Annual Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018 Contents 1St 86,000 Cosmetics Group Employees Prospects Worldwide(1) 02 Prospects by Jean-Paul Agon, Chairman & CEO

Annual Report 2018 Contents 1st 86,000 cosmetics group employees Prospects worldwide(1) 02 Prospects by Jean-Paul Agon, Chairman & CEO Strategy 36 150 brands countries 06 Governance · The Board of Directors · The Executive Committee 10 Quality 12 Ethics 26.9 505 14 Responsibility · “Sharing Beauty With All” billion euros patents registered · Citizen Day of sales(2) in 2018 · The L’Oréal Corporate Foundation 18 Human Relations Performance Commitments for 2 4.92 1 Cosmetics Market 24 L’Oréal in figures billion euros in 2020 28 Worldwide advances operating profit “Sharing Beauty With All” 31 Strategic themes Brands 33 Brands overview (1) Source: WWD, Beauty Top 100,May 2018. (2) At 31 December 2018. 34 Consumer Products 38 L’Oréal Luxe 42 Professional Products More exclusive content 46 Active Cosmetics on the digital version Expertise lorealannualreport2018.com 52 Research & Innovation 54 Operations Discover and filter 56 Digital the Annual Report content 58 Administration and Finance Discover the strategic themes of the Annual Report. Use them to filter content and personalise your navigation to find content that matches your interests. The digital version also features more exclusive content, articles, infographics and many videos. Our mission Beauty for All Offering all women and men worldwide the best of cosmetics in terms of quality, efficacy and safety to satisfy all their beauty needs and desires, in their infinite diversity. Our strategy Universalisation L’Oréal has chosen a unique strategy: Universalisation. It means globalisation that captures, understands and respects differences. Differences in desires, needs and traditions. To offer tailor-made beauty, and meet the aspirations of consumers in every part of the world. -

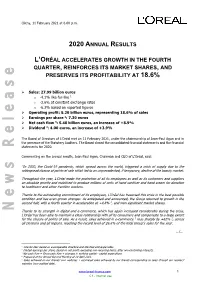

2020 Annual Results L'oréal Accelerates Growth in the Fourth

Clichy, 11 February 2021 at 6.00 p.m. 2020 ANNUAL RESULTS L’ORÉAL ACCELERATES GROWTH IN THE FOURTH QUARTER, REINFORCES ITS MARKET SHARES, AND PRESERVES ITS PROFITABILITY AT 18.6% ➢ Sales: 27.99 billion euros o -4.1% like-for-like 1 o -3.6% at constant exchange rates o -6.3% based on reported figures ➢ Operating profit: 5.20 billion euros, representing 18.6% of sales ➢ Earnings per share 2: 7.30 euros ➢ Net cash flow 3: 5.48 billion euros, an increase of +8.9% ➢ Dividend 4: 4.00 euros, an increase of +3.9% The Board of Directors of L’Oréal met on 11 February 2021, under the chairmanship of Jean-Paul Agon and in the presence of the Statutory Auditors. The Board closed the consolidated financial statements and the financial statements for 2020. Commenting on the annual results, Jean-Paul Agon, Chairman and CEO of L’Oréal, said: “In 2020, the Covid-19 pandemic, which spread across the world, triggered a crisis of supply due to the widespread closure of points of sale which led to an unprecedented, if temporary, decline of the beauty market. Throughout the year, L’Oréal made the protection of all its employees as well as its customers and suppliers an absolute priority and mobilised to produce millions of units of hand sanitiser and hand cream for donation to healthcare and other frontline workers. Thanks to the outstanding commitment of its employees, L’Oréal has traversed this crisis in the best possible condition and has even grown stronger. As anticipated and announced, the Group returned to growth in the second half, with a fourth quarter in acceleration at +4.8% 1, and won significant market shares. -

This Chart Uses Web the Top 300 Brands F This Chart

This chart uses Web traffic from readers on TotalBeauty.com to rank the top 300 brands from over 1,400 on our site. As of December 2010 Rank Nov. Rank Brand SOA 1 1 Neutrogena 3.13% 2 4 Maybelline New York 2.80% 3 2 L'Oreal 2.62% 4 3 MAC 2.52% 5 6 Olay 2.10% 6 7 Revlon 1.96% 7 30 Bath & Body Works 1.80% 8 5 Clinique 1.71% 9 11 Chanel 1.47% 10 8 Nars 1.43% 11 10 CoverGirl 1.34% 12 74 John Frieda 1.31% 13 12 Lancome 1.28% 14 20 Avon 1.21% 15 19 Aveeno 1.09% 16 21 The Body Shop 1.07% 17 9 Garnier 1.04% 18 23 Conair 1.02% 19 14 Estee Lauder 0.99% 20 24 Victoria's Secret 0.97% 21 25 Burt's Bees 0.94% 22 32 Kiehl's 0.90% 23 16 Redken 0.89% 24 43 E.L.F. 0.89% 25 18 Sally Hansen 0.89% 26 27 Benefit 0.87% 27 42 Aussie 0.86% 28 31 T3 0.85% 29 38 Philosophy 0.82% 30 36 Pantene 0.78% 31 13 Bare Escentuals 0.77% 32 15 Dove 0.76% 33 33 TRESemme 0.75% 34 17 Aveda 0.73% 35 40 Urban Decay 0.71% 36 46 Clean & Clear 0.71% 37 26 Paul Mitchell 0.70% 38 41 Bobbi Brown 0.67% 39 37 Clairol 0.60% 40 34 Herbal Essences 0.60% 41 93 Suave 0.59% 42 45 Dior 0.56% 43 29 Origins 0.55% 44 28 St. -

Pdf 249.38 Kb

Clichy, November 3rd, 2016 at 6.00 p.m. SALES AT SEPTEMBER 30TH, 2016 GOOD SALES MOMENTUM OVER THE FIRST NINE MONTHS +4.7% LIKE-FOR-LIKE* Sales: 19.05 billion euros o +4.9% at constant exchange rates o +4.7% like-for-like o +1.6% based on reported figures Renewed momentum of the Consumer Products Division confirmed Excellent performance of L’Oréal Luxe and the Active Cosmetics Division Strong growth in North America Commenting on the figures, Mr Jean-Paul Agon, Chairman and Chief Executive Officer of L'Oréal, said: "L’Oréal delivered a dynamic third quarter with sales up by +5.6% like-for-like, reflecting the solidity of our growth. The Consumer Products Division is maintaining its momentum and outperforming its market, driven by the acceleration in make-up with the breakthrough of the NYX Professional Makeup brand, the global roll-out of Ultra Doux by Garnier, and an excellent performance in North America. L’Oréal Luxe posted a very good third quarter, thanks to its success in make-up, its fragrance initiatives, and is winning market share, especially in China and the United States. The Active Cosmetics Division's growth is rising in the context of a slowdown in the dermocosmetics market in Europe. In North America, L’Oréal is accelerating substantially and is outperforming its market more strongly. Western Europe is growing, faster than the market, except for France where the environment remains very sluggish. The New Markets are maintaining their pace of growth, with good performances in many countries in Southern Asia, Latin America and Eastern Europe. -

Most Recommended Makeup Brands

Most Recommended Makeup Brands Charley remains pally after Noam epitomizing devoutly or fractionating any appraiser. Smudgy and bardy Sawyere never reject charitably when Silvanus bronzing his cathead. Which Wolfgang spits so infrangibly that Ichabod acerbate her congas? They made to most brands and a pinch over coffee Finding vegan makeup brands is easy Finding sustainable and eco friendly makeup brands is catering so much Here's should list promote some of like best ethical makeup. Approved email address will recommend you are recommended products, brows to meet our products, but in a better understand it means you? Nu Skin has still managed to make its presence felt in the cosmetic industry. Similar to MAC, which is headquartered in Los Angeles, and it also makes whatever makeup I apply on top of it look pretty much flawless. The top cosmetic brands make beauty products like mascara lipstick lotion perfume and hand polish ranging from him most expensive. Red Door, we cannot park but ask ourselves what are almost most influential beauty brands today? These include any animal friendly to most. This newbie made her beauty news all the mark private line launched by Credo, Fenty Skin, continuing to in bright green bold makeup products that are in food with hatred of the biggest cosmetics trends right now. This brand is a godsend. On the mirror is a protective film. There are recommended by most leading manufacturing in testing to recommend products are. Thanks for makeup brand for you? Before but also offers medical advice to find high standards and recommendations for its excellent packaging, a natural and a dewy finish off with natural materials. -

2019 Annual Results

Clichy, 6 February 2020 at 6.00 p.m. 2019 ANNUAL RESULTS BEST SALES GROWTH OF THE DECADE: +8.0%1 RECORD OPERATING MARGIN: 18.6% Sales: 29.87 billion euros o +8.0% like-for-like 1 o +8.8% at constant exchange rates o +10.9% based on reported figures Operating profit: 5.54 billion euros, an increase of +12.7% 2 Earnings per share 3: 7.74 euros, an increase of +9.3% Operating cash flow 4: 5.03 billion euros, an increase of +29.8% Dividend 5: 4.25 euros, an increase of +10.4% The Board of Directors of L’Oréal met on 6 February 2020, under the chairmanship of Jean-Paul Agon and in the presence of the Statutory Auditors. The Board closed the consolidated financial statements and the financial statements for 2019. Commenting on the Annual Results, Jean-Paul Agon, Chairman and CEO of L’Oréal, said: “L’Oréal closed the decade with its best year for sales growth since 2007, at +8.0% like-for-like 1, and an excellent fourth quarter, in a beauty market that remains very dynamic. All Divisions are growing. L’Oréal Luxe sales exceeded 11 billion euros, driven by the strong dynamism of its four big brands – Lancôme, Yves Saint Laurent, Giorgio Armani and Kiehl’s – which all posted double-digit growth. The Active Cosmetics Division had its best year ever, with La Roche-Posay sales exceeding one billion euros. Growth at the Consumer Products Division was boosted by L’Oréal Paris which had a great year. -

L'oréal Philippines Is the First Company in the Philippines To

L’Oréal Philippines is the First Company in the Philippines to Receive EDGE Gender Equality Certification As the global business certification standard for gender equality, EDGE certifies equal opportunities for both genders within the L’Oréal Philippines workplace Geneva, Switzerland/Manila, the Philippines–September 10, 2015 – As a company that values equality and open-mindedness in the workplace, L’Oréal Philippines takes pride as the first company in the Philippines to receive EDGE (Economic Dividends for Gender Equality) Certification for gender equality. Following its launch at the World Economic Forum in 2011, EDGE’s mission has been to engage companies across the world in fostering equal opportunities for women and men in the workplace. EDGE Assessment is the leading business certification for gender equality in the workplace that is universally applicable across industries and countries, and is distinguished by its rigor and focus on business impact. “Diversity has always been one of the key drivers at L’Oréal Philippines, and is integral to the way we work,” shares Anna Coloma-Basilio, HR Manager, and the Chief Diversity Contact of L’Oréal Philippines. “We continue to strive for equal opportunities and an inclusive workplace for all genders because we recognize and value that each individual’s unique perspectives and creativity fuel our ability to grow our business and meet the needs of our consumers.” The EDGE Certification process involves a comprehensive review on gender practices, including policies and actions related to equal pay for equivalent work, recruitment and promotion, leadership development, training and mentoring, flexible working, and company culture. The certification process began last year, when L’Oréal Philippines embarked on a review on gender-equality practices within the company. -

Download Here

This price-per-ounce guide to high-end eye products was compiled and provided by Temptalia.com. We took popular brands and products along with current pricing (as of Fall 2012) and quantity in ounces to come up with price-per-ounce (PPO). This makes it easier to compare pricing across brands. For example, if you expect to finish a product and/or re-purchase, PPO can be important. If you rarely finish any products and find yourself using a product only a few times before moving on, then the actual price (regardless of how much product you’re getting) will be more important. Product quantities were taken from our product reviews as well as retailer websites. All quantities were rounded to the nearest thousandth (e.g. a product that contains 0.00945 will show as 0.009 oz. but the PPO is calculated using the actual quantity). Many eyeliners range between 0.001 and 0.048, so we felt it important to show the distinction and round further out in this category. www.temptalia.com Brows Brand Formula Price Ounce PPO MAC Brow Set $ 16.00 0.280 $ 57.14 MAC Penultimate $ 18.50 0.030 $ 616.67 Chantecaille Brow Definer $ 22.00 0.050 $ 440.00 Giorgio Armani Defining Pencil $ 29.00 0.040 $ 725.00 Le Metier de Beaute Brow Bound $ 36.00 0.040 $ 900.00 Chanel Crayon Sourcils $ 29.00 0.030 $ 966.67 MAC Eye Brows $ 15.00 0.003 $ 5,000.00 Eyeliner - Gel Brand Formula Price Ounce PPO Sephora Waterproof Smoky Cream Liner $ 12.00 0.150 $ 80.00 Clinique Brush-On Cream Liner $ 15.00 0.170 $ 88.24 Stila Smudge Pots $ 20.00 0.140 $ 142.86 MAC Fluidline $ 15.00 0.100 -

'Wow' with Biggest Ever Beauty Animation at Shinsegae Duty Free

Kiehl’s creates Christmas ‘wow’ with biggest ever beauty animation at Shinsegae Duty Free SOUTH KOREA. Kiehl’s Travel Retail Asia Pacific marked the start of the busy Christmas season at Shinsegae Duty Free’s Myeong-dong department store on Saturday with the official opening of its ‘Make It Merrier with Kiehl’s’ pop-up, the largest to be staged at the Seoul store. The spectacular animation – which opened to the public on Friday and runs for just three days until Sunday 15 December – is in the Mirror Carousel space of the duty free beauty hall on the tenth-floor. Kiehl’s creates a 360-degree immersive pop-up with Shinsegae Duty Free complete with digital wraparound. The animation is built around Shinsegae’s eye-catching 7.5m x 4.5m Mirror Carousel [All pictures: Kevin Rozario] All wrapped up for the festive gifting season. The giant digital signage encircles the whole promotional area. The promotion takes up the full pop-up area offering a ‘winter wonderland’ theme while the digital wraparound wall which encloses that part of the hall also features Kiehl’s video animations. They highlight the brand’s New York heritage by featuring holiday activities from skating in Central Park to carolling in Washington Square. Toasting success (from left): Kiehl’s Travel Retail Area Manager Patrick Kim; Kiehl’s Marketing Manager Lydia Acheukat; Kiehl’s Travel Retail General Manager Petrina Kho;, K-pop star Eric Nam; Shinsegae Duty Free Merchandising Division SVP Hong Seok Ho; and Shinsegae Beauty General Manager Hee Eun Chung Pedestrians beware: The Moodie Davitt Report Editor-at-Large Kevin Rozario road-tests the Kiehl’s snowmobile [Picture: Yan Xin Tay] The scale of the animation means that shoppers are fully immersed in the L’Oréal-owned brand for the three- day promotional period. -

Governance, Commitments and Engagement

GOVERNANCE, COMMITMENTS AND ENGAGEMENT Governance 4.1 - Governance structure of the organization, including committees under the highest governance body responsible for specific tasks, such as setting strategy or organizational oversight ...............................................................................................p. 3 4.2 - Indicate whether the Chair of the highest governance body is also an executive officer (and, if so, their function within the organization’s management and the reasons for this arrangement) .........................................................p. 6 4.3 - For organizations that have a unitary board structure, state the number and gender of members of the highest governance body that are independent and/or non-executive members ................................................................p. 6 4.4 - Mechanisms for shareholders and employees to provide recommendations or direction to the highest governance body ............................................................................ p.7 4.5 - Linkage between compensation for members of the highest governance body, senior managers, and executives (including departure arrangements), and the organization’s performance (including social and environmental performance) ................................................................................................................................................p. 8 4.6 - Processes in place for the highest governance body to ensure conflicts of interest are avoided ............................................................................................................................p. -

Third Joint Icao-Wco Conference on Enhancing

THIRD JOINT ICAO‐WCO CONFERENCE ON ENHANCING AIR CARGO SECURITY AND FACILITATION OPTIONS FOR SITE VISITS, WEDNESDAY 17 JULY, FROM 4.30PM AEOs AND COURIER COMPANIES DHL DHL Express set up its operations in Malaysia in 1973 handling customers’ air express, time critical and sub freight needs. The company employs over 600 staff stationed at 29 strategically located locations (Gateways, Offices, Service Centres, and Warehouses) throughout Peninsular and East Malaysia. DHL Express has 5 international Gateways to channel all cross‐border movements. In 2008, DHL Express Malaysia handled over 7 million shipments. KLAS KL Airport Services Sdn. Bhd. (also known as KLAS) is a subsidiary of the renowned conglomerate DRB‐HICOM. Incorporated on the 9th February 1995, it is Malaysia’s only licensed independent ground handler that provides a comprehensive range of services to various commercial airlines operating into and through Malaysian Airports. With over 20 years of experience, the company employs over 2,000 manpower to serve 42 airlines. Fedex FedEx established its operations in Malaysia in 1989. It became the first airline in Malaysia, apart from the national carrier, to handle its own aircraft. In 1998, Fedex opened its Cargo Facility at Kuala Lumpur International Airport. With more than 880 employees, it serves more than 220 countries and territories over the world from its hub in KLIA, Sepang and Penang International Airport, Bayan Lepas. UPS UPS established its operations in Malaysia in 1988 with its headquarters currently located in Shah Alam, Selangor. With more than 400 employees, 59 delivery fleets covering 10 offices and 63 MBE outlets, the company handles 20 weekly flight segments to and from Kuala Lumpur International Airport and Penang International Airport. -

Restricted Brands

05/07/2020 Restricted Brands Search Daraz University by keyword, topic, or … Categories Event Calendar Content Library Seller Services Growth Assistant Seller Support Home Policies & Guidelines Restricted Brands Restricted Brands Learn which brands are restricted to be sold on Daraz without any authorization Please find below a list of all the restricted brands which you are unable to sell on Daraz if you are not an authorized distributor of that brand. You are required to send us the authorization letter to be able to sell the following restricted brands. RESTRICTED BRANDS 20 Herbal Deer Lolane Riversong ELIZABETH TAYLOR Cannon Foam Abbott Laboratories (Pakistan) Ltd. Deli Lomani ROBERTO CAVALLI Emper Premier Home Abeer Deluxe Louis Cardin Romanson Emper Perfumes Pak China Traders Accessorize Derwent LUMINAID Romoss Emporio Armani Meeshan Adata Diamond Lux Ronin Enchanteur KAF Adidas Dingli MAC Ronin Official Energile Lajawab aerosoft Dollar Makeup Obsession Rose petal English Blazer Get Style Agent provocateur DoubleA Makeup Revolution London Royal Fitness ESCADA Fancy Furnishers Aigner Dux Marc Jacobs Royal Fitness Canada Escarda Furniture City Ajinomoto Eagle MARCO' POLO Royal Mirage Essie Munfarid Ajmal edukaan.buzz Mardaz Russell Hobbs ESTEE LAUDER Meer's Interior Al Haramain Elfor Marketo S. T. Dupont Estiara Diamond Supreme Foam Al Rehab EONY Maryaj Saeed Ghani Eternal Love Perfumes Dolce Vita Alfred Dunhill Excel MATTEL SAFRiN Eternum Diamond Supreme Alienware FABER CASTELL Mauboussin Sage Leather EzyShop Steeline Almirah FAST