Cease to Resist: How the FCC’S Failure to Enforce Its Rules Created a New Wave of Media Consolidation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Volume XII, No

March 31—April 6, 2011 Volume XII, No. 13 Willie Nelson added to line-up for “Kokua For Japan” on April 10 World-renowned entertainer Willie Nelson will perform at “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa on April 10, 2011 from noon to 5 p.m. All proceeds to benefit the American Red Cross for the Japan earthquake and Pacific tsunami relief efforts. Nelson will join previously announced entertainers including: Henry Kapono with special guests Michael McDonald and Mick Fleetwood; Loretta Ables Sayre; The Brothers Cazimero; Cecilio & Kapono; Kalapana; Cecilio & Kompany; Amy Hanaialii; Na Leo; John Cruz; Natural Vibrations; ManoaDNA; Robi Kahakalau; Mailani; Taimane; Go Jimmy Go; Jerry Santos; Gregg Hammer Band; and Kenny Endo Taiko. On-air personalities from Clear Channel Radio and local broadcast and cable TV stations will host the program. “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan, will be held on Sunday, April 10, 2011 from noon to 5 p.m. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa. Tickets are available for $15 via Honolulu Box Office. Visit HonoluluBoxOffice.com for on-line purchasing or call 808-550-8457 for charge-by-phone. -

Spanish Language Broadcasting Collection

Spanish Language Broadcasting Collection NMAH.AC.1404 IrMarie Fraticelli, Edwin A. Rodriguez, and Justine Thomas This collection received Federal support from the Latino Initiatives Pool, administered by the Smithsonian Latino Center. Archives Center, National Museum of American History P.O. Box 37012 Suite 1100, MRC 601 Washington, D.C. 20013-7012 [email protected] http://americanhistory.si.edu/archives Table of Contents Collection Overview ........................................................................................................ 1 Administrative Information .............................................................................................. 1 Arrangement..................................................................................................................... 2 Biographical / Historical.................................................................................................... 2 Scope and Contents........................................................................................................ 2 Names and Subjects ...................................................................................................... 2 Container Listing ............................................................................................................. 4 Series 1: Gilda Mirós, (bulk 1950 - 2016, undated) (bulk 1950 - 2016, undated).................................................................................................................... 4 Series 2: Hector Aguilar, 1940 - 2002, undated.................................................... -

PUBLIC VERSION AT&T Good Faith Complaint.Pdf

PUBLIC VERSION %HIRUH WKH )('(5$/ &20081,&$7,216 &200,66,21 :DVKLQJWRQ '& ',5(&79 //& $1' $7 7 6(59,&(6 ,1& &RPSODLQDQWV Y 0% 'RFNHW 1R )LOH 1RBBBBBBBBB '((5),(/' 0(',$ ,1& '((5),(/' 0(',$ 3257 $57+85 /,&(16(( //& (;3(',7(' '((5),(/' 0(',$ &,1&,11$7, /,&(16(( //& 75($70(17 '((5),(/' 0(',$ 02%,/( /,&(16(( //& 5(48(67(' '((5),(/' 0(',$ 52&+(67(5 /,&(16(( //& '((5),(/' 0(',$ 6$1 $1721,2 /,&(16(( //& *2&20 0(',$ 2) ,//,12,6 //& +2:$5' 67,5. +2/',1*6 //& +6+ )/,17 :(<, /,&(16(( //& +6+ 0<57/( %($&+ ::0% /,&(16(( //& 0(5&85< %52$'&$67,1* &203$1< ,1& 036 0(',$ 2) 7(11(66(( /,&(16(( //& 036 0(',$ 2) *$,1(69,//( /,&(16(( //& 036 0(',$ 2) 7$//$+$66(( /,&(16(( //& 036 0(',$ 2) 6&5$1721 /,&(16(( //& 1$6+9,//( /,&(16( +2/',1*6 //& .075 7(/(9,6,21 //& 6(&21' *(1(5$7,21 2) ,2:$ /7' $1' :$,77 %52$'&$67,1* ,1& 'HIHQGDQWV 9(5,),(' &203/$,17 2) ',5(&79 //& $1' $7 7 6(59,&(6 ,1& )25 7+( 67$7,21 *52836¶ )$,/85( 72 1(*27,$7( ,1 *22' )$,7+ PUBLIC VERSION 6HDQ $ /HY &DWK\ &DUSLQR .HYLQ - 0LOOHU &KULVWRSKHU 0 +HLPDQQ 0DWWKHZ 0 'XII\ *DU\ / 3KLOOLSV .(//2** +$16(1 72'' 'DYLG / /DZVRQ ),*(/ )5('(5,&. 3//& $7 7 6(59,&(6 ,1& 0 6WUHHW 1: 6XLWH WK 6WUHHW 1: 6XLWH :DVKLQJWRQ '& :DVKLQJWRQ '& Counsel for DIRECTV, LLC and AT&T Services, Inc. -XQH PUBLIC VERSION 6800$5< ,Q IODJUDQW YLRODWLRQ RI WKH &RPPLVVLRQ¶V UXOHV QLQH VWDWLRQ JURXSV WKH ³6WDWLRQ *URXSV´ KDYH VLPSO\ UHIXVHG WR QHJRWLDWH UHWUDQVPLVVLRQ FRQVHQW ZLWK ',5(&79 DQG $7 7 6HUYLFHV FROOHFWLYHO\ ³$7 7´ IRU PRQWKV RQ HQG ,QGHHG WKH 6WDWLRQ *URXSV HDFK RI ZKLFK DSSHDUV WR EH PDQDJHG DQG FRQWUROOHG -

Retrans Blackouts 2010-2018

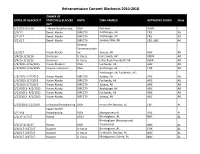

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

Appendix a Stations Transitioning on June 12

APPENDIX A STATIONS TRANSITIONING ON JUNE 12 DMA CITY ST NETWORK CALLSIGN LICENSEE 1 ABILENE-SWEETWATER SWEETWATER TX ABC/CW (D KTXS-TV BLUESTONE LICENSE HOLDINGS INC. 2 ALBANY GA ALBANY GA NBC WALB WALB LICENSE SUBSIDIARY, LLC 3 ALBANY GA ALBANY GA FOX WFXL BARRINGTON ALBANY LICENSE LLC 4 ALBANY-SCHENECTADY-TROY ADAMS MA ABC WCDC-TV YOUNG BROADCASTING OF ALBANY, INC. 5 ALBANY-SCHENECTADY-TROY ALBANY NY NBC WNYT WNYT-TV, LLC 6 ALBANY-SCHENECTADY-TROY ALBANY NY ABC WTEN YOUNG BROADCASTING OF ALBANY, INC. 7 ALBANY-SCHENECTADY-TROY ALBANY NY FOX WXXA-TV NEWPORT TELEVISION LICENSE LLC 8 ALBANY-SCHENECTADY-TROY PITTSFIELD MA MYTV WNYA VENTURE TECHNOLOGIES GROUP, LLC 9 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CW WCWN FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 10 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CBS WRGB FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 11 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CW KASY-TV ACME TELEVISION LICENSES OF NEW MEXICO, LLC 12 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM UNIVISION KLUZ-TV ENTRAVISION HOLDINGS, LLC 13 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM PBS KNME-TV REGENTS OF THE UNIV. OF NM & BD.OF EDUC.OF CITY OF ALBUQ.,NM 14 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM ABC KOAT-TV KOAT HEARST-ARGYLE TELEVISION, INC. 15 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM NBC KOB-TV KOB-TV, LLC 16 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CBS KRQE LIN OF NEW MEXICO, LLC 17 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM TELEFUTURKTFQ-TV TELEFUTURA ALBUQUERQUE LLC 18 ALBUQUERQUE-SANTA FE CARLSBAD NM ABC KOCT KOAT HEARST-ARGYLE TELEVISION, INC. -

Television Broadcasters'adoption of Digital

TELEVISION BROADCASTERS’ ADOPTION OF DIGITAL MULTICAST AND ANCILLARY SERVICES: AN ANALYSIS OF THE PRIMARY CORE, SUPPORTING, AND ENVIRONMENTAL DRIVERS By TODD ANDREW HOLMES A THESIS PRESENTED TO THE GRADUATE SCHOOL OF THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN MASS COMMUNICATION UNIVERSITY OF FLORIDA 2008 1 © 2008 Todd Andrew Holmes 2 To all who have inspired my intellectual curiosity and academic pursuits, and to all who have supported me in reaching this milestone 3 ACKNOWLEDGMENTS First and foremost, I would like to thank my chair, Dr. Ostroff, for the enormous amount of time and guidance he gave to me in helping me to complete this research study. His support and direction were absolutely critical in the successful completion of this paper. I also would like to thank the members of my committee, Dr. Chan-Olmsted and Dr. Brown, for their thoughts and ideas concerning my research topic. Second, I would like to thank the nine television executives who took time out of their busy schedules to meet with me and who very openly and willingly shared with me their thoughts on the research topic. Their help was absolutely vital to the completion of this study. Third, I would like to thank my parents who continued to keep me moving along on the thesis through their inquiries and encouragement. Their own academic achievements have continued to inspire me throughout this process. Lastly, special thanks go to all my friends, the Gator Guzzlers and many others, who heard me talk about this thesis for months and with whom I had to skip out on a lot of activities. -

Multicasts, ATSC 3.0 Turn Broadcasting Into a Multichannel Platform

Perspectives from FSF Scholars October 12, 2020 Vol. 15, No. 53 Multicasts, ATSC 3.0 Turn Broadcasting Into a Multichannel Platform by Andrew Long * I. Introduction and Summary Consumers today enjoy a wealth of choices in the multichannel video programming distribution marketplace. This vibrantly competitive environment represents a dramatic departure from decades past, when claims as to the existence of bottlenecks were used to justify intrusive government intervention. One rising, and perhaps unexpected and largely unreported, source of multichannel competition is over-the-air broadcasting. Of course, dramatic changes in the media marketplace have been occurring for many years – and yet, due to its size, procedures, and inherent inertia, the "Communications Regulatory Complex" simply is unable to keep pace, especially in the face of considerable reflexive opposition by those who oppose any deregulatory changes. But with regard to broadcasting, cable, direct broadcast satellite (DBS), telco TV, and other media outlets, continued imposition of legacy regulatory restrictions of various types are in increasing tension with their First Amendment rights. Over the last ten years, the number of U.S. households that utilize an antenna to view their local television stations has increased by over a third, from nearly 11.8 million to 16 million. One explanation for that is the improved picture and audio quality that digital television (DTV) The Free State Foundation P.O. Box 60680, Potomac, MD 20859 [email protected] www.freestatefoundation.org delivers. Another is that, as consumers "cut the cord" – that is, discontinue their subscriptions to traditional multichannel video programming distributors (MVPDs) and transition to streaming options like Netflix, Hulu, Disney+, and/or Amazon Prime Video – over-the-air television provides a free means to continue to receive the popular content, both national and local, that television stations carry. -

Kmsb, Kttu Eeo Public File Report I. Vacancy List

Page: 1/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 I. VACANCY LIST See Section II, the "Master Recruitment Source List" ("MRSL") for recruitment source data Recruitment Sources ("RS") RS Referring Job Title Used to Fill Vacancy Hiree Account Executive 1-22 12 National Account Manager 1-11, 13-18, 20-22 17 Account Executive - 9990 6, 17 17 Page: 2/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 II. MASTER RECRUITMENT SOURCE LIST ("MRSL") Source Entitled No. of Interviewees RS to Vacancy Referred by RS RS Information Number Notification? Over (Yes/No) Reporting Period Arizona Broadcasters Association 426 N 44th St Ste 310 Phoenix, Arizona 85008 1 Phone : 602-252-4833 N 0 Url : http://www.azbroadcasters.org Jennifer Latko Manual Posting Arizona Hispanic Chamber of Commerce 255 E Osborn Rd #201 Phoenix, Arizona 85012 2 Phone : 602-294-6086 N 0 Email : [email protected] Fax : 1-602-279-8900 Joseph Ortiz Arizona State University POB 871312, Student Svc Bldg #329 Tempe, Arizona 85287 3 Phone : 480-965-5112 N 0 Email : [email protected] Career Services Arizona State University of Cronkite Alumni-Walter Cronkite School of Jour. & Mass Comm. Stauffer Hall A 231 PO Box 871305 Tempe, Arizona 85287 4 Phone : 480-965-5011 N 0 Email : [email protected] Fax : 1-480-965-7041 Mike Wong Arizona@Work 2797 E Ajo Way Tucson, Arizona 85713 5 Phone : 520-243-6700 N 0 Rosemary Cora-Cruz Manual Posting Career Builder 200 N. LaSalle St Suite 1100 Chicago, Illinois 60601 6 Phone : 773-527-3600 N 0 Url : http://www.careerbuilder.com Career Service Manual Posting Page: 3/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 II. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

Ebonics Hearing

S. HRG. 105±20 EBONICS HEARING BEFORE A SUBCOMMITTEE OF THE COMMITTEE ON APPROPRIATIONS UNITED STATES SENATE ONE HUNDRED FIFTH CONGRESS FIRST SESSION SPECIAL HEARING Printed for the use of the Committee on Appropriations ( U.S. GOVERNMENT PRINTING OFFICE 39±641 cc WASHINGTON : 1997 For sale by the U.S. Government Printing Office Superintendent of Documents, Congressional Sales Office, Washington, DC 20402 COMMITTEE ON APPROPRIATIONS TED STEVENS, Alaska, Chairman THAD COCHRAN, Mississippi ROBERT C. BYRD, West Virginia ARLEN SPECTER, Pennsylvania DANIEL K. INOUYE, Hawaii PETE V. DOMENICI, New Mexico ERNEST F. HOLLINGS, South Carolina CHRISTOPHER S. BOND, Missouri PATRICK J. LEAHY, Vermont SLADE GORTON, Washington DALE BUMPERS, Arkansas MITCH MCCONNELL, Kentucky FRANK R. LAUTENBERG, New Jersey CONRAD BURNS, Montana TOM HARKIN, Iowa RICHARD C. SHELBY, Alabama BARBARA A. MIKULSKI, Maryland JUDD GREGG, New Hampshire HARRY REID, Nevada ROBERT F. BENNETT, Utah HERB KOHL, Wisconsin BEN NIGHTHORSE CAMPBELL, Colorado PATTY MURRAY, Washington LARRY CRAIG, Idaho BYRON DORGAN, North Dakota LAUCH FAIRCLOTH, North Carolina BARBARA BOXER, California KAY BAILEY HUTCHISON, Texas STEVEN J. CORTESE, Staff Director LISA SUTHERLAND, Deputy Staff Director JAMES H. ENGLISH, Minority Staff Director SUBCOMMITTEE ON DEPARTMENTS OF LABOR, HEALTH AND HUMAN SERVICES, AND EDUCATION, AND RELATED AGENCIES ARLEN SPECTER, Pennsylvania, Chairman THAD COCHRAN, Mississippi TOM HARKIN, Iowa SLADE GORTON, Washington ERNEST F. HOLLINGS, South Carolina CHRISTOPHER S. BOND, Missouri DANIEL K. INOUYE, Hawaii JUDD GREGG, New Hampshire DALE BUMPERS, Arkansas LAUCH FAIRCLOTH, North Carolina HARRY REID, Nevada LARRY E. CRAIG, Idaho HERB KOHL, Wisconsin KAY BAILEY HUTCHISON, Texas PATTY MURRAY, Washington Majority Professional Staff CRAIG A. HIGGINS and BETTILOU TAYLOR Minority Professional Staff MARSHA SIMON (II) 2 CONTENTS Page Opening remarks of Senator Arlen Specter .......................................................... -

Data Breach Reports

CONTENTS Information & Background on ITRC ........... 2 Methodology .............................................. 3 ITRC Breach Stats Report Summary .......... 4 ITRC Breach Stats Report ..........................5 ITRC Breach Report ................................ 42 Information and Background on ITRC Information management is critically important to all of us - as employees and consumers. For that reason, the Identity Theft Resource Center has been tracking security breaches since 2005, looking for patterns, new trends and any information that may better help us to educate consumers and businesses on the need for understanding the value of protecting personal identifying information. What is a breach? The ITRC defines a data breach as an incident in which an individual name plus a Social Security number, driver’s license number, medical record or financial record (credit/ debit cards included) is potentially put at risk because of exposure. This exposure can occur either electronically or in paper format. The ITRC will also capture breaches that do not, by the nature of the incident, trigger data breach notification laws. Generally, these breaches consist of the exposure of user names, emails and passwords without involving sensitive personal identifying information. These breach incidents will be included by name but without the total number of records exposed. There are currently two ITRC breach reports which are updated and posted on-line on a weekly basis. The ITRC Breach Report presents detailed information about data exposure events along with running totals for a specific year. Breaches are broken down into five categories, as follows: business, banking/credit/financial, educational, Government/Military and medical/healthcare. The ITRC Breach Stats Report provides a summary of this information by category. -

Before The FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 InTheMatterOf

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 In the Matter of ) ) Application of Sinclair Broadcast ) MB Docket No. 17-179 Group and Tribune Media Company ) For Consent to Assign or Transfer ) Control of Licenses and Authorizations ) COMMENTS OF FREE PRESS Dana J. Floberg Free Press 1025 Connecticut Ave, NW Suite 1110 Washington, DC 20036 November 2, 2017 TABLE OF CONTENTS INTRODUCTION AND SUMMARY…………………………………………………………………....3 I. Sinclair’s Refusal to Identify Divestiture Candidates Demonstrates Disdain for Media Ownership Rules…………………………………………………………………………………...4 II. Sinclair Fails to Offer Any Specific Plans to Substantially Improve Local News Coverage……...6 III. Sinclair’s Stated Plan to Compete with Major Syndicators is Vague and Unsupported………….. 8 IV. Shared Newsrooms that Sinclair Touts as Benefits Instead Promise Harmful Consolidatory Impacts for Viewers……………………………………………………………………………….. 9 V. Sinclair Statements Regarding Staffing Reductions Raise More Red Flags……………………... 12 CONCLUSION…………………………………………………………………………………………...13