Annual Report and Financial Statements 2016 International Public Partnerships Annual Report and Financial Statements 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Banks and Fintechs Create and Capture Value with Mobile Payment

How banks and fintechs create and capture value with mobile payment via their business value network: A value network case study of ING’s Mobiel Betalen and WeChat Pay’s Quick Pay. Author: Laura Frank University of Twente P.O. Box 217, 7500AE Enschede The Netherlands Network value analysis of mobile payment solutions has shown that in order to deliver value and create the service, a network of partners is required. Solutions of different providers, banks and fintechs, have shown that both have similar network partners in place. Common partners among mobile payment solutions are banks or actors with a payment license, smartphone manufacturers, stores, merchants and generally places that accept mobile payments. Depending on the technology that got chosen by the payment provider, further actors are part of the network. All actors within the network receive their own individual value by being part of the network. Mobile payment solutions that make use of quick response (QR) codes for payments are easier to facilitate than payment solutions that make use of near field communication (NFC). This is due to that users and merchants simply need a unique QR code that is connected to their mobile payment account, while payment solutions that make use of NFC technology need payment terminals that facilitate contactless payments as well as a suitable smartphone. By limiting the payment solution to only certain smartphones, payment terminals and operating systems, providers limit their potential user base. Even though multiple network partners of the fintech and bank payment solution got distinguished, some value chain elements still remain, as the parent companies of both take on multiple task and functions of the network. -

The 7 Habits of Successful “New” Payments Leaders

The 7 Habits Of Successful “New” Payments Leaders Best practices and insights by industry front runners Content 00. Preamble 01 Part One 01. Using Payments as a Competitive Advantage 04 Part Two 02. 08 Driving Teamwork: Connecting All Departments Part Three 03. 12 Building Open Relationships with Payment Partners Part Four 04. 16 Leveraging Growth-Hacking Technology Part Five 20 05. Delivering Positive Experiences Part Six 06. 24 Defining New Performance Indicators Part Seven 07. 28 Playing a Leadership Role 08. Edgar, Dunn & Company’s perspective 32 09. SafeCharge Vision: Answering the needs of the new payment leaders 34 The 7 Habits Of Successful “New” Payments Leaders Best practices and insights by industry front runners 1 Preamble Traditionally, online businesses were primarily concerned with the cost of payment acceptance. Their1 objective was to reduce this cost as much as possible over time. The Payments function has always been an important part of the business, however, its exposure and its influence in the business was limited. The function was part of the corporate infrastructure, typically serving other strategic areas such as Finance and IT, and managed with an operational mind-set. To understand the evolution of the Payments function and its role in organisations, Edgar, Dunn & Company and SafeCharge teamed up to undertake a study to identify the perspective or “habits” of Payments leaders who operate within the “new” paradigm that positions Payments holistically as one of the strategic drivers of growth for online businesses. One-on-one interviews were conducted with 12 Payments leaders from across different geographies and industry sectors (including merchants in Europe and North America across verticals such as airlines, apparel / fashion, digital content, gaming) to identify what these seasoned industry professionals believed the best practices and insights were to drive a successful payment strategy in a fast-evolving ecosystem. -

London Stock Exchange

LONDON STOCK EXCHANGE Sponsored by: Event Partners: ISRAEL INVESTOR SUMMIT Contents Event Partners: Agenda 5 Welcome from London Stock Exchange 6 Welcome from UK Israel Business 7 Keynote Speakers 8 Sponsored by: In conversation: Why Israeli IPOs in London are back in fashion 9 Panel: What are institutional investors looking for from growth businesses? 10 Panel: Demystifying the new world of digital advertising 12 Panel: The Next Generation of IPOs 14 UK Israel Business Events 16 Ahead of the curve: the growth of European technology deals 18 Corporate reputation about much more than financial performance 22 Israel market overview 24 Organised by: 3 steps for London to obtain a greater share of Israeli IPOs 28 ISRAEL INVESTOR SUMMIT ISRAEL INVESTOR SUMMIT Agenda INVESTOR 8:15 – 8:50 Registration and Coffee 8:50 – 9:00 Welcoming Remarks DELEGATION Xavier Rolet, Chief Executive, London Stock Exchange 9:00 – 9:20 Keynote speaker TO ISRAEL Professor Leo Leiderman, Chief Economist, Bank Hapoalim 9:20 – 9:40 Why Israeli IPOs in London are back in fashion 18-20 May 2015 Gal Haber, Plus500 in conversation with Anthony Silverman, StockWell Communications 9:40 – 10:25 What are institutional investors looking for from growth businesses? Moderator: John V Millar, London Stock Exchange Richard Penny, Legal & General Guy Feld, Hargreave Hale Justin Waine, Puma Investments 10:25 – 11:55 Coffee & Networking 10:55 – 11:40 Demystifying the new world of digital advertising Moderator: Peter McNally, ShoreCapital Ofer Druker, Matomy Ran Goldstein, Crossrider Hagai Tal, Marimedia Ory Weihs, CEO, XLMedia Following the Israel Investor Summit, UK Israel Business and the Sponsors and Partners of the 11:40 – 12:30 The Next Generation of IPOs Summit will be arranging a two day trip to Israel for institutional investors. -

Smart Against Fraud One Place — Many Rules

No. 6 | 2018/19 Artificial Intelligence Revolution as an opportunity Smart against fraud Rule Based becomes Risk Based: Self-learning algorithms protect your sales | page 4 One place — many rules What marketplace traders need to look out for today | page 12 trustly.com Payments that know no borders Grow your business across Europe with the next generation of bank payments. Faster payments Simplified refunds Unrivalled coverage Proud online banking payment partner of 2 trustly.com Security Debtors Payments Rule Based becomes Many accounts – Risk Based | page 4 little effort | page 24 that know Products no borders New in Computop Paygate | page 18 Grow your business across In this issue Europe with the next generation New Subsidiaries .......10 of bank payments. Projectmanagement ..... 14 Intelligence Artificial Intelligence ..... 16 Faster payments PCI and GDPR ..........28 is key ”We don‘t need artificial intelligence, natural intelligence is enough by far” — snappy sayings like this have been circulating Simplified refunds Imprint Publisher more frequently again in recent times. Because AI, also in e-com- Computop Wirtschaftsinformatik GmbH merce, is on everyone‘s lips again. What once appeared on the ho- Unrivalled coverage Schwarzenbergstraße 4 • 96050 Bamberg • Germany rizon as a spectre or a promise, depending on one‘s point of view, Editors is within reach with today‘s networking and computing power. Frank Arnoldt, Ralf Gladis ”It depends on how you use AI” — that‘s more like it. Critics will Coordination also state that AI in a fraud prevention application makes sense. Henning Brandt Contributors And more transparency in data analysis can optimise processes - Melissa Hager, Norman Krieghoff, Donata Noack, consumers who do not want to do so have good new protection Tobias Weidemann options at their fingertips thanks to the GDPR. -

Online Distribution & Digital Product

Half Year Presentation- September 2016 Online Distribution & Digital Product Hub Half Year Presentation- September 2016 Disclaimer The information contained in these slides and communicated verbally to you, including the speech(es) of the presenter(s) and any materials distributed at or in connection therewith (together, the "Presentation") is confidential. Reliance upon the Presentation for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested. If any person is in any doubt as to the contents of the Presentation, they should seek independent advice from a person who is authorized for the purposes of the Financial Services and Markets Act 2000 (“FSMA") and who specializes in advising on investments of this kind. The Presentation is being supplied to you solely for your information. The The Presentation is being distributed only to, and is directed at, authorized The Company is under no obligation to update or keep current the Presentation has been prepared by, and is the sole responsibility of persons or exempt persons within the meaning of the FSMA or any order information contained in this Presentation or to correct any inaccuracies Crossrider plc. (the "Company"). The directors of the Company have taken made thereunder or to those persons falling within the following articles of which may become apparent, and any opinions expressed in it are subject all reasonable care to ensure that the facts stated herein are true to the the Financial Services and Markets Act 2000 (Financial Promotion) Order to change without notice. -

Payments Orchestration Layer Necessary Functionality in the Payments Stack August 22, 2019

Payments Orchestration Layer Necessary functionality in the payments stack August 22, 2019 RPGC Strategy Note Series ABSTRACT: This white paper presents the business case for enterprise merchants to utilize an abstraction layer that consolidates payments functionality into a single business-oriented architecture. The payments ecosystem is complex, exacerbated by fragmentation. No single Payment Service Provider can fully service every market and each merchant must develop the exact same logic and requirements to comply with the changes imposed by the card schemes. In-house solutions are typically engineering driven and since payments expertise is rare among engineers, most legacy architecture is manual and burdensome on IT. The proposed business-oriented architecture, called a Payments Orchestration Layer (POL), addresses these above challenges. POLs are built on four key pillars of global connectivity, smart routing, real-time ledgers and end-user tools. This architecture allows merchants to use payments to further pursue their goals of enhancing the customer experience, lowering costs and supporting market growth. Copyright © 2019 Retail Payments Global Consulting, L.L.C. All rights reserved. The Need for a Payment Orchestration Layer 1. THE PROBLEM STATEMENT Payments do not exist for their own sake. The payments function is the merchant’s revenue gathering platform that must balance three overarching business goals: • Enhance the customer experience, increasing sales by maximizing approval rates and mitigating the effect of outages. • Support growth by connecting to multiple endpoints1 that enable customers to pay using the currencies and forms of payment which they prefer. • Lower the cost of payment processing and operations and thereby contributing to the company’s bottom line. -

Visa Europe Merchant Agent List

Visa Europe Merchant Agent List Effective November 2019 ______________________________________________________________________ Please note: the Merchant Agent Self Registration Programme is now CLOSED and we will not be accepting any further self-registrations. What to do going forward: Visa clients will be required to register their merchant agents via the PRM tool. These changes were communicated in a Visa Business News article to clients, dated 6 June 2019. Merchant Agents will now be registered by the Visa Client as Merchant Servicers through the Program Request Management (PRM) Tool. This will replace the current self-registration process via the Merchant Agent Registration Form (MARF). The current weblisting will be removed 31 December 2019 and Merchant Servicers will be listed on the Visa Global Registry of Service Providers. Please work with your acquirer(s) to register you as a Merchant Servicer. If the acquirer does not register your organization as a client, you will be at risk of not being listed as on the Visa Global Registry of Service Providers. All the Merchant Agents listed below have successfully completed a Merchant Agent Registration Form (MARF). The listed Merchant Agents have validated Payment Card Industry Data Security Standard (PCI DSS) compliance for the services indicated unless they have confirmed their services are out of scope of PCI DSS (see validation method). 1 The validation date is when the Merchant Agent was last PCI DSS validated. PCI DSS assessments are valid for one year, with the next annual PCI DSS validation due one year from the validation date. PCI DSS revalidations that are 1 to 30 days late are noted in orange, and PCI DSS revalidations that are 31 to 60 days late are noted in red. -

Safecharge Point of Sale App Increase Sales by Accepting QR Code Payments QR Code Payments: a Growing Trend

SafeCharge Point of Sale app Increase sales by accepting QR code payments QR code payments: A growing trend Today, billions of people across the globe use their mobile devices as their wallets to make purchases. One of the most popular ways of payment on mobile devices is by QR code. These payment methods are fast, convenient, and extremely easy to use. Alipay and WeChat Pay are highly popular QR code based payment methods used by majority of Chinese population and growing beyond to other countries. The two payment method together account for to over 1 billion monthly active users in China. Millions of these mobile payment users are travelling across the globe yearly. 93% of Chinese tourists say that mobile payment is their preferred choice for shopping, and 91% of them would be willing to spend more if overseas businesses accepted Chinese mobile payments. QR-code based payments are fast gaining traction in Western-Europe as well. In the Netherlands, the local payment method iDeal enables shoppers to purchase goods and services by simply scanning a QR code, and the solution is also available via Bancontact in Belgium. 02 SafeCharge Point of Sale app The SafeCharge Point of Sale app is developed to enable businesses to accept the new generation of mobile payments, grow their customer base and increase their revenue. It creates a unique opportunity for businesses to easily accept WeChat Pay and Alipay wherever the potential shoppers are; in a shop, a pop-up store or an outdoor market. Thanks to the quick setup and effortless integration, the travel, hospitality and retail businesses across Europe have quickly adopted the app to accept QR code payments from the globe-trotting Chinese customers. -

Payments As a Service Tracker™ MARCH 2018

Payments as a Service Tracker™ MARCH 2018 Flour, Butter, Mobile: Payments Tech As A Key Bakery Ingredient Tanya Li on Flour Bakery + Cafe’s The Co-op launches in-aisle Check out the top providers in loyalty and payments approach grocery payment app the PaaS space – Page 6 (Feature Story) – Page 10 (News and Trends) – Page 16 (Scorecard) Table of Contents PAGE What’s Inside The latest developments in payments platforms, including Google and 03 Amazon’s moves in the space PAGE Feature Story Tanya Li, assistant director of operations for Flour Bakery + Cafe, on choosing 06 the right partners to provide customers with friendly and fast payments PAGE News and Trends 10 The latest headlines from around the PaaS world PAGE Methodology | Top Ten Providers Best of the bunch 14 Who’s on top and how they got there PAGE Scorecard The results are in 16 See the top PaaS providers PAGE About 77 Information on PYMNTS.com Payments as a Service Tracker™ © 2018 PYMNTS.com All Rights Reserved March 2018 | 2 What’s Inside he payments space is seeing new competition as other interested parties with an Amazon financial Ttech giants look to enter and claim some of the product similar to a checking account. action. These tech giants aren’t alone in their bids to Google has been working to push its Google increase their involvements in payments, however. Pay payments solution and expand uptake. In a Recent headlines track a number of players looking recent PYMNTS interview, Pali Bhat, Google’s vice to expand their roles in the space. -

Payment Methods Report 2019 Innovations in the Way We Pay

Insights into Payments Payment Methods Report 2019 Innovations in the Way We Pay Endorsement partners: Key media partner: Payment Methods Report 2019 Innovations in the Way We Pay Contact us For inquiries on editorial opportunities please contact: Email: [email protected] To subscribe to our newsletters, click here For general advertising information, contact: Mihaela Mihaila Email: [email protected] RELEASE VERSION 1.0 JUNE 2019 COPYRIGHT © THE PAYPERS BV ALL RIGHTS RESERVED TEL: +31 20 893 4315 FAX: +31 20 658 0671 MAIL: [email protected] Management Summary The fourth edition of our Payment Methods Report presents the latest updates, trends, and innovations in the way people pay in an omnichannel world. By providing insightful content, we aim to keep our readers updated with the latest dynamics of the payments industry, an industry that is continually evolving at a rapid pace. There is a lot of interest into what is new in (e)commerce payments, and the results of a Worldpay report show it clearly: overall, ecommerce is expected to surpass USD 4.6 trillion globally by 2022, with 140 online payment methods in use today. According to the report, e-wallets have gained a lot of popularity thanks to the seamless experience they provide. Online banking payments are also in the spotlight, as they are convenient for both consumers and merchants, while cash is still king at the POS. As more studies like this have appeared, it has become clear to us that an in-depth approach to the status of payment methods and innovations in the way people pay would be useful. -

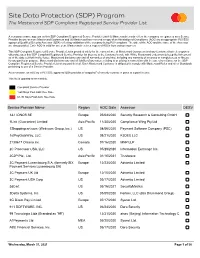

Mastercard SDP Compliant Registered Service Provider List

Site Data Protection (SDP) Program The Mastercard SDP Compliant Registered Service Provider List A company’s name appears on this SDP Compliant Registered Service Provider List if (i) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers and (ii) Mastercard has received a copy of an Attestation of Compliance (AOC) by an appropriate PCI SSC approved Qualified Security Assessor (QSA) reflecting validation of the company being PCI compliant. The date of the AOC and the name of the Assessor are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This SDP Compliant Registered Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this SDP Compliant Registered Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the SDP Compliant Registered Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a PCI SSC approved QSA provides a “snapshot” of security controls in place at a point in time. -

X-Border Payments Optimization Tracker™ June 2017

X-BORDER PAYMENTS OPTIMIZATION TRACKER™ JUNE 2017 A MONTHLY UPDATE ON THE TRENDS AND PLAYERS DRIVING CROSS-BORDER PAYMENTS X-Border marketplaces FedEx bridges The top performers and the need for international borders in the X-border space better payout solutions with BlueSnap – Page 9 in our provider directory – Page 5 (Feature Story) (News and Trends) – Page 17 (Scorecard) X-Border Marketplaces And The Search for Better Payout Solutions © 2017 PYMNTS.com all rights reserved X-Border Payments Optimization Tracker™ Table of Contents What’s Inside 03 Behind the rush amongst payment service providers to offer settlements in multiple currencies. Feature Story 05 Tomas Likar, VP of strategy and business development for Hyperwallet, on building a seamless payout process for cross-border marketplaces. News & Trends 09 The latest headlines from around the world of cross-border commerce. Methodology 13 The organizing framework for evaluating the industry players that deliver merchant payment processing services aimed at enhancing cross-border commerce. Top 25 Rankings 14 The results are in. See who the top performers are. Watch List 15 The newest additions to the Tracker’s Scorecard. Scorecard 17 See how all the providers rank in our comprehensive provider directory. About 96 Information on the X-Border Payments Optimization Landscape™ and PYMNTS.com. © 2017 PYMNTS.com all rights reserved 2 What’s Inside y 2020, some 940 million cross-border shoppers Meanwhile, First Data announced the launch of its Global are expected to spend $1 trillion on eCommerce PFAC solution. The solution will give payment facilitators Btransactions, according to McKinsey. access to a single integration interface that can enable their merchants to seamlessly authorize transactions in And while growth in cross-border trade has created more than 150 currencies and make settlements in 17 new opportunities for businesses and consumers alike, currencies worldwide.