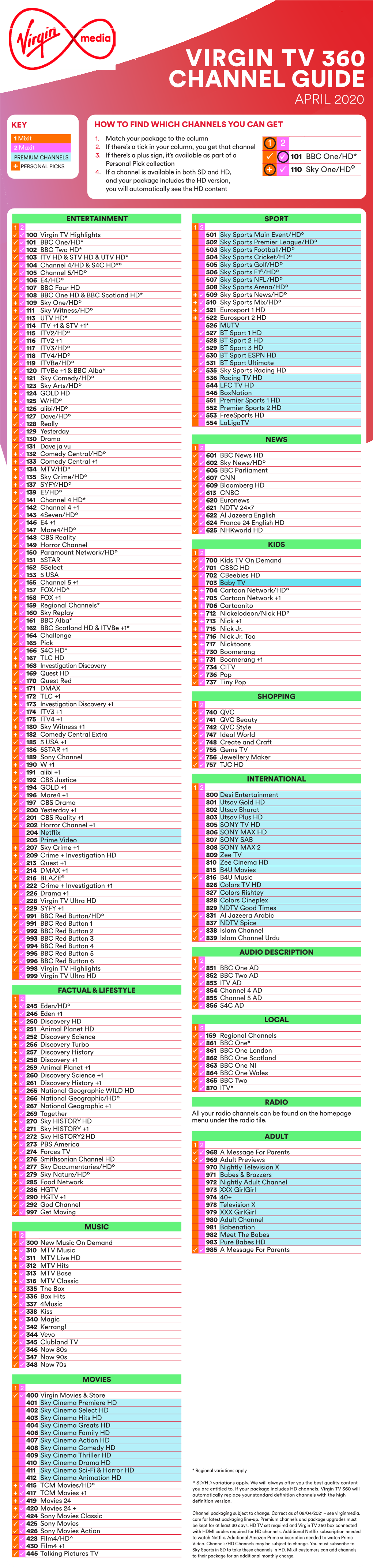

Virgin Tv 360 Channel Guide April 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strictly Private and Confidential

The BBC’s distribution arrangements for its UK public services A study examining whether the BBC’s distribution arrangements represent value for money By Mediatique on behalf of the BBC Trust November 2013 Mediatique Limited is a registered limited company in England and Wales. Company No. 4575079. VAT registration 927 5293 00 Contents 1. Overview of key findings and recommendations ........................................................................................ 4 Distribution expenditure measured against universality obligations and commercial benchmarks .................................... 4 Decision-making in relation to key principles and objectives: Governance and internal reporting lines ............................. 7 Fit for future purpose ........................................................................................................................................................... 8 Summary of key recommendations ................................................................................................................................... 10 2 Introduction .............................................................................................................................................. 11 The BBC’s current distribution footprint ............................................................................................................................ 12 Television .......................................................................................................................................................................... -

Virgin Media Submission

NON-CONFIDENTIAL VERSION VIRGIN MEDIA LIMITED OFCOM INVESTIGATION INTO THE UK PAY TV INDUSTRY1 SUPPLEMENTARY SUBMISSION OF 15 AUGUST 2008 1. INTRODUCTION: UK PAY TV CONSUMERS CAN BE BETTER SERVED 1.1 In January 2007, Virgin Media Limited ("Virgin Media"), together with British Telecommunications plc, Setanta Sport Holdings Limited and Top Up TV Europe Limited (together, "the Parties"), jointly made a submission to Ofcom demonstrating that competition in the UK pay TV market is not working effectively, and calling for Ofcom to make a market investigation reference to the Competition Commission. In this initial submission, a number of subsequent submissions and responses to numerous information request responses2, Virgin Media has provided voluminous evidence of market failure and highlighted specific areas of consumer detriment which result from this market failure. 1.2 Consumers would be demonstrably better off if steps were taken to remedy the features of the market which are preventing, restricting or distorting competition in the supply of pay TV in the UK. Against that background, this supplementary submission provides: (a) further evidence that consumers are not being well served by the current market structure; and (b) [CONFIDENTIAL], a more detailed explanation of the ways that Virgin Media could innovate (and the types of offerings consumers could expect to see) were the distorting features of the market corrected. 1.3 Ofcom has a discretion under section 131 of the Enterprise Act ("EA") to make a market investigation reference to the Competition Commission where: "… it has reasonable grounds to suspect that any feature, or combination of features, of a market in the United Kingdom for goods and services prevents, restricts or distorts competition in connection with the supply or acquisition of any goods or services in the United Kingdom or a part of the United Kingdom." 1.4 There can be no question such "reasonable grounds" have been established since the inception of this process approximately nineteen months ago. -

Supplemental Information

Supplemental Information of the Consolidated Financial Results for the Third Quarter Ended December 31, 2016 2016 年度第 3 四半期連結業績補足資料 February 2, 2017 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average foreign exchange rates 期中平均為替レート 2 ■ Results by segment セグメント別業績 2 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 3 ■ Depreciation and amortization by segment セグメント別減価償却費及び償却費 3 ■ Amortization of film costs 繰延映画製作費の償却費 3 ■ Restructuring charges by segment セグメント別構造改革費用 4 ■ Period-end foreign exchange rates 期末為替レート 4 ■ Inventory by segment セグメント別棚卸資産 4 ■ Film costs (balance) 繰延映画製作費(残高) 4 ■ Long-lived assets by segment セグメント別固定資産 4 ■ Goodwill by segment セグメント別営業権 5 ■ Research and development expenses by segment セグメント別研究開発費 5 ■ Additions to long-lived assets excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額 5 ■ Depreciation and amortization excluding Financial Services 金融分野を除くソニー連結の減価償却費及び償却費 5 ■ Unit sales of key products 主要製品販売台数 5 Pictures Segment Supplemental Information (English only) 6 ■ Pictures Segment Aggregated U.S. Dollar Information 6 ■ Motion Pictures 6 - Motion Pictures Box Office for films released in North America - Select films to be released in the U.S. - Top 10 Home Entertainment titles released - Select Home Entertainment titles to be released ■ Television Productions 8 - Television Series with an original broadcast on a U.S. network - Television Series with a new season to premiere on a U.S. network - Select Television Series in U.S. off-network syndication -

Gigabit-Broadband in the UK: Government Targets and Policy

BRIEFING PAPER Number CBP 8392, 30 April 2021 Gigabit-broadband in the By Georgina Hutton UK: Government targets and policy Contents: 1. Gigabit-capable broadband: what and why? 2. Gigabit-capable broadband in the UK 3. Government targets 4. Government policy: promoting a competitive market 5. Policy reforms to help build gigabit infrastructure Glossary www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 Gigabit-broadband in the UK: Government targets and policy Contents Summary 3 1. Gigabit-capable broadband: what and why? 5 1.1 Background: superfast broadband 5 1.2 Do we need a digital infrastructure upgrade? 5 1.3 What is gigabit-capable broadband? 7 1.4 Is telecommunications a reserved power? 8 2. Gigabit-capable broadband in the UK 9 International comparisons 11 3. Government targets 12 3.1 May Government target (2018) 12 3.2 Johnson Government 12 4. Government policy: promoting a competitive market 16 4.1 Government policy approach 16 4.2 How much will a nationwide gigabit-capable network cost? 17 4.3 What can a competitive market deliver? 17 4.4 Where are commercial providers building networks? 18 5. Policy reforms to help build gigabit infrastructure 20 5.1 “Barrier Busting Task Force” 20 5.2 Fibre broadband to new builds 22 5.3 Tax relief 24 5.4 Ofcom’s work in promoting gigabit-broadband 25 5.5 Consumer take-up 27 5.6 Retiring the copper network 28 Glossary 31 ` Contributing Authors: Carl Baker, Section 2, Broadband coverage statistics Cover page image copyright: Blue Fiber by Michael Wyszomierski. -

FREEVIEW DTT Multiplexes (UK Inc NI) Incorporating Planned Local TV and Temporary HD Muxes

As at 07 December 2020 FREEVIEW DTT Multiplexes (UK inc NI) incorporating planned Local TV and Temporary HD muxes 3PSB: Available from all transmitters (*primary and relay) 3 COM: From *80 primary transmitters only Temp HD - 25 Transmiters BBC A (PSB1) BBC A (PSB1) continued BBC B (PSB3) HD SDN (COM4) ARQIVA A (COM5) ARQIVA B (COM6) ARQIVA C (COM7) HD ARQIVA D (COM8) HD LCN LCN LCN LCN LCN LCN LCN 1 BBC ONE 65 TBN UK 12 QUEST 11 Sky Arts 22 Ideal World 64 Free Sports BBC RADIO: 1 BBC ONE NI Cambridge, Lincolnshire, 74 Shopping Quarter 13 E4 (Wales only) 17 Really 23 Dave ja vu 70 Quest Red+1 722 Merseyside, Oxford, 1 BBC ONE Scot Solent, Somerset, Surrey, 101 BBC 1 Scot HD 16 QVC 19 Dave 26 Yesterday 83 NOW XMAS Tyne Tees, WM 1 BBC ONE Wales 101 BBC 1 Wales HD 20 Drama 30 4Music 33 Sony Movies 86 More4+1 2 BBC TWO 101 BBC ONE HD 21 5 USA 35 Pick 36 QVC Beauty 88 TogetherTV+1 (00:00-21:00) 2 BBC TWO NI BBC RADIO: 101 BBC ONE NI HD 27 ITVBe 39 Quest Red 37 QVC Style 93 PBS America+1 726 BBC Solent Dorset 2 BBC TWO Wales BBC Stoke 102 BBC 2 Wales HD 28 ITV2 +1 42 Food Network 38 DMAX 96 Forces TV 7 BBC ALBA (Scot only) 102 BBC TWO HD 31 5 STAR 44 Gems TV 40 CBS Justice 106 BBC FOUR HD 9 BBC FOUR 102 BBC TWO NI HD 32 Paramount Network 46 Film4+1 43 HGTV 107 BBC NEWS HD Sony Movies Action 9 BBC SCOTLAND (Scot only) BBC RADIO: 103 ITV HD 41 47 Challenge 67 CBS Drama 111 QVC HD (exc Wales) 734 Essex, Northampton, CLOSED 24 BBC FOUR (Scot only) Sheffield, 103 ITV Wales HD 45 Channel 5+1 48 4Seven 71 Jewellery Maker 112 QVC Beauty HD 201 CBBC -

('Sky') to the BBC Trust Review of BBC Red Button and Online Services

Response of British Sky Broadcasting Limited (‘Sky’) to the BBC Trust review of BBC Red Button and Online services 1. Introduction 1.1 BBC Trust service licence reviews are an important part of the overall regulatory framework for BBC services established by the BBC Framework Agreement, and are one of the ways in which the BBC Trust exercises independent oversight of the BBC’s activities. 1.2 The Framework Agreement requires that the Trust conduct reviews at least every five years and that there be public consultation. In this way, service reviews sit alongside Public Value Tests, conducted when new services are proposed or changes put forward to existing services, as the key opportunities for robust and detailed scrutiny of the BBC’s public services. 1.3 It is therefore incumbent on the Trust to consider, as part of its service reviews, the market impact of the relevant services and, particularly, the Trust’s duty to require the BBC “endeavour to minimise its negative competitive impacts on the wider market” under the competitive impact principle.1 If the Trust did not consider such impacts as part of the service review, then it is conceivable that such matters would only be considered on launch of the service, and never again, irrespective of changes in the service or the market context in which it operated. This cannot have been intended by Government in settling the Framework Agreement and requiring reviews every five years. 1.4 Sky’s interest in the BBC’s red button and online services arises principally from its role as the provider of a direct to home satellite television platform by which certain of the BBC’s services are made available to over 10 million homes. -

Annex 2: Providers Required to Respond (Red Indicates Those Who Did Not Respond Within the Required Timeframe)

Video on demand access services report 2016 Annex 2: Providers required to respond (red indicates those who did not respond within the required timeframe) Provider Service(s) AETN UK A&E Networks UK Channel 4 Television Corp All4 Amazon Instant Video Amazon Instant Video AMC Networks Programme AMC Channel Services Ltd AMC Networks International AMC/MGM/Extreme Sports Channels Broadcasting Ltd AXN Northern Europe Ltd ANIMAX (Germany) Arsenal Broadband Ltd Arsenal Player Tinizine Ltd Azoomee Barcroft TV (Barcroft Media) Barcroft TV Bay TV Liverpool Ltd Bay TV Liverpool BBC Worldwide Ltd BBC Worldwide British Film Institute BFI Player Blinkbox Entertainment Ltd BlinkBox British Sign Language Broadcasting BSL Zone Player Trust BT PLC BT TV (BT Vision, BT Sport) Cambridge TV Productions Ltd Cambridge TV Turner Broadcasting System Cartoon Network, Boomerang, Cartoonito, CNN, Europe Ltd Adult Swim, TNT, Boing, TCM Cinema CBS AMC Networks EMEA CBS Reality, CBS Drama, CBS Action, Channels Partnership CBS Europe CBS AMC Networks UK CBS Reality, CBS Drama, CBS Action, Channels Partnership Horror Channel Estuary TV CIC Ltd Channel 7 Chelsea Football Club Chelsea TV Online LocalBuzz Media Networks chizwickbuzz.net Chrominance Television Chrominance Television Cirkus Ltd Cirkus Classical TV Ltd Classical TV Paramount UK Partnership Comedy Central Community Channel Community Channel Curzon Cinemas Ltd Curzon Home Cinema Channel 5 Broadcasting Ltd Demand5 Digitaltheatre.com Ltd www.digitaltheatre.com Discovery Corporate Services Discovery Services Play -

SONY Channel a Timeless Entertainment Sponsorship Opportunity

SONY Channel A Timeless Entertainment Sponsorship Opportunity Channel Investment Start Platforms Available Now On-air The Opportunity Scheduling & Accreditation Sky Media and Sony Television Network are excited to • 6 months share a exclusive opportunity for a brand to uniquely • Sponsorship of Sony Channel (09:00-23:59) align themselves with the much-loved Timeless Program examples include; Taggart, M*A*S*H, The Entertainment programming strand on Sony • Walton’s, Little House on The Prairie, Who Wants to be a Channel. Millionaire and Murder, She Wrote. • 10” opener/closers & 5” break bumpers This nostalgic and heart-warming channel strand • Approx. 450 hours of sponsored content per month provides the perfect opportunity to reach out to a 45+ Adults audience and create that lasting • Approx. 3,600 sponsorship credits per month association with content that the viewers adore. About the SONY Channel Audience About SONY Channel • 4.9m 45+ Adults reached in Q1 2020 Following Sony Channel’s rebranding, the channel • 92% of the Sony Channel audience is 45+ captures the love of great classic drama and • 1.1m Average no. Adults 45+ watching Sony Channel entertainment with a warm and familiar mix of each week Sony Pictures Entertainment and acquired scripts. Average Time Spent watching Sony Channel is Bringing the channel closer to the Studio and it’s • 65min viewers. +5% longer than BBC2 Source: BARB/ADVANTAGE/Adults 45+/Q12020/Jan – Mar 2020 With a fresh look into their top performing content, the channel boasts some of the most treasured Why the 45+ Audience? classics and iconic quiz shows such as Highway to The older we get, the more nostalgic we become…. -

So What Better Way to Celebrate Than to Catch up with the Lovely Adele, SBC’S Brand Ambassador

This year SBC are celebrating 11 Years on QVC – so what better way to celebrate than to catch up with the lovely Adele, SBC’s Brand Ambassador. So, come with us, back in time, to dig a little deeper into Adele’s years on QVC! 1. So, Adele, what did you do before you became SBC’s knowledgeable Brand Ambassador? I worked for the NHS, before re-training in 2007 as a Holistic Therapist. I have always been interested in holistic therapy, it is a form of healing that considers the whole person - body, mind, spirit, and emotions - in the quest for optimal health and wellness. I then began working for a Beauty and Wellness Spa based in Bury St. Edmunds, which was an ideal environment to practice my skills as a holistic therapist, whilst learning a lot about skincare. 2. How did you get into presenting? The Spa I worked for was, and still is, under the same parent company as SBC, and I was asked by the CEO if I fancied presenting on QVC for them. Surprised, excited, and terrified, I auditioned and in 2010 I had my first experience on QVC. 3. Do you remember who was presenting your first show? Of course, it was Jilly Halliday, and she was so lovely and really helped with my nerves. It was a great first experience. 4. If you can remember, how did you feel before your very first show? Honestly, I was sick with nerves. Once we got going I realised that all we were doing is chatting about the products. -

12027336.Pdf

Dear Stockholder Against the backdrop of challenging macroeconomic environment in The reinvigoration of Virgin Media Business continued during the year which UK household budgets have been under pressure our leadership with revenue growth increasing to 7% in 2011 compared to 3% in 2010 team and dedicated employees have ensured that 2011 was year We are continuing to exploit our inherent advantage in having deep of significant accomplishment We also made important strategic fibre network that passes aver half of the UKs businesses giving us progress as the demand for better broadband and entertainment significant performance and cost advantages with focus on higher gathered momentum while delivering another very solid financial margin data services We are at the heart of Government public service performance initiatives having been selected as one of only three providers an the Government telecommunications procurement framework We hove Our residential business is serving fast growing market of increasingly also attained key quality and security accreditations that reinforce our discerning data-hungry and digitally-savvy households As people use strong position In the private sector we continue to win new contracts more devices and access content and applications more frequently including our first mobile backhaul agreement in September 2011 and for longer we are well placed to meet and further stimulate that burgeoning demand for greater connectivity We remain proactive in the capital markets too Our actions to increase the Companys operational -

Channel Guide August 2018

CHANNEL GUIDE AUGUST 2018 KEY HOW TO FIND WHICH CHANNELS YOU HAVE 1 PLAYER PREMIUM CHANNELS 1. Match your ENTERTAINMENT package 1 2 3 4 5 6 2 MORE to the column 100 Virgin Media Previews 3 M+ 101 BBC One If there’s a tick 4 MIX 2. 102 BBC Two in your column, 103 ITV 5 FUN you get that 104 Channel 4 6 FULL HOUSE channel ENTERTAINMENT SPORT 1 2 3 4 5 6 1 2 3 4 5 6 100 Virgin Media Previews 501 Sky Sports Main Event 101 BBC One HD 102 BBC Two 502 Sky Sports Premier 103 ITV League HD 104 Channel 4 503 Sky Sports Football HD 105 Channel 5 504 Sky Sports Cricket HD 106 E4 505 Sky Sports Golf HD 107 BBC Four 506 Sky Sports F1® HD 108 BBC One HD 507 Sky Sports Action HD 109 Sky One HD 508 Sky Sports Arena HD 110 Sky One 509 Sky Sports News HD 111 Sky Living HD 510 Sky Sports Mix HD 112 Sky Living 511 Sky Sports Main Event 113 ITV HD 512 Sky Sports Premier 114 ITV +1 League 115 ITV2 513 Sky Sports Football 116 ITV2 +1 514 Sky Sports Cricket 117 ITV3 515 Sky Sports Golf 118 ITV4 516 Sky Sports F1® 119 ITVBe 517 Sky Sports Action 120 ITVBe +1 518 Sky Sports Arena 121 Sky Two 519 Sky Sports News 122 Sky Arts 520 Sky Sports Mix 123 Pick 521 Eurosport 1 HD 132 Comedy Central 522 Eurosport 2 HD 133 Comedy Central +1 523 Eurosport 1 134 MTV 524 Eurosport 2 135 SYFY 526 MUTV 136 SYFY +1 527 BT Sport 1 HD 137 Universal TV 528 BT Sport 2 HD 138 Universal -

Analysys Mason Report on Developments in Cable for Superfast Broadband

Final report for Ofcom Future capability of cable networks for superfast broadband 23 April 2014 Rod Parker, Alex Slinger, Malcolm Taylor, Matt Yardley Ref: 39065-174-B . Future capability of cable networks for superfast broadband | i Contents 1 Executive summary 1 2 Introduction 5 3 Cable network origins and development 6 3.1 History of cable networks and their move into broadband provision 6 3.2 The development of DOCSIS and EuroDOCSIS 8 4 Cable network elements and architecture 10 4.1 Introduction 10 4.2 Transmission elements 10 4.3 Description of key cable network elements 13 4.4 Cable access network architecture 19 5 HFC network implementation, including DOCSIS 3.0 specification 21 5.1 Introduction 21 5.2 HFC performance considerations 21 5.3 Delivery of broadband services using DOCSIS 3.0 24 5.4 Limitations of DOCSIS 3.0 specification 27 5.5 Implications for current broadband performance under DOCSIS 3.0 30 6 DOCSIS 3.1 specification 33 6.1 Introduction 33 6.2 Reference architecture 34 6.3 PHY layer frequency plan 35 6.4 PHY layer data encoding options 37 6.5 MAC and upper layer protocol interface (MULPI) features of DOCSIS 3.1 39 6.6 Development roadmap 40 6.7 Backwards compatibility 42 6.8 Implications for broadband service bandwidth of introducing DOCSIS 3.1 43 6.9 Flexibility of DOCSIS 3.1 to meet evolving service demands from customers 47 6.10 Beyond DOCSIS 3.1 47 7 Addressing future broadband growth with HFC systems – expanding DOCSIS 3.0 and migration to DOCSIS 3.1 49 7.1 Considerations of future broadband growth 49 7.2 Key levers for increasing HFC data capacity 52 7.3 DOCSIS 3.0 upgrades 53 7.4 DOCSIS 3.1 upgrades 64 7.5 Summary 69 Ref: 39065-174-B .