Aclaris Therapeutics Research & Development Day September 27

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Study Protocol: Amendment 3

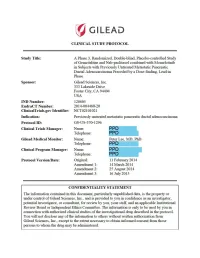

(!') GILEAU CLINICAL STUDY PROTOCOL Study Title: A Phase 3, Randomized, Double-blind, Placebo-controlled Study of Gemcitabine and Nab-paclitaxel combined with Momelotinib in Subjects with Previously Unu·eated Metastatic Pancreatic Ductal Adenocarcinoma Preceded by a Dose-fmding, Lead-in Phase Sponsor: Gilead Sciences, Inc. 333 Lakeside Drive Foster City, CA 94404 USA IND Number: 120605 EudraCT Number: 2014-004480-20 ClinicalTrials.gov Identifier: NCT021 01021 Indication: Previously unu·eated metastatic pancreatic ductal adenocarcinoma Protocol ID: GS-US-370-1296 Clinical Trials Manager: Name: PPD Telephone: PPD Gilead Medical Monitor: Name: Peter Lee, MD, PhD Telephone: PPD Clinical Program Manager: Name: PPD Telephone: PPD Protocol Version/Date: Original: 11 Febmary 2014 Amendment 1: 14 March 2014 Amendment 2: 25 August 2014 Amendment 3: 16 July 2015 CONFIDENTIALITY STATEMENT The inf01mation contained in this document, pruiicularly unpublished data, is the prope1iy or under conu·ol of Gilead Sciences, Inc., and is provided to you in confidence as an investigator, potential investigator, or consultant, for review by you, your staff, and an applicable Institutional Review Board or Independent Ethics Committee. The infonnation is only to be used by you in connection with authorized clinical studies of the investigational dmg described in the protocol. You will not disclose any of the infonnation to others without written authorization from Gilead Sciences, Inc., except to the extent necessa1y to obtain infonned consent from those persons -

Abstract Supplement

2018 ABSTRACT SUPPLEMENT SAN FRANCISCO June 20-23 • Marriott Marquis Federation of Clinical Immunology Societies June 20-23, 2018 San Francisco, California FOCIS 2018 Abstract Supplement TABLE OF CONTENTS Abstracts by Subject Area …………………………………………………………...……………………………….2 Allergy/asthma ……………………………………………………………………………………………………...2 Autoimmune neurologic diseases .............................................................................................................. 7 Autoimmune rheumatologic diseases ...................................................................................................... 19 Bone marrow or stem cell transplantation ............................................................................................... 37 Cytokines/chemokines ............................................................................................................................ 42 Diabetes and other autoimmune endocrine diseases .............................................................................. 47 General Autoimmunity…………………………………………………………………………………………….58 Genetics .................................................................................................................................................. 70 Immune monitoring .................................................................................................................................. 74 Immunity & infection ................................................................................................................................ 82 Immunodeficiency: -

Granulocyte Colony-Stimulating Factor (G-CSF)

British Journal of Cancer (1999) 80(1/2), 229–235 © 1999 Cancer Research Campaign Article no. bjoc.1998.0344 Granulocyte colony-stimulating factor (G-CSF) transiently suppresses mitogen-stimulated T-cell proliferative response E Reyes1, I García-Castro2, F Esquivel1, J Hornedo2, H Cortes-Funes2, J Solovera3 and M Alvarez-Mon1 1Medicine/Immune System Diseases Oncology Service, Department of Medicine ‘Principe de Asturias’ University Hospital, Alcalá University, Carretera Madrid- Barcelona, Km 33.600, 28871 Alcalá de Henares, Madrid, Spain; 2Medical Oncology Department, ‘12 de Octubre’ University Hospital, Madrid, Spain; 3Amgen, S.A. Barcelona, Spain Summary Granulocyte colony-stimulation factor (G-CSF) is a cytokine that selectively promotes growth and maturation of neutrophils and may modulate the cytokine response to inflammatory stimuli. The purpose of this study was to examine the effect of G-CSF on ex vivo peripheral blood mononuclear cell (PBMC) functions. Ten patients with breast cancer were included in a clinical trial in which r-metHuG-CSF was administrered daily for 5 days to mobilize peripheral blood stem cells. Ten healthy women were also included as controls. Our data show that G-CSF treatment induces an increase in peripheral blood leucocyte, neutrophil, lymphocyte and monocyte counts. We have found a modulation in the percentages of CD19+, CD45+CD14+, CD4+CD45RA+ and CD4+CD45RO+ cells in PBMC fractions during G-CSF treatment. We have also found a significant reduction in the proliferative response of PBMC to mitogenic stimulation that reverted 14 days after the fifth and the last dose of G-CSF. Furthermore, it was not associated with significant changes in the pattern of cytokine production. -

Cytokines As Cellular Pathophysiology of Many Diseases

Review Mediators of Inflammation, 5, 417-423 (1996) CYTOKINES and their receptors are involved in the Cytokines as cellular pathophysiology of many diseases. Here we pre- sent a detailed review on cytokines, receptors and communicators signalling routes, and show that one important lesson from cytokine biology is the complex and diverse regulation of cytokine activity. The activ- cA ity of cytokines is controlled at the level of trans- R. Debets and H. F. J. Savelkoul cription, translation, storage, processing, post- translational modification, trapping, binding by soluble proteins, and receptor number and/or Department of Immunology, Erasmus University, function. Translation of this diverse regulation in P.O. Box 1738, 3000 DR Rotterdam, The Netherlands strategies aimed at the control of cytokine activity will result in the development of more specific and selective drugs to treat diseases. CACorresponding Author Key words: Control of activity, Cytokine, Interference in cytokine activity, Receptor, Signalling routes Introduction lation and act locally to restore homeostasis. Cytokines bind with high affinity to specific For over two decades, it has been recognized receptors on the surface of target cells. When that immune-competent cells produce peptide cytokine receptors are expressed on the cyto- mediators, now termed cytokines. Cytokines act kine-producing cell, autocrine cellular activation as chemical communicators between cells, but may be the result. If the receptor is expressed mostly not as effector molecules in their own on a neighbouring cell, binding may result in right. The biological function of many cytokines paracrine cytokine activation. These features is mediated through their ability to regulate could explain the sometimes high local concen- gene expression in target cells. -

Following High-Dose Chemotherapy and Autologous Bone Marrow Transplantation

Bone Marrow Transplantation, (1997) 19, 315–322 1997 Stockton Press All rights reserved 0268–3369/97 $12.00 A phase I trial of recombinant human interleukin-1b (OCT-43) following high-dose chemotherapy and autologous bone marrow transplantation M Elkordy, M Crump, JJ Vredenburgh, WP Petros, A Hussein, P Rubin, M Ross, C Gilbert, C Modlin, B Meisenberg, D Coniglio, J Rabinowitz, M Laughlin, J Kurtzberg and WP Peters Duke University, Bone Marrow Transplant Program, Durham, NC, USA Summary: The use of lineage-specific hematopoietic growth factors such as GM-CSF and G-CSF shortens the duration of neu- We studied the effects of escalating doses of recombi- tropenia following high-dose chemotherapy and ABMT.1–3 nant human IL-1b in patients receiving high-dose Recently with molecular cloning much interest has emerged chemotherapy and ABMT for metastatic breast cancer in the use of growth factors, which have multilineage pro- or malignant melanoma. Sixteen patients received IL- liferative effects, to shorten the duration of neutropenia and 1b, 4 to 32 ng/kg/day administered subcutaneously for platelet transfusion-dependence and to decrease the number 7 days beginning 3 h after bone marrow infusion. Three of red blood cell transfusions.4 patients at the highest dose level also received G-CSF IL-1b is a polypeptide which exerts effects on hemato- following completion of IL-1b. All patients completed poiesis through several mechanisms, and produces a broad the 7 days of therapy. The majority of patients experi- spectrum of metabolic, immunologic and inflammatory enced chills and fever following one or more injections, effects.5,6 In addition to having a direct stimulatory effect and seven had severe pain at the injection site. -

The Immunomodulatory Impact of Multipotential Stromal Cells on Monocytes in Healthy People and Patients with Rheumatoid Arthritis

The immunomodulatory impact of multipotential stromal cells on monocytes in healthy people and patients with rheumatoid arthritis Priyanka Dutta Submitted in accordance with the requirements for the degree of Doctor of Philosophy The University of Leeds Faculty of Medicine and Health School of Medicine September 2020 Primary Supervisor: Professor Michael McDermott Secondary Supervisor: Dr Elena Jones Secondary Supervisor: Professor Graham Cook The candidate confirms that the work submitted is her own work and that appropriate credit has been given where reference has been made to the work of others. This copy has been supplied on the understanding that it is copyright material and no quotation from the thesis may be published without proper acknowledgement. The right of Priyanka Dutta to be identified as Author of this work has been asserted by her in accordance with the Copyright, Designs and Patents Act 1988. i Acknowledgements I would like to express my deep gratitude to my supervisors Professor Michael McDermott, Dr Elena Jones and Professor Graham Cook for providing me with this opportunity. Thank you for all your understanding, guidance and immense support inside and outside of the lab. Thanks for sharing your knowledge and ideas to support this PhD work, most of all thank you for your patience. Also, thanks to Chi Wong, Rekha Parmar, Adam Davidson and Elizabeth Straszynski for their great support in the lab, as well as the staff and patients at Chapel Allerton Hospital for providing patient samples. Thank you to Professor Paul Genever for providing the Y201 and Y202 MSC immortalised cell lines and to Dr Andreia Riberio and Professor Rhodri for their expert advice on optimisation of the whole blood assay. -

(12) Patent Application Publication (10) Pub. No.: US 2013/0237439 A1 Stolen Et Al

US 2013 02374.39A1 (19) United States (12) Patent Application Publication (10) Pub. No.: US 2013/0237439 A1 Stolen et al. (43) Pub. Date: Sep. 12, 2013 (54) SYSTEMIS AND METHODS USING Publication Classification BOMARKERPANEL, DATA (71) Applicants: Craig M. Stolen, New Brighton, MN (51) Int. Cl. (US); Timothy E. Meyer, North Oaks, GOIN33/68 (2006.01) MN (US); Milan Seth, Minneapolis, MN (52) U.S. Cl. (US); Francis G. Spinale, Blythewood, CPC .................................. G0IN33/6893 (2013.01) SC (US); Nicholas David Wold, Arden USPC .............................................. 506/9; 435/7.92 Hills, MN (US) (72) Inventors: Craig M. Stolen, New Brighton, MN (US); Timothy E. Meyer, North Oaks, (57) ABSTRACT MN (US); Milan Seth, Minneapolis, MN (US); Francis G. Spinale, Blythewood, SC (US); Nicholas David Wold, Arden Embodiments of the disclosure are related to systems and Hills, MN (US) methods for utilizing biomarker panel data with respect to (73) Assignees: MEDICAL UNIVERSITY OF medical devices and methods, amongst other things. In an SOUTH CAROLINA, CHARLESTON, embodiment, the disclosure can include a method of predict SC (US); CARDIAC PACEMAKERS, ing the likelihood of response to CRT therapy. The method INC., ST. PAUL, MN (US) can include quantifying levels of one or more biomarkers in a (21) Appl. No.: 13/756,129 biological sample of a patient, analyzing the quantified levels to determine response to CRT therapy, wherein a panel of (22) Filed: Jan. 31, 2013 biomarkers includes at least two selected from the group Related U.S. Application Data consisting of CRP, SGP-130, SIL-2R, STNFR-II, IFNg, BNP (60) Provisional application No. -

Cytokine Signaling in Multiple Sclerosis and Its Therapeutic Applications

Review Cytokine Signaling in Multiple Sclerosis and Its Therapeutic Applications Pushpalatha Palle 1,2,†, Kelly L. Monaghan 1,2,†, Sarah M. Milne 1,2 and Edwin C.K. Wan 1,2,* 1 Department of Microbiology, Immunology, and Cell Biology, West Virginia University School of Medicine, Morgantown, WV 26506, USA; [email protected] (P.P.); [email protected] (K.L.M.); [email protected] (S.M.M.) 2 Center for Basic and Translational Stroke Research and the Center for Neurodegenerative Diseases, Blanchette Rockefeller Neurosciences Institute, West Virginia University School of Medicine, Morgantown, WV 26506, USA * Correspondence: [email protected]; Tel.: +1‐304‐263‐6293; Fax: +1‐304‐293‐7823 † These authors contributed equally to this work. Received: 22 August 2017; Accepted: 11 October 2017; Published: 13 October 2017 Abstract: Multiple sclerosis (MS) is one of the most common neurological disorders in young adults. The etiology of MS is not known but it is widely accepted that it is autoimmune in nature. Disease onset is believed to be initiated by the activation of CD4+ T cells that target autoantigens of the central nervous system (CNS) and their infiltration into the CNS, followed by the expansion of local and infiltrated peripheral effector myeloid cells that create an inflammatory milieu within the CNS, which ultimately lead to tissue damage and demyelination. Clinical studies have shown that progression of MS correlates with the abnormal expression of certain cytokines. The use of experimental autoimmune encephalomyelitis (EAE) model further delineates the role of these cytokines in neuroinflammation and the therapeutic potential of manipulating their biological activity in vivo. -

An Emerging Role for the Anti-Inflammatory Cytokine

Tsai et al. Journal of Biomedical Science 2013, 20:40 http://www.jbiomedsci.com/content/20/1/40 REVIEW Open Access An emerging role for the anti-inflammatory cytokine interleukin-10 in dengue virus infection Tsung-Ting Tsai1,2, Yi-Jui Chuang2,3, Yee-Shin Lin1,3,4, Shu-Wen Wan3,4, Chia-Ling Chen3,4 and Chiou-Feng Lin1,2,3,4* Abstract Infection with dengue virus (DENV) causes both mild dengue fever and severe dengue diseases, such as dengue hemorrhagic fever and dengue shock syndrome. The pathogenic mechanisms for DENV are complicated, involving viral cytotoxicity, immunopathogenesis, autoimmunity, and underlying host diseases. Viral load correlates with disease severity, while the antibody-dependent enhancement of infection largely determines the secondary effects of DENV infection. Epidemiological and experimental studies have revealed an association between the plasma levels of interleukin (IL)-10, which is the master anti-inflammatory cytokine, and disease severity in patients with DENV infection. Based on current knowledge of IL-10-mediated immune regulation during infection, researchers speculate an emerging role for IL-10 in clinical disease prognosis and dengue pathogenesis. However, the regulation of dengue pathogenesis has not been fully elucidated. This review article discusses the regulation and implications of IL-10 in DENV infection. For future strategies against DENV infection, manipulating IL-10 may be an effective antiviral treatment in addition to the development of a safe dengue vaccine. Keywords: DENV, Antibody-dependent -

Hematologie 2021 POST-ASH

ONLINE 21. PRAŽSKÉ HEMATOLOGICKÉ DNY Hematologie 2021 POST-ASH KAM NÁS POSOUVÁ TO NEJLEPŠÍ Z LOŇSKÉ SVĚTOVÉ HEMATOLOGIE 28. – 29. 1. 2021 Clarion Congress Hotel Prague (Freyova 33, Praha 9 – Vysočany) PROGRAM KONFERENCE A SBORNÍK ABSTRAKTŮ 21. PRAŽSKÉ HEMATOLOGICKÉ DNY ONLINE Hematologie 2021 28. – 29. 1. 2021 OBSAH 2 POST-ASH OBSAH 2 ÚVODNÍ SLOVO 3 DŮLEŽITÉ INFORMACE 4 SCHÉMA ODBORNÉHO PROGRAMU 6 PODROBNÝ PROGRAM KONFERENCE 7 POSTEROVÁ SEKCE 11 OŠETŘOVATELSKÝ PROGRAM 16 SATELITNÍ SYMPOZIA 18 SBORNÍK ABSTRAKTŮ 25 ABECEDNÍ REJSTŘÍK AUTORŮ 119 PŘEHLED PARTNERŮ A VYSTAVOVATELŮ 122 21. PRAŽSKÉ HEMATOLOGICKÉ DNY ONLINE Hematologie 2021 28. – 29. 1. 2021 ÚVODNÍ SLOVO 3 POST-ASH Vážené kolegyně, vážení kolegové, milí hosté 21 pražských hematologických dnů-HEMATOLOGIE 2021, loni jsme na 20 pražských hematologických dnech zahájili novou tradici, kterou účastníci velmi přivítali: uspořádat konferenci na začátku roku a reflektovat při nich to nejlepší, co se v našem oboru odehrálo na loňských světových kongresech Jsou to především ASH a EHA, ale i více specializované konference I když celý loňský rok poznamenala pandemie, bylo nám celou dobu jasné, že úspěšnou tradici nesmíme přerušit Optimisté v našich řadách doufali, že se podaří uspořádat konferenci v klasickém formátu, nicméně připravovali jsme paralelně všechny varianty Nakonec zvítězila varianta výhradně online Podobně jako našim dětem chybí interakce se spolužáky, i my budeme postrádat milá setkání s kolegy, hovory ve frontě na kávu, diskusi v přednáškových sálech i chutný štrůdl v hotelu -

Effects of Biological Therapies on Molecular Features of Rheumatoid

International Journal of Molecular Sciences Review Effects of Biological Therapies on Molecular Features of Rheumatoid Arthritis , Chary Lopez-Pedrera * y , Nuria Barbarroja y, Alejandra M. Patiño-Trives, Maria Luque-Tévar, Eduardo Collantes-Estevez , Alejandro Escudero-Contreras z and Carlos Pérez-Sánchez z Rheumatology Service, Reina Sofia Hospital, Maimonides Institute for Research in Biomedicine of Cordoba (IMIBIC), University of Cordoba, E-14004 Córdoba, Spain; [email protected] (N.B.); [email protected] (A.M.P.-T.); [email protected] (M.L.-T.); [email protected] (E.C.-E.); [email protected] (A.E.-C.); [email protected] (C.P.-S.) * Correspondence: [email protected] or [email protected]; Tel.: +34-957-213-795 These authors shared first authorship. y These authors shared last authorship. z Received: 31 October 2020; Accepted: 27 November 2020; Published: 28 November 2020 Abstract: Rheumatoid arthritis (RA) is an autoimmune and chronic inflammatory disease primarily affecting the joints, and closely related to specific autoantibodies that mostly target modified self-epitopes. Relevant findings in the field of RA pathogenesis have been described. In particular, new insights come from studies on synovial fibroblasts and cells belonging to the innate and adaptive immune system, which documented the aberrant production of inflammatory mediators, oxidative stress and NETosis, along with relevant alterations of the genome and on the regulatory epigenetic mechanisms. In recent years, the advances in the understanding of RA pathogenesis by identifying key cells and cytokines allowed the development of new targeted disease-modifying antirheumatic drugs (DMARDs). These drugs considerably improved treatment outcomes for the majority of patients. -

WO 2013/179143 A2 5 December 2013 (05.12.2013) P O P C T

(12) INTERNATIONAL APPLICATION PUBLISHED UNDER THE PATENT COOPERATION TREATY (PCT) (19) World Intellectual Property Organization International Bureau (10) International Publication Number (43) International Publication Date WO 2013/179143 A2 5 December 2013 (05.12.2013) P O P C T (51) International Patent Classification: (81) Designated States (unless otherwise indicated, for every A61M 1/36 (2006.01) A61K 38/19 (2006.01) kind of national protection available): AE, AG, AL, AM, C07K 16/28 (2006.01) A61M 1/34 (2006.01) AO, AT, AU, AZ, BA, BB, BG, BH, BN, BR, BW, BY, A61P 35/00 (2006.01) BZ, CA, CH, CL, CN, CO, CR, CU, CZ, DE, DK, DM, DO, DZ, EC, EE, EG, ES, FI, GB, GD, GE, GH, GM, GT, (21) International Application Number: HN, HR, HU, ID, IL, IN, IS, JP, KE, KG, KN, KP, KR, PCT/IB2013/001583 KZ, LA, LC, LK, LR, LS, LT, LU, LY, MA, MD, ME, (22) International Filing Date: MG, MK, MN, MW, MX, MY, MZ, NA, NG, NI, NO, NZ, 3 1 May 2013 (3 1.05.2013) OM, PA, PE, PG, PH, PL, PT, QA, RO, RS, RU, RW, SC, SD, SE, SG, SK, SL, SM, ST, SV, SY, TH, TJ, TM, TN, (25) Filing Language: English TR, TT, TZ, UA, UG, US, UZ, VC, VN, ZA, ZM, ZW. (26) Publication Language: English (84) Designated States (unless otherwise indicated, for every (30) Priority Data: kind of regional protection available): ARIPO (BW, GH, PCT/EP20 12/002340 1 June 2012 (01 .06.2012) EP GM, KE, LR, LS, MW, MZ, NA, RW, SD, SL, SZ, TZ, 12196527.