Columbia FDI Profiles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Año 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Cartera Cartera Cartera Cartera Cartera Cartera Cartera Cartera Cartera C

EVOLUCION DE LA CARTERA CHILE 65 Año 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Cartera Cartera Cartera Cartera Cartera Cartera Cartera Cartera Cartera Cartera 1 Aguas A Aguas A Aguas A Aguas A Aguas A Aguas A Aguas A Aguas A Aguas A Aguas A 2 Andina B Almendral Almendral Almendral Andina B Andina B Andina B Andina B Andina B Andina B 3 Banmedica Andina B Andina B Andina B Banmedica Andrómaco Andrómaco Andrómaco Andrómaco Andrómaco 4 Banvida Banmedica Banmedica Banmedica Banvida Banmedica Banmedica Banmedica Banmedica Banmedica 5 Bbvacl Banvida Banvida Banvida Bbvacl Banvida Banvida Banvida Banvida Banvida 6 Bci Bbvacl Bbvacl Bbvacl Bci Bbvacl Bci Bci Bci Bci 7 Besalco Bci Bci Bci Besalco Bci Besalco Besalco Besalco Besalco 8 Bsantander Besalco Besalco Besalco Bsantander Besalco Bsantander Bsantander Bsantander Bsantander 9 Cap Bsantander Bsantander Bsantander Cap Bsantander Cap Cap Cap Cap 10 Cct Cap Cap Cap Cct Cap Cct Cementos CCU CCU 11 Cementos Cct Cct Cct Cementos Cct Cementos Cencosud Cementos Cementos 12 CCU Cementos Cementos Cementos Cencosud Cementos Cencosud CCU Cencosud Cencosud 13 Cge CCU CCU CCU CCU Cencosud CCU Cge Cge Cge 14 Chile Cge Cge Cge Cge CCU Cge Chile Chile Chile 15 Chilectra Chile Chile Chile Chile Cge Chile Cintac Cintac Cintac 16 Cintac Chilectra Chilectra Chilectra Cintac Chile Cintac Cmpc Cmpc Cmpc 17 Cmpc Cintac Cintac Cintac Cmpc Cintac Cmpc Colbun Colbun Colbun 18 Colbun Cmpc Cmpc Cmpc Colbun Cmpc Colbun Conchatoro Conchatoro Conchatoro 19 Coloso Colbun Colbun Colbun Coloso Colbun Conchatoro Copec -

Impacts of Nonstate, Market-Driven Governance on Chilean Forests

Impacts of nonstate, market-driven governance on Chilean forests Robert Heilmayra,1 and Eric F. Lambinb,c,d,1 aEmmett Interdisciplinary Program for Environment and Resources, Stanford University, Stanford, CA 94305; bGeorges Lemaître Centre for Earth and Climate Research, Earth and Life Institute, Université Catholique de Louvain, 1348 Louvain-la-Neuve, Belgium; cSchool of Earth, Energy, and Environmental Sciences, Stanford University, Stanford, CA 94305; and dWoods Institute for the Environment, Stanford University, Stanford, CA 94305 Contributed by Eric F. Lambin, January 13, 2016 (sent for review August 10, 2015) Global markets for agricultural products, timber, and minerals are regimes may exceed the benefits for landowners, minimizing the po- critically important drivers of deforestation. The supply chains driving tential for large-scale conservation benefits (15). In addition, suppliers land use change may also provide opportunities to halt deforesta- may be able to circumvent environmental agreements by segmenting tion. Market campaigns, moratoria, and certification schemes have markets and shipping production that fails to meet environmental been promoted as powerful tools to achieve conservation goals. standards to consumers with weaker environmental concerns (16). Despite their promise, there have been few opportunities to rigor- Even if initially effective, corporate commitments to environmental ously quantify the ability of these nonstate, market-driven (NSMD) practices may wane as public attention turns elsewhere (17). governance regimes to deliver conservation outcomes. This study Such critiques highlight the importance of clear program eval- analyzes the impacts of three NSMD governance systems that sought uation to determine the effectiveness of NSMD governance re- to end the conversion of natural forests to plantations in Chile at the gimes. -

CSAV's Subsidiary Companies

IDENTIFICATION OF THE COMPANY • Name Compañía Sud Americana de Vapores S.A. • Ticker code Vapores • Tax Number 90.160.000 - 7 • Type of Entity Stock listed company • Securities Register Number 76 • Legal Address Valparaíso, Chile CONSTITUTION DOCUMENTS Compañía Sud Americana de Vapores was incorporated by public deed dated October 4, 1872 before the Valparaíso notary Julio César Escala. Its existence was authorized by Supreme Decree 2,347 of October 9, 1872. These documents were registered on page 486 ff, No.147 and page 497 ff, No.148 respectively in the Valparaíso Registrar of Commerce on October 15, 1872. OFFICES Valparaíso Plaza Sotomayor 50, Valparaíso Postal Code 2360171 PO Box 49-V Telephone: (56-32) 220 3000 Telefax: (56-32) 220 3333 Santiago Hendaya 60, floors 10 to 14, Las Condes Postal Code 6760399 PO Box 186 – Correo 34 Telephone: (56-2) 2330 7000 Telefax: (56-2) 2330 7700 WEB SITE www.csav.com SHAREHOLDER SERVICES DCV Registros S.A. Huérfanos 770 Piso 22 Santiago, Chile Telephone: (56-2) 2393 9003 [email protected] INVESTOR RELATIONS Vivien Swett Senior Vice President, Investor Relations Telephone: (56-32) 220 3296 [email protected] Founded in 1872 CSAV in 2013 Consolidated Financial Statements 2 Chairman’s statement 18 Results analysis 76 Consolidated Statement of Financial Position 4 Board of directors 22 CSAV’s services 78 Consolidated Statement of Comprehensive Income 6 Management 26 Other activities 80 Statement of Changes in Net Equity 81 Consolidated Statement of Cash Flows Activities and businesses General information -

Banchile – Informe Final

Banchile Asesoría Financiera S.A. 3 de noviembre de 2017 Informe al Directorio de Enel Generación Chile S.A. Proyecto Elqui Información Importante El presente documento ha sido preparado por Banchile Asesoría Financiera S.A. (“Banchile”) a solicitud del Directorio de Enel Generación Chile S.A. (el “Directorio de EGC” o el “Cliente”) para actuar como su evaluador independiente en los términos del artículo 147 de la Ley 18.046 en conexión con la reorganización corporativa propuesta (la “Transacción” o “Elqui”). Las recomendaciones y conclusiones aquí contenidas constituyen el mejor parecer u opinión de Banchile respecto de la evaluación de la Transacción al tiempo de elaboración de este documento, considerando la metodología de trabajo utilizada y la información disponible. Sin embargo, las conclusiones contenidas en el presente informe podrían variar si se dispusieran de otros antecedentes o información o se utilizaren otros criterios de valorización no considerados en el desarrollo del presente informe. Banchile no tendrá obligación alguna de comunicar dichas variaciones como así tampoco cuando las opiniones o información contenidas en el documento, o los supuestos sobre los cuales se elaboró el presente informe, se modificaren. Este informe fue preparado para ser usado exclusivamente para efectos de la Transacción y consideración de Enel Generación Chile S.A. (“EGC” o “la Compañía”) y, por tanto, debe ser utilizado exclusivamente en dicho contexto, no pudiendo ser utilizado para otro propósito sin el consentimiento previo y por escrito de Banchile. En la elaboración del informe se ha utilizado únicamente información pública e información proporcionada por la Compañía, respecto de la cual Banchile ha asumido, sin realizar una verificación independiente, su completa y total veracidad, integridad, exactitud, suficiencia, consistencia y razonabilidad. -

The Santiago Exchange Indices Methodology Consultation

The Santiago Exchange Indices Methodology Consultation SANTIAGO, APRIL 2, 2018: In August 2016, the Santiago Exchange (the “Exchange”) and S&P Dow Jones Indices (“S&P DJI”) signed an Index Operation and License Agreement. The Exchange’s partnership with S&P DJI, the world’s leading provider of index-based concepts, data and research, includes the adoption of international index methodology standards and the integration of operational processes and business strategies and enhances the visibility, governance, and transparency of the existing indices. The agreement also enables the development, licensing, distribution and management of current and future indices which will be designed to serve as innovative and practical tools for local and global investors. The new and existing Santiago Exchange indices will be co-branded under the “S&P/CLX” name (the “Indices”) that can be used to underlie liquid financial products, expanding the breadth and depth of the Chilean capital market. As part of this transition, S&P DJI and the Exchange are conducting a consultation with members of the investment community on potential changes to the following Santiago Exchange indices to ensure that they continue to meet their objectives and are aligned with the needs of local and international market participants. • Indice General de Precios y Acciones (“IGPA”) • IGPA Large, IGPA Mid, and IGPA Small (collectively “IGPA Size Indices”) • Indice de Precios Selectivo de Acciones (“IPSA”) IGPA The IGPA is designed to serve as a broad country benchmark of the Chilean market. Based on a review of the index’s methodology and existing data, and to ensure that the index continues to satisfy its objective, S&P DJI and the Exchange are proposing to increase the minimum bursatility presence1 required for index eligibility. -

Deal Trends in Latin America

Deal Trends in Latin America Essential data for strategic decisions September 2020 | Issue 12 Table of Contents Deal Activity in Latin America……………..…………..…………………………….................... 4 Deal Activity in Latin America: LTM YoY Trends by Country................................ 5 M&A Activity in Latin America: Top Deals (Announced) H1 2020........................ 6 Activity in Latin America: Sector Trends LTM YoY………………………………… 7 Deal Activity in Latin America: LTM YoY by Largest Subsector........................... 8 Deal Activity in Latin America: Cross-Border Intra-regional Deals 2020 LTM….. 9 Deal Activity in Latin America: Cross-Border Deal Count………………………… 10 Key Metrics by Country …………………….…………..….……….…………………………….. 12 Data Dispatch: Latin America……………………………………………………….................... 13 Panjiva Research: Highlighting LatAm Supply Chain Data……………………………………. 14 Behind the Data……………………………………………………………………....................... 15 2 Data color order: Complimentary colors: Footer : Never change the footer text on individual slides. Change, turn on or off Deal Trends in Latin America Editor’s Note Deal Trends in Latin America explores deal activity in Argentina, Brazil, Chile, Colombia, Ecuador, Contributors: Mexico, Panama, Peru, Uruguay, and Venezuela. This publication brought to you by S&P Global Market Intelligence. Kai Wong [email protected] Market Development For analysis contained in this report, data was collected on M&A and Private Placements in these countries Private Equity Solutions between Q3 2017 and Q2 2020.* We also examined trends in various industries, cross-border activity, S&P Global Market Intelligence currencies, and assessed macroeconomic conditions in the region. Yu Yu Li Key Highlights: [email protected] Market Development While 2019 was a strong year, deal activity has since slowed down in the region due to the global COVID-19 Private Equity Solutions pandemic. -

Gobierno Corporativo: Ranking De Empresas Chilenas Con Mayor Transacción En La Bolsa De Valores1 Revista Lasallista De Investigación, Vol

Revista Lasallista de Investigación ISSN: 1794-4449 Corporación Universitaria Lasallista Severino-González, Pedro; Acuña-Moraga, Omar Gobierno corporativo: ranking de empresas chilenas con mayor transacción en la bolsa de valores1 Revista Lasallista de Investigación, vol. 16, núm. 1, 2019, pp. 103-114 Corporación Universitaria Lasallista DOI: 10.22507/rli.v16n1a3 Disponible en: http://www.redalyc.org/articulo.oa?id=69563162007 Cómo citar el artículo Número completo Sistema de Información Científica Redalyc Más información del artículo Red de Revistas Científicas de América Latina y el Caribe, España y Portugal Página de la revista en redalyc.org Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto Artículo original / Original article / Artigo original DOI: 10.22507/rli.v16n1a3 Gobierno corporativo: ranking de empresas chilenas con mayor transacción en la bolsa de valores1 Pedro Severino-González2, Omar Acuña-Moraga3 Resumen se puede mencionar el cambio significativo en la posición de AntarChile S. A. y Introducción. Debido a los conflictos de SalfaCorp S. A. Conclusión. El bajo interés, problemas de agencia, prácticas desempeño generalizado es debido a la deshonestas y falta a la responsabilidad rigurosidad de la nueva norma, provocando social, en todo el mundo se han diseñado una disminución de 72% a 39% de normas, estándares y reglamentos que cumplimiento. pretenden resguardar los intereses de cada stakeholders, como consecuencia de una Palabras clave: gobierno corporativo, situación crítica que afecta la relación entre norma, gestión, economía de la empresa, el principal y el agente. Objetivo. Esta Responsabilidad Social Empresarial. investigación tiene como objetivo analizar las prácticas de gobierno corporativo de empresas chilenas que forman parte del Corporate governance: ranking IPSA4. -

Estudio Comparativo De Rentabilidad Accionaria Y Contable En Empresas Chilenas Antes Y Después De Su Emisión De Adr’S

ESTUDIO COMPARATIVO DE RENTABILIDAD ACCIONARIA Y CONTABLE EN EMPRESAS CHILENAS ANTES Y DESPUÉS DE SU EMISIÓN DE ADR’S. Tesina presentada como requisito para optar al Grado de Licenciado en Administración. Profesores Responsables: Mónica Raddatz T. Horacio Sanhueza B. Osvaldo Rojas Q. Profesor Patrocinante : Leonardo Pacheco Caro. Presentado por Alonso Andrés Muñoz Martínez Pedro Alexis Molina Cid VALDIVIA- CHILE 2005 ÍNDICE DE MATERIAS Página. Resumen 1.- Introducción 1 2.- Marco de Referencia del Estudio 3 2.1.- Definición de ADR`s 3 Esquema general ADR 4 2.2.- Tipos de ADR`s 5 2.3.- Requisitos para optar al Sistema de ADR 6 2.4 .- Ventajas del Sistema ADR 8 2.5.- Desventajas del Sistema de ADR 9 3.- Material y Metodología de Análisis 10 3.1.- Empresas a Analizar 10 3.2.- Periodo de Análisis 10 3.3.- Variables 10 3.4.- Cálculo de Rentabilidad Bursátil 11 3.5.- Cálculo de Rentabilidad sobre el Patrimonio 12 3.6.- Tipo y Diseño de Investigación 13 4.- Presentación y Discusión de Resultados 14 4.1.- Rentabilidad accionaria 14 4.1.1.- Comportamiento de Rentabilidades Individuales 14 4.1.2.- Comportamiento de Rentabilidades Promedio 15 4.2.- Rentabilidad sobre Patrimonio 18 4.2.1.- Comportamiento Individual 18 4.2.2.- Rentabilidad sobre Patrimonio Promedio 19 5.- Conclusiones 21 6.- Bibliografía 23 7.- Anexos 24 ÍNDICE DE TABLAS Tabla N° 1 Pendiente de la Tendencia de la Rentabilidad Bursátil Individual. Tabla N° 2 Rentabilidad Promedio Bursátil de Empresas con Emisión de ADR´s. Tabla N° 3 Pendiente de la Rentabilidad sobre Patrimonio Individual. -

Nómina De Acciones

NÓMINA DE ACCIONES NÓMINA DE ACIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN REPORTE TRIMESTRAL NÓMINA DE ACCIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN La Superintendencia de Pensiones emitió la Circular N° 2.026 que deroga la Circular N° 2.010, relativa a los Parámetros para el cálculo de los límites de inversión de los Fondos de Pensiones y Fondos de Cesantía, la que entrará en vigencia el 20 de marzo de 2018. En la Circular, se publica la nómina de las acciones de sociedades anónimas abiertas nacionales que cumplen con los requisitos definidos por el Régimen de Inversión de los Fondos de Pensiones, para ser consideradas en las categorías generales de inversión. Cabe señalar que aquellas acciones que no cumplan con los requisitos antes señalados, podrán ser adquiridas bajo las condiciones establecidas para la categoría restringida, definida en el citado Régimen. El detalle de esta información se encuentra a continuación: ACCIONES DE SOCIEDADES ANÓNIMAS ABIERTAS 1. De acuerdo a lo dispuesto en el inciso sexto del artículo 45 del D.L 3.500 de 1980 y en el Régimen de Inversión de los Fondos de Pensiones las acciones elegibles en categoría general, tanto por instrumento como por emisor, a partir del 20 de marzo de 2018, en virtud del cumplimiento del requisito de presencia ajustada mayor o igual a 25% o contar con un Market Maker en los términos y condiciones establecidos en la Normativa vigente, son las siguientes: RAZÓN SOCIAL NEMOTÉCNICO SERIE AES GENER S.A. AESGENER ÚNICA AGUAS ANDINAS S.A. -

Kathleen C. Barclay, Amcham Chile; Ari Bermann, 3M Chile; Ruth Bradley, Freelance Journalist; John Of

bUSiness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°287, MAY 2013 Chile and Peru: Pacific Partners TRADE TESTIMONIAL SPECIAL REPORT INTELLECTUAL PROPERTY Garden of the Andes Chilean Investment Protecting Pharmaceutical Abroad Patents Planes desde 250 minutos para hablar con cualquier compañía* Cuota inicial** nextel.cl *Sólo llamadas nacionales **Costo cero de la cuota inicial sujeto al valor del plan y al cumplimiento de condiciones contractuales. CONTENTS bUSiness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°287, MAY 2013 TRADE TESTIMONIAL SPotliGHT 6 26 42 LIFE IN THE SLOW LANE Chile and Peru: Success is Brewing Chile and California: Partners Pacific Partners Chilean herbal tea brand Garden for Prosperity Who Flung Dung? TRADE TESTIMONIAL SPECIAL REPORT INTELLECTUAL PROPERTY of the Andes has had to work Garden of the Andes Chilean Investment Protecting Pharmaceutical The annual meeting of the Kim Jong-il, the baby- Abroad Patents hard to earn its place on the Chile-California Council was held faced North Korean leader, shelves of US supermarkets and in San Francisco in April and is more interested in 12 specialty stores. AmCham President Kathleen playing with his toys than Chile and Peru: Barclay was in attendance. starting World War III, Pacific Partners SecondarY storY Economic SNAPSHot writes Mr. Eneldo. Despite a dispute 8 34 Protecting Pharmaceutical between Chile and Global Economics Update: Patents Moderation Appears Temporary Peru over their Chile’s Constitutional Court voted Growth in emerging economies, maritime border, both unanimously to reject an accusation including Chile, as well as a countries are working that a bill to strengthen protection resurgence in US growth, means together to increase for pharmaceutical patents is the global economic recovery economic integration. -

FORM 20-F Embotelladora Andina S.A

Table of Contents As filed with the Securities and Exchange Commission on April 28, 2017 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 Commission file number 001-13142 Embotelladora Andina S.A. (Exact name of Registrant as specified in its charter) Andina Bottling Company (Translation of Registrant’s name in English) Republic of Chile (Jurisdiction of incorporation or organization) Miraflores 9153, 7th Floor Renca - Santiago, Chile (Address of principal executive offices) Paula Vicuña, Tel. (56-2) 2338-0520 E-mail: [email protected] Miraflores 9153, 7th Floor - Renca - Santiago, Chile (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Series A Shares, Series B Shares of New York Stock Exchange Registrant represented by American Depositary Shares Securities registered or to be registered pursuant to Section 12(g) of the Act: None Table of Contents Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Series A Shares 473,289,301 Series B Shares 473,281,303 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Articles-15829 Recurso 1.Pdf

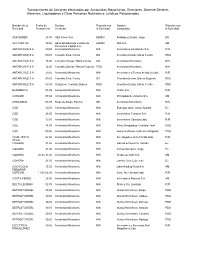

Transacciones de Acciones efectuadas por Accionistas Mayoritarios, Directores, Gerente General, Gerentes, Liquidadores y Otras Personas Naturales o Jurídicas Relacionadas Nombre de la Fecha de Nombre Relación con Nombre Relación con Sociedad Transacción Vendedor la Sociedad Comprador la Sociedad AES GENER 28.05 AES Gener S.A. EMISO Rodríguez Grossi, Jorge DG AFP CAPITAL 30.05 Administradora de Fondos de EMISO ING S.A. AM Pensiones Capital S.A. ANTARCHILE S A 29.05 Accionista Minoritario NIN Inversiones Limatambo S.A. PJR ANTARCHILE S A 09.05 Croxatto Silva, Carlos DG Croxatto Ortuzar, María Cecilia PDG ANTARCHILE S A 16.05 Croxatto Ortuzar, María Cecilia DG Accionista Minoritario NIN ANTARCHILE S A 16.05 Croxatto Ortuzar, Blanca Eugenia PDG Accionista Minoritario NIN ANTARCHILE S A 29.05 Accionista Minoritario NIN Inversiones y Rentas Ancabela Ltda. PJR ANTARCHILE S A 09.05 Croxatto Silva, Carlos DG Croxatto Ortuzar, Blanca Eugenia PDG ANTARCHILE S A 09.05 Ortuzar de Croxatto, Blanca PDG Croxatto Ortuzar, María Cecilia PDG BANMEDICA 05.05 Accionista Minoritario NIN Green S.A. PJR CAROZZI 07.04 Accionista Minoritario NIN Principado de Asturias S.A. AM CENCOSUD 08.05 Rivas de Diego, Patricio GE Accionista Minoritario NIN CGE 20.05 Accionista Minoritario NIN Estrougo Ortiz, Jaime Azarias EJ CGE 28.05 Accionista Minoritario NIN Inversiones Tunquen S.A. PJR CGE 13.05 Accionista Minoritario NIN Inversiones Caucura Ltda. PJR CGE 14.03 Accionista Minoritario NIN Pérez Respaldiza, Cristobal José PDG CGE 09.05 Accionista Minoritario NIN Heinsen Widow, Gabrielle Margarita PDG CLUB HIPICO 02.06 Accionista Minoritario NIN Inv. Ongolmo de la Florida Ltda.