TA 322B.WC1 Federal Income Taxation of Corporations and Shareholders II Cross-Listed with and Equivalent to LLM 322B.WC1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Academic Guidelines Distribution Project

University of Pennsylvania ScholarlyCommons Organizational Dynamics Working Papers Organizational Dynamics Programs June 2007 Academic Guidelines Distribution Project Kimberly A. Perry University of Pennsylvania, [email protected] Larry Starr University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/od_working_papers Perry, Kimberly A. and Starr, Larry, "Academic Guidelines Distribution Project" (2007). Organizational Dynamics Working Papers. 3. https://repository.upenn.edu/od_working_papers/3 Organizational Dynamics Working Paper #06-18. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/od_working_papers/3 For more information, please contact [email protected]. Academic Guidelines Distribution Project Abstract The number and scope of programs of organizational and executive coaching has dramatically increased over the past 15 years. An unknown number of private and professional consulting companies offer proprietary or standardized workshops, classes, and coaching services. A growing number of academic institutions in the United States and Canada offer or have plans to offer "coaching programs" packaged or delivered as educational workshops; graduate courses; post-baccalaureate and/or graduate certificates; degree programs or graduate concentrations within degree programs; and as direct coaching service to enhance personal and professional development for students, faculty, and members of the academic administration. Academic coaching programs are located in many areas within a university including within schools or departments of psychology, business, education, public policy, and human resources. A single institution may have multiple yet autonomous coaching programs or offerings. This results in separate and often inconsistent policies and standards by those who establish and deliver the programs, confusion or miscommunication by those who buy the programs, and little interaction between program managers within a single institution, as well as between institutions. -

2020-2021 GGU Catalog

GOLDEN GATE UNIVERSITY CATALOG 2020–2021 Golden Gate University Catalog 2020-2021 Contents Contents .............................................................................................. 1 Content Disclaimer About GGU ........................................................................................ 2 The content in this document was published on June 05, 2020. For School of Undergraduate Studies ....................................................... 4 the most current catalog information, see catalog.ggu.edu School of Accounting ....................................................................... 53 Edward S. Ageno School of Business ............................................... 64 Bruce F. Braden School of Taxation .............................................. 132 School of Law ................................................................................ 138 Libraries ......................................................................................... 140 Admission ....................................................................................... 141 Financial Planning .......................................................................... 151 Enrollment ...................................................................................... 167 Academic Requirements ................................................................. 181 Student Services ............................................................................. 185 Graduation and Commencement ................................................... -

Commencement Program, 1957

Golden Gate University School of Law GGU Law Digital Commons Commencement About GGU School of Law 6-1957 Commencement Program, 1957 Follow this and additional works at: http://digitalcommons.law.ggu.edu/commencement Part of the Legal Education Commons Recommended Citation "Commencement Program, 1957" (1957). Commencement. Paper 25. http://digitalcommons.law.ggu.edu/commencement/25 This Presentation is brought to you for free and open access by the About GGU School of Law at GGU Law Digital Commons. It has been accepted for inclusion in Commencement by an authorized administrator of GGU Law Digital Commons. For more information, please contact [email protected]. 6/ifty- fi4xt6 @/tnnua/ @ommeneement GOLDEN GATE COLLEGE WAR MEMORIAL VETERANS BUILDING FRIDAY, JUNE 14, 1957 EIGHT O'CLOCK P. M. BOARD OF TRUSTEES OF GOLDEN GATE COLLEGE BOARD OF TRUSTEES CARL H. .ALLEN JOHN H. CoUPIN FRED DRExLER ROY S. FROTHINGHAM JAMBS E. HAMMOND ALEXANDER R. HERON MILTON C. KENNEDY HARRYLANGB RUDOLPH E. LINDQUIST LLOYD D. LUCKMANN NAGEL T. MINER WARREN H. PILLSBURY VAUGHN D. SEIDEL A. B. TICHENOR EMIL G. WUNNER PROGRAM MUSICAL PRELUDE DR. WENDELL 0TEY Professor of Music, San Francisco State College Two Fugues on the "Magnificat" . Pachelbel Francaise Poulenc Allegro in G . Franck * PROCESSIONAL March inC ... • . Beethoven * WELCOME NAGEL T. MINER President, Golden Gate College * INVOCATION THE REv. PAUL H. BUCHHOLZ, D.D. * COMMENCEMENT GREETINGS MR. JAMEs E. HAMMOND President, Board of Directors of the YMCA of San Francisco The Consonata Organ has been furnished through the courtesy of Leathurby Company, 183 Golden Gate Avenue, San Francisco, Calif. PROGRAM COMMENCEMENT ADDRESS Introduction NAGEL T. -

Golden Gate College School of Law Bulletin - 1966-1967

Golden Gate University School of Law GGU Law Digital Commons Law School Bulletins & Prospectus About GGU School of Law 1966 Golden Gate College School of Law Bulletin - 1966-1967 Follow this and additional works at: http://digitalcommons.law.ggu.edu/bulletins Part of the Curriculum and Instruction Commons Recommended Citation "Golden Gate College School of Law Bulletin - 1966-1967" (1966). Law School Bulletins & Prospectus. Paper 25. http://digitalcommons.law.ggu.edu/bulletins/25 This Newsletter or Magazine is brought to you for free and open access by the About GGU School of Law at GGU Law Digital Commons. It has been accepted for inclusion in Law School Bulletins & Prospectus by an authorized administrator of GGU Law Digital Commons. For more information, please contact [email protected]. GOLDEN GATE COLLEGE BULLETIN VOL. IV MARCH 1966 NO.7 SCHOOL OF LAW 1966-1967 GOLDEN GATE COLLEGE AND ACCREDITED BY THE COMMITTEE OF BAR EXAMINERS, STATE BAR OF CALIFORNIA GOLDEN GATE COLLEGE This Bulletin is one of a series which describes the undergraduate programs in Accounting, Business Administration, Economics, Insur ance, Political Science, Traffic and Transportation, and General Edu cation; the graduate programs in Business and Public Administration; and the program of the School of Law. These yearly bulletins are available free of charge to persons desiring information about Golden Gate College. Copies of the bulletin for the School of Law may be obtained from the Dean of the School. All correspondence, inquiries, requests for information (including class schedules), application for admission and transcripts or other documents concerning the School of Law .should be addressed as follows: Dean, School of Law Golden Gate College 536 Mission Street San Francisco, California 94105 Requests for copies of other bulletins should be addressed as follows: Director of Admissions Golden Gate College 220 Golden Gate Avenue San Francisco, California 94102 All telephone inquiries should be made to 775-5774 (Area Code 415). -

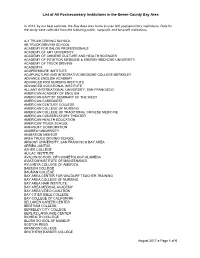

List of All Postsecondary Institutions in the Seven-County Bay Area

List of All Postsecondary Institutions in the Seven-County Bay Area In 2012, by our best estimate, the Bay Area was home to over 300 postsecondary institutions. Data for the study were collected from the following public, nonprofit, and for-profit institutions. A-1 TRUCK DRIVING SCHOOL AB TRUCK DRIVING SCHOOL ACADEMY FOR SALON PROFESSIONALS ACADEMY OF ART UNIVERSITY ACADEMY OF CHINESE CULTURE AND HEALTH SCIENCES ACADEMY OF INTUITION MEDICINE & ENERGY MEDICINE UNIVERSITY ACADEMY OF TRUCK DRIVING ACADEMYX ACUPRESSURE INSTITUTE ACUPUNCTURE AND INTEGRATIVE MEDICINE COLLEGE-BERKELEY ADVANCE ENGLISH ACADEMY ADVANCED PRO NURSING INSTITUTE ADVANCED VOCATIONAL INSTITUTE ALLIANT INTERNATIONAL UNIVERSITY, SAN FRANCISCO AMERICAN ACADEMY OF ENGLISH AMERICAN BAPTIST SEMINARY OF THE WEST AMERICAN CAREQUEST AMERICAN CENTURY COLLEGE AMERICAN COLLEGE OF NURSING AMERICAN COLLEGE OF TRADITIONAL CHINESE MEDICINE AMERICAN CONSERVATORY THEATER AMERICAN HEALTH EDUCATION AMERICAN TRUCK SCHOOL AMFASOFT CORPORATION ANDREW UNIVERSITY ANIMATION MENTOR AREA TRUCK DRIVING SCHOOL ARGOSY UNIVERSITY, SAN FRANCISCO BAY AREA ARRIBA JUNTOS ASHER COLLEGE AU LAC INSTITUTE AVALON SCHOOL OF COSMETOLOGY-ALAMEDA AVIATION INSTITUTE OF MAINTENANCE AYUVIDYA COLLEGE OF AMERICA BABSON COLLEGE BAUMAN COLLEGE BAY AREA CENTER FOR WALDORF TEACHER TRAINING BAY AREA COLLEGE OF NURSING BAY AREA HAIR INSTITUTE BAY AREA MEDICAL ACADEMY BAY AREA VIDEO COALITION BAY CITIES BIBLE COLLEGE BAY COLLEGE OF CALIFORNIA BELLAKEN CAREER CENTER BENTHAM COLLEGE BERKELEY CITY COLLEGE BERLITZ LANGUAGE CENTER -

1997-1998 WIU Catalog

Western International University 1997-1998 Catalog CollegeSource Visit the CollegeSource Online website at http://www.collegesource.org Copyright & Disclaimer Information: Copyright © 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. CollegeSource®, Inc. and Career Guidance Foundation. CollegeSource® digital catalogs are derivative works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content is owned and copyrighted by the appropriate school. While CollegeSource®, Inc. and Career Guidance Foundation provides information as a service to the public, copyright is retained on all digital catalogs. Copyright & Disclaimer Information: Copyright © 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. CollegeSource®, Inc. and Career Guidance Foundation. CollegeSource® digital catalogs are derivative works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content is owned and copyrighted by the appropriate school. While CollegeSource®, Inc. and Career Guidance Foundation provides information as a service to the public, copyright is retained on all digital catalogs. Copyright & Disclaimer You may: Information • print copies of the information for your own personal use, Copyright ©1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. • store the files on your own computer for per- CollegeSource®, Inc. and Career Guidance Foundation. sonal use only, or • reference this material from your own docu- CollegeSource® digital catalogs are derivative ments. works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content CollegeSource®, Inc. and Career Guidance is owned and copyrighted by the appropriate school. Foundation reserves the right to revoke such authorization at any time, and any such use shall be While CollegeSource®, Inc. -

Schools Receiving Scholarship Dollars From

SCHOOLS RECEIVING SCHOLARSHIP DOLLARS FROM NEWH Academy of Art University $5,500.00 Fashion Institute of Design & Merchandising $18,200.00 Albuquerque Technical Vocational Institute $1,000.00 Fashion Institute of Technology $34,000.00 Alexandria Technical College $1,500.00 Florida Atlantic University $1,000.00 Algonquin College $1,000.00 Florida Culinary Institute $1,000.00 American College for the Applied Arts $20,350.00 Florida International University $49,000.00 American College of Business $7,000.00 Florida Metropolitan University $2,250.00 American Intercontinental University $9,500.00 Florida State University $51,250.00 Anne Arundel Community College $3,000.00 Fullerton Community College $1,000.00 Arapahoe Community College $2,500.00 Georgia Institute of Technology $4,350.00 Arizona Culinary Institute $500.00 Georgia Southern University $34,250.00 Arizona State University $10,350.00 Georgia State University $16,000.00 Art Center College of Design $28,050.00 Glendale Community College $2,350.00 Atlanta Intercontinental University $2,000.00 Gnomon School of Visual Effects $1,250.00 Auburn University $7,000.00 Golden Gate University $2,500.00 Austin Community College $2,000.00 Gwinnett Technical College $600.00 Baylor University $1,000.00 Harrington College of Design $46,750.00 Bellevue College $5,500.00 High Point University $2,500.00 Berkeley College $1,500.00 Houston Community College $4,000.00 Berry College $9,000.00 Hudson County Community College/Culinary Arts $3,500.00 Boston University $6,500.00 Humber College $6,000.00 Brenau -

Golden Gate University School of Taxation Taxation of Financial Instruments Fall 2015 TA 363 SF Location Instructor: Navin Sethi

Golden Gate University School of Taxation Taxation of Financial Instruments Fall 2015 TA 363 SF Location Instructor: Navin Sethi, CPA, JD,LLM Email: [email protected] Phone: 415 894-8354 COURSE DESCRITION: This course will focus on the taxation of financial instruments, products and transactions. We will begin by covering basic principles, including financial terminology, types of market participants, as well as the tax concepts of timing, character, and source. From there, the coursed will be divided into three broad categories- Equity, Debt and Derivatives. Within those Categories we will study the detailed rules regarding tax treatment of financial instruments including stocks, bonds; options forward contracts, futures contracts, convertible and contingent payment instruments, swaps, as well as hybrid instruments. Tax issues that will be addressed include wash sales, constructive sales, short sale rules, straddles, market discount, and original issue discount. Section 1256 and notional principal contract regulations. Will also discuss new innovative financial products being created such as ETFs and Bitcoins. PREREQUISITE: NONE . The catalog has some that are listed, but class is designed so not required. Professor approval for waiver available. OUTCOMES: This course will enable the student to: 1. Understand basic financial product and market terminology. 2. Determine the appropriate tax rate for different types of transactions and products. 3. Differentiate dealers from traders and investors. 4. Determine when tax rules will alter timing, character and/or source of income. 5. Understand tax and reporting consequences of investing in foreign entities. COURSE TOPICS : The following topics (see below for details) will be covered: • Overview of financial markets and participants • Investors vs. -

1999-2000 WIU Catalog

Western International University 1999-2000 Catalog CollegeSource Visit Career Guidance Foundation at http://www.collegesource.org Copyright & Disclaimer Information: Copyright © 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. CollegeSource®, Inc. and Career Guidance Foundation. CollegeSource® digital catalogs are derivative works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content is owned and copyrighted by the appropriate school. While CollegeSource®, Inc. and Career Guidance Foundation provides information as a service to the public, copyright is retained on all digital catalogs. Copyright & Disclaimer Information: Copyright © 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. CollegeSource®, Inc. and Career Guidance Foundation. CollegeSource® digital catalogs are derivative works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content is owned and copyrighted by the appropriate school. While CollegeSource®, Inc. and Career Guidance Foundation provides information as a service to the public, copyright is retained on all digital catalogs. Copyright & Disclaimer You may: Information • print copies of the information for your own personal use, Copyright ©1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007. • store the files on your own computer for per- CollegeSource®, Inc. and Career Guidance Foundation. sonal use only, or • reference this material from your own docu- CollegeSource® digital catalogs are derivative ments. works owned and copyrighted by CollegeSource®, Inc. and Career Guidance Foundation. Catalog content CollegeSource®, Inc. and Career Guidance is owned and copyrighted by the appropriate school. Foundation reserves the right to revoke such authorization at any time, and any such use shall be While CollegeSource®, Inc. -

A True Pioneer of the Legal Profession and the San Francisco Bench Lee Baxter

Golden Gate University Law Review Volume 48 | Issue 2 Article 2 May 2018 A True Pioneer of the Legal Profession and the San Francisco Bench Lee Baxter Follow this and additional works at: https://digitalcommons.law.ggu.edu/ggulrev Part of the Judges Commons Recommended Citation Lee Baxter, A True Pioneer of the Legal Profession and the San Francisco Bench, 48 Golden Gate U. L. Rev. 111 (2018). https://digitalcommons.law.ggu.edu/ggulrev/vol48/iss2/2 This Article is brought to you for free and open access by the Academic Journals at GGU Law Digital Commons. It has been accepted for inclusion in Golden Gate University Law Review by an authorized editor of GGU Law Digital Commons. For more information, please contact [email protected]. Baxter: A True Pioneer of the San Francisco Bench ARTICLE A TRUE PIONEER OF THE LEGAL PROFESSION AND THE SAN FRANCISCO BENCH THE HONORABLE LEE BAXTER*1 “Where I come from, women didn’t become lawyers.” Judge Baxter stressed this point several times in the conversation with her. It was not too long ago that the legal profession was hostile to women. Judge Bax- ter recalled that as late as 1921, women lawyers were prohibited from joining and participating in the San Francisco Bar Association. Since then, with the courage of women like Judge Baxter, more women than men are going to law school and many women hold prestigious positions within private practice, the court, and in government. While San Francisco has become a progressive area on the cutting edge of accepting diverse populations into the legal profession, this did not come without courageous people. -

2020-2021 Law School Student Handbook

GOLDEN GATE UNIVERSITY LAW STUDENT HANDBOOK 2020–2021 Golden Gate University School of Law Student Handbook 2020-2021 Contents Content Disclaimer Contents .............................................................................................. 1 The content in this document was published on June 9, 2020. For the most current catalog information, see catalog.ggu.edu Welcome Message .............................................................................. 2 Admission ........................................................................................... 3 Financial Aid .................................................................................... 13 General Information ......................................................................... 19 Disability Services & Policy ............................................................. 31 Discrimination & Harassment, Sexual Harassment, Title IX Policy 40 Drug and Alcohol-Free Policy .......................................................... 52 Special Programs .............................................................................. 56 Administrative Rules & Procedures.................................................. 64 Academic Standards ......................................................................... 84 Examination Procedures ................................................................... 95 Student Conduct Standards ............................................................. 101 Graduate Law Programs ................................................................ -

FOIA 12‐13607 Submitted to ICE FOIA May 3, 2012

Student and Exchange Visitor Program U.S. Immigration and Customs Enforcement FOIA 12‐13607 Submitted to ICE FOIA May 3, 2012 Summary List of SEVP‐Certified Schools located in California, along with flags indicating school education levels School School Local Local Local Local Private Private PrivHighLvl Public Vocation Flight Language Higher Other F M School School Address City State ZIP TrngLvl EduLvl HighLvl Code Name EdLvl ElemLvl MidLvl TechEduLvl TrngLvl LOS214F00078000 The Buckley School 3900 Stansbury Ave Sherman Oaks CA 91423 Y Y Y N N N N N N Y N LOS214F00086000 California Baptist University 8432 Magnolia Avenue Riverside CA 92504 N N N N N N Y Y N Y N LOS214F00091000 California Institute of Technology 1200 E. California Blvd., 250‐86 Pasadena CA 91125 N N N N N N N Y N Y N California Polytechnic State San Luis N N N N N N N Y N Y N LOS214F00093000 University, San Luis Obispo 1 Grand Avenue Obispo CA 93407 LOS214F00097000 Cate School 1960 Cate Mesa Road Carpinteria CA 93013 N N Y N N N N N N Y N LOS214F00101000 CERRITOS COLLEGE 11110 ALONDRA BLVD. NORWALK CA 90650 N N N N N N Y Y N Y N International Student & Scholar N N N N N N N Y N Y N Services, 11139 Anderson St., SSC‐ LOS214F00109000 Loma Linda University (LLU) 1201E Loma Linda CA 92350 LOS ANGELES UNIFIED SCHOOL N N N Y N N N N N Y N LOS214F00110000 DISTRICT 333 S. Beaudry, 29th floor Los Angeles CA 90017 LOS214F00117000 Linfield Christian School 31950 Pauba Road Temecula CA 92592 Y Y Y N N N N N N Y N LOS214F00147000 Besant Hill School of Happy Valley 8585 Ojai‐Santa Paula Road Ojai CA 93023 N N Y N N N N N N Y N Hebrew Union College‐Jewish N N N N N N N Y N Y N LOS214F00150000 Institute of Religion 3077 University Ave Los Angeles CA 90007 LOS214F00161000 Desert Sands Unified School District 47‐950 Dune Palms Rd.