Twinning Project Fiche for “Strengthening

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Goodwill Impairment Test of the Cellular Segment June 30Th, 2019

Bezeq The Israel Telecommunication Corporation Limited Goodwill Impairment Test of the Cellular Segment June 30th, 2019 August 2019 14 Kreminitzky St., Tel Aviv 6789912 I Tel.: 03-5617801 I Fax: 077-3181607 Introduction and Limit of Liability • We were retained by Bezeq The Israel Telecommunication Corp. Ltd. (hereunder “Bezeq” and/or “Bezeq Group” and/or the ”Client”) to prepare a goodwill impairment test report (the “Report”) of the cellular business unit (hereunder: “Pelephone” and/or the “Cellular Segment”) as of June 30th, 2019. • The Report intended solely for the use of the Client and is . This Report may not be reproduced, in whole or in part, and the findings of this Report may not be used by a third party for any purpose, without our expressed written consent. Notwithstanding any of the above, this Report may be included in the Client’s financial statements of as of June. 30, 2017. • For the purpose of preparing this Report, we relied upon financial and other information including prospective financial information obtained from the Company and/or the Client and/or anyone on their behalf (the “Information”). We assumed that the Information is credible and therefore did not perform an independent audit of the information. In addition, nothing suggesting that the Information may be unreasonable has come to our attention. The Information has not been examined in an independent manner, and therefore this Report does not constitute a verification of the Information’s correctness, completeness and accuracy. If the case that the Information is not complete nor accurate or credible, the results of this valuation might change. -

Cellcom Israel Ltd. Announces Agreement to Purchase Golan Telecom

November 5, 2015 Cellcom Israel Ltd. Announces Agreement To Purchase Golan Telecom NETANYA, Israel, Nov. 5, 2015 /PRNewswire/ -- Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that the Company entered an agreement (the "Agreement" with Golan Telecom Ltd., or Golan, and its shareholders for the purchase of 100% of the shares of Golan, an Israeli cellular operator, for the sum of NIS 1.17 billion ("Purchase Price"). Golan is one of the four other Mobile Network Operators ("MNO") operating in Israel in addition to Cellcom Israel. It launched operations in 2012 with a strong brand recognized for low-cost services, and primarily provides cellular services to approximately 900,000 customers (as of November 2015), with a comparatively low churn. Golan is expected to end 2015 with total revenues exceeding NIS 500 million1. The Purchase Price represents an Enterprise Value, or EV2 of NIS 1 billion for Golan and EV/Adjusted EBITDA multiple of approximately 5.0, based on Golan's forecasted Adjusted EBITDA for 2015 (NIS 204 million)3. Ami Erel, the Company's Chairman of the Board, said: "In the last few years, Cellcom Group has repeatedly proven its ability to increase its service offerings, going from a cellular only operator to a full service communications group, with cellular, fixed line, internet and TV offerings, and succeeding despite the fierce competition. The acquisition of Golan Telecom will allow us to add a low-cost brand to our portfolio, and I'm confident that Cellcom's management will be able to successfully combine Golan's operations as the Company's low cost brand. -

Cellcom Israel Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20–F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from___________ to __________________ OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ……………………………. Commission file number 001-33271 CELLCOM ISRAEL LTD. (Exact name of Registrant as specified in its charter and translation of Registrant’s name into English) ISRAEL (Jurisdiction of incorporation or organization) 10 Hagavish Street, Netanya 4250708, Israel (Address of principal executive offices) Liat Menahemi Stadler, 972-52-9989595 (phone), 972-98607986 (fax), [email protected], 10 Hagavish Street, Netanya 4250708, Israel (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol Name of each exchange on which registered Ordinary Shares, par value NIS 0.01 per share (CEL) New York Stock Exchange (“NYSE”)*1 Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None (Title of Class) * We voluntarily delisted our ordinary shares from the NYSE on February 8, 2021. -

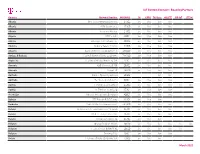

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Cellcom Israel Announces Developments Re Legal Actions Against Golan Telecom

CELLCOM ISRAEL ANNOUNCES DEVELOPMENTS RE LEGAL ACTIONS AGAINST GOLAN TELECOM Netanya, Israel – July 21, 2016 – Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that following the Company's previously reported legal actions against Golan Telecom in relation to Golan Telecom's hosting agreement with Hot Mobile Ltd., another Israeli cellular operator, the district court granted an interim injunction against the consummation of the Golan Telecom – Hot Mobile agreement, as requested by the Company. For additional details see the Company's most recent annual report for the year ended December 31, 2015 on Form 20-F, filed on March 21, 2016, under "Item 3 Key Information - D. Risk Factors– Risks Related to our Business –We face intense competition in all aspects of our business" and "- Risks Related to the Proposed Acquisition of Golan Telecom Ltd." and under "Item 4. Information on the Company - B. Business Overview - General - Agreement for the Purchase of Golan", and under "-Competition – Cellular" and " - Government Regulation – Additional MNOs", and the Company's current reports on Form 6-K date March 28, 2016, April 12, 2016, May 16, 2016, June 13, 2016 and July 12, 2016. About Cellcom Israel Cellcom Israel Ltd., established in 1994, is the largest Israeli cellular provider; Cellcom Israel provides its approximately 2.813 million cellular subscribers (as at March 31, 2016) with a broad range of value added services including cellular telephony, roaming services for tourists in Israel and for its subscribers abroad and additional services in the areas of music, video, mobile office etc., based on Cellcom Israel's technologically advanced infrastructure. -

Cellcom Israel Ltd. Announces Preliminary Review of Possibility to Purchase Golan Telecom

CELLCOM ISRAEL LTD. ANNOUNCES PRELIMINARY REVIEW OF POSSIBILITY TO PURCHASE GOLAN TELECOM Netanya, Israel –August 27, 2015 – Cellcom Israel Ltd. (NYSE: CEL) (TASE: CEL) (hereinafter: the "Company") announced today that although the company is not required to report this information, the Company's controlling shareholder will report this information under its Israeli reporting obligations and therefore the Company is publishing this press release regarding its intention to review the possible purchase of holdings in, or assets of, Golan Telecom Ltd., or Golan Telecom, an Israeli mobile network operator and competitor of the Company, following an invitation by Bank Rothschild, representing Golan Telecom's shareholders. There is no assurance that the Company will make an offer to purchase Golan Telecom nor as to the execution of such a sale. Finally, the Company can provide no assurances as to the impact of this sale, and any potential sale of holdings in, or assets of, Golan, on the parties' agreements or the competitive environment in the market. For additional details regarding the Company's agreements with Golan Telecom Ltd. and the competitive environment in which we operate see the Company's most recent annual report for the year ended December 31, 2014 on Form 20-F, filed on March 16, 2015, under "Item 3. Key Information – D. Risk Factors – Risks Related to our Business –"We face intense competition in all aspects of our business" and "Item 4. Information on the Company – B. Business Overview – Network and Technology - Network and Cell Sites Sharing Agreements", "Competition – Cellular" and "Government Regulation – Network Sharing" and "- Additional MNOs" and the Company's current report regarding the Company's results of operations in the second quarter of 2015, on form 6-K, dated May 14, 2015 under "Other Developments During the First Quarter of 2015 and Subsequent to the End of the Reporting Period – Network Sharing Agreements". -

The 14Th Workshop on Mobile Computing

ACM HotMobile 2013: The 14th Workshop on Mobile Computing Systems & Applications Feb 26-27, 2013 Jekyll Island, Georgia, USA General Chair Sharad Agarwal, Microsoft Research, US Program Chair Alexander Varshavsky, AT&T Labs, US Poster & Demo Chair Nilanjan Banerjee, University of Maryland, US Student Volunteer Chair Souvik Sen, HP Labs, US Publicity Chair Andreas Bulling, Lancaster University, UK Web Chair Christos Efstratiou, University of Cambridge, UK Sponsored by ACM, ACM SIGMOBILE, Microsoft Research, Telefonica, AT&T Labs, Google The Association for Computing Machinery 2 Penn Plaza, Suite 701 New York New York 10121-0701 ACM COPYRIGHT NOTICE. Copyright © 2013 by the Association for Computing Machinery, Inc. Permission to make digital or hard copies of part or all of this work for personal or classroom use is granted without fee provided that copies are not made or distributed for profit or commercial advantage and that copies bear this notice and the full citation on the first page. Copyrights for components of this work owned by others than ACM must be honored. Abstracting with credit is permitted. To copy otherwise, to republish, to post on servers, or to redistribute to lists, requires prior specific permission and/or a fee. Request permissions from Publications Dept., ACM, Inc., fax +1 (212) 869-0481, or [email protected]. For other copying of articles that carry a code at the bottom of the first or last page, copying is permitted provided that the per-copy fee indicated in the code is paid through the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, +1-978-750-8400, +1-978-750-4470 (fax). -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1111 – 1.XI.2016 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 1 NOVEMBER 2016) __________________________________________________________________ Geneva, 2016 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1111 of 1.XI.2016. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at www.itu.int/itu-t/inr/forms/mnc.html . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website at www.itu.int/itu-t/bulletin/annex.html . 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities. -

Designing the Future of the 5G Revolution

DESIGNING THE FUTURE OF THE 5G REVOLUTION NOVEMBER 17-18, 2020 VIRTUAL EXPO Mobile 5G Innovation Israel event, initiated by the Israel Export Institute and the Foreign Trade Administration at the Ministry of Economy and Industry is our first biggest virtual Mobile Technology Expo. The virtual Expo will be held on November 17-18, 2020 and will stay LIVE till January! This event will include Israel’s leading companies presenting the latest technology for: 5G, MEC, Connected Car, XR, IoT, Smart City, Smart Home, Telehealth, Industry 4.0, AI & Machine Learning, Big Data & Analytics, FinTech and much more. We invite you to join us and schedule 1:1 meetings with the most innovative companies in Israel. Contents The Israel Export & International Cooperation Institute 3 The Foreign Trade Administration 4 Index by Company 5 Index by Category 17 Company Profiles 25 Contents 2 The Israel Export & International Cooperation Institute ISRAEL EXPORT INSTITUTE The Israel Export & International Cooperation Institute, supported by member firms, private sector bodies and the government of Israel, advances business relationships between Israeli exporters and overseas businesses and organizations. By providing a wide range of export-oriented services to Israeli companies and complementary services to the international business community, the Institute helps build successful joint ventures, strategic alliances and trade partnerships. The IEICI’s High Tech Department is the leader in business matching between the more than 1,500 companies in the Israeli high tech industry and worldwide business partners at all levels. It has a proven ability to identify and match suitable potential business partners, organize one-on-one business meetings, and is a focal point for contacts with the government as well as with industry. -

Regulatory Story Go to Market News Section

4/4/2018 Agreement with HOT Mobile - RNS - London Stock Exchange Regulatory Story Go to market news section Mobile Tornado Group PLC - MBT Agreement with HOT Mobile Released 07:00 04-Oct-2017 RNS Number : 6189S Mobile Tornado Group PLC 04 October 2017 Mobile Tornado Group plc ("Mobile Tornado" or the "Company") Cooperaon Agreement to Provide PTToC services to HOT Mobile Customers The new technology enables Push-To-Talk (PTT) services on 3G and 4G networks and Wi-Fi networks Mobile Tornado, a leading provider of carrier grade professional end-to-end Push-to- Talk soluons over any IP network, and HOT Mobile, the fastest growing cellular Company in Israel, announces it has recently signed an agreement under which Mobile Tornado will provide its advanced Push-To-Talk over Cellular (PTToC) soluons to HOT Mobile customers in Israel. As part of the agreement, HOT Mobile will offer Mobile Tornado's PTToC services to customers of its MIRS network as well as other customers with PTT needs. Mobile Tornado's carrier-grade PTT technology enables PTT over cellular networks and the Internet, enabling individual users as well as large user groups to use push-to-talk (PTT), push-to-locate (PTL), push-to-alert (PTA) and push-to-message (PTM) services. The PTT services are used by government agencies, security organisaons, security companies, ulies and infrastructure companies, as well as manufacturing and service companies. Onboarding takes place via the MIRS 4G app, which is also available on Google Play and in the App Store. The app can be installed on smart devices as well as a wide range of rugged devices. -

International Broadband Data Report )

Federal Communications Commission DA 16-97 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) International Comparison Requirements Pursuant ) GN Docket No. 15-191 to the Broadband Data Improvement Act ) ) International Broadband Data Report ) FIFTH REPORT Adopted: January 28, 2016 Released: January 29, 2016 By the Chief, International Bureau: TABLE OF CONTENTS Heading Paragraph # I. INTRODUCTION .................................................................................................................................. 1 II. BACKGROUND .................................................................................................................................... 2 III. DISCUSSION ...................................................................................................................................... 13 A. Fixed Broadband Coverage Comparison with Europe .................................................................. 14 B. Broadband Subscription (OECD Countries) .................................................................................. 22 C. Fixed Broadband Speeds ................................................................................................................ 26 D. Broadband Pricing Plans ................................................................................................................ 32 E. Other Relevant Information and International Developments ....................................................... 43 IV. CONCLUSION ................................................................................................................................... -

Cellular ARPU 65.0 72.1 (9.9%)

Israel Cellcom Company Presentation | 2015 1 FORWARD LOOKING STATEMENTS The following information contains, or may be deemed to contain forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995 and the Israeli Securities Law, 1968). In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial results, our anticipated growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause such differences include, but are not limited to: changes to the terms of our license, new legislation or decisions by the regulator affecting our operations, the outcome of legal proceedings to which we are a party, particularly class action lawsuits, our ability to maintain or obtain permits to construct and operate cell sites, and other risks and uncertainties detailed from time to time in our filings with the U.S. Securities and Exchange Commission, including under the caption “Risk Factors” in our Annual Report for the year ended December 31, 2014. Although we believe the expectations reflected in the forward-looking statements contained herein are reasonable, we cannot guarantee future results, level of activity, performance or achievements.