Annual Report 2003 Improving Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Broadband Coverage 97% Fixed and Mobile Broadband

Connectivity Broadband market developments in the EU Digital Economy and Society Index Report 2019 Connectivity The Digital Economy and Society Index (DESI) is a composite index that summarises relevant indicators on Europe’s digital performance and tracks the progress of EU Member States in digital competitiveness. The five dimensions of the DESI 1 Connectivity Fixed broadband, mobile broadband, fast and ultrafast Finland, Sweden, the Netherlands and Denmark, have the most broadband and prices advanced digital economies in the EU followed by the UK, 2 Human capital Internet user skills and advanced skills Luxembourg, Ireland and Estonia. 3 Use of internet Citizens' use of internet services and online transactions Bulgaria, Romania, Greece and Poland have the lowest scores on the index. 4 Integration of Business digitisation and e-commerce digital technology 5 Digital public e-Government and e-health services Digital Economy and Society Index (DESI) 2019 80 1 Connectivity 2 Human capital 3 Use of internet services 4 Integration of digital technology 5 Digital public services 70 60 50 40 30 20 10 0 FI SE NL DK UK LU IE EE BE MT ES DE AT EU LT FR SI LV CZ PT HR SK CY HU IT PL EL RO BG Source: DESI 2019, European Commission DESI Report 2019 – Connectivity 2 In Connectivity, Denmark had the highest score, followed by Luxembourg, the Netherlands, Sweden and Finland. Greece, Croatia and Lithuania had the weakest performance in this dimension of the DESI. Connectivity indicators in DESI 2019 EU The connectivity dimension looks at both the demand and the supply side of 1a1 Fixed broadband coverage 97% fixed and mobile broadband. -

Glaxosmithkline Bangladesh Limited (GSK)

GlaxoSmithKline Bangladesh Limited (GSK) Recruitment and Selection Process of GlaxoSmithKline Bangladesh Limited: An Evaluation nd Date of Submission: 2 September, 2014 ©Daffodil International University DAFFODIL INTERNATIONAL UNIVERSITY Internship Report On Recruitment and Selection Process of GlaxoSmithKline Bangladesh Limited: An Evaluation Submitted To Dr. Zakir Hossain Dean& Professor Faculty of Business & Economics Daffodil International University Submitted By Ishrat Jahan ID: 131-14-1019 Masters of Business Administration Daffodil International University Date of Submission: 2nd September, 2014 ©Daffodil International University Letter of Transmittal September 2, 2014 To Dr. Zakir Hossain Dean & Professor Faculty of Business and Economics Daffodil International University Dhaka-1205 Subject: Submission of internship report on recruitment and selection process: An evaluation of GlaxoSmithKline Bangladesh Limited Sir, I am highly satisfied to submit my report on recruitment and selection process: an evaluation of GSK. For preparing this report I tried my best to accumulate relevant and upgraded information from available sources. In preparing this report, I tried my level best to make it a complete one and sincerely look forward to any possible correction. I am very glad because you also given the opportunity to prepare this report .I hope that this report will meet the standards of your judgments. Your Sincerely ---------------- Ishrat Jahan ©Daffodil International University i Certificate of the Supervisor This is to certify that the internship report titled ―Recruitment and Selection Process of GlaxoSmithKline Bangladesh Limited: An Evaluation‖, has been prepared by Ms. Ishrat Jahan bearing ID: 131-14-1019 under my supervision, a practical study on GlaxoSmithKline Bangladesh Limited. I think on the basic of declaration Ms. -

The Everyday Lives of Recovering Heroin Users

The everyday lives of recovering heroin users Joanne Neale Sarah Nettleton Lucy Pickering The everyday lives of recovering heroin users The everyday lives of recovering heroin users Joanne Neale Sarah Nettleton Lucy Pickering Joanne Neale Professor of Public Health Faculty of Health & Life Sciences Oxford Brookes University Jack Straw’s Lane Marston Oxford OX3 0FL Email: [email protected] Sarah Nettleton Reader in Sociology Department of Sociology Wentworth College University of York Heslington York YO10 5DD Email: [email protected] Lucy Pickering Lecturer in Anthropology School of Social and Political Sciences University of Glasgow Adam Smith Building Glasgow G12 8RT Email: [email protected] Published by the RSA 8 John Adam Street London WC2N 6EZ +44 (0)20 7930 5115 Registered as a charity in England and Wales no. 212424 and in Scotland no. SCO 37784 Copyright © Joanne Neale 2012 The RSA is an enlightenment organisation devoted to finding innovative and practical solutions to today’s pressing social problems Cover photo: ‘Wings of butterfly,’ John Foxx. © Thinkstock Designed by Soapbox, www.soapbox.co.uk Printed and bound by CPI Antony Rowe www.theRSA.org Contents Acknowledgements 9 Foreword 10 Chapter 1: Setting the scene 14 Why read this book? 14 Why focus on recovery? 15 What is recovery? 15 A study of the everyday lives of recovering heroin users 17 Structure of the book 18 Chapter 2: Considering recovery 20 Introduction 20 Mapping services and support 20 Factors that can encourage and sustain recovery efforts -

Annual Report 2013

Annual Report 2013 “ Being active and having a positive outlook on life is what keeps me going every day.” Overview of 2013 “ Our performance in 2013 was defined by remarkable &R D output and further delivery of sustained financial performance for our shareholders.” Please go to page 4 for more More at gsk.com Performance highlights £26.5bn £8.0bn £7.0bn £5.2bn Group turnover Core* operating profit Total operating profit Returned to shareholders 6 112.2p 112.5p 13% Major medicines approved Core* earnings per share Total earnings per share Estimated return on R&D investment 10 6 1st 1st Potential phase III study starts in 2014/15 Potential medicines with phase III data in Access to Medicines Index Pharmaceutical company to sign AllTrials expected 2014/15 campaign for research transparency Front cover story Betty, aged 65, (pictured) has Chronic “ Health is important to me, Obstructive Pulmonary Disease (COPD). She only has 25% lung capacity. This means I try to take care of my she finds even everyday tasks difficult, but medicines and inhaled oxygen allow her to health with all the tools live as normal a life as she can. Betty’s mindset I have and do the best is to stay busy and active, so every week she goes to rehab exercise classes. that I can with it.” COPD is a disease of the lungs that leads to Betty, COPD patient, damaged airways, causing them to become North Carolina, USA narrower and making it harder for air to get in and out. 210 million people around the world are estimated to have COPD. -

![Beecham Group PLC and Another V Triomed (Pty) Ltd [2002] 4 All SA 193 (SCA)](https://docslib.b-cdn.net/cover/9907/beecham-group-plc-and-another-v-triomed-pty-ltd-2002-4-all-sa-193-sca-369907.webp)

Beecham Group PLC and Another V Triomed (Pty) Ltd [2002] 4 All SA 193 (SCA)

Beecham Group PLC and another v Triomed (Pty) Ltd [2002] 4 All SA 193 (SCA) Division: Supreme Court of Appeal Date: 19 September 2002 Case No: 100/01 Before: Harms, Scott, Mpati, Conradie JJA and Jones AJA Sourced by: PR Cronje Summarised by: D.Harris Parallel Citation: 2003 (3) SA 639 (SCA) . Editor's Summary . Cases Referred to . Judgment . [1] Intellectual property Trade marks Registration of shape as trade mark Where shape is not intended to be used to distinguish owner's products from those of another, it cannot be regarded as a trade mark Application for expungement from trade marks register therefore allowed. Editor's Summary Both parties involved in the present matter were players in the pharmaceutical industry. The Appellants sought the upholding of a trade mark for the shape of a tablet, and a finding that the Respondent had infringed the trade mark. The Respondent imported a tablet with the same composition and shape as that of the Appellants. In the court a quo, the Respondent applied for the expungement from the trade mark register of the shape trade mark. The Appellants launched a counterapplication for relief for trade mark infringement. The latter application failed while that of the Respondent succeeded. Held Interested parties may apply to court for the removal of an entry wrongly made or remaining on the trade mark register. The first question posed by the Court was whether the Appellants' shape mark constituted a trade mark in terms of section 10(1) of the Trade Marks Act 194 of 1993 ("the Act"). -

Gilead and Glaxo's HIV Battle Intensifies

February 14, 2017 Gilead and Glaxo’s HIV battle intensifies Madeleine Armstrong The first phase II data with Gilead’s HIV integrase inhibitor bictegravir have set up a showdown with Glaxosmithkline/Viiv Healthcare’s marketed product dolutegravir. But Glaxo is already one step ahead with data from a two-drug combo that could reduce the side-effect burden for HIV patients. Glaxo believes that this doublet could “reshape the whole game”, the group's chief executive, Andrew Witty, said on its fourth-quarter earnings call. HIV has been one of the group’s main drivers in recent quarters as it has taken market share from Gilead, which is becoming increasingly reliant on HIV as its hepatitis C franchise slows (see tables below). Bictegravir vs dolutegravir The phase II study, presented today at the Conference on Retroviruses and Opportunistic Infections in Seattle, compared bictegravir plus emtricitabine and tenofovir alafenamide – known as FTC/TAF – with dolutegravir plus FTC/TAF in 98 treatment-naive, HIV-infected adults. Both are the latest iterations of the integrase inhibitor class, and unlike older products with the same mechanism do not require boosting – taking another drug to raise circulating levels – so have a lower risk of adverse events and drug-drug interactions. The phase II trial found similar response rates with a bictegravir-containing regimen versus a dolutegravir- containing therapy, which should boost confidence in Gilead’s compound ahead of phase III readouts expected mid-year. It found a 97% response in the bictegravir arm at 24 and 48 weeks, versus 94% at week 24 and 91% at week 48 in the dolutegravir arm, but the difference was not statistically significant. -

List of Active Bayer Companies with at Least a Share of 50% Last Update: 17.8.2020 Country Company

List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Algeria Bayer Algerie S.P.A. Argentina Bayer S.A. Argentina Biagro S.A. Argentina Monsanto Argentina SRL Australia Bayer Australia Limited Australia Bayer CropScience Holdings Pty Ltd Australia Bayer CropScience Pty Limited Australia Cotton Growers Services Pty. Limited Australia Imaxeon Pty. Ltd. Australia Monsanto Australia Pty Ltd Bangladesh Bayer CropScience Ltd. Belgium Bayer Agriculture BVBA Belgium Bayer CropScience NV Belgium Bayer NV Bermuda MonSure Limited Bolivia Bayer Boliviana Ltda Bolivia Monsanto Bolivia S.A. Bosnia & Herzeg. Bayer d.o.o. Sarajevo Brazil Alkagro do Brasil Ltda Brazil Bayer S.A. Brazil D&PL Brasil Ltda Brazil Monsanto do Brasil Ltda. Brazil Rede Agro Fidelidade e Intermediacao S.A. Brazil Schering do Brasil Química e Farmacêutica Ltda. Brazil Stoneville Brasil Ltda. Bulgaria Bayer Bulgaria EOOD Burkina Faso Monsanto Burkina Faso SARL Chile Bayer Finance & Portfolio Management S.A. Chile Bayer Finance Ltda. Chile Bayer S.A. Chile Monsanto Chile, S.A. Costa Rica Bayer Business Services Costa Rica, SRL Costa Rica Bayer Medical S.R.L. Costa Rica Bayer S.A. Curacao Pianosa B.V. Germany Adverio Pharma GmbH - 1 - List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Germany AgrEvo Verwaltungsgesellschaft mbH Germany Alcafleu Management GmbH & Co. KG Germany BGI Deutschland GmbH Germany Bayer 04 Immobilien GmbH Germany Bayer 04 Leverkusen Fußball GmbH Germany Bayer 04 Leverkusen -

Pharma Pricing, Non-Profit Ties Get Increasing Scrutiny from Prosecutors

REGULATORY UPDATE REGULATORY UPDATE CONSUMER DRUGS Pediatric Rare Disease Voucher Japan Wants EMA To Stay In Digital Marketing: Health Care Brands’ Program Faces Expiration, p. 12 UK Post-Brexit, p. 15 Window Into Consumers’ Lives, p. 20 Pharma intelligence Pinkpink.pharmamedtechbi.comSheetVol. 78 / No. 38 September 19, 2016 informa Mylan NV was subpoenaed for material Pharma Pricing, Non-Profit Ties Get about the pricing of its generic doxycycline and communications with competitors. And Valeant Pharmaceuticals International Inc. is Increasing Scrutiny From Prosecutors facing several probes about its pricing and BRENDA SANDBURG [email protected] patient assistance programs (see chart, p. 5). Mylan’s doxycycline price increases were called out by Sen. Bernie Sanders, I-Vt., and Rep. Elijah Cummings, D-Md., in October 2014 when they sent letters to 14 generic drug makers about the pricing of their prod- ucts. They noted that from October 2013 to April 2014, the average price charged for a 500-count bottle of 100 mg tablets had risen from $20 to $1,829, an 8,281% increase. Mylan is now under fire for repeatedly rais- ing the price of its severe allergy treatment EpiPen (epinephrine), which has increased from about $100 for a two-pack in 2008 to more than $600. Members of Congress sent a flurry of letters to the company requesting an explanation for the price hikes. And on Sept. 6, New York Attorney Gen- Shutterstock: blvdone Shutterstock: eral Eric Schneiderman announced that his office has begun an investigation into rug makers have been unable to programs, contractual agreements with Mylan with regard to EpiPen, saying a pre- shake free of government inves- pharmacy benefit managers, support of liminary review revealed that Mylan may Dtigations of their marketing and non-profit organizations, and calculation have inserted potentially anticompetitive sales practices. -

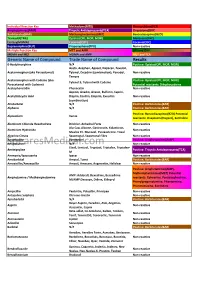

Cross Reaction Guide

Individual Reaction Key Methadone(MTD) Phencyclidine(PCP) Amphetamines(AMP) Tricyclic Antidepressants(TCA) Oxycodone(OXY) Barbiturates(BAR) Methamphetamines(MET) Benzodiazepines(BZO) Tramadol(TML) Opiates(OPI, MOP, MOR) Marijuana(THC) Ecstasy(MDMA) Cotinine(COT) Cocaine(COC) Buprenorphine(BUP) Propoxyphene(PPX) Non-reactive Multiple Reaction Key MET and AMP OPI and OXY MDMA and MET MDMA and AMP MET and TCA Generic Name of Compound Trade Name of Compound Results 6-Acetylmorphine N/A Positive: Opiates(OPI, MOP, MOR) Aceta, Acephen, Apacet, Dapacen, Feverall, Acetaminophen (aka Paracetamol) Tylenol, Excedrin (combination), Panadol, Non-reactive Tempra Acetaminophen with Codeine (aka Positive: Opiates(OPI, MOP, MOR) Tylenol 3, Tylenol with Codeine Paracetamol with Codeine) Potential reactants: Dihydrocodeine Acetophenetidin Phenacetin Non-reactive Aspirin, Anadin, Anasin, Bufferin, Caprin, Acetylsalicyclic Acid Disprin, Ecotrin, Empirin, Excedrin Non-reactive (combination) Allobarbital N/A Positive: Barbiturates(BAR) Alphenol N/A Positive: Barbiturates(BAR) Positive: Benzodiazepines(BZO) Potential Alprazolam Xanax reactants: Oxaprozin (Daypro), Sertraline Aluminum Chloride Hexahydrate Drichlor, Anhydrol Forte Non-reactive Alu-Cap, Alisone, Gastrocote, Kolanticon, Aluminum Hydroxide Non-reactive Maalox TC, Mucogel, Pyrogastrone, Topal Alverine Citrate Spasmonal, Spasmonal Fibre Non-reactive Amantadine Symmetrel Positive: Amphetamines(AMP) SpearesMedical.comAminopyrine N/A Non-reactive Elavil, Lentizol, Tryptizol, Triptafen, Triptafen- Amitriptyline -

Steven Sanders, Et Al. V. Bayer (AG) Aktiengesellschaft, Et Al. 03-CV-1546-Second Consolidated Amended Complaint

Q,^.IGiNAL &&,iN 2i 4- L UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK -_DOF x Consolidated Civil Action IN RE BAYER AG SECURITIES No. 03 CV 1546 (WHP) LITIGATION Class Action x 71 :n = SECOND CONSOLIDATED AMENDED COMPLAINT Jury Trial Demand MILBERG WEISS BERSHAD & SCHULMAN LLP Melvyn I. Weiss (MW-1392) Michael C . Spencer (MS-8874) Lee A. Weiss (LW-1130) Jennifer Sclar (JS-7313) One Pennsylvania Plaza New York, NY 10119 (212) 594-5300 Attorneys for Lead Plaintiff January 14, 2005 i • ' Table of Contents Page SUMMARY OF CLAIMS ...............................................................................................................2 JURISDICTION AND VENUE ...................................................................................................... 8 A. General Jurisdiction and Venue ............................................................................... 8 B. Subject Matter Jurisdiction Over Claims of Foreign Purchasers on Foreign Exchanges ................................................................................................................ 8 PARTIES .......................................................................................................................................12 RELEVANT EVENTS ..................................................................................................................14 A. Background of the Statin Market ...........................................................................14 B. FDA Approval and Introduction of Baycol; Early Safety Warnings -

GSK Q1 Report 2021

Calibrating Precision GSK Pakistan Limited FirstAnnual Quarter Report Report 20212020 CORPORATE INFORMATION As at March 31, 2021 Board of Directors Management Committee Disclosure Committee Mr. Dmytro Oliinyk Ms. Erum Shakir Rahim Ms. Erum Shakir Rahim Chairman Chief Executive Officer Chairperson Ms. Erum Shakir Rahim Mr. Abdul Samad* Mr. Abdul Samad* Chief Executive Officer Chief Financial Officer Member Mr. Abdul Samad* Mehar-e-daraksha Ameer Mr. Dmytro Oliinyk Chief Financial Officer Legal Director Member Ms. Maheen Rahman Dr. Tariq Farooq Mehar-e-daraksha Ameer Independent Director Business Unit Director BU 1 Member Mr. Muneer Kamal Syed Nasir Farid** Company Secretary Independent Director Business Unit Director BU 2 Ms. Mehar-e-daraksha Ameer Mr. Mehmood Mandviwalla Dr. Naved Masoom Ali Non-Executive Director Business Unit Director BU 3 Chief Financial Officer Mr. Mark Dawson Khurram Amjad Mr. Abdul Samad* Non-Executive Director Director Commercial Chief Internal Auditor Excellence & CTC Audit Committee Syed Ahsan Ejaz Dr. Gohar Nayab Khan Mr. Muneer Kamal Regulatory Affairs Cluster Bankers Chairman Head - Pakistan & Iran Citibank NA Mr. Dmytro Oliinyk Mr. Abdul Haseeb Pirzada Deutsche Bank A.G. Member Director Corporate Affairs and Habib Bank Limited Administration Meezan Bank Limited Mr. Mark Dawson Standard Chartered Bank (Pakistan) Ltd Member Mr. Zain Anjum Country Compliance Officer Auditors Mr. Mehmood Mandviwalla Member Dr. Yousuf Hasan Khan Yousuf Adil & Co. Chartered Director Medical Accountants Ms. Maheen Rahman Member Syed Nabigh Raza Alam Legal Advisors Tech Head Hashmi & Hashmi Human Resource Mr. Obaid Siddiqui Faisal, Mahmood Ghani and Co & Remuneration Head of Procurement Legal Consultancy Inc. Committee Mr. Farqaleet Iqbal Registered Office Mr. -

GSK Annual Report 2016

Annual Report Transcending boundaries is in our DNA. This is evident in how we continue to discover, develop and bring to market, new medicines and vaccines to address the unmet needs of healthcare providers and their patients. As a responsible healthcare company, we drive change by adopting new and innovative methodologies, aligned with our values, so that we can better serve the evolving needs of our society and enable more patients to benefit from our medicines. We firmly believe that keeping the patient at the heart of everything we do is integral to our success; inspiring us to continue on this journey and transcend boundaries. GSK Contents 002 026 062 Our Vision, Mission and Core Vaccines Key Operating and Financial Data Values 028 065 004 Primary Care Direct Cash Flow Statement Corporate Information 030 066 006 Specialty Business Unit Horizontal Analysis Financial Highlights 031 067 007 Medical Affairs Vertical Analysis DUPONT Analysis 032 070 008 Awards 2016 Statement of Compliance with the The GSK Story 034 Code of Corporate Governance 010 Global Manufacturing & Supply 072 GSK Expectations (GMS) Review Report to the Members 011 035 073 Strategic Priorities Warehousing and Auditors Report to the Members 012 Distribution (W&D) 074 Company Profile & 036 Balance Sheet Group Structure Environment Health & Safety (EHS) 075 014 Profit and Loss Account Our Behaviour 038 Quality Management System (QMS) 076 015 Cash Flow Statement Organogram 040 Corporate Social Responsibility 077 016 (CSR) Statement of Changes in Equity Geographical Presence