Larrain Vial Servicios Profesionales Ltda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CSAV's Subsidiary Companies

IDENTIFICATION OF THE COMPANY • Name Compañía Sud Americana de Vapores S.A. • Ticker code Vapores • Tax Number 90.160.000 - 7 • Type of Entity Stock listed company • Securities Register Number 76 • Legal Address Valparaíso, Chile CONSTITUTION DOCUMENTS Compañía Sud Americana de Vapores was incorporated by public deed dated October 4, 1872 before the Valparaíso notary Julio César Escala. Its existence was authorized by Supreme Decree 2,347 of October 9, 1872. These documents were registered on page 486 ff, No.147 and page 497 ff, No.148 respectively in the Valparaíso Registrar of Commerce on October 15, 1872. OFFICES Valparaíso Plaza Sotomayor 50, Valparaíso Postal Code 2360171 PO Box 49-V Telephone: (56-32) 220 3000 Telefax: (56-32) 220 3333 Santiago Hendaya 60, floors 10 to 14, Las Condes Postal Code 6760399 PO Box 186 – Correo 34 Telephone: (56-2) 2330 7000 Telefax: (56-2) 2330 7700 WEB SITE www.csav.com SHAREHOLDER SERVICES DCV Registros S.A. Huérfanos 770 Piso 22 Santiago, Chile Telephone: (56-2) 2393 9003 [email protected] INVESTOR RELATIONS Vivien Swett Senior Vice President, Investor Relations Telephone: (56-32) 220 3296 [email protected] Founded in 1872 CSAV in 2013 Consolidated Financial Statements 2 Chairman’s statement 18 Results analysis 76 Consolidated Statement of Financial Position 4 Board of directors 22 CSAV’s services 78 Consolidated Statement of Comprehensive Income 6 Management 26 Other activities 80 Statement of Changes in Net Equity 81 Consolidated Statement of Cash Flows Activities and businesses General information -

Banchile – Informe Final

Banchile Asesoría Financiera S.A. 3 de noviembre de 2017 Informe al Directorio de Enel Generación Chile S.A. Proyecto Elqui Información Importante El presente documento ha sido preparado por Banchile Asesoría Financiera S.A. (“Banchile”) a solicitud del Directorio de Enel Generación Chile S.A. (el “Directorio de EGC” o el “Cliente”) para actuar como su evaluador independiente en los términos del artículo 147 de la Ley 18.046 en conexión con la reorganización corporativa propuesta (la “Transacción” o “Elqui”). Las recomendaciones y conclusiones aquí contenidas constituyen el mejor parecer u opinión de Banchile respecto de la evaluación de la Transacción al tiempo de elaboración de este documento, considerando la metodología de trabajo utilizada y la información disponible. Sin embargo, las conclusiones contenidas en el presente informe podrían variar si se dispusieran de otros antecedentes o información o se utilizaren otros criterios de valorización no considerados en el desarrollo del presente informe. Banchile no tendrá obligación alguna de comunicar dichas variaciones como así tampoco cuando las opiniones o información contenidas en el documento, o los supuestos sobre los cuales se elaboró el presente informe, se modificaren. Este informe fue preparado para ser usado exclusivamente para efectos de la Transacción y consideración de Enel Generación Chile S.A. (“EGC” o “la Compañía”) y, por tanto, debe ser utilizado exclusivamente en dicho contexto, no pudiendo ser utilizado para otro propósito sin el consentimiento previo y por escrito de Banchile. En la elaboración del informe se ha utilizado únicamente información pública e información proporcionada por la Compañía, respecto de la cual Banchile ha asumido, sin realizar una verificación independiente, su completa y total veracidad, integridad, exactitud, suficiencia, consistencia y razonabilidad. -

Nómina De Acciones

NÓMINA DE ACCIONES NÓMINA DE ACIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN REPORTE TRIMESTRAL NÓMINA DE ACCIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN La Superintendencia de Pensiones emitió la Circular N° 2.026 que deroga la Circular N° 2.010, relativa a los Parámetros para el cálculo de los límites de inversión de los Fondos de Pensiones y Fondos de Cesantía, la que entrará en vigencia el 20 de marzo de 2018. En la Circular, se publica la nómina de las acciones de sociedades anónimas abiertas nacionales que cumplen con los requisitos definidos por el Régimen de Inversión de los Fondos de Pensiones, para ser consideradas en las categorías generales de inversión. Cabe señalar que aquellas acciones que no cumplan con los requisitos antes señalados, podrán ser adquiridas bajo las condiciones establecidas para la categoría restringida, definida en el citado Régimen. El detalle de esta información se encuentra a continuación: ACCIONES DE SOCIEDADES ANÓNIMAS ABIERTAS 1. De acuerdo a lo dispuesto en el inciso sexto del artículo 45 del D.L 3.500 de 1980 y en el Régimen de Inversión de los Fondos de Pensiones las acciones elegibles en categoría general, tanto por instrumento como por emisor, a partir del 20 de marzo de 2018, en virtud del cumplimiento del requisito de presencia ajustada mayor o igual a 25% o contar con un Market Maker en los términos y condiciones establecidos en la Normativa vigente, son las siguientes: RAZÓN SOCIAL NEMOTÉCNICO SERIE AES GENER S.A. AESGENER ÚNICA AGUAS ANDINAS S.A. -

Kathleen C. Barclay, Amcham Chile; Ari Bermann, 3M Chile; Ruth Bradley, Freelance Journalist; John Of

bUSiness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°287, MAY 2013 Chile and Peru: Pacific Partners TRADE TESTIMONIAL SPECIAL REPORT INTELLECTUAL PROPERTY Garden of the Andes Chilean Investment Protecting Pharmaceutical Abroad Patents Planes desde 250 minutos para hablar con cualquier compañía* Cuota inicial** nextel.cl *Sólo llamadas nacionales **Costo cero de la cuota inicial sujeto al valor del plan y al cumplimiento de condiciones contractuales. CONTENTS bUSiness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°287, MAY 2013 TRADE TESTIMONIAL SPotliGHT 6 26 42 LIFE IN THE SLOW LANE Chile and Peru: Success is Brewing Chile and California: Partners Pacific Partners Chilean herbal tea brand Garden for Prosperity Who Flung Dung? TRADE TESTIMONIAL SPECIAL REPORT INTELLECTUAL PROPERTY of the Andes has had to work Garden of the Andes Chilean Investment Protecting Pharmaceutical The annual meeting of the Kim Jong-il, the baby- Abroad Patents hard to earn its place on the Chile-California Council was held faced North Korean leader, shelves of US supermarkets and in San Francisco in April and is more interested in 12 specialty stores. AmCham President Kathleen playing with his toys than Chile and Peru: Barclay was in attendance. starting World War III, Pacific Partners SecondarY storY Economic SNAPSHot writes Mr. Eneldo. Despite a dispute 8 34 Protecting Pharmaceutical between Chile and Global Economics Update: Patents Moderation Appears Temporary Peru over their Chile’s Constitutional Court voted Growth in emerging economies, maritime border, both unanimously to reject an accusation including Chile, as well as a countries are working that a bill to strengthen protection resurgence in US growth, means together to increase for pharmaceutical patents is the global economic recovery economic integration. -

Articles-15829 Recurso 1.Pdf

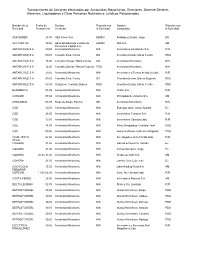

Transacciones de Acciones efectuadas por Accionistas Mayoritarios, Directores, Gerente General, Gerentes, Liquidadores y Otras Personas Naturales o Jurídicas Relacionadas Nombre de la Fecha de Nombre Relación con Nombre Relación con Sociedad Transacción Vendedor la Sociedad Comprador la Sociedad AES GENER 28.05 AES Gener S.A. EMISO Rodríguez Grossi, Jorge DG AFP CAPITAL 30.05 Administradora de Fondos de EMISO ING S.A. AM Pensiones Capital S.A. ANTARCHILE S A 29.05 Accionista Minoritario NIN Inversiones Limatambo S.A. PJR ANTARCHILE S A 09.05 Croxatto Silva, Carlos DG Croxatto Ortuzar, María Cecilia PDG ANTARCHILE S A 16.05 Croxatto Ortuzar, María Cecilia DG Accionista Minoritario NIN ANTARCHILE S A 16.05 Croxatto Ortuzar, Blanca Eugenia PDG Accionista Minoritario NIN ANTARCHILE S A 29.05 Accionista Minoritario NIN Inversiones y Rentas Ancabela Ltda. PJR ANTARCHILE S A 09.05 Croxatto Silva, Carlos DG Croxatto Ortuzar, Blanca Eugenia PDG ANTARCHILE S A 09.05 Ortuzar de Croxatto, Blanca PDG Croxatto Ortuzar, María Cecilia PDG BANMEDICA 05.05 Accionista Minoritario NIN Green S.A. PJR CAROZZI 07.04 Accionista Minoritario NIN Principado de Asturias S.A. AM CENCOSUD 08.05 Rivas de Diego, Patricio GE Accionista Minoritario NIN CGE 20.05 Accionista Minoritario NIN Estrougo Ortiz, Jaime Azarias EJ CGE 28.05 Accionista Minoritario NIN Inversiones Tunquen S.A. PJR CGE 13.05 Accionista Minoritario NIN Inversiones Caucura Ltda. PJR CGE 14.03 Accionista Minoritario NIN Pérez Respaldiza, Cristobal José PDG CGE 09.05 Accionista Minoritario NIN Heinsen Widow, Gabrielle Margarita PDG CLUB HIPICO 02.06 Accionista Minoritario NIN Inv. Ongolmo de la Florida Ltda. -

Compañía Sud Americana De Vapores Sa (Csav)

Clasificadora de Riesgo HUMPHREYS LTDA. An affiliate of MOODY´S INVESTORS SERVICE COMPAÑÍA SUD AMERICANA DE VAPORES S.A. (CSAV) Noviembre 2004 Categoría de Riesgo y Contacto1 Tipo de Instrumento Categoría Contactos Títulos Accionarios Primera Clase Nivel 2 Socio Responsable Alejandro Sierra M. Tendencia Favorable Gerente a Cargo Aldo Reyes D. Analista Margarita Andrade P. Otros Títulos: Teléfono 56-2-204 7293 Bonos A+ Fax 56-2-223 4937 Tendencia En Observación Correo Electrónico [email protected] Sitio Web www.moodyschile.cl EEFF base 30 junio 2004 Tipo de Reseña Clasificación de Acciones Número y Fecha de Inscripción de Instrumentos Bono Series A1 y A2 N° 274 de 12.10.01 Estado de Resultados Consolidados (MUS$ de cada Año) Junio Año Año Año Año Año 2004 2003 2002 2001 2000 1999 Ingresos Operacionales 1.204.482 2.135.539 1.674.948 1.735.112 1.743.761 1.079.760 Resultados Operacionales 33.818 66.531 34.691 19.094 41.104 35.862 Resultados No Operacionales 42.990 15.048 16.522 16.815 6.891 (414) Resultados Finales 71.132 72.323 36.778 26.081 43.083 30.940 Balance General Consolidado (MUS$ de cada Año) Junio Año Año Año Año Año 2004 2003 2002 2001 2000 1999 Activo Circulante 716.600 564.584 518.009 480.734 430.601 338.938 Activo Fijo 267.884 272.109 262.307 264.338 283.727 332.448 Otros Activos 454.093 441.295 299.150 310.400 368.093 206.261 Pasivo Circulante 462.892 341.866 374.784 274.831 209.728 139.465 Pasivo Largo Plazo 341.001 345.399 179.627 281.756 363.823 265.315 Interés Minoritario 20.648 22.081 22.584 16.247 26.552 13.417 Patrimonio 614.036 568.642 502.471 482.638 482.318 459.450 Total Activos/Pasivos 1.438.577 1.277.988 1.079.466 1.055.472 1.082.421 877.647 1 Moody’s Investors Service, Inc. -

2005 Annual Report 2005 23 23 Administrative and Selling Expenses Were USD 364 Our Pessimism About 2006 Has Also Been Confirmed Million, 43% More Than in 2004

Founded in 1872 Annual Report 2005 Germany Hamburg USA New Jersey Brazil Sao Paulo Valparaiso Chile Santiago Annual Report 2005 2 Annual Report 4 Chairman’s Letter to the Shareholders 7 Board of Directors 8 Management 11 Historical Summary: India A Regional Company Going Global New Delhi China 5 CSAV and the Community Hong Kong 9 Description of the Company and the Industry 2 The CSAV Group in 2005 26 CSAV Services 2 Services of Norasia Container Lines Ltd. 4 Services of Companhia Libra de Navegaçao and Montemar Marítima S.A. 6 Other Activities of the Year 48 General Information 52 Material Information 55 Subsidiary Companies of CSAV 68 Other Subsidiaries and Associate Companies 84 Summarized Ownership Structure of Subsidiaries 88 Investments as a Percentage of the Total Assets 9 Financial Statements 206 Statement of Liability Regional offices CSAV Annual Report 2005 Chairman’s Letter to the Shareholders Dear Shareholder, I am writing to inform you about the Company’s activities during 2005. CSAV obtained a net income of USD 2,0,67, the second highest in its history, despite incurring losses in the last quarter for reasons which we will explain later. CSAV again increased its group sales, from USD 2,685,886,778 to USD ,894,960,977, which represents a growth of 45%. The volume of containers carried by the Company increased by 29.9%, enabling us to become the 4th shipping company in this business. This improvement was due to the favourable development of the global economy which grew by 4,5% (our forecast was 4,2%) and also the satisfactory growth of the Chilean economy which, using a new method of calculation, rose by 6.% (our forecast was 5.8% using the old system). -

Annual Report 2009 2009 Annual Report NOTICE This Document Has Been Prepared by IBERDROLA S.A

1 mm grosor cartón1 mm grosor 15 mm de camisa + 15 mm de camisa + 1 mm grosor cartón Annual Report 2009 Annual Report 2009 10x10 mm 15 mm de camisa + 1 mm grosor cartón 15 mm de camisa + 1 mm grosor cartón NOTICE This document has been prepared by IBERDROLA S.A. for use by shareholders, investors, analysts and the media with respect to information corresponding to fiscal year 2009 and at the General Shareholders’ Meeting of IBERDROLA, S.A., which has been called for March 26 and 27, 2010. The Company does not assume any responsibility for this document if it is used for a purpose other than as indicated above. IBERDROLA, S.A. also assumes no obligation to update or revise this document. FORWARD-LOOKING STATEMENTS This document contains forward-looking information and statements regarding IBERDROLA, S.A., including information extracted from the 2008-2010 Strategic Plan that was approved by the Board of Directors of Iberdrola, S.A. on October 23, 2007. The relevant documents in connection therewith were submitted to the National Securities Market Commission (Comisión Nacional del Mercado de Valores) (CNMV) on October 24, 2007, on which date they were also provided to the financial community and the media. The 2008-2010 Strategic Plan may be viewed on the Company’s website: www.iberdrola.com. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. -

See Who Attended

Company Name First Name Last Name Job Title Country 24Sea Gert De Sitter Owner Belgium 2EN S.A. George Droukas Data analyst Greece 2EN S.A. Yannis Panourgias Managing Director Greece 3E Geert Palmers CEO Belgium 3E Baris Adiloglu Technical Manager Belgium 3E David Schillebeeckx Wind Analyst Belgium 3E Grégoire Leroy Product Manager Wind Resource Modelling Belgium 3E Rogelio Avendaño Reyes Regional Manager Belgium 3E Luc Dewilde Senior Business Developer Belgium 3E Luis Ferreira Wind Consultant Belgium 3E Grégory Ignace Senior Wind Consultant Belgium 3E Romain Willaime Sales Manager Belgium 3E Santiago Estrada Sales Team Manager Belgium 3E Thomas De Vylder Marketing & Communication Manager Belgium 4C Offshore Ltd. Tom Russell Press Coordinator United Kingdom 4C Offshore Ltd. Lauren Anderson United Kingdom 4Cast GmbH & Co. KG Horst Bidiak Senior Product Manager Germany 4Subsea Berit Scharff VP Offshore Wind Norway 8.2 Consulting AG Bruno Allain Président / CEO Germany 8.2 Consulting AG Antoine Ancelin Commercial employee Germany 8.2 Monitoring GmbH Bernd Hoering Managing Director Germany A Word About Wind Zoe Wicker Client Services Manager United Kingdom A Word About Wind Richard Heap Editor-in-Chief United Kingdom AAGES Antonio Esteban Garmendia Director - Business Development Spain ABB Sofia Sauvageot Global Account Executive France ABB Jesús Illana Account Manager Spain ABB Miguel Angel Sanchis Ferri Senior Product Manager Spain ABB Antoni Carrera Group Account Manager Spain ABB Luis andres Arismendi Gomez Segment Marketing Manager Spain -

Enel Chile Project Elqui – Roadshow Presentation

Enel Chile Project Elqui – Roadshow Presentation November 20th, 2017 Chile Enel Chile Chile Agenda Project Elqui Process Overview A New Equity Story for Enel Chile Closing Remarks 2 Project Elqui Overview Chile Proposed transaction Enel Chile (“EC”) is lauching a transaction consisting of a corporate reorganization that would entail i) the merger of Enel Chile with EGP Latin America (“EGPL”), and ii) a Tender Offer (“TO”) launched by Enel Chile over Enel Generación Chile (“EGC”) Current situation 1 Cash & Stock(1) PTO 2 Merger EGP Chile – EC Similar 100.0% 60.6% 100.0% 60.6% Latin America Latin America Chile Chile Chile PTO 60-100.0% 100.0% 60.0% 99.1% 100.0% 75-100% 99.1% 100.0% 75-100% 99.1% Generación Distribución Generación Distribución Generación Distribución Chile Chile Chile Chile Chile Chile Merger subject to minimum PTO acceptance of more than 75% of EGC share capital 3 1. EC would pay part of the PTO price to subscribe and deliver the shares of EC to EGC shareholders Project Elqui Overview Chile Transaction rationale and conditions Transaction Rationale Enel SpA Minimum Conditions 1.1 Consolidating Enel Chile leadership position in the Chilean energy 1. The transaction must be executed on market space terms 2.2 Increasing Enel Chile market capitalization, resulting in greater 2. The transaction must be EPS accretive for liquidity Enel Chile 3.3 Integrating the renewable energy platform of EGPL in the 3. Enel should maintain a similar ownership conventional generation platform of Enel Chile, providing a clear and stake in EC after the Reorganization sustainable path for growth 4. -

2006 Annual Report 189 2006 190 Annual Report 2006 Management Analysis

Founded in 1872 Annual Report 1 6 200 2 Annual Report 6 200 AAnnual Report and Financial Statements 2006 4 Chairman’s Letter to the Shareholders 6 Board of Directors 8 Management 11 Historical Summary: A Regional Company Going Global 15 Description of the Company and the Industry Sector 19 The CSAV Group in 2006 22 CSAV Services 28 Services of Norasia Container Lines Ltd. 30 Services of Companhia Libra de Navegaçao and Compañía Libra de Navegación (Uruguay) S.A. 32 Other Activities in the Year 44 General Information 48 Material Information 51 CSAV Subsidiary Companies 65 Other Subsidiary and Associate Companies 82 Summary of Ownership of Subsidiaries 86 Investments as Proportion of Total Assets 91 Financial Statements 204 Declaration of Responsibility Annual Report 3 6 200 CChairman’s Letter to the Shareholders Dear Shareholder, I should like to comment on the Company’s business during 2006. CSAV last year produced a loss of US$58,241,000. In my letter to shareholders published in the previous AnnualAnnual Report,Report, II hadhad forecastedforecasted 2006 by saying that “it will be a very bad year from the point of view of thethe freightfreight inin thethe containership business”. I made the same forecast at the shareholders meeting held on April 19, 2006. In the letter mentioned above, I added: “The problem for containerships has already been explained to shareholdersshareholders inin thethe financial statements of September and December 2005. It is very simple: there is anan imbalanceimbalance between supply and demand in this freight market. Capacity has risen and continues toto riserise because practically all shipowners, seeing the good results and tariff increases of thethe yearsyears 2004 and most of 2005, ordered the building of new ships, many of which with largerlarger capacitycapacity than existing ones. -

Inversionistas Chilenos En Argentina

MINISTERIO DE RELACIONES EXTERIORES - CHILE Dirección General de Relaciones Económicas Internacionales Dirección de Asuntos Económicos Bilaterales Departamento de Inversiones en el Extranjero EMPRESAS CHILENAS CON INVERSIONES EN EL EXTERIOR, SEGUN PAGINAS WEB DE CADA EMPRESA INVERSIONISTA EMPRESAS CHILENAS CON INVERSIONES DIRECTAS EN : ARGENTINA NOMBRE EMPRESA DIRECCION PÁGINA WEB 1 AGENCIAS UNIVERSALES S.A. (AGUNSA) http://www.agunsa.com/index.php?option=com_content&task=view&id=45&Itemid=46&pais=true 2 ANASAC http://www.anasac.cl/anasac/empresa/filiales 3 AGROBERRIES http://www.agroberries.cl/company.html 4 ALUSA S.A. http://www.alusa.cl/inicio.html 5 ATENTUS S.A http://www.atentus.com/ 6 AQB S.A. http://www.aqbargentina.com.ar/historia.php 7 CELULOSA ARAUCO Y CONSTITUCION (CELCO) http://www.arauco.cl/default.asp 8 CEM (EX INDUGAS) http://www.cembrass.com.ar/esp/main.html 9 CENCOSUD S.A. http://www.cencosud.cl/unidades_easy_argentina.htm 10 CESMEC http://www.cesmec.cl/nueva/acerca/index.act 11 CHILE FILMS http://www.cinecolor.com.ar/ 12 CIA. GENERAL DE ELECTRICIDAD - CGE http://www.cge.cl/sectorelectrico/Paginas/SectorElectrico.aspx 13 CIA. SUDAMERICANA DE VAPORES http://www.csav.com/csav/abusoffices.nsf/frmfilter?OpenForm&Seq=4#a1 14 CIDEF http://www.cidef.com.ar/ 15 COLCHONES ROSEN http://www.rosenthestore.com/home.html 16 COASIN http://www.coasin.com/fileadmin/Template/img/Principal/Minternacional.swf 17 CORESA S.A. http://www.coresa.com.ar/ 18 CORPORA TRES MONTES S.A. http://www.tmluc.cl/ 19 EMBOTELLADORA ANDINA S.A. http://www.cocacola-edasa.com.ar/edasa/ 20 EMBOTELLADORA COCA-COLA POLAR S.A.