Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

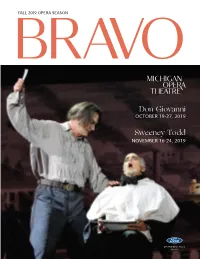

Don Giovanni Sweeney Todd

FALL 2019 OPERA SEASON B R AVO Don Giovanni OCTOBER 19-27, 2019 Sweeney Todd NOVEMBER 16-24, 2019 2019 Fall Opera Season Sponsor e Katherine McGregor Dessert Parlor …at e Whitney. Named a er David Whitney’s daughter, Katherine Whitney McGregor, our intimate dessert parlor on the Mansion’s third oor features a variety of decadent cakes, tortes, and miniature desserts. e menu also includes chef-prepared specialties, pies, and “Drinkable Desserts.” Don’t miss the amazing aming dessert station featuring Bananas Foster and Cherries Jubilee. Reserve tonight’s table online at www.thewhitney.com or call 313-832-5700 4421 Woodward Ave., Detroit Pre- eater Menu Available on performance date with today’s ticket. Choose one from each course: FIRST COURSE Caesar Side Salad Chef’s Soup of the Day e Whitney Duet MAIN COURSE Grilled Lamb Chops Lake Superior White sh Pan Roasted “Brick” Chicken Sautéed Gnocchi View current menus DESSERT and reserve online at Chocolate Mousse or www.thewhitney.com Mixed Berry Sorbet with Fresh Berries or call 313-832-5700 $39.95 4421 Woodward Ave., Detroit e Katherine McGregor Dessert Parlor …at e Whitney. Named a er David Whitney’s daughter, Katherine Whitney McGregor, our intimate dessert parlor on the Mansion’s third oor features a variety of decadent cakes, tortes, and miniature desserts. e menu also includes chef-prepared specialties, pies, and “Drinkable Desserts.” Don’t miss the amazing aming dessert station featuring Bananas Foster and Cherries Jubilee. Reserve tonight’s table online at www.thewhitney.com or call 313-832-5700 4421 Woodward Ave., Detroit Pre- eater Menu Available on performance date with today’s ticket. -

The Hours Begin to Sing Songs by American Composers Performed by Soprano Lisa Delan New Cd Released by Pentatone Classics

FOR IMMEDIATE RELEASE THE HOURS BEGIN TO SING SONGS BY AMERICAN COMPOSERS PERFORMED BY SOPRANO LISA DELAN NEW CD RELEASED BY PENTATONE CLASSICS A new CD, The Hours Begin to Sing, with songs by American composers performed by soprano Lisa Delan, has just been released on the PentaTone Classics label (PTC 5186 459). The recording features the art songs of William Bolcom, John Corigliano, David Garner, Gordon Getty, Jake Heggie and Luna Pearl Woolf and is the partner CD to the 2009 album And If The Song Be Worth A Smile. Ms. Delan and pianist Kristin Pankonin, joined by guest artists Matt Haimovitz, David Krakauer and Maxim Rubtsov, present four premiere recordings, three of which were written specifically for this disc. 2 Ms. Delan states, “To be part of the creative process of new songs from their inception to fruition is an exhilarating – and altogether humbling – experience. Myriad externalities influence the direction of the journey from the moment the text speaks to a composer until the moment the performers speak the text, but the great wonder is in what happens in-between, in the mind and hand of the composer.” Contents of the CD PentaTone Classics (PTC 5186 459) THE HOURS BEGIN TO SING Lisa Delan, soprano Kristin Pankonin, piano Matt Haimovitz, cello David Krakauer, clarinet Maxim Rubtsov, flute Jake Heggie (1961) – From The Book of Nightmares For Soprano, Cello, and Piano Poems by Galway Kinnell I. The Nightmare II. In a Restaurant III. My Father’s Eyes IV. Back You Go David Garner (1954) – Vilna Poems For Soprano, Clarinet, Cello and Piano Poems by Avrom Sutzkever Unter dayne vayse shtern Shpiltsayg In kartser Ekzekutzie Vi azoy? In torbe funem vint John Corigliano (1938) – Three Irish Folksong Settings For Soprano and Flute I. -

Boston Symphony Orchestra Concert Programs, Season 118, 1998-1999

BOSTON SYMPHONY ORCHESTRA 1 I O Z AWA ' T W E N T Y- F I F 1 H ANNIVERSARY SEASO N 1 1 8th Season • 1 998-99 Bring your Steinway: < With floor plans from acre gated community atop 2,100 to 5,000 square feet, prestigious Fisher Hill you can bring your Concert Jointly marketed by Sotheby's Grand to Longyear. International Realty and You'll be enjoying full-service, Hammond Residential Real Estate. single-floor condominium living at Priced from $1,100,000. its absolutefinest, all harmoniously Call Hammond Real Estate at located on an extraordinary eight- (617) 731-4644, ext. 410. LONGYEAR at Jisner Jiill BROOKLINE Seiji Ozawa, Music Director 25TH ANNIVERSARY SEASON Bernard Haitink, Principal Guest Conductor One Hundred and Eighteenth Season, 1998-99 Trustees of the Boston Symphony Orchestra, Inc. R. Willis Leith, Jr., Chairman Nicholas T. Zervas, President Peter A. Brooke, Vice-Chairman William J. Poorvu, Vice-Chairman and Treasurer Harvey Chet Krentzman, Vice-Chairman Ray Stata, Vice-Chairman Harlan E. Anderson Deborah B. Davis Edna S. Kalman Vincent M. O'Reilly Gabriella Beranek Nina L. Doggett George Krupp Peter C. Read James E Cleary Nancy J. Fitzpatrick Mrs. August R. Meyer Hannah H. Schneider John F. Cogan, Jr. Charles K. Gifford, Richard P. Morse Thomas G. Sternberg Julian Cohen ex-ojficio Mrs. Robert B. Stephen R. Weiner William F. Connell Avram J. Goldberg Newman Margaret Williams- William M. Crozier, Jr. Thelma E. Goldberg Robert P. O'Block, DeCelles, ex-qfficio Nader F Darehshori Julian T. Houston ex-ojficio Life Trustees Vernon R. -

Samuel Ramey

welcome to LOS i\Ilgeles upera http://www.losangelesopera.comlproduction/index.asp?... •• PURCHASE TICKETS • 2003/2004 SEASON LA AMNATION DE FAD T La damnation de Faust The damnation of Faust / Hector Berlioz Nicholas and In French with English Supertitles Ticket Information Alexandra Lucia di Samuel Ramey, Synopsis Lammermoor r-----------.., Program Notes Denyce Graves and Photo Gallery Orfeo ed Euridice Paul Groves star in a spectacular new Recital: production by Achim Ask an Expert Hei-Kyung Hong Forward to a Freyer with Kent Friend Recital: Cecilia Nagano conducting. Bartoli Generously Madama Europe's master Underwritten by: Butterfly theatre artist Achim Freyer matches his New production Die Frau ohne made possible by a Schatten painterly visual imagery with Hector generous gift from Mr. and Mrs. Recital: Dmitri Berlioz's vivid musical imagination in the premiere of Hvorostovsky Milan Panic this new production featuring a cast of more than Le nozze di 100 singers and dancers. The legend of Faust, which Figaro tells the story of the man who sold his soul to the II trovatol'"e Devil, has captivated great imaginations for centuries. Marlowe, Goethe, Gounod, Schumann, Liszt, Mahler and Stravinsky all found inspiration in SEASON G!J1]) the Faust tale, which continues to reverberate in SPONSOR Audt today's modern world. Originally conceived as an oratoriO, Hector Berlioz's dramatic La damnation de Faust is now a mainstay of opera houses around the world. Haunting melodies and startling orchestrations flood the score and illustrate the beWitching tale of Faust's desperate struggle for power, riches, youth and, ultimately, redemption. PRODUCTION DATES: Wednesday September 10, 20036:30 p.m. -

Coa-Program-For-Web.Pdf

HOUSTON GRAND OPERA AND SID MOORHEAD, CHAIRMAN WELCOME YOU TO THE TAMARA WILSON, LIVESTREAM HOST E. LOREN MEEKER, GUEST JUDGE FRIDAY, FEBRUARY 5, 2021 AT 7 P.M. BROADCAST LIVE FROM THE WORTHAM THEATER CENTER TEXT TO VOTE TEXT TO GIVE Text to vote for the Audience Choice Award. On page Support these remarkable artists who represent 9, you will see a number associated with each finalist. the future of opera. Text the number listed next to the finalist’s name to 713-538-2304 and your vote will be recorded. One Text HGO to 61094 to invest in the next generation vote per phone number will be registered. of soul-stirring inspiration on our stage! 2 WELCOME TO CONCERT OF ARIAS 2021 SID MOORHEAD Chairman A multi-generation Texan, Sid Moorhead is the owner of in HGO’s Overture group and Laureate Society, and he serves Moorhead’s Blueberry Farm, the first commercial blueberry on the company’s Special Events committee. farm in Texas. The farm, which has been in the Moorhead family for three generations, sits on 28 acres in Conroe and Sid was a computer analyst before taking over the family boasts over 9,000 blueberry plants. It is open seasonally, from business and embracing the art of berry farming. He loves to the end of May through mid-July, when people from far and travel—especially to Europe—and has joined the HGO Patrons wide (including many fellow opera-lovers and HGO staffers) visit on trips to Italy and Vienna. to pick berries. “It’s wonderful. -

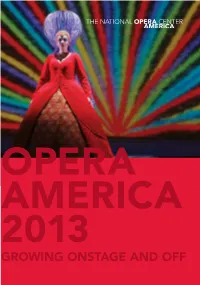

2013 Year in Review

OPERA AMERICA 2013 GROWING ONSTAGE AND OFF OPTION 1 TABLE OF CONTENTS A SURGE OF INNOVATION 6 RESONATING IN NEW SPACES 14 A COMMUNITY OF VOICES 20 OPERA AMERICA FINANCIAL REPORT 28 ANNUAL FIELD REPORT 30 SUPPORT FOR OPERA AMERICA 55 COVER: Maria Aleida as Queen of the Night in Opera Carolina’s production of The Magic Flute. Photo by Jon Silla. LEFT: Nina Yoshida Nelsen, Ji Hyun Jang and Mihoko Kinoshita in Houston Grand Opera’s production of The Memory Stone by Marty Regan and Kenny Fries. Photo by Felix Sanchez. CONCEPT AND DESIGN FOR ANNUAL REPORT BY THE LETTER FROM THE CHAIRMAN Since its inception OPERA America has existed as a community of like-minded individuals committed to the artistic and financial strength of the field. This past year, our definition of community expanded: our conference, held in Vancouver, affirmed our commitment to all of North America, while our growing partnership with Opera Europa continued to bridge the continents through our shared dedication to an art form that knows no borders. Most profoundly, however, the opening of the National Opera Center in New York has created a new center for our community, a tangible space where individual and company members can gather for auditions, recitals and professional learning programs. The center’s technology capabilities enable us to share these offerings globally, even as its flexible amenities enable us to share our love for opera locally. We are delighted to present our global, national and local achievements of the past year through this Annual Report. To our members we offer gratitude for your support of these achievements. -

Ildar Abdrazakov Las Versiones Del Demonio

ENTREVISTA Ildar Abdrazakov Las versiones del demonio por Ingrid Haas ldar Abdrazakov es uno de los grandes bajos en la actualidad. A sus 39 años, goza ya de una carrera sólida y llena de éxitos en teatros tan importantes como la Scala de Milán, Iel Metropolitan Opera House de Nueva York, Washington Opera, Los Ángeles Ópera, Royal Opera House de Londres, Opéra Bastille de París, el Teatro Mariinsky, el Liceu de Barcelona, el Real de Madrid, la Ópera de Montecarlo, la Ópera de San Francisco, la Ópera Estatal de Viena y la Ópera Estatal de Baviera, entre otras. La voz de Abdrazakov ha conquistado a los públicos más exigentes y a directores de orquesta de la talla de Riccardo Muti, James Levine, Valery Gergiev, Gianandrea Noseda, Anthony Pappano, Riccardo Chailly y Bertrand de Billy, sólo por nombrar a algunos. “En las tres Con su cavernoso timbre, innegable musicalidad y gallarda versiones de presencia escénica, Abdrazakov ha cantado una amplia gama de Mefistófeles que he roles que van desde Fígaro en Le nozze di Figaro de Mozart, el rol cantado, mi Fausto titular y Leporello en Don Giovanni, Moïse en Moïse et Pharaon, ha sido siempre Assur en Semiramide, Don Basilio en Il Barbiere di Siviglia, las Ramón Vargas” tres de Rossini, Oroveso en Norma de Bellini, Méphistophélès Foto: Sergei Misenko en las versiones de Faust de Gounod y La damnation de Faust de Berlioz, el rol principal de Mefistofelede Boito, los Cuatro Sí, en efecto. Vine a cantar hace unos años a la Ciudad de México: Villanos de Les contes d’Hoffmann, Walter en Luisa Miller así un recital en la Sala Nezahualcóyotl y el Requiem de Verdi en como Oberto y Attila en las óperas homónimas de Verdi, Dosifei en Bellas Artes. -

Cast Amendment for Il Trittico

1 FEBRUARY 2016 CAST AMENDMENT IL TRITTICO (Giacomo Puccini) 25, 29 Februry; 3, 5, 8 and 15 March at 6.30pm To her great disappointment, Austrian soprano Martina Serafin has been forced to withdraw from her role debut as Giorgetta in Il tabarro due to an injury suffered before Christmas. She has made good progress since the accident, but unfortunately she is still not adequately mobile to undertake this role for The Royal Opera. The role of Giorgetta will now be sung by American soprano Patricia Racette . Patricia Racette made her Royal Opera debut in 1996 as Mimì ( La bohème ). She has previously sung the role of Giorgetta for Theater an der Wien, and will perform the role in Rome in April 2016. Her other recent engagements include Nedda ( Pagliacci ) for the Metropolitan Opera, New York, Katerina Ismailova ( Lady Macbeth of Mtsensk ) for English National Opera and Elle ( La Voix humaine ) for Chicago Opera Theater. The rest of the cast remains unchanged, with Italian baritone Lucio Gallo as Michele, American tenor Carl Tanner as Luigi, Italian tenor Carlo Bosi as Tinca, British bass Jeremy White as Talpa, Korean tenor and Jette Parker Young Artist David Junghoon Kim as Ballad Seller, Russian mezzo-soprano Irina Mishura as Frugola, Australian soprano and Jette Parker Young Artist Lauren Fagan and Portguese tenor Luis Gomes as the Lovers and Italian conductor Nicola Luisotti . PRESS OFFICE CONTACTS Ann Richards/David Brownlie-Marshall/Celia Moran/Emily Meredith [email protected] / [email protected] / [email protected] /[email protected] For all Royal Opera House press releases visit www.roh.org.uk/press . -

EMILY DICKINSON's POETIC IMAGERY in 21ST-CENTURY SONGS by LORI LAITMAN, JAKE HEGGIE, and DARON HAGEN by Shin-Yeong Noh Submit

EMILY DICKINSON’S POETIC IMAGERY IN 21ST-CENTURY SONGS BY LORI LAITMAN, JAKE HEGGIE, AND DARON HAGEN by Shin-Yeong Noh Submitted to the faculty of the Jacobs School of Music in partial fulfillment of the requirements for the degree, Doctor of Music Indiana University May 2019 Accepted by the faculty of the Indiana University Jacobs School of Music, in partial fulfillment of the requirements for the degree Doctor of Music Doctoral Committee ______________________________________ Andrew Mead, Research Director ______________________________________ Patricia Stiles, Chair ______________________________________ Gary Arvin ______________________________________ Mary Ann Hart March 7, 2019 ii Copyright © 2019 Shin-Yeong Noh iii To My Husband, Youngbo, and My Son iv Acknowledgements This work would not have been possible without many people who aided and supported me. I am grateful to all of my committee members for their advice and guidance. I am especially indebted to my research director, Dr. Andrew Mead, who provided me with immeasurable wisdom and encouragement. His inspiration has given me huge confidence in my study. I owe my gratitude to my teacher, committee chair, Prof. Patricia Stiles, who has been very careful and supportive of my voice, career goals, health, and everything. Her instructions on the expressive performance have inspired me to consider the relationship between music and text, and my interest in song interpretation resulted in this study. I am thankful to the publishers for giving me permission to use the scores. Especially, I must thank Lori Laitman, who offered me her latest versions of the songs with a very neat and clear copy. She is always prompt and nice to me. -

Transcript Released 4/22/2021 CHRIS LARGENT: Hey There, Let Me Take You Off This Busy Main Road of Van Ness Avenue, Follow Me Through This Parklet

North Stage Door - Episode 1 Transcript Released 4/22/2021 CHRIS LARGENT: Hey there, let me take you off this busy main road of Van Ness Avenue, follow me through this parklet. I’m going to bring you into the secret world - not accessible to the general public...The North Stage Door! Welcome to San Francisco Opera's new podcast! I'm your host, Chris Largent and I'm delighted to sweep you into this massive hive of creativity, stagecraft and performance at one of opera’s most exciting companies. Along the way, we’ll meet singers, directors, designers -- and some surprise guests; like Pixar’s Chief Creative Officer and Academy Award Winning Director Pete Docter, and internationally acclaimed opera star Patricia Racette. In normal times, walking around backstage, there would be a flurry of activity. But, it's not really happening like that this year...our stage has been dark. Our season? Canceled. This moment of social distancing has given us time to reflect -- how can this venerable artform that is entirely dependent on precision planning, hundreds and hundreds of people from different disciplines collaborating behind the scenes, and thousands in the audience --- how might this artform of opera adapt to a different reality, yet still adhere to restrictions necessary to keep everyone safe? How can we satisfy the craving we’re all feeling... to experience opera live and come together as a community again? Luckily, San Francisco Opera is in the process of answering this question with a production of Barber of Seville that is unlike any other --and is taking shape as I speak. -

Ildar Abdrazakov

POWER PLAYERS Russian Arias for Bass ILDAR ABDRAZAKOV CONSTANTINE ORBELIAN, CONDUCTOR KAUNAS CITY SYMPHONY ORCHESTRA KAUNAS STATE CHOIR 1 0 13491 34562 8 ORIGINAL DELOS DE 3456 ILDAR ABDRAZAKOV • POWER PLAYERS DIGITAL iconic characters The dynamics of power in Russian opera and its most DE 3456 (707) 996-3844 • © 2013 Delos Productions, Inc., © 2013 Delos Productions, 95476-9998 CA Sonoma, 343, Box P.O. (800) 364-0645 [email protected] www.delosmusic.com CONSTANTINE ORBELIAN, CONDUCTOR ORBELIAN, CONSTANTINE ORCHESTRA CITY SYMPHONY KAUNAS CHOIR STATE KAUNAS Arias from: Arias Rachmaninov: Aleko the Tsar & Ludmila,Glinka: A Life for Ruslan Igor Borodin: Prince Boris GodunovMussorgsky: The Demon Rubinstein: Onegin, Iolanthe Eugene Tchaikovsky: Peace and War Prokofiev: Rimsky-Korsakov: Sadko 66:49 Time: Total Russian Arias for Bass ABDRAZAKOV ILDAR POWER PLAYERS ORIGINAL DELOS DE 3456 ILDAR ABDRAZAKOV • POWER PLAYERS DIGITAL POWER PLAYERS Russian Arias for Bass ILDAR ABDRAZAKOV 1. Sergei Rachmaninov: Aleko – “Ves tabor spit” (All the camp is asleep) (6:19) 2. Mikhail Glinka: Ruslan & Ludmila – “Farlaf’s Rondo” (3:34) 3. Glinka: Ruslan & Ludmila – “O pole, pole” (Oh, field, field) (11:47) 4. Alexander Borodin: Prince Igor – “Ne sna ne otdykha” (There’s no sleep, no repose) (7:38) 5. Modest Mussorgsky: Boris Godunov – “Kak vo gorode bylo vo Kazani” (At Kazan, where long ago I fought) (2:11) 6. Anton Rubinstein: The Demon – “Na Vozdushnom Okeane” (In the ocean of the sky) (5:05) 7. Piotr Tchaikovsky: Eugene Onegin – “Liubvi vsem vozrasty pokorny” (Love has nothing to do with age) (5:37) 8. Tchaikovsky: Iolanthe – “Gospod moi, yesli greshin ya” (Oh Lord, have pity on me!) (4:31) 9. -

The American Opera Series May 16 – November 28, 2015

The American Opera Series May 16 – November 28, 2015 The WFMT Radio Network is proud to make the American Opera Series available to our affiliates. The American Opera Series is designed to complement the Metropolitan Opera Broadcasts, filling in the schedule to complete the year. This year the American Opera Series features great performances by the Lyric Opera of Chicago, LA Opera, San Francisco Opera, Glimmerglass Festival and Opera Southwest. The American Opera Series for 2015 will bring distinction to your station’s schedule, and unmatched enjoyment to your listeners. Highlights of the American Opera Series include: • The American Opera Series celebrates the Fourth of July (which falls on a Saturday) with Lyric Opera of Chicago’s stellar production of George Gershwin’s Porgy and Bess. • LA Opera brings us The Figaro Trilogy, including Mozart’s The Marriage of Figaro, Rossini’s The Barber of Seville, and John Corigliano’s The Ghosts of Versailles. • The world premiere of Marco Tutino’s Two Women (La Ciociara) starring Anna Caterina Antonacci, based on the novel by Alberto Moravia that became a classic film, staged by San Francisco Opera. • Opera Southwest’s notable reconstruction of Franco Faccio’s 1865 opera Amleto (Hamlet), believed lost for over 135 years, in its American premiere. In addition, this season we’re pleased to announce that we are now including multimedia assets for use on your station’s website and publications! You can find the supplemental materials at the following link: American Opera Series Supplemental Materials Please note: If you have trouble accessing the supplemental materials, please send me an email at [email protected] Program Hours* Weeks Code Start Date Lyric Opera of Chicago 3 - 5 9 LOC 5/16/15 LA Opera 2 ½ - 3 ¼ 6 LAO 7/18/15 San Francisco Opera 1 ¾ - 4 ¾ 10 SFO 8/29/15 Glimmerglass Festival 3 - 3 ½ 3 GLI 11/7/15 Opera Southwest Presents: Amleto 3 1 OSW 11/28/15 Los Angeles Opera’s Production of The Ghosts of Versailles Credit: Craig Henry *Please note: all timings are approximate, and actual times will vary.