FORM 10-K Nbcuniversal Media

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Ownership Chart

In 1983, 50 corporations controlled the vast majority of all news media in the U.S. At the time, Ben Bagdikian was called "alarmist" for pointing this out in his book, The Media Monopoly . In his 4th edition, published in 1992, he wrote "in the U.S., fewer than two dozen of these extraordinary creatures own and operate 90% of the mass media" -- controlling almost all of America's newspapers, magazines, TV and radio stations, books, records, movies, videos, wire services and photo agencies. He predicted then that eventually this number would fall to about half a dozen companies. This was greeted with skepticism at the time. When the 6th edition of The Media Monopoly was published in 2000, the number had fallen to six. Since then, there have been more mergers and the scope has expanded to include new media like the Internet market. More than 1 in 4 Internet users in the U.S. now log in with AOL Time-Warner, the world's largest media corporation. In 2004, Bagdikian's revised and expanded book, The New Media Monopoly , shows that only 5 huge corporations -- Time Warner, Disney, Murdoch's News Corporation, Bertelsmann of Germany, and Viacom (formerly CBS) -- now control most of the media industry in the U.S. General Electric's NBC is a close sixth. Who Controls the Media? Parent General Electric Time Warner The Walt Viacom News Company Disney Co. Corporation $100.5 billion $26.8 billion $18.9 billion 1998 revenues 1998 revenues $23 billion 1998 revenues $13 billion 1998 revenues 1998 revenues Background GE/NBC's ranks No. -

Daftar Pustaka

DAFTAR PUSTAKA Aisyah, Munity, Peer Group Effect on Moslem Consumer’s Decision To Purchase Halal-Labeled Cosmetics Al-Iqtishad: Vol. VII No. 2, Juli 2015. Angelidis, J. and N. Ibrahim: 2004, An Exploratory Study of the Impact of Degree of Religiousness upon an Individuals Corporate Social Responsive Orientation, Journal of Business Ethics 51, 119–128. Aridhona, Julia. 2017. Hubungan Perilaku Prososial dan Religiusitas dengan moral pada remaja Arifin, B. (2012). Etika dan Profesi Kependidikan. Jogjakarta: Ar-Ruzz Media. Bloodgood, J.M., Turnley, W.H. and Mudrack, P. (2008), The influence of ethics instruction, religiosity, and intelligence on cheating behavior, Journal of Business Ethics, Vol. 82 No. 3, pp. 557-571. Brady, N. and Hart, D. (2007), An exploration into the developmental psychology of ethical theory with implications for business practice and pedagogy, Journal of Business Ethics, Vol. 76 No. 4, pp. 397-412. Candy, V. (2013), Social responsibility and globalization, Journal of Applied Business Research, Vol. 29 No. 5, pp. 1353-1366. CNBC Indonesia. (2018, 01 Mei). 15 Bank Ini Kemungkinan Masuk Kategori Sistematik. Diperoleh 12 Juli 2018, dari https://www.cnbcindonesia.com/market/20180501074731- 17-13108/15-bank-ini-kemungkinan-masuk-kategori-sistemik CNN Indonesia. (2017, 26 Januari). Kredit Macet BNI Meningkat akibat tunggakan Dua Kreditur Jumbo. Diperoleh 12 Juli 2018, dari https://www.cnnindonesia.com/ekonomi/20170126180729-78-189299/kredit-macet-bni- meningkat-akibat-tunggakan-dua-debitur-jumbo Corner, P. D. (2009). Workplace spirituality and business ethics: Insights from an Eastern spiritual tradition. Journal of Business Ethics, 85, 377–389. Cornwall, M., S. L. Albrecht, P. H. Cunningham and B. -

A Retrospective Analysis of Vertical Mergers in Multichannel Video Programming Distribution Markets: the Comcast-NBCU Merger

PHOENIX CENTER FOR ADVANCED LEGAL & ECONOMIC PUBLIC POLICY STUDIES 5335 Wisconsin Avenue, NW, Suite 440 Washington, D.C. 20015 Tel: (+1) (202) 274-0235 • Fax: (+1) (202) 318-4909 www.phoenix-center.org Lawrence J. Spiwak, President 16 March 2018 VIA EMAIL Douglas Rathbun Competition Policy and Advocacy Section Antitrust Division U.S. Department of Justice 950 Pennsylvania Ave., NW, Room 3413 Washington, DC 20530 RE: USDOJ Roundtable on Antitrust Consent Decrees Dear Mr. Rathbun: The Department announced that it intends to hold a public roundtable on April 26, 2018 which will focus on antitrust consent decrees, including the regulatory nature of consent decrees that involve behavioral remedies. To help inform the discussion, please find attached a copy of a recent Phoenix Center paper entitled A Retrospective Analysis of Vertical Mergers in Multichannel Video Programming Distribution Markets: The Comcast-NBCU Merger. In this paper, Phoenix Center Chief Economist Dr. George S. Ford presents a retrospective analysis of the price effects of the Comcast-NBCU merger. In particular, Dr. Ford conducts an econometric analysis of data on the prices paid for programming by multichannel video programing distributors (“MVPDs”) before and after the transaction and finds no evidence that Comcast’s programming prices rose after the merger. The analysis covers general interest programming, news channels, and national and regional sports networks. Given these results, Dr. Ford concludes that there is either a lack of a net positive effect on incentives to raise programming prices above competitive levels following the vertical merger or that the behavioral remedies placed on the Comcast-NBCU merger were effective. -

Alphabetical Channel Guide 800-355-5668

Miami www.gethotwired.com ALPHABETICAL CHANNEL GUIDE 800-355-5668 Looking for your favorite channel? Our alphabetical channel reference guide makes it easy to find, and you’ll see the packages that include it! Availability of local channels varies by region. Please see your rate sheet for the packages available at your property. Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package 5StarMAX 712 774 Cinemax A&E 95 488 ABC 10 WPLG 10 410 Local Local Local Local ABC Family 62 432 AccuWeather 27 ActionMAX 713 775 Cinemax AMC 84 479 America TeVe WJAN 21 Local Local Local Local En Espanol Package American Heroes Channel 112 Animal Planet 61 420 AWE 256 491 AXS TV 493 Azteca America 399 Local Local Local Local En Espanol Package Bandamax 625 En Espanol Package Bang U 810 Adult BBC America 51 BBC World 115 Becon WBEC 397 Local Local Local Local beIN Sports 214 502 beIN Sports (en Espanol) 602 En Espanol Package BET 85 499 BET Gospel 114 Big Ten Network 208 458 Bloomberg 222 Boomerang 302 Bravo 77 471 Brazzers TV 811 Adult CanalSur 618 En Espanol Package Cartoon Network 301 433 CBS 4 WFOR 4 404 Local Local Local Local CBS Sports Network 201 459 Centric 106 Chiller 109 CineLatino 630 En Espanol Package Cinemax 710 772 Cinemax Cloo Network 108 CMT 93 CMT Pure Country 94 CNBC 48 473 CNBC World 116 CNN 49 465 CNN en Espanol 617 En Espanol Package CNN International 221 Comedy Central 29 426 Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package -

Appendix a Stations Transitioning on June 12

APPENDIX A STATIONS TRANSITIONING ON JUNE 12 DMA CITY ST NETWORK CALLSIGN LICENSEE 1 ABILENE-SWEETWATER SWEETWATER TX ABC/CW (D KTXS-TV BLUESTONE LICENSE HOLDINGS INC. 2 ALBANY GA ALBANY GA NBC WALB WALB LICENSE SUBSIDIARY, LLC 3 ALBANY GA ALBANY GA FOX WFXL BARRINGTON ALBANY LICENSE LLC 4 ALBANY-SCHENECTADY-TROY ADAMS MA ABC WCDC-TV YOUNG BROADCASTING OF ALBANY, INC. 5 ALBANY-SCHENECTADY-TROY ALBANY NY NBC WNYT WNYT-TV, LLC 6 ALBANY-SCHENECTADY-TROY ALBANY NY ABC WTEN YOUNG BROADCASTING OF ALBANY, INC. 7 ALBANY-SCHENECTADY-TROY ALBANY NY FOX WXXA-TV NEWPORT TELEVISION LICENSE LLC 8 ALBANY-SCHENECTADY-TROY PITTSFIELD MA MYTV WNYA VENTURE TECHNOLOGIES GROUP, LLC 9 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CW WCWN FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 10 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CBS WRGB FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 11 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CW KASY-TV ACME TELEVISION LICENSES OF NEW MEXICO, LLC 12 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM UNIVISION KLUZ-TV ENTRAVISION HOLDINGS, LLC 13 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM PBS KNME-TV REGENTS OF THE UNIV. OF NM & BD.OF EDUC.OF CITY OF ALBUQ.,NM 14 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM ABC KOAT-TV KOAT HEARST-ARGYLE TELEVISION, INC. 15 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM NBC KOB-TV KOB-TV, LLC 16 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CBS KRQE LIN OF NEW MEXICO, LLC 17 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM TELEFUTURKTFQ-TV TELEFUTURA ALBUQUERQUE LLC 18 ALBUQUERQUE-SANTA FE CARLSBAD NM ABC KOCT KOAT HEARST-ARGYLE TELEVISION, INC. -

Channel Lineup

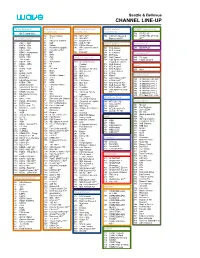

Seattle & Bellevue CHANNEL LINEUP TV On Demand* Expanded Content* Expanded Content* Digital Variety* STARZ* (continued) (continued) (continued) (continued) 1 On Demand Menu 716 STARZ HD** 50 Travel Channel 774 MTV HD** 791 Hallmark Movies & 720 STARZ Kids & Family Local Broadcast* 51 TLC 775 VH1 HD** Mysteries HD** HD** 52 Discovery Channel 777 Oxygen HD** 2 CBUT CBC 53 A&E 778 AXS TV HD** Digital Sports* MOVIEPLEX* 3 KWPX ION 54 History 779 HDNet Movies** 4 KOMO ABC 55 National Geographic 782 NBC Sports Network 501 FCS Atlantic 450 MOVIEPLEX 5 KING NBC 56 Comedy Central HD** 502 FCS Central 6 KONG Independent 57 BET 784 FXX HD** 503 FCS Pacific International* 7 KIRO CBS 58 Spike 505 ESPNews 8 KCTS PBS 59 Syfy Digital Favorites* 507 Golf Channel 335 TV Japan 9 TV Listings 60 TBS 508 CBS Sports Network 339 Filipino Channel 10 KSTW CW 62 Nickelodeon 200 American Heroes Expanded Content 11 KZJO JOEtv 63 FX Channel 511 MLB Network Here!* 12 HSN 64 E! 201 Science 513 NFL Network 65 TV Land 13 KCPQ FOX 203 Destination America 514 NFL RedZone 460 Here! 14 QVC 66 Bravo 205 BBC America 515 Tennis Channel 15 KVOS MeTV 67 TCM 206 MTV2 516 ESPNU 17 EVINE Live 68 Weather Channel 207 BET Jams 517 HRTV PayPerView* 18 KCTS Plus 69 TruTV 208 Tr3s 738 Golf Channel HD** 800 IN DEMAND HD PPV 19 Educational Access 70 GSN 209 CMT Music 743 ESPNU HD** 801 IN DEMAND PPV 1 20 KTBW TBN 71 OWN 210 BET Soul 749 NFL Network HD** 802 IN DEMAND PPV 2 21 Seattle Channel 72 Cooking Channel 211 Nick Jr. -

Cablelabs Studio Code List 05/01/2006

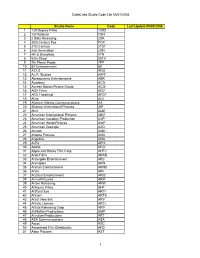

CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 1 120 Degree Films 120D 2 1st National FSN 3 2 Silks Releasing 2SR 4 20th Century Fox FOX 5 21st Century 21ST 6 2nd Generation 2GN 7 4th & Broadway 4TH 8 50th Street 50TH 9 7th Planet Prods 7PP 10 8X Entertainment 8X 11 A.D.G. ADG 12 A.I.P. Studios AIPS 13 Abramorama Entertainment ABR 14 Academy ACD 15 Access Motion Picture Group ACM 16 ADV Films ADV 17 AFD Theatrical AFDT 18 Alive ALV 19 Alliance Atlantis Communications AA 20 Alliance International Pictures AIP 21 Almi ALM 22 American International Pictures AINT 23 American Vacation Production AVP 24 American World Pictures AWP 25 American Zoetrope AZO 26 Amoon AMO 27 Andora Pictures AND 28 Angelika ANG 29 A-Pix APIX 30 Apollo APO 31 Apple and Honey Film Corp. AHFC 32 Arab Films ARAB 33 Arcangelo Entertainment ARC 34 Arenaplex ARN 35 Arenas Entertainment ARNS 36 Aries ARI 37 Ariztical Entertainment ARIZ 38 Arrival Pictures ARR 39 Arrow Releasing ARW 40 Arthouse Films AHF 41 Artificial Eye ARTI 42 Artisan ARTS 43 Artist View Ent. ARV 44 Artistic License ARTL 45 Artists Releasing Corp ARP 46 ArtMattan Productions AMP 47 Artrution Productions ART 48 ASA Communications ASA 49 Ascot ASC 50 Associated Film Distribution AFD 51 Astor Pictures AST 1 CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 52 Astral Films ASRL 53 At An Angle ANGL 54 Atlantic ATL 55 Atopia ATP 56 Attitude Films ATT 57 Avalanche Films AVF 58 Avatar Films AVA 59 Avco Embassy AEM 60 Avenue AVE 61 B&W Prods. -

Over the Past Ten Years, Good Machine, a New York-Based

MoMA | press | Releases | 2001 | Good Marchine: Tenth Anniversary Page 1 of 4 For Immediate Release February 2001 THE MUSEUM OF MODERN ART TO CELEBRATE TENTH ANNIVERSARY OF GOOD MACHINE, NEW YORK-BASED PRODUCTION COMPANY Good Machine: Tenth Anniversary February 13-23, 2001 The Roy and Niuta Titus Theatre 1 Over the past ten years, Good Machine, a New York-based production company helmed by Ted Hope, David Linde and James Schamus, has become one of the major forces in independent film culture worldwide. Dedicated to the work of emerging, innovative filmmakers, Good Machine has produced or co-produced films by, among others, Ang Lee, Todd Solondz, Nicole Holofcener, Ed Burns, Cheryl Dunye and Hal Hartley. Beginning with Tui Shou (Pushing Hands) (1992), the first collaboration between Good Machine and director Ang Lee, The Museum of Modern Art presents eight feature films and five shorts from February 13 through 23, 2001 at the Roy and Niuta Titus Theatre 1. "Good Machine proves that audiences do want to be entertained intelligently and engaged substantively," remarks Laurence Kardish, Senior Curator, Department of Film and Video, who organized the series. "Their achievements are reflected in this Tenth Anniversary series and are, in large part, due to Good Machine's collaborations with filmmakers and its respect for the creative process." In addition to producing and co-producing films, Good Machine has gone on to establish an international sales company involved in distributing diverse and unusual works such as Joan Chen's Xiu Xiu: The Sent-Down Girl (1998) and Lars Von Trier's Dancer in the Dark (2000). -

PBIFF 2012 Film Announcement-1

FOR IMMEDIATE RELEASE National Press Contact: March 13, 2012 Carol Marshall Carol Marshall Public Relations, Inc. 818/760‐6450 [email protected] Local Press Contact: Profile Marketing & PR Joanne Polin [email protected] 561‐350‐8784 Hillary Reynolds [email protected] 954‐815‐1186 17th PALM BEACH INTERNATIONAL FILM FESTIVAL UNVEILS 2012 LINE‐UP * * * “ROBOT & FRANK” OPENS FESTIVAL THURSDAY, APRIL 12; CLOSES WITH “SASSY PANTS” * * * Festival Presents 40 World and U.S. Premiere Feature Films BOCA RATON, FL – The Palm Beach International Film Festival (PBIFF) announced its highly anticipated film line‐up for the 17th edition, April 12‐19, 2012, featuring 25 World Premieres, 14 U.S. Premieres and 2 North American Premieres. PBIFF (www.pbifilmfest.org) will present features, documentaries and short films from the U.S. and around the world, including Netherlands, Spain, Argentina, Tanzania, Italy, France, England, Israel, Thailand, Guinea‐Bissau, Portugal, Australia, Canada, Romania and Sweden, and will play host to filmmakers, producers, and actors to represent and discuss their films. “We are excited about this year’s program,” comments PBIFF Director Randi Emerman, “which reflects our ongoing mission to engage with the community, expanding and enhancing its knowledge of the world through the unique lens of independent film.† We encourage people to take this opportunity to enjoy these diversely international stories.ʺ Opening Night kicks off with Robot & Frank, directed by Jake Schreier. Set in the near future, Frank, a retired cat burglar, has two grown kids who are concerned he can no longer live alone.† They are tempted to place him in a nursing home until Frankʹs son chooses a different option: against the old manʹs wishes, he buys Frank a walking, talking humanoid robot programmed to improve his physical and mental health. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

Media Influence Matrix Romania

N O V E M B E R 2 0 1 9 MEDIA INFLUENCE MATRIX: ROMANIA Author: Dumitrita Holdis Editor: Marius Dragomir Published by CEU Center for Media, Data and Society (CMDS), Budapest, 2019 About CMDS About the authors The Center for Media, Data and Society Dumitrita Holdis works as a researcher for the (CMDS) is a research center for the study of Center for Media, Data and Society at CEU. media, communication, and information Previously she has been co-managing the “Sound policy and its impact on society and Relations” project, while teaching courses and practice. Founded in 2004 as the Center for conducting research on academic podcasting. Media and Communication Studies, CMDS She has done research also on media is part of Central European University’s representation, migration, and labour School of Public Policy and serves as a focal integration. She holds a BA in Sociology from point for an international network of the Babes-Bolyai University, Cluj-Napoca and a acclaimed scholars, research institutions and activists. MA degree in Sociology and Social Anthropology from the Central European University. She also has professional background in project management and administration. She CMDS ADVISORY BOARD has worked and lived in Romania, Hungary, France and Turkey. Clara-Luz Álvarez Floriana Fossato Ellen Hume Monroe Price Marius Dragomir is the Director of the Center Anya Schiffrin for Media, Data and Society. He previously Stefaan G. Verhulst worked for the Open Society Foundations (OSF) for over a decade. Since 2007, he has managed the research and policy portfolio of the Program on Independent Journalism (PIJ), formerly the Network Media Program (NMP), in London. -

Omnicom Group Table of Table 08 People

DIVERSE TALENT COLLECTIVE STRENGTH 2019 CORPORATE RESPONSIBILITY REPORT WITH 2020 UPDATES Omnicom is a group of thousands of individuals across more than 70 countries collectively bringing their passion and creativity to over 5,000 brands. The talent of this diverse group of people allows us to create a positive and lasting impact on the world the best way we know how: through our work. Contents 04 Letter from Our CEO 05 About Omnicom Group Table of Table 08 People 27 Community 40 Environment 48 Governance 52 About This Report 53 UN Global Compact (UNGC) Communication on Progress 54 GRI Standards Content Index Governance About This Report UNGC Progress GRI Index In a world that’s rapidly changing, Omnicom grounds itself in its Furthermore, we supported Theirworld again in 2019 through its commitments to having the industry’s most innovative, collaborative #WriteTheWrong campaign, which raised awareness of the 260 million and diverse talent. Through diverse perspectives and collective strength, children who do not attend school each day. Our work on the our organization is able to uphold the highest standards of excellence and #WriteTheWrong campaign helped secure $2.3 billion in commitments creativity for our clients and the communities we share around the globe. to education over one week and underscored our own commitment to UN Sustainable Development Goal 4. While this report focuses on our 2019 activities, its release comes at a time of uncertainty and unrest in the wake of the COVID-19 pandemic We also continued our progress against our goals of reducing the and the racial inequalities brought to light by George Floyd’s tragic death.