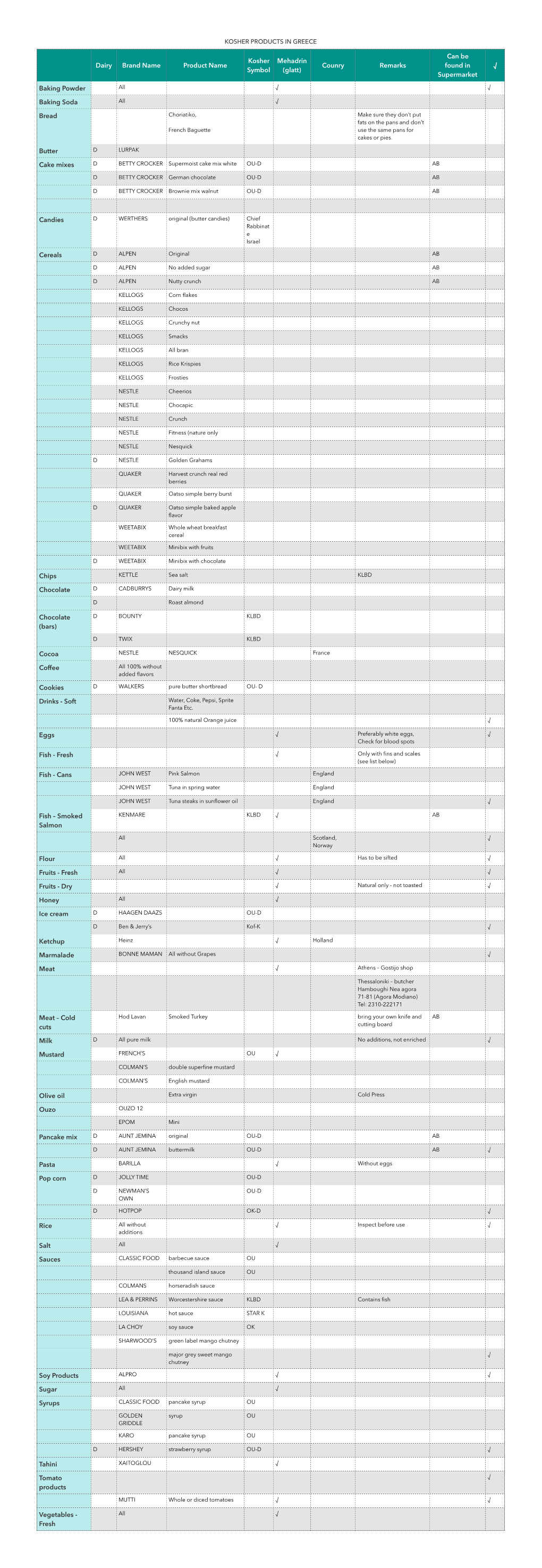

Kosher Products List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consumer Trends Snack Bars in the United Kingdom

MARKET ACCESS SECRETARIAT Global Analysis Report Consumer Trends Snack Bars in the United Kingdom February 2014 EXECUTIVE SUMMARY CONTENTS The snack bar market in the United Kingdom (U.K.) was Executive summary ........................ 1 valued at US$821.1 million in 2012, benefitting from a nation of consumers looking for convenient, on-the-go meal and snack Introduction ..................................... 2 options. The market is expected to grow to US$1.05 billion by 2017. Retail sales ..................................... 2 Close to half (47%) of British adults eat snacks on-the-go Competitive Landscape ................. 3 (while away from home, work or place of study) at least once a week. Mintel estimates there are 6.4 billion on-the-go adult Consumer Attitudes ........................ 4 snacking occasions annually, with 16-24 year olds and 35-44 year olds together accounting for around 1.5 billion of those Snack Bar Trends……………… ..... 5 occasions. Market Shares by Brand................. 7 Furthermore, close to 18% of adult consumers in the U.K. report snacking on-the-go at least once a day. This rises to Distribution Channels ..................... 9 33% among 16-24 year olds and 38% among students, according to Mintel (June 2010). Product Extensions and Innovation ............................. 10 Consumers in the U.K. are particularly big on-the-go breakfast eaters, with 22% of adults having breakfast outside of the home at least once a week. This trend is more New Product Examples ............... 12 prevalent amongst men (27%), consumers who work or go to school full-time (33%) and the 25-34 age demographic (38%), Resources ................................... 13 according to Mintel (February 2011). -

Traub X Crosswalk Report

Understanding the Unprecedented: Quarantine and its Effects on the American Consumer Overview As the Coronavirus crisis takes its toll on both the psyche and wallets of Americans, we conducted a study to address its impact on the consumer. In our first edition of the Coronavirus Consumer Report we addressed the following questions: 1. How has the Coronavirus and related crisis impacted the ways in which consumers engage in 1 digital content and make purchase decisions? 2. How will these trends shift as the crisis continues and we settle into our “new normal”? The 2 first two weeks of the crisis were a shock to the system. What will the next phase look like from a consumer perspective? 3. Will these trends or some of these trends achieve a level of permanence even after the crisis 3 abates? In order to answer these questions, we partnered with data insights analytics firm, Crosswalk, to analyze the digital data of over 5 million consumers. This edition of the Coronavirus Consumer Report covers the first two weeks of the crisis when Americans went from living what were essentially their normal lives to sheltering at home or a version of it within the span of days. We plan to provide pulse check updates throughout the crisis to see how the trends evolve over time. For this report, Traub and Crosswalk conducted a study of 5.29M consumers who provided self- identified information via social media platforms. We sourced parsed data from digital networks, consumption trends, habits, and language. We then applied our proprietary funnel system to filter the data and assign inferences based on proven correlations between specific data points and demographically known characteristics. -

Nutrient Content

USDA National Nutrient Database for Standard ReferenceRelease 28 Nutrients: 20:5 n-3 (EPA) (g) Food Subset: All Foods Ordered by: Nutrient Content Measured by: Household Report Run at: September 18, 2016 04:44 EDT 20:5 n-3 (EPA)(g) NDB_No Description Weight(g) Measure Per Measure 04591 Fish oil, menhaden 13.6 1.0 tbsp 1.791 15197 Fish, herring, Pacific, cooked, dry heat 144.0 1.0 fillet 1.788 04593 Fish oil, salmon 13.6 1.0 tbsp 1.771 04594 Fish oil, sardine 13.6 1.0 tbsp 1.379 15040 Fish, herring, Atlantic, cooked, dry heat 143.0 1.0 fillet 1.300 83110 Fish, mackerel, salted 80.0 1.0 piece (5-1/2" x 1-1/2" x 1/2") 1.295 15041 Fish, herring, Atlantic, pickled 140.0 1.0 cup 1.180 15046 Fish, mackerel, Atlantic, raw 112.0 1.0 fillet 1.006 35190 Salmon, red (sockeye), filets with skin, smoked (Alaska Native) 108.0 1.0 filet 0.977 15094 Fish, shad, american, raw 85.0 3.0 oz 0.923 15210 Fish, salmon, chinook, cooked, dry heat 85.0 3.0 oz 0.858 15078 Fish, salmon, chinook, raw 85.0 3.0 oz 0.857 04590 Fish oil, herring 13.6 1.0 tbsp 0.853 15043 Fish, herring, Pacific, raw 85.0 3.0 oz 0.824 15208 Fish, sablefish, cooked, dry heat 85.0 3.0 oz 0.737 15236 Fish, salmon, Atlantic, farmed, raw 85.0 3.0 oz 0.733 15181 Fish, salmon, pink, canned, without salt, solids with bone and liquid 85.0 3.0 oz 0.718 15088 Fish, sardine, Atlantic, canned in oil, drained solids with bone 149.0 1.0 cup, drained 0.705 15116 Fish, trout, rainbow, wild, cooked, dry heat 143.0 1.0 fillet 0.669 15237 Fish, salmon, Atlantic, farmed, cooked, dry heat 85.0 3.0 oz 0.586 15239 -

Fiscal 2018 Annual Report

FISCAL 2018 ANNUAL REPORT Fiscal 2018 Financial Highlights Change In millions, except per share and 52 weeks ended 52 weeks ended on a constant- profit margin data May 27, 2018 May 28, 2017 Change currency basis* Net Sales $ 15,740 $ 15,620 1% Organic Net Sales* Flat Operating Profit $ 2,509 $ 2,566 (2%) Total Segment Operating Profit* $ 2,792 $ 2,953 (5%) (6%) Operating Profit Margin 15.9% 16.4% -50 basis points Adjusted Operating Profit Margin* 17.2% 18.1% -90 basis points Net Earnings Attributable to General Mills $ 2,131 $ 1,658 29% Diluted Earnings per Share (EPS) $ 3.64 $ 2.77 31% Adjusted Diluted EPS, Excluding Certain $ 3.11 $ 3.08 1% Flat Items Affecting Comparability* Average Diluted Shares Outstanding 586 598 (2%) Dividends per Share $ 1.96 $ 1.92 2% Net Sales Total Segment Adjusted Diluted Free Cash Flow* Dollars in millions Operating Profit* Earnings per Share* Dollars in millions Dollars in millions Dollars $3.11 $3,154 $17,910 $2,218 $17,630 $3,035 $3,000 $3.08 $2,953 $16,563 $2,035 $2,792 $1,959 $15,740 $15,620 $1,936 $1,731 $2.92 $2.86 $2.82 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 *See page 45 of form 10-K herein for discussion of non-GAAP measures. Fiscal 2018 Net Sales $15.7 Billion Total Company Net Sales by Product Platform Total Company Net Sales by Reporting Segment Our portfolio is focused on five global growth In fiscal 2018, we reported net sales in four platforms. -

General Mills' 2005 Annual Report

General Mills 2005 Annual Report General Mills at a Glance Selected Brands Cheerios, Betty Crocker, Wheaties, Pillsbury, Gold Medal, Hamburger Helper, Old El Paso, Totino’s, Yoplait, Green Giant, Progresso, Bisquick, Nature Valley, Cascadian Farm, Grands!, Chex Mix, Lucky Charms, Pop.Secret, Bugles, Total, Häagen-Dazs, Chex, Muir Glen, Fruit Roll-Ups, Gardetto’s, Kix, Colombo, Wanchai Ferry, Latina, La Salteña, Forno de Minas, Frescarini, Nouriche, Cinnamon Toast Crunch U.S. Retail Bakeries and International Joint Ventures Foodservice Our U.S. Retail business This segment of our We market our products in We are partners in several segment includes the business generates over $1.7 more than 100 countries out- joint ventures around the six major marketing divisions billion in sales. We customize side the United States.Our world. Cereal Partners listed below. We market our packaging of our retail prod- largest international brands Worldwide is our joint venture products in a variety of ucts and market them to are Häagen-Dazs ice cream, with Nestlé. We participate domestic retail outlets includ- convenience stores and food- Old El Paso Mexican foods, in four Häagen-Dazs joint ing traditional grocery stores, service outlets such as Green Giant vegetables and ventures, the largest of which natural food chains, mass schools, restaurants and hotels. Pillsbury dough products. is in Japan. And we are merchandisers and member- We sell baking mixes and This business segment partners with DuPont in ship stores. This segment frozen dough-based products accounts for 15 percent of 8th Continent, which produces accounts for 69 percent of to supermarket, retail and total company sales. -

Nestlé and General Mills Joint Venture

Cereal Partners Worldwide A Nestlé and General Mills joint venture Making healthy breakfasts easier This publication is not intended for commercial communication At Cereal Partners Worldwide (CPW) we aim to provide our consumers around the world with a healthy start to their day. Our breakfast cereals are a convenient and tasty way to eat a nutritious breakfast. Combining forces for over two decades Established in 1990, CPW is a 50-50 joint venture between General Mills and Nestlé. It owes its success to the support and know-how of Fast facts its partner companies. The joint venture combines Nestlé’s strong worldwide presence and brands, its deep local market and distribution 50/50 joint venture Nestlé knowledge, and its production facilities, with General Mills’ technical and General Mills excellence in cereal products and processes, its proven cereal marketing Sales of 2 billion CHF (2012) expertise, as well as its wide portfolio of successful US cereal brands. 4500 employees The powerful combination is a proven competitive advantage and a secret of success. The joint venture has returned profit equally to its 17 factories partners since 1998. Three R&D centres Operations in 40 countries Sales in 140+ markets Headquarters in Lausanne, Around the world Switzerland Over 50 brands worldwide From its headquarters in Lausanne, Switzerland, CPW is managed by its Global brands : Fitness®, ® ® own fully accountable leadership team with the CEO reporting into the Cheerios , Chocapic and Nesquik® CPW Supervisory Board, chaired by the CEOs of Nestlé and General Mills. Operating outside General Mills’ home breakfast cereal markets the US and Canada, CPW drives sales in over 140 countries around the world, building on Nestlé’s presence and infrastructure. -

Grocery Goliaths

HOW FOOD MONOPOLIES IMPACT CONSUMERS About Food & Water Watch Food & Water Watch works to ensure the food, water and fish we consume is safe, accessible and sustainable. So we can all enjoy and trust in what we eat and drink, we help people take charge of where their food comes from, keep clean, affordable, public tap water flowing freely to our homes, protect the environmental quality of oceans, force government to do its job protecting citizens, and educate about the importance of keeping shared resources under public control. Food & Water Watch California Office 1616 P St. NW, Ste. 300 1814 Franklin St., Ste. 1100 Washington, DC 20036 Oakland, CA 94612 tel: (202) 683-2500 tel: (510) 922-0720 fax: (202) 683-2501 fax: (510) 922-0723 [email protected] [email protected] foodandwaterwatch.org Copyright © December 2013 by Food & Water Watch. All rights reserved. This report can be viewed or downloaded at foodandwaterwatch.org. HOW FOOD MONOPOLIES IMPACT CONSUMERS Executive Summary . 2 Introduction . 3 Supersizing the Supermarket . 3 The Rise of Monolithic Food Manufacturers. 4 Intense consolidation throughout the supermarket . 7 Consumer choice limited. 7 Storewide domination by a few firms . 8 Supermarket Strategies to Manipulate Shoppers . 9 Sensory manipulation . .10 Product placement . .10 Slotting fees and category captains . .11 Advertising and promotions . .11 Conclusion and Recommendations. .12 Appendix A: Market Share of 100 Grocery Items . .13 Appendix B: Top Food Conglomerates’ Widespread Presence in the Grocery Store . .27 Methodology . .29 Endnotes. .30 Executive Summary Safeway.4 Walmart alone sold nearly a third (28.8 5 Groceries are big business, with Americans spending percent) of all groceries in 2012. -

Clip Box Tops and Earn Cash for Our School!

clip box tops and earn cash for our school! Earn cash for your school every time you shop for groceries. Clip Box Tops from hundreds of your favorite products.* Each Box Tops coupon is worth 10¢ for our school—and that adds up fast! BAKING Lucky Charms® Cereal: • Pillsbury® Grands!® Biscuits • Nature Valley® Chewy Trail Mix Bars Towels & Napkins: Desserts: • Chocolate Lucky Charms® Cereal • Pillsbury® Grands! Jr.® Biscuits • Nature Valley® Crunchy Granola Bars • KLEENEX® Dinner Napkins (50 count) • Betty Crocker® Brownie Mixes Oatmeal Crisp® Cereal: • Pillsbury® Grands!® Sweet Rolls • Nature Valley® Healthy Heart Chewy • SCOTT® Paper Towels • Betty Crocker Complete Desserts® • Oatmeal Crisp® Almond Cereal • Pillsbury® Pizza Crust Granola Bars • SCOTT® Rags in a Box • Betty Crocker® Cookie Pouches • Oatmeal Crisp® Raisin Cereal • Pillsbury® Sweet Rolls • Nature Valley® Nut Clusters • SCOTT® Shop Towels • Betty Crocker® Decadent Supreme® Raisin Nut Bran Cereal Butter, Margarine and Spreads: • Nature Valley® Roasted Nut Crunch Bars • VIVA® Paper Towels • Betty Crocker® Frosting Reese’s Puffs® Cereal • LAND O LAKES® Butter (sticks) • Nature Valley® Sweet & Salty Nut Granola Bars Wipes: • Betty Crocker® Gluten Free Brownie Mix Total® Cereal: • LAND O LAKES® Fresh Buttery Taste® Spread Nature Valley® Granola Thins • SCOTT® Pre-Moistened Wipes • Betty Crocker® Gluten Free Cake Mix • Total® Raisin Bran Cereal (sticks and tubs) NEW Nature Valley® Protein Chewy Bars • Betty Crocker® Gluten Free Cookie Mix • Whole Grain Total® Cereal • LAND O LAKES® -

Liste Des Produits Sélectionnés — Cette Liste Éditée Par L’ACIP Est Exclusivement Destinée À L’Usage Privé Dans Le Cadre Du Cercle De Famille

Liste des Produits Sélectionnes Liste des Produits Sélectionnés — Cette liste éditée par l’ACIP est exclusivement destinée à l’usage privé dans le cadre du cercle de famille� Toute autre utilisation, notamment reproduction, diffusion en public, télédiffusion, sans autorisation écrite de l’ACIP est strictement interdite sous peine de poursuites judiciaires de même que tout montage, coupure ou addition� JUILLET 2019 La liste est établie par les services du Grand Rabbin de Paris� Nous déclarons après enquête, que les produits qui y figurent ne comprennent, à la date de la présente publication, aucune matière religieusement interdite, mais nous rappelons qu’à chaque instant les industriels peuvent modifier les compositions� Les produits non-certifiés par le Beth Din de Paris référencés dans cette liste ne peuvent être commercialisés en se prévalant de la garantie du Beth Din de Paris� REMARQUES IMPORTANTES A lire attentivement avant de consulter la liste : 1 Seuls sont autorisés les produits signalés dans cette liste� 2 Lorsqu’une rubrique ne mentionne aucune marque ou spécialité, le produit est autorisé sans distinction� Exemple : SEL� Par contre, lorsqu’un certain nombre de spécialités sont indiquées, celles qui ne le sont pas sont interdites� Exemple HARIBO : les fraises TAGADA ne figurent pas sur la liste : elles sont donc interdites (en l’occurrence, elles sont à base de gélatine d’origine porcine)� 3 Les spécialités dont les mentions sont précédées du logo contiennent du lait� Il s'agit de lait non surveillé� Les spécialités dont les -

GENERAL MILLS, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED May 30, 2010 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number: 001-01185 GENERAL MILLS, INC. (Exact name of registrant as specified in its charter) Delaware 41-0274440 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Number One General Mills Boulevard 55426 Minneapolis, Minnesota (Zip Code) (Address of principal executive offices) (763) 764-7600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Name of each exchange Title of each class on which registered Common Stock, $.10 par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ⌧ No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ⌧ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Coca-Cola Products

041717 Dublin_258 ATM 4A Inside Store Ground Fresh USDA Choice, Throughout the Day Beef Chuck Ground Beef Boneless from Chuck Chuck Roast Family Pack 99 99 lb. $2lb. $3 Happy In the Husk Del Monte Bi-Color Golden Ripe Sweet Corn Bananas Earth Day ! each 12 99 39¢lb. /$3 Aunt Millie’s Coca-Cola Family Style Bread Products Butter Top Wheat, Honey Wheat or 6 pk., 16.9 oz. btls. Honey Butter White (22 oz.) or Italian (24 oz.) or 6 pk., 7.5 oz. cans or Deluxe White Hamburger or Hot Dog Buns (plus deposit) (8 ct.) 2/$3 4/$9 Kellogg’s Dannon or Cereal Creamette or Chobani Frosted Flakes (15 oz.), Corn Pops (12.5 oz.) Ronzoni Pasta Greek Yogurt or Froot Loops or 10 - 16 oz. or Chobani Flips (4.2 - 5.3 oz.) or Apple Jacks (12.2 oz.) (excludes lasagna) Dannon Drink (7 oz.) $199 88¢ 88¢ Dean’s DairyPure Charmin Sour Cream or Stouffer’s Essentials or Lean Cuisine Bath Tissue French Onion Dip (12 ct. giant rolls) or Cottage Cheese Frozen Entrees or Bounty Basic Paper Towels 8 oz. 5.25 - 12.88 oz. (6 ct.) ~2.47-50� 97 49 WHEN$1 YOU BUY ANY COMBINATION OF 6 97¢ PARTICIPATING ITEMS WITH COUPON. $5 Ad is effective Monday, April 17 thru Sunday, April 23, 2017. We reserve the right to limit quantities & are not responsible for pictorial or typographical errors. GROCERYGROCERY VALUE,VALUE, VVARIETYARIETY & SSAVINGSAVINGS Knorr Pasta or Rice Sides 3.8 - 5.7 oz. 10/$10 Gatorade 7-Up Sports Drink Products (32 oz.), Prime Chews (1 oz.) or 2 liter Propel (24 - 33.8 oz.) (plus deposit) 10/$10 10/$10 Bush’s Best Tide Baked Beans or Liquid Laundry Peanut Butter Grillin’ Beans Detergent 16 oz. -

Menu Cereal Corner Coffee

MENU CEREAL CORNER COFFEE CEREALES IMPORTADOS : (Leche incluida en el • GENERAL MILLS CEREALES precio) WHEATIES • KELLOGG´S FROOT LOOPS Bol S: 3 euro • KELLOGG'S FROOT LOOPS UNICORN CEREAL Bol M: 3,5 euro • KELLOGG’S CEREALS Bol L: 4 euro SMORZ • GENERAL MILLS LUCKY CHARMS (SIN GLUTEN) • GENERAL MILLS CHOCOLATE LUCKY CHARMS • GENERAL MILLS REESE'S PEANUT BUTTER PUFFS • GENERAL MILLS CHEERIOS CHOCOLATE PEANUT BUTTER • KELLOGG’S SUPER MARIO • GENERAL MILLS BLASTED CEREAL SHRED CHOCOLATE CREMA • KELLOGG´S APPLE JACKS DE CACAHUETE CEREALS • KELLOGG'S CINNABON • GENERAL MILLS CEREALS CEREALES DE CANELA KIX • • GENERAL MILLS CEREALS KELLOGG’S CEREALS DONUT SHOP PINK DONUT WHEATIES • GENERAL MILLS CEREALES • KELLOGG’S CEREALS COCOA PUF DONUT SHOP CHOCOLATE MENU CEREAL CORNER COFFEE • KELLOGG’S CEREALS FROSTED FLAKES • POST CHIPS AHOY NUEVO MARSHMALLOW • POST FRUITY PEBBLES (SIN GLUTEN) • KELLOGG’S CEREALS • QUAKER CAPTAIN CRUNCH DISNEYFROZEN CON NUBÉS DE AZÚCAR • %uaker Captain Crunch Berrie • KELLOGG’S CEREALS MINI- • %uaker Captain Crunch WHEATS GLASEADOS Peanut Butter • KELLOGG'S CEREALS CON PASAS CEREALES NACIONALES • KELLOG’S CEREALES KRAVE CHOCOLATE (Leche incluida en el precio) • POST CEREALES ALPHA BITS Bol S: 2,5 EUROS • POST CEREALES SHREDDED WHEAT FROSTED SMORES Bol M: 2,70 EUROS Bol L: 3,10 EUROS • POST CEREALES SHREDDED WHEAT FROSTED BERRY • KELLOG’S KRAVE CHOCOLATE BLANCO • QUAKER CAPTAIN CRUNCH • SPRINKLED DONUT KELLOG’S KRAVE NUT CHOCOLATE • • KELLOG’S RICE KRIESPIES • POST OREO CEREAL • KELLOG’S SMACKES • KELLOG’S CORN FLAKES