Managing Director/CEO's Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Obi Patience Igwara ETHNICITY, NATIONALISM and NATION

Obi Patience Igwara ETHNICITY, NATIONALISM AND NATION-BUILDING IN NIGERIA, 1970-1992 Submitted for examination for the degree of Ph.D. London School of Economics and Political Science University of London 1993 UMI Number: U615538 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U615538 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 V - x \ - 1^0 r La 2 ABSTRACT This dissertation explores the relationship between ethnicity and nation-building and nationalism in Nigeria. It is argued that ethnicity is not necessarily incompatible with nationalism and nation-building. Ethnicity and nationalism both play a role in nation-state formation. They are each functional to political stability and, therefore, to civil peace and to the ability of individual Nigerians to pursue their non-political goals. Ethnicity is functional to political stability because it provides the basis for political socialization and for popular allegiance to political actors. It provides the framework within which patronage is institutionalized and related to traditional forms of welfare within a state which is itself unable to provide such benefits to its subjects. -

Prospectus and the Securities Which It Offers Have Been Cleared and Registered by the Securities & Exchange Commission

This document is important and should be read carefully. If you are in any doubt about its content or the action to take, kindly consult your Stockbroker, Accountant, Banker, Solicitor or any other professional adviser for guidance immediately. FOR INFORMATION CONCERNING CERTAIN RISK FACTORS WHICH SHOULD BE CONSIDERED BY PROSPECTIVE INVESTORS, SEE “RISK FACTORS” ON PAGE 19 SKYE BANK PLC RC: 142191 Offer for Subscription of 2,231,599,145 Ordinary shares of 50 Kobo each at N14.00 per share Payable in full on Application APPLICATION LIST OPENS: Monday, 14 January, 2008 APPLICATION LIST CLOSES: Wednesday, 20 February, 2008 Issuing Houses: RC:189502 RC:485600 RC:446599 This Prospectus and the securities which it offers have been cleared and registered by the Securities & Exchange Commission. It is a civil wrong and a criminal offence under the Investments and Securities Act Cap I24 Laws of the Federation of Nigeria 2004 to issue a Prospectus which contains false or misleading information. Clearance and registration n of this Prospectus and the securities which it offers do not relieve the parties from any liability arising under the Act for false and misleading statements contained herein or for any omission of a material fact. This Prospectus is dated Tuesday, 8 January, 2008 Offer for Subscription Page 1 CONTENTS DEFINITIONS 3 ABRIDGED TIMETABLE 4 THE OFFER 5 SUMMARY OF THE OFFER 6 Corporate Directory ......................................................................................................10 Directors and Other Parties to the -

PROVISIONAL LIST.Pdf

S/N NAME YEAR OF CALL BRANCH PHONE NO EMAIL 1 JONATHAN FELIX ABA 2 SYLVESTER C. IFEAKOR ABA 3 NSIKAK UTANG IJIOMA ABA 4 ORAKWE OBIANUJU IFEYINWA ABA 5 OGUNJI CHIDOZIE KINGSLEY ABA 6 UCHENNA V. OBODOCHUKWU ABA 7 KEVIN CHUKWUDI NWUFO, SAN ABA 8 NWOGU IFIONU TAGBO ABA 9 ANIAWONWA NJIDEKA LINDA ABA 10 UKOH NDUDIM ISAAC ABA 11 EKENE RICHIE IREMEKA ABA 12 HIPPOLITUS U. UDENSI ABA 13 ABIGAIL C. AGBAI ABA 14 UKPAI OKORIE UKAIRO ABA 15 ONYINYECHI GIFT OGBODO ABA 16 EZINMA UKPAI UKAIRO ABA 17 GRACE UZOME UKEJE ABA 18 AJUGA JOHN ONWUKWE ABA 19 ONUCHUKWU CHARLES NSOBUNDU ABA 20 IREM ENYINNAYA OKERE ABA 21 ONYEKACHI OKWUOSA MUKOSOLU ABA 22 CHINYERE C. UMEOJIAKA ABA 23 OBIORA AKINWUMI OBIANWU, SAN ABA 24 NWAUGO VICTOR CHIMA ABA 25 NWABUIKWU K. MGBEMENA ABA 26 KANU FRANCIS ONYEBUCHI ABA 27 MARK ISRAEL CHIJIOKE ABA 28 EMEKA E. AGWULONU ABA 29 TREASURE E. N. UDO ABA 30 JULIET N. UDECHUKWU ABA 31 AWA CHUKWU IKECHUKWU ABA 32 CHIMUANYA V. OKWANDU ABA 33 CHIBUEZE OWUALAH ABA 34 AMANZE LINUS ALOMA ABA 35 CHINONSO ONONUJU ABA 36 MABEL OGONNAYA EZE ABA 37 BOB CHIEDOZIE OGU ABA 38 DANDY CHIMAOBI NWOKONNA ABA 39 JOHN IFEANYICHUKWU KALU ABA 40 UGOCHUKWU UKIWE ABA 41 FELIX EGBULE AGBARIRI, SAN ABA 42 OMENIHU CHINWEUBA ABA 43 IGNATIUS O. NWOKO ABA 44 ICHIE MATTHEW EKEOMA ABA 45 ICHIE CORDELIA CHINWENDU ABA 46 NNAMDI G. NWABEKE ABA 47 NNAOCHIE ADAOBI ANANSO ABA 48 OGOJIAKU RUFUS UMUNNA ABA 49 EPHRAIM CHINEDU DURU ABA 50 UGONWANYI S. AHAIWE ABA 51 EMMANUEL E. -

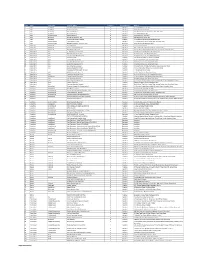

S/No State City/Town Provider Name Category Coverage Type Address

S/No State City/Town Provider Name Category Coverage Type Address 1 Abia AbaNorth John Okorie Memorial Hospital D Medical 12-14, Akabogu Street, Aba 2 Abia AbaNorth Springs Clinic, Aba D Medical 18, Scotland Crescent, Aba 3 Abia AbaSouth Simeone Hospital D Medical 2/4, Abagana Street, Umuocham, Aba, ABia State. 4 Abia AbaNorth Mendel Hospital D Medical 20, TENANT ROAD, ABA. 5 Abia UmuahiaNorth Obioma Hospital D Medical 21, School Road, Umuahia 6 Abia AbaNorth New Era Hospital Ltd, Aba D Medical 212/215 Azikiwe Road, Aba 7 Abia AbaNorth Living Word Mission Hospital D Medical 7, Umuocham Road, off Aba-Owerri Rd. Aba 8 Abia UmuahiaNorth Uche Medicare Clinic D Medical C 25 World Bank Housing Estate,Umuahia,Abia state 9 Abia UmuahiaSouth MEDPLUS LIMITED - Umuahia Abia C Pharmacy Shop 18, Shoprite Mall Abia State. 10 Adamawa YolaNorth Peace Hospital D Medical 2, Luggere Street, Yola 11 Adamawa YolaNorth Da'ama Specialist Hospital D Medical 70/72, Atiku Abubakar Road, Yola, Adamawa State. 12 Adamawa YolaSouth New Boshang Hospital D Medical Ngurore Road, Karewa G.R.A Extension, Jimeta Yola, Adamawa State. 13 Akwa Ibom Uyo St. Athanasius' Hospital,Ltd D Medical 1,Ufeh Street, Fed H/Estate, Abak Road, Uyo. 14 Akwa Ibom Uyo Mfonabasi Medical Centre D Medical 10, Gibbs Street, Uyo, Akwa Ibom State 15 Akwa Ibom Uyo Gateway Clinic And Maternity D Medical 15, Okon Essien Lane, Uyo, Akwa Ibom State. 16 Akwa Ibom Uyo Fulcare Hospital C Medical 15B, Ekpanya Street, Uyo Akwa Ibom State. 17 Akwa Ibom Uyo Unwana Family Hospital D Medical 16, Nkemba Street, Uyo, Akwa Ibom State 18 Akwa Ibom Uyo Good Health Specialist Clinic D Medical 26, Udobio Street, Uyo, Akwa Ibom State. -

International Journal of Contemporary Social

INTERNATIONALINTERNATIONAL JOURNAL OF JOURNAL CONTEMPORARY OF CONTEMPORARY Vol. 1:1, 2013 SOCIAL SCIENTIFIC RESEARCH www.iscprce.org/ ijcssr SOCIAL SCIENTIFIC RESEARCH VOL. 1:1, 2013 www.iscprce.org/ ijcssr RELIGION, POLITICS AND THE STATE IN NIGERIA, 1985- 1995 Dr. Etim E. Okon Senior Lecturer Department of Religious and Cultural Studies University of Calabar Calabar, Nigeria Email: [email protected] Phone: +2348038025231 ABSTRACT This paper examines critically the religious dimension of political decisions and policies in the Babangida era. It is obvious that religion was manipulated in the Babangida era as a major influence and determinant of public policy. The negative impact of the manipulation of religion for political purposes is still lingering in the horizon. Religion was not only bastardized, but was reasonably politicized and contaminated. Babangida used religion to obtain legitimacy and consolidate his grip on political power. KEYWORDS: Religion, Islam, politics, Nigeria, Babangida INTRODUCTION Religion is an indispensable factor in nation building. Historically, Christianity and Islam have contributed immensely to the socio-political development of Nigeria. Both religions, at one time and another have acted as harbingers of civilization and “… the fountain of morality in our social evolution” (Kalu, 1980:317, 318). Though exotic, from the point of view of origin, Islam and Christianity have so permeated the Nigerian culture and society, that they have unconsciously assumed the status of an indigenous faith in some communities. That is true of Islam in northern Nigeria and Christianity in the south. Majority of Nigerian people see themselves either as Christians or Muslims. An insignificant proportion identifies themselves as votaries of traditional religions. -

An Assessment of Civil Military Relations in Nigeria As an Emerging Democracy, 1999-2007

AN ASSESSMENT OF CIVIL MILITARY RELATIONS IN NIGERIA AS AN EMERGING DEMOCRACY, 1999-2007 BY MOHAMMED LAWAL TAFIDA DEPARTMENT OF POLITICAL SCIENCE AND INTERNATIONAL STUDIES, AHMADU BELLO UNIVERSITY, ZARIA NIGERIA JUNE 2015 DECLARATION I hereby declare that this thesis entitled An Assessment of Civil-Military Relations in Nigeria as an Emerging Democracy, 1999-2007 has been carried out and written by me under the supervision of Dr. Hudu Ayuba Abdullahi, Dr. Mohamed Faal and Professor Paul Pindar Izah in the Department of Political Science and International Studies, Faculty of Social Sciences, Ahmadu Bello University, Zaria, Nigeria. The information derived from the literature has been duly acknowledged in the text and a list of references provided in the work. No part of this dissertation has been previously presented for another degree programme in any university. Mohammed Lawal TAFIDA ____________________ _____________________ Signature Date CERTIFICATION PAGE This thesis entitled: AN ASSESSMENT OF CIVIL-MILITARY RELATIONS IN NIGERIA AS AN EMERGING DEMOCRACY, 1999-2007 meets the regulations governing the award of the degree of Doctor of Philosophy in Political Science of the Ahmadu Bello University Zaria and is approved for its contribution to knowledge and literary presentation. Dr. Hudu Ayuba Abdullahi ___________________ ________________ Chairman, Supervisory Committee Signature Date Dr. Mohamed Faal________ ___________________ _______________ Member, Supervisory Committee Signature Date Professor Paul Pindar Izah ___________________ -

Parochial Political Culture: the Bane of Nigeria Development Rosemary Anazodo (Ph.D) Department of Public Administration Nnamdi

Review of Public Administration & Management Vo. 1 No. 2 Parochial Political Culture: The Bane of Nigeria Development Rosemary Anazodo (Ph.D) Department of Public Administration Nnamdi Azikiwe University, Awka. E-mail:[email protected] Agbionu, Tina Uchenna Department of Business Administration Nnamdi Azikiwe University, Awka, Nig E-mail:[email protected] Ezenwile Uche Department of Public Administration Anambra State University, Uli Anambra State Abstract This paper examined the effect of parochial political culture on national development in Nigeria. It is imperative at this time more than any other in the history of Nigeria, a country at crossroad to vigorously address the challenges posed by the parochial political culture , without which political stability, political innovation, national development among others would be a mirage. For many decades Nigeria has been on a steady decline in regards to all indicators of national development. On this premise the paper intends to investigate how Nigeria’s political culture impedes her national development. Based on the assertions above, some objectives were formulated to guide the study. Theories of two republics and Prebendalism formed the basis of the study. Some findings were made and recommendations provided on the way forward . Keywords; Parochial, Political Culture, Development. Introduction Nigeria is sadly at the other side of political and economic development. Annual income per head is dismally low, economic and social infrastructures are underdeveloped and manufacturing base is weak. 1 Review of Public Administration & Management Vo. 1 No. 2 Nigeria is a rich country whose economy has been mismanaged over the years. The excellent investment opportunities have been affected by unstable political atmosphere and threats to security of life and property (Abimboye, 2010:18). -

The Venus Medicare Hospital Directory

NATIONWIDE PROVIDER DIRECTORY CATEGORY 1 HOSPITALS S/N STATE CITY/TOWN/DISTRICT HEALTHCARE PROVIDER ADDRESS TERMS & CONDITIONS SERVICES Primary, O&G, General Surgery, Paediatrics, 1 FCT/ABUJA CENTRAL AREA Limi Hospital & Maternity Plot 541Central District, Behind NDIC/ICPC HQ, Abuja Nil Internal Medicine Primary, Int. Med, Paediatrics,O&G, GARKI Garki Hospital Abuja Tafawa Balewa Way, Area 3, Garki, Abuja Private Wards not available. Surgery,Dermatology Amana Medical Centre 5 Ilorin str, off ogbomosho str,Area 8, Garki Nil No.5 Plot 802 Malumfashi Close, Off Emeka Anyaoku Strt, Alliance Clinics and Services Area 11 Nil Primary, Int. Med, Paediatrics Primary, O&G, General Surgery, Paediatrics, Internal Medicine Dara Medical Clinics Plot 202 Bacita Close, off Plateau Street, Area 2 Nil Primary, O&G, General Surgery, Paediatrics, Internal Medicine Sybron Medical Centre 25, Mungo Park Close, Area 11, Garki, Abuja Nil Primary, O&G, Paediatrics,Int Medicine, Gen Guinea Savannah Medical Centre Communal Centre, NNPC Housing Estate, Area II, Garki Nil Surgery, Laboratory Bio-Royal Hospital Ltd 11, Jebba Close, Off Ogun Street, Area 2, Garki Nil Primary, Surgery, Paediatrics. Primary, Family Med, O & G, Gen Surgery, Royal Specialist Hospital 2 Kukawa Street, Off Gimbiyan Street Area 11, Garki, Abuja Nil Urology, ENT, Radiology, Paediatrics No.4 Ikot Ekpene Close, Off Emeka Anyaoku Street Crystal Clinics (opposite National Assembly Clinic) Garki Area 11 Nil Primary, O&G, Paediatrics, Internal Medicine, Surgery Model Care Hospital & Consultancy Primary, Paediatrics, Surgery and ENT Limited No 5 Jaba Close, off Dunukofia Street by FCDA Garki, Abuja Nil Surgery Primary, O&G, General Surgery, Paediatrics, GARKI II Fereprod Medical Centre Obbo Crescent, off Ahmadu Bello Way, Garki II Nil Internal Medicine Holy Trinity Hospital 22 Oroago Str, by Ferma/Old CBN HQ, Garki II Nil Primary only. -

<Ffflhor WORT

AMERICA'S LEADING MAGAZINE <ffflHOR ON AFRICA $4 WORT MARCH-APRIL 1984 CEUTA MELILLA me GAMMA Ban|ul ~ GUINEA GUINEA BISSAUfConakry Bissau Freetown SUMA LEONE CENTRAL AFRICAN Monrovia REPUBLIC CAMEROON 1 Bang,., MAURITIUS 0 Port Louis LESOTHO Maseru Copyright © 1984 by the African-American Institute, Inc. MARCH-APRIL 1984 AMERICAS VOLUME 29, NUMBER 2 LEADING MAGAZINE ON AFRICA A Publication of the VREPORT African-American Institute The African-American Institute Interview Chairman Flight Lieutenant Jerry Rawlings, George N. Lindsay Chairman of the Provisional National Defense Council, Ghana President Donald B. Easum Interviewed by Margaret A. Novicki Nigeria The Coup and the Future Publisher By Larry Diamond Frank E. Ferrari Editor Upper Volta Margaret A. Novicki Six Months into Sankara's Revolution 16 Assistant Editor By Howard Schissel Michael Maren Editorial Assistant Jason Zweig Ivory Coast Editorial Secretary Hard Times for an African Alana Lee Success Story 20 Interns By George McFarlane George N. Archer Savona Bailey-McClain Letter from Kampala Uganda's Security Nightmare 24 By Rick Wells Circulation. Subscriptions, Ad- IN THIS ISSUE vertising, Management, and Pro- African Update 27 duction Services by Transaction 1984 began with international attention fo- Editor: Michael Maren Periodicals Consortium: cused on Nigeria in the aftermath of its New Assistant Editor: Jason Zweig Year's military coup. This issue of Africa Report Editors takes a look at recent political and economic Researcher: Stephen Adkisson Alex Fundock III trends and events in West Africa — a region that George P. Bassett has undergone some fundamental changes over Guinea the past two years- Sekou Toure's Ouverture Art Governmental corruption and economic de- 43 Dena Leiter cline were the seeds that sowed the 1979 and By Justin Mendy Scott E. -

Page 1 of 67 OPERATION AURE 7/21/2008

OPERATION AURE Page 1 of 67 OPERATION 'AURE’: The Northern Military Counter-Rebellion of July 1966 By Nowa Omoigui BACKGROUND In the early hours of January 15, 1966, citing a laundry list of complaints against the political class, there was a military rebellion in Nigeria against the first republic [http://www.dawodu.com/nzeogwu2.htm]. Led by a group of Majors who were predominantly of eastern origin, the Prime Minister, a federal minister, two regional premiers, along with top Army officers were brutally assassinated. A number of civilians were also killed. [http://www.gamji.com/NEWS1103.htm] The coup succeeded in Kaduna the northern region capital, failed in Lagos the federal capital and Ibadan the western regional capital, but barely took place in Benin the midwestern capital, and Enugu the eastern capital. The majority of those murdered were northerners, accompanied by some westerners and two Midwesterners. No easterner lost his or her life. On January 16, rather than approve the appointment of Zanna Bukar Dipcharima, a politician of northern origin, as acting Prime Minister, the acting President, Nwafor Orizu, himself of eastern origin, handed over power to Major-General JTU Aguiyi- Ironsi, the GOC of the Nigerian Army, also of eastern origin. This was allegedly at the behest of the rump cabinet, allegedly to enable Ironsi put down the revolt which, as of then, had already failed in southern Nigeria. Until it became apparent recently in separate testimony by Alhaji Shehu Shagari and Chief Richard Akinjide, it had always been publicly assumed in the lay Press that the hand-over was voluntary although unconstitutional - since no such provision existed in the Nigerian constitution. -

Nigerian Electricity Regulatory Commission

FIRST QUARTER 2019 NERC QUARTERLY REPORTS NIGERIAN ELECTRICITY REGULATORY COMMISSION Electricity on Demand QUARTERLY REPORT FIRST QUARTER 2019 NIGERIAN ELECTRICITY REGULATORY COMMISSION PLOT 1387| CADASTRAL ZONE A00| CENTRAL BUSINESS DISTRICT| P.M.B. 136| GARKI| ABUJA www.nerc.gov.ng 1 [NIGERIAN ELECTRICITY REGULATORY COMMISSION] FIRST QUARTER 2019 NERC QUARTERLY REPORTS © 2019 Nigerian Electricity Regulatory Commission NERC quarterly report is prepared in compliance with Section 55(3) of the Electric Power Sector Reform (EPSR) Act 2004, which mandates the Commission to submit the quarterly reports of its activities to the President and the National Assembly. The report analyses the state of the Nigerian electricity industry (covering both the operational and commercial performance), regulatory functions, consumer affairs as well as the Commission’s finances and staff development. The report is directed at a wide spectrum of readers including energy economists, electrical engineers, financial and market analysts, potential investors, government officials and institutions, the private sector as well as general readers. NERC quarterly report is freely available to stakeholders of the Nigerian Electricity Supply Industry (NESI), government agencies and corporations. Individuals can also access any particular issue freely from the Commission’s Website. Please direct all inquiries, comments and suggestions on the report to: The Commissioner Planning, Research and Strategy Division Nigerian Electricity Regulatory Commission Plot 1387 Cadastral Zone A00 Central Business District P.M.B 136, Garki, Abuja Nigeria NERC website: www.nerc.gov.ng Contact Centre: Tel: +234 (09) 462 1400, +234 (09) 462 1410 Email: [email protected] 2 [NIGERIAN ELECTRICITY REGULATORY COMMISSION] FIRST QUARTER 2019 NERC QUARTERLY REPORTS EDITORIAL NERC quarterly report is prepared by the Planning, Research &Strategy (PRS) Division of the Commission led by Dr Musiliu. -

Review of Public Administration and Management

Review of Public Administration & Management Vo. 1 No. 2 Review of Public Administration and Management Vol. 1 No. 2 ISSN 2315-7844 Nov, 2012 A bi-annual Journal of the Department of Public Adminitration Nnamdi Azikiwe Univeristy, Awka, Nigeria Website: http://reviewofpublicadministration.wordpress.com E-mail:[email protected] i Review of Public Administration & Management Vo. 1 No. 2 Review of Public Administration and Management © Department of Public Administration, Nnamdi Azikiwe University Awka, Nigeria Published Nov, 2012 by Department of Public Administration, Nnamdi Azikiwe University, Awka, Nigeria All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any other information storage and retrieval system, without prior permission of the publishers. ii Review of Public Administration & Management Vo. 1 No. 2 Editorial Board Chief Editor: Prof. M.C. Muo, Ph.D, Nnamdi Azikiwe University, Awka Managing Editor: Emma E.O. Chukiwuemeka, h.D, Nnamdi Azikiwe University, Awka Members: Prof. F.C. Nze, Nnamdi Azikiwe University, Awka Prof. J.C. Okoye , Ph.D - Nnamdi Azikiwe University, Awka Prof. Ezimma Nnabuife, Ph.D Nnamdi Azikiwe University, Awka Prof. Chikelue Ofuebe, Ph.D University of Nigeria Nsukka Ngozi Ewuim, Ph.D Nnamdi Azikiwe University, Awka Okey Francis Chikeleze, Ph.D Enugu State University of Science and Technology, Enugu Consulting Editors: Prof. Kunle Awotokun, Ph.D – Obafemi Awolowo University, Ife Prof. Emma Ezeani, Ph.D – University of Nigeria, Nsukka Prof. Ike Ndolo, Ph.D – Enugu State University ofScience and Tech, Enugu Prof. Charles Okigbo, Ph.D – North Dakota State University, United States of America Prof.B.C.