What Drives the Value Premium?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A STOCK MARKET CORRECTION SURVIVAL GUIDE What You Need to Do Now

Investment and Company Research Select Research SPECIAL REPORT A STOCK MARKET CORRECTION SURVIVAL GUIDE What You Need To Do Now Rob Goldman August 1, 2014 [email protected] CONCLUSION The start of a major correction rarely begins with one catalyst. Instead, they commence in response to multiple events, often within a week of one another. In my view, this has just happened in the past two trading sessions and investors must act quickly and decisively in the near term. The good news is that money can be made even in the throes of a corrective phase and we provide you with specific guidance in this special report. INTRODUCTION "The four most dangerous words in investing are: this time it's different." Sir John Templeton Mid-morning on Wednesday, July 30th, we viewed early economic and market events as a signal that the stock market rally was officially over and that we in fact entered into the start of a corrective phase a week earlier when the S&P 500 Index reached the 1991 mark. We issued a blog on our website and throughout cyberspace proclaiming the market top. The combination of Wednesday’s events (in the AM and PM) with Thursday’s economic news prompted the biggest stock selloff in months and only affirms the thesis made in the blog. Figure 1: S&P 200-Day Performance www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2014 Page 1 of 9 Investment and Company Research Select Research SPECIAL REPORT While others may argue otherwise and trading on Friday may be a temporary return to a bullish stance, we deem the situation urgent enough to produce this special report with the intention of explaining the current correction and providing guidance on how to respond to it. -

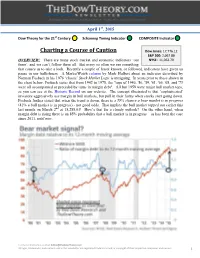

Dow Theory for the 21St Century Schannep Timing Indicator COMPOSITE Indicator

st April 1 , 2015 Dow Theory for the 21st Century Schannep Timing Indicator COMPOSITE Indicator Charting a Course of Caution Dow Jones: 17,776.12 S&P 500: 2,067.88 OVERVIEW: There are many stock market and economic indicators ‘out NYSE: 11,062.79 there’, and we can’t follow them all. But every so often we see something that causes us to take a look. Recently a couple of lesser known, or followed, indicators have given us pause in our bullishness. A MarketWatch column by Mark Hulbert about an indicator described by Norman Fosback in his 1976 ‘classic’ Stock Market Logic is intriguing. In years prior to those shown in the chart below, Fosback states that from 1942 to 1975, the "tops of 1946, '56, '59, '61, '66, '68, and '73 were all accompanied or preceded by turns in margin debt". All but 1959 were major bull market tops, as you can see at the Historic Record on our website. The concept illustrated is that ‘sophisticated’ investors aggressively use margin in bull markets, but pull in their horns when stocks start going down. Fosback further stated that when the trend is down, there is a 59% chance a bear market is in progress (41% a bull market is in progress) - not good odds. That implies the bull market topped out earlier this last month on March 2nd at 18,288.63! How’s that for a cloudy outlook? On the other hand, when margin debt is rising there is an 85% probability that a bull market is in progress – as has been the case since 2011, until now. -

An Exploitable Anomaly in the Ukrainian Stock Market?

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Caporale, Guglielmo Maria; Gil-Alana, Luis; Plastun, Alex Working Paper The weekend effect: An exploitable anomaly in the Ukrainian stock market? DIW Discussion Papers, No. 1458 Provided in Cooperation with: German Institute for Economic Research (DIW Berlin) Suggested Citation: Caporale, Guglielmo Maria; Gil-Alana, Luis; Plastun, Alex (2015) : The weekend effect: An exploitable anomaly in the Ukrainian stock market?, DIW Discussion Papers, No. 1458, Deutsches Institut für Wirtschaftsforschung (DIW), Berlin This Version is available at: http://hdl.handle.net/10419/107690 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend -

Investor Sentiment, Post-Earnings Announcement Drift, and Accruals

Investor Sentiment, Post-Earnings Announcement Drift, and Accruals Joshua Livnat New York University Quantitative Management Associates Christine Petrovits College of William & Mary We examine whether stock price reactions to earnings surprises and accruals vary systematically with investor sentiment. Using quarterly drift tests and monthly trading strategy tests, we find that holding good news firms (and low accrual firms) following pessimistic sentiment periods earns higher abnormal returns than holding good news firms (and low accrual firms) following optimistic sentiment periods. We also document that abnormal returns in the short-window around earnings announcements for good news firms are higher during periods of low sentiment. Overall, our results indicate that investor sentiment influences the source of excess returns from accounting-based trading strategies. Keywords: Investor Sentiment, Post-Earnings Announcement Drift, Accruals, Anomalies INTRODUCTION We investigate whether investor sentiment influences the immediate and long-run market reactions to earnings surprises and accruals. Investor sentiment broadly represents the mood of investors at any given time. Relying on behavioral finance theories, several studies examine how waves of investor sentiment affect assets prices (e.g., Brown and Cliff, 2005; Baker and Wurgler, 2006; Lemmon and Portniaguina, 2006). The general result from this literature is that following periods of low (high) investor sentiment, subsequent market returns are relatively high (low), suggesting that stocks are underpriced (overpriced) in low (high) sentiment states but that prices eventually revert to fundamental values. Because a common explanation for post-earnings announcement drift is that investors initially underreact to the earnings news and a common explanation for the accruals anomaly is that investors initially overreact to accruals, it is possible that investor sentiment plays a role in how these two accounting anomalies unfold. -

Momentum – the Premier Market Anomaly

Momentum – The Premier Market Anomaly Fama/French (2008): Momentum is "the center stage anomaly of recent years…an anomaly that is above suspicion…the premier market anomaly." This paper will share a simple example of the power of momentum, and more specifically, the power of combining relative strength momentum with absolute momentum. Absolute momentum is often referred to as trend following or time-series momentum. We highly recommend those who want to go further in depth to pick up Gary Antonacci’s book, Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk1. We will start by creating a benchmark global equity portfolio that is equally allocated to US large cap stocks, US small cap stocks, and International stocks2. The benchmark portfolio is rebalanced monthly. Our analysis period is 1972–2014 which includes three substantial bear markets (1973-1974, 2000-2002, and 2008-2009) along with one of the most prolific bull market runs in recent history from 1982–1999. 1 Gary Antonacci is not affiliated with Lorintine Capital. Lorintine Capital does not receive any compensation for mentioning his book nor is it an endorsement. We provide his book as a third-party reference for those interested in learning more about momentum and the concepts presented in this paper. 2 Historical data represents index data. You cannot invest directly in an index. Indexes do not include fees, expenses, or transaction costs. All examples are hypothetical. Past performance does not guarantee future results. 1 Since 1972 our benchmark portfolio has produced double digit annual returns with a Compound Annual Growth Rate (CAGR) of 10.85%, enough to grow $100 to $8,465.493. -

Modern Portfolio Theory, Part One

Modern Portfolio Theory, Part One Introduction and Overview Modern Portfolio Theory suggests that you can maximize your investment returns, given the amount of risk (or volatility) you are willing to take on. This is the idea to be developed and evaluated during this 10-part series. Part One provides an introduction to the issues. by Donald R. Chambers e are inundated with advice ory” or MPT. The most important advances emerged: efficient market Wregarding investment deci- point of MPT is that diversification theory and equilibrium pricing sions from numerous sources (bro- reduces risk without reducing expected theory. kers, columnists, economists) and return. MPT uses mathematics and Led by Professor Eugene Fama, through a variety of media (televi- statistics to demonstrate diversifica- MPT pioneers established a frame- sion, magazines, seminars). But tion clearly and carefully. work for discussing the idea that the suggested answers regarding This series focuses on relatively security markets are informationally investment decisions not only vary simple and easy-to-implement efficient. This means that secu- tremendously but often rity prices already reflect directly conflict with each MPT does not describe or prescribe invest- available information and other—leaving the typical that it is therefore not investor in a quandary. ing perfectly. But even if it’s not perfect, possible to use available On top of this MPT has major implications that should be information to identify complexity, conditions under-priced or over- change. Markets crash considered by every investor. priced securities. and firms once viewed as In the wake of difficult providing solutions, such as Merrill investment concepts. -

Analysis of the Stock Market Anomalies in the Context of Changing the Information Paradigm

EASTERN JOURNAL OF EUROPEAN STUDIES Volume 10, Issue 1, June 2019 | 239 Analysis of the stock market anomalies in the context of changing the information paradigm Kostyantyn MALYSHENKO*, Vadim MALYSHENKO**, Elena Yu. PONOMAREVA***, Marina ANASHKINA**** Abstract The present paper describes the results of a comprehensive research in the information efficiency of the Ukrainian stock market in the context of a financial paradigm transformation which causes a need to modify the EMH (efficient market hypothesis). The aim of the research is to identify the market inefficiencies (anomalies) that occur in the market and contradict the EMH provisions. The database used for the research is from both the world and the Ukrainian stock markets (from 2008 to 2013). Besides, the authors compiled their own event database on Ukrainian mass media data with clear formalization of the event evaluation, which excludes any judgmental approach. Both the standard statistical procedures and the authors’ event analysis become the instruments for the analysis. To randomize the research, an event date was shifted by 1-5 days with the reference to the emissions by the moving average method. The research becomes the basis for a new information paradigm, and the fourth form of information efficiency was justified. These changes underlaid the evaluation methodology for the arisen anomalies being the result of explicit or implicit collusion at the stock market of Ukraine. Keywords: anomalies of the stock market, information efficiency, event analysis, efficient market hypothesis (EMH), fractal market hypothesis (FMH), coherent market hypothesis (CMH) * Kostyantyn MALYSHENKO is Senior Researcher at the National Research Institute for Vine and Wine Magarach; e-mail: [email protected]. -

ALL ABOUT MARKET TIMING the Easy Way to Get Started FM Masonson141331-6 8/27/03 10:24 AM Page Ii

FM_Masonson141331-6 8/27/03 10:24 AM Page i ALL ABOUT MARKET TIMING The Easy Way to Get Started FM_Masonson141331-6 8/27/03 10:24 AM Page ii OTHER TITLES IN THE “ALL ABOUT . .” FINANCE SERIES All About Stocks, 2nd edition by Esme Faerber All About Bonds and Bond Mutual Funds, 2nd edition by Esme Faerber All About Options, 2nd edition by Thomas McCafferty All About Futures, 2nd edition by Russel Wasendorf All About Commodities by Thomas McCafferty and Russel Wasendorf All About Real Estate Investing, 2nd edition by William Benke and Joseph M. Fowler All About DRIPs and DSPs by George C. Fisher All About Mutual Funds, 2nd edition by Bruce Jacobs All About Stock Market Strategies by David Brown and Kassandra Bentley All About Index Funds by Richard Ferri All About Hedge Funds by Robert Jaegar All About Technical Analysis by Constance Brown All About Exchange-Traded Funds by Archie Richards FM_Masonson141331-6 8/27/03 10:24 AM Page iii ALL ABOUT MARKET TIMING The Easy Way to Get Started LESLIE N. MASONSON McGraw-Hill New York Chicago San Francisco Lisbon London Madrid Mexico City Milan New Delhi San Juan Seoul Singapore Sydney Toronto ebook_copyright 6x9.qxd 10/21/03 11:43 AM Page 1 Copyright © 2004 by Leslie M. Masonson. All rights reserved. Manufactured in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher. -

This Item Was Submitted to Loughborough's Institutional

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Loughborough University Institutional Repository This item was submitted to Loughborough’s Institutional Repository (https://dspace.lboro.ac.uk/) by the author and is made available under the following Creative Commons Licence conditions. For the full text of this licence, please go to: http://creativecommons.org/licenses/by-nc-nd/2.5/ Information efficiency changes following FTSE 100 index revisions Wael Dayaa, Khelifa Mazouza,* and Mark Freemana a Bradford University School of Management, Emm Lane, Bradford, BD9 4JL, UK Abstract This study examines the impact of FTSE 100 index revisions on the informational efficiency of the underlying stocks. Our study spans the 1986-2009 period. We estimate the speed of price adjustment and price inefficiency from the partial adjustment with noise model of Amihud and Mendelson (1987). We report a significant improvement (no change) in the informational efficiency of the stocks added to (deleted from) the FTSE 100 index. The asymmetric effect of additions and deletions on the informational efficiency can be attributed, at least partly, to certain aspects of liquidity and other fundamental characteristics, which improve following additions but do not diminish after deletions. Cross-sectional analysis also indicates that stocks with low pre-addition market quality benefit more from joining the index. JEL classification: G15 Keywords: Index revisions; market quality; liquidity; idiosyncratic risk *Corresponding author: Email: [email protected]; Telephone: +44(0) 1274 2343 49 Acknowledgments We are grateful to the comments of an anonymous referee and the editor that have considerably enhanced the paper. -

Market Efficiency and Market Anomalies: Three Essays Investigating the Opinions and Behavior of Finance Professors Both As Resea

Florida State University Libraries Electronic Theses, Treatises and Dissertations The Graduate School 2007 Market Efficiency and Market Anomalies: Three Essays Investigating the Opinions and Behavior of Finance Professors Both as Researchers and as Investors Colbrin (Colby) A. Wright Follow this and additional works at the FSU Digital Library. For more information, please contact [email protected] THE FLORIDA STATE UNIVERSITY COLLEGE OF BUSINESS MARKET EFFICIENCY AND MARKET ANOMALIES: THREE ESSAYS INVESTIGATING THE OPINIONS AND BEHAVIOR OF FINANCE PROFESSORS BOTH AS RESEARCHERS AND AS INVESTORS By COLBRIN (COLBY) A. WRIGHT A Dissertation submitted to the Department of Finance in partial fulfillment of the requirements for the degree of Doctor of Philosophy Degree Awarded: Summer Semester, 2007 The members of the Committee approve the dissertation of Colbrin A. Wright defended on May 22, 2007. _____________________________ David Peterson Professor Directing Dissertation _____________________________ Michael Brady Outside Committee Member _____________________________ Gary Benesh Committee Member _____________________________ James Doran Committee Member Approved: _________________________________ William Christiansen, Chair, Department of Finance _________________________________ Caryn L. Beck-Dudley, Dean, College of Business The Office of Graduate Studies has verified and approved the above named committee members. ii To my wonderful wife, Misty, whose unremunerated and oft-times unrecognized work as a mother is both unequivocally more challenging and infinitely more important than any of my professional accomplishments. Thanks for being my rock when the winds and rains have beat upon me. iii ACKNOWLEDGEMENTS No great work in life is ever accomplished alone. While readily acknowledging that my dissertation is no “great work,” I would like to gratefully acknowledge the many individuals who have improved the quality of this dissertation and influenced me along the way. -

Technical Analysis

ptg TECHNICAL ANALYSIS ptg Download at www.wowebook.com This page intentionally left blank ptg Download at www.wowebook.com TECHNICAL ANALYSIS THE COMPLETE RESOURCE FOR FINANCIAL MARKET TECHNICIANS SECOND EDITION ptg Charles D. Kirkpatrick II, CMT Julie Dahlquist, Ph.D., CMT Download at www.wowebook.com Vice President, Publisher: Tim Moore Associate Publisher and Director of Marketing: Amy Neidlinger Executive Editor: Jim Boyd Editorial Assistant: Pamela Boland Operations Manager: Gina Kanouse Senior Marketing Manager: Julie Phifer Publicity Manager: Laura Czaja Assistant Marketing Manager: Megan Colvin Cover Designer: Chuti Prasertsith Managing Editor: Kristy Hart Project Editor: Betsy Harris Copy Editor: Karen Annett Proofreader: Kathy Ruiz Indexer: Erika Millen Compositor: Bronkella Publishing Manufacturing Buyer: Dan Uhrig © 2011 by Pearson Education, Inc. Publishing as FT Press Upper Saddle River, New Jersey 07458 FT Press offers excellent discounts on this book when ordered in quantity for bulk purchases or special sales. For more information, please contact U.S. Corporate and Government Sales, 1-800-382-3419, [email protected]. For sales outside the U.S., please contact International Sales at [email protected]. ptg Company and product names mentioned herein are the trademarks or registered trademarks of their respective owners. All rights reserved. No part of this book may be reproduced, in any form or by any means, without permission in writing from the publisher. Printed in the United States of America First Printing November 2010 ISBN-10: 0-13-705944-2 ISBN-13: 978-0-13-705944-7 Pearson Education LTD. Pearson Education Australia PTY, Limited. Pearson Education Singapore, Pte. Ltd. Pearson Education Asia, Ltd. -

The History of the Cross Section of Stock Returns∗

The History of the Cross Section of Stock Returns∗ Juhani T. Linnainmaa Michael R. Roberts June 2017 (Draft) Abstract Using data spanning the 20th century, we show that the majority of accounting-based return anomalies, including investment and profitability, are most likely an artifact of data snooping. When examined out-of-sample by moving either backward or forward in time, most anomalies' average returns and Sharpe ratios decrease, while their volatilities and correlations with other anomalies increase. The data-snooping problem is so severe that even the true asset pricing model is expected to be rejected when tested using in- sample data. The few anomalies that do persist out-of-sample correlate with the shift from investment in physical capital to intangible capital, and the increasing reliance on debt financing observed over the 20th century. Our results emphasize the importance of validating asset pricing models out-of-sample, question the extent to which investors learn of mispricing from academic research, and highlight the linkages between anomalies and economic fundamentals. ∗Juhani Linnainmaa is with the University of Southern California and NBER and Michael Roberts is with the Wharton School of the University of Pennsylvania and NBER. We thank Jules van Binsbergen, Mike Cooper (discussant), Ken French, Chris Hrdlicka (discussant), Travis Johnson (discussant), Mark Leary, Jon Lewellen (discussant), David McLean, Toby Moskowitz, Robert Novy-Marx, Christian Opp, Jeff Pontiff, Nick Roussanov, and Rob Stambaugh for helpful discussions, and seminar and conference participants at Carnegie Mellon University, Georgia State University, Northwestern University, University of Lugano, University of Copenhagen, University of Texas at Austin, American Finance Association 2017, NBER Behavioral Finance 2017, SFS 2016 Finance Cavalcade, and Western Finance Association 2016, meetings for valuable comments.