View Inventorisation Report on E-Waste 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

September 04, 2017 DIXON TECHNOLOGIES (INDIA) LIMITED

DIXON TECHNOLOGIES (INDIA) LIMITED September 04, 2017 SMC Ranking (3/5) About the Company Issue Highlights Incorporated in 1993, Dixon Technologies is engaged in manufacturing products in the Industry Consumer Durable consumer durables, lighting and mobile phones markets. The product portfolio of the Total Issue (Shares) - Offer for sale 3,053,675 company includes (i) Consumer electronics like LED TVs (ii) Home appliances like washing Total Issue (Shares) - Fresh Issue 339,750 machines (iii) Lighting products like LED bulb, tube lights, CFL bulbs etc. and (iv) Mobile Net Offer to the Public 3,393,425 phones. Dixon manufacture products for popular retail brands including Panasonic, Issue Size (Rs. Cr.) 597-600 Price Band (Rs.) 1760-1766 Philips, Haier, Gionee, Surya Roshni, Reliance Retail, Intex Technologies, Mitashi and Offer Date 6-Sep-16 Dish. The company is also a leading Original Design Manufacturer (ODM) in India. The Close Date 8-Sep-16 Company develops and designs products in-house at its R&D facility. The ODM business Face Value 10 contributes over 25% of its revenue. The company has six manufacturing facilities located Lot Size 8 Per Equity Share in the states of Uttar Pradesh and Uttarakhand. Issue Composition In shares Total Issue for Sale 3,393,425 QIB 1,696,713 NIB 509,014 Retail 1,187,699 Shareholding Pattern (%) Competitive Strengths Particulars Pre-issue Post -issue Promoters & promoters group 46.20% 39.21% Leading market position in key verticals: The Company believes that its experience in QIB 28.53% 25.51% manufacturing, successful backward integration and design capabilities, strong NIB 4.35% 4.49% relationships with its global suppliers and anchor customers have helped the company to Retail 20.92% 30.78% Total 100.00% 100.00% achieve leading position in its key verticals. -

Standard-Essential Patents: the International Landscape

Intellectual Property Committee │ ABA Section of Antitrust Law Spring 2014 Standard-Essential Patents: The International Landscape Koren W. Wong-Ervin* Federal Trade Commission Investigations and litigation involving standard-essential patents (SEPs) have begun to spring up around the globe. On April 29, 2014, the European Commission (EC) confirmed that it adopted two decisions, one involving Samsung Electronics Co., Ltd. and the other involving Motorola Mobility Inc. (MMI), that for the first time in the European Union (EU), establish a framework for determining whether and under what circumstances patent owners seeking to enforce SEPs in the European Economic Area (EEA) may violate EU antitrust laws. Both decisions create a “safe harbor” approach from injunctive relief, under which implementers can demonstrate that they are a “willing licensee” by agreeing that a court or a mutually agreed arbitrator shall adjudicate the fair, reasonable and non-discriminatory (FRAND) terms in the event that negotiations fail. The decisions do not preclude injunctive relief for FRAND-encumbered SEPs per se, nor do they make findings on the definition of a “willing licensee” outside the safe harbor.1 While the EC’s approach is similar to the approach taken by the U.S. Federal Trade Commission (FTC) in MMI/Google, there are differences. For example, the EC’s decisions preclude injunctions only in the EEA, and only on patents granted in the EEA, whereas the FTC’s consent decree in MMI/Google covers patents issued or pending in the United States or anywhere else in the world. In China, in April 2014, the Guangdong People’s Court made public two decisions in Huawei v. -

Media Times December 2016

MEDIA TIMES ﻮر य ﯽ اﻟﻨ गम ﻟ ोत ﺖ ا ﻤ ٰ ा ﻠ ﻈ म ﻟ ो ا ﻦ स ﻣ म त U N IR IV M ER H SITY OF KAS MEDIA EDUCATION RESEARCH CENTRE UNIVERSITY OF KASHMIR JOURNAL ISS No. 0975/6647 | Vol: 26 | No 1 MEDIA TIMES | DECEMBER 2016 MEDIA TIMES DECEMBER 2016 06 | Flashfloods And Unity 37 | A Trip To Kousarnag Arif Nazir Danish Pathan 08 | Nanny Care 39 | Rejected By Society, Humaira Ahad Forgotten By Govt Hayat Manan 10 | Lost Aroma 41 Hirra Azmat | Heaven, On The Verge Of Destruction 11 | Ladies Feeling Special Bintul Huda Shahina Rahim 42 | Women in Advertising 12 | Kashmir’s Karate Kid B.M. Hussain Abid Rashid 44 | Restoring Remains 14 | Land of Kings Imran Ali Buth Hasina Jamiel 46 | Mental Conflicts And Creativity 18 | Historical Remains Mu’azzam Bhat of Islamia School Furqan Khushid 48 | Travelling In A Local Bus! Munawar Hussain 20 | Forgotten Boxer Adil Amin 49 | Foodlog Muneem Farooq 22 | A Night In The Mourning Village 51 | How to Shed Procrastination Syed Shahriyar Muhammad Nadeem 23 | Kargil’s State of Education 52 Zakir Hussain | Being Divorcee is Not a Taboo Saba Gul 24 | Boulevard’s French Bakery Ikhlaq ul Rehman 54 | Restructuring Links Saba Khan 26 | From Despair To Hope Peer Viqar 56 | Women with Unmatched 27 | Spreading Smiles Resilience Sabeeha Shaheen Ali Saiffuiddin 58 | Trending Is What? 28 | KOH-E-MARAN History Saher Iqbal Revisited Ubeer Naqushbandi 59 | Ignored Manasbal Lake Showket Wani 30 | Life and Times of a Nomad Yawar Shafi 61 | A Day With Educated Labour Wajahat Shabir 32 | Symbol of Communal Unity Sheikh Adnan 62 | -

The Occupied Clinic Militarism and Care in Kashmir / Saiba Varma the OCCUPIED CLINIC the Occupied Clinic

The Occupied Clinic Militarism and Care in Kashmir / Saiba Varma THE OCCUPIED CLINIC The Occupied Clinic Militarism and Care in Kashmir • SAIBA VARMA DUKE UNIVERSITY PRESS DURHAM AND LONDON 2020 © 2020 Duke University Press All rights reserved Printed in the United States of America on acid- free paper ∞ Text design by Amy Ruth Buchanan Cover design by Courtney Leigh Richardson Typeset in Portrait by Copperline Book Services Library of Congress Cataloging- in- Publication Data Names: Varma, Saiba, [date] author. Title: The occupied clinic : militarism and care in Kashmir / Saiba Varma. Description: Durham : Duke University Press, 2020. | Includes bibliographical references and index. Identifiers:lccn 2019058232 (print) | lccn 2019058233 (ebook) isbn 9781478009924 (hardcover) isbn 9781478010982 (paperback) isbn 9781478012511 (ebook) Subjects: lcsh: Psychiatric clinics—India—Jammu and Kashmir. | War victims—Mental health—India—Jammu and Kashmir. | War victims—Mental health services— India—Jammu and Kashmir. | Civil-military relations— India—Jammu and Kashmir. | Military occupation— Psychological aspects. Classification:lcc rc451.i42 j36 2020 (print) | lcc rc451.i42 (ebook) | ddc 362.2/109546—dc23 lc record available at https://lccn.loc.gov/2019058232 isbn ebook record available at https://lccn.loc.gov/2019058233 Duke University Press gratefully acknowledges the Office of Vice Chancellor for Research at the University of California, San Diego, which provided funds toward the publication of this book. Cover art: Untitled, from The Depth of a Scar series. © Faisal Magray. Courtesy of the artist. For Nani, who always knew how to put the world back together CONTENTS MAP viii NOTE ON TRANSLITERATION ix ACKNOWLEDGMENTS xi LETTER TO NO ONE xv INTRODUCTION. Care 1 CHAPTER 1. -

Dixon Technologies (India) Limited Corporate Presentation

Dixon Technologies (India) Limited Corporate Presentation October 2017 Company Overview Dixon Technologies (India) Limited Corporate Presentation 2 Dixon Overview – Largest Home Grown Design-Focused Products & Solutions Company Business overview Engaged in manufacturing of products in the consumer durables, lighting and mobile phones markets in India. Company also provide solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels Fully integrated end-to-end product and solution suite to original equipment manufacturers (“OEMs”) ranging from global sourcing, manufacturing, quality testing and packaging to logistics Diversified product portfolio: LED TVs, washing machine, lighting products (LED bulbs &tubelights, downlighters and CFL bulbs) and mobile phones Leading Market position1: Leading manufacturer of FPD TVs (50.4%), washing machines (42.6%) and CFL and LED lights (38.9%) Founders: 20+ years of experience; Mr Sunil Vachani has been awarded “Man of Electronics” by CEAMA in 2015 Manufacturing Facilities: 6 state-of-the-art manufacturing units in Noida and Dehradun; accredited with quality and environmental management systems certificates Backward integration & global sourcing: In-house capabilities for panel assembly, PCB assembly, wound components, sheet metal and plastic moulding R&D capabilities: Leading original design manufacturer (“ODM”) of lighting products, LED TVs and semi-automatic washing machines Financial Snapshot: Revenue, EBITDA and PAT has grown at -

IBEF Presentation

CONSUMER DURABLES For updated information, please visit www.ibef.org January 2020 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……..4 Market Overview …………………….……..6 Recent Trends and Strategies …………..15 Growth Drivers……………………............18 Opportunities…….……….......……………23 Industry Associations…….……......……...27 Useful Information……….......…………….29 EXECUTIVE SUMMARY . Indian appliance and consumer electronics market stood at Rs Indian Appliance and Consumer Electronics Industry (US$ 76,400 crore (US$ 10.93 billion) in 2019. billion) 30 . It is expected to increase at a 9 per cent CAGR to reach Rs 3.15 CAGR 11.7% trillion (US$ 48.37 billion) in 2022. 20 21.18 . According to the retail chains and brands, there is 9-12 per cent 10 10.93 increase in the sales of consumer electronics in Diwali season in 0 October 2019. 2018 2025F . Electronics hardware production in the country increased from Rs 1.90 trillion (US$ 31.13 billion) in FY14 to Rs 3.88 trillion (US$ 60.13 Electronics Hardware Production in India (US$ billion) billion) in FY18. Demand for electronics hardware in India is 80 expected to reach US$ 400 billion by FY24*. CAGR 26.7% 60 . Consumer durable exports reached US$ 362.12 million in 2018. 40 Consumer electronics exports from India reached US$ 451.29 million 60.13 20 in FY19. 31.13 0 . Television industry in India is estimated to have reached Rs 740 FY14 FY18 billion (US$ 10.59 billion) in CY2018 and projected to reach Rs 955 billion (US$ 13.66 billion) in CY2021. Television Market in India (US$ billion) . ByY F 22, television industry in India is estimated to reach Rs 15 CAGR 9.8% 1,227.34 billion (US$ 17.56 billion). -

NW-49 Final FSR Jhelum Report

FEASIBILITY REPORT ON DETAILED HYDROGRAPHIC SURVEY IN JHELUM RIVER (110.27 KM) FROM WULAR LAKE TO DANGPORA VILLAGE (REGION-I, NW- 49) Submitted To INLAND WATERWAYS AUTHORITY OF INDIA A-13, Sector-1, NOIDA DIST-Gautam Buddha Nagar UTTAR PRADESH PIN- 201 301(UP) Email: [email protected] Web: www.iwai.nic.in Submitted By TOJO VIKAS INTERNATIONAL PVT LTD Plot No.4, 1st Floor, Mehrauli Road New Delhi-110074, Tel: +91-11-46739200/217 Fax: +91-11-26852633 Email: [email protected] Web: www.tojovikas.com VOLUME – I MAIN REPORT First Survey: 9 Jan to 5 May 2017 Revised Survey: 2 Dec 2017 to 25 Dec 2017 ACKNOWLEDGEMENT Tojo Vikas International Pvt. Ltd. (TVIPL) express their gratitude to Mrs. Nutan Guha Biswas, IAS, Chairperson, for sparing their valuable time and guidance for completing this Project of "Detailed Hydrographic Survey in Ravi River." We would also like to thanks Shri Pravir Pandey, Vice-Chairman (IA&AS), Shri Alok Ranjan, Member (Finance) and Shri S.K.Gangwar, Member (Technical). TVIPL would also like to thank Irrigation & Flood control Department of Srinagar for providing the data utilised in this report. TVIPL wishes to express their gratitude to Shri S.V.K. Reddy Chief Engineer-I, Cdr. P.K. Srivastava, Ex-Hydrographic Chief, IWAI for his guidance and inspiration for this project. We would also like to thank Shri Rajiv Singhal, A.H.S. for invaluable support and suggestions provided throughout the survey period. TVIPL is pleased to place on record their sincere thanks to other staff and officers of IWAI for their excellent support and co-operation through out the survey period. -

A Review of Indian Mobile Phone Sector

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 20, Issue 2. Ver. II (February. 2018), PP 08-17 www.iosrjournals.org A Review of Indian Mobile Phone Sector Akash C.Mathapati, Dr.K Vidyavati Assistant Professor, Department of Management Studies, Dr.P G Halakatti College of Engineering, Vijayapura Professor, MBA Department, Sahyadri College of Engineering & Management, Mangaluru Corresponding Author: Akash C.Mathapati, Abstract: The Paper Has Attempted To Understand The Indian Mobile Handset Overview, Market Size, Competitive Landscape With Some Of The Category Data. Also Some Relevant Studies On Indian Mobile Handset And Its Global Comparison Have Been Focused With The Impact On Economy And Society. Keywords: India, Mobile handsets, market size, Global Comparisons, GSM --------------------------------------------------------------------------------------------------------------------------------------- Date of Submission: 15-01-2018 Date of acceptance: 09-02-2018 ------------------------------------------------------------------------------------------------------------------------------------- I. Introduction India is currently the 2nd second-largest telecom market and has registered strong growth in the past decade and a half. The Indian mobile economy is growing quickly and will contribute extensively to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in association with the “Boston Consulting Group” (BCG). The direct and reformist strategies of the GoI have been instrumental alongside solid customer request in the quick development in the Indian telecom division. The administration has empowered simple market section to telecom gear and a proactive administrative and reasonable structure that has guaranteed openness of telecom administrations to the customer at sensible costs. The deregulation of "Outside Direct Investment" (FDI) standards has made the segment one of the top developing and a main 5 business opportunity maker in the nation. -

Claudia Tapia, Director IPR Policy at the Ericsson

DT: a new technological and economic paradigm Dr Claudia Tapia, Director IPR Policy All views expressed in this speech are those of the author and do not necessarily represent the views of Ericsson Ericsson at a glance NETWORKS IT MEDIA INDUSTRIES Create one network for Transform IT to accelerate Delight the TV Connect industries to a million different needs business agility consumer every day accelerate performance Worldwide mobile 42,000 Patents 40% traffic provided by 222,6 B. SEK Net Sales our networks R&D Employees Licensing Countries with 23,700 >100 agreements 180 customers Average p.a. Licensing revenues Employees 5 B. usd in R&D 10 b. Sek 111,000 Page 2 415,000,000,000 Page 3 STANDARDISATION PROCESS Early Technical Unapproved contribution investment (described in R&D in a patent) Adopted by Standard FRAND CONSENSUS in essential commitment standard patent Return on Access to the investment standard Interoperable high performance devices at a FRAND = Fair, Reasonable and Non- reasonable price DiscriminatoryPage 4 (terms and conditions) 4,000,000,000,000 Page 5 3,452,040 Page 6 3G and LTE (3GPP - 1999 – Dec. 2014 ) 262,773 Submitted contributions 43,917 Approved contributions (16,7%) Source: Signals Research Group. The Essentials of IP, from 3G through LTE Release 12, May 2015 Page 7 LTE approved Contributions for 13 WGs (2009 - Q3 2015) –Source: ABI Research COMPANY RANK Ericsson 1 Huawei 2 Nokia Networks 3 Qualcomm 4 ALU 5 ZTE 6 Samsung 7 Anritsu 8 Rohde & Schwarz 9 CATT 10 Page 8 Principles of standardisation CONSENSUS TRANSPARENCY IMPARTIALITY OPENNESS .. -

Presenting Karbonn a New Generation of Mobile Phones That Redefines Life in Every Way

Presenting Karbonn A new generation of mobile phones that redefines life in every way. Loaded with features, looks, quality, technology, service and more, it is the perfect harmony of style and function. Discover Karbonn. Live your life. About Us Welcome to the Karbonn World In the telecom arena, technology and innovation have created a multitude of opportunities. Today, as the world opens up to new avenues in communication, the consumer is becoming equally demanding - expecting the latest trends, faster. To ring in new changes designed to truly delight the consumer, two Indian telecom majors have joined forces to trigger the revolution - UTL and Jaina. The UTL Group is a multi division telecom group with an annual turnover of Rs 1600 crore and over 2000 employees. Headquartered in Bangalore, it is a leading Indian telecom powerhouse with interests that span across manufacturing, services and distribution. The credentials are endless: leading suppliers of landline telephones and electronic exchanges in India; leading supplier of telecom equipment to cellular operators; build- and-operate state-wide area networks for several state governments; business relations with reputed international and national telecom brands as principal, vendor or business partner; closely linked with the mobile phone revolution in the country - promoted JTM, (erstwhile mobile operator for Karnataka, Andhra Pradesh and Punjab); successfully represented reputed mobile phone brands like Alcatel, Nokia, Samsung and Virgin in the country, either as regional or national distribution partners. The Jaina Group is a reputed distribution house with interests in telecom and consumer durables. Headquartered in Delhi, the company has represented, with distinction, prominent brands such as Nokia, Samsung, Siemens, Panasonic and Philips (LCD devices) as regional or national distribution partners. -

Press Release Intex Technologies (India)

Press Release Intex Technologies (India) Ltd October 9, 2017 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE A-; Negative Removed from credit 138.28 Long-term Bank Facilities (Single A Minus; watch; Rating Revised from (reduced from 162.00) Outlook: Negative) CARE A; (Single A) CARE A2+; Removed from credit 274.00 Short-term Bank Facilities (A Two Plus) watch; Rating Revised from (reduced from 411.00) CARE A1; (A One) 412.28 Total Facilities (Rs. Four hundred Twelve crore Twenty Eight Lacs only) Details of instruments/facilities in Annexure-1 Detailed Rationale& Key Rating Drivers The ratings assigned had been placed on ‘Credit Watch with negative implications’ on account of Delhi High Court issuing interim injunction against ITIL from selling ‘AQUA’ branded smartphones and accessories and the possible impact of the same on the credit risk profile of the company. The removal of credit watch for ITIL takes into account the High Court Judgment setting aside the earlier injunction order of the Delhi High Court thereby allowing ITIL to continue selling under the AQUA brand. The revision in the ratings of Intex Technologies (India) Limited (ITIL) takes into account the moderation in its financial performance marked by decline in sales and operating profitability during FY17. The ratings are also constrained by high level of competition in the IT hardware and mobile handset segment, volatility in profitability margins, dependency on imports and the associated regulatory risks. However, the ratings continue to derive strength from the experienced promoters and management team, long track record of operations and established brand name, diversified product portfolio, widespread distribution network and well-defined foreign exchange risk mitigation policy. -

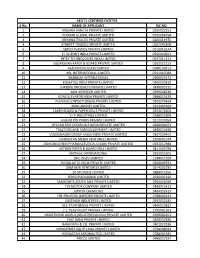

S.No. NAME of APPLICANT IEC NO. 1 KRISHNA VANIJYA

AEO T1 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 KRISHNA VANIJYA PRIVATE LIMITED 0205022553 2 PODDAR GLOBAL PRIVATE LIMITED 0595004458 3 KRISHNA TISSUES PRIVATE LIMITED 0206014970 4 STARPET TRADING PRIVATE LIMITED 0507042808 5 SERVO PLASTICS PRIVATE LIMITED 0210013524 6 E I DUPONT INDIA PRIVATE LIMITED 0596020651 7 INTEX TECHNOLOGIES INDIA LIMITED 0597011231 8 SUDARSHAN PAPER & BOARD PRIVATE LIMITED 0203021215 9 ASAHI INDIA GLASS LIMITED 0588130311 10 KPL INTERNATIONAL LIMITED 0591047080 11 NASIBDAR INTERNATIONAL 0300029471 12 KOMATSU INDIA PRIVATE LIMITED 0406005818 13 SUPERFIL PRODUCTS PRIVATE LIMITED 0490005152 14 SAM AGRITECH LIMITED 0999008226 15 KONE ELEVATOR INDIA PRIVATE LIMITED 0488015430 16 PHOENIX CONTACT (INDIA) PRIVATE LIMITED 0505070464 17 INDO AMINES LIMITED 0394064364 18 LAXMI BOARD & PAPER MILLS PRIVATE LIMITED 0394076303 19 V I P INDUSTRIES LIMITED 0388025808 20 NUEVO POLYMERS PRIVATE LIMITED 0212022059 21 DECCAN FINE CHEMICALS INDIA PRIVATE LIMITED 4608000071 22 TRACTORS AND FARM EQUIPMENT LIMITED 0488024838 23 VOLKSWAGEN GROUP SALES INDIA PRIVATE LIMITED 0307020401 24 HINDUSTAN MEDIA VENTURES LIMITED 2109001674 25 DSM SINOCHEM PHARMACEUTICALS INDIA PRIVATE LIMITED 0592057984 26 ASTRON PAPER & BOARD MILL LIMITED 0811005798 27 SARTHAK INTERNATIONAL 0305015605 28 SML ISUZU LIMITED 1288011369 29 SKODA AUTO INDIA PRIVATE LIMITED 0300009551 30 SAM AGRI VENTURES LIMITED 0914002295 31 20 MICRONS LIMITED 0888015356 32 SERVO PACKAGING LIMITED 2596001292 33 SAMSONITE SOUTH ASIA PRIVATE LIMITED 0395056039 34 TVS MOTOR COMPANY LIMITED 0488015413 35 JUPITER CHEMICALS 0494032413 36 THE PRINTERS (MYSORE) PRIVATE LIMITED 0788002431 37 EASTMAN INDUSTRIES LIMITED 0392052245 38 KCC PAINT(INDIA) PRIVATE LIMITED 0406023832 39 J. J. PLASTALLOY PRIVATE LIMITED 1595001361 40 ARMSTRONG WORLD INDUSTRIES (INDIA) PRIVATE LIMITED 0300062401 41 FMC INDIA PRIVATE LIMITED 0300037830 42 RAM NATH & CO.