of Macedonia were acquisitions of shares by way of execution of a notarised share purchase agreements in accordance with the Law on Trade Companies. The trend, pursuant to the statistical data of the CPC, shows an increase of transactions relative to 2014, when the CPC reviewed and approved: ••

7 M&As performed in the Republic of Macedonia; and 21 M&As performed outside the Republic of Macedonia.

Based on this statistical source, the number of notifications of concentrations approved by the CPC has increased by nearly 22%. The number of the transactions performed in the Republic of Macedonia increased by 12.5%.1

Significant deals and highlights

The mergers that occurred in the telecommunications sector in 2015 are the most significant deals to have taken place in the last 12 months in the Republic of Macedonia. Merger of T-Mobile Macedonia AD Skopje into Makedonski Telekom AD Skopje Makedonski Telekom, a subsidiary of Magyar Telekom and member of Deutsche Telekom Group, acquired its 100% subsidiary, T-Mobile Makedonija, by way of accession. The transaction was closed on 1 July 2015. The accession was driven by and implemented due to economic and market factors which, in the view of the management of the participating companies, would generate better economic results and improvement of the business venture in the future operations. The expectations are that this merger will create better conditions for Makedonski Telekom to cope with the competition in the market for electronic communications via a competitive portfolio of integrated fixed and mobile products and services. Merger of VIP Operator DOOEL Skopje and ONE DOOEL Skopje The merger of two other providers of mobile and other telecommunication services in the

GLI - Mergers & Acquisitions Fifth Edition © Published and reproduced with kind permission by Global Legal Group Ltd, London www.globallegalinsights.com

133

- Polenak Law Firm

- Macedonia

Republic of Macedonia, VIP Operator DOOEL Skopje, a subsidiary of Telekom Austria Group, and ONE DOOEL Skopje, a subsidiary of Telekom Slovenije, represents the second most significant M&A deal in the telecommunications sector in 2015. The transaction was closed on 1 October 2015, causing termination of the merging companies and a creation of a new entity named one.Vip DOO Skopje. The parties expect that this merger will result in improvement of the relevant services to final users, as well as increase of the market share of the newly established company, resulting in increased competitiveness of the company on the market of ICT services in the country. Following this merger, according to the data of the Agency for Electronic Communications, Makedonski Telekom’s share on the market will be 47%, and the new company one.Vip will hold the remaining 53% of the market. During the period until full integration of all operative and technical systems, expected to be completed by the end of 2016, one.Vip shall continue to operate through the current two separate networks, payment systems, tariff portfolios and sales sites of VIP and ONE. Acquisition of cable operators by Blizoo DOOEL Skopje In 2015 Blizoo DOOEL Skopje acquired the shares of several cable operators, covering six cities in the country, including Bitola, Kichevo, Strumica, Radovish, Kumanovo. The acquisition in each case was performed by execution of a share purchase agreement and acquisition of share(s). The purpose of this acquisition is expansion of the operations of Blizoo DOOEL Skopje on the entire territory of the Republic of Macedonia, thereby providing its services to a larger volume of consumers. Other notable M&A transactions in 2015 include: •

••acquisition by Links Evropa DOOEL Skopje of Rudnik SASA DOO Makedonska Kamenica, thus acquiring the largest copper mine and the biggest zinc and lead mine; acquisition of Ekskluziv Farma from Prishtina, Kosova by Feniks Farma DOOEL, active in the sector of sales and distribution of pharmaceutical products; and acquisition of Saponia Komerc DOOEL Skopje by Eurotabak DOO Skopje, in the sector of trade with chemical products.

Key developments

Notably, M&Atransactions are governed by the size of the market. Republic of Macedonia, being a small market, has limited M&A opportunities, leading to limited M&A transactions. In addition, the interest in acquisitions in the financial, real estate and telecom sector is declining, leaving a number of opportunities without completion. The interest of international financial institutions has shifted from equity investments into increasing their loan portfolio on the market. Also, international finance institutions have several divestments in the financial sector. The role of institutional investors in M&A transactions is not expected to increase. Pension funds tend to diversify the portfolio between investments in state securities and securities tradeable on local and foreign markets issued by listed companies, and private equity funds are not sufficiently developed. Though there is an increase in legislation activity, none of the amendments made in the governing laws will affect the M&A market. The Law on Technological Industrial Development Zones and the benefits for investors it provides have achieved increased investment activity, resulting in the presence of international companies in the technological industrial development zones. Indirectly, this has affected the M&A market by several transactions with companies operating in these

GLI - Mergers & Acquisitions Fifth Edition © Published and reproduced with kind permission by Global Legal Group Ltd, London www.globallegalinsights.com

134

- Polenak Law Firm

- Macedonia

zones. For example, in 2014 Visteon Electronics acquired the local company owned by Johnson Controls holding a production plant in the zone in Skopje.

Industry sector focus

There is an expansion of activities in the following sectors: ••••

Automotive Component Sector; Information and Communication Technology Sector; Agricultural and Agro-processing Industry; and Textile and Clothing Industry.

Automotive Component Sector. Republic of Macedonia’s proximity to the rapidly

growing automotive manufacturing base in Central and Eastern Europe and Turkey, which have become a regional superpower in the automotive industry, makes it an ideal location. The geographical proximity to these markets allows low distribution costs and “just-in-time” product delivery from Macedonia. Save for the excellent location, the opening of various industrial development zones in various locations in the Republic of Macedonia by the Macedonia Government has attracted many international companies which operate in this sector. Since the adoption of the Law on the Technological Industrial Development Zones, large numbers of benefits for investing in the industrial development zones have been offered to the relevant investors. Such benefits have included various tax breaks, support during construction, low rent for lease of the construction land, and others. This has resulted in the opening of many factories for production of automotive components by large international globally known companies such as Johnson Matthey, Mensan Automotive, Visteon, Ruen Kocani, Kromberg and Schubert and others.

Information and Communication Technology Sector. The Republic of Macedonia has the

fastest-growing ICT market in the Adriatic region. In this sector, the Republic of Macedonia offers a skilled and cost-effective workforce, excellent language skills of employees, sophisticated telecommunication infrastructure, low corporate taxes and a government which is highly supportive of foreign direct investments. The Macedonian IT market has shown significant growth in the past five years. This growth has been spurred by large investments in IT by the government and telecommunications companies, continued spending in the financial sector, a decrease in the price of IT equipment, and a decrease in VAT for IT equipment. In the years from 2008 to 2013 the biggest foreign direct investments in the ICT sector in Macedonia were in the telecommunications sector, amounting to €174m or 87%. In the field of M&Ain the ICT sector, the largest fluctuation occurred in 2015, which resulted in a complete restructuring of the Macedonia market for mobile telephony. More specifically, these changes resulted as a consequence of the acquisition of T-Mobile Macedonia DOOEL Skopje by Makedonski Telekom AD Skopje and the merger of VIP Operator DOOEL Skopje and ONE DOOEL Skopje into the newly established entity one.Vip DOO Skopje, both M&As described above.

Agricultural and Agro-processing Industry. This sector is also one of the fastest-growing

sectors in the Republic of Macedonia. It includes: exceptional business conditions (flat taxation, great agricultural incentives, and special conditions for investments); applied EU standards (introduction of both GLOBALGAP and HACCP as national standards); excellent supply (the combination of the Mediterranean and continental climate offers an excellent supply of quality products); high performance sector (the agribusiness industry development is rated with +10.2% in the last three years); and diversified products (a variety of the best tastes of agro-processing products). Agriculture, with the inclusion of hunting, forestry, and

GLI - Mergers & Acquisitions Fifth Edition © Published and reproduced with kind permission by Global Legal Group Ltd, London www.globallegalinsights.com

135

- Polenak Law Firm

- Macedonia

fishing, is the third-biggest sector by participation in GDP, regarding the services and industry. Approximately 300 companies are currently operating in this sector. However, in relation to M&A, no changes were performed in these companies during 2015.

Textile and Clothing Industry. The textile and clothing industry makes a great contribution

to the Macedonian economy. The clothing industry, today, is one of the locomotive sectors of the Macedonian economy in terms of industrial production, employment, and export earnings. This industry represents: 17% of the industries GDP; 17% of the country’s total exports; and 35% of the total number of employees in industry. This industry is a major tradition in the Republic of Macedonia and large numbers of companies operate in this sector. However, no M&As were performed in these companies during 2015.

Other important industry sectors in the Republic of Macedonia are Healthcare Products (Pharmaceuticals and Medical Devices), Chemicals, Energy, Real Estate, Tourism and others. Considering that the Republic of Macedonia is a growing economy and new companies establish their business in the Republic of Macedonia at a steady rate, it is expected in the future for more fluctuations to occur in the field of M&A. It will not be a surprise if, in the future, a large number of companies in various sectors participate in M&A procedures in order for their portfolios of products to be enriched, or for them to become more competitive in the relevant market.

For now, the fastest-growing sectors in the Republic of Macedonia are the Automotive Component Sector and the Information and Communication Technology Sector. This is shown by the number of M&As which were performed in 2015, especially in the ICT Sector. Taking this into perspective, it is to be expected that this tendency will continue in the following years.

2015 inbound investments The rate of foreign direct investments through 2015 has decreased compared to the same rate in 2014. The majority of foreign investment in 2015 was in the automotive industry.

Below is an overview of the major investors brought to Macedonia and the investments agreed upon in the course of 2015. The numbers below are projections which refer to the total period of the investment, which usually is 5 to 10 years.

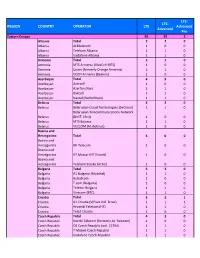

- Name of investor

- Number

- Value of investment (EUR)

- Place of

- employed

- investment

1. 2. 3. 4. 5.

KSS, USA

Marquardt, Germany

CAPCON

1,000

600

20 million

35 to 50 million

16.5 million

20 million

Kicevo Veles Skopje Prilep

/

400

GENTHERM USA

DEMPO GROUP Turkey

2,000

- 400 to 600

- 5.5 to 6 million (3 million in

the first phase and 2.5 to 3 million in the second phase)

The year ahead

The parliamentary elections scheduled for 2016 and the political situation will most likely adversely affect the volume of M&A transactions. Despite the elections, it is expected that the economy in 2016 will continue its steady growth between 3–4% (depending on the institution making the economic analysis and prognosis).