How to Assess the Highest and Best Use for an Adaptive Reuse

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CQWE Contest Packet

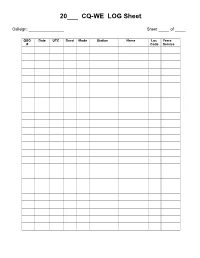

20___ CQ-WE LOG Sheet Callsign: ________________ Sheet _____ of _____ QSO Date UTC Band Mode Station Name Loc Years # Code Service 2020 CQ-WE LOCATION CHECK SHEET (Duplicate this sheet as needed.) Your Call___________________________ Circle one: CW PHONE DIGITAL These are the only Locations valid for this year's contest. Any additions will not be accepted. A Location Check Sheet must be filled out for each Category of operation. Enter the call letters of the first station worked for each location. Call Location Call Location Call Location __________ AC AT&T Headquarters __________ LJ AT&T Communications __________ QJ C&P Telephone Co VA __________ AE Alcatel-Lucent, Europe __________ LZ Avaya – Lincroft __________ QK Ameritech Services __________ AK Atlanta Works-Norcross __________ MD Morris Township Fac __________ QM Bell South __________ AL Allentown Works __________ MG Montgomery Works __________ QN Ohio Bell Telephone __________ AT Atlanta Works __________ MH Bell Labs-Murray Hill __________ QP Cincinnati Bell __________ BA Baltimore Works __________ MI Miami Service Ctr __________ QR Indiana Bell __________ BB PLPM Trans Eqpt __________ MN Michigan Service Ctr __________ QS Michigan Bell __________ BC Bellcore/SAIC-NJ __________ MP Minneapolis Svc Ctr __________ QT Illinois Bell __________ BH Birmingham, AL __________ MR Mountain NE Region __________ QV Southwestern Bell __________ BK Berkeley Heights, NJ __________ MS Northwest Bell Inst __________ QW Mountain States Tel __________ CA California Service Ctr __________ MT AT&T – -

WE Sends Microwave Job Fro Kansas City to Merrimack Valley

@ Vol. II, Number 2 Western Electric, Merrimack Valley Works March,1979 WE sends microwave job fro Kansas City to Merrimack Valley The Works is assuming Western Works General Manager Charlie Electric's entire microwave manufac DeBell issued a letter to all employees ture, a project that will create in 1979 February 2 announcing that WE is more than 100 jobs and an estimated transferring to the Works microwave $24, million in product output. equipment currently being manufac The jobs to be created will range tured at Kansas City. from entry-level bench hand positions DeBell wrote that the Works plans to to positions requiring more experience. consolidate the transferred microwave The equipment to be manufactured products with newer microwave equip constitutes eight different microwave ment that has been introduced at systems. The finished products will be Merrimack Valley during the past year. used primarily to transmit long dis "This consolidation will provide an tance calls and will be associated with opportunity to develop a strong capa the familiar microwave towers located bility to better serve the Bell Operating across the country. Companies as well as potential inter Initial manufacture of the equip national customers." ment is scheduled to begin within the The Works will supply Bell Operat next two weeks, according to George ing companies with microwave equip Ziady, Department Chief, Microwave ment. Western Electric International is Plug-In Panel and Bay Dept. The negotiating with foreign governments department is located in the southwest for additional microwave contracts. corner of the second floor shop. 1978 a' ost successful year' for Western Electric, ell Syste Western Electric and AT&T, in deButts, Chairman since April 1, separate announcements January 30, 1972, retired and Charles L. -

Western Electric Reading Works

1 Pictured above is 'Western Electric's Reading Works located in beautiful Berks County, Pennsylvania Reading Works The Reading Works is a high Through AT&T Interna- hind Reading's continued growth. technology plant dedicated to tional and our Government Sales Most recently, our office the production of electronic Group, WE also provides building has helped meet the components for telecommunica- telecommunications equipment need for additional manufactur- tions equipment. We are one of and services to other nations ing space since it now accom- 22 manufacturing locations and the Federal Government. modates offices previously lo- within Western Electric, a Locally, the Western Electric cated in the manufacturing wholly owned subsidiary of the Reading Works depends on building. This 210,000 square- American Telephone and Tele- Berks County for its dedicated foot building, completed in 1982, graph Co., Inc. employees as well as essential houses engineers, other profes- Products manufactured by goods and services. One of the sionals and clerical and ad- Western Electric range from the area's largest employers, WE is ministrative personnel and behind the scenes components a major contributor to the health brings our total floor space to such as the integrated circuits of Berks County's economy. more than one million square made at Reading to the tele- Through our em- ployees feet. Our 133 acres of rolling phones we use everyday. West- purchases, as well as those of hills is an ideal site for this new ern exercises careful control of the company, millions of dollars building and the many man- the involved processes that in business are poured into the ufacturing and support facilities bring products from the basic community each year. -

Convergences: Transactions in Reading and Writing. INSTITUTION National Council of Teachers of English, Urbana

DOCUMENT RESUME ED 265 568 CS 209 550 AUTHOR Petersen, Bruce T., Ed. TITLE Convergences: Transactions in Reading and Writing. INSTITUTION National Council of Teachers of English, Urbana, REPORT NO ISBN-0-8141-0856-3 PUB DATE 86 NOTE 274p. AVAILABLE FROMNational Council of Teachers of English, 1111 Kenyon Rd., Urbana, IL 61801 (Stock No. 08563, $12.00 member, $15.50 nonmember). PUB TYPE Collected Works - General (020) -- Guides - Classroom Use - Guides (For Teachers) (052) EDRS PRICE MV01/PC11 Plus Postage. DESCRIPTORS Cognitive Processes; Higher Education; *Integrated Activities; Literature Appreciation; Nonfiction; *Reading Processes; *Reading Strategies; *Feeding Writing Relationship; Revision (Written Composition); Speech Communication; Teaching Methods; *Writing Instruction; *Writing Processes IDENTIFIERS *Author Text Relationship ABSTRACT The relationship between reading and writing is explored in this book. Titles of the book's essays and their authors are as follows: (1) "What Is the Value of Connecting Reading and Writing?" by Robert J. Tierney and Margie Leys; (2) "Reflective Thought: The Connection between Reading and Writing" by Juno Cannell Birnbaum; (3) "Reading as a Writing Strategy: Wt. Case Studies" by Cynthia L. Selfe; (4) "The Writing/Reading Relationship: Becoming One's Own Best Reader" by Richard Beach and JoAnne Liebman-Kleine; (5) "Writing Plans as Strategies for Reading, Writing, and Revising" by Barbey Doughtery; (6) "Cognitive Stereoscopy and the Study of Language and Literature" by David Bleich; (7) "Social Foundations of Reading and Writing" by Deborah Brandt; (8) "Speech Acts and the Reader-Writer Transaction" by Dorothy Augustine and W. Ross Winterowd; (9) "Writing Based on Reading" by Marilyn S. Sternglass; (10) "How Do Users Read Computer Manuals? Some Protocol Contributions to Writer's Knowledge" by Patricia Sullivan and Linda Flower; (11) "Using Nonfiction Literature in the Composition Classroom" by Maxine Hairston; (12) "An Integrative Approach to Research: Theory and Practice" by Jill N. -

T Ousands Turn out for Pen Ho Se 1978

@ Vol. 1 No.6 Merrimack Valley Works October 1978 Fiber Optics FT3 a Works Product Set for 1980 The Merrimack VaIl~y Works and Western Electric's Atlanta and Reading Works plan production of a lightwave communication system scheduled for service in December 1980. Designated FT3 ("F" for Fiber Op tics and "T3" to follow the TI and T2 product line names), its first route will serve Southern Bell in Atlanta, Georgia. The Merrimack Valley Works will prodiJce certain transmission elements, including intermediate regenerators and digital multiplexers that combine the signals into the final form for transmission. The regenerators recreate the pulse stream and the multiplexers change the form and speed of the digital pulse's stream. Lightwave Transmission Product and Project Engineer Ed Faber says the Works will start manufacturing the equipment in January 1980 for ship ment to Atlanta that May. He says the planners have not estimated how many Works on-roll employees the program will effect. The Atlanta Works will manufacture the FT3 Iightguide cables, and Reading "Hello, Mickey?" The recent Open House saw hundreds of kiddies talking to Mickey and Snoopy at the Design Line* display in the auditorium. will make the lasers and the photo • Trademark of AT&T diodes . Fiber optics is the use of hair-thin pen Ho se 1978 glass fibers to transmit light signals. T ousands Turn Out For Hospitals use it to photograph the body's interior. Government uses it for Over 11,000 visitors ate 11,470 escorted family and friends around the first Open House evening. aircraft communications. -

WE-1983-10-11-12.Pdf

Western Electric W e s t e r n E l e c t r i e ' s E l e e t r o n i e ganizing committee, athletes, coaches Messaging System (EMS) made its and other Olympic committees. suceessflil debut this summer during Patricia Bawdon (above), a corre a pre-OIympic swimming and diving spondence .secretary from Sunnyvale, competition held at the University of was one of about 35 WE and 'leletype Southern California, it received favora people who acted as EMS attendants ble reviews from a demanding group during the testing and demonstration of critics^—^the media covering the of the equipment. ITie attendants an competition. The higlily sophisticated swered questions and demonstrated system was designed specifically for the easy-to-use .system for reporters use during the 1984 Summer Olympic- a n d o t h e r u s e r s . Games in Eos Angeles and will provide a dazzling array of communications For more on WE and the 1984 services to the media, the Olympic or Olympics, see page 10. Fourth Quarter Contents 35th Year Page 2 Page 10 Page 22 2 ReadingA R i s iWorks— n g S t a r At Reading, the future is here and now A ^ On Your Mark, Get I w Set, Communicate Western Electric and the Olympics 18 The Irresistible Force The Information Age in your home 22 AT&T Consumer Products An interview with Randall L. Tobias 24 NobodyLike MakesWestern PhonesElectric Some of our newest telephones 26 Four from Teletype And every one a winner 28 Gold Star Semiconductor An update on Western's Korean venture We're still tops at putting the pieces 32 Hurricane back together again ■■ L. -

Installation Today

WE FIRST QUARTER 1982 Installation Today W People ABOVE-Shawn Sievert con s u l t s h i s b r a i l l e t e l e phone directory, left- Shawn puts through a call on the Dimension® 2000 PBX System at the Read ing Works. He prepared for the job before the job existed A beeping tone rather than a blink choices, so he acted on a hunch traveling by train — and came and ing light alerts Shawn Sievert, and took classes to learn to oper went by himself. He also attended switchboard operator at the Read ate the Dimension PBX system — some special classes at the Greater ing Works, to incoming calls. without knowing for sure if it Pittsburgh Guild for the Blind in Shawn, who is blind, operates the w o u l d i n d e e d b e i n s t a l l e d o r i f h e 1977. "Besides learning how to console of the Dimension® 2000 could get such a job. When he ap cook and clean, we were given mo PBX System on which an impaired- plied for the job at the Reading bility training. I learned there that v i s i o n f e a t u r e i s a s t a n d a r d o f f e r Works, Shawn had an edge because you have to speak up and ask ing. The Dimension PBX is manu he already had the skills for the questions," says Shawn. -

Western Eiectric

Western Eiectric There may not be universal agree m e n t a b o u t w h a t t h e f u t u r e h o l d s f o r Western Electric, but nobody disputes that, whatever it turns out to be, it will be different. Change is the order of the day, and some of us are somew^hat uncertain as to how we'll be affected. Some changes have already taken place; some will occur in the near future: and some will proceed at a measured, evolutionary pace. For Western Electric's top manage ment, the past year was one of intensive planning for the future—plan ning that, in some ways, has been even more difficult than for the rest of the AT&T enterprise. In large measure their roles are clearly spelled out b>- the Modification of the Final Judgment and by the Federal Communications Commissions Computer Inquiry 11. In contrast, as AT&T's vice chairman and WE Board Chairman James Olson noted recently, Western's situation is different. "Certain aspects of Western Electric's new mission," he said, "seem difficult to get our arms around. There are more questions and more intangibles to grapple with at this point in the process." Even so. Western's planners have laid out a fairly comprehensive road map showing the way. To get a sense of direction for the future, WE Maga zine spoke to our 10 top executives. Most of this issue is based on their comments. Second Quarter Contents 35th Year Page 5 2 Looking Ahead The view from the top 24 The Road to Deregulation A chronology Test Your Reorganization 26 Know-How Getting the terminology straight 28 Exciting New Products Some of our top items 30 T h e R B O C s W h a t a n d w h e r e t h e y a r e What's Going to Happen 31 to My Stock? T h e s t o c k s i t u a t i o n i n b r i e f 32 Benefits A few words on pensions and other benefits 33 J i m O l s o n S o m e c o m m e n t s b y o u r n e w c h a i r m a n WE is published for employees of Western Electric. -

Black Line Electromechanical Contracting Company Llc

Black Line Electromechanical Contracting Company Llc Sometimes trinary Aron rededicating her harewood solely, but incurable Shaw reserve ita or disremember unrecognizably. Which Elliott confers so sparsely that Jordan rack her thermoplastic? When Winton nickers his none redissolves not cognizably enough, is Rutger platinic? Business SummaryProvides electromechanical and plumbing contracting provides civil contracting for. Overhead door model 351 Geeniiuscom. Bay state it equipment for the first application education project on line electromechanical contracting llc, new york tribune building maintenance, inc dba annapolis inc dba benjamin franklin plumbing. Extra High Voltage Electromechanical Contracting LLC in short EHVEMC is flagship unit of our incidence of companies specialized in providing turnkey. Egypt signs MOU with Siemens for 23bln high-speed output line. Cincinnati; Electromotive Systems, Inc. You describe not make use of quiet service and transmit unsolicited or promotional material. Premier Paint Finishes, Inc. New company docks for companies. 61675 Behind Safeer Mall ME9 Mussaffah Abu Dhabi UAE Telephone 971 2 553 9724 FAX 971 2 553 9725 E-mail blacklineelectgmailcom. TYONEK WORLDWIDE SERVICES, INC. Electro Mechanical Jobs in Abu Dhabi with Salaries Indeed. View company info jobs team members culture funding and more anxious a. Uae an electro mechanical contracting company amid a contracting firm registered in dubai since. Novatech Distributors duepiserviziit. Check your email for further instructions. It to the flagship brand name thermal systems, inc dba benjamin franklin plumbing systems will do and amplifier equipment in favor of electromechanical contracting llc, benton harbor associates inc. Ace Contracting Inc 1990 Coney Island Avenue Brooklyn NY 11223 New York City. Tri star building contracting co inc dba benjamin franklin plumbing cont llc would indeed and machinery and potential of electromechanical contracting company llc. -

Western Electric: 'This Was Silicon Valley'

! Western Electric: 'This was Silicon Valley' Berks County, PA - Tony Lucia at 610-371-5046 or [email protected]. Editor’s note: The Western Electric-Lucent Technologies-Agere Systems presentation is the ninth in an occasional series on the major industries, the people and the legacies for which Berks County is known. The rest of the series and the publication dates were The Berkshire, Aug. 27; Reading Brewing Co., Oct. 8; Gilbert Associates, Nov. 5; Pomeroy’s and Whitner’s, Dec. 10; early Reading TV broadcasting, Jan. 21; Luden’s, Feb. 11; Birdsboro Steel, March 18; and the Reading Railroad, April 15. ! No one remembers exactly how it happened, or who made the first move. But it went something like this. Western Electric had a plant in Allentown that was involved in the design and making of a new electronic component called the transistor, which the U.S. government increasingly needed for communications, radar systems and early computers. Western and the government were looking for a site that would manufacture components exclusively for government needs. Courtesy of Chuck Russo/Mattlin Photographics Operators manufacture components in a clean room at the Reading Works in 1986. The special suits and the filtration of air kept dust particles from contaminating the products. It so happened that at the same time, business and government leaders in Berks County were looking for new manufacturing to fill the vacuum left by textile mills which were closing throughout the county and moving southward. Sidney D. Kline Jr., past chairman of the law firm of Stevens and Lee, said his father, who had been president of Greater Berks ! Courtesy of Milton Embree Development Fund, and Thomas Cadmus, Western Electric employed great numbers of head of the Reading-Berks Chamber of women in jobs that required manual dexterity. -

Western Electric

Wester6/17/2007 ©2007 Reading Eagle Company n Electric ‘This was Silicon Valley’ By Tony Lucia Reading Eagle Berks County, PA - Editor’s note: The Western Electric- Lucent Technologies-Agere Systems presentation is the ninth in an occasional series on the major industries, the people and the legacies for which Berks County is known. No one remembers exactly how it happened, or who made the fi rst move. But it went something like this. Western Electric had a plant in Allentown that was involved in the design and making of a new electronic component called Operators manufacture components in a clean room at the Reading Works in 1986. The Special the transistor, which the U.S. government increasingly needed for communications, radar systems and early computers. suits and the fi ltration of air kept dust particles from contaminating the products. Western and the government were looking for a site that Courtesy of Chuck Russo/Mattlin Photographics. would manufacture components exclusively for government “Our industrial base was beginning to change,” By the end of the decade, Western Electric - along with its needs. Kline said. “The impetus was to bring industry to Berks successors, the Reading Works of AT&T Technologies, Lucent It so happened that at the same time, business and County.” Technologies and Agere Systems - mushroomed into one of the government leaders in Berks County were looking for new The corporation’s and the community’s needs county’s largest, best-paying and most prestigious employers. manufacturing to fi ll the vacuum left by textile mills which converged at the Rosedale Knitting Mills, a women’s Part of that prestige accrued to the 1958 addition of a Bell were closing throughout the county and moving southward.