Swiss Equity Research Baskets Quarterly Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

Private Capital in Switzerland

DOWNLOAD THE DATA PACK PRIVATE CAPITAL IN SWITZERLAND KEY FACTS 52 €632mn €1.9bn Total number of Average size of Average allocation to Switzerland-based Switzerland-based funds private capital among funds in market, closed in 2018 YTD across Switzerland-based targeting an aggregate all private capital. investors. €13bn. Fig. 2: Annual Switzerland-Based Private Capital Fig. 1: Annual Switzerland-Based Private Capital Fundraising by Asset Class, 2008 - 2018 YTD Fundraising, 2008 - 2018 YTD (As at October 2018) (As at October 2018) 39 100% 5 1.2 40 22 5.9 35 34 Natural Resources 35 32 33 30 31 80% 14.6 30 26 36 Private Debt 25 24 24 10.4 19 60% 20 16 Infrastructure 15 14.4 9.3 8.4 9.6 9.5 40% 10 7.8 6.9 6.2 6.8 Real Estate 5.8 212 55.2 5 2.5 Proportion of Total 0 20% Private Equity & 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Venture Capital 0% YTD Year of Final Close No. of Funds Aggregate Capital No. of Funds Closed Aggregate Capital Raised (€bn) Closed Raised (€bn) Source: Preqin Pro Source: Preqin Pro Fig. 3: Switzerland-Based Private Capital: Median Net Fig. 4: Switzerland-Based Private Capital Assets under IRRs by Vintage Year (As at October 2018) Management by Asset Class, 2008 - 2018 18% 17.0%16.7% 50 16% 14.3% 40 14% 11.5% 11.3% 30 12% 10.9% 10.5% 10% 9.2% (€bn) 20 8.1% 8.5% 8% 6.4% 10 6% Assets under Management 4% 0 Median Net IRR since Inception 2% Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 0% Mar-18 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Private Equity Real Estate Infrastructure Vintage Year Private Debt Natural Resources Source: Preqin Pro Source: Preqin Pro 1 ©Preqin Ltd. -

Update on Partners Group

Update on Partners Group February 2021 Gonzalo Fernández Castro Private Equity Americas | Hal Avidano Co-Head Private Equity Integrated Investments Americas UPDATE ON PARTNERS GROUP 2 Table of contents 1 Overview 2 Clients 3 Industry 4 Investments 5 ESG 6 Financials OVERVIEW 3 About us Dedicated to private markets Leveraging strong resources • Our AuM stands at USD 109 billion:1 USD 52 billion in • We have over 1,500 employees worldwide2 across 20 corporate equity & USD 57 billion real assets / financing offices and over 750 private markets professionals • We leverage our database of over 36,000 private markets • Our platform, portfolio and network provide extensive assets to generate attractive deal flow synergies and opportunities for owners and entrepreneurs We have a global presence with 20 offices across key investment regions Tokyo Shanghai Seoul Toronto Dubai Denver London New York Mumbai Guernsey Luxembourg Manila Houston Munich Paris Singapore Zug Milan São Paulo Sydney Americas Europe Asia Pacific For illustrative purposes only. Source: Partners Group (2020). 1 Unaudited, inclusive of all Partners Group affiliates, as of 31 December 2020. 2 As of 31 December 2020. OVERVIEW 4 About our portfolio Partner to business Entrepreneurial ownership Corporate assets (USD 52 billion AuM1) Healthcare Industrials Consumer & services Technology Real assets / financing (USD 57 billion AuM2) Infrastructure Real estate Real asset services Financing We are "responsible for the dreams" of the 200,000+ partners and employees who work alongside us in our portfolio For illustrative purposes only. Source: Partners Group (2019). 1 Corporate equity includes Partners Group's private equity asset under management as of 31 December 2020. -

DWS (CH) II Small and Mid Caps Switzerland

Marketing Material DWS (CH) II Small and Mid Caps Switzerland Equity Funds - Europe - Regions/Countries August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class FD (in %) The goal of the sub-fund is primarily to achieve long-term growth in Swiss Francs through investment in a portfolio of stocks from Swiss issuers that are listed in a representative Swiss equities index of small and medium enterprises or the small and mid- cap subindex of a Swiss equities index (“the benchmark”). The investment strategy is based on a transparent and comprehensible investment process, focuses on stock selection. Fund Benchmark (since 09/08/2006): SPI EXTRA Total Return (RI) Past performance is no indication of current or future performance, and the performance data do not take account of the commissions and costs Fund Management's Comment incurred on the issue and redemption of units. For detailed comments on the fund and its corresponding markets please see the annual report. Cumulative performance (in %) - share class FD 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 CHF 3.0 42.7 36.1 77.7 421.8 29.6 10.8 12.2 29.9 -21.6 29.3 1.8 EUR 2.7 42.0 42.2 80.2 650.5 30.2 12.5 12.5 19.4 -18.6 33.7 2.2 BM IN CHF 2.5 34.9 39.1 90.5 284.2 23.7 11.6 13.8 29.7 -17.2 30.4 8.1 Further Characteristics (3 years) / VAR (1 year) - share class FD Volatility 18.36% Maximum Drawdown -21.26% VAR (99%/10 days) 7.23% Sharpe Ratio -- Information Ratio -0.16 Correlation Coefficient 0.97 Alpha -1.26% Beta 1.05 Tracking Error -

The Future of Digital Transformation and Innovation Unconference

The Future of Digital Transformation and Innovation unConference 6 October 2016 USERNAME: PASSWORD: Practical Solutions Your Business for the 4th Industrial Revolution Brussels, Belgium, by The Conference Board Celebrating its 100 Year Anniversary! CONFIRMED SPEAKERS Brian Anderson Associate Program Director The Demand Institute ( jointly operated by The Conference Board and Nielsen ) Andrea Bonime-Blanc CEO GEC Risk Advisory Lindsey Canning Partner, Intellectual Property White & Case LLP London Bonnie Cheuk Director, Global Head of Digital, Knowledge & Social Collaboration Euroclear Kieran Conlon VP Sales & Services International Globoforce Martin Curley Former VP & Director Intel Labs Europe Intel Corporation David Dab Chief Innovation Officer ING Belgium Wim De Waele CEO Eggsplore John Higgins Director General Digital Europe Richard Hughes Director of Social Strategy BroadVision Joshua Jost Chief Storyteller Anderson Walsh Spencer Mark Leiter Chairman Leiter & Company Bertrand Liard Partner, Intellectual Property White & Case LLP Paris Jacquelyn MacLennan Partner, Competition White & Case LLP Brussels and London Ann Mettler Head of European Political Strategy Centre European Commission Dragan Pendic Head of Digital & Data Trust RelianceACSN Wil Schoenmakers Management Group PA Consulting Philippe Trichet Digital Expert Director Boston Consulting Group Nicolas van Zeebroeck Innovation and Digital Business Solvay Brussels School Philip Weiss Author of “Hyperthinking”, Founder ZN Sponsors WHY? WHO? Digital is set to revolutionize the The unConference is designed for 400+ C-suite and senior level executives, world. Is your company set for this? leading different functions in large organizations and different industries. Businesses have always changed—in reaction to changes in the marketplace WHAT? or in capabilities. But digital The event will be an integrated blend of transformation presents a new 1. -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Longer Term Investments Medical Devices

Longer Term Investments Medical devices Chief Investment Office GWM | 11 April 2019 6:53 pm BST Lachlan Towart, Analyst; Stefan R Meyer, Analyst • The aging population and growth of the over-65 age group will create more opportunities for companies selling medical products and devices. • Other drivers of this industry include better penetration in emerging markets due to improved infrastructure, innovative new treatments, increased affordability due to rising per-capita GDP and a growing prevalence of "lifestyle diseases" such as obesity due to urbanization. • We identified five key markets for implantable or wearable devices, including consumer products such as hearing aids, dental implants and corrective lenses. We estimate their total market size at USD 114.8bn with a rate of potential growth in the mid-single digits. • The theme is relatively defensive and should appeal to quality- focused investors. We recommend exposure to it via a diversified portfolio of stocks across our preferred markets and segments. Medical devices can assist in the treatment of many conditions. Some reduce the risk of a treated condition worsening, perhaps as an alternative to drug therapy; others improve users' quality of life or functionality; and still others can solve problems untreatable with drugs. Devices like joint replacements effectively offer permanent long-term solutions (i.e. a cure). Medical devices are primarily used by the over-65 age group, whose growth will outpace the broader population's over the coming decades. Demand is also supported by the rise of "lifestyle diseases" like obesity, itself related to urbanization. The medical device industry has matured, but still represents a substantial opportunity, in our view. -

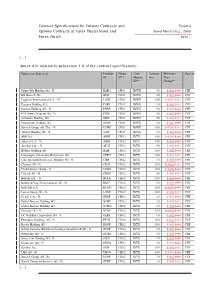

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Nextgen WEALTH MANAGERS 30.06.2020

ESG Swiss Equities Certificate NextGen WEALTH MANAGERS 30.06.2020 Objective & Strategy ESG Swiss Equities certificate invests in a financial and ESG criteria scored weighted index. The index tracks Swiss financially sound companies that generate investment performance and integrate corporate social responsability, ethics and sustainability characteristics in order to have a long term positive environmental, social, governance (ESG) impact. It aims to be a reference by providing a specific solution that allows capital markets to redirect investment flows toward a more sustainable economy. Only companies with a financial and ESG score equal or above the median are eligible for inclusion in the ESG Swiss Equities Index. The dynamic strategy is based upon a synthetic notional investment allocation and reallocation in the Index Components following a specific and monitored process of eligibility defined by NextGen Wealth Managers SA. Monthly Comment Classification In June, the ESG Swiss Equities certificate registered a performance of 2.78% compared to Asset Type Equities May's 2.78%. The certificate’s benchmark, the Swiss Performance Index (SPI), performed Region Switzerland positively at 1.55% against 2.86% in the previous month. Since the beginning of the year, the Style ESG Systematic two baskets stand at -8.11% for the certificate and -3.13% for the benchmark. Since inception, cumulated performances are respectively at 12.34% and 34.73% (representing annualized performances of 2.72% and 7.12%) for annualized volatilities of 13.07% and 9.59%. The portfolio's allocation in large capitalization companies remains around 36% against 9% in middle capitalization companies and 54% in small capitalization companies. -

Julius Baer Multicooperation Annual Report 2005 As at June 30, 2005 (Audited)

Julius Baer Multicooperation Annual Report 2005 as at June 30, 2005 (audited) Subscriptions are only valid if made on the basis of the current Prospectus, the latest Annual Report and the latest Semi-Annual Report if published thereafter. The Articles of Association, the valid Prospectus and the Annual and Semi-Annual Reports may be obtained free of charge at the representative in Switzerland and the respective paying agent. Only the German version of the present Annual Report has been reviewed by the independent auditor. Consequently, the independent auditor's report only refers to the German version of the Report; other versions result from a conscientious translation made under the responsibility of the Board. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Julius Baer Investment Funds Services Ltd., Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH - 8010 Zurich Paying agent in Germany: Bank Julius Bär (Deutschland) AG, Messe Turm, Friedrich-Ebert-Anlage 49, Postfach 15 01 52, D - 60061 Frankfurt on the Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Contents Page Organisation and Management 4 Independent Auditor's Report 5 Notes to the Financial Statements 6 Julius Baer Multicooperation (Umbrella Fund) MCOO Julius Baer Multicooperation - Emerging Markets Value Stock Fund HESF Julius Baer Multicooperation -

Bekanntmachung Auf Keyinvest Bezugsrechtsemission AMS AG

Bekanntmachung auf KeyInvest Bezugsrechtsemission AMS AG Rights issue AMS AG Im Zusammenhang mit der Kapitalerhöhung der AMS AG (Bloomberg Code: AMS SE) durch Bezugsrechtsemission wurden die Bedingungen der unten genannten Produkte der UBS AG, per 16. März 2020 angepasst. Die detaillierten Informationen befinden sich in der entsprechenden Produktedokumentation (Termsheets). With regard to the rights issue of AMS AG (Bloomberg Code: AMS SE), UBS AG will adjust the terms of the following products as of 16th March 2020. Detailed information can be found in the respective product documentation (Termsheets). ISIN Name CH0406766680 PERLES Plus on AMS AG CH0434739725 Kick-In Certificate on AMS AG / U-Blox / ABB CH0434739717 Kick-In Certificate on AMS AG / U-Blox / ABB CH0524660716 8.40% p.a. Callable Kick-In GOAL on AMS AG / Logitech / Temenos CH0391676241 PERLES Plus on AMS AG CH0405218907 PERLES Plus on AMS AG CH0428536335 9.00% p.a. ER Worst of Kick-In GOAL on AMS AG / Temenos / OC Oerlikon CH0437181537 Kick-In Certificate on AMS AG / Autoneum Holding AG / Dufry AG CH0524663124 10.20% p.a. ER Kick-In GOAL on AMS AG CH0522755518 6.00% p.a. Callable Kick-In GOAL on AMS AG / Kühne + Nagel / Swatch I / Richemont / LafargeHolcim CH0509384506 6.496023402505% p.a. Kick-In GOAL on AMS AG / Credit Suisse / Swiss Re CH0512543437 FACTOR CERTIFICATE ON AMS AG CH0512543445 FACTOR CERTIFICATE ON AMS AG CH0512547974 FACTOR CERTIFICATE ON AMS AG CH0527058983 FACTOR CERTIFICATE ON AMS AG CH0453246909 CHF MINI-FUTURE ON AMS AG CH0521942109 CHF EQUITY-WARRANT