Australian Wine Exports Soar Under Chafta Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 BAROSSA WINE SHOW RESULTS CA TALOGUE Ne

#BarossaWS19 | #barossa |#barossawine |#barossa #BarossaWS19 SHARE THE GOODNEWS: 2019 BAROSSA WINE SHOW RESULTS CATALOGUE 42nd43rd BarossaBarossa WineWine ShowShow Major Sponsors 20192018 Barossa Wine Show Results Catalogue printed by: Judges & Committee Judges Committee Chairman of Judges Wine of Provenance Committee Chair Nick Ryan Judges Andrew Quin, Hentley Farm Andrew Wigan Panel Chair Judges Phil Reedman Committee PJ Charteris Louisa Rose Alex MacClelland, Bethany Wines Sue Bell Amanda Longworth, Adam Wadewitz Wine of Provenance Barossa Grape & Wine Association Associate Judge Bernadette Kaeding, Rojomoma Judges Katie Spain John Hughes, Rieslingfreak Mark Pygott, MW Peter Kelly, Thorn-Clarke Wines Tash Mooney Richard Langford, Two Hands Wines Phil Lehmann Brock Harrison, Elderton Wines Tim Pelquest-Hunt Will John, Yalumba Adrian Sparks Marie Clay, Treasury Wine Estates Kelly Wellington Helen McCarthy, Mountadam Vineyards Dave Bursey, Henschke Wines Associate Judges Mark Bulman Kate Hongell Ben Thoman Angus Seabrook Clare Dry Simon Mussared Greg Clack Caitlin Brown Brooke Blair Premium Section CLASSES 1 to 20 For wines vintaged from grapes grown in the Barossa Valley (Minimum 85%) Fortified Section CLASSES 21 to 24 For fortified wines vintaged from grapes grown in the Barossa Valley (Minimum 85%). Wines not necessarily commercially available. BAROSSA WINE SHOW 2019 1 RESULTS CATALOGUE Trophies 2019 Winners THE PERNOD RICARD WINEMAKERS - L HUGO GRAMP MEMORIAL TROPHY Best 2019 Riesling, Class 1 Class 1 – Entry 23 – 2019 Dandelion Vineyards -

Wine List 2020

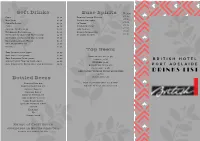

Soft Drinks Base Spirits W/ Mix $7.50 Coke $4.50 Dewars Scotch Whisky $8.50 Diet Coke $4.50 Cougar Bourbon $8.00 Coke No Sugar $4.50 42 Vodka $8.50 Fanta $4.50 Bundaberg Rum $9.00 Cascade Ginger Beer $4.50 Jack Daniels $7.50 Bundaberg Sarsparilla $4.50 Bombay Saphire Gin $7.50 Mt Franklin Sparkling Water 330ml $4.50 ST Agnes Brandy Mt Franklin Sparkling Water 750ml $8.50 British Btl Spring Water $3.50 Real Peach Iced Tea $5.00 Red Bull $4.50 Tap Beers Keri Orange Juice 300ml $4.00 Keri Apple Juice 300ml $4.00 Coopers Pale Ale (4.5%) Keri Pineapple Juice 300ml $4.00 Furphy (4.4%) B R I T I S H H O T E L Spring Valley Tomato Juice 250ml $4.00 Guinness (4.2%) P O R T A D E L A I D E Keri Kids Fruity Drink Apple and B/Currant $3.50 Hahn Super Dry (4.6%) Hahn Light (2.4%) James Squire "Orchard Crush" Apple Cider D R I N K S L I S T (4.8%) Bottled Beers West End (4.5%) Coopers Pale Ale Plus 3 rotating craft beer taps! Coopers Sparkling Ale Ask one of staff for more info Coopers Dark Ale Coopers Stout Coopers Session Ale James Boags Premium James Boags Light Cascade Premium Light Corona Heiniken VB Crown Lager Range of Craft Beers available in Bottle and Can please see board for list White Wine Red Wine Sparkling K1 Geoff Hardy Sauvignon Blanc G 8.5 Caudo Sangiovese G.7.5 Lois blanc de blanc sparkling G 8.5 Adelaide Hills S.A. -

What We Tasted

what we tasted A complete list of all the wines tasted by our expert panels for the October 2020 issue of Winestate. BEST BUYS Jaeschkes Hill River Clare Pioneer Road Langhorne Yarra Burn South Eastern Bec Hardy Wines Burk Salter Riverland SA Estate Polish Hill River Creek Cabernet Sauvignon Australia Prosecco NV Pertaringa Tipsy Hill Merlot Cabernet 2016 10 Chains Pemberton Valley Riesling 2016 2019 McLaren Vale Cabernet Sauvignon Blanc 2019 Zilzie Liv Lighter South Sauvignon 2017 Burk Salter Riverland SA Jaeschkes Hill River Clare Reillys Barking Mad Clare Eastern Australia Pinot Merlot Cabernet 2017 10 Chains Pemberton Estate Polish Hill River Valley Grenache Shiraz Noir 2019 Bird’s Eye View McLaren Shiraz 2018 Valley Riesling 2017 2018 Vale Cabernet Sauvignon Carillion Origins Arbitrage Zilzie Liv Lighter Victoria 2018 Wrattonbully Merlot Army Of Grapes Margaret Jaeschkes Hill River Clare Reillys Barking Mad Pinot Grigio 2020 Cabernet Shiraz Petit River Riesling 2020 Estate Polish Hill River Watervale Clare Valley Black Wattle Vineyards Verdot 2018 Atkins Farm Langhorne Valley Riesling 2018 Riesling 2019 Mt Benson Cabernet Sauvignon 2018 Carillion Origins Volcanics Creek Cabernet Sauvignon Jaeschkes Hill River Clare Renmark Vineyards CABERNET & BLENDS Orange Cabernet 2018 Estate Polish Hill River Renmark Creek South Allandale Single Vineyard Black Wattle Vineyards Sauvignon 2018 Atkins Farm Langhorne Valley Riesling 2019 Australia Cabernet Hilltops Cabernet ‘The Icon’ Mt Benson Sauvignon 2019 Cabernet Sauvignon 2018 Castelli Great -

2019 Royal Adelaide Wine Show

ROYAL ADELAIDE WINE SHOW 2019CATALOGUE OF RESULTS / $10 THANKS TO OUR SPONSORS 2019 ROYAL ADELAIDE WINE SHOW TROPHIES AND PRIZES JUDGES PROGRAM MAGAZINE CATALOGUE OF RESULTS 2019 ROYAL ADELAIDE WINE SHOW BOARD OF MANAGEMENT CHIEF EXECUTIVE WINE COMMITTEE President John W Rothwell Greg Follett (Chair) Rob J Hunt - Trustee WINE SHOW Andrew Hardy Chairman MANAGER Fiona Donald Trevor G James Katie Johnson Emma Shaw Kate Laurie Deputy Chairman GENERAL MANAGER Peter Godden Hamish C Findlay Michelle Hocking Bill Seppelt Treasurer SPONSORSHIP MANAGER Nick Ryan Robert L Snewin / Trustee Karen Holthouse Charlie M Downer / Trustee Andrew M Hardy / Trustee Belinda A Cay Jock VE Gosse John E Schutz Michael P Siebert (L - R): Kate Laurie, Andrew Hardy, Bill Seppelt, Peter Godden, Nick Ryan, Greg Follett, Fiona Donald Absent: Emma Shaw ROYAL ADELAIDE WINE SHOW COMMITTEE JUDGING PANELS 2019 ROYAL ADELAIDE WINE SHOW Judging took place in the Ridley Centre at the Adelaide Showground, Goodwood Road, Wayville, South Australia from Sunday 29 September to Wednesday 2 October 2019. The Ridley Centre is climate controlled with an average temperature of 21°. SUNDAY 29 SEPTEMBER 2019 PANEL A PANEL B PANEL C PANEL D PANEL E PANEL F Sarah Crowe Wendy Stuckey Paul Hotker Gwyn Olsen Charlie Seppelt Sue Bell Cate Looney Marie Clay Natalie Cleghorn Matt Brooke Joe Czerwinski Alex MacKenzie Shannon Burgess- Brock Harrison Tom Wallace Garth Cliff Benjamin Marx Anthony Kosovich Moore MONDAY 30 SEPTEMBER 2019 PANEL A PANEL B PANEL C PANEL D PANEL E PANEL F Sarah Crowe Wendy -

Download the Official Tasting Booklet for the London ATT 2019

AUSTRALIA TRADE TASTING 2019 22 JANUARY B1, LONDON #ATTwine Floorplan Introduction Welcome to our Australia Trade Tasting. We are We’re excited to introduce these new elements delighted to return to B1, Victoria House again, to this year’s tasting: to host what has become one of the largest Focus table featuring wines made by women tastings in the UK calendar. winemakers and owners, following on from the Australia has thousands of wineries, dotted success of our Women in Wine event in 2017. throughout 65 wine regions across the country. Master classes on alternative varieties in McLaren Our unique climate and vast landscape enables Vale; Australian sparkling wine led by House of us to produce an incredibly diverse range of wine, Arras Winemaker Ed Carr; and the latest flavour which can be seen in more than 100 different research by The Australian Wine Research grape varieties. Australian winemakers are proud Institute. creators and innovators and we are lucky to have TABLES 1–61 TABLES the freedom to make exceptional wine, and to do Aroma Wall – this interactive installation will EXHIBITOR ROOM 1 ROOM EXHIBITOR it our own way. We’re not beholden by tradition showcase some of the key aroma compounds but continue to create our own traditions and that make Australian wines so iconic in a fun and push the boundaries in the pursuit of the most engaging way. diverse, thrilling wines in the world. Global launch of Australian Wine Discovered As this year’s tasting, we’ll be showcasing over – today is the launch of our new education 1000 wines, representing 45 wine regions. -

2018 RMWA Catalogue of Results

2018 CATALOGUE OF RESULTS The Royal Melbourne Wine Awards (RMWA) is Australia’s most respected wine show recognising and rewarding excellence in Australian winemaking. — Conducted by The Royal Agricultural Society of Victoria (RASV) and renowned both nationally and internationally as one of Australia’s largest and most prestigious wine award programs, RMWA are continually developing with new classes and categories to ensure their industry relevance and value. THE ROYAL AGRICULTURAL SOCIETY OF VICTORIA (RASV) THANKS THE FOLLOWING PARTNERS AND SUPPORTERS FOR THEIR INVOLVEMENT. PRESENTING PARTNER MAJOR SPONSOR EVENT TICKETING PARTNER TROPHY SPONSORS 2018 Catalogue of Results The Royal Agricultural Society of Victoria Limited ABN 66 006 728 785 ACN 006 728 785 Melbourne Showgrounds Epsom Road Ascot Vale VIC 3032 Telephone +61 3 9281 7444 Facsimile +61 3 9281 7592 www.rasv.com.au List of Office Bearers As at 28/08/2018 Patron Her Excellency the Honourable Linda Dessau AC – Governor of Victoria Board of Directors MJ (Matthew) Coleman (President) DS (Scott) Chapman (Deputy President) CGV (Catherine) Ainsworth D (Darrin) Grimsey AJ (Alan) Hawkes NE (Noelene) King OAM PJB (Jason) Ronald OAM Chief Executive Officer P. Guerra Company Secretary J. Perry Organising Committee Angie Bradbury (Chair) Matt Harrop (Chair of Judges) Tom Carson Samantha Isherwood Manager Michael Katoa Event Coordinator, Food Kirsten Stubbings Telephone: +61 3 9281 7440 & Beverage Email: [email protected] Contents CEO’s Message 3 Chair of Judges’ Report 5 Judges’ Biographies -

$149Pp Child: $129Pp

BAROSSA & HAHNDORF SUPERSPRINT DAY TOUR From AUD $149pp Child: $129pp Duration: 8.5 hours Get closer to the rest of South Australia’s action with this Depart: 9:00am Big 4 The Bend Holiday bucket list tour all rolled into one exhilarating day. Famous wineries with some of the oldest and rarest Shiraz vines in Park & Rydges Pit Lane Hotel the world, a brand new artisan chocolate shop, the iconic Hahndorf German village, and a wall that whispers to you. Return: 5:30pm Big 4 The Bend Holiday This is the best of the Barossa and Hahndorf - supercharged. Park & Rydges Pit Lane Hotel Tour Includes: • Complimentary glass of bubbles to kickstart your day. • Luxury travel in comfortable small group tour vehicles brought to you by local tour operator Juggle House Operates: Limited Seats Available Experiences. 22, 23, 26, 27, 28, 29, 30 • Insighful and light-hearted comentary on your journey, about townships and locations between destinations. August Murray River Lakes and Coorong Immerse yourself in the beauty and fascination of Australia’s longest river as your journey meanders across the first and oldest Bridge to span the Murray. Discover the highlights of this 130-million-year-old natural Provenance Barossa playground, with slow waters and sandy cliffs. Your local tour guide will Located in the historic Penfolds building in Nuriootpa, share insights on the towns as you venture through this region on the way Provenance remains home to their cellar door, where you can to the Barossa and Adelaide Hills. sample your favourite wine. This newest Barossa precinct also the chance to see a local coffee roaster in action at Bean Addiction or sample their extensive list of teas; taste local gins at Barossa Distilling Whispering Wall Company’s amazing space - ‘The Distillery’; choose from a range of craft Its remarkable acoustics will have you buzzing all day. -

2018 Barossa Wine Show Results Catalogue 42Nd Barossa Wine Show Major Sponsors 2018

2018 Barossa Wine Show Results Catalogue 42nd Barossa Wine Show Major Sponsors 2018 Barossa Wine Show Results Catalogue printed by: Judges & Committee Judges Committee Chairman of Judges Wine of Provenance Committee Chairs Nick Ryan Judges Andrew Quin, Hentley Farm Andrew Wigan Shavaughn Wells, Penfolds Panel Chair Judges Brian Walsh Committee Jen Pfeiffer Helen McCarthy Alex MacClelland, Bethany Wines Kerri Thompson Amanda Longworth, Peter Godden Wine of Provenance Barossa Grape & Wine Association Associate Judge Ashleigh Fox, Judges Chris Tanghe Barossa Grape & Wine Association Chris Tanghe Bernadette Kaeding, Rojomoma Corinne Mui John Hughes, Rieslingfreak Corey Ryan Peter Kelly, Thorn-Clarke Wines Hamish Seabrook Richard Langford, Elderton Wines Kelly Wellington Dan Swincer, Pernod Ricard Toby Barlow Will John, Yalumba Associate Judges Brett Hayes Damian Boyle Kate Hongell Katherine Katalinic Luke Broadbent Mark Bulman Nic Schirripa Riley Harrison Trent Burge Premium Section CLASSES 1 to 20 For wines vintaged from grapes grown in the Barossa Valley (Minimum 85%) Museum Section CLASSES 21 TO 26 For wines vintaged from grapes grown in the Barossa Valley (Minimum 85%). Wines not necessarily commercially available. 2013 Vintage and Older. BAROSSA WINE SHOW 2018 1 RESULTS CATALOGUE Trophies 2018 Winners RIEDEL BEST IN CLASS Best Sparkling Wine, Class 8 Class 8 - Entry 3 - Teusner Wines 2010 MC Sparkling Shiraz RIEDEL BEST IN CLASS Best Red Wine – Other Blends, Class 12 Class 12 - Entry 9 - The Yalumba Wine Company 2016 Hand Picked Shiraz -

2018 KPMG Sydney Royal Wine Show Results Catalogue

30 July - 2 August 2018 Sydney Showground Sydney Olympic Park CATALOGUE www.rasnsw.com.au Thank you from the President Thank you for entering in this Sydney Royal Competition and congratulations to those who were successful in winning a prestigious Sydney Royal award. Our Sydney Royal competitions showcase excellence in rural produce and the passion of so many talented producers across NSW and interstate each year. The standard of entries from right across the country continues to be remarkably high which is immensely pleasing for everyone involved in the Royal Agricultural Society of NSW (RAS). Rewarding excellence and encouraging innovation in food and wine production is at the heart of our charter, and in turn supports a viable and prosperous future for our agricultural communities. To be the recipient of a Sydney Royal award is a significant achievement representing months, years and sometimes decades of hard work and dedication and is highly regarded by fellow producers. To help winning Exhibitors promote their success, the RAS provides Champion, Trophy, Gold, Silver and Bronze medal winners with Sydney Royal artwork to use on product packaging and other marketing materials to promote their success. The RAS has a solid reputation for impartial judging standards, quality and distinction. We review our Competitions every year to ensure they remain relevant to industry standards and are up-to-date with changing trends. In the same manner, we value the strong links we have with agricultural industries and welcome feedback from producers and exhibitors. There are many people involved in making our Competitions the world-class events they are and we take this opportunity to thank our stewards and judges for their time, expertise and energy. -

2017 RMWA Catalogue of Results

2017 CATALOGUE OF RESULTS THE ROYAL AGRICULTURAL SOCIETY OF VICTORIA THANKS AND ACKNOWLEDGES THE FOLLOWING SPONSORS PRESENTING PARTNER OF THE AWARDS PRESENTATION EVENT PARTNER EVENT TICKETING PARTNER TROPHY SPONSORS 2017 Catalogue of Results The Royal Agricultural Society of Victoria Limited ABN 66 006 728 785 ACN 006 728 785 Melbourne Showgrounds Epsom Road Ascot Vale VIC 3032 Telephone +61 3 9281 7444 Facsimile +61 3 9281 7592 www.rasv.com.au List of Office Bearers As at 26/06/2017 Patron Her Excellency the Honourable Linda Dessau AM – Governor of Victoria Board of Directors MJ (Matthew) Coleman CGV (Catherine) Ainsworth DS (Scott) Chapman D (Darrin) Grimsey AJ (Alan) Hawkes NE (Noelene) King OAM JA (Joy) Potter PJB (Jason) Ronald OAM Chairman M. J. Coleman Chief Executive Officer M. O’Sullivan Company Secretary J. Perry Organising Committee Angie Bradbury (Chair) Tom Carson (Chair of Judges) Chris Crawford Matt Harrop Samantha Isherwood Gabrielle Poy Matt Skinner Nick Stock Event Manager, Beverage Michael Katoa Telephone: +61 3 9281 7425 Email: [email protected] Event Coordinator Ania Ligas Contents CEO’s Message 3 Chair of Judges’ Report 5 Judges’ Biographies 6 2017 Major Trophy Winners 14 2017 Trophy Winners 18 Consistency of Excellence Medal 20 2017 Report on Entries 22 Past Jimmy Watson Memorial Trophy Winners 23 2017 Results 25 Best Vermouth Best Sparkling Best Riesling Best Chardonnay Best Semillon Best Sauvignon Blanc or Blend of Semillon & Sauvignon Blanc Best Single Varietal White Best White Blend Best Sweet White Wine Best -

Sale Results Catalogue All Sales Subject to the Conditions Printed in This Catalogue Created On: 01/10/2021 4:57:14 PM

Endeavour Group Limited. ABN: Page 1 of 15 Sale Results Catalogue All sales subject to the conditions printed in this catalogue Created on: 01/10/2021 4:57:14 PM F21SF022 - 04 TUE: Spirits, Fortifieds & Desserts Bidding closed 9:00 PM Tuesday, May 4, 2021 A Buyers Premium of 15% excluding GST applies to all lots. All lots sold GST inclusive, except where marked '#'. AUSTRALIA > Australia A-E Lot No Description Vintage Quantity Bottle Winning Price Classification 1 ALL SAINTS Old Liqueur Muscat, Rutherglen. Minor Label Damage. NV 1 Crock $55.0000000000 00000000 2 ALL SAINTS The Vintage Celebrating 150 Years Fortified Shiraz, 2005 1 Half Bottle $38.0000000000 Rutherglen. Screwcap Closure. 00000000 3 ALL SAINTS The Vintage Celebrating 150 Years Fortified Shiraz, 2005 1 Half Bottle $38.0000000000 Rutherglen. Screwcap Closure. 00000000 4 AUDREY WILKINSON VINEYARDS Muscat, Australia. Wax Capsule/s, NV 1 500ml $33.0000000000 Minor Capsule Damage. 00000000 5 BARBARESSO Oyzo, Australia. Screwcap Closure, Level Down Slightly. NV 1 700ml $26.0000000000 00000000 6 BLEASDALE VINEYARD Vintage Port, Langhorne Creek. Minor Label 1987 1 Bottle $48.0000000000 Damage. 00000000 7 BONNEYVIEW WINES Reserve Port, South Australia. Minor Label 1979 1 Bottle $17.0000000000 Damage, Minor Label Stain/s, Level Down. 00000000 8 BRIAN BARRY WINES Old Court House 14 YO Tawny Port, South NV 1 Bottle $17.0000000000 Australia. Damaged Wax Capsule/s. 00000000 9 BUNDABERG 37.1% ABV, Bundaberg. Screwcap Closure, Minor Label NV 1 Bottle $500.000000000 Damage. 000000000 10 BUNDABERG Black Vat 65 1994 Limited Release 40% ABV, Bundaberg. NV 1 700ml Passed In Screwcap Closure. -

129Th ANNUAL RUTHERGLEN WINE SHOW Incorporating the AUSTRALIAN FORTIFIED WINE SHOW

20172017 129th ANNUAL RUTHERGLEN WINE SHOW Incorporating THE AUSTRALIAN FORTIFIED WINE SHOW final.indd 5 2/9/09 1:57:30 PM NEW LOOK NEW LOCATION SPECIALTY PRESS SERVICE | DESIGN | PRINT 52 Merkel Street Thurgoona NSW 2640 (02) 6021 3366 [email protected] www.specialtypress.com.au FOR ALL YOUR PRINT NEEDS 84577 SP Mktg-Rglen Wine Show Schedule COVER.indd 2 11/07/2017 1:51 pm 129th RUTHERGLEN WINE SHOW 2017 SPECIAL AWARDS SUTHERLAND SMITH R L SEPPELT Best Australian Dry White Table Wine Best Australian Dry Red Wine made from fruit grown in 2017 and 2016 Vintages Rutherglen Region of Victoria DE IULLIS WINES 104/7 2016, 2015 and 2014 Vintages RUTHERGLEN ESTATES 245/6 JOHN C BROWN MEMORIAL TROPHY Best Australian Dry White Wine made from fruit grown in THE BORDER WINE & FOOD SOCIETY the NE Region of Victoria ALBURY WODONGA 2017 and 2016 Vintages Best Australian Dry Red Wine made from fruit grown in PIZZINI 102/25 the NE Region of Victoria 2016, 2015 and 2014 Vintages THE WINEMAKERS OF RUTHERGLEN RUTHERGLEN ESTATES 245/6 Best Australian Dry White Table wine made from fruit grown in the Rutherglen Region of Victoria RUTHERGLEN BEEFSTEAK & BURGUNDY CLUB 2017 and 2016 Vintages Best Australian Dry Red Wine RUTHERGLEN ESTATES 118(c)/5 2016 and 2015 Vintages REDMAN WINES 231/23 RUTHERGLEN WINE SHOW Best Australian Dry white Table Wine, Chardonnay, MULTI-COLOR 2017 Vintage and Older Best Australian Dry Red Wine, Pinot Noir AUSTRALIAN VINTAGE 123/2 2016 Vintage and Older HOME HILL WINERY 214/6 THE PORTAVIN Best Australian Dry White Table