Exclusion/Military Servicemember Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lead Contamination of State Armories

Division of Military and Naval Affairs Lead Contamination of State Armories Report 2019-S-50 September 2020 OFFICE OF THE NEW YORK STATE COMPTROLLER Thomas P. DiNapoli, State Comptroller Division of State Government Accountability Audit Highlights Objectives To determine whether the Division of Military and Naval Affairs (DMNA) has implemented adequate controls to ensure all armories are tested for lead and are remediated where excessive levels are detected. The audit covers the period January 1, 2015 through March 12, 2020. About the Program Historically, armories were built with an indoor firing range (IFR), used for training purposes. The firing of weapons inside the IFR resulted in lead dust accumulation throughout.Although IFRs in New York have not been used in more than 20 years, over time, the accumulation of lead dust has been transported to other areas of the armory on Soldiers’ shoes; through the heating, ventilation, and air conditioning system; and as a result of weapons cleaning, maintenance, movement, or storage. Personal exposures to lead can occur through ingestion, inhalation, and dermal contact and can result in growth disorders as well as damage to the nervous system, kidneys, and reproductive system. Lead is considered a cumulative poison, as it is transported by the bloodstream and accumulates in the bones and organs. Exposure to lead is especially dangerous for young and unborn children. DMNA is the State’s executive agency responsible for managing New York’s military forces, including the New York National Guard. The Department of Defense (DOD) National Guard Bureau (NGB) acts as a federal authority over the New York National Guard, and provides them with federal resources, including funding, regulatory guidance, and equipment. -

THE NEW YORK GUARD ENTINEL New York Guards—Since 1917 Fully Trained, Ready to Respond

THE NEW YORK GUARD ENTINEL New York GuardS—Since 1917 Fully trained, ready to respond. Summer/Fall 2015 The New York Guard Decon Team certify their skills during AT The New York Guard Sentinel is published quarterly and has a circulation of about 500 soldiers through direct email. It is distributed free to all members of the New York Guard and other interested parties. GOVERNOR ANDREW M. CUOMO Front Cover: Soldiers from the 15th Decontamination Commander In Chief Company, 9th Battalion, 88th Brigade of the New York State Guard trained and certified with their Class B Chemical Suits during a decontamination ex- MAJOR GENERAL PATRICK A. MURPHY ercise/certification held during Annual Training— New York State Adjutant General Photo by Captain Mark Getman, NYG PAO. As a member of the New York Guard, you are a part BRIGADER GENERAL STEPHEN BUCARIA of history and that history is documented in every is- New York Guard Commanding General sue of The State Guard Sentinel. Let everyone know about the real world missions and training in the NY Guard. COLONEL DAVID WARAGER Commander, Recruiting/Retention; Public Affairs Directorate RECRUIT BY E-MAIL Print out a couple of copies and tack them up in the break room at work, place them on a table in your of- CAPTAIN MARK GETMAN fice or waiting room, or leave them in your classroom. Editor in Chief - Deputy Public Affairs Officer Your friends, relatives, associates, coworkers, and classmates might just be looking for a way to serve and you could receive the credit. SPECIALIST LLOYD SABIN Copy Editor LIZAVETA GETMAN Graphics, Layout and Design BE PROUD OF YOUR SERVICE! MISSION STATEMENT The Recruitment Team at Headquarters is standing by to make sure YOU get the credit you deserve for The New York Guard augments every recruit you bring in. -

New York Naval Militia Newsletter Spring 2020

NEW YORK NAVAL MILITIA NEWSLETTER SPRING 2020 NEW YORK NAVAL MILITIA 330 Old Niskayuna Road Latham, New York 12110 NYNM - An entity of the 1 (518) 786-4583 New York State Division of Military & Naval Affairs Fax: (518) 786-4427 http://dmna.ny.gov/nynm/ COMMANDER’S CORNER: RDML Warren T. Smith Commander New York Naval Militia To All Members of the New York Naval Militia: All of us understand by now that we are in the midst of a state, national, and global emergency the scale of which we have never experienced before. While comparisons to World War II and the Spanish flu pandemic following WWI give some historical context, the unprecedented nature of virus transmission facilitated by international air travel and global commerce as well as the rapid dissemination of information – some accurate, some speculation, and some nonsense – means that we are in uncharted waters. No one is or will remain immune from the effects, whether physical, psychological or economic, which will be long lasting. The health care system of no city or country is adequately prepared to administer to the numbers of people who require care. The good news is that our Naval Militia members have responded. The number of Militia men and women on active duty has grown to 81 as of this writing, some working at Latham, others with the various Joint Task Forces deployed around the state. While the primary demand has been for medical and logistics specialties, some general purpose Militia members have been working side by side with the NY State Guard and National Guard helping with the transport of test samples from collection sites to labs, the cleaning of public facilities, and the distribution of food to communities in need. -

How the National Guard Grew out of Progressive Era Reforms Matthew Am Rgis Iowa State University

Iowa State University Capstones, Theses and Graduate Theses and Dissertations Dissertations 2016 America's Progressive Army: How the National Guard grew out of Progressive Era Reforms Matthew aM rgis Iowa State University Follow this and additional works at: https://lib.dr.iastate.edu/etd Part of the Military History Commons, and the United States History Commons Recommended Citation Margis, Matthew, "America's Progressive Army: How the National Guard grew out of Progressive Era Reforms" (2016). Graduate Theses and Dissertations. 15764. https://lib.dr.iastate.edu/etd/15764 This Dissertation is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. America’s progressive army: How the National Guard grew out of progressive era reforms by Matthew J. Margis A dissertation submitted to the graduate faculty in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY Major: Rural, Agricultural, Technological, Environmental History Program of Study Committee: Timothy Wolters, Major Professor Julie Courtwright Jeffrey Bremer Amy Bix John Monroe Iowa State University Ames, Iowa 2016 Copyright © Matthew J. Margis, 2016. All rights reserved. ii DEDICATION This is dedicated to my parents, and the loving memory of Anna Pattarozzi, -

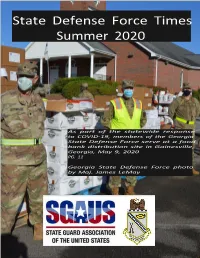

State Defense Force Times

State Defense Force Times and rescue efforts, provided medical services, and distributed food and water to hurricane victims. SGAUS is composed of over 3,000 soldiers throughout the 50 states and several territories, and over 570 attended the largest SGAUS Conference in its history. The annual conference provides opportunities for soldiers to obtain training in best practices in their specialties including communications, engineering, law, chaplain services, search and rescue, public affairs, and coordination with the United States Federal Emergency Management Agency (FEMA). Organized as a military force, each SDF reports to the state’s governor through the adjutant general, and best practices and training are developed through SGAUS and disseminated through the conference. SFC Patricia Isenberg of the South Carolina State Guard leads the way at the Hurricane Hike at the 2017 SGAUS Annual Conference in Myrtle Beach, SouthSpring Carolina. (Photo: – Summer Ms. Ronnie Berndt of2018 Hickory, North Carolina) The SGAUS Conference concluded on 23 September 2017 with its annual banquet. The South Carolina State Guard hosted the annual Keynoting the conference was former South conference of the State Guard Association of the Carolina Congressman Jim DeMint. United States (SGAUS) from September 21 – 23, 2017. SGAUS, the professional association of A Message from the Editor… State Defense Forces (SDF), provides organizational and training information for the Articles and images for the SDF Times are state militias organized under Title 10 of the welcome. Please send all articles to CPT (TN) United States Federal Code. Under Title 10 each Steven Estes at: state may organize a military force to respond to emergencies such as the recent Harvey and Irma [email protected]. -

2012 New York City

2018 NEW YORK CITY ST. PATRICK'S DAY PARADE SATURDAY MARCH 17, 2018 LINE OF MARCH Mounted Police Military Escort: "THE FIGHTING 69TH" The 69th Regiment of New York 1st Battalion, 69th Infantry Lieutenant Colonel Don Makay, Commanding Piper for the Regiment, Pipe Major Joe Brady Battalion Staff: Major Brandon Gendron, Executive Officer Lieutenant Taylor Maningo, Adjutant Lieutenant Kevin Wong, Intelligence Officer Major Jason Secrest, Operations Officer Captain Nakaya Mair, Signal Officer Guests of the Regiment: LTG Daniel Hokanson, Vice Chief, National Guard Bureau Major General Anthony German, The Adjutant General of the New York National Guard MG Kevin Bradley, Acting Deputy Director, Air National Guard BG Joseph Biehler, Deputy CDR-Operations, 42ID Command Chief Master Sergeant Amy Giaquinto, New York National Guard Command Chief Master Sergeant Maureen Dooley, Command Chief, New York Air National Guard Battalion Color Guard: Command Sergeant Major Thomas Seifert, Command Sergeant Major 69th Infantry BN Regimental Wolfhounds Sergeant Quentin Davis, NCO of the year Specialist Ilya Titov, Soldier of the year . 42nd Infantry Division Band, New York Army National Guard Headquarters and Headquarters Company Captain David Tuttle, Commanding Sergeant First Class Jason Cooley, First Sergeant Company A Captain Dennis Tierney, Commanding First Sergeant Jairo Aquino, First Sergeant Company B Captain Matt Calvo, Commanding First Sergeant Celso Benites, First Sergeant Company C Captain Max Rose, Commanding First Sergeant Sean Goodridge, First Sergeant Company D Captain Richard Reilly, Commanding First Sergeant Tim Boyle, First Sergeant Copyrighted by the New York City St. Patrick's Day Parade, Inc. No part of this document may be reproduced, in any form or by any means, without the Express written permission from the St. -

Final Armory Historic Context

FINAL ARMORY HISTORIC CONTEXT ARMY NATIONAL GUARD NATIONAL GUARD BUREAU June 2008 FINAL HISTORIC CONTEXT STUDY Prepared for: Army National Guard Washington, DC Prepared by: Burns & McDonnell Engineering Company, Inc Engineers-Architects-Consultants Kansas City, Missouri And Architectural and Historical Research, LLC Kansas City, Missouri Below is the Disclaimer which accompanied the historic context when submitted to the NGB in draft form in 2005. Due to reorganization of the document prior to its finalization, the section in which Burns & McDonnell references below has been changed and is now Section II of the document, which is written in its entirety by Ms. Renee Hilton, Historical Services Division, Office of Public Affairs &Strategic Communications, National Guard Bureau. TABLE OF CONTENTS 1.0 INTRODUCTION, BACKGROUND, AND METHODOLOGY ........................... 1-1 1.1 INTRODUCTION ........................................................................................... 1-1 1.2 BACKGROUND............................................................................................. 1-1 1.3 SURVEY BOUNDARIES AND RESOURCES ............................................... 1-2 1.4 SURVEY OBJECTIVES................................................................................. 1-2 1.5 METHODOLOGY .......................................................................................... 1-3 1.6 REGISTRATION REQUIREMENTS.............................................................. 1-4 1.7 HISTORIC INTEGRITY ................................................................................ -

State of New York in Senate

STATE OF NEW YORK ________________________________________________________________________ 5234 2021-2022 Regular Sessions IN SENATE February 26, 2021 ___________ Introduced by Sen. SKOUFIS -- read twice and ordered printed, and when printed to be committed to the Committee on Veterans, Homeland Securi- ty and Military Affairs AN ACT to amend the general construction law, the executive law, the education law, the election law, the military law, the insurance law, the private housing finance law, the public officers law, the tax law, the economic development law, the civil service law, and the real property tax law, in relation to including members of the space force as being members of the armed forces or veterans eligible for certain credits and benefits The People of the State of New York, represented in Senate and Assem- bly, do enact as follows: 1 Section 1. Section 13-a of the general construction law, as amended by 2 chapter 490 of the laws of 2019, is amended to read as follows 3 § 13-a. Armed forces of the United States. "Armed forces of the United 4 States" means the army, navy, marine corps, air force, space force and 5 coast guard, including all components thereof, and the national guard 6 when in the service of the United States pursuant to call as provided by 7 law. Pursuant to this definition no person shall be considered a member 8 or veteran of the armed forces of the United States unless his or her 9 service therein is or was on a full-time active duty basis, other than 10 active duty for training or he or she was employed -

New York Naval Militia Newsletter Summer 2020

NEW YORK NAVAL MILITIA NEWSLETTER SUMMER 2020 NEW YORK NAVAL MILITIA 330 Old Niskayuna Road Latham, New York 12110 NYNM - An entity of the 1 (518) 786-4583 New York State Division of Military & Naval Affairs Fax: (518) 786-4427 http://dmna.ny.gov/nynm/ COMMANDER’S CORNER: RDML Warren T. Smith Commander New York Naval Militia During the course of the last few extraordinary months, I have had the opportunity to meet with many of our Naval Militia members who have responded to the call to State Active Duty for the COVID-19 pandemic. In every instance, I have been impressed and proud of the outstanding job our Naval Militia has been doing. From the personnel staffing the testing sites in Albany, the Bronx and on Long Island to the pop-up hospital and warehouse activities at the Javits Center, and from our JRSOI and medical teams at Camp Smith to those auditing and processing payments at Latham, every Militia member has been professional and enthusiastic about their role in facing down this challenge. At the same time, our MEBS crew members have carried on with their daily missions maintaining our NYNM fleet of boats at Leeds, patrolling the Hudson at Verplanck, and working with the Coast Guard in and around New York harbor. While the number of Army and Air National Guard members on duty has waxed and waned, the Naval Militia and New York Guard have been a fairly steady presence – one that is frequently noted and greatly appreciated by the Adjutant General’s office. Operation Lake Ontario never fully materialized before it was called off, but we recognize that hurricane season is underway, and the need to bring more of our Militia members on duty on short notice remains a real possibility. -

Quality of Internal Control Certification

Thomas P. DiNapoli OFFICE OF THE COMPTROLLER NEW YORK STATE COMPTROLLER DIVISION OF STATE GOVERNMENT ACCOUNTABILITY Audit Objective............................... 2 Audit Results – Summary.............. 2 DIVISION OF MILITARY Background..................................... 2 AND NAVAL AFFAIRS Audit Findings ................................ 3 Quality of Internal Control Certification .................................. 3 Audit Scope and Methodology....... 5 QUALITY OF INTERNAL Authority......................................... 6 CONTROL CERTIFICATION Reporting Requirements................ 6 Contributors to the Report ............ 6 Appendix A - Auditee Response.... 7 Report 2008-S-112 AUDIT OBJECTIVE together to provide reasonable assurance that the organization will achieve its objectives Our objective was to determine whether the and mission. While the overall purpose of Division of Military and Naval Affairs internal control is to help an organization (DMNA) submitted a quality internal control achieve its mission, internal control also helps certification to the Division of Budget by an organization to promote orderly, April 30, 2008. economical, efficient and effective operations, and produce quality products and services AUDIT RESULTS - SUMMARY consistent with the organization's mission; safeguard resources against loss due to waste, The Division of Budget (DOB) requires abuse, mismanagement, errors and fraud; agencies to certify compliance with the promote adherence to laws, regulations, State’s Internal Control Act annually by contracts -

Interview with Tennessee State Guard's MAJ Anthony

Message from the President Maj. Gen. (CA) Jay Coggan s of this writing, the nation has been at war for 120 days with a vicious enemy that attacks Americans at the cellular level, the COVID-19 virus. Over 1,000,000 Americans have been infected, and at least 60,000 Americans have died from the illness - more than all of the American Soldiers, Marines, Airmen, and ASailors who died in the Vietnam War that lasted roughly 10 years. This pandemic led to a response by the nation’s State Defense Forces (SDFs). And fortunately for the nation, our SDFs were ready to respond. As President of the State Guard Association of the United States, it is incumbent upon me to survey SDFs to determine how active we are in this national response, as well as to determine how effective our response is now and how it might be better. I’m pleased to report that the response of our SDFs is outstanding. SGAUS tracked those states and territories that have been called upon to respond. In reaching out in the last 30 days I found that 13 states and territories put Soldiers on State Active Duty (SAD). Ten of these states (Alaska, California, Connecticut, Maryland, New Jay M. Coggan York, Ohio, Puerto Rico, Tennessee, Texas, and Virginia) put Soldiers on some form of paid President, State Guard Association SAD, 3 states had both paid and unpaid SAD Soldiers (California, Ohio, and Texas), and of the United States 4 states activated Soldiers without pay (Georgia, Indiana, Maryland, and South Carolina). Major General (CA), Commanding In all, at least 1,075 Soldiers went on State Active Duty, the most SDF Soldiers deploying at California Military Department one time since the Korean War 70 years ago. -

National Guard

Volume 12 Number 1 www.dmna.ny.gov Serving the New York Army and Air National Guard, Naval Militia, New York Guard and Families FROM THE LEADERSHIP Army and Air NCOs can Learn from Each Other hether they’re running transport hubs from attack. But I’ve learned from fellow NCOs Wa lanes training exercise Soldiers and Airmen serve jointly in the Army that the way they do at Camp Smith or launching in the New York National Guard things works too. a mission from Gabreski Air Counterdrug Task Force. Our Army and Air Guard NCOs National Guard Base, it can be And New York National Guard are going to be called on more and easy for our NCOs to forget that Soldiers and Airmen serve together more frequently to work together they are part of something bigger in the 2nd and 24th Civil Support while responding to state missions. than their battalion, squadron, Teams, our units trained to identify I want us to understand the chal- brigade or wing. chemical, radiological, biological lenges we each face and the things Sure, the Army National Guard and nuclear threats. we can learn from each other. and Air National Guard are part of Our Air Guard and Army Guard Everything new that we learn is the Army and Air Force. That’s right officers work side-by-side in our another tool in our toolbox when it on our uniforms. Joint Forces Headquarters. comes time to solving problems. And that means we have differ- In our operations section, for To help this process I will be ent leadership structures, different example, an Air National Guard holding a joint senior NCO confer- cultures, and even different profes- officer serves as the deputy to an ence later this year.