TPP-GRIT GRIT for Family Members

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

REV Entry List

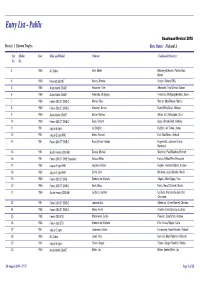

Entry List - Public Goodwood Revival 2018 Race(s): 1 Kinrara Trophy - Race Status: National A Car Shelter Year Make and Model Entrant Confirmed Driver(s) No. No. 3 1963 AC Cobra Hunt, Martin Blakeney-Edwards, Patrick/Hunt, Martin 4 1960 Maserati 3500GT Rosina, Stefano Rosina, Stefano/TBC, 5 1960 Aston Martin DB4GT Alexander, Tom Alexander, Tom/Wilmott, Adrian 6 1960 Aston Martin DB4GT Friedrichs, Wolfgang Friedrichs, Wolfgang/Hadfield, Simon 7 1960 Ferrari 250 GT SWB/C Werner, Max Werner, Max/Werner, Moritz 8 1960 Ferrari 250 GT SWB/C Allemann, Benno Dowd, Mike/Gnani, Michael 9 1960 Aston Martin DB4GT Mosler, Mathias Gillian, G.C./Woodgate, Chris 10 1960 Ferrari 250 GT SWB/C Gaye, Vincent Gaye, Vincent/Reid, Anthony 11 1961 Jaguar E-type Ian Dalglish Dalglish, Ian/Turner, James 12 1961 Jaguar E-type FHC Meins, Richard Huff, Rob/Meins, Richard 14 1961 Ferrari 250 GT SWB/C Racing Team Holland Hugenholtz, John/van Oranje, Bernhard 15 1961 Austin Healey 3000 Mk1 Darcey, Michael Woolmer, Paul/Woolmer, Richard 16 1961 Ferrari 250 GT SWB 'Breadvan' Halusa, Niklas Halusa, Niklas/Pirro, Emanuele 17 1962 Jaguar E-type FHC Hayden, Andrew Hayden, Andrew/Hibberd, Andrew 18 1962 Jaguar E-type FHC Corrie, John Minshaw, Jason/Stretton, Martin 19 1960 Ferrari 250 GT SWB Scuderia del Viadotto Vögele, Alain/Vögele, Yves 20 1960 Ferrari 250 GT SWB/C Devis, Marc Devis, Marc/O'Connell, Martin 21 1960 Austin Healey 3000 Mk1 Le Blanc, Karsten Le Blanc, Karsten/van Lanschot, Christiaen 23 1961 Ferrari 250 GT SWB/C Lanzante Ltd. Ellerbrock, Olivier/Glaesel, Christian -

REV Entry List

Entry List Goodwood Revival 2019 Race(s): 1 Kinrara Trophy presented by Hackett - For closed-cockpit GT cars, of three litres and over, of a type that raced before 1963 Race Status: National A Car Shelter Year Make and Model Entrant Confirmed Driver(s) No. No. 1 1961 Ferrari 250 GT SWB/C Macari, Joe Kristensen, Tom/Macari, Joe 2 1962 Ferrari 250 GT SWB Evans, Chris/Livingstone, Ian Cottingham, James/TBC, 3 1962 AC Cobra Lovett, Paul Bryant, Oliver/Sergison, Ewen 4 1961 Ferrari 250 GT SWB/C Racing Team Holland Franchitti, Dario/Hugenholtz, John 5 1960 Aston Martin DB4GT Alexander, Tom Alexander, Tom/Le Blanc, Karsten 6 1960 Aston Martin DB4GT Friedrichs, Wolfgang Hadfield, Simon/Turner, Darren 7 1960 Ferrari 250 GT SWB/C Gaye, Vincent Gaye, Vincent/Twyman, Joe 8 1963 Austin-Healey 3000 Steinke, Thomas Draper, Julien/Steinke, Thomas 9 1961 Jaguar E-type Coombs Automotive Graham, Stuart/March, Charlie 10 1960 Aston Martin DB4GT Müller, Urs Müller, Arlette/Müller, Urs 11 1960 Ferrari 250 GT SWB/C Devis, Marc Devis, Marc/O'Connell, Martin 12 1962 Ferrari 250 GTO FICA FRIO Ltd Monteverde, Carlos/Pearson, Gary 14 1961 Jaguar E-type FHC Meins, Richard Bentley, Andrew/Meins, Richard 15 1961 Jaguar E-type Lindemann, Adam Lindemann, Adam/Meaden, Richard 16 1961 Jaguar E-type FHC Midgley, Mark Lockie, Calum/Midgley, Mark 17 1962 Jaguar E-type FHC Hayden, Andrew Hayden, Andrew/Hibberd, Andrew 18 1964 Jaguar E-type FHC Hart, David Hart, David/Hart, Olivier 20 1962 Ferrari 250 GT SWB Dumolin, Christian Dumolin, Christian/Thibaut, Pierre-Alain 21 1960 -

Phil Hill on the Iconic Ferrari 250 GTO "Why Are We Driving This Damn Coupe?"

Article from Road and Track: https://www.roadandtrack.com/motorsports/news/a18029/ferrari-gto- history/ Phil Hill on the Iconic Ferrari 250 GTO "Why are we driving this damn coupe?" By Phil Hill Apr 20, 2017 In honor of what would be his 90th birthday, we're republishing this story, from the January 2000 issue of Road & Track, by the legendary Phil Hill. Many of you probably know Hill as a brilliant racer, notably the only American-born F1 champ, but he also wrote a number of eloquent, insightful articles for R&T, like this on the Ferrari 250 GTO. Enjoy. – Ed. When Olivier Gendebien and I were assigned to drive the new Ferrari GTO at Sebring in 1962, we were somewhat offended. Stirling Moss, Innes Ireland, the Rodriguez brothers, and other drivers were in sports prototypes, aiming for an overall win, and we wondered if there was a conspiracy against us. "Why are we driving this damn coupe?" There was an excellent reason Olivier and I were in the GTO. The Manufacturers' World Championship for 1962 was based on points scored by Grand Touring cars. Sports cars were now called prototypes, and while Stirling, Innes, and the others were running for the glory of the overall win, we were chasing points for the championship ... and earned the maximum by winning the GT class and finishing 2nd overall. As it turned out, the GTO was a delight to drive. That's probably because the emphasis put on the GTs to win the championship meant there was extra effort put into this car, so the GTO was a giant step beyond the Grand Touring cars built up to that point. -

Pirelli-Ferrari Monza-Press Release

PRESS RELEASE A NEW CHAPTER FOR PIRELLI AND FERRARI: BESPOKE P ZERO RUBBER FOR THE FERRARI MONZA, MARANELLO’S FIRST CAR WITH 21-INCH TYRES AT THE PARIS MOTOR SHOW, THE FERRARI MONZA SP1 AND SP2 WILL SHOWCASE TYRES SPECIFICALLY DEVELOPED TO MATCH THE CHARACTERISTICS OF THE LIMITED EDITION SPORTS CAR Paris, October 2, 2018 – The traditional collaboration between Pirelli and Ferrari starts another chapter inspired by the open-topped racing cars of the 1950s, brought right up to date with the latest technology from Maranello: the Ferrari Monza SP1 and SP2. These limited edition cars – highlighting a new “Icon” range – reinterpret the open cars that used to dominate the Mille Miglia and World Sports Car Championship. Pirelli has created a bespoke P Zero for the Ferrari Monza SP1 and SP2, starting with a precise requirement for the car’s development: 21-inch diameter tyres. This choice has been made for the first time in Ferrari’s history, presenting Pirelli’s engineers with the challenge of offering the usual levels of stiffness, comfort and performance that is synonymous with Ferrari, despite the record size. The front P Zero tyres also have the crucial task of faithfully conveying to the driver what the road is doing via the steering wheel, in order to maximise driving pleasure. Furthermore, the tyres had to play their part in keeping weight to a minimum on the new car. To achieve this, instead of the traditional reinforced textiles, the bead area was redesigned to maintain lateral rigidity while minimising weight: this solution has saved 1.2 kilograms. -

Best of Show at 2020 Cavallino Classic Wins Peninsula Classic Best of the Best Award Two Years in a Row

Best of Show at 2020 Cavallino Classic Wins Peninsula Classic Best of the Best Award two years in a row. 1954 Ferrari 750 Monza, coachwork by Scaglietti takes Top Honors. Copyright Peter Singhoff It is with great honor that we announce you that the 1954 Ferrari 750 Monza, coachwork by Scaglietti, Best of Show at Cavallino 2020, has been awarded today, February 9th, with the Peninsula Classics 2020 Best of the Best Award. It is the thirD time that the car winning the Best of Show at Cavallino is honored with this prestigious award. In 2012 Cavallino won with the Best of Show 1962 Ferrari 250 GTO anD in 2019 with the 1958 Ferrari 355 Sport, making it with toDay’s awarD, two years in a row success! The 1954 Ferrari 750 Monza was chosen from a selection of stunning ‘Best of Show’ winners from the most prestigious Concours around the world. It is a Ferrari with a long racing history debuting with a 2 litre motor at the San Marino GranD Prix in June 1954 bringing the highest place on the podium to the Scuderia Ferrari. Its story of victories lasts till the early 60s. The car then spent the next 50 years disassembled, even though its chassis, body, engine, and gearbox were all carefully preserved in a small San Francisco warehouse. In 2016 a complete restoration of car started. The vintage certification team at Ferrari Classiche in Maranello was also helpful in piecing together the early racing career of the car while campaigneD by Ferrari. The vehicle’s livery was restoreD to that which it sporteD in its first Carrera Panamericana race in 1954. -

The Fast Lane

DATABANK The Fast Lane IN MONTEREY THIS PAST AUGUST, RM Auctions’ sale of classic cars became the highest grossing ever when 87 percent of the 120 vehicles on offer sold for a combined $125 million, with more than a dozen cars setting benchmarks for individual models. Among these was a 1967 Ferrari 275 GTB/4*S N.A.R.T. Spider, which brought $27.5 million. The month before, a 1954 Mercedes-Benz W196R Formula 1 sold for $29,650,095 at Bonhams’ Goodwood Festival of Speed sale in England, the highest price paid for a car at auction. (The figure was topped in October when Connecticut- based collector Paul Pappalardo sold a 1963 Ferrari 250 GTO to an unnamed buyer for $52 million, setting a new private sale record.) As anomalous as such astronomical prices may seem, they are part of an overall upward trend in classic car sales. To take the temperature of the red-hot auto market, we looked at data from more than 20,000 sales by 23 auction houses that specialize in classic cars over a 15-year period from 1998 to 2012. While the highest prices have been achieved since then, new records may very well be set at the Scottsdale sales January 12–19. BY ROMAN KRAEUSSL !! A 1967 Ferrari 275 GTB/4*S N.A.R.T. (North American Racing Team) Spider, above, was sold for $27.5 million (est. $14–17 million) by RM Auctions this past August, setting an auction record for the Italian automaker. The car, one of only 10 built, retailed for less than $15,000 in the 1960s. -

Ferrari 250 GTO Is the Car That Every Man Dreams of Having

Beat: Automobiles Ferrari 250 GTO is the car that every man dreams of having F 250 GTO is the most beautiful car Bologna Italy, 30.10.2017, 21:58 Time USPA NEWS - The Ferrari 250 GTO is a GT car produced by Ferrari from 1962 to 1964 for homologation into the FIA's Group 3 Grand Touring Car category. It was powered by Ferrari's Tipo 168/62 V12 engine. The "250" in its name denotes the displacement in cubic centimeters of each of its cylinders; "GTO" stands for "Gran Turismo Omologato",Italian for "Grand Touring Homologated." Just 39 250 GTOs were manufactured between 1962 and 1964. This includes 33 cars with 1962-63 bodywork (Series I), three with 1964 (Series II) bodywork similar to the Ferrari 250 LM, and three "330 GTO" specials with a larger engine. Four of the older 1962-1963 (Series I) cars were updated in 1964 with Series II bodies. When new, the GTO cost $18,000 in the United States, with buyers personally approved by Enzo Ferrari and his dealer for North America, Luigi Chinetti. In May 2012 the 1962 250 GTO made for Stirling Moss set an all-time record selling price of $38,115,000. In October 2013, Connecticut-based collector Paul Pappalardo sold chassis number 5111GT to an unnamed buyer for a new record of around $52 million. In 2004, Sports Car International placed the 250 GTO eighth on a list of Top Sports Cars of the 1960s, and nominated it the top sports car of all time. Similarly, Motor Trend Classic placed the 250 GTO first on a list of the "Greatest Ferraris of All Time." Popular Mechanics named it the "Hottest Car of All Time." Tipo 168/62 V12 engine The 250 GTO was designed to compete in GT racing, where its rivals would include the Shelby Cobra, Jaguar E-Type and Aston Martin DP214. -

2020-07 Autoitalia

070_073_AI293_Amelia v2_CR.qxp_AI Template 18/05/2020 11:07 Page 70 Amelia Island Concours d’Elegance The 25th year of the Florida event was celebrated in style Story & images by Keith Bluemel he Amelia Island Concours d’Elegance renown is as a team owner and astute businessman. ABOVE: Lovely OSCA by celebrated its silver anniversary at its In the UK, the Penske Organisation is the owner of Michelotti predates regular location on the fairways of the Maranello Sales, as well as the Maranello Ferrari Lancia Fulvia shape Golf Club at Amelia Island in Florida. Each Service and Classic Parts divisions. BELOW: Iso Rivolta and year over the past quarter of a century, To put into perspective the achievements of the Ferrari 250 GTO Tevent chairman Bill Warner and his team have Penske racing team, over a 53-year period it has won gathered superb arrays of cars and motorcycles of more than 540 races, 13 national championships and multiple genres for the delectation of the visitors, 18 Indianapolis 500s. As is the custom at the concours, and 2020 was no exception. there was a class for the cars of the honouree. In fact, Each year there is an honouree, and for 2020 it was this year there were four: cars that he’d driven; Team Roger Penske, aka ‘The Captain’. He was a proficient Penske cars; Team Penske Sunoco cars; and race driver in his time, but in more recent years his Indianapolis 500 winners. The displays certainly 70 auto italia 070_073_AI293_Amelia v2_CR.qxp_AI Template 18/05/2020 11:08 Page 71 provided an eclectic array of machinery, ranging from cars raced early in his career, like a Ferrari 250 GTO (chassis # 3987 GT) through a Porsche 917/30 CanAm car, resplendent in blue-and-yellow Sunoco livery, right up to current racers. -

Volume 18 Issue 4

Hello FCA Southwest Region Members, I am honored to serve as your President at this exciting time in our club’s history. The Ferrari Club of America celebrating our 50th Anniversary, Ferrari Passione, and our Region hosting the International FCA Event in Palm Springs October 1 0–14, 2012. I am a proud, original owner, of a red, 1998 355GTS. I enjoy tracking, rallying, and showing my car. I’ve participated in four International FCA Events including Monterey ’04, Indy ’05, Watkins Glen ’07 and Road America ’09. My car has won three Platinum Awards and one Gold Award as well as three Coppa Bella Machinas. The International FCA Events are a wonderful opportunity to meet fellow Ferrari enthusiasts from all over the world. You also get a chance to work on your car and get it ready to be shown in the Concours if you choose. If you have never shown your car it is a delightful learning experience. We plan on having a seminar in the near future to educate our members on what the judges are looking October –December 2011 for and how points are deducted. You would be surprised at how you get to know your car when you pay attention to details. Also, if you have never driven your car on the track, there is a whole new world to explore. There will be track instructors to help the beginners and seasoned drivers hoping to President ’s learn “the line” at a new track. The Rally is another way to enjoy your beautiful machine with your partner. -

The Elio Re Ferrari Toy Model Collection - August 13

10/01/21 07:19:55 The Elio Re Ferrari Toy Model Collection - August 13 Auction Opens: Fri, Jun 4 7:00am PT Auction Closes: Fri, Aug 13 10:00am PT Lot Title Lot Title ER0001 1964 Ferrari 250 LM Scale Model Car ER0015A 1962 Ferrari GTO 1:18 Scale Model Car ER0001A Ferrari Grand Prix Scale Model Car ER0016 1956-1957 Ferrari 500 TRC Scale Model Car ER0002 Marklin Sprint 1956 Ferrari v Mercedes Slot ER0016A 1957 Ferrari 250 Testa Rossa 1:18 Scale Model Car Set Car ER0002A Ferrari 312 Battery Powered Remote Control ER0016B 1963 Ferrari 250 P Scale Model Car Car ER0017 Ferrari 250 GT 1:16 Scale Model Car ER0003 Marklin Sprint 1956 Ferrari v Mercedes Slot ER0018 Go Magicar Motoring Battery-Powered Cars Car Set and Roadway Game ER0003A Ferrari 312 T2 1:12 Scale Model Car ER0018A 1957 Ferrari 250 Testa Rossa 1:18 Scale Model ER0004 1954 Ferrari 250 Monza Scale Model Car Car ER0004A Ferrari 250 Le Mans Remote Control Car ER0019 1952 Ferrari 212 Inters Scale Model Car ER0005 1962 Ferrari 196 SP Scale Model Car ER0019A Ferrari 1:43 Scale Model Car ER0005A Ferrari 312 T5 1:14 Scale Model Car ER0020 1963 Ferrari 250 P Scale Model Car ER0006 1958 Ferrari 250 GT Scale Model Car ER0020A Ferrari 156 F1 1:43 Scale Model Car ER0006A Ferrari Testarossa Toy Car ER0021 1957 Ferrari 335 S 1:32 Slot Car ER0007 Ferrari 250 Monza Scale Model Car ER0021A Ferrari 246 GTS Jet-Car de Norev 1:43 Scale ER0007A Ferrari 312 T5 1:14 Scale Model Car Model Car ER0008 1964 Ferrari Dino 246 S Scale Model Car ER0022 Ferrari and Mercedes Benz Battery-Operated Remote Control Cars -

Brand Model Year Km Color Location Ferrari 250 Gto

SUPER CARS BRAND MODEL YEAR KM COLOR LOCATION PRICE FERRARI 250 GTO 1962 Rosso / Nero USA / EUR price on request FERRARI 250 GTO 1962 Rosso cina / Beige Europe 68,000,000.00 € FERRARI 250 GTO 1963 Rosso / beige Europe 58.000.000,00 $ FERRARI 330 LMB 1963 Rosso / Nero USA 25.000.000,00 $ FERRARI 330 SP 1994 Rosso / Nero USA 5.500.000,00 $ FERRARI 340 MM 1953 Blue / black Italy 8.000.000,00 € FERRARI 288 GTO Various Red / Black Europe p FERRARI 275 GTB short noise 1965 Red / Red USA 2,200,000.00 € FERRARI 275 GTB/2 1962 Green / beige Italy 2,000,000.00 € 250 GT SWB california FERRARI 1961 Beige / Beige UK 9,300,000.00 € 250Spider GT SWB california FERRARI 1962 Red / Black Itlay 1.000.000,00 £ Spider FERRARI 250 GT SWB STEEL BODY 1962 Red / Beige Europe 8,500,000.00 € FERRARI 250 GT SWB Berl.Comp. Alu 1960 Blu / Black France 11,000,000.00 € FERRARI 250 GT SWB Berl.Comp. Alu 1961 Red / Black USA on request FERRARI DINO 246 GT 1972 46,000 Red / Black Itay 300,000.00 € FERRARI BB 512 CARBU 1977 36,000 Black / beige Italy 350,000.00 € FERRARI ENZO 2004 30,000 Black/ Black-Yellow France 2,100,000.00 € FERRARI ENZO 2004 3,200 Yellow / black Italia 2,300,000.00 € FERRARI F40 CAT 1992 9000 miles Blue / black UK 1,150,000.00 € FERRARI F40 CAT 1991 5,800 Red / red France 1,200,000.00 € FERRARI F40 1990 11,200 Red / red Germany 1,200,000.00 € FERRARI F40 1990 12,875 Red / red Europe 1,150,000.00 € FERRARI F40 1988 14,000 Red/red Europe 990,000.00 € Page 1 de 3 SUPER CARS BRAND MODEL YEAR KM COLOR LOCATION PRICE FERRARI F40 LM 1990 Red / red UK 4,900,000.00 -

Ferrari 250 GTO the Autobiography of 4153 GT Keith Bluemel Publishing by Porter Press International

Ferrari 250 GTO The Autobiography of 4153 GT Keith Bluemel Publishing by Porter Press International Publication Date: September 2015 Standard Edition, Hardback RRP: £60.00, ISBN: 978‐1‐907085‐27‐ 7 Page extent: 320 pp over 300 photographs, including colour. This magnificent book tells the story of a Ferrari 250 GTO with a particularly interesting and varied history. The car is chassis number 4153 GT and it won the Tour de France – an arduous 10‐day race‐cum‐rally – in the hands of Lucien Bianchi and Georges Berger in 1964. That success typifies this car’s competition life, for it did virtually every form of motorsport, including endurance racing (it finished fourth in the Le Mans 24 Hours in 1963), hill‐climbing and rallying. All this is covered in fascinating detail, supported by a fine collection of period photographs, including colour. Any Ferrari enthusiast will enjoy this addition to the ‘Great Cars’ series. Key Content: This GTO’s racing career started with great promise at Le Mans in 1963, with fourth place for Pierre Dumay and Léon Dernier. Two busy seasons in 1964–65 brought 14 competition outings, with the win for Lucien Bianchi/Georges Berger in the 1964 Tour de France the highlight – and there was also a trip to Africa for the Angolan Grand Prix. The great Belgian teams, Ecurie Francorchamps and Ecurie National Belge, raced 4153 GT until the end of 1965. The car’s little‐known competition career in Spain in the period 1966–69 is uncovered for the first time, with interview input from owner/driver Eugenio Baturone.