CFA Institute Research Challenge Hosted by CFA Society of Greece University of the Piraeus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commission Decision of 14 August 1998 On

21.5.1999 EN Official Journal of the European Communities L 128/1 II (Acts whose publication is not obligatory) COMMISSION COMMISSION DECISION of 14 August 1998 on aid granted by Greece to Olympic Airways (notified under document number C(1998) 2423) (Only the Greek text is authentic) (Text with EEA relevance) (1999/332/EC) THE COMMISSION OF THE EUROPEAN market and the Agreement on the European COMMUNITIES, Economic Area (the EEA Agreement') by virtue of Article 92(3)(c) of the Treaty and of Article 61(3)(c) of the EEA Agreement. The aid Having regard tothe Treaty establishing the European comprised: Community, and in particular the first subparagraph of Article 93(2) thereof, (a) loan guarantees extended to the company Having regard to the Agreement on the European until then pursuant toArticle 6 ofGreek Economic Area, and in particular point (a) of Article Law No96/75 of26 June 1975; 62(1) thereof, (b) new loan guarantees totalling USD 378 Having given the parties concerned notice (1), in million for loans to be contracted before 31 accordance with the provisions of the abovementioned December 1997 for the purchase of new Articles, tosubmit their comments,and having regard aircraft; to those comments, (c) easing of the undertaking's debt burden by Whereas: GRD 427 billion; (d) conversion of GRD 64 billion of the undertaking's debt toequity; THE FACTS I (e) a capital injection of GRD 54 billion in three instalments of GRD 19, 23 and 12 billion in 1995, 1996 and 1997 respectively. (1) On 7 October 1994, the Commission adopted Decision 94/696/EC on the aid granted by Greece toOlympic Airways ( 2) (hereinafter the initial Decison' according to which the aid (2) The last four of these five measures formed part granted and tobe granted by Greece toOlympic of a restructuring and recapitalisation plan for Airways (OA') is compatible with the common OA which had initially been submitted tothe Commission. -

EU Competition Report Q3

EU Competition Report JULY – SEPTEMBER 2010 www.clearygottlieb.com HORIZONTAL AGREEMENTS cartel, and the attribution of liability among the various companies of the same group), together with supporting evidence. Immediately Commission decisions afterwards, the Commission granted each party access (at the DRAM Cartel Commission’s premises) to a selection of key documents from the On May 19, 2010, the European Commission issued its long-awaited case file, including all leniency statements. Parties were also invited first cartel settlement decision (the first since the Commission to comment on the Commission’s allegations at this stage. 1 introduced the settlement procedure in June 2008). The settlement • During the second meeting the Commission provided parties with decision imposed a total of €331,273,800 in fines on ten producers of feedback on their arguments and observations submitted following Dynamic Random Access Memory (“DRAM”) chips that were found to the first meeting and partial file access. have participated in cartel conduct in violation of Article 101 TFEU. Between July 1, 1998, and June 15, 2002, the cartel participants • Finally, during a third meeting the Commission disclosed to each engaged in a network of mostly bilateral contacts through which they party the range within which its fine would ultimately fall, without exchanged pricing information and coordinated prices and quotations disclosing methodology that the Commission intended to use to for DRAM sold to major PC or server manufacturers in the EEA. All calculate the actual fine. participants agreed to follow the settlement procedure and received a Following the third settlement meeting, the Commission set a time limit 2 10% settlement discount as provided by the Settlement Notice. -

Final List EMD2015 02062015

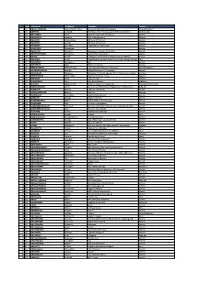

N° Title LastName FirstName Company Country 1 Dr ABDUL RAHMAN Noorul Shaiful Fitri Universiti Malaysia Terengganu United Kingdom 2 Mr ABSPOEL Lodewijk Nl Ministry For Infrastructure And Environment Netherlands 3 Mr ABU-JABER Nizar German Jordanian University Jordan 4 Ms ADAMIDOU Despina Een -Praxi Network Greece 5 Mr ADAMOU Christoforos Ministry Of Tourism Greece 6 Mr ADAMOU Ioannis Ministry Of Tourism Greece 7 Mr AFENDRAS Evangelos Independent Consultant Greece 8 Mr AFENTAKIS Theodoros Greece 9 Mr AGALIOTIS Dionisios Vocational Institute Of Piraeus Greece 10 Mr AGATHOCLEOUS Panayiotis Cyprus Ports Authority Cyprus 11 Mr AGGOS Petros European Commission'S Representation Athens Greece 12 Dr AGOSTINI Paola Euro-Mediterranean Center On Climate Change (Cmcc) Italy 13 Mr AGRAPIDIS Panagiotis Oss Greece 14 Ms AGRAPIDIS Sofia Rep Ec In Greece Greece 15 Mr AHMAD NAJIB Ahmad Fayas Liverpool John Moores University United Kingdom 16 Dr AIFANDOPOULOU Georgia Hellenic Institute Of Transport Greece 17 Mr AKHALADZE Mamuka Maritime Transport Agency Of The Moesd Of Georgia Georgia 18 Mr AKINGUNOLA Folorunsho Nigeria Merchant Navy Nigeria 19 Mr AKKANEN Mika City Of Turku Finland 20 Ms AL BAYSSARI Paty Blue Fleet Group Lebanon 21 Dr AL KINDI Mohammed Al Safina Marine Consultancy United Arab Emirates 22 Ms ALBUQUERQUE Karen Brazilian Confederation Of Agriculture And Livesto Belgium 23 Mr ALDMOUR Ammar Embassy Of Jordan Jordan 24 Mr ALEKSANDERSEN Øistein Nofir As Norway 25 Ms ALEVRIDOU Alexandra Euroconsultants S.A. Greece 26 Mr ALEXAKIS George Region Of Crete -

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

The Airline That Knows Greece Best We Are … AEGEAN

The airline that knows Greece best We are … AEGEAN Full service carrier, Greece’s ………. ………. largest airline focused on quality since 2008 services & efficiency We fly to ………. We own 61 aircraft ………. 145 destinations in 40 countries 7 times awarded Star Alliance ………. as Best Regional ………. member Airline in Europe since 2010 We are … AEGEAN Acquisition of ………. Olympic Air in ………. 6 hubs in Greece and 2013 1 in Cyprus Total coverage of all ………. Scheduled & charter, Greek destinations, ………. even in small islands short & medium haul (via Olympic Air) services in Europe & Middle East Timeline of key events, evolution of passenger traffic 2016 2015 Delivery of 7 14,0 6th time new aircraft awarded by A320ceo Skytrax 12,5 13,0 2011 2013 Intl traffic Olympic Air 11,6 2003 exceeds Acquired 12,0 First Year with domestic for Profits before Taxes 2007 the fist time Listing in Stock 11,0 Market, First 2010 10,2 2003 A320 2005 Aegean joins Low Cost Carriers Deliveries Lufthansa Star Alliance enter Greek Market 10,0 Agreement, 8,8 2001 Airbus A320 Merger with Order 9,0 Cronus, First Intl Olympic Flights 1999/2000 8,0 Air Greece 2002–2003 acquisition Olympic and Aegean sole competitors 6,6 6,5 6,2 6,1 7,0 5,9 May 1999 Domestic 5,2 6,0 Deregulation. Launch of Scheduled 4,5 Million of Passengers 5,0 Flights International 4,0 3,6 4,0 2,8 2,5 3,0 2,4 2,0 1,5 0,3 Domestic 1,0 0,0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 20164 2016 Report destinations available aircraft 61 145 16,2mil. -

University of the Aegean Shipping, Trade and Transport Department

University of the Aegean Shipping, Trade and Transport Department Georgia Tsitsou “High-speed rail and air transport competition: The case of Athens – Thessaloniki” 16/10/2019 Research Dissertation for the Master Program “Shipping, Trade and Transport Department – ΝΑΜΕ” Author: Georgia Tsitsou Supervisor: Seraphim Kapros Chios 1 Abstract This research dissertation analyses the potential of the high speed train to compete with the airline market. The context proposed is hypothetical, given that the high speed train alternative is not yet available on the route subject to research. In order to model passenger preferences relative to the characteristics of the alternatives, experimental design techniques are applied, which allow for the design of the market that will be evaluated by current airline passengers. Based upon the information collected, modal choices are analysed, estimating a logit model with both alternatives. Demand modelling allows us to predict the substitutability level of the high speed train in comparison with the plane for the city pair Athens – Thessaloniki and in reverse, for different types of traveler. The results obtained confirm that the high speed train will have an important impact on the airline market. The simulation of different policies related to service variables stresses the fact that this impact will mainly depend on the relation gender – price, age – time, occupancy – accuracy/ reliability and reasons for travelling – accuracy/ reliability. In contrast, in the city pair Thessaloniki – Athens, there is statistically significant correlation between gender and fewer stops or better connections and reason for travelling and price. Suggestions that were provided at the final part of the dissertation concentrate on gaining a better overview of passengers’ preference for each mode of transport and needs by conducting a respective research in train platforms. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

A Bold Move in the Right Direction After Years of Extreme EU- and IMF-Imposed Austerity, Greeks Gave a Meltdown Is a Haunting Outcome for the EU’S Political Elite

14 February 2015, Hellenic Voice Hellenic Voice, February 2015 15 Anti-Austerity Syriza Wins Big, But Editorial Viewpoint Is it on Collision Course With EU? By Daniel Politi_ It was a historic day in Greece on Election Day. The damning popular verdict on Europe’s response to financial A bold Move in the Right Direction After years of extreme EU- and IMF-imposed austerity, Greeks gave a meltdown is a haunting outcome for the EU’s political elite. For ew Prime Minister Alexis Tsipras has shown a bold initiative right from the getgo/ the Phanar’s Emissary in the US maybe reduced too as a result, perhaps through the good clear vote against that economic prescription for their ailing country. the first time, power has been handed to populist outsiders deeply same day of his swearing in by doing so without the presence of a cleric. This is offices of the new Prime minister as a breath of clean-and non-corrupt- air! There is hope for And while a victory for the leftist Syriza party was expected, the opposed to Brussels and Berlin, albeit not anti-European, unlike bound to have a tremendous impact nationwide-maybe worldwide too-limiting the your soul’s rest, O Archbishop Christodoulos of Greece! O Patriarch Petros of Alexandria! huge margin has come as a surprise. The two parties that have ruled their counterparts on the far right across the EU. For the first time Church’sN role and influence in the Governmental affairs. Moreover, the morbid influence of The time for the Evil’s retribution may have finally arrived! the country since the fall of the military junta in 1974 were reduced a child of the European crisis, an explicitly anti-austerity party will to mere spectators as the big question Sunday night was whether take office in the EU. -

Change 3, FAA Order 7340.2A Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.2A CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2A, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to the interested aviation public. 3. EFFECTIVE DATE. July 29, 2010. 4. EXPLANATION OF CHANGES. Changes, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. Y[fa\.Uj-Koef p^/2, Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: k/^///V/<+///0 Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 7/29/10 JO 7340.2A CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−2 . 4/8/10 CAM−1−1 through CAM−1−2 . 7/29/10 1−1−1 . 8/27/09 1−1−1 . 7/29/10 2−1−23 through 2−1−27 . 4/8/10 2−1−23 through 2−1−27 . 7/29/10 2−2−28 . 4/8/10 2−2−28 . 4/8/10 2−2−23 . -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Prior Compliance List of Aircraft Operators Specifying the Administering Member State for Each Aircraft Operator – June 2014

Prior compliance list of aircraft operators specifying the administering Member State for each aircraft operator – June 2014 Inclusion in the prior compliance list allows aircraft operators to know which Member State will most likely be attributed to them as their administering Member State so they can get in contact with the competent authority of that Member State to discuss the requirements and the next steps. Due to a number of reasons, and especially because a number of aircraft operators use services of management companies, some of those operators have not been identified in the latest update of the EEA- wide list of aircraft operators adopted on 5 February 2014. The present version of the prior compliance list includes those aircraft operators, which have submitted their fleet lists between December 2013 and January 2014. BELGIUM CRCO Identification no. Operator Name State of the Operator 31102 ACT AIRLINES TURKEY 7649 AIRBORNE EXPRESS UNITED STATES 33612 ALLIED AIR LIMITED NIGERIA 29424 ASTRAL AVIATION LTD KENYA 31416 AVIA TRAFFIC COMPANY TAJIKISTAN 30020 AVIASTAR-TU CO. RUSSIAN FEDERATION 40259 BRAVO CARGO UNITED ARAB EMIRATES 908 BRUSSELS AIRLINES BELGIUM 25996 CAIRO AVIATION EGYPT 4369 CAL CARGO AIRLINES ISRAEL 29517 CAPITAL AVTN SRVCS NETHERLANDS 39758 CHALLENGER AERO PHILIPPINES f11336 CORPORATE WINGS LLC UNITED STATES 32909 CRESAIR INC UNITED STATES 32432 EGYPTAIR CARGO EGYPT f12977 EXCELLENT INVESTMENT UNITED STATES LLC 32486 FAYARD ENTERPRISES UNITED STATES f11102 FedEx Express Corporate UNITED STATES Aviation 13457 Flying -

Koliadimitraloukiamsc2014.Pdf

ΣΧΟΛΗ ΕΠΙΣΤΗΜΩΝ ΔΙΟΙΚΗΣΗΣ ΕΠΙΧΕΙΡΗΣΕΩΝ ΤΜΗΜΑ ΛΟΓΙΣΤΙΚΗΣ ΚΑΙ ΧΡΗΜΑΤΟΟΙΚΟΝΟΜΙΚΗΣ ΠΡΟΓΡΑΜΜΑ ΜΕΤΑΠΤΥΧΙΑΚΩΝ ΣΠΟΥΔΩΝ ΣΤΗΝ ΣΤΡΑΤΗΓΙΚΗ ΔΙΟΙΚΗΤΙΚΗ ΛΟΓΙΣΤΙΚΗ ΚΑΙ ΧΡΗΜΑΤΟΟΙΚΟΝΟΜΙΚΗ ΔΙΟΙΚΗΣΗ Διπλωματική Εργασία «ΣΥΓΧΩΝΕΥΣΕΙΣ ΚΑΙ ΕΞΑΓΟΡΕΣ ΜΕΤΑΞΥ ΕΠΙΧΕΙΡΗΣΕΩΝ. ΜΕΛΕΤΗ ΠΕΡΙΠΤΩΣΗΣ ΕΞΑΓΟΡΑΣ ΕΠΙΧΕΙΡΗΣΕΩΣ OLYMPIC AIR ΑΠΟ ΤΗΝ AEGEAN.» της ΚΟΛΙΑ ΔΗΜΗΤΡΑΣ ΛΟΥΚΙΑΣ Επιβλέπων Καθηγητής: Παπαδόπουλος Συμεών Υποβλήθηκε ως απαιτούμενο για την απόκτηση του Μεταπτυχιακού Διπλώματος στην Στρατηγική Διοικητική Λογιστική και Χρηματοοικονομική Διοίκηση Νοέμβριος 2014 1 Περιεχόμενα Πρόλογος ................................................................................................................................... 4 Μέρος Πρώτο : Θεωρητική Προσέγγιση Συγχωνεύσεων και Εξαγορών ................................... 7 Ορισμός εννοιών συγχωνεύσεις και εξαγορές ..................................................................... 7 Εξέλιξη Συγχωνεύσεων και Εξαγορών................................................................................... 8 Μέθοδοι Συγχωνεύσεων και Εξαγορών .............................................................................. 13 Κίνητρα συγχωνεύσεων και εξαγορών ................................................................................ 17 Κίνητρα Σ&Ε σε περιόδους χρηματοοικονομικών κρίσεων . .......................................... 30 Στάδια Συγχωνεύσεων και Εξαγορών ................................................................................. 34 Έρευνα ............................................................................................................................