Spring Office Market Report 2018 Greater Montreal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cahiers De Géographie Du Québec

Document généré le 24 sept. 2021 23:27 Cahiers de géographie du Québec Le nouveau centre-ville de Montréal Clément Demers Volume 27, numéro 71, 1983 Résumé de l'article Le centre-ville de Montréal vient de connaître un boom immobilier qui n'a URI : https://id.erudit.org/iderudit/021609ar d'égal que celui des années 1960-62. Cette activité fébrile sera suivie d'un DOI : https://doi.org/10.7202/021609ar inévitable ralentissement, puis d'une éventuelle reprise. Les bâtiments publics et privés qui viennent d'être construits ont en quelque sorte refaçonné Aller au sommaire du numéro certaines parties du quartier. Cette transformation s'inscrit dans le prolongement du développement des décennies précédentes, bien qu'elle présente certaines particularités à divers points de vue. Le présent article Éditeur(s) effectue l'analyse de cette récente relance et propose certaines réflexions sur l'avenir du centre-ville de Montréal. Département de géographie de l'Université Laval ISSN 0007-9766 (imprimé) 1708-8968 (numérique) Découvrir la revue Citer cet article Demers, C. (1983). Le nouveau centre-ville de Montréal. Cahiers de géographie du Québec, 27(71), 209–235. https://doi.org/10.7202/021609ar Tous droits réservés © Cahiers de géographie du Québec, 1983 Ce document est protégé par la loi sur le droit d’auteur. L’utilisation des services d’Érudit (y compris la reproduction) est assujettie à sa politique d’utilisation que vous pouvez consulter en ligne. https://apropos.erudit.org/fr/usagers/politique-dutilisation/ Cet article est diffusé et préservé par Érudit. Érudit est un consortium interuniversitaire sans but lucratif composé de l’Université de Montréal, l’Université Laval et l’Université du Québec à Montréal. -

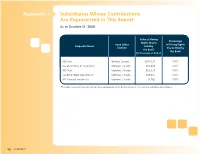

Subsidiaries Whose Contributions Are Represented in This Report As at October 31, 2009

Appendix 1 Subsidiaries Whose Contributions Are Represented In This Report As at October 31, 2009 Value of Voting Percentage Rights Shares Head Office of Voting Rights Corporate Name Held by Location Shares Held by the Bank1 the Bank (In thousands of dollars) B2B Trust Toronto, Canada $286,530 100% Laurentian Trust of Canada Inc. Montreal, Canada $85,409 100% LBC Trust Montreal, Canada $62,074 100% Laurentian Bank Securities Inc. Montreal, Canada $39,307 100% LBC Financial Services Inc. Montreal, Canada $4,763 100% 1 The book value of shares with voting rights corresponds to the Bank’s interest in the equity of subsidiary shareholders. 23 APPENDIX Appendix 2 Employee Population by Province and Status As at October 31, 2009 Province Full-Time Part-Time Temporary Total Alberta 10 – – 10 British Columbia 6 – – 6 Newfoundland 1 – – 1 Nova Scotia 1 – – 1 Ontario 369 4 81 454 Québec 2,513 617 275 3,405 TOTAL 2,900 621 356 3,877 24 APPENDIX Appendix 3 Financing by commercial client loan – Amounts authorized during the year As at October 31, 2009 0 − 25,000 − 100,000 − 250,000 − 500,000 − 1,000,000 − 5,000,000 Province Total 24,999 99,999 249,999 499,999 999,999 4,999,999 and over British Columbia Authorized amount 168,993 168,993 Number of clients 1 1 New Brunswick Authorized amount Number of clients Ontario Authorized amount 151,900 1,024,068 3,108,000 8,718,154 30,347,394 189,266,928 296,349,931 528,966,375 Number of clients 16 18 20 26 43 90 29 242 Québec Authorized amount 16,050,180 92,265,280 172,437,714 229,601,369 267,927,253 689,934,205 -

Review Market Report 2017 Greater Montreal Area

YEAR-END OFFICE REVIEW MARKET REPORT 2017 GREATER MONTREAL AREA PAGE 1 2017 YEAR-END REVIEW OFFICE MARKET REPORT | GREATER MONTREAL YEAR-END OFFICE REVIEW MARKET REPORT 2017 GREATER MONTREAL AREA 2017 proved to be a very successful 15.5% to 14.7%. The GMA’s vacancy year for the Greater Montreal Area, rate is expected to tick back up as the Province’s unemployment over the next months, as many rates dropped to unprecedented mixed-use and office projects are lows and the city’s economy currently under construction on thrived in numerous activity and off-island. sectors. Artificial intelligence (AI) stole the spotlight last year, as Overall, the average net rental rates Montreal is becoming a growing in the GMA remained relatively hub for AI. The city is now home unchanged over the past year, to AI research laboratories from hovering around $14.00 per square Microsoft, Facebook, Google, foot (psf) for all office classes, while Samsung and Thales, and local- the additional rates remained in based AI players such as Element the vicinity of $13.00 psf. However, AI keep on expanding at a the gap between rental rates in drastic pace. The metropolitan the Downtown core and the other area maintained the sustained submarkets remains significant, as economic growth witnessed over net rental rates in the central areas the past years in 2017, leaning are closer to $17.00 psf and the towards an optimistic outlook for additional rents are approaching the years to come. $18.00 psf. From an office market perspective, The demand for quality office there has been a healthy decrease space in the Downtown Core is in available space, slightly shifting improving. -

1, PLACE VILLE MARIE MONTRÉAL (Québec)

1, PLACE VILLE MARIE MONTRÉAL (Québec) BUILDING SPECIFICATIONS Montreal’s iconic 46-storey cruciform-shaped tower offers the most prestigious and vibrant working any employee need is met or exceeded using the latest in ongoing environment available in the city. Thousands of people emerge daily from Montreal’s famous sustainable development practices. The Plave Ville Marie building underground city to make their way to work at PVM via one of the public transit arteries that received LEED Silver EB accreditation in December 2014. converge below the property, granting access to two metro stations, two train stations, and the city’s At the base of the property, the 189,000-square-foot retail plaza grants downtown bus terminal. 1 Place Ville Marie is the centerpiece of a four-building, 3-million-square-foot access to over 75 shops and amenities providing the convenience sought development that is widely recognized as the epicentre of Montreal’s business community. by all modern-day offce workers for whom time is in short supply. The building’s 36,000-square-foot foor plates provide effciency and fexibility and can be subdivided The building’s pedestrian plaza spreads out over two acres to provide into smaller pods. Each foor is equipped with over 200 windows measuring 32.5 square feet, safe and harmonious green spaces and seating areas for quiet which food the space with natural light and provide access to the best views the city has to offer. contemplation, or for casual gatherings and team meetings. Our on-site The building’s modern comfort control systems and access to power and redundancy ensure that management team is always available to cater to any tenant need. -

Building Sustainability Togethertm

2014 SUSTAINABILITY REPORT BUILDING CORPORATE PROFILE SUSTAINABILITY TM CEO’S MESSAGE TOGETHER SUSTAINABILITY AT EVERY STAGE Building Sustainability Together is our approach to GREEN AT WORKTM creating enduring value. It is about bringing capable, committed people together to develop and operate SUPPORTING COMMUNITIES best-in-class properties and to inspire and drive positive change at every stage of a building’s life cycle. AWARDS AND RECOGNITION < > | CORPORATE PROFILE | CADILLAC FAIRVIEW 2014 SUSTAINABILITY REPORT 1 ABOUT THIS REPORT Our 2014 Sustainability Report highlights Cadillac Fairview’s activities and accomplishments between September 1, 2013 and August 31, 2014. It encompasses all of Cadillac Fairview’s Canadian commercial and retail properties as part > CORPORATE PROFILE of the GREEN AT WORK™ program. Specifically, performance data focuses on the following areas: CEO’S MESSAGE > Energy data includes all reported electricity, natural gas, steam and chilled water consumption for office buildings, SUSTAINABILITY AT and for the common area within retail EVERY STAGE properties. Data is normalized for weather, occupancy, major users and GREEN AT WORKTM portfolio changes. > Water data includes all properties, The Cadillac Fairview Corporation Limited is one of North America’s largest owners, but excludes major users. Waste data SUPPORTING COMMUNITIES operators and developers of commercial real estate. Cadillac Fairview focuses on includes all properties. > Greenhouse gas emissions data includes developing and managing high quality office, retail and mixed-use properties in Canada client and common areas at commercial AWARDS AND RECOGNITION and the United States, as well as international investments in real estate companies and office properties. Data includes common areas for retail properties, but excludes investment funds. -

PRIME COMMERCIAL SPACE This New Development Building Is Located in Downtown Montreal Near Concordia University and Metro Station

FOR LEASE De Maisonneuve Boulevard West 15 0 0 Montreal | Qc Approximate Delivery Date December 2021 PRIME COMMERCIAL SPACE This new development building is located in downtown Montreal near Concordia University and Metro station. With eight available spaces to choose from, on the corner of De Maisonneuve Boulevard West & Mackay Street of varying square footage to suit your needs. LOCATION | 1500 De Maisonneuve Boulevard West | Montreal 1500 DE MAISONNEUVE BOULEVARD WEST 100 NIV. 45.8 PLAN | Ground floor 8 UNITS AVAILABLE Unit 1: 688 SQ. FT. Unit 2: 749 SQ. FT. UNIT: 8 Unit 3: 1,256 SQ. FT. LOADING LOADING DOCK BAY Unit 4: 385 SQ. FT. Unit 5: 1,756 SQ. FT. Unit 6: 646 SQ. FT. Unit 7: 1,671 SQ. FT. UNIT: 7 Unit 8: 1,224 SQ. FT. TOTAL SQ.FT. : 8,375 SQ. FT. PRICE PER SQ. FT. UNIT: 6 Unit 1: 65 PSF NET. Unit 2: 70 PSF NET. Unit 3: 80 PSF NET. Unit 4: 120 PSF NET. Unit 5: 110 PSF NET. Unit 6: 100 PSF NET. UNIT: 1 UNIT: 2 UNIT: 3 UNIT: 5 Unit 7: 65 PSF NET. Unit 8: 90 PSF NET. OPEX & CAM: APPROXIMATELY 35 PSF UNIT: 4 100 NIV. 45.8 DE MAISONNEUVE BOULEVARD WEST MACKAY STREET PEDESTRIAN TRAFFIC | MAR 17, 2018 - JAN 23, 2019 1500 Boulevard De Maisonnuver West - Pedestrians PRM Properties Inc 1500 Boulevard De Maisonnuver West Mar 17, 2018 - Jan 23, 2019 16,018 25,711 18,325 Typical Day Tue, Apr 24 - Busiest Day Thursday Average 112,208 144,644 5,013,531 Typical Week Peak Week Beginning Sun, Aug 19 Total Visitors Weekdays Weekends Average Daily Activity 1,500 1,000 500 12 AM 5 AM 10 AM 3 PM 8 PM 15,000 Hours % Total __ 5am - 11am 13% 2,120 10,000 -

The Churches of the Europeans in Québec

The Europeans in Québec Lower Canada and Québec The Churches of the Europeans in Québec Compiled by Jacques Gagné - [email protected] Updated: April 2012 The Europeans in Québec Lower Canada and Québec The Churches of the Europeans in Québec Churches of the Scandinavian, Baltic States, Germanic, Icelandic people in Montréal, Québec City, Lower St. Lawrence, Western Québec, Eastern Townships, Richelieu River Valley - The churches of immigrants from Sweden, Norway, Denmark, Finland, Estonia, Latvia. Lithuania, Iceland, Germany, the Netherlands, Belgium, Switzerland, Austria plus those from Eastern European countries - Churches which were organized in Québec from 1621 to 2005. Also included within this document you will find a number of book titles relating to the subject. Major Repositories quoted within this compilation QFHS - Quebec Family History Society in Pointe Claire BAnQ - Bibliothèque Archives nationales du Québec in Montréal Ancestry.ca - The Canadian division of Ancestry.com Lutheran Church-Canada - East District Conference Lutheran Church-Canada - Montreal Lutheran Council United Church of Canada Archives- Montreal & Ottawa Conference United Church of Canada Archives - Montreal Presbytery Anglican Archives - Montreal Diocese, Québec Diocese, Ottawa Diocese Presbyterian Archives – Toronto Creuzbourg's Jäger Corps From Wikipedia, the free encyclopedia Creuzbourg's Jäger Corps (Jäger-Corps von Creuzbourg) was an independent Jäger battalion raised by thecounty of Hesse-Hanau and put to the disposition of the British Crown, as part of the German Allied contingent during the American Revolutionary War. The corps fought at the Battle of Oriskany, although mostly serving as garrison of different Canadian posts. 2 After the Treaty of Paris 1783 the Hesse-Hanau contingent was repatriated. -

BONAVENTURE Quartier Bonaventure Transportation Objectives: Environment

QUARTIER BONAVENTURE THE NEW MONTREAL Transformation of the Bonaventure Expressway, Phase 1 Summary of the Detailed Pre-project Design Studies, March 2009 QUARTIER BONAVENTURE THE NEW MONTREAL Transformation of the Bonaventure Expressway, Phase 1 Summary of the Detailed Pre-project Design Studies, March 2009 A city gateway to be redefi ned. Quartier Bonaventure A neighbourhood steeped in history, focused on the future The logo and signature represent drive and ambition by a moving line pointing towards the sky. The inter- secting lines demonstrate a determination to mend the east and west axes in order to create a true living environment in the heart of a historic site that will live once again. The colours represent the overriding presence of the St. Lawrence River and the need for the project to refl ect sustainable development. Finally, the contrast between dark blue and electric blue shows the balance between the strength of a structuring project for Montreal and the will to redefi ne this area in an imaginative and inspiring way, from both architec- tural and urban planning perspectives. Quartier Bonaventure CONTENTS PREFACE ° The Quartier Bonaventure: redefi ne Montreal of the future in an imaginative and inspiring way 1 ° The mission of the Société du Havre de Montréal : Bring the City to the St. Lawrence River 2 ° A project that has developed over time 3 SECTION 1 BACKGROUND ° A district at the centre of Montreal history 6 ° An urban reconstruction project inspired by the magic of its historic site 7 ° Creating Quartier Bonaventure -

October 11, 2016 York St

WESTMOUNT INDEPENDENT Weekly. Vol. 21 No. 21b We are Westmount October 22, 3125 Front east fence to be removed: city Dog spa day held to raise awareness Neighbours disappointed by of breed-specific legislation (BSL) outcome of Roslyn school redo BH L7EB::@ SG::@:H parking area dominates the streetscape on Roslyn Ave. An outcry from neighbours around They claimed the design had been ill- Roslyn School highlighted some of the cit - conceived, that residents had never been izen concerns at the city council meeting consulted and the city had not been en - October 3. The outcome of the major pro - forcing the same strict regulations it im - ject to redo the property was not what was poses on private homeowners. expected, they said. Urban Planning director Joanne Poirier Instead of enhancing the aesthetics of told the Independent the day after the meet - the neighbourhood, the new 6-foot-high ing that the portion of chain-link fencing chain-link fencing surrounding the entire around the southeast section at Roslyn and site made it look like “a penitentiary,” one Westmount Ave. had been installed with - claimed. out approval, and the city had sent out a A garbage container keeps filling up and notice as soon as it was done ordering mit - has not been moved back into its place igation of the problem. since the construction, and the expanded “We also had a meeting [two weeks ago now] with authorities from the [English Mon - continued on p. 16 Letters p. 8 At a “Pity Party” hosted by Pampered Petson September 25, Tyson, a 12-year-old pit bull, receives the Art Scene by H. -

Évolution Historique Du Territoire Du Centre-Ville De Montréal

1 ÉVOLUTION HISTORIQUE DU TERRITOIRE DU CENTRE-VILLE DE MONTRÉAL ÉVOLUTION HISTORIQUE DU TERRITOIRE DU CENTRE-VILLE DE MONTRÉAL JUIN 2016 2 ÉVOLUTION HISTORIQUE HISTORIQUEDU TERRITOIRE DU CENTRE-VILLE DE MONTRÉAL DU TERRITOIRE DU CENTRE-VILLE DE MONTRÉAL Cette étude a été réalisée pour le Bureau de projets Pour chaque thématique, il s’agissait de faire ressortir du centre-ville, de l’arrondissement de Ville-Marie, dans les grandes périodes et les moments de transition, le cadre de l’élaboration de la Stratégie centre-ville. de même que les moteurs des transformations. Les influences et les interrelations entre chaque thématique L’objectif est de documenter l’évolution historique sont aussi soulignées. du territoire du centre-ville, tel que retenu dans la Stratégie, ce qui correspond à peu près au territoire Une synthèse chronologique a ensuite été réalisée de la Ville de Montréal avant les premières annexions sous la forme de cartes, reprenant les thématiques de villages limitrophes. L’étude couvre ainsi le terri- de l’étude, illustrant cinq grandes périodes de l’histoire toire de l’arrondissement de Ville-Marie, le quartier du territoire: Milton-Parc, Griffintown et le secteur est de Pointe- e e Saint-Charles, jusqu’au pont Victoria. fin 17 – fin 18 : Ville fortifiée, centre de la traite des fourrures, Le parti pris a été de suivre l’évolution urbaine selon fin 18e – mi 19e: Cité commerciale de l’Empire des thématiques ou composantes du territoire, soit: britannique, e e les activités économiques, mi-19 – fin 19 : Métropole industrielle du Canada, e e l’habitat et la population, fin 19 – mi 20 : Centre de la métropole canadienne, les espaces communs et de socialisation, mi 20e – début 21e: Centre-ville moderne, les services à la communauté, dense et multifonctionnel. -

Revue De Presse Non-Exhaustive

REVUE DE PRESSE NON‐EXHAUSTIVE Médias présents à l’avant‐première média : Mario Vallée (Magazine Fugues/Decorum) Gabrielle Leblanc (PatWhite) Pedro Reiz (Le Devoir) Marcel Pleau (journaliste indépendant) Nathalie Pommerleau (Radio‐Canada) Paul‐Guy Leclerc (Dossier Média) François Cardinal (La Presse) Nadia Sijskova (journaliste indépendante) Sun Huaiyu (Radio‐Canada) François Cormier (Radio‐Canada TV) Patrice Puiberneau (V Télé) Jessika Brazeau (Rythme FM) Claude Deschenes (Culture Communication Création) Marc‐André Carignan (D'ici et D'ailleurs.ca) François Bourque (Le Soleil) Hélène Lefranc (Ordre des Architectes du Québec) Marc‐André Carignan (CIBL FM) Maxime Bergeron (La Presse) 1 CAHIER SPÉCIAL DU JOURNAL LES AFFAIRES CONSACRÉ À L’ÉVÉNEMENT (17 AVRIL 2014) 2 3 4 5 6 UNE SÉLECTION DE REPORTAGES PARUS OU DIFFUSÉS SUR L’ÉVÉNEMENT : 7 8 9 Cet article a été publié le Mardi 8 avril 2014 à 17 h 21 min et est classé dans IMMOBILIER L’exposition architecturale Le Montréal du Futur aura lieu du 23 au 28 avril. Un événement unique mettant en valeur les projets immobiliers commerciaux, résidentiels et institutionnels qui changeront le visage du Montréal métropolitain au cours des prochaines années. Cet événement gratuit et ouvert au public aura lieu à la Grande-Place du complexe Desjardins, situé dans le Quartier des spectacles au centre-ville de Montréal, en plein coeur de nombreux futurs développements urbains. Cette activité biennale présentera un nombre important de maquettes et dessins provenant des divers promoteurs et organismes, incluant une section spéciale préparée par le Développement urbain et économique de la Ville de Montréal. Il s’agit d’un événement haut de gamme qui permettra aux exposants et partenaires de démontrer leur leadership dans le développement de la région de Montréal. -

Fall Program September to December 2018

FALL PROGRAM SEPTEMBER TO DECEMBER 2018 Our professional counsellors are here to listen as you explain your situation and to guide you toward services and resources in your community. Contact us! Artwork by Marie-Françoise M. created during the Society’s art therapy workshops for people with dementia CONTENTS Alzheimer Society of Montreal SERVICES FOR CAREGIVERS ............................. 2 Alzheimer Service Centre SERVICES FOR PEOPLE LIVING WITH DEMENTIA ........... 10 4505 Notre-Dame Street West, Montréal SERVICES FOR PEOPLE LIVING WITH DEMENTIA 514-369-0800 | [email protected] AND THEIR CAREGIVERS ................................ 12 SERVICES FOR PROFESSIONALS AND ORGANIZATIONS ..... 14 Opening hours: SERVICES FOR ALL — ALZHEIMER CAFÉ .................. 17 Monday to Friday, 9 a.m. to 5 p.m. SERVICES POURFOR CAREGIVERS PROCHES AIDANTS THE COUNSELLING- NETWORK Chalet Coolbrooke, DDO Do you have a friend or family member living with Alzheimer’s 260 Spring Garden Street disease or a related form of dementia? Would you like to talk about your situation and the challenges you are facing? Do you need support and want to know where you can find it? Our counsellors are available to meet caregivers at the following locations to offer accompaniment, free and confidential counselling, training, information, resources, and support. Carrefour des 6–12 ans de Pierrefonds-Est inc. To discuss your situation or make 4773 Lalande Boulevard an appointment: 514-369-0800 [email protected] Foyer Dorval 225 de la Présentation Avenue 2 FALL