Weekly News Digest #5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Take-Two Interactive Software, Inc. Equity Analyst Report

Merrimack College Merrimack ScholarWorks Honors Senior Capstone Projects Honors Program Spring 2016 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College, [email protected] Follow this and additional works at: https://scholarworks.merrimack.edu/honors_capstones Part of the Finance and Financial Management Commons Recommended Citation Goncalves, Brian Nelson, "Take-Two Interactive Software, Inc. Equity Analyst Report" (2016). Honors Senior Capstone Projects. 7. https://scholarworks.merrimack.edu/honors_capstones/7 This Capstone - Open Access is brought to you for free and open access by the Honors Program at Merrimack ScholarWorks. It has been accepted for inclusion in Honors Senior Capstone Projects by an authorized administrator of Merrimack ScholarWorks. For more information, please contact [email protected]. Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 1 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College Honors Department May 5, 2016 Author Notes Brian Nelson Goncalves, Finance Department and Honors Program, at Merrimack Collegei. Brian Nelson Goncalves is a Senior Honors student at Merrimack College. This report was created with the intent to educate investors while also serving as the students Senior Honors Capstone. Full disclosure, Brian is a long time share holder of Take-Two Interactive Software, Inc. 1 Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 2 Table of Contents -

2K and Bethesda Softworks Release Legendary Bundles February 11

2K and Bethesda Softworks Release Legendary Bundles February 11, 2014 8:00 AM ET The Elder Scrolls® V: Skyrim and BioShock® Infinite; Borderlands® 2 and Dishonored™ bundles deliver supreme quality at an unprecedented price NEW YORK--(BUSINESS WIRE)--Feb. 11, 2014-- 2K and Bethesda Softworks® today announced that four of the most critically-acclaimed video games of their generation – The Elder Scrolls® V: Skyrim, BioShock® Infinite, Borderlands® 2, and Dishonored™ – are now available in two all-new bundles* for $29.99 each in North America on the Xbox 360 games and entertainment system from Microsoft, PlayStation®3 computer entertainment system, and Windows PC. ● The Elder Scrolls V: Skyrim & BioShock Infinite Bundle combines two blockbusters from world-renowned developers Bethesda Game Studios and Irrational Games. ● The Borderlands 2 & Dishonored Bundle combines Gearbox Software’s fan favorite shooter-looter with Arkane Studio’s first- person action breakout hit. Critics agree that Skyrim, BioShock Infinite, Borderlands 2, and Dishonored are four of the most celebrated and influential games of all time. 2K and Bethesda Softworks(R) today announced that four of the most critically- ● Skyrim garnered more than 50 perfect review acclaimed video games of their generation - The Elder Scrolls(R) V: Skyrim, scores and more than 200 awards on its way BioShock(R) Infinite, Borderlands(R) 2, and Dishonored(TM) - are now available to a 94 overall rating**, earning praise from in two all-new bundles* for $29.99 each in North America on the Xbox 360 some of the industry’s most influential and games and entertainment system from Microsoft, PlayStation(R)3 computer respected critics. -

Download (763Kb)

CHAPTER II. THEORITICAL REVIEW A. Online Game Online games rised rapidly in our society. Technology development is the basic of the using internet. Many people play online games in their daily, for example senior high school students. They play online games by using PC or smartphone. Online games which is be played over a computer network which is connected to the internet, especially one enabling two or more players to participate simultaneously from different location (Oxford dictionary :1980). Another definition according to Eddy Liem, the director of Gamer of Indonesia stated that online games is a game which is can be played by connecting to the internet through Personal Computer or consul game like play station, X-Box, etc. Based on the explanation above it can be concluded that online games is a game which is played by using PC or smartphone and it has to connect to the internet. 1. Kinds of Online games Nowaday there are so many number of online games. The gamer only need to download game and it is free. Online games divided into two kinds, web based games and text based games. Web based games is an aplication on the server internet where the user need to access the internet to play these games A Correlation Between Playing..., Wiwi Yulianti, FKIP UMP, 2017 without install the games in the PC or smartphone. Text based games is a game which is can be used computer in low specification, so user only able to interact to others by using texts not picture. There are five kinds of online games: a. -

Exploiting Steam Lobbies and Matchmaking by Luigi Auriemma

Revision 1 EXPLOITING STEAM LOBBIES AND MATCHMAKING BY LUIGI AURIEMMA Description of the security vulnerabilities that affected the Steam lobbies and all the games using the Steam Matchmaking functionalities. TABLE OF CONTENTS Contents Introduction ______________________________________________________________________________________________ 1 Steam lobbies and security risks _______________________________________________________________________ 2 Description of the issues ________________________________________________________________________________ 4 The proof-of-concept ____________________________________________________________________________________ 7 FAQ ________________________________________________________________________________________________________ 8 History ____________________________________________________________________________________________________ 9 Company Information __________________________________________________________________________________ 10 INTRODUCTION Introduction STEAM "Steam1 is an internet-based digital distribution, digital rights management, multiplayer, and communications platform developed by Valve Corporation. It is used to distribute games and related media from small, independent developers and larger software houses online."2 It's not easy to define Steam because it's not just a platform for buying games but also a social network, a market for game items, a framework3 for integrating various functionalities in games, an anti-cheat, a cloud and more. But the most important and attractive -

Demon's Souls Free Download Pc Demon’S Souls PC Download Free

demon's souls free download pc Demon’s Souls PC Download Free. Demon’s Souls Pc Download – Everything you need to know. Demon’s Souls is a best action role-playing game that is created by Fromsoftware that is available for the PlayStation 3. This particular game is published by Sony computer Entertainment by February 2009. It is associated with little bit complicated gameplay where players has to make the control five different worlds from hub that is well known as Nexus. It is little bit complicated game where you will have to create genuine strategies. It is your responsibility to consider right platform where you can easily get Demon’s Souls Pc Download. You will able to make the access of both modes like single player and multiplayer. It is classic video game where you will have to create powerful character that will enable you to win the game. All you need to perform the role of adventurer. In the forthcoming pargraphs, we are going to discuss important information regarding Demon’s Souls. Demon’s Souls Download – Important things to know. If you want to get Demon’s Souls Download then user should find out right service provider that will able to offer the game with genuine features. In order to win such complicated game then a person should pay close attention on following important things. Gameplay. Demon’s Souls is one of the most complicated game where you will have to explore cursed land of Boletaria. In order to choose a player then a person should pay close attention on the character class. -

A FUTURISTIC PORTABLE DIY LAPTOP What We Stand For

The Android APK • SEGA Gaming on your ODROID • Linux Gaming Year One Issue #9 Sep 2014 ODROIDMagazineMagazine BUILD YOUR OWN WALL-E THE LOVABLE PIXAR ROBOT COMES TO LIFE WITH AN ODROID-U3 • BASH BASICS • FREEDOMOTIC 3D PRINT AN • WEATHER FORECAST ODROID-POWERED • 10-NODE U3 CLUSTER • ODROID-SHOW GARDENING SYSTEM 3DPONICS PLUS: A FUTURISTIC PORTABLE DIY LAPTOP What we stand for. We strive to symbolize the edge technology, future, youth, humanity, and engineering. Our philosophy is based on Developers. And our efforts to keep close relationships with developers around the world. For that, you can always count on having the quality and sophistication that is the hallmark of our products. Simple, modern and distinctive. So you can have the best to accomplish everything you can dream of. We are now shipping the ODROID U3 devices to EU countries! Come and visit our online store to shop! Address: Max-Pollin-Straße 1 85104 Pförring Germany Telephone & Fax phone : +49 (0) 8403 / 920-920 email : [email protected] Our ODROID products can be found at http://bit.ly/1tXPXwe EDITORIAL With the introduction of the ODROID-W and ODROID Weath- er Board, there have been several projects posted recently on the ODROID forums involving home automation, ambient lighting, and cool robotics. This month, we feature several of those projects, including predicting whether to go fishing this weekend, building a custom laptop case, taking care of your garden remotely, and building a faithful reproduction of everyone’s favorite robot, Wall-E! Hardkernel will be demonstrat- ing the new XU3 at ARM Techcon on Oc- tober 1st - 3rd, 2014 in San Jose, Califor- nia. -

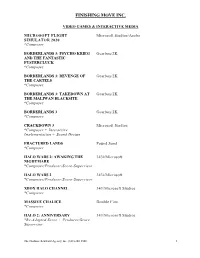

Finishing Move Inc

FINISHING MOVE INC. VIDEO GAMES & INTERACTIVE MEDIA MICROSOFT FLIGHT Microsoft Studios/Asobo SIMULATOR 2020 *Composer BORDERLANDS 3: PSYCHO KRIEG Gearbox/2K AND THE FANTASTIC FUSTERCLUCK *Composer BORDERLANDS 3: REVENGE OF Gearbox/2K THE CARTELS *Composer BORDERLANDS 3: TAKEDOWN AT Gearbox/2K THE MALIWAN BLACKSITE *Composer BORDERLANDS 3 Gearbox/2K *Composer CRACKDOWN 3 Microsoft Studios *Composer + Interactive Implementation + Sound Design FRACTURED LANDS Pound Sand *Composer HALO WARS 2: AWAKING THE 343i/Microsoft NIGHTMARE *Composer/Producer/Score-Supervisor HALO WARS 2 343i/Microsoft *Composer/Producer/Score-Supervisor XBOX HALO CHANNEL 343/Microsoft Studios *Composer MASSIVE CHALICE Double Fine *Composer HALO 2: ANNIVERSARY 343/Microsoft Studios *Re-Adapted Score + Producer/Score Supervisor The Gorfaine/Schwartz Agency, Inc. (818) 260-8500 1 FINISHING MOVE INC. OVERDRIVE Anki *Composer + Interactive Implementationb OVERDRIVE: SUPERTRUCKS Anki *Composer + Interactive Implementation OVERDRIVE: FAST AND FURIOUS Anki EDITION *Composer COZMO Anki *Producer/Score Supervisor + Interactive Implementation TILT BRUSH Google *Composer DROPCHORD Double Fine *Composer CALLING Hudson Soft *Composer MICROSOFT FLIGHT Microsoft Studios *Additional music GHOST RECON FUTURE SOLDIER *Synth programming HALO COMBAT EVOLVED 343/Microsoft Studios ANNIVERSARY *Re-Adapted Score + Programming BORDERLANDS 2 *Guitars + Synth Programming ASSASSIN'S CREED BROTHERHOOD Ubisoft *Guitars BORDERLANDS *Guitars + Synth Programming ASSASSIN'S CREED REVELATIONS Ubisoft *Guitars + Synth Programming The Gorfaine/Schwartz Agency, Inc. (818) 260-8500 2 FINISHING MOVE INC. NEED FOR SPEED SHIFT *Additional Music ASSASSIN'S CREED II Ubisoft *Guitars TIGER WOODS 2004 *Additional Music The Gorfaine/Schwartz Agency, Inc. (818) 260-8500 3 . -

1080-Pinballgamelist.Pdf

No. Table Name Table Type 1 12 Days Christmas VPX Table 2 2001 (Gottlieb 1971) VP 9 Table 3 24 (Stern 2009) VP 9 Table 4 250cc (Inder 1992) VP 9 Table 5 4 Roses (Williams 1962) VP 9 Table 6 4 Square (Gottlieb 1971) VP 9 Table 7 Aaron Spelling (Data East 1992) VP 9 Table 8 Abra Ca Dabra (Gottlieb 1975) VP 9 Table 9 ACDC (Stern 2012) VP 9 Table 10 ACDC Pro - PM5 (Stern 2012) PM5 Table 11 ACDC Pro (Stern 2012) VP 9 Table 12 Addams Family Golden (Williams 1994) VP 9 Table 13 Adventures of Rocky and Bullwinkle and Friends (Data East 1993) VP 9 Table 14 Aerosmith Future Table 15 Agents 777 (GamePlan 1984) VP 9 Table 16 Air Aces (Bally 1975) VP 9 Table 17 Airborne (Capcom 1996) VP 9 Table 18 Airborne Avenger (Atari 1977) VP 9 Table 19 Airport (Gottlieb 1969) VP 9 Table 20 Aladdin's Castle (Bally 1976) VP 9 Table 21 Alaska (Interflip 1978) VP 9 Table 22 Algar (Williams 1980) VP 9 Table 23 Ali (Stern 1980) VP 9 Table 24 Ali Baba (Gottlieb 1948) VP 9 Table 25 Alice Cooper Future Table 26 Alien Poker (Williams 1980) VP 9 Table 27 Alien Star (Gottlieb 1984) VP 9 Table 28 Alive! (Brunswick 1978) VPX Table 29 Alle Neune (NSM 1976) VP 9 Table 30 Alley Cats (Williams 1985) VP 9 Table 31 Alpine Club (Williams 1965) VP 9 Table 32 Al's Garage Band Goes On World Tour (Alivin G. 1992) VP 9 Table 33 Amazing Spiderman (Gottlieb 1980) VP 9 Table 34 Amazon Hunt (Gottlieb 1983) VP 9 Table 35 America 1492 (Juegos Populares 1986) VP 9 Table 36 Amigo (Bally 1973) VP 9 Table 37 Andromeda (GamePlan 1985) VP 9 Table 38 Animaniacs SE Future Table 39 Antar (Playmatic 1979) -

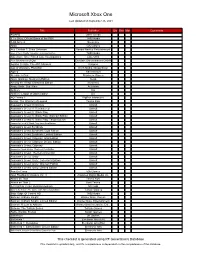

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

Download-Godfall Update Zip

1 / 4 Download-Godfall Update Zip Download games for PC absolutely free, all uploaded to mega, uploaded, googledrive and torrent.. The world's best games for Mac OS X. Come and enjoy games for mac presented FREE and available for all macOS computers.. Mar 27, 2021 — Ascend in Godfall, the first-of-its-kind, looter-slasher, melee action-RPG. ... OTHERWISE YOU WILL NEED TO DOWNLOAD FULL GAME AGAIN):. Patch Update v 2.0.93 · Patch Update v 2.0.95 · Patch Update v2.1.17 · Patch ... Just extract the .zip or .rar file (you may need WinRAR to extract ) and search for .... GOG – UPDATE V1.23 – ONE FTP LINK – TORRENT. Cyberpunk 2077 is an open-world, action-adventure story set in Night City…. (more…) Read More / 12 .... DlGames - free download pc game, ps3 games , ps4 games ,xbox games, skidrow, ... PES 2021 PS4 HEN 6.72 BITBOX PATCH (PES 2020 Update Season 2021) Direct ... Download Godfall PS5-BigBlueBox PPSA-01347 PKG Full Direct Links .... File Type: (Zip file) Comments: 0. ... Download Name: Monsters' Den: Godfall - Trainer +5 v1.19.0 {MrAntiFun} Category: PC Gaming PC Game ... Date of creation / update of trainer: 11/18/2020. hey would you be able to do a trainer for godfall?. Jun 18, 2020 — PUBG's new update lets PS4, Xbox One Players to team up; check ... Zip Code(92371) Tested From A First Generation PlayStation 4(PS4)(Destiny Glacier White) Console, On 1 Gig Download/Upload Fiberoptic Internet Through Internet Service ... Preparing for a mission in Godfall, out next week on PS5 .... The biggest totally free game fix & trainer library online for PC Games [https://gamecopyworld.com]. -

Dukenukemforever.Com

dukenukemforever.com << < > >> conTenTS SeTuP . 2 THe duke STorY. 3 conTroLS. 4 SInGLe PLAYer cAmPAIGn ���������������������������������������6 Hud. 7 eGo ������������������������������������������������������������������������������������� 8 WeAPonS. 8 GeAr / PIckuPS ������������������������������������������������������������� 12 edf. 14 enemIeS ����������������������������������������������������������������������������� 14 oPTIonS . 16 muLTIPLAYer . 17 muLTIPLAYer LeveLS / XP . 19 muLTIPLAYer cHALLenGeS . 19 muLTIPLAYer GAme modeS . 20 muLTIPLAYer PIckuPS. 22 mY dIGS . 23 cHAnGe room. 23 credITS . 24 LImITed SofTWAre WArrAnTY, LIcenSe AGreemenT & InformATIon InformATIon uSe dIScLoSureS ������������������������ 35 cuSTomer SuPPorT ����������������������������������������������� 37 << > >>1 Installation SeTuP Please ensure your computer is connected to the Internet prior to beginning the duke nukem forever installation process. Insert the duke nukem forever minimum System requirements DVD-rom into your computer’s DVD-rom drive. (duke nukem forever will not oS microsoft Windows XP / Windows vista / Windows 7 work in computers equipped only with cd-rom drives.) Please ensure the DVD- (Please note Windows XP 64 is not supported) rom logo is visible on your optical drive’s door or panel. The Installation process Processor Intel core 2 duo @ 2.0 GHz / Amd Athlon 64 X2 will conduct a one-time online check to verify the disc and download an activation @ 2.0 GHz file, and will prompt you for a Product code. The code can be found on the back memory 1 GB cover of your instruction manual. Hard drive 10 GB free space video memory 256 mB video card nvidia Geforce 7600 / ATI radeon Hd 2600 Sound card DirectX compatible THe duke STorY Peripherals K eyboard and mouse or microsoft Xbox 360® controller If you’ve ever wondered why we’re able to sit comfortably in our homes without the threat of our babes being abducted out from under us, the answer can be summed up in two words: duke nukem. -

Chromehounds™

CH_XBOX360_MNLINT.qxp 4/28/06 10:43 AM Page 2 Thank you for purchasing Chromehounds™. Please note that this software is WARNING designed for use with the Xbox 360™ video game and entertainment system from Microsoft®. Be sure to read this software manual thoroughly before you start Before playing this game, read the Xbox 360™ Instruction Manual and any playing. peripheral manuals for important safety and health information. Keep all manuals for future reference. For replacement manuals see www.xbox.com/support or call Xbox Customer Support (see inside of back cover). TM Important Health Warning About Playing Video Games Photosensitive Seizures TABLE OF CONTENTS A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have BACKGROUND HISTORY . 2 an undiagnosed condition that can cause these “photosensitive epileptic NEROIMUS . 4 seizures” while watching video games. THE THREE NATIONS OF NEROIMUS . 4 These seizures may have a variety of symptoms, including lightheadedness, GETTING STARTED . 6 altered vision, eye or face twitching, jerking or shaking of arms or legs, CONNECT TO XBOX LIVE® . 6 disorientation, confusion, or momentary loss of awareness. Seizures may also TITLE SCREEN . 7 cause loss of consciousness or convulsions that can lead to injury from falling OPTIONS . 7 down or striking nearby objects. GAME CONTROLS . 8 SCREEN DISPLAYS . 10 Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents should watch for or ask their children about the above GARAGE.