March 2016 M&A and Investment Summary Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Staffing M&A Funders and Advisors

Global Market Information and Forecasts Staffing M&A Funders and Advisors 2 September 2020 | Adam Pode, Director of Research (EMEA & APAC) | [email protected] M&A Funders and Advisors Directory | 2 September 2020 Introduction Use this report to identify M&A • This directory provides full records for over 30 companies operating in the M&A space funders and advisors and around the world. Some firms provide services in just one market while others provide understand the nature of their international and cross-border M&A advice and services in up to 40+ countries. They are services listed in alphabetical order, and an index is provided at the rear of this document (page 34). • An additional 115+ firms who have been identified as providing M&A services are also shown (pages 28 to 33). We have tried to make this report as exhaustive as possible, but if there are additional companies you believe should be listed, or if you would like to contribute a “full” entry within this directory, please contact the author, shown below. • This report is designed as a standalone document but can also be read in conjunction with our M&A reports which are available to subscribers of Staffing Industry Analysts’ research services. These included our interactive dashboard of staffing and workforce solutions M&A activity, which details more than 1,300 transactions in the sector. • If you are interested in joining our service or require further information, please contact Tina McGarvey at [email protected]. In addition, you can subscribe free to our Daily News, which reports deals as and when they happen, by clicking here. -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business. Introduction The Denver Office of Economic Development is pleased to release this fifth annual edition of the Denver Capital Matrix. This publication is designed as a tool to assist business owners and entrepreneurs with discovering the myriad of capital sources in and around the Mile High City. As a strategic initiative of the Denver Office of Economic Development’s JumpStart strategic plan, the Denver Capital Matrix provides a comprehensive directory of financing Definitions sources, from traditional bank lending, to venture capital firms, private Venture Capital – Venture capital is capital provided by investors to small businesses and start-up firms that demonstrate possible high- equity firms, angel investors, mezzanine sources and more. growth opportunities. Venture capital investments have a potential for considerable loss or profit and are generally designated for new and Small businesses provide the greatest opportunity for job creation speculative enterprises that seek to generate a return through a potential today. Yet, a lack of needed financing often prevents businesses from initial public offering or sale of the company. implementing expansion plans and adding payroll. Through this updated resource, we’re striving to help connect businesses to start-up Angel Investor – An angel investor is a high net worth individual active in and expansion capital so that they can thrive in Denver. venture financing, typically participating at an early stage of growth. Private Equity – Private equity is an individual or consortium of investors and funds that make investments directly into private companies or initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. -

The 2018 Preqin Private Capital Fund Terms Advisor – Sample Pages

THE 2018 PREQIN PRIVATE CAPITAL FUND TERMS ADVISOR – SAMPLE PAGES 1. EXECUTIVE SUMMARY Fig. 1.1: Annual Global Private Capital Fundraising, 2000 - 2018 YTD (As at June 2018) 2,500 2,307 2,340 2,044 1,945 2,000 1,855 1,632 1,642 1,659 nvestors remain satisfied with private The opaque nature of private capital 1,570 1,500 1,424 capital, with fundraising in 2017 surpassing investments makes it consistently difficult 1,333 I 1,183 1,118 the $800bn mark for the first time on record for a consensus or benchmark to be reached 1,000 921 (Fig. 1.1). More capital was also distributed across the industry. Unique features change 811 768 848 667 688 712 669 700 across fewer funds, resulting in the average the profile of a given fund, and greatly 605 583 547 587 575 500 387 451 fund size growing to $507mn in 2017 affect how fees are set out and levied. 2017 365 327 322 274 239 172 222 compared to $411mn in 2016. This suggests once again saw greater movement towards 135 106 that competition in the market remains transparency throughout the industry, as 0 fierce and that managers will need to ensure voiced by many investors interviewed by 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 they are continually providing satisfaction Preqin during the course of the year. It is to and striving for an alignment of interests clear at this point that the momentum is 2018 YTD Year of Final Close with their LPs. -

Powerpoint Template

BeBeez Magazine 10 febbraio 2018 - n.3/2018 - Le news del private capital dal 3 febbraio al 9 febbraio 2018 Per le news del weekend appuntamento lunedì su BeBeez Gli azionisti di Italo-Ntv accettano l’offerta di Global Infrastructure Partners In Private Equity pag. 3 I EdiBeez srl - Corso Italia, 22 – 20122 Milano – PIVA 09375120962 1 SOMMARIO PRIVATE EQUITY In Italia 3 All’estero 4 SOCIETA’ 6 PRIVATE DEBT 6 REAL ESTATE In Italia 7 All’estero 7 VENTURE CAPITAL 9 ANGELS & INCUBATORS 9 CROWDFUNDING 10 CRISI E RILANCI 10 NPL 11 LIBRI 12 ARTE 13 EdiBeez srl - Corso Italia, 22 – 20122 Milano – PIVA 09375120962 2 PRIVATE EQUITY LA SETTIMANA DEL PRIVATE EQUITY IN ITALIA BC Partners studia l’exit dai ristoranti Il Cda di Ntv rimanda a oggi la Old Wild West decisione sull’offerta del fondo GIP 9 febbraio 2018 - Mentre Cigierre è in corsa per 7 febbraio 2018 - Il consiglio di amministrazione comprare Sebeto, la holding a capo delle catene di di Nuovo Trasporto Viaggiatori (Ntv) che si è riunito ristorazione Rossopomodoro, Anema&Cozze, ieri ha lasciato aperti lavori sino a questo pomeriggio (si Rossosapore e Ham Holy Burger, controllate dai veda qui il comunicato stampa), per valutare con il fondi Change Capital e Quadrivio, ma per le quali in supporto dei propri advisor quale decisione prendere a pole position pare ci sia il fondo OPCapita. Leggi tutto. proposito dell’offerta inattesa da parte del fondo Global Infrastructure Partners di acquisto del 100% della società per 1,9 miliardi di euro di valore dell’equity, Leggi tutto. -

1Q 2019 Relationship Management Purpose-Built for Finance Learn More at Affinity.Co

Co-sponsored by Global League Tables 1Q 2019 Relationship Management Purpose-Built for Finance Learn more at affinity.co IMPROVE ELIMINATE SUPPORT DISCOVER PROPIERTARY CROSSING YOUR NEW EXECUTIVE DEAL FLOW WIRES PORTFOLIO CONNECTIONS Learn why 500+ firms use Affinity's patented technology to leverage their network and increase deal flow “Within weeks of moving “The biggest problems Affinity “Let’s be honest, no one wants to Affinity, we were able to helps me solve are how to to use Salesforce reporting. easily discover and manage track all of my activity and how Affinity isn’t just better for most the 1,000s of entrepreneur to prioritize my time. It makes teams, it’ll make the difference and venture community me a better investor. All of the between managing your relationships already latent things I need to do on a day-to- pipeline to success, versus not within our team." day basis I now do in Affinity.” tracking it at all.” ERIC EMMONS KYLE LUI KEVIN ZHANG Managing Director Partner Principal MassMutual Ventures DCM Ventures Bain Capital Ventures [email protected]@affinity.co AffinityAffinity is a relationship is a relationship intelligence intelligence platform platform built to builtexpand to expandand evolve and theevolve traditional the traditional CRM. AffinityCRM. Affinityinstantly instantly surfaces surfaces all all www.affinity.cowww.affinity.co of yourof team’s your team’sdata to data show to you show who you is bestwho issuited best tosuited make to the make crucial the crucialintroductions introductions you need you to need close to your close next your big next deal. big deal. -

Fresh Money 2013-Q4 Copyright

Fresh Money 2013-Q4 http://jaycaplan.com/ Date VC/PE Website Headline Location Techrockies Reports that Boulder Ventures Is To Raise $100M 12/26/13 Boulder Ventures http://www.boulderventures.com/ Sixth Fund Boulder, CO Boston-based private equity firm Mansa Capital Management Raises $50M to invest in healthcare information technology (HCIT) and services companies that help to contain healthcare 12/21/13 Mansa Capital Management http://www.mansacapital.com/ costs and improve clinical outcomes Boston PE Firn Welsh, Carson, Anderson & Stowe Raising $3B 12th PE Fund for growth-oriented companies in the healthcare and 12/13/13 Welsh, Carson, Anderson & Stowe http://www.welshcarson.com/ information/business services industries New York 12/21/13 Economic Development Corp. http://www.nycedc.com/press-release/deputy-mayor-steel-and-nycedc-announce-two-new-initiatives-dramatically-grow-citysWSJ: New York City to Start $50M Venture Fund for Biotech New York Growth PE Firm Great Point Partners closes $215M health care 12/21/13 Great Point Partners http://www.gppfunds.com/ investment Fund II Greenwich, CT 12/13/13 Investor AB http://www.investorgrowthcapital.com/ Investor Growth Capital Ends Venture Investing New York Biomark Capital Forms $200M VC fund by Splitting Off from 12/3/13 Biomark Capital http://biomarkcapital.com/ Burrill Capital Greenwich, CT 12/3/13 5AM Venture Management http://5amventures.com/ 5AM Ventures Raises $250M Fourth Life Science Venture Fund Menlo Park CA, Boston MA Gilde Healthcare closes €145 million ($200 million) Utrecht, The Netherlands, 11/26/13 Gilde Healthcare http://www.gildehealthcare.com/ transatlantic growth capital fund Cambridge, MA Edmond de Rothschild Investment Partners Closes 4th €192M 11/4/13 Edmond de Rothschild Investment Partnershttp://www.edmond-de-rothschild.fr/En/edrip/Pages/default.aspxEuropean Life Science Fund Paris, France Palo Alto, CA, Boston, MA, Venture Debt Leader Hercules Technology Growth Capital Westminster, CO, McLean, VA, 11/4/13 Hercules Technology Growth Capital, http://www.htgc.com/Inc. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

The State of Growth Equity for Minority Business: a River of Capital Flowing Past Our Communities

The State of Growth Equity for Minority Business | 1 The State of Growth Equity for Minority Business: A river of capital flowing past our communities Marlene Orozco and Eutiquio “Tiq” Chapa The State of Growth Equity for Minority Business | 2 The NAIC (www.naicpe.com) was formed in 1971 as About this White Paper the American Association of MESBICs (AAMESBIC), Inc., under President Richard M. Nixon’s Black Capital- ism program, which sought to ease access to capital The National Association of Investment for diverse business. During the 1980s, AAMESBIC Companies, Inc. (NAIC) commissioned this report lobbied successfully for legislation that would allow alongside the report by Lawrence C. Manson, Jr., diverse firms to repurchase the preferred stock from “Access to Capital: Accelerating Growth of Diverse- the U.S. Small Business Administration (SBA) while and Women-Owned Businesses,” as part of a grant raising funds that were not SBA regulated. AAMESBIC from the Minority Business Development Agency firms began approaching pension funds and other (MBDA), an agency within the United States Depart- institutional investors to raise larger pools of capital. ment of Commerce. The grant seeks to facilitate the aggregation and deployment of $1 billion in growth In the next decade, the organization changed its name equity capital to ethnically Diverse- and Women- to the National Association of Investment Companies, Owned Business Enterprises (DWBEs). Inc. as most members had turned from reliance on the SBA to become independent, institutional private equi- ty firms. Today, the NAIC has a membership of more In this report, Marlene Orozco, Chief Executive Officer than 80 diverse private equity and hedge fund firms of Stratified Insights, LLC, a premier research managing more than $165 billion in assets. -

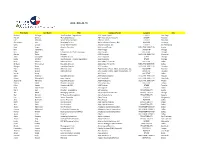

2019 - Dallas, Tx

2019 - DALLAS, TX First Name Last Name Title Company Name Category City Richard Bollinger Vice President, Originations 36th Street Capital LENDER San Diego Patrick Gimlett Managing Director AB Private Credit Investors LENDER Houston Eric Petersen Senior Vice President Abacus Finance LENDER New York Christopher Lisle Managing Partner Acclaro Growth Partners, LLC ADVISOR leesburg Lilies Lanway Senior Vice President Accord Financial, Inc. LENDER St. Petersburg Sara Singer Chapter Executive ACG Central Texas EXECUTIVE DIRECTOR Austin Kim Hammond CEO ACG Chicago ACG STAFF Chicago Kris Mayo Convention and Events Manager ACG Chicago ACG STAFF Chicago Marcie Taylor Director ACG Cincinnati EXECUTIVE DIRECTOR Cincinnati John O'Loughlin President & CEO ACG Corporate OTHER Chicago Leslie Whittet Vice President - Chapter Operations ACG Corporate OTHER Chicago Kristi Roberts Administration ACG Dallas / Ft. Worth ACG STAFF Dallas Brittany Timmerman Executive Director ACG Dallas / Ft. Worth EXECUTIVE DIRECTOR Dallas Morgan Stone Executive Director ACG Houston EXECUTIVE DIRECTOR Houston Marc Wilkins Administration ACG Houston /Assoc. Mgmt. Consultants, LLC ACG STAFF Houston Dale Wilkins Administration ACG Houston /Assoc. Mgmt. Consultants, LLC ACG STAFF Houston Yu-chi Wang ACG Intern ACG STAFF Dallas Katie Newland Executive Director ACG National Capital EXECUTIVE DIRECTOR McLean Robert Blumenfeld exec Director ACG New York EXECUTIVE DIRECTOR New York Stephanie McAlaine Executive Director ACG Philadelphia EXECUTIVE DIRECTOR Wayne Sherry Smith Chapter Executive -

CED 2014 Innovators Report Hires

INNOVATORS REPORT 2013 Trends in North Carolina Entrepreneurship 2013 IPO WATCH 226 NATIONAL 9 STATEWIDE 1. Aerie Pharmaceuticals 26 2. ChannelAdvisor SOUTHEAST 3. Chimerix 4. Heat Biologics 5. LipoScience 6. Ply Gem Holdings 7. Quintiles 8. Regado Biosciences 9. Stock Building Supply REPORT SOURCES: CED, National Venture Capital Association (NVCA), North Carolina Biotechnology Center, Ernst & Young, PricewaterhouseCoopers, SBIR.gov The Innovators Report is made possible by generous gifts to the CED Annual Fund. Thank you to our many supporters! For more information on how to contribute, please visit www.cednc.org/donate. MAJOR MERGERS & NC EVENTS ACQUISITIONS* DSM Pharmaceuticals Patheon $2.6 billion Santarus Salix Pharmaceuticals $2.6 billion COMPANY PRA International Kolberg, Kravis & Roberts $1.3 billion MILESTONES Solstas Lab Partners Quest Diagnostics $570 million Medicago Mitsubishi Tanabe Pharma $357 million Recognized as Advanced Liquid Logic Illumina $96 million 50 million Named Cracks a “Disrupter” sponsored 2013 Top 50 for the wireless Exam Design Pearson VUE app installs Fierce in Digital industry by Top 15 Health Entrepreneur Magazine Geomagic 3D Systems GrassRoots Biotechnology Monsanto Novella Clinical Quintiles Secure Enterprise Computing Agio Technology Axial Republic Appia Scioderm Exchange Wireless Tekelec Oracle ACQUIRED ACQUIRED BY *Partial listing DEALS & PARTNERSHIPS Signs up Yahoo! Sports, Bloomberg, CBS and Gannett $70 million deal with Toyama Chemical Company and a $58 million BARDA contact CHATHAM THERAPEUTICS -

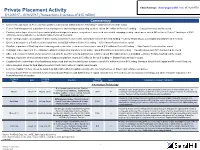

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in Excess of $15 Million) Commentary

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in excess of $15 million) Commentary . Element AI, a provider of AI as a Service platform, raised $102 million in Series A funding — Data Collective led the round. Fusion Risk Management, a provider of risk management and contingency planning services, raised $41 million in Series C funding — Catalyst Investors led the round. Conviva, a developer of an intelligent control platform designed to power every internet-connected screen with engaging viewing experiences, raised $40 million in Series F funding at a $260 million pre-money valuation — Australia Future Fund led the round. Drone Racing League, an organizer of drone racing competitions and events, raised $25 million in Series B funding — Liberty Media Group, Lux Capital and Sky UK led the round. Entelo, a developer of a SaaS recruitment platform, raised $20 million in Series C1 funding — US Venture Partners led the round. ShipBob, a provider of SaaS logistics technology and services for e-commerce businesses, raised $18 million in Series B funding — Bain Capital Ventures led the round. HelloSign, a developer of a free eSignature platform designed to sign documents online, raised $16 million in Series E funding — Foundry Group and Zach Coelius led the round. AEye, a developer of robotic vision systems created to be used for sensing autonomous vehicles, raised $16 million in Series A funding — Kleiner Perkins Caufield led the round. Highspot, a provider of a cloud-based sales engagement platform, raised $15 million in Series B funding — Shasta Ventures led the round. -

Deals Closed in Q2 2017 Deals Closed in Q2 2017

28 | BUYOUTS | July 24, 2017 www.buyoutsnews.com DEALS CLOSEDCLOSED IN IN Q2 Q2 2017 2017 Sponsor Acquiring entity (if Target Value ($Mil) Industry Add-on? Secondary? Deal Type Target add-on) Advisors 125 South Wacker 125 South Wacker Drive, 145.000 Real Estate No No Standalone Buyout - Drive, Chicago SPV Chicago ABRY Partners LLC Confie Seguros Inc EZ Insurance Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Louis p Ferrari Agency Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Rodney D Young Insurance 0.000 Financials Yes No Standalone Buyout - Inc ABRY Partners LLC Confie Seguros Inc Tremont Spirit Insurance Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Valletta Insurance Inc 0.000 Financials Yes No Standalone Buyout - Accel Partners JAGGAER Inc POOL4TOOL AG 0.000 High Technology Yes No Standalone Buyout goetzpartners Corp Finance Signal Hill Capital Group LLC Advent International GTM do Brasil Quantiq Distribuidora Ltda 172.053 Materials Yes Yes Standalone Buyout Bradesco BBI Corp Comercio de Produtos Quimicos Ltda Advent International UNIT4 NV Assistance Software EMEA 0.000 High Technology Yes No Standalone Buyout Corum Group Ltd. Corp BV Advent International GMD SA 84.700 High Technology No No Carve-out - Corp Advent International Invercap Holdings SA de CV 0.000 Financials No No Standalone Buyout - Corp AE Industrial Belcan LLC Schafer Corp 0.000 Industrials Yes Yes Standalone Buyout Raymond James & Partners LLC Associates