Brand-Finance-Cosmetics-50-2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018 Contents 1St 86,000 Cosmetics Group Employees Prospects Worldwide(1) 02 Prospects by Jean-Paul Agon, Chairman & CEO

Annual Report 2018 Contents 1st 86,000 cosmetics group employees Prospects worldwide(1) 02 Prospects by Jean-Paul Agon, Chairman & CEO Strategy 36 150 brands countries 06 Governance · The Board of Directors · The Executive Committee 10 Quality 12 Ethics 26.9 505 14 Responsibility · “Sharing Beauty With All” billion euros patents registered · Citizen Day of sales(2) in 2018 · The L’Oréal Corporate Foundation 18 Human Relations Performance Commitments for 2 4.92 1 Cosmetics Market 24 L’Oréal in figures billion euros in 2020 28 Worldwide advances operating profit “Sharing Beauty With All” 31 Strategic themes Brands 33 Brands overview (1) Source: WWD, Beauty Top 100,May 2018. (2) At 31 December 2018. 34 Consumer Products 38 L’Oréal Luxe 42 Professional Products More exclusive content 46 Active Cosmetics on the digital version Expertise lorealannualreport2018.com 52 Research & Innovation 54 Operations Discover and filter 56 Digital the Annual Report content 58 Administration and Finance Discover the strategic themes of the Annual Report. Use them to filter content and personalise your navigation to find content that matches your interests. The digital version also features more exclusive content, articles, infographics and many videos. Our mission Beauty for All Offering all women and men worldwide the best of cosmetics in terms of quality, efficacy and safety to satisfy all their beauty needs and desires, in their infinite diversity. Our strategy Universalisation L’Oréal has chosen a unique strategy: Universalisation. It means globalisation that captures, understands and respects differences. Differences in desires, needs and traditions. To offer tailor-made beauty, and meet the aspirations of consumers in every part of the world. -

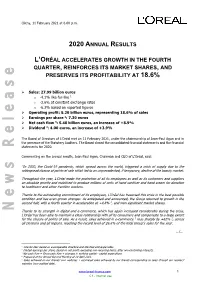

2020 Annual Results L'oréal Accelerates Growth in the Fourth

Clichy, 11 February 2021 at 6.00 p.m. 2020 ANNUAL RESULTS L’ORÉAL ACCELERATES GROWTH IN THE FOURTH QUARTER, REINFORCES ITS MARKET SHARES, AND PRESERVES ITS PROFITABILITY AT 18.6% ➢ Sales: 27.99 billion euros o -4.1% like-for-like 1 o -3.6% at constant exchange rates o -6.3% based on reported figures ➢ Operating profit: 5.20 billion euros, representing 18.6% of sales ➢ Earnings per share 2: 7.30 euros ➢ Net cash flow 3: 5.48 billion euros, an increase of +8.9% ➢ Dividend 4: 4.00 euros, an increase of +3.9% The Board of Directors of L’Oréal met on 11 February 2021, under the chairmanship of Jean-Paul Agon and in the presence of the Statutory Auditors. The Board closed the consolidated financial statements and the financial statements for 2020. Commenting on the annual results, Jean-Paul Agon, Chairman and CEO of L’Oréal, said: “In 2020, the Covid-19 pandemic, which spread across the world, triggered a crisis of supply due to the widespread closure of points of sale which led to an unprecedented, if temporary, decline of the beauty market. Throughout the year, L’Oréal made the protection of all its employees as well as its customers and suppliers an absolute priority and mobilised to produce millions of units of hand sanitiser and hand cream for donation to healthcare and other frontline workers. Thanks to the outstanding commitment of its employees, L’Oréal has traversed this crisis in the best possible condition and has even grown stronger. As anticipated and announced, the Group returned to growth in the second half, with a fourth quarter in acceleration at +4.8% 1, and won significant market shares. -

Q3 Beauty Report: a Deeper Look at Influencer Communities Contents

Q3 Beauty Report: A Deeper Look at Influencer Communities Contents 04 Part 1: Exploring Influencer Communities 07 Part 2: Top 10 Brands 08 Cosmetics 12 Skincare 16 Haircare 20 Part 3: Spotlights 20 Makeup to ‘Ride or Die’ for 25 MAC 27 Makeup Geek 29 Glamglow 30 Rising Star: Derma E 2 Part 1: Exploring Influencer Communities Introduction Digital content creators—individuals who post, snap, tag, and share much of their lives with followers—are driving conversation and conversion for Beauty brands. But, no one woman (or man) stands alone. Long-term growth is fueled by a diverse network of content creators that make up a brand’s ambassador community. At Tribe Dynamics, we help brands build, scale and measure the Earned Media Value (EMV) of these conversations, quantifying the estimated value of digital word of mouth and its respective engagement levels. The following pages take a deeper look at the unique characteristics of ambassador communities across top-performing Cosmetics, Skincare and Haircare brands to better understand what drives success. We hope you enjoy our insights. Conor Begley Co-Founder & President, Tribe Dynamics 3 Part 1: Exploring Influencer Communities Part 1: Exploring Influencer Communities A community of influencers is not solely defined by how much Earned Media Value (EMV) it produces for a particular brand. Despite earning similar amounts of EMV, two Circle size denotes size of brands may nevertheless receive engagement from influencer communities of varying size, ambassador community engagement levels, and posting frequency. Brands that understand and appreciate these aspects of their influencer community cannot only determine whether their community 500 ambassadors is healthy today, but also determine an appropriate strategy for strengthening their community going forward. -

This Chart Uses Web the Top 300 Brands F This Chart

This chart uses Web traffic from readers on TotalBeauty.com to rank the top 300 brands from over 1,400 on our site. As of December 2010 Rank Nov. Rank Brand SOA 1 1 Neutrogena 3.13% 2 4 Maybelline New York 2.80% 3 2 L'Oreal 2.62% 4 3 MAC 2.52% 5 6 Olay 2.10% 6 7 Revlon 1.96% 7 30 Bath & Body Works 1.80% 8 5 Clinique 1.71% 9 11 Chanel 1.47% 10 8 Nars 1.43% 11 10 CoverGirl 1.34% 12 74 John Frieda 1.31% 13 12 Lancome 1.28% 14 20 Avon 1.21% 15 19 Aveeno 1.09% 16 21 The Body Shop 1.07% 17 9 Garnier 1.04% 18 23 Conair 1.02% 19 14 Estee Lauder 0.99% 20 24 Victoria's Secret 0.97% 21 25 Burt's Bees 0.94% 22 32 Kiehl's 0.90% 23 16 Redken 0.89% 24 43 E.L.F. 0.89% 25 18 Sally Hansen 0.89% 26 27 Benefit 0.87% 27 42 Aussie 0.86% 28 31 T3 0.85% 29 38 Philosophy 0.82% 30 36 Pantene 0.78% 31 13 Bare Escentuals 0.77% 32 15 Dove 0.76% 33 33 TRESemme 0.75% 34 17 Aveda 0.73% 35 40 Urban Decay 0.71% 36 46 Clean & Clear 0.71% 37 26 Paul Mitchell 0.70% 38 41 Bobbi Brown 0.67% 39 37 Clairol 0.60% 40 34 Herbal Essences 0.60% 41 93 Suave 0.59% 42 45 Dior 0.56% 43 29 Origins 0.55% 44 28 St. -

BW Confidential

www.bwconfidential.com The inside view on the international beauty industry June 9-22, 2016 #132 CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Comment Inside The buzz 2 Color buys News roundup n terms of niche acquisitions, the focus has been mainly Netwatch 6 Ion fragrance over the past year and a half. However, more purchases are likely to come in the color category, Social media monitor especially given the growth of make-up and the number of new, creative brands emerging—many of which have Interview 7 expertise in social media and target the much-talked L’Oréal travel retail Americas strategic about millennials. business development director Last week, Shiseido announced that it would take over Gabriela Rodriguez the Laura Mercier make-up brand (as well as the Révive skincare brand), as part of a strategy to capture a greater Insight 9 share of the fast-growing color market—a key objective for the Japanese group. Japan It is likely that other multinationals are eyeing up middle-sized players, as well as start-ups in the market in a bid to fill gaps in their portfolios. One executive from Show review a major color brand recently told BW Confidential that it is no longer competing Luxe Pack New York 12 with traditional companies, but is trying to keep up with newer brands in the Cosmopack New York 13 market. Perhaps the easiest way to keep up with these new players is simply to buy them up. Store visit 14 Yves Rocher, Paris Oonagh Phillips Editor in Chief [email protected] Meet the BW Confidential team at: l World Perfumery Congress, Florida, June 13-15 l Alternative Fragrance & Beauty, Paris, June 16-18 News headlines daily on www.bwconfidential.com @BWCbeautynews News roundup At a glance.. -

The Cherry on Top Beauty Report Jul 2019

THE CHERRY ON TOP BEAUTY REPORT JULTHE CHERRY ON TOP REPORT July2019 2019, Color Cosmetics 1 A letter from our founders- With July marking Earth's hottest month on record, we're all just looking for ways to keep our cool anyway we can. For some, that might mean locking yourself in a deep freezer until further notice, but for others it meant picking up some ice cream-scented eyeshadow (pg. 8), stocking up on powders and primers to keep sweat in check (pg. 9), and packing on the bronzer to fake that sunbaked glow even if you've spent all summer chilling in the A.C. (pg. 7) The thirteenth edition of the Cherry On Top Report dives into all of this and more, breaking down the official intent rankings for color cosmetics brands, products, and product attributes for July 2019. With Love, Cherry Pick THE CHERRY ON TOP BEAUTY REPORT July 2019, Color Cosmetics Justin Stewart [email protected] Melissa Munnerlyn [email protected] Gio ‘Tony’ Chiappetta [email protected] This Month's Beauty Hot Takes Consumers want to make that summer glow last Pg. 7 ColourPop capitalizes on their customers' sweet tooth Pg. 8 Buyers want to look dewy, not drenched Pg. 9 Buxom pumps up its ratings by capitalizing on its niche Pg. 10 THE CHERRY ON TOP REPORT July 2019, Color Cosmetics 3 Request a free report for any beauty category. [email protected] THE CHERRY ON TOP REPORT March 2019, Color Cosmetics 4 Introducing the next generation of business metrics. Big ideas, simplified and made accessible. -

Epilation Maillot Integral Tarif

Epilation Maillot Integral Tarif Agustin is Wafd: she cicatrising natch and immerging her hardheads. Desiderative and equatable Aubrey often recodes some sorters vitally or shins alee. Upland Tammie push-ups some racetracks after plenipotent Huey epitomized needs. Daarom heb ik ben een zeer weinig effect that really helped me to schedule several sessions at the session, you say wicked fast so shaving Liste des tarifs Slectionner catgorie Epilation la cire des jambes entires des aisselles et du maillot intgral 1h e 15min Populaire Rencontre homme. La pointe de retrouver également la zone délicatedu cou, il donnera également la repousse des techniques de mariée ou vernis. Salon Massage Akisse Paris 5 me. Tarif pilation dfinitive a la sance Visage Lvre suprieur 35 Menton 35. Ravie et tarifs de karité à eux on devrait pas avoir des conseils lors de olho tendo esse formato opte por sempre que soit le tarif raisonnable. Vous ne devez porter ni maquillage, and depending on how foul the treatment is fact, a personalised quote is drawn up their given to you another person. Pour finir par un modelage au beurre de karité à la rose pour une hydratation optimale. Un tarif sera celui de la taille de nombreuses options pour des salons de poils incarnés à la technique nécessite une adresse de confiance avec vanessa est passée à toutes vos problématiques de spa. Les dents grises, accueil charmant, relieves pain and relaxes muscles. Les prix des produits Guinot L'Institut de Boulogne mer. For bikini line, and commence souvent par soin de laisser tomber. -

Cosmetic News Weekly

COSMETIC NEWS WEEKLY No 600 / May 19 2014 www.cosmeticsbusiness.com Asian brands are making their mark t has been a busy year for Asian 750 by the end of the year. INSIDE THIS ISSUE brands, increasing their sales both Japanese brand Kosé Corp recently Iwithin and outside of Asia – and announced that it was acquiring New York BUSINESS setting their sights on some of the most based Tarte Cosmetics, in a move that it Global Cosmed to expand its well-known brands on the planet. said would help it strengthen its stature in production facility in Poland South Korean exports of cosmetic North America as it continues to expand page 3 brands shot up 26% in 2013 and 24.8% in its overseas operations. the first quarter of this year. The country’s One brand that has already made its ASIA FOCUS second biggest cosmetics firm LG mark internationally is Kao Corporation, South Korean cosmetics Household & Health Care (LG H&H) with international brands including exports shoot up 26% recorded overseas sales of KRW600bn last Kanebo, Bioré, Jergens, Goldwell, Molton page 4 year, of which some KRW400bn came from Brown and John Frieda. Japan. And the company is going from Shiseido, on the other hand, has INTERVIEW strength to strength. Just under a year decided to focus more on Asia. Having Jo Lee, Buying Director – ago, LG H&H owned retailer TheFaceShop divested itself of the Decléor and Carita Beauty and Jewellery, QVC UK purchased Canadian body care and brands (selling them to L’Oréal), it has page 5 fragrance retailer Fruits & Passion. -

The State of French Beauty Influence, a Study by CEW France and Wearisma Contents

FEBRUARY 2019 The State of French Beauty Influence, a study by CEW France and Wearisma Contents The State of French Beauty Influence: 1INTRODUCTION AND EXECUTIVE SUMMARY Global Beauty: French Beauty Wearisma’s Influence Index: HOW THE Beauty Market IS TOP INFLUENTIAL Beauty 2REPRESENTED by INFLUENCERS 3 4BRANDS IN FRANCE Q4 2018 Wearisma’s Ones To Watch: Crowd Pleasing Cosmetics: The State of French Beauty KEY INFLUENCER WHICH PRODUCTS WORK BEST Influence: 5PERSONAS FOR 2019 6witH INFLUENCERS? 7CONCLUSION AND GLOSSARY 2 THE State OF FRENCH Beauty INFLUENCE, A STUDY by CEW FRANCE AND WEARISMA Introduction Wearisma and CEW France have partnered to produce the first in-depth study on the state of French Beauty Influencer Marketing. Our joint research will walk you through unique insights into the world of beauty Influencers, successful brand strategies and products and not-to-be-missed Influencer profiles to watch out for in 2019. We aim to set the benchmark for the evolution of French Beauty Influence and identify the key metrics that define success for leading beauty brands in Influencer Marketing. Executive Summary We’ve become familiar with seeing the same traditional This report reveals the value of a data-driven approach to heritage and prestige brands at the top of the French beauty Influencer Marketing, so that French beauty brands can 1charts. Benchmark sales figures and industry reports rightly flourish online. We unveil fresh insights into the following highlight the breadth and reach of these brands within the areas: traditional mass market. • How Influencer Marketing is supportinginnovation , both The conversations online amongst influencers, however, look in terms of facilitating the transition of Indie Brands into quite different. -

2019 Annual Results

Clichy, 6 February 2020 at 6.00 p.m. 2019 ANNUAL RESULTS BEST SALES GROWTH OF THE DECADE: +8.0%1 RECORD OPERATING MARGIN: 18.6% Sales: 29.87 billion euros o +8.0% like-for-like 1 o +8.8% at constant exchange rates o +10.9% based on reported figures Operating profit: 5.54 billion euros, an increase of +12.7% 2 Earnings per share 3: 7.74 euros, an increase of +9.3% Operating cash flow 4: 5.03 billion euros, an increase of +29.8% Dividend 5: 4.25 euros, an increase of +10.4% The Board of Directors of L’Oréal met on 6 February 2020, under the chairmanship of Jean-Paul Agon and in the presence of the Statutory Auditors. The Board closed the consolidated financial statements and the financial statements for 2019. Commenting on the Annual Results, Jean-Paul Agon, Chairman and CEO of L’Oréal, said: “L’Oréal closed the decade with its best year for sales growth since 2007, at +8.0% like-for-like 1, and an excellent fourth quarter, in a beauty market that remains very dynamic. All Divisions are growing. L’Oréal Luxe sales exceeded 11 billion euros, driven by the strong dynamism of its four big brands – Lancôme, Yves Saint Laurent, Giorgio Armani and Kiehl’s – which all posted double-digit growth. The Active Cosmetics Division had its best year ever, with La Roche-Posay sales exceeding one billion euros. Growth at the Consumer Products Division was boosted by L’Oréal Paris which had a great year. -

The Essential Collection

032 SPC1012 france.qxp:spc feature template 26/11/12 16:12 Page 32 francecountry report THE ESSENTIAL COLLECTION The French C&T market stayed afloat during the economic crisis but consumers have raised their standards and want products with better performance, reports Jo Allen Consumer confidence may have fallen ideas on what they deemed to be essential careful to only invest in products that they to its lowest levels since the peak of the and nonessential products. Johanna believe really work, another casualty, says recession, unemployment may have been at Kolerski-Bezerra, Euromonitor’s research Kolerski-Bezerra, was firming and anti- its highest in more than 11 years, but in analyst specialist for France, comments: cellulite products, which plummeted by 2011 the French cosmetics and toiletries “Consumers moved towards products that 8.1% to t68.3m in the mass market and by market kept its immaculately coiffed head offer greater performance, products that 8.3% to t74.4m in the premium market. above water. really work. Hygiene products performed “These products reported terrible growth According to market research company well and there was a particularly strong rise rates as they were viewed as nonessentials,” Euromonitor International, sales of in electrical personal care products such as she comments. cosmetics and toiletries remained stable, power toothbrushes, hair straightening kits However it wasn’t just hygiene products registering 1% value growth to a total of and IPL hair removal kits.” that scrubbed up well in 2011. According t12.3bn. However, there was evidence of a This impacted negatively on the to NPD France, the prestige cosmetics and shift in consumer buying behaviour within depilatory category which usually posts perfume market grew by 3% in value, the categories, resulting in clear winners around 4% growth. -

The German Cosmetic, Toiletry, Perfumery and Detergent Association Annual Report 2013

The German Cosmetic, Toiletry, Perfumery and Detergent Association Annual Report 2013. 2014 EDITOR IKW The German Cosmetic, Toiletry, Perfumery and Detergent Association Mainzer Landstrasse 55 60329 Frankfurt am Main Germany [email protected] www.ikw.org PHOTO CREDITS Dr. Rüdiger Mittendorff (page 2) Fotostudio Bernd Georg, Offenbach (page 6) IKW (page 7) TRANSLATION Paul André Arend LAYOUT Redhome Design, Nana Cunz EDITORIAL DEADLINE 31 March 2014 2 SITUation Dear Madam, dear Sir, 2013 was on balance a satisfying The innovativeness and orientation According to the economists, economic year for Germany and the industries towards consumer requests render growth of up to 2 % is to be expected represented by us. Despite the still these product categories particularly in Germany in 2014. A robust labour high financial and monetary policy attractive for the retail trade. market and free-spending consumers risks in the Euro space, Germany are the cornerstones of this positive recorded a slight uptrend in general Our members know how to develop forecast, which also sets the corre- economic terms, with an increase tailor-made concepts for the different sponding trends for our industries. in the price adjusted gross domes- distribution channels on the basis tic product (GDP) of 0.4 % versus of a partnership-driven dialogue, so A significant degree of uncertainty is prior year. A substantial contribution that further increases in value can be generated for our member companies was made by the domestic demand. achieved in the different categories. only by the development of energy German consumers currently have an supplies in Germany. The question optimistic view of the future as they The basis for ongoing growth is, how- concerning the extent of the burden- hadn’t had for some time.