India- Chennai- Residential Q4 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Village Panchayats in Tamil Nadu District Code District Name

List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 1 Kanchipuram 1 Kanchipuram 1 Angambakkam 2 Ariaperumbakkam 3 Arpakkam 4 Asoor 5 Avalur 6 Ayyengarkulam 7 Damal 8 Elayanarvelur 9 Kalakattoor 10 Kalur 11 Kambarajapuram 12 Karuppadithattadai 13 Kavanthandalam 14 Keelambi 15 Kilar 16 Keelkadirpur 17 Keelperamanallur 18 Kolivakkam 19 Konerikuppam 20 Kuram 21 Magaral 22 Melkadirpur 23 Melottivakkam 24 Musaravakkam 25 Muthavedu 26 Muttavakkam 27 Narapakkam 28 Nathapettai 29 Olakkolapattu 30 Orikkai 31 Perumbakkam 32 Punjarasanthangal 33 Putheri 34 Sirukaveripakkam 35 Sirunaiperugal 36 Thammanur 37 Thenambakkam 38 Thimmasamudram 39 Thilruparuthikundram 40 Thirupukuzhi List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 41 Valathottam 42 Vippedu 43 Vishar 2 Walajabad 1 Agaram 2 Alapakkam 3 Ariyambakkam 4 Athivakkam 5 Attuputhur 6 Aymicheri 7 Ayyampettai 8 Devariyambakkam 9 Ekanampettai 10 Enadur 11 Govindavadi 12 Illuppapattu 13 Injambakkam 14 Kaliyanoor 15 Karai 16 Karur 17 Kattavakkam 18 Keelottivakkam 19 Kithiripettai 20 Kottavakkam 21 Kunnavakkam 22 Kuthirambakkam 23 Marutham 24 Muthyalpettai 25 Nathanallur 26 Nayakkenpettai 27 Nayakkenkuppam 28 Olaiyur 29 Paduneli 30 Palaiyaseevaram 31 Paranthur 32 Podavur 33 Poosivakkam 34 Pullalur 35 Puliyambakkam 36 Purisai List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 37 -

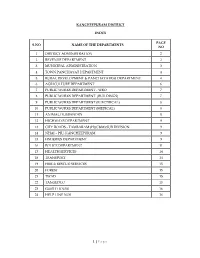

P Age KANCHEEPURAM DISTRICT INDEX S.NO NAME of THE

KANCHEEPURAM DISTRICT INDEX PAGE S.NO NAME OF THE DEPARTMENTS NO 1 DISTRICT ADMINISTRATION 2 2 REVENUE DEPARTMENT 2 3 MUNICIPAL ADMINISTRATION 3 4 TOWN PANCHAYAT DEPARTMENT 4 5 RURAL DEVELOPMENT & PANCHAYATRAJ DEPARTMENT 4 6 AGRICULTURE DEPARTMENT 6 7 PUBLIC WORKS DEPARTMENT - WRO 7 8 PUBLIC WORKS DEPARTMENT (BUILDINGS) 7 9 PUBLIC WORKS DEPARTMENT (ELECTRICAL) 8 10 PUBLIC WORKS DEPARTMENT (MEDICAL) 8 11 ANIMAL HUSBANDRY 8 12 HIGHWAYS DEPARTMENT 9 13 CITY ROADS - TAMBARAM (H)(C&M) SUB DIVISION 9 14 NHAI – PIU, KANCHEEPURAM 9 15 FISHERIES DEPARTMENT 9 16 POLICE DEPARTMENT 11 17 HEALTH SERVICES 14 18 TRANSPORT 14 19 FIRE & RESCUE SERVICES 15 20 FOREST 15 21 TWAD 15 22 TANGEDCO 15 23 GUEST HOUSE 16 24 HELP LINE NOS 16 1 | Page DISTRICT ADMINISTRATION Thiru.P.Ponniah, I.A.S., 044- 27237433 District Collector 044-27238477 9444134000 044-27238478 DRO (District Revenue Officer) 044-27237945 9445000903 044-27238995 Project Officer DRDA 044-27237153 7373704201 044-27238651 9443258833 044-27223353 Personal Assistant (General) 044-27237789 9445008138 044-27237909 Personal Assistant (Agriculture) 044-27237426 9444493040 Personal Assistant (Election) 044-27238445 9842503969 Personal Assistant (Accounts) 044-27237426 9600255568 7904127878 Special Deputy Collector (SSS) 044-27236623 9445461737 AC (Excise) 044-27237424 9942845207 DADWO (Adi Dravidar Welfare) 044-27236655 7338801259 DBCWO (Backward Class) 044-27236588 9443356133 DDAWO (Differently Abled) 044-27431853 9445497075 9445000168 District Supply Officer 044-27237424 9123555284 DSWO (Social Welfare) -

Thiruvallur District

DISTRICT DISASTER MANAGEMENT PLAN FOR 2017 TIRUVALLUR DISTRICT tmt.E.sundaravalli, I.A.S., DISTRICT COLLECTOR TIRUVALLUR DISTRICT TAMIL NADU 2 COLLECTORATE, TIRUVALLUR 3 tiruvallur district 4 DISTRICT DISASTER MANAGEMENT PLAN TIRUVALLUR DISTRICT - 2017 INDEX Sl. DETAILS No PAGE NO. 1 List of abbreviations present in the plan 5-6 2 Introduction 7-13 3 District Profile 14-21 4 Disaster Management Goals (2017-2030) 22-28 Hazard, Risk and Vulnerability analysis with sample maps & link to 5 29-68 all vulnerable maps 6 Institutional Machanism 69-74 7 Preparedness 75-78 Prevention & Mitigation Plan (2015-2030) 8 (What Major & Minor Disaster will be addressed through mitigation 79-108 measures) Response Plan - Including Incident Response System (Covering 9 109-112 Rescue, Evacuation and Relief) 10 Recovery and Reconstruction Plan 113-124 11 Mainstreaming of Disaster Management in Developmental Plans 125-147 12 Community & other Stakeholder participation 148-156 Linkages / Co-oridnation with other agencies for Disaster 13 157-165 Management 14 Budget and Other Financial allocation - Outlays of major schemes 166-169 15 Monitoring and Evaluation 170-198 Risk Communications Strategies (Telecommunication /VHF/ Media 16 199 / CDRRP etc.,) Important contact Numbers and provision for link to detailed 17 200-267 information 18 Dos and Don’ts during all possible Hazards including Heat Wave 268-278 19 Important G.Os 279-320 20 Linkages with IDRN 321 21 Specific issues on various Vulnerable Groups have been addressed 322-324 22 Mock Drill Schedules 325-336 -

Branch Libraries List

ADDRESS OF BRANCH LIBRARIES 1 District Central Library, 16 Branch Library, 307, Anna Salai, 2D, Nadu Street, Chengalpet – 603 002. Achirupakkam – 603 301. 2 Branch Library, 17 Branch Library, 78, Station Road, Main Road, Kattangolathur – 603 203. Thozhupedu – 603 310. 3 Branch Library, 18 Branch Library, Gandhi Street, Main Road, Guduvancheri – 603 202. Orathy – 603 307. 4 Branch Library, 19 Branch Library, 2/45, B. Santhaimedu, Ladakaranai, Endathur, Singaperrumal Koil – 603 204. Uthiramerur – 603 406. 5 Branch Library, 20 Branch Library, 129, Thiruvalluvar Salai, Bajanai Koil Street, Maraimalai Nagar – 603 209. Elapakkam – 603 201. 6 Branch Library, 21 Branch Library, 5, West Mada Street, 5/55, Salt Road, Thiruporur – 603 110. Cheyyur – 603 202. 7 Branch Library, 22 Branch Library, 34, Mamallapuram Salai, Angalamman Koil Street, Thirukazhukundram – 603 109. Kuvathur – 603 305. 8 Branch Library, 23 Branch Library, 203, Kulakarai Street, 2, East Coast Road, Sembakkam – 603 108. Kadapakkam – 603 304. 9 Branch Library, 24 Branch Library, 105, W2, Brahmanar Street, 9, Chakkaram Kodhandarama P.V. Kalathur – 603 405. Iyengar Street, Uthiramerur – 603 406. 10 Branch Library, 25 Branch Library, East Raja Street, Hospital Road, Mamallapuram – 603 104. Kaliyampoondi – 603 403. 11 Branch Library, 26 Branch Library, Nesco Joint, 1/172, Road Street, Kalpakkam – 603 102. Manampathi – 603 403. 12 Branch Library, 27 Branch Library, 70, Car Street, Main Road, Madhuranthagam – 603 306. Perunagar – 603 404. 13 Branch Library, 28 Branch Library, 3, Othavadai Street, Perumal Koil Street, Karunguzhi – 603 303. Salavakkam – 603 107. 14 Branch Library, 29 Branch Library, Railway Station Road, 138, Pillaiyar Koil Street, Padalam – 603 308. -

Indusrialization of the Madurai-Tuticorin Corridor

INDUSTRIALIZATION OF THE MADURAI – TUTICORIN CORRIDOR THE UNEXPLORED OPPORTUNITY EXECUTIVE SUMMARY For Confederation of Indian Industry By Scope e-Knowledge Center Pvt Ltd Table of Contents SI.NO Topic Page No 1 Introduction 3 i. Introduction 4 ii. Methodology and Approach 4 iii. Framework of Analysis 5 2 Key Indicators 6 i. Demographics and Key Economic 7 Indicators, 2003 ii. Infrastructure 7 ii. Existing Resources, Industries & 11 Clusters 3 Way Forward – The Hubs, The 12 Satellites And The Corridors i. The Approach for the Industrial 13 Development of the Corridor ii. Roles to be played 18 iii. Conclusions & Outlook 20 1.0 Introduction Introduction The Confederation of Indian Industry (CII), Tamil Nadu branch’s Task Force for Industrialisation of Tamil Nadu, has appointed Scope e-Knowledge Center Pvt. Ltd., Chennai to carry out a study on the industrialisation potential of the southern districts of Tamil Nadu and suggest the way forward for achieving the objective. This report covers seven districts: Madurai, Virudhunagar, Ramanathapuram, Tirunelveli, Sivagangai, Tuticorin and Kanniyakumari. It is based on extensive discussions with government officials, industries, trade, services, CII council members and NGOs, in every district covered as well as exhaustive secondary and Internet research. The study was conducted by Scope e-Knowledge Center, Chennai, in partnership with Madras Consultancy Group, Chennai. Methodology and Approach • The study employed a combination of Primary & Secondary research tools • Secondary Research helped in -

The Chennai Comprehensive Transportation Study (CCTS)

ACKNOWLEDGEMENT The consultants are grateful to Tmt. Susan Mathew, I.A.S., Addl. Chief Secretary to Govt. & Vice-Chairperson, CMDA and Thiru Dayanand Kataria, I.A.S., Member - Secretary, CMDA for the valuable support and encouragement extended to the Study. Our thanks are also due to the former Vice-Chairman, Thiru T.R. Srinivasan, I.A.S., (Retd.) and former Member-Secretary Thiru Md. Nasimuddin, I.A.S. for having given an opportunity to undertake the Chennai Comprehensive Transportation Study. The consultants also thank Thiru.Vikram Kapur, I.A.S. for the guidance and encouragement given in taking the Study forward. We place our record of sincere gratitude to the Project Management Unit of TNUDP-III in CMDA, comprising Thiru K. Kumar, Chief Planner, Thiru M. Sivashanmugam, Senior Planner, & Tmt. R. Meena, Assistant Planner for their unstinted and valuable contribution throughout the assignment. We thank Thiru C. Palanivelu, Member-Chief Planner for the guidance and support extended. The comments and suggestions of the World Bank on the stage reports are duly acknowledged. The consultants are thankful to the Steering Committee comprising the Secretaries to Govt., and Heads of Departments concerned with urban transport, chaired by Vice- Chairperson, CMDA and the Technical Committee chaired by the Chief Planner, CMDA and represented by Department of Highways, Southern Railways, Metropolitan Transport Corporation, Chennai Municipal Corporation, Chennai Port Trust, Chennai Traffic Police, Chennai Sub-urban Police, Commissionerate of Municipal Administration, IIT-Madras and the representatives of NGOs. The consultants place on record the support and cooperation extended by the officers and staff of CMDA and various project implementing organizations and the residents of Chennai, without whom the study would not have been successful. -

Mr. Hemant B Patel, No. 6, Copper Beach Road, Panaiyur, Sholinganallur, Chennai-600 119

Mr. Hemant B Patel, No. 6, Copper Beach Road, Panaiyur, Sholinganallur, Chennai-600 119. Contact No. : 98840 73700 Our Ref. : MoEF&CC/CRZ/03.19 The Member Secretary & Director, EAC for Projects Related to Coastal Regulation Zone (CRZ), Ministry of Environment, Forest and Climate Change, Indira Paryavaran Bhawan, 6th Floor, Jal Wing, Jor Bagh Road, Aliganj, New Delhi-110 003. 27th June 2018 Respected Sir, Sub : Post Facto CRZ Clearance for Permissible Activity – Residential Building Survey No. 5 (5/29 as per Patta) of Sholinganallur Village (earlier Tambaram Taluk, Kancheepuram District) at Door No. 6, Copper Beach Road, Panaiyur, Sholiganallur in Greater Chennai Corporation Area, Tamil Nadu - reg. Ref. : MoEF&CC Notification S.O 1002(E) dated 6th March 2018. I,Hemant B Patel, had constructed a Residential Building with a with a Built-up Area of 2226.26 sq.m (2 BHK in Ground, 3 BHK in First Floors & Covered Area in Second Floor) over an Extent of 2,090.32 sq.m in Survey Nos. 5 (5/29 as per Patta) of Sholinganallur Village (earlier Tambaram Taluk, Kancheepuram District) at Door No. 6, Copper Beach Road, Panaiyur, Sholiganallur in Greater Chennai Corporation Area (which is expanded in the Year 2011) was completed in the Year 2008. It is accessible from the East Coast Road (ECR)/SH-49 Chennai-Puducherry Section. The Project Site is located in-between 12o53’29.75”-12o53’31.56” North Latitude and 80o14’54.85”- 80o14’56.63” East Longitude - Survey of India Topo Sheet No. 66 D/1 & 5. The Plot Area falls between 477-525 m from the High Tide Line (HTL), the Building Area falls between 502-520 m from HTL. -

SNO APP.No Name Contact Address Reason 1 AP-1 K

SNO APP.No Name Contact Address Reason 1 AP-1 K. Pandeeswaran No.2/545, Then Colony, Vilampatti Post, Intercaste Marriage certificate not enclosed Sivakasi, Virudhunagar – 626 124 2 AP-2 P. Karthigai Selvi No.2/545, Then Colony, Vilampatti Post, Only one ID proof attached. Sivakasi, Virudhunagar – 626 124 3 AP-8 N. Esakkiappan No.37/45E, Nandhagopalapuram, Above age Thoothukudi – 628 002. 4 AP-25 M. Dinesh No.4/133, Kothamalai Road,Vadaku Only one ID proof attached. Street,Vadugam Post,Rasipuram Taluk, Namakkal – 637 407. 5 AP-26 K. Venkatesh No.4/47, Kettupatti, Only one ID proof attached. Dokkupodhanahalli, Dharmapuri – 636 807. 6 AP-28 P. Manipandi 1stStreet, 24thWard, Self attestation not found in the enclosures Sivaji Nagar, and photo Theni – 625 531. 7 AP-49 K. Sobanbabu No.10/4, T.K.Garden, 3rdStreet, Korukkupet, Self attestation not found in the enclosures Chennai – 600 021. and photo 8 AP-58 S. Barkavi No.168, Sivaji Nagar, Veerampattinam, Community Certificate Wrongly enclosed Pondicherry – 605 007. 9 AP-60 V.A.Kishor Kumar No.19, Thilagar nagar, Ist st, Kaladipet, Only one ID proof attached. Thiruvottiyur, Chennai -600 019 10 AP-61 D.Anbalagan No.8/171, Church Street, Only one ID proof attached. Komathimuthupuram Post, Panaiyoor(via) Changarankovil Taluk, Tirunelveli, 627 761. 11 AP-64 S. Arun kannan No. 15D, Poonga Nagar, Kaladipet, Only one ID proof attached. Thiruvottiyur, Ch – 600 019 12 AP-69 K. Lavanya Priyadharshini No, 35, A Block, Nochi Nagar, Mylapore, Only one ID proof attached. Chennai – 600 004 13 AP-70 G. -

THIRU VIKRAMKAPUR, IAS, Proc.No. RT /5039 /2008-C Dated:04

PROCEEDINGS OF THE MEMBER SECRETARY, CMDA, CHENNAI-8. PRESENT: THIRU VIKRAMKAPUR, I.A.S., Proc.No. RT /5039 /2008-C Dated:04.09.2008. Sub: CMDA - Planning Permission - Delegation of powers to Executive Officers of Town Panchayats within CMA - orders - issued. The Government in G.O.Ms.No 190 H&UD Department, dated 2.09.2008 has approved the Second Master Plan for Chennai Metropolitan Area (CMA) which was notified in the Tamil Nadu Government Gazette on 2.09.2008. The Second Master Plan for CMA including the Development Regulations contained therein comes into operation from the date of publication of the notification in the Tamil Nadu Government Gazette. 2. Powers for issue of planning permissions, to the Executive Officer of the Town Panchayats within CMA have been delegated earlier in different Authority proceedings. Since the revised Development Regulations (forming part of the Second Master Plan) have come into force, a need has arisen to issue a revised delegation of powers with reference to the Second Master Plan Development Regulations to the Executive Officers for issue of planning permissions. 3. Under Sub-section (3) of section 9-C of the Tamil Nadu Town and Country Planning Act, 1971 (as amended from time to time), the CMDA hereby delegates its powers for issue of planning permission to the Executive Officers of Town Panchayats excluding Porur Town Panchayats within CMA (i.e. (i) Minjur, (ii) Chinnasekkadu, (iii) Puzhal, (iv) Naravarrikuppam, (v) Thirunindravur, (vi) Thirumazhisai, (vii) Mangadu, (viii) Nandambakkam, (ix) Meenambakkam, (x) Kundrathur, (xi) Thiruneermalai, (xii) Perungalathur, (xiii) Peerkankaranai, (xiv) Chitlapakkam, (xv) Sembakkam, (xvi) Madambakkam, (xvii) Perungudi, (xviii) Pallikaranai and (xix) Sholinganallur Town 1 Panchayats) in respect of the following developments subject to the restrictions mentioned hereunder: (A). -

The Institute of Road Transport Driver Training Wing, Gummidipundi

THE INSTITUTE OF ROAD TRANSPORT DRIVER TRAINING WING, GUMMIDIPUNDI LIST OF TRAINEES COMPLETED THE HVDT COURSE Roll.No:17SKGU2210 Thiru.BARATH KUMAR E S/o. Thiru.ELANCHEZHIAN D 2/829, RAILWAY STATION ST PERUMAL NAICKEN PALAYAM 1 8903739190 GUMMIDIPUNDI MELPATTAMBAKKAM PO,PANRUTTI TK CUDDALORE DIST Pincode:607104 Roll.No:17SKGU3031 Thiru.BHARATH KUMAR P S/o. Thiru.PONNURENGAM 950 44TH BLOCK 2 SATHIYAMOORTHI NAGAR 9789826462 GUMMIDIPUNDI VYASARPADI CHENNAI Pincode:600039 Roll.No:17SKGU4002 Thiru.ANANDH B S/o. Thiru.BALASUBRAMANIAN K 2/157 NATESAN NAGAR 3 3RD STREET 9445516645 GUMMIDIPUNDI IYYPANTHANGAL CHENNAI Pincode:600056 Roll.No:17SKGU4004 Thiru.BHARATHI VELU C S/o. Thiru.CHELLAN 286 VELAPAKKAM VILLAGE 4 PERIYAPALAYAM PO 9789781793 GUMMIDIPUNDI UTHUKOTTAI TK THIRUVALLUR DIST Pincode:601102 Roll.No:17SKGU4006 Thiru.ILAMPARITHI P S/o. Thiru.PARTHIBAN A 133 BLA MURUGAN TEMPLE ST 5 ELAPAKKAM VILLAGE & POST 9952053996 GUMMIDIPUNDI MADURANDAGAM TK KANCHIPURAM DT Pincode:603201 Roll.No:17SKGU4008 Thiru.ANANTH P S/o. Thiru.PANNEER SELVAM S 10/191 CANAL BANK ROAD 6 KASTHURIBAI NAGAR 9940056339 GUMMIDIPUNDI ADYAR CHENNAI Pincode:600020 Roll.No:17SKGU4010 Thiru.VIJAYAKUMAR R S/o. Thiru.RAJENDIRAN TELUGU COLONY ROAD 7 DEENADAYALAN NAGAR 9790303527 GUMMIDIPUNDI KAVARAPETTAI THIRUVALLUR DIST Pincode:601206 Roll.No:17SKGU4011 Thiru.ULIS GRANT P S/o. Thiru.PANNEER G 68 THAYUMAN CHETTY STREET 8 PONNERI 9791745741 GUMMIDIPUNDI THIRUVALLUR THIRUVALLUR DIST Pincode:601204 Roll.No:17SKGU4012 Thiru.BALAMURUGAN S S/o. Thiru.SUNDARRAJAN N 23A,EGAMBARAPURAM ST 9 BIG KANCHEEPURAM 9698307081 GUMMIDIPUNDI KANCHEEPURAM DIST Pincode:631502 Roll.No:17SKGU4014 Thiru.SARANRAJ M S/o. Thiru.MUNUSAMY K 5 VOC STREET 10 DR. -

99 Bus Time Schedule & Line Route

99 bus time schedule & line map 99 Tambaram West - Adyar View In Website Mode The 99 bus line (Tambaram West - Adyar) has 5 routes. For regular weekdays, their operation hours are: (1) Adayar Depot: 7:00 PM - 10:44 PM (2) Adyar: 24 hours (3) Chrompet (Depot): 5:46 AM - 10:25 PM (4) Shozhinganallur: 3:31 PM - 5:17 PM (5) Tambaram West: 2:01 AM - 11:31 PM Use the Moovit App to ƒnd the closest 99 bus station near you and ƒnd out when is the next 99 bus arriving. Direction: Adayar Depot 99 bus Time Schedule 4 stops Adayar Depot Route Timetable: VIEW LINE SCHEDULE Sunday 7:00 PM - 10:44 PM Monday 7:00 PM - 10:44 PM Adyar Old Depot Tuesday 7:00 PM - 10:44 PM Adayar O.T. Wednesday 7:00 PM - 10:44 PM Adyar Telephone Exchange Thursday 7:00 PM - 10:44 PM Adyar Bus Terminus Friday 7:00 PM - 10:44 PM Saturday 7:00 PM - 10:44 PM 99 bus Info Direction: Adayar Depot Stops: 4 Trip Duration: 3 min Line Summary: Adyar Old Depot, Adayar O.T., Adyar Telephone Exchange, Adyar Bus Terminus Direction: Adyar 99 bus Time Schedule 46 stops Adyar Route Timetable: VIEW LINE SCHEDULE Sunday 24 hours Monday 24 hours Tambaram West Tuesday 24 hours Tambaram East Wednesday 24 hours Poondi Bazaar Thursday 24 hours 140 Velachery - Tambaram Main Road, Chennai Friday 24 hours Convent Saturday 24 hours Aathi Nagar Selaiyur Camp Road 99 bus Info Direction: Adyar Mahalakshmi Nagar Stops: 46 Trip Duration: 72 min Line Summary: Tambaram West, Tambaram East, Rajakilpakkam Poondi Bazaar, Convent, Aathi Nagar, Selaiyur, Camp Road, Mahalakshmi Nagar, Rajakilpakkam, Kamarajapuram Kamarajapuram, Sembakkam, Prince College, S.I.V.E.T., Santhosh Puram, Vengaivasal Road Sembakkam Junction, Medavakkam Koot Road Bus Terminus, Medavakkam Koot Road, Medavakkam Junction, Prince College Puthu Nagar, Perumbakkam, Junction Of Perumbakkam & Nookam Village, Global Hospital, S.I.V.E.T. -

WATER QUALITY ASSESSMENT of SHOLINGANALLUR LAKE 1L . Maria Subashini 2P.Dayakar 1,2 Assistant Professor, Department of Civil E

International Journal of Pure and Applied Mathematics Volume 116 No. 13 2017, 459-464 ISSN: 1311-8080 (printed version); ISSN: 1314-3395 (on-line version) url: http://www.ijpam.eu Special Issue ijpam.eu WATER QUALITY ASSESSMENT OF SHOLINGANALLUR LAKE 1L . Maria subashini 2P.Dayakar 1,2 Assistant Professor, Department of Civil Engineering, BIST, BIHER, Bharath University, Chennai. [email protected] Abstract: A lake is a large body of water surrounded by A lake may be defined as an enclosed body of water land, inhabited by various aquatic life forms, for all (usually freshwater) totally surrounded by land and with practical purpose, pure water is considered to that which no direct access to the sea. A lake may also be isolated, has low dissolved or suspended solids and obnoxious with no observable direct water input and, on occasions, gases as well low in biological life. Such high quality of no direct output. In many circumstances these isolated water may be required only for drinking purposes while lakes are saline due to evaporation or groundwater inputs. for other uses like agriculture and industry, the quality of Depending on its origin, a lake may occur anywhere water can be quite flexible and water polluted up to within a river basin. A headwater lake has no single river certain extent in general sense can be regarded as pure. input but is maintained by inflow from many small tributary streams, by direct surface rainfall and by Keywords: lakes, water quality, total dissolved solids, groundwater inflow. Such lakes almost invariably have a turbidity.