W. P. Carey & Co

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AUTOMOTIVE AFTERMARKET OUTLOOK and REFLECTIONS from OUR Nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018

GAMCO Investors, Inc. November 21, 2018 One Corporate Center Rye, NY 10580-1435 Tel (914) 921-5150 www.gabelli.com AUTOMOTIVE AFTERMARKET OUTLOOK AND REFLECTIONS FROM OUR nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018 PRESENTING COMPANIES 10/31/2018 10/31/2017 11/1/2016 Company Exchange Ticker Price (a) Price (a) Price (a) AutoZone, Inc NYSE AZO $ 733.47 $ 589.50 $ 734.45 Boyd Group Income Fund (b) TSX BYD.UN 120.31 96.10 81.17 BYD Company Ltd (c) SHE 002594 46.79 62.79 55.57 Cooper Tire & Rubber Co. NYSE CTB 30.89 32.80 35.10 Dana, Inc. " DAN 15.47 30.49 15.00 Donaldson Company, Inc " DCI 51.28 47.21 35.46 Gentex Corporation NASDAQ GNTX 21.05 19.04 15.96 Genuine Parts Co. NYSE GPC 97.92 88.23 86.43 Lear Corporation " LEA 132.90 175.59 121.30 Monro, Inc. NASDAQ MNRO 74.40 49.35 53.32 Motorcar Parts of America, Inc " MPAA 21.18 28.91 26.19 Navistar International Corp NYSE NAV 33.49 42.31 23.01 O'Reilly Automotive, Inc NASDAQ ORLY 320.75 210.95 264.24 Penske Automotive Group NYSE PAG 44.02 46.62 42.83 Rush Enterprises, Inc. NASDAQ RUSHB 35.95 47.59 24.77 Standard Motor Products, Inc NYSE SMP 53.90 43.67 46.88 Superior Industries International, Inc. " SUP 9.83 15.55 22.95 Tenneco, Inc. " TEN 34.43 58.11 56.06 US Auto Parts Network, Inc. NASDAQ PRTS 1.19 2.56 2.27 Veoneer, Inc. -

HD [email protected] Or by Writing to the Directors at the Following Address

THE HOME DEPOT PROXY STATEMENT AND NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS Thursday, May 21, 2020 at 9:00 a.m., Eastern Time COBB GALLERIA CENTRE, ATLANTA, GA Table of Contents INVESTOR FACTSHEET Strategy Our One Home Depot strategy aims to deliver shareholder value and grow our market share by providing best- in-class customer service through a seamless, interconnected shopping experience for our customers. We are continuously improving our online and in-store experience and providing enhanced training for our associates. In addition, to ensure we are the product authority in home improvement, we strive to provide unique and comprehensive product offerings, continued innovation, and exceptional convenience and value. To execute our strategy, we have committed approximately $11 billion over a multi-year period to investments in our stores, associates, interconnected and digital experience, pro customer experience, services business, supply chain, and product and innovation. Shareholder Return Principles Our first priority for our use of cash is investing in our business, as reflected by our One Home Depot strategy. Our use of the remainder of our cash is guided by our shareholder return principles: • Dividend Principle: Look to increase the dividend every year as we grow earnings • Return on Invested Capital Principle: Maintain a high return on invested capital, benchmarking all uses of excess liquidity against value created for shareholders through share repurchases • Share Repurchase Principle: After meeting the needs of the business, look to return excess cash to shareholders in the form of share repurchases Key Financial Performance Metrics Set forth below are key financial performance metrics for the indicated fiscal years. -

U.S. Corporate Scores 2018

01 DISCLOSURE INSIGHT ACTION U.S. CORPORATE SCORES 2018 02 CORPORATE DISCLOSURE TO INVESTORS IN NORTH AMERICA 124 9 28 510 63 192 CONTENTS 03 04 CDP scoring methodology 2018 06 The A-List: North America 08 Corporate scores 34 Appendix I: CDP Activity classification system (cdp-acs) 40 Appendix II: Investor Members and Signatories 46 Appendix III: CDP Supply Chain Members Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. All information and views expressed herein by CDP are based on their judgment at the time of this report and are subject to change without notice due to economic, political, industry and firm-specific factors. -

Printmgr File

THE HOME DEPOT PROXY STATEMENT AND NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS THURSDAY,MAY 17, 2018 AT 9:00 A.M., EASTERN TIME COBB ENERGY PERFORMING ARTS CENTRE, ATLANTA GA DEAR FELLOW SHAREHOLDERS: Your Board and management team are committed to creating long-term value for our shareholders. This commitment is reflected in our core values, which provide the foundation for our business and reflect the culture that was built by our founders nearly 40 years ago. We would like to highlight for you some actions we took in fiscal 2017 to ensure we are optimizing our governance practices to support continued value creation over the long term. The Board engages with management to address both the short-term needs and long-term strategies necessary to meet our customers’ expectations in a rapidly evolving retail landscape. As we and others have noted, there has been more change in retail over the past three years than in the prior 10 to 20 years. Company strategy is discussed regularly at Board meetings, and directors annually participate in an in-depth strategy session with management. Through these strategy sessions we tap into the ideas, viewpoints and experiences of our diverse and highly-skilled board members. The results of our strategy discussions helped shape the long-term strategy of investing in the “One Home Depot” experience outlined at our Investor and Analyst Conference in December 2017. We have continued to focus on Board refreshment to align our Board’s strengths with the evolving retail landscape. We are excited to announce Stephanie Linnartz, Executive Vice President and Global Chief Marketing and Commercial Officer of Marriott International, as a new director nominee. -

1100 E Williams St, Apex, NC 27502 Autozone

OFFERING MEMORANDUM 1100 E Williams St, Apex, NC 27502 AutoZone ™ EXCLUSIVELY LISTED BY CONRAD SARREAL CHAD KURZ KYLE MATTHEWS Associate SVP & National Director BROKER OF RECORD [email protected] [email protected] LIC # C27092 ™ DIR (310) 919-5760 DIR (214) 692-2927 MOB (626) 230-1006 MOB (562) 480-2937 LIC # 01982875 (CA) LIC # 01911198 (CA) CONTENTS 4 EXECUTIVE SUMMARY 5 FINANCIAL OVERVIEW 6 TENANT OVERVIEW 12 AREA OVERVIEW ™ EXECUTIVE SUMMARY Investment Highlights PROPERTY • High-Quality Construction – Brick exterior with metal canopies • Low Rent/SF – AutoZone is only paying $12.92/SF which is lower than most of their other fee simple build-to-suit rents • Minimal Landlord Responsibilities – Tenant responsible for parking lot, maintenance of HVAC, taxes, and insurance LOCATION • Top 2 MSA – Apex is a suburb of Raleigh and located in the 2nd largest MSA in North Carolina • Explosive Growth – 1-mile population grew by ±110% between ’00 and ’10 and ±46% between ’10 and ’17 • Affluent Suburb – Average household incomes within a 3-mile and 5-mile radius exceed $117,000 (above Top 2 MSA) • Excellent Retail Synergy – E Williams St is anchored by a Walmart Supercenter and features other notable tenants such as Dunkin Donuts, Family Dollar, Firestone, Arby’s, BB&T Bank, McDonald’s, and more • Busy Traffic Counts – E Williams St sees an average traffic count of ± 38,000 VPD and is located off of US Highway 1 which has an average traffic count of ± 33,000 VPD • Upcoming Developments – Upcoming Apex Developments include a 92-acre -

Invoice Register

Claim Total Claim Date: 3/20/2018 Description: Amount Vendors Claims for Approval (Pages 2-170): $5,064,514.91 322 Manual Checks (Page 171) $3,235.09 1 Total $5,067,750.00 Payroll Related Payments (Issued since last commission meeting): Payroll Prepaid Withholdings - (Page 172): $985,080.73 6 Payroll Manual Checks - (Pages 173-174): $21,695.18 19 Payroll (3/9/2018) $1,435,000.98 Payroll Total $2,441,776.89 TOTAL: $7,509,526.89 TOTAL VENDOR COUNT: 348 Payments over $1,000,000.00 (included above): NA City of Lawrence Open Item Listing Vendor Invoice Purchase Due Line No. Line Item Description Account No. Line No. Total Invoice Total Order Date Douglas County 302791 03/20/18 1 Prisoner Care 4th Qtr 2017 001-1-1065-2828 6,545.95 585,091.56 JLE Expenses 4th Qtr 2017 Shredding 4th Qtr 2017 JLE Utilities 4th Qtr 2017 CSW Wages & Expenses 4th Qtr 2017 ECC Wages & Expenses 4th Qtr 2017 Sustainability Wages 4th Qtr 2017 Emp Benefits-Regular 4th Qtr 2017 Emp Benefits-WC 4th Qtr 2017 Douglas County 302791 03/20/18 1 Prisoner Care 4th Qtr 2017 001-1-1065-2828 2,423.86 585,091.56 JLE Expenses 4th Qtr 2017 Shredding 4th Qtr 2017 JLE Utilities 4th Qtr 2017 CSW Wages & Expenses 4th Qtr 2017 ECC Wages & Expenses 4th Qtr 2017 Sustainability Wages 4th Qtr 2017 Emp Benefits-Regular 4th Qtr 2017 Emp Benefits-WC 4th Qtr 2017 Douglas County 302791 03/20/18 1 Prisoner Care 4th Qtr 2017 001-1-1065-2828 12.78 585,091.56 JLE Expenses 4th Qtr 2017 Shredding 4th Qtr 2017 JLE Utilities 4th Qtr 2017 CSW Wages & Expenses 4th Qtr 2017 ECC Wages & Expenses 4th Qtr 2017 Sustainability Wages 4th Qtr 2017 Emp Benefits-Regular 4th Qtr 2017 Emp Benefits-WC 4th Qtr 2017 Douglas County 302791 03/20/18 1 Prisoner Care 4th Qtr 2017 001-1-1020-2325 11,896.76 585,091.56 JLE Expenses 4th Qtr 2017 Shredding 4th Qtr 2017 JLE Utilities 4th Qtr 2017 CSW Wages & Expenses 4th Qtr 2017 ECC Wages & Expenses 4th Qtr 2017 Sustainability Wages 4th Qtr 2017 Emp Benefits-Regular 4th Qtr 2017 Emp Benefits-WC 4th Qtr 2017 Report created 3/19/2018 2:03:58 PM Page 2 of 170 Vendor Invoice Purchase Due Line No. -

Automotive Aftermarket Stock Performance*

Weekly Automotive Aftermarket Intelligence Report January 12, 2015 AUTOMOTIVE AFTERMARKET Automotive Aftermarket Stock Performance* 20% SLIPPING LEADING 15% Cooper Tire Remy 10% CarMax Pep Boys Lithia Uni-Select 5% Goodyear S&P 500 Penske Last Month’s Return Solera Boyd Monro (0.7%) KAR Advance Auto Genuine Parts 0% AutoZone O'Reilly Snap-on Sonic AutoNation Tenneco Asbury Dorman Copart (5%) Last Month’s Return Last Month’s Standard Motor LKQ Federal-Mogul Group 1 (10%) MPA (15%) U.S. Auto Parts S&P 500 Rush (20%) Last Week’s Return (0.7%) LAGGING IMPROVING (25%) (10%) (5%) 0% 5% Last Week’s Return Percent Change Segment Index1 1 Week 1 Month LTM Suppliers (1.6%) 0.7% 11.6% Retailers & Distributors (2.1%) (0.7%) 30.9% Independent Service Providers & Dealers (2.1%) 2.6% 28.1% Collision (0.8%) (3.2%) (4.3%) BB&T Automotive Aftermarket Index (1.1%) 0.7% 21.7% S&P 500 (0.7%) (0.7%) 12.0% 1 Weighted by market capitalization *Size of the bubble represents relative market capitalization Source: Capital IQ 1 Automotive Aftermarket Stock Performance 40% 30% 20% 10% 0% (10%) (20%) Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Suppliers Retailers & Distributors Independent Service Providers & Dealers Collision Source: Capital IQ BB&T Automotive Aftermarket Index S&P 500 Index Most Recent Quarter Sales Growth (Year-Over-Year) 50.6% 50% 45.8% 40% 35.9% 32.6% 30% 28.5% 21.3% 20% 17.5% 15.5% 12.2% 11.2% 10.7% 10% 10.5% 9.4% 10.4% 10.1% 9.8% 10.4% 7.1% 7.7% 8.2%8.0% 8.6% 8.3% 7.8% 6.0% 5.1% 2.1% 2.1% 3.8% 0.2% 0% (2.7%) (10%) (6.9%) LKQ Corp. -

2015 Annual Report

2015 ANNUAL REPORT Notice of Annual Meeting of Stockholders and Proxy Statement Corporate Profile AutoZone, Inc. is the nation’s leading retailer and a leading of original equipment quality import replacement parts. We also distributor of automotive replacement parts and accessories in sell the ALLDATA brand automotive diagnostic and repair software the United States. We began operations in 1979 and at August through www.alldata.com and www.alldatadiy.com. Additionally, 29, 2015, operated 5,141 AutoZone stores in the United States, we sell automotive hard parts, maintenance items, accessories, including Puerto Rico; 441 stores in Mexico; seven stores in and non-automotive products through www.autozone.com, and Brazil; and 20 Interamerican Motor Corporation (“IMC”) branches. accessories and performance parts through www.autoanything. Each AutoZone store carries an extensive product line for cars, com, and our commercial customers can make purchases through sport utility vehicles, vans and light trucks, including new and www.autozonepro.com and www.imcparts.net. We do not derive remanufactured automotive hard parts, maintenance items, revenue from automotive repair or installation services. accessories and non-automotive products. At August 29, 2015, • 5,609 locations (5,141 in 49 states, the District of in 4,141 of our domestic AutoZone stores we also have a Columbia and Puerto Rico in the U.S., 441 stores in commercial sales program that provides commercial credit and Mexico, seven stores in Brazil and 20 IMC branches) prompt delivery of parts and other products to local, regional • 4,141 domestic Commercial programs and national repair garages, dealers, service stations and public • 10 Distribution centers (8 in the United States, sector accounts. -

EXCLUSIVE LISTING Autozone New Orleans 20-Year NNN Ground Lease with Increases

Net Lease Investment Services File Photograph EXCLUSIVE LISTING AutoZone NEW ORLEANS 20-Year NNN Ground Lease with Increases • Price: $1,179,000 – 6.15% Cap Rate • Fortune 500 Investment Grade Tenant • One of America’s Most Successful and Profitable Companies For more information, please contact: Robert C. Sanner, Partner/Broker Richard M. Sanner, Associate 415-677-0439 415-677-0429 [email protected] [email protected] LIC #00869657 LIC # 01792433 www.ctbtnnn.com The information contained herein has been given to us by the owner of the property or other sources we deem reliable. We have no reason to doubt its accuracy, but we do not guarantee it. All information should be verified prior to purchase or lease. Net Lease Investment Services AutoZone New Orleans, Louisiana LOCATION Southwest corner of South Claiborne Avenue and General Taylor, New Orleans, Louisiana LOT SIZE Approximately 0.92 acres – 40,000+/- square feet. • Only the land is for sale. IMPROVEMENTS Under construction, to be completed in June 2011, a 6,782+/- square foot freestanding AUTOZONE retail store. • The improvements are built and owned by the tenant. The improvements are not for sale. GROUND LEASE Ground leased to AUTOZONE, INC. for 20 years from December 16, 2010 until December 31, 2030. The net annual rent of $72,504 increases has increases as shown below. The lease is absolute net, with the tenant responsible for taxes, insurance and all maintenance, including roof and structure. There are four 5-year options to renew with increases as shown below. THE LEASE IS IN FULL FORCE AND EFFECT. RENT IS BEING PAID. -

2011 Cycle 3 Leaps Introduction

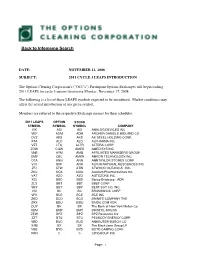

TOBack: to Infomemo SearchALL CLEARING MEMBERS #25104 FROM: FRANCES KRISCHUNAS NATIONAL OPERATIONS DATE: NOVEMBER 12, 2008 SUBJECT: 2011 CYCLE 3 LEAPS INTRODUCTION The Options Clearing Corporation's ("OCC's") Participant Options Exchanges will begin trading 2011 LEAPS for cycle 3 options beginning Monday, November 17, 2008. The following is a list of those LEAPS symbols expected to be introduced. Market conditions may affect the actual introduction of any given symbol. Members are referred to the respective Exchange memos for their schedules. 2011 LEAPS OPTION STOCK SYMBOL SYMBOL SYMBOL COMPANY VIK ADI ADI ANALOG DEVICES INC VEF ADM ADM ARCHER DANIELS MIDLAND CO OVZ AKS AKS AK STEEL HOLDING CORP. XTA ALO ALO ALPHARMA INC VZT LTQ ALTR ALTERA CORP ZOW CQW AMED AMEDISYS INC VNB AYM AMG AFFILIATED MANAGERS GROUP OMY QEL AMKR AMKOR TECHNOLOGY,INC. OTA ANN ANN ANNTAYLOR STORES CORP VJV BNF ANR ALPHA NATURAL RESOURCES INC ZFJ ATW ATW ATWOOD OCEANICS , INC ZKU UQX AUXL Auxilium Pharmaceuticals Inc. VAT AZO AZO AUTOZONE INC. XSJ BBD BBD Banco Bradesco - ADR ZLS BBT BBT BB&T CORP VBY BBY BBY BEST BUY CO. INC. VXI BC BC BRUNSWICK CORP VFK BCE BCE BCE INC ZKO BCO BCO BRINK'S COMPANY THE ZRX BDU BIDU BAIDU.COM ADR OUY BK BK The Bank of New York Mellon Co VBM BMY BMY BRISTOL-MYERS ZEW BPZ BPZ BPZ Resources Inc ZZT BTU BTU PEABODY ENERGY CORP. VBD BUD BUD ANHEUSER-BUSCH CO XJM BX BX The Blackstone Group LP VBB BYD BYD BOYD GAMING CORP. VRN C C CITIGROUP INC Page: 1 2011 LEAPS OPTION STOCK SYMBOL SYMBOL SYMBOL COMPANY OYH CAG CAG CONAGRA FOODS OCJ CAH CAH CARDINAL HEALTH INC OVJ CAL CAL CONTINENTAL AIRLINES CLB ZCB CBS CBS CBS Corporation CL B ZBK CCJ CCJ CAMECO CORPORATION VCM CQL CENX CENTURY ALUMINUM COMPANY ZJZ CHL CHL China Mobile Limited ZXN CMC CMC COMMERCIAL METALS COMPANY OX CNM CME CME Group Inc ZTK QCY CMED CHINA MEDICAL TECH INC SPON ADR VBE CMI CMI CUMMINS INC. -

CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents

Rating Corporate Workplaces on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality NEWS CEI 2021 Corporate Equality Index © 2021 by the Human Rights Campaign Foundation. The Human Rights Campaign Foundation owns all right, title and interest in and to this publication and all derivative works thereof. Permission for reproduction and redistribution is granted if the publication is (1) reproduced in its entirety and (2) distributed free of charge. The Human Rights Campaign name and the Equality logo are trademarks of the Human Rights Campaign. The Human Rights Campaign Foundation and design incorporating the Equality logo are trademarks of the Human Rights Campaign Foundation. ISBN-13 978-1-934765-58-6 CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents Rating Workplaces Corporate on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality 2 Message from the HRC Foundation President NEWS 3 EXECUTIVE SUMMARY 5 Key Findings 7 Equality at the Fortune-Ranked Companies 8 Accelerating Global Equality 10 Spotlight: HRC’s Equidad Programs 13 FINDINGS 14 Criteria 1: Workforce Protections 16 Criteria 2: Inclusive Benefits 17 Continued Need for Partner Benefits 18 Understanding Transgender-Inclusive Healthcare Coverage 19 Criteria 3: Supporting an Inclusive Culture & Corporate Social Responsibility 19 Internal Education and Training Best Practices 20 LGBTQ Employee Resource Group or Diversity Council 22 Outreach or Engagement with the LGBTQ Community 24 Corporate Social Responsibility 25 Spotlight: Equality -

Interim Financial Statements DESJARDINS Etfs

Interim Financial Statements DESJARDINS ETFs As at June 30, 2021 INTERIM FINANCIAL STATEMENTS (UNAUDITED) | NOTICE The following Desjardins ETFs’ Interim Financial Statements have not been subject to a review by the Funds’ external auditors. The Desjardins Exchange Traded Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. Commissions, management fees and expenses all may be associated with an investment in exchange traded funds. Please read the prospectus before investing. Desjardins Global Asset Management Inc. is the manager and portfolio manager of the Desjardins Exchange Traded Funds. Desjardins is a trademark owned by the Fédération des caisses Desjardins du Québec used under license. DESJARDINS RI GLOBAL MULTIFACTOR — FOSSIL FUEL RESERVES FREE ETF STATEMENT OF FINANCIAL POSITION (Unaudited) STATEMENT OF COMPREHENSIVE INCOME (Unaudited) AS AT JUNE 30 DECEMBER 31 PERIODS ENDED JUNE 30 2021 2020 2021 2020 $ $ $ $ Income ASSETS Dividends 135,434 101,105 Current Assets Foreign exchange gain (loss) on cash (4,526) 24,199 Cash 84,668 74,707 Revenue from securities lending activities 162 61 Investments at fair value through profit or loss (FVTPL) 14,318,475 10,020,095 Changes in fair value: Investments at fair value through profit or loss (FVTPL) Net realized gain (loss) on investments 461,159 325,797 pledged as collateral 270,863 95,612 Net unrealized gain (loss) on investments 467,105 49,851 Receivable for investments sold 7,943 33,687 1,059,334 501,013 Interest,