Confectionery

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kraft Foods Inc(Kft)

KRAFT FOODS INC (KFT) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/28/2011 Filed Period 12/31/2010 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 (Mark one) FORM 10-K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 COMMISSION FILE NUMBER 1-16483 Kraft Foods Inc. (Exact name of registrant as specified in its charter) Virginia 52-2284372 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) Three Lakes Drive, Northfield, Illinois 60093-2753 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: 847-646-2000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, no par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections. -

Extending the Product Life Cycle Through Repositioning

CADBURY V-5 9/8/05 1:38 PM Page 1 Extending the Product Life cycle through Repositioning Overview This study looks: ! The Cadbury Snack range ! The product life cycle ! Repositioning as a strategy for maturity introduction Cadbury Ireland is a subsidiary of Cadbury-Schweppes plc, a global leader in the manufacture of confectionery and beverage products. Cadbury Ireland was set up in 1932 and The Product today has three production plants, in Coolock and Dun Life Cycle concept Laoghaire in Dublin and Rathmore, Co. Kerry. More than 200 products are exported from Ireland to 30 countries The product life cycle model helps marketers identify the ! around the world, contributing over 110m to Irish trade. different stages that the sales and profits of a product go The distinctive taste of Cadbury Ireland’s products is due through during the course of its lifetime. There are five to the use of local ingredients and the company is one of stages to the product life cycle: introduction, growth, the largest users of indigenous Irish materials. maturity, saturation and decline. Cadbury Snack The Product Life Cycle Model The Cadbury Snack range was launched in the 1950s in SALES Ireland. The range consists of three main products: ! Snack Wafer in distinctive pink packaging ! Snack Shortcake in distinctive yellow packaging ! Snack Sandwich in distinctive purple packaging Introduction Growth Maturity Saturation Decline TIME The Snack range is the third biggest confectionery brand 1. Introduction: Sales are slow as the product is not yet in Ireland accounting for over !22m of Cadbury retail known. Costs are high due to heavy marketing spend to sales. -

Kosher Nosh Guide Summer 2020

k Kosher Nosh Guide Summer 2020 For the latest information check www.isitkosher.uk CONTENTS 5 USING THE PRODUCT LISTINGS 5 EXPLANATION OF KASHRUT SYMBOLS 5 PROBLEMATIC E NUMBERS 6 BISCUITS 6 BREAD 7 CHOCOLATE & SWEET SPREADS 7 CONFECTIONERY 18 CRACKERS, RICE & CORN CAKES 18 CRISPS & SNACKS 20 DESSERTS 21 ENERGY & PROTEIN SNACKS 22 ENERGY DRINKS 23 FRUIT SNACKS 24 HOT CHOCOLATE & MALTED DRINKS 24 ICE CREAM CONES & WAFERS 25 ICE CREAMS, LOLLIES & SORBET 29 MILK SHAKES & MIXES 30 NUTS & SEEDS 31 PEANUT BUTTER & MARMITE 31 POPCORN 31 SNACK BARS 34 SOFT DRINKS 42 SUGAR FREE CONFECTIONERY 43 SYRUPS & TOPPINGS 43 YOGHURT DRINKS 44 YOGHURTS & DAIRY DESSERTS The information in this guide is only applicable to products made for the UK market. All details are correct at the time of going to press but are subject to change. For the latest information check www.isitkosher.uk. Sign up for email alerts and updates on www.kosher.org.uk or join Facebook KLBD Kosher Direct. No assumptions should be made about the kosher status of products not listed, even if others in the range are approved or certified. It is preferable, whenever possible, to buy products made under Rabbinical supervision. WARNING: The designation ‘Parev’ does not guarantee that a product is suitable for those with dairy or lactose intolerance. WARNING: The ‘Nut Free’ symbol is displayed next to a product based on information from manufacturers. The KLBD takes no responsibility for this designation. You are advised to check the allergen information on each product. k GUESS WHAT'S IN YOUR FOOD k USING THE PRODUCT LISTINGS Hi Noshers! PRODUCTS WHICH ARE KLBD CERTIFIED Even in these difficult times, and perhaps now more than ever, Like many kashrut authorities around the world, the KLBD uses the American we need our Nosh! kosher logo system. -

Hello. Come and Get a Real Taste of Cadbury

Hello. Come and get a real taste of Cadbury. Who we are, why we’re different and what we’re doing to achieve our vision of being not just the biggest but also the best confectionery company in the world. Where to start? Well, we create chocolate, gum and candy brands people love – brands like Cadbury Dairy Milk, Trident and Halls. So, let’s start there… Did you know? 3 60 200 35,000 50,000 millions We make and sell three We operate in over Every day, millions kinds of confectionery: 60 countries and sell We’re nearly 200 We work with around 35,000 We employ around of people around the chocolate, gum and candy nearly everywhere years young direct and indirect suppliers 50,000 people world enjoy our brands chocolatedelicious brands We love chocolate. It’s been a big part of our lives since our earliest days. When John Cadbury started his business way back in 1824, did he realise he was laying the foundations for one of the world’s great chocolate companies? We don’t know for sure. But what we do know is that today, for many people around the world, only Cadbury chocolate will do. A glass and a half hero Cadbury Dairy Milk is at the heart of our success. Loved by millions of people in over 30 countries around the world, it generates around £500 million of sales each year. And no matter where in the world Cadbury Dairy Milk is enjoyed, there’s always a glass and a half of fresh, natural milk in every half pound. -

The Cadbury Foundation Donates €56000 to Support

23rd October 2017: The Cadbury Foundation donates €56,000 to support Aware’s ‘Beat the Blues’ initiative The Cadbury Foundation, which has been in operation for over 80 years, has donated €56,000 to Irish mental health organisation and Cadbury Ireland charity partner, Aware, to support their ‘Beat the Blues’ initiative for secondary schools. A positive mental health programme, Beat the Blues is aimed at senior cycle students throughout Ireland. Delivered over two class periods, the programme is designed to teach students about mental health and equip them with the tools to deal with life’s challenges. Speaking about The Cadbury Foundation donation to Aware, Eoin Kellett, Managing Director at Mondelez Ireland said: “The whole team at Cadbury Ireland is very proud of our association with Aware and all of the positive work they do around mental health in Ireland. The ‘Beat the Blues’ programme is one of many great initiatives that Aware implements every year. It is so important to educate younger generations about the early signs of mental health issues and to equip them with the knowledge they need to care for their mental health. All too often, we hear of tragic circumstances arising from young people suffering with mental health issues. This programme opens the door for young people to talk about mental health and we are honoured to support such an important initiative.” To mark the donation, Eoin Kellett, Gerry O’Brien, Head of Fundraising at Aware, and Dublin football legend and Aware ambassador, Bernard Brogan, paid a visit to Larkin Community College, Cathal Brugha Street, Dublin 1, to join Bernard’s fellow Dublin teammate and Aware mental health trainer, Kevin McManamon, where he was delivering a ‘Beat The Blues’ talk to the school’s students. -

Brummies Have Spoken Loudly and Opt for Wispa in Battle of Cadbury

Brummies have spoken loudly and opt for Wispa in battle of Cadbury Heroes at Christmas • Survey finds Wispa is Birmingham’s Hero of Cadbury Heroes • The Hazel Whirl is the Rose of all Roses, with Hazel in Caramel also scoring highly • Almost two-thirds of Birmingham adults believe Christmas isn’t complete without chocolate To mark 20 years since Cadbury’s Heroes hit our store selves and entered our annual Christmas gifting traditions, Mondelēz International, maker of the some of the UK’s best loved brands including Cadbury, Oreo and Maynards Bassets, has revealed the official consumer rankings of Cadbury Heroes and Roses, as decided by the Birmingham public. Mondelēz International worked with YouGov to ask Brits to pick their favourite from a box of Cadbury Heroes and Cadbury Roses, with the results sure to spark a debate. In what many may consider a surprise result, Wispa proved to be Birmingham’s favourite selection from a box of Cadbury Heroes, taking the top spot and a place in the city’s heart (and belly). Despite its place in British and Birmingham culture, the UK’s favourite chocolate1, Cadbury Dairy Milk, had to settle for second place in the official rankings, pushing Cadbury Dairy Milk Caramel in to third place. Eclairs are the last to be eaten and last in the standings, however it’s a close call between all options, including more recent addition additions, Dinky Decker and Creme Egg Twisted. Tastes appear to vary across the country, with the UK as a whole plumping for Crunchie and Twirl as their top Heroes of choice, with Birmingham’s favourite coming in fourth place nationally. -

Aldi, West Ewell Date of Visit: 28.07.18

Store and location: Aldi, West Ewell Date of visit: 28.07.18 Brand Product Sugar reduction category Calorie reduction category soft drinks levy Entrance No promotions in entrance Gondola Ends Store layout does not include gondola ends Trolley checkout area The Foodie market Quinoa bars (Coco & cashew) Biscuits n/a The Foodie market Quinoa bars (Goki & cranberry) Biscuits n/a Passions Popcorn (sweet) Sweet Confectionary n/a Passions Popcorn (sweet & salted) Sweet Confectionary n/a Wrigleys Extra chewing gum (peppermint) n/a n/a Wrigleys Extra chewing gum (spearmint) n/a n/a Wrigleys Extra chewing gum (cool breeze) n/a n/a Wrigleys Extra chewing gum (extra white) n/a n/a Passion Deli Pea snacks (sea salt & vingar) n/a Crisps and savoury snacks Passion Deli Pea snacks (sweet chilli) n/a Crisps and savoury snacks The Foodie market Hike protein bars (Cacao) Biscuits n/a The Foodie market Hike protein bars (Berry) Biscuits n/a Dominion Complimints (strongmint) - sugar free n/a n/a Dominion Complimints (spearmint) - sugar free n/a n/a Dominion Complimints (strongmint) - sugar free n/a n/a Passions Deli Red Lentil Snacks (Tangy tomoto) n/a Crisps and savoury snacks Passions Deli Red Lentil Snacks (barbecue) n/a Crisps and savoury snacks Foodie Market Flatbread thin bites (multi-seed) n/a Savoury biscuits, crackers and crispbreads Foodie Market Flatbread thin bites (cheddar & cracked black pepper) n/a Savoury biscuits, crackers and crispbreads Foodie Market Flatbread thin bites (sweet chilli) n/a Savoury biscuits, crackers and crispbreads Dominion -

Cross-Sectional Survey of the Amount of Sugar and Energy in Chocolate Confectionery Sold in the UK in 1992 and 2017

nutrients Article Cross-Sectional Survey of the Amount of Sugar and Energy in Chocolate Confectionery Sold in the UK in 1992 and 2017 Kawther M. Hashem *, Feng J. He, Sarah A. Alderton and Graham A. MacGregor Wolfson Institute of Preventive Medicine, Barts and The London School of Medicine & Dentistry, Queen Mary University of London, Charterhouse Square, London EC1M 6BQ, UK * Correspondence: [email protected]; Tel.: +44-(0)20-7882-6219 Received: 20 June 2019; Accepted: 31 July 2019; Published: 3 August 2019 Abstract: The study aimed to compare the sugar (1992, 2017) and energy (2017) content of chocolate confectionery available in the UK between 1992 and 2017 using cross-sectional surveys. All major UK retailers operating at the time were included. Sugar content in 1992 was obtained from a booklet and sugar and energy content from 2017 were collected from product packaging in-store. In 1992, the average sugar content of chocolate confectionery was 46.6 10.3 g/100 g and in 2017 it was ± 47.3 12.1 g/100 g. Sugar content ranged from 0.5 to 75.2 g/100g, with large variations between ± different categories of chocolate and within the same category of chocolate. There were 23 products found in both 1992 and 2017. The average sugar content per 100 g for these products was 44.6 9.4 g ± in 1992 and 54.7 6.3 g in 2017, representing a 23% increase in sugar content (p < 0.001). The results ± show that the sugar content of chocolate confectionery has increased since 1992, which is concerning. -

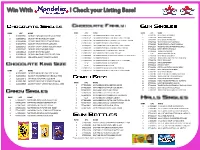

Live Nation Program

Win With ! Check your Listing Base! RANK UPC NAME RANK UPC NAME RANK UPC NAME 1 61200000542 CADBURY CARAMILK BAR REGULAR 50GM 1 61200225914 CADBURY DAIRY MILK LARGE 100 GM 1 5770032943 DENTYNE ICE SPEARMINT 2 5770022560 TRIDENT SPEARMINT 2 61200003451 CADBURY MR BIG REGULAR 60GM 2 61200225921 CADBURY DAIRY MILK FRUIT&NUT LARGE 100 GM 3 61200225938 CADBURY DAIRY MILK HAZELNUT CHOCOLATE 100GM 3 5770032937 DENTYNE ICE PEPPERMINT 3 61200003499 CADBURY WUNDERBAR REGULAR 58GM 4 5770022568 TRIDENT FRESHMINT SUPERPAK 4 61200225969 CADBURY CARAMILK LARGE 100 GM 4 61200225952 CADBURY CRUNCHIE REGULAR 44GM 5 5770022565 TRIDENT TROPICAL TWIST SUPERPAK 5 70221011116 TOBLERONESWISS MILK -YELLOW- LARGE 100GM 5 61200002423 CADBURY CRISPY CRUNCH REGULAR 48GM 6 5770022717 TRIDENT LAYERS STRAWBERRY&CITRUS 6 61200002201 CADBURY DAIRY MILK ALMOND LARGE 100 GM 7 61200225037 CADBURY MINI EGGS BAG 33GM 7 5770033148 DENTYNE FIRE CINNAMON 7 61200033243 CADBURY BURNT ALMOND LARGE 100 GM 8 61200084450 CADBURY DAIRYMILK 42GM 8 5770022564 TRIDENT PEPPERMINT 8 61200033212 NEILSON JERSEY MILK LARGE 100 GM 9 TBD TRIDENT ORIGINAL (NEW) 9 61200084436 CADBURY DAIRYMILK FRUIT & NUT 42GM 9 61200013894 CADBURY DARK MILK ROASTED CARAMELIZED HAZELNUT 10 5770001038 DENTYNE ICE AVALANCHE 10 70221005160 TOBLERONE 35GM/TOBLERONE 50GM 10 61200013887 CADBURY DARK MILK 11 5770022562 TRIDENT WATERMELON TWIST SUPERPAK 11 61200013900 CADBURY DARK MILK CRUNCHY SALTED CARAMEL 12 5770001320 STRIDE SPEARMINT 12 NEW CADBURY DARK MILK RASPBERRY 13 5770001317 STRIDE PEPPERMINT 13 NEW CADBURY -

Top Sellers Retail Planograms

Improve your sales Market insight Market Trends Must stocks New products Increase your footfall Top sellers Retail planograms www.bestway.co.uk www.batleys.co.uk MARKET INSIGHT Premium is driving value growth in Everyday Enjoyment is still the chocolate within the total market. Ensure biggest driver in confectionery. your range offers trade up across block The must stock products are Cadbury Twirl, and singles, for example Lindt Kinder Surprise, Snickers capitalise on the growing protein trend 26% of confectionery is with 1 in 10 shoppers having consumed bought on impulse a protein bar in the last 3 months (Source: Mars Confectionery July 2017) (Source: HIM CTP Tracker 2016) EnsurE you’vE got a corE rangE of Ensure your range offers mars and products in diffErEnt pack formats snickers protein bars to capitalisE on impulsE purchasEs in your storE Growth in sharing occasions is less about social gatherings but Shoppers are spending more on sugar more about informal and everyday with sugar bags being the key driver. consumption. Treat is growing +9% (Source: Kantar Worldpanel 26.03.17, IRI One System Total IC 27.03.17) (Source: Kantar Worldpanel In Home Occasions, Sept 2016) MARKET INSIGHT Shoppers are looking for value for chocolate blocks and sharing bags money, so it is vital you stock price are seen by shoppers as allowable and inexpensive ways of consuming marked packs, sharing bags and confectionery. Ensure that these formats multipacks prominently in your store are available on the main fixture. Ensure you stock a balanced range of confectionery between chocolate and sugar. 60% of your sales value comes from the Must Stock range so make sure you stock up the Must Stock lines Capitalise on NPD within growing segments to encourage trial, keep shoppers interested and to encourage shoppers to trade up MUST STOCK LINES These are the ‘Must Stock’ lines which customers expect to see in a convenience store. -

KRAFT FOODS INC. (Exact Name of Registrant As Specified in Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): September 6, 2012 KRAFT FOODS INC. (Exact Name of Registrant as Specified in Charter) Virginia 1-16483 52-2284372 (State or Other Jurisdiction (Commission (I.R.S. Employer of Incorporation) File Number) Identification No.) Three Lakes Drive, Northfield, Illinois 60093-2753 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (847) 646-2000 Not Applicable (Former Name or Former Address, if Changed Since Last Report.) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 7.01. Regulation FD Disclosure. This information will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. -

Sports Snacks: Food Options for Hungry Athletes | Active.Com Sports Snacks: Food Options for Hungry Athletes by Nancy Clark, MS RD CSSD • for Active.Com

Sports Snacks: Food Options for Hungry Athletes | Active.com Sports Snacks: Food Options for Hungry Athletes By Nancy Clark, MS RD CSSD • For Active.com "What should I eat before I exercise?" That’s a key question—as well as what to eat during extended exercise— that athletes commonly ask me. While they know the words carbs, proteins and fats, they often don't know how to translate those words into food choices. The goal of this article is to offer specific food suggestions to fit a variety of sports situations. This is far from a complete list. Please be sure to experiment with new pre- and during exercise foods to learn which ones settle best in your gut, don’t “talk back,” and enhance your performance. Pre-Event Carbo-Loading Dinner: • Pasta with tomato sauce, meatballs, green beans, French bread, low fat/skim milk, frozen yogurt with strawberries • Turkey with potato, stuffing, low fat gravy, winter squash, cranberry sauce, dinner rolls, apple crisp with reduced-fat ice cream Pre-Game Breakfast For example, 1 to 2 hours before a 9 a.m. cross-country meet or soccer game • Wheaties (or other dry cereal) with low fat milk and banana • Oatmeal with applesauce and brown sugar • Cream of Wheat with raisins • Bagel or English muffin with peanut butter • Poached eggs with two slices of toast • Yogurt and granola Liquid “Meals” If you have trouble digesting solid food • Fruit smoothie (milk, yogurt or juice blended with frozen berries, banana chunks) • Carnation Instant Breakfast • Boost • Ensure • Low fat chocolate milk • Vanilla pudding • Pureed peaches Brunch 4 hours before a 1 p.m.