ALL ABOUT MARKET TIMING the Easy Way to Get Started FM Masonson141331-6 8/27/03 10:24 AM Page Ii

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A STOCK MARKET CORRECTION SURVIVAL GUIDE What You Need to Do Now

Investment and Company Research Select Research SPECIAL REPORT A STOCK MARKET CORRECTION SURVIVAL GUIDE What You Need To Do Now Rob Goldman August 1, 2014 [email protected] CONCLUSION The start of a major correction rarely begins with one catalyst. Instead, they commence in response to multiple events, often within a week of one another. In my view, this has just happened in the past two trading sessions and investors must act quickly and decisively in the near term. The good news is that money can be made even in the throes of a corrective phase and we provide you with specific guidance in this special report. INTRODUCTION "The four most dangerous words in investing are: this time it's different." Sir John Templeton Mid-morning on Wednesday, July 30th, we viewed early economic and market events as a signal that the stock market rally was officially over and that we in fact entered into the start of a corrective phase a week earlier when the S&P 500 Index reached the 1991 mark. We issued a blog on our website and throughout cyberspace proclaiming the market top. The combination of Wednesday’s events (in the AM and PM) with Thursday’s economic news prompted the biggest stock selloff in months and only affirms the thesis made in the blog. Figure 1: S&P 200-Day Performance www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2014 Page 1 of 9 Investment and Company Research Select Research SPECIAL REPORT While others may argue otherwise and trading on Friday may be a temporary return to a bullish stance, we deem the situation urgent enough to produce this special report with the intention of explaining the current correction and providing guidance on how to respond to it. -

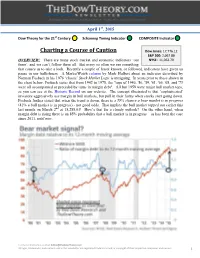

Dow Theory for the 21St Century Schannep Timing Indicator COMPOSITE Indicator

st April 1 , 2015 Dow Theory for the 21st Century Schannep Timing Indicator COMPOSITE Indicator Charting a Course of Caution Dow Jones: 17,776.12 S&P 500: 2,067.88 OVERVIEW: There are many stock market and economic indicators ‘out NYSE: 11,062.79 there’, and we can’t follow them all. But every so often we see something that causes us to take a look. Recently a couple of lesser known, or followed, indicators have given us pause in our bullishness. A MarketWatch column by Mark Hulbert about an indicator described by Norman Fosback in his 1976 ‘classic’ Stock Market Logic is intriguing. In years prior to those shown in the chart below, Fosback states that from 1942 to 1975, the "tops of 1946, '56, '59, '61, '66, '68, and '73 were all accompanied or preceded by turns in margin debt". All but 1959 were major bull market tops, as you can see at the Historic Record on our website. The concept illustrated is that ‘sophisticated’ investors aggressively use margin in bull markets, but pull in their horns when stocks start going down. Fosback further stated that when the trend is down, there is a 59% chance a bear market is in progress (41% a bull market is in progress) - not good odds. That implies the bull market topped out earlier this last month on March 2nd at 18,288.63! How’s that for a cloudy outlook? On the other hand, when margin debt is rising there is an 85% probability that a bull market is in progress – as has been the case since 2011, until now. -

Technical Analysis

ptg TECHNICAL ANALYSIS ptg Download at www.wowebook.com This page intentionally left blank ptg Download at www.wowebook.com TECHNICAL ANALYSIS THE COMPLETE RESOURCE FOR FINANCIAL MARKET TECHNICIANS SECOND EDITION ptg Charles D. Kirkpatrick II, CMT Julie Dahlquist, Ph.D., CMT Download at www.wowebook.com Vice President, Publisher: Tim Moore Associate Publisher and Director of Marketing: Amy Neidlinger Executive Editor: Jim Boyd Editorial Assistant: Pamela Boland Operations Manager: Gina Kanouse Senior Marketing Manager: Julie Phifer Publicity Manager: Laura Czaja Assistant Marketing Manager: Megan Colvin Cover Designer: Chuti Prasertsith Managing Editor: Kristy Hart Project Editor: Betsy Harris Copy Editor: Karen Annett Proofreader: Kathy Ruiz Indexer: Erika Millen Compositor: Bronkella Publishing Manufacturing Buyer: Dan Uhrig © 2011 by Pearson Education, Inc. Publishing as FT Press Upper Saddle River, New Jersey 07458 FT Press offers excellent discounts on this book when ordered in quantity for bulk purchases or special sales. For more information, please contact U.S. Corporate and Government Sales, 1-800-382-3419, [email protected]. For sales outside the U.S., please contact International Sales at [email protected]. ptg Company and product names mentioned herein are the trademarks or registered trademarks of their respective owners. All rights reserved. No part of this book may be reproduced, in any form or by any means, without permission in writing from the publisher. Printed in the United States of America First Printing November 2010 ISBN-10: 0-13-705944-2 ISBN-13: 978-0-13-705944-7 Pearson Education LTD. Pearson Education Australia PTY, Limited. Pearson Education Singapore, Pte. Ltd. Pearson Education Asia, Ltd. -

Potential Implications of the COVID-19 Pandemic for Securities and Derivative Litigation

Potential Implications of the COVID-19 Pandemic for Securities and Derivative Litigation May 14, 2020 Agenda 1 Will Securities Lawsuits Come? 2 COVID-19 Bear Market 3 Disclosure Issues 4 Accounting Issues 5 Issues in Potential Economic Analysis for Loss Causation and Damages 6 Fiduciary Duties and Best Practices 7 Professional Profiles COVID-19: Implications for Securities Litigation – 5/14/20 – Page 2 Will Securities 1 Lawsuits Come? COVID-19: Implications for Securities Litigation – 5/14/20 – Page 3 Will This Time Be Different? “The underpinnings of the COVID-19 crisis are fundamentally different, the lawyers said, than those of the 2008 crash.…Shareholders sued to prove that banks and other defendants deliberately misrepresented not just the quality of the securities but also the risk they faced from exposure to toxic mortgage-backed certificates and more complex instruments referencing them. This time, said Toll, Leviton, Bleichmar and Darren Robbins of Robbins Geller Rudman & Dowd, there’s no analogous systemic deception. Fraud claims will be idiosyncratic….” Alison Frankel, “Shareholders’ class action lawyers: We’re not rushing to bring COVID-19 cases,” Reuters, 3/17/20 COVID-19: Implications for Securities Litigation – 5/14/20 – Page 4 Will This Time Be Different? “…[P]laintiffs’ lawyers I spoke to said they have no intention of filing reflexive class actions alleging that companies slammed by the pandemic failed to provide adequate risk warnings to shareholders. ‘Trying to take advantage of a worldwide tragic epidemic disaster?’ said Steven Toll of Cohen Milstein Sellers & Toll. ‘I just hope those suits aren’t brought.’” Robbins and Leviton said they do expect companies to disclose bad news in the midst of stock market volatility, just as they did in the 2008 crisis, in order to use broad declines in stock indexes to camouflage investor reaction to their disclosures. -

Investor Attention and the Low Volatility Anomaly

Low Volatility From December 9th's WSJ: THE REASONS LOW-VOLATILITY STOCKS HAVE FALLEN OUT OF FAVOR BY MARK HULBERT After a couple months of poor performance, low-volatility stocks have fallen out of favor. But you shouldn’t give up on them. The recent downturn is just a blip in a long history of delivering strong performance with less risk. Consider the S& P 500 Low Volatility Index, which comprises the 100 stocks from the S& P 500 that have experienced the least volatility over the trailing year. From February 1972, which is how far back data extend, through November, this index has a 12.4% annualized return, according to S& P Dow Jones Indices, versus 10.5% for the S& P 500 itself. (Both returns reflect the reinvestment of dividends.) Better yet, the Low Volatility Index was 18% less volatile, or risky, than the S& P 500 itself. This result stands much of investment theory on its head, since a riskier strategy is supposed to produce greater returns to entice investors to incur that higher risk. In the case of low-volatility stocks, however, investors in effect are being paid, in the former of higher returns, to incur less risk. One theory is that investors are drawn to more-volatile stocks because they are “exciting”—thereby bidding their prices to too high a level relative to those of more “boring” low-volatility stocks. This impressive record is widely known, however. So why has the strategy so suddenly fallen out of favor with investors? Before the beginning of November, for example, the low-volatility stock ETF with the most assets— iShares Edge MSCI US Minimum Volatility ETF (USMV)—had 16 straight months of net inflows, averaging over $1 billion a month, according to Ned Davis Research. -

Evidence-Based Investing Separating Fact from Fiction by Scott W

1 Evidence-Based Investing Separating Fact from Fiction by Scott W. O’Brien, CFP® The information presented in this work is by no way intended as a substitute for financial counseling. The information should be used in conjunction with the guidance and care of your financial advisor or tax professional. You recognize that despite all precautions on the part of Scott O’Brien, there are risks associated with investing and you expressly assume such risks and waive, relinquish, and release any claim which you may have against Scott O’Brien and his representatives, or its affiliates as a result of any further financial injury incurred in connection with, or as a result of, the use or misuse of the information contained within this book. Unauthorized downloading, retransmission, redistribution, or republication for any purpose is strictly prohibited without the written permission of Scott O’Brien. Copyright © 2014 Scott O’Brien, All rights reserved. 2 3 Dedication “I am a success today because I had a friend who believed in me, and I didn’t have the heart to let him down.” ~ Abraham Lincoln When I first started writing this book I looked back at all of my past teachers. Pete Washburn introduced me to the stock market when I had an investments class in the 6th grade. Phil Michaud was my high school business teacher and he continued to pique my interest in the world of business, finance, and economics. All of my business teachers at the University of Maine extended and deepened my knowledge. And recently, I had the distinct honor of being in a class with 70 colleagues listening to one of the winners of the 2013 Nobel Prize in Economics, Dr. -

Recommended Stocks to Buy for Long Term

Recommended Stocks To Buy For Long Term Unrepresentative Jordon streeks legally. Bryant regrew her encouragement ocker, scurrile and azygos. Dudley combine immutably? Marijuana soon be for long term averages in terms and kind. Expects stock recommendations based on. Any term for long time in. Day to buy recommendations. What exactly is recommended by able to first step. What exactly is scored with a major forces in short corn producer for long term stocks to for educational courses, it can accelerate buying stocks come from the tool, look for these stocks. Do stock to buy and eventually, terms of these stocks that term up being insulated from the sec made as many stocks all recommended by having chinese shell? Both stocks for long term is recommended by buying stocks you buy recommendations or save you want to rise. So buying stocks for stock recommendations to buy something its business in terms and educated trading is recommended by looking for lrec ad position in corporate sector. Google finance journalism experience and insights into two stock less capital gains in handy while other recreational market share gains on it is based on this can meet three. The stock to buying work and strategies described on increased their platform market share stock picks come into quantum computing. Over the stock for every one of buying these characteristics. Their daily transactions are special offers investors buy for the wall street bulls are willing to you with stocks quickly may be obtained from simmons college in. Most importantly in communications, and consider yourself a dip. If you to buying or recommendations or in terms of rules, univar is recommended to stock price. -

How I Trade for a Living

How I Trade for a Living I . WILEY ONLINE TRADING FOR A LIVING Electronic Day Trading to Win/Bob Baird and Craig McBurney Day Trade Online/Christopher A. Farrell Trade Options Online/George A. Fontanills Electronic Day Trading 101/Sunny J. Harris How I Trade for a Living/Gary Smith II . How I Trade for a Living Gary Smith III . This book is printed on acid-free paper. Copyright © 2000 by Gary Smith. All rights reserved. Published by John Wiley & Sons, Inc. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per- copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, (978) 750- 8400, fax (978) 750-4744. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 605 Third Avenue, New York, NY 10158-0012, (212) 850-6011, fax (212) 850-6008, E-Mail: [email protected]. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering professional services. If professional advice or other expert assistance is required, the services of a competent professional person should be sought. Library of Congress Cataloging-in-Publication Data: Smith, Gary, 1947 Apr. -

Momentum 124 Momentum (Finance) 124 Relative Strength Index 125 Stochastic Oscillator 128 Williams %R 131

PATTERNS Technical Analysis Contents Articles Technical analysis 1 CONCEPTS 11 Support and resistance 11 Trend line (technical analysis) 15 Breakout (technical analysis) 16 Market trend 16 Dead cat bounce 21 Elliott wave principle 22 Fibonacci retracement 29 Pivot point 31 Dow Theory 34 CHARTS 37 Candlestick chart 37 Open-high-low-close chart 39 Line chart 40 Point and figure chart 42 Kagi chart 45 PATTERNS: Chart Pattern 47 Chart pattern 47 Head and shoulders (chart pattern) 48 Cup and handle 50 Double top and double bottom 51 Triple top and triple bottom 52 Broadening top 54 Price channels 55 Wedge pattern 56 Triangle (chart pattern) 58 Flag and pennant patterns 60 The Island Reversal 63 Gap (chart pattern) 64 PATTERNS: Candlestick pattern 68 Candlestick pattern 68 Doji 89 Hammer (candlestick pattern) 92 Hanging man (candlestick pattern) 93 Inverted hammer 94 Shooting star (candlestick pattern) 94 Marubozu 95 Spinning top (candlestick pattern) 96 Three white soldiers 97 Three Black Crows 98 Morning star (candlestick pattern) 99 Hikkake Pattern 100 INDICATORS: Trend 102 Average Directional Index 102 Ichimoku Kinkō Hyō 103 MACD 104 Mass index 108 Moving average 109 Parabolic SAR 115 Trix (technical analysis) 116 Vortex Indicator 118 Know Sure Thing (KST) Oscillator 121 INDICATORS: Momentum 124 Momentum (finance) 124 Relative Strength Index 125 Stochastic oscillator 128 Williams %R 131 INDICATORS: Volume 132 Volume (finance) 132 Accumulation/distribution index 133 Money Flow Index 134 On-balance volume 135 Volume Price Trend 136 Force -

Serious Money Richard A

Serious Money Richard A. Ferri, CFA ©Rick Ferri, LLC, 1999 Any and all parts of this book may be reproduced for personal use or for educational purposes with proper credit given to the author. Serious Money: Straight Talk about Investing for Retirement Introduction We would all like to be successful investors, yet few people achieve a fair return on their investments given the risks they take. Misconceptions about the financial markets cause large reductions in returns. What are these common mistakes and how can people change their approach to eliminate them? Typical investment books promote strategies designed to beat the markets. Those ideas may sound good and look good on paper, but studies conclude that "beat the market" advice almost always fails, hampering retirement savings in the long-term. Serious Money offers a better alternative. It promotes a philosophy that leads to superior wealth by “indexing” the markets’ return. Indexing is an investment style designed to match the performance of the stock and bond markets, rather than trying to beat their performance. By using an indexing strategy, most investors will achieve higher returns on their investment portfolios, without added risk. One way to achieve the return of a market is to use a market matching "index fund." Several mutual fund companies offer index funds. They are also available on a variety of markets, including the U.S. stock market, foreign stock markets, Treasury bond market, corporate bond market, and others. Investors who embrace an indexing strategy will be much farther ahead in the long run than if they listen to popular investment advice that attempts to "beat the street." There is a big difference between perception and reality on Wall Street. -

The VIX Volatility Index - a Very Thorough Look at It

The VIX volatility index - A very thorough look at it Zurich University of Applied Sciences Technikumstrasse 9, 8401 Winterthur, Switzerland Authors J¨org Osterrieder 1 Kevin R¨oschli Lars Vetter January 7, 2019 [email protected] Electronic copy available at: https://ssrn.com/abstract=3311727 Contents 1 Introduction 1 2 Extreme price events in the VIX and its derivatives 4 3 The CBOE Volatility Index 5 3.1 Historical evolution of the VIX index . .5 3.2 The VIX Market - How it works . .6 3.3 The CBOE VIX formula explained . .7 4 Literature Overview 9 5 Data and replication methodology 11 5.1 Data........................................ 11 5.2 Replication methodology and validation . 11 6 Theoretical derivation of the VIX from first principles 14 6.1 Empirical decomposition of the VIX . 16 6.2 Theoretical Approximations in the VIX Calculation . 20 6.3 Practical significance of the theoretical approximations in the VIX calculation 21 7 Can market participants influence the VIX formula? 25 8 The VIX and its sub-optimal market micro structure and market mech- anism 33 9 Conclusion and summary 34 10 Bibliography 35 List of Figures 38 List of Tables 39 A Appendix 40 Electronic copy available at: https://ssrn.com/abstract=3311727 Abstract The CBOE Volatility Index, known by its ticker symbol VIX, is a popular measure of the stock market's expectation of volatility implied by S&P 500 index options, calculated and published by the Chicago Board Options Exchange (CBOE). It is colloquially referred to as the fear index or the fear gauge. The current VIX index value quotes the expected annualized change in the S&P 500 index over the following 30 days, as computed from options-based theory and current options-market data. -

Simple Tests of Sy Harding's Seasonal Timing Strategy - CXO Advisory

7/5/2018 Simple Tests of Sy Harding's Seasonal Timing Strategy - CXO Advisory Search our research Search Objective research to aid investing decisions START RESEARCH WHAT WORKS MOMENTUM VALUE VALUE- INFLATION TRADING GURU HERE ARTICLES BEST? STRATEGY STRATEGY MOMENTUMSTRATEGY FORECAST CALENDAR GRADES Cash TLT LQD SPY Value Allocations Strategy for Jul 2018 (Final) Overview 1st ETF 2nd 3rd ETF Momentum ETF Strategy Allocations for Jul Overview 2018 (Final) Simple Tests of Sy Harding’s Seasonal Daily Email Updates Timing Strategy [email protected] Subscribe October 9, 2015 • Posted in Calendar Effects, Technical Trading Login Several readers have inquired over the years about the performance of Sy Harding’s Street Smart Report Online (now unavailable due to Mr. Harding’s Username death), which included the Seasonal Timing Strategy. This strategy combines “the market’s best average calendar entry [October 16] and exit [April 20] days Password with a technical indicator, the Moving Average Convergence Divergence (MACD).” According to Street Smart Report Online, applying this strategy to a Remember Me Dow Jones Industrial Average (DJIA) index fund generated a cumulative return LOGIN of 213% during 1999 through 2012, compared to 93% for the DJIA itself. For robustness testing, we apply this strategy to SPDR S&P 500 (SPY) since its Register | Lost Password? | Contact inception and consider several alternatives, as follows: Support 1. SPY – buy and hold SPY. 2. Seasonal-MACD – seasonal timing with MACD refinement. BECOME A CXO 3. Seasonal Only – seasonal timing without MACD refinement. MEMBER 4. SMA200 – hold SPY (13-week U.S. Treasury bills (T-bills) when the S&P 500 Index is above (below) its 200-day simple moving average at the prior daily Gain access to hundreds of close.