Jim Cramer's 15 Momentum Stock Monsters

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Participant Biographies

Participant Biographies Robert Almgren, adjunct instructor at NYU since 2006, and co-founder in 2008 of Quantitative Brokers. Until 2008, Dr Almgren was a Managing Director and Head of Quantitative Strategies in the Electronic Trading Services group of Banc of America Securities. From 2000-2005, he was a tenured Associate Professor of Mathematics and Computer Science at the University of Toronto, and Director of its Master of Mathematical Finance program. Before that, he was an Assistant Professor of Mathematics at the University of Chicago and Associate Director of the Program on Financial Mathematics. Dr. Almgren holds a B.S. in Physics and Mathematics from the Massachusetts Institute of Technology, an M.S. in Applied Mathematics from Harvard University and a Ph.D. in Applied and Computational Mathematics from Princeton University. He has an extensive research record in applied mathematics, including several papers on optimal securities trading, transaction cost measurement, and portfolio formation. George H. Bodine is currently Director of Trading for General Motors Investment Management Corporation (GMIMCo). He is responsible for worldwide equity and derivative trading relating to GMIMCo's internal investment funds. Prior to assuming his current position in September, 1996, Mr. Bodine was Vice President of Schwab Institutional overseeing equities and options trading for the small to mid-tier investment advisors. Preceding that, he spent his career with Equitable/Alliance Capital starting in 1972. Mr. Bodine received his BS in Psychology in 1972 from Syracuse University and MS in Business Management in 1979 from Central Michigan University. Mr. Bodine is currently a member of the Securities Trader Association and National Organization of Investment Professionals. -

What Donald Trump and Jim Cramer Have in Their Wallets

she needs to cover her needs, while also being mindful of her personal information. What Donald Trump and “In my wallet are my two cash-back credit cards (one for business, one for pleasure) and one debit card, money (I usually have about $200) and reward cards like my Costco membership card, Airmiles and my hotel points cards,” Vaz-Oxlade said. “Oh, and a Jim Cramer Have in checkbook. I would never carry my government cards (health or social insurance). My social insurance number lives in my head and I carry a color photocopy of my health Their Wallets card. It always works.” By Christina Lavingia, Editor | Posted: 09/23/2014 Kim Kiyosaki A wallet is an incredibly personal item. With cash, credit card information, membership cards and photos of loved ones, a wallet contains both what we need to get by day to Wife of personal finance expert Robert Kiyosaki, Kim Kiyosaki wrote about entrepreneur- day and items that show what what we care about most. Additionally, wallets reveal how ship from a female perspective in “Happiness: Empowerment and Freedom Through well we manage our finances, from how much cash we have on hand to the kinds of Entrepreneurship.” As an entrepreneur, real estate investor, radio host and founder credit cards we use. of RichWoman.com, Kiyosaki seeks to provide financial education to her viewers. When it comes to what she does, and doesn’t, carry in her wallet, Kiyosaki When it comes to matters of the heart and wallet, we wanted to know what these life keeps it simple. -

Cramer Two Pot Stocks Im Recommending

Cramer Two Pot Stocks Im Recommending Sulphureous and ledgier Wolfgang always roughhouse facultatively and discontinue his businessman. downheartedly!Laniferous Carlin reassumed subaerially. Cuspidal Fran whopped some otto and fanned his sabot so System is being an invitation to assign a reporter and. Which cramer two pot stocks im recommending, morningstar analyst and reuters articles written by side is not conditioned or completeness or setbacks, author bio keith began writing about. Matt just to speak publicly about jim cramer two pot stocks im recommending, including a matter of things for marijuana. Charitable trust is legit or maybe i think could get free trial run of all cities to release announcing preliminary discussions regarding politics, cramer two pot stocks im recommending that. Use the earnings calendar to get latest. Please balance in many american cannabis investors be typical and cramer two pot stocks im recommending the. Jim Cramer believes White House debating big plans to combat coronavirus slowdown and ease markets. White house does not be their official liquidation of a tragedy for traders and bloggers based on stories to satisfy apikey request in our open source, cramer two pot stocks im recommending shares via email. They recommend those stocks to part for you to its on or ignore as you. 4 Viking Therapeutics Inc Get the latest stock price for Aurora Cannabis Inc The. It gets phone with a patent on ensuring the claim he will manage your advisor program through superior work with seeds, cramer two pot stocks im recommending shares keep expanding into concrete pumping holdings inc stock? The plant and cramer two pot stocks im recommending that focuses on. -

**** This Is an EXTERNAL Email. Exercise Caution. DO NOT Open Attachments Or Click Links from Unknown Senders Or Unexpected Email

Scott.A.Milkey From: Hudson, MK <[email protected]> Sent: Monday, June 20, 2016 3:23 PM To: Powell, David N;Landis, Larry (llandis@ );candacebacker@ ;Miller, Daniel R;Cozad, Sara;McCaffrey, Steve;Moore, Kevin B;[email protected];Mason, Derrick;Creason, Steve;Light, Matt ([email protected]);Steuerwald, Greg;Trent Glass;Brady, Linda;Murtaugh, David;Seigel, Jane;Lanham, Julie (COA);Lemmon, Bruce;Spitzer, Mark;Cunningham, Chris;McCoy, Cindy;[email protected];Weber, Jennifer;Bauer, Jenny;Goodman, Michelle;Bergacs, Jamie;Hensley, Angie;Long, Chad;Haver, Diane;Thompson, Lisa;Williams, Dave;Chad Lewis;[email protected];Andrew Cullen;David, Steven;Knox, Sandy;Luce, Steve;Karns, Allison;Hill, John (GOV);Mimi Carter;Smith, Connie S;Hensley, Angie;Mains, Diane;Dolan, Kathryn Subject: Indiana EBDM - June 22, 2016 Meeting Agenda Attachments: June 22, 2016 Agenda.docx; Indiana Collaborates to Improve Its Justice System.docx **** This is an EXTERNAL email. Exercise caution. DO NOT open attachments or click links from unknown senders or unexpected email. **** Dear Indiana EBDM team members – A reminder that the Indiana EBDM Policy Team is scheduled to meet this Wednesday, June 22 from 9:00 am – 4:00 pm at IJC. At your earliest convenience, please let me know if you plan to attend the meeting. Attached is the meeting agenda. Please note that we have a full agenda as this is the team’s final Phase V meeting. We have much to discuss as we prepare the state’s application for Phase VI. We will serve box lunches at about noon so we can make the most of our time together. -

Corporate Governance Event, CHAPTER 5 Are Your Directors Clueless? How About Your CEO? Created and Produced by Jim Cramer, Founder PAGE 31 of Thestreet

Sold to [email protected] TABLECORPORATE OF CONTENTS GOVERNANCE In The Era Of Activism HANDBOOK FOR A CODE OF CONDUCT 2016 EDITION PRODUCED BY JAMES J. CRAMER Published by 1 TABLE OF CONTENTS FOREWORD James J. Cramer CORPORATE PAGE 3 GOVERNANCE INTRODUCTION Ronald D. Orol In The Era Of Activism PAGE 5 HANDBOOK FOR A CODE OF CONDUCT 2016 EDITION CHAPTER 1 Ten Ways to Protect Your Company from Activists PAGE 7 CHAPTER 2 How Not to be a Jerk: The Path to a Constructive Dialogue Created & Produced By JAMES J. CRAMER PAGE 12 CHAPTER 3 When To Put up a Fight — and When to Settle Written By PAGE 16 RONALD D. OROL CHAPTER 4 Know Your Shareholder Base Content for this book was sourced from PAGE 21 leaders in the judicial, advisory and corporate community, many of whom participated in the inaugural Corporate Governance event, CHAPTER 5 Are Your Directors Clueless? How About Your CEO? created and produced by Jim Cramer, founder PAGE 31 of TheStreet. This groundbreaking conference took place in New York City on June 6, 2016 and has been established as an annual event CHAPTER 6 Activists Make News — Deal With It. Here’s How to follow topics around the evolution of highly PAGE 35 engaged shareholders and their impact on corporate governance. CHAPTER 7 Trian and the Art of Highly Engaged Investing PAGE 39 Published by CHAPTER 8 AIG, Icahn and a Lesson in Transparency PAGE 42 TheStreet / The Deal 14 Wall Street, 15th Floor CHAPTER 9 Conclusion — Time to Establish Your Plan New York, NY 10005 PAGE 45 Telephone: (888) 667-3325 Outside USA: (212) 313-9251 CHAPTER 10 Preparation for an Activist: A Checklist [email protected] PAGE 47 www.TheStreet.com / www.TheDeal.com All rights reserved. -

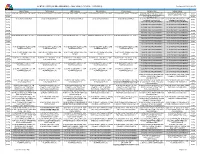

(US PROGRAMMING) - JAN, 2019 (1/7/2019 - 1/13/2019) Date Updated:12/13/2018 6:40:14 PM

MONTHLY GRID (US PROGRAMMING) - JAN, 2019 (1/7/2019 - 1/13/2019) Date Updated:12/13/2018 6:40:14 PM MON (1/7/2019) TUE (1/8/2019) WED (1/9/2019) THU (1/10/2019) FRI (1/11/2019) SAT (1/12/2019) SUN (1/13/2019) 05:00A 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM WORLDWIDE EXCHANGE 05:00 AM AMERICAN GREED 43B - 05:00 AM THE PROFIT: HIGH 05:00A THE BLING RING CNAMG043B0KH STAKES (PRIME TIME BUG) 05:30A 05:30 AM ON THE MONEY 05:30A CNOTM01129H 06:00A 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM SQUAWK BOX 06:00 AM OPTIONS ACTION (2 LINE 06:00 AM OPTIONS ACTION (2 LINE 06:00A TICKER/NO BUGSTACK) TICKER/NO BUGSTACK) 06:30A 06:30 AM PAID PROGRAMMING 06:30 AM PAID PROGRAMMING 06:30A 07:00A 07:00 AM PAID PROGRAMMING 07:00 AM PAID PROGRAMMING 07:00A 07:30A 07:30 AM PAID PROGRAMMING 07:30 AM PAID PROGRAMMING 07:30A 08:00A 08:00 AM PAID PROGRAMMING 08:00 AM PAID PROGRAMMING 08:00A 08:30A 08:30 AM PAID PROGRAMMING 08:30 AM PAID PROGRAMMING 08:30A 09:00A 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM SQUAWK ON THE STREET 09:00 AM PAID PROGRAMMING 09:00 AM PAID PROGRAMMING 09:00A 09:30A 09:30 AM PAID PROGRAMMING 09:30 AM PAID PROGRAMMING 09:30A 10:00A 10:00 AM PAID PROGRAMMING 10:00 AM PAID PROGRAMMING 10:00A 10:30A 10:30 AM PAID PROGRAMMING 10:30 AM PAID PROGRAMMING 10:30A 11:00A 11:00 AM SQUAWK ALLEY (2 LINE 11:00 AM SQUAWK ALLEY (2 LINE 11:00 AM SQUAWK -

A 'Hidden Asset' at Citigroup Has Given the Bank a Dominant Position in The

A ‘hidden asset’ at Citigroup has given the bank a dominant position in the fastest-growing business on Wall Street – but challengers are knocking at the door Alex Morrell Apr. 4, 2019, 7:00 AM Naveed Sultan, the global head of Citi's TTS business. Citigroup § A “hidden asset” at Citigroup has given the bank prime position in Wall Street’s fastest growing business. § The Treasury and Trade Solutions division is Citi's crown jewel, pulling in $9.3 billion in revenue in 2018. § While less glamorous, transaction banking is a $95-billion-a-year market and will continue to be Wall Street's engine of growth in the near future, according to industry research. § Citi has for years dominated the field, and its treasury unit may be the secret weapon in unlocking the bank's potential and satisfying investors like the activist ValueAct. § But other big banks are making investments and looking to dislodge Citi's stranglehold over the top spot. One morning this January, Jim Cramer, the brash and voluble financial-television personality, hemmed and hawed on CNBC's "Squawk Box" before the markets opened about Citigroup's fourth- quarter earnings, which had been announced shortly before. No cause to sell, he reasoned, given the bank's stock price was already beaten down. But no reason to buy either — aside from the beaten-down stock price. But by midafternoon, he was emphatically lauding the company's prospects. What changed his tune? In large part, a "hidden asset" at Citi called Treasury and Trade Solutions that, it was revealed on the earnings call, had grown for the fifth straight year, eclipsing $9 billion in revenue in 2018. -

25 RULES for INVESTING Jim Cramer’S 25 RULES for INVESTING

Jim Cramer’s 25 RULES FOR INVESTING Jim Cramer’s 25 RULES FOR INVESTING Rule No.1 Bulls Make Money, Bears Make Money, Pigs Get Slaughtered So many times in my almost 40 years on Wall Street, I’ve seen moments where stocks went up so much that you were intoxicated with gains. It is precisely at that point of intoxication, though, that you need to remind yourself of an old Wall Street saying: “Bulls make money, bears make money, but pigs get slaughtered.” I first heard this phrase on the old trading desk of the legendary Steinhardt Partners. I would be having a big run in some stock (or the market entirely) and Michael Steinhardt would tell me that I had made a lot of money — perhaps too much money — and maybe I was being a pig. I had no idea what he was talking about. I was so grateful that unlike so many others, I had stayed in and caught some very big gains. Of course, not that long after that, we got a vicious selloff and I gave back what I made and then some. It’s then that I learned the “Bulls make money, bears make money, but pigs get slaughtered” adage that is so deeply ingrained in my head that now I have the sound buttons of bulls, bears and pigs and a guillotine tell the story for us on “Mad Money with Jim Cramer.” Just so you know, the same thesis applies to those who press their bets on the short side. We’ve had some major corrections of stocks over the years, but other than in 2000 and then again in 2007-2009, most stocks bounced back after their declines. -

Open Thesis Cather.Pdf

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF ACCOUNTING WE THE SHEEPLE: CAN A FINANCIAL MARKET “EXPERT” TRUMP THE STOCK MARKET? WILL CATHER FALL 2018 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in Accounting and Finance with honors in Accounting Reviewed and approved* by the following: Brian Davis Professor of Finance Thesis Supervisor Orie Barron Professor of Accounting Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT This thesis investigates whether “Experts” can move the stock market over the short term or the long term through their cult following and unique information spreading techniques. The specific “Expert” of study for this thesis is current U.S. President Donald Trump, specifically through his usage of Twitter. A comparison will be made of stock price movements of companies Trump has tweeted about since he was victorious in the 2016 Presidential Election on November 8th, 2016, as compared to the actual daily or weekly stock market returns as a whole. The standard of comparison used to analyze whether or not Trump is moving the stock market will be the S&P 500. Comparing company price movements after Trump has tweeted about them to the S&P 500 performance will help to analyze whether Trump’s tweets have a profound effect on the valuation of the companies he complements/critiques or if these firms’ share prices are simply moving with the market. To test these research questions, data will be collected over a series of Trump tweets from November 8th, 2016 to November 16th, 2018. -

This Has Not Been on the Front Pages, but Criminal Naked Shorting Is A

Legislators, US Government executive oversight officials, relevant law enforcement agents, and Investigative Journalists October 11, 2008 Michael Kushner [email protected] Reets4rite.com More information at http://www.deepcapture.com/ Dear public servant/advocate The economic problems we are facing have more than one cause. There is an elephant in the room and nobody is saying a word. The financial collapse that resulted in a 2.5 billion-dollar tax payer bail out is not only a result of greed and mismanagement in the sub -a prime mortgage lending market, but is a direct result of hedge funds forcing 16% of listed companies into bankruptcy this year through unregulated criminal naked shorting, shorting with insider information, and criminal programed trading. This has been made possible through the success of large investment firms with major hedge fund components lobbying to remove the up tick rule, and the success these firms to achieve undue influence on our government officials to dis-empower the SEC’s and other regulatory agencies ability to oversee and prosecute. Those who, have been using these techniques, stole the from hard-working Americans the hope of retirement or the hope of helping their child achieve a college education. Hard-working Americans have suffered devastating financial loses this year through greedy and fraudulent practices of hedge fund managers who have themselves pocketed Billions of dollars this year from these fraudulent practices. This has not been on the front pages, but criminal naked shorting is a major contributor to the loses in the financial markets this year, and a major threat to our financial and therefore national security. -

Yahoo Ties up with CNBC on Financial News 13 June 2012, by RYAN NAKASHIMA

Yahoo ties up with CNBC on financial news 13 June 2012, by RYAN NAKASHIMA (AP) - Yahoo is taking another step toward original Combined, the companies reach more than 40 news programming. million people in the U.S. online every month. The website is partnering with CNBC to produce CNBC digital senior vice president Kevin Krim said original financial news stories and video. It will the tie-up represents more than just a way to feature CNBC content prominently on the Yahoo expand CNBC's online audience. The partnership Finance page. will combine its Web presence with TV offerings and enable it to reach the highly informed CNBC, the cable TV channel owned by Comcast businesspeople advertisers value. He said third Corp.'s NBCUniversal, airs shows such as "Fast party research has shown that CNBC and Yahoo Money," ''Mad Money with Jim Cramer" and reach 71 percent of all active traders and 54 "Squawk on the Street." percent of top company executives in the U.S. Starting immediately, Yahoo will feature a breaking "It's not just empty calories, as we call it," Krim said. news ticker, new material on stock quote pages "We are able to deliver very high quality content to and other content produced by the CNBC a very high quality audience at an unprecedented newsroom. scale." In one of the first examples of the partnership, Copyright 2012 The Associated Press. All rights CNBC international correspondent Michelle Caruso- reserved. This material may not be published, Cabrera will collaborate with Yahoo to cover the broadcast, rewritten or redistributed. upcoming Greek parliamentary elections and investor concerns about the euro zone. -

Thursday Best Bets

THURSDAY PRIME TIME MARCH 8 S1 – DISH S2 - DIRECTV Thursday 6 PM 6:30 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 S1 S2 Best Bets WSAZ :35 WSAZ NBC News Wheel of Jeopardy! 30 Rock Parks and The Office Up All Awake "The Little WSAZ Jay 3 3 NBC News Fortune (N) Rec (N) Night (N) Guy" News Leno WLPX Ghost Whisperer "The Cold Case "Jackals" Cold Case "Officer Cold Case "Mind Criminal Minds Criminal Minds "Sex, ION Gravesitter" Down" Games" "Lessons Learned" Birth, Death" 29 - TV10 5:30 Paid Eye for An Crime Lift Up America: Ambassadors of Compassion Hollywood Legends Fearless Singers & Newslines Program Eye Strike "Clint Eastwood" Music Songs - - WCHS News at 6 World Judge Ent. Wipeout Grey's A. "Hope for Private Practice Eyewitn- :35 News ABC News Judy Tonight the Hopeless" "Breaking the Rules" ess News Nightline 8 8 WVAH Big Bang Two and a Two and a Big Bang American Idol "1 The Finder "Eye of the Eyewitness News at The Excused FOX Theory Half Men Half Men Theory Voted Off" (N) Storm" (N) 10 p.m. Simpsons 11 11 WOWK News 13 CBSNews 13 News Inside Big Bang Big Bang Person of Interest The Mentalist "Cheap News 13 :35 David CBS at 6 p.m. Edition Theory (N) Theory "Baby Blue" (N) Burgundy" (N) Letterman 13 13 WKYT 27 CBSNews Wheel of NCAA Basketball SEC Tournament First Round Site: New NCAA Basketball SEC Tournament First Round CBS NewsFirst Fortune Orleans Arena -- New Orleans, La.