Craig Boundy Chief Executive Officer Experian 475 Anton Blvd. Costa Mesa, CA 92626 Christopher A. Cartwright President And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 24, 2021 Via First Class and Electronic Mail Jack Dorsey Chief

OFFICE OF THE ATTORNEY GENERAL CONNECTICUT william tong attorney general March 24, 2021 Via First Class and Electronic Mail Jack Dorsey Chief Executive Officer Twitter, Inc. 1355 Market St. San Francisco, CA 94103 Mark Zuckerberg Chairman & Chief Executive Officer Facebook, Inc. 1 Hacker Way Menlo Park, CA 94025 Re: Vaccine Disinformation Dear Messrs. Dorsey and Zuckerberg: As Attorneys General committed to protecting the safety and well-being of the residents of our states, we write to express our concern about the use of your platforms to spread fraudulent information about coronavirus vaccines and to seek your cooperation in curtailing the dissemination of such information. The people and groups spreading falsehoods and misleading Americans about the safety of coronavirus vaccines are threatening the health of our communities, slowing progress in getting our residents protected from the virus, and undermining economic recovery in our states. As safe and effective vaccines become available, the end of this pandemic is in sight. This end, however, depends on the widespread acceptance of these vaccines as safe and effective. Unfortunately, misinformation disseminated via your platforms has increased vaccine hesitancy, which will slow economic recovery and, more importantly, ultimately cause even more unnecessary deaths. A small group of individuals use your platforms to downplay the dangers of COVID-19 and spread misinformation about the safety of vaccines. These individuals lack medical expertise and are often motivated by financial interests. According to a recent report by the Center for Countering Digital Hate1, so-called “anti-vaxxer” accounts on Facebook, YouTube, Instagram, and Twitter reach more than 59 million followers. -

Title Here – Option 1

Post Election Briefing - State Attorneys General Stephen Cobb: Partner, Former Deputy Attorney General of Virginia Jim Schultz: Partner, Former Senior Associate White House Counsel, Former General Counsel to Pennsylvania Governor Bill Shepherd: Partner, Florida’s Former Statewide Prosecutor December 8, 2020 Copyright © 2020 Holland & Knight LLP. All Rights Reserved Thank you for joining today’s program • All participants are on mute • Please ask questions via Q&A box • Today’s program is being recorded and will be posted on our website • For technical assistance please reach out to the host via the chat box 2 Today’s Presenters Stephen Cobb Jim Schultz Bill Shepherd Partner Partner Partner Former Deputy Former Senior Associate Florida’s Former Attorney General White House Counsel, Statewide Prosecutor of Virginia Former General Counsel to Pennsylvania Governor 3 The Growing Role of State Attorneys General Looking Back on 2020 The Election Results 2021 – What to Expect 4 Priorities of State Attorneys General During 2020 • Consumer Protection • False Claims Act • Antitrust • Environmental Enforcement Actions • COVID-19 • Data Breach/Data Privacy 5 State Attorney General Race Results . Indiana . Pennsylvania . Todd Rokita (R) defeated Jonathan Weinzapfel (D) . Josh Shapiro* (D) defeated Heather Heidelbaugh (R) . Missouri . Utah . Eric Schmitt* (R) defeated Richard Finneran (D) . Sean D. Reyes* (R) defeated Greg Skordas (D) . Montana . Vermont . Austin Knudsen (R) defeated Ralph Graybill (D) vs. T.J. Donovan* (D) defeated H Brooke Paige (R) . North Carolina . Washington . Josh Stein* (D) defeated Jim O’Neill (R) . Bob Ferguson* (D) defeated Matt Larkin (R) . Oregon . West Virginia . Ellen Rosenblum* (D) defeated Michael Cross (R) . Patrick Morrisey* (R) defeated Sam Brown Petsonk (D) Aside from the 10 races detailed above, Maine’s next state legislature and the governors of New Hampshire, Puerto Rico, and American Samoa are due to appoint new AGs. -

Comments of the Maine Attorney General

COMMENTS OF THE MAINE ATTORNEY GENERAL ON THE ROLE OF STATES IN ENFORCING FEDERAL ANTITRUST LAWS OUTSIDE THE MERGER AREA July 15, 2005 Attorney General G. Steven Rowe is grateful for the opportunity to present these views in response to the Commission’s request for public comment, 70 Fed. Reg. 28,902 (May 19, 2005).1 Summary The Sherman Act supplemented rather than preempted preexisting state statutes, creating a system of concurrent authority grounded in federalism. Maine has brought approximately twenty-five enforcement actions in each of the last two decades, under state and federal law, in both state and federal court. Maine’s antitrust record over the past twenty years illustrates the benefits and value of concurrent state enforcement. The Maine Attorney General has contributed special knowledge of local conditions to cooperative enforcement endeavors with federal agencies and brought actions to address violations of which federal agencies were unaware and with which they might have been ill- equipped to deal. Our antitrust experience has also enabled us to mount rapid-response advocacy or negotiating efforts involving local matters affecting competition in critical ways. Finally, acting as parens patriae, the Maine Attorney General has recovered very substantial sums in restitution and damages for consumers and citizens. 1 This document was prepared with the help of Maine antitrust staff, Assistant Attorneys General Francis Ackerman and Christina Moylan. We acknowledge the valuable assistance of Robert Hubbard, Chair of the National Association of Attorneys General Antitrust Task Force and Chief of Litigation in the New York Attorney General’s Antitrust Bureau. His contribution, and those of other state antitrust staff who have commented on prior drafts, are greatly appreciated. -

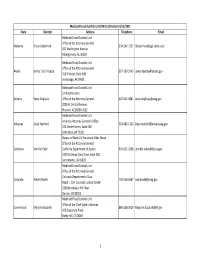

Medicaid Fraud Control Unit (MFCU) Directors 4/15/2021

Medicaid Fraud Control Unit (MFCU) Directors 4/15/2021 State Director Address Telephone Email Medicaid Fraud Control Unit Office of the Attorney General Alabama Bruce Lieberman 334‐242‐7327 [email protected] 501 Washington Avenue Montgomery, AL 36130 Medicaid Fraud Control Unit Office of the Attorney General Alaska James "Jay" Fayette 907‐269‐5140 [email protected] 310 K Street, Suite 308 Anchorage, AK 99501 Medicaid Fraud Control Unit Criminal Division Arizona Steve Duplissis Office of the Attorney General 602‐542‐3881 [email protected] 2005 N. Central Avenue Phoenix, AZ 85004‐1592 Medicaid Fraud Control Unit Arkansas Attorney General's Office Arkansas Lloyd Warford 501‐682‐1320 [email protected] 323 Center Street, Suite 200 Little Rock, AR 72201 Bureau of Medi‐Cal Fraud and Elder Abuse Office of the Attorney General California Jennifer Euler California Department of Justice 916‐621‐1858 [email protected] 2329 Gateway Oaks Drive, Suite 200 Sacramento, CA 95833 Medicaid Fraud Control Unit Office of the Attorney General Colorado Department of Law Colorado Robert Booth 720‐508‐6687 [email protected] Ralph L. Carr Colorado Judicial Center 1300 Broadway, 9th Floor Denver, CO 80203 Medicaid Fraud Control Unit Office of the Chief State's Attorney Connecticut Marjorie Sozanski 860‐258‐5929 [email protected] 300 Corporate Place Rocky Hill, CT 06067 1 Medicaid Fraud Control Unit (MFCU) Directors 4/15/2021 State Director Address Telephone Email Medicaid Fraud Control Unit Office of the Attorney General Delaware Edward Black (Acting) 302‐577‐4209 [email protected] 820 N French Street, 5th Floor Wilmington, DE 19801 Medicaid Fraud Control Unit District of Office of D.C. -

August 16, 2017 the Honorable Roger Wicker Chairman Senate

August 16, 2017 The Honorable Roger Wicker Chairman Senate Subcommittee on Communications, Technology, Innovation and the Internet Committee on Commerce, Science and Transportation The Honorable Brian Schatz Ranking Member Senate Subcommittee on Communications, Technology, Innovation and the Internet Committee on Commerce, Science, and Transportation The Honorable Marsha Blackburn Chairman House of Representatives Subcommittee on Communications and Technology Committee on Energy and Commerce The Honorable Michael Doyle Ranking Member House of Representative Subcommittee on Communications and Technology Committee on Energy and Commerce RE: Amendment of Communications Decency Act Dear Chairman Wicker, Ranking Member Schatz, Chairman Blackburn, and Ranking Member Doyle: In 2013, Attorneys General from 49 states and territories wrote to Congress, informing it that some courts have interpreted the Communications Decency Act of 1996 (“CDA”) to render state and local authorities unable to take action against companies that actively profit from the promotion and facilitation of sex trafficking and crimes against children. Unfortunately, nearly four years later, this problem persists and these criminal profiteers often continue to operate with impunity. The recent news highlighting the potential complicity of online classified-ad company Backpage.com in soliciting sex traffickers’ ads for its website once again underscores the need 1850 M Street, NW to expand, not limit, the ability of all law-enforcement agencies to fight sex Twelfth Floor Washington, DC 20036 Phone: (202) 326-6000 http://www.naag.org/ trafficking.1 The undersigned Attorneys General once again respectfully request that the United States Congress amend the CDA to affirm that state, territorial, and local authorities retain their traditional jurisdiction to investigate and prosecute those who facilitate illicit acts and endanger our most vulnerable citizens. -

Expressions of Legislative Sentiment Recognizing

MAINE STATE LEGISLATURE The following document is provided by the LAW AND LEGISLATIVE DIGITAL LIBRARY at the Maine State Law and Legislative Reference Library http://legislature.maine.gov/lawlib Reproduced from electronic originals (may include minor formatting differences from printed original) Senate Legislative Record One Hundred and Twenty-Sixth Legislature State of Maine Daily Edition First Regular Session December 5, 2012 - July 9, 2013 First Special Session August 29, 2013 Second Regular Session January 8, 2014 - May 1, 2014 First Confirmation Session July 31, 2014 Second Confirmation Session September 30, 2014 pages 1 - 2435 SENATE LEGISLATIVE RECORD Senate Legislative Sentiment Appendix Cheryl DiCara, of Brunswick, on her retirement from the extend our appreciation to Mr. Seitzinger for his commitment to Department of Health and Human Services after 29 years of the citizens of Augusta and congratulate him on his receiving this service. During her career at the department, Ms. DiCara award; (SLS 7) provided direction and leadership for state initiatives concerning The Family Violence Project, of Augusta, which is the the prevention of injury and suicide. She helped to establish recipient of the 2012 Kennebec Valley Chamber of Commerce Maine as a national leader in the effort to prevent youth suicide Community Service Award. The Family Violence Project provides and has been fundamental in uniting public and private entities to support and services for survivors of domestic violence in assist in this important work. We send our appreciation to Ms. Kennebec County and Somerset County. Under the leadership of DiCara for her dedicated service and commitment to and Deborah Shephard, the Family Violence Project each year compassion for the people of Maine, and we extend our handles 4,000 calls and nearly 3,000 face to face visits with congratulations and best wishes to her on her retirement; (SLS 1) victims at its 3 outreach offices and provides 5,000 nights of Wild Oats Bakery and Cafe, of Brunswick, on its being safety for victims at its shelters. -

US Pennsylvania State Attorney General, AG Shapiro

Stay up to date with information about COVID-19. Click here Share Press Release March 25, 2020 | Topic: Consumers HARRISBURG― Attorney General Josh Shapiro today issued a letter with co-leading Attorneys General Hector Balderas, William Tong, and T.J. Donovan, and 29 of their Attorneys General colleagues, requesting that Amazon, Facebook, Ebay, Walmart, and Craigslist more rigorously monitor price gouging practices by online sellers using their services. “Ripping off consumers by jacking up prices in the middle of a public emergency is against the law and online resellers like Amazon must join in this ght,” said Attorney General Josh Shapiro in his letter. “These companies form the backbone of online retail and have an obligation to stop illegal price gouging now and put strong practices into place to stop it from happening in the future.” “Americans are already worried about their health and the health of their loved ones during this pandemic. They shouldn’t also have to worry about being ripped off on the critical supplies they need to get through it,” said Adam Garber, U.S. PIRG Education Fund Consumer Watchdog. “We’re grateful for the leadership of Pennsylvania Attorney General Shapiro and 33 Attorneys General who joined him in calling for more robust protections on these online marketplaces during this crisis.” The letter lists several examples of price-gouging on these marketplace platforms, all of which took place only in March: on Craigslist, a two-liter bottle of hand sanitizer was being sold for $250; on Facebook Marketplace, an eight-ounce bottle was being sold for $40; and on Ebay, packs of face masks were being sold for $40 and $50. -

March 25, 2020 Jeff Bezos, Founder/CEO Amazon HQ 410

March 25, 2020 Jeff Bezos, Founder/CEO Amazon HQ 410 Terry Ave. N Seattle WA 98109-5210 Dear Mr. Bezos, We write in our capacity as the top law enforcement officers for our respective states. We want the business community and American consumers to know that we endeavor to balance the twin imperatives of commerce and consumer protection in the marketplace. And, while we appreciate reports of the efforts made by platforms and online retailers to crack down on price gouging as the American community faces an unprecedented public health crisis, we are calling on you to do more at a time that requires national unity. That is why we are reaching out to you and other platforms and online retailers directly to address this problem. As COVID-19 spreads throughout the country, it is especially important unscrupulous sellers do not take advantage of Americans by selling products at unconscionable prices. Unfortunately, independent third-party organizations and journalists have documented many examples of price-gouging of items people need to protect themselves since the World Health Organization declared a global health emergency on January 30. For example:1 ● On Amazon, U.S. PIRG Education Fund found that more than half of hand sanitizers and facemasks available spiked by at least 50% compared to the average price. One in six products sold directly by Amazon saw similar price spikes. 1 See, e.g., Tiffany, Kaitlin, The Hand-Sanitizer Hawkers Aren’t Sorry, THE ATLANTIC (Mar. 11, 2020), https://www.theatlantic.com/health/archive/2020/03/hand-sanitizer-online-sales-ebay-craigslist-price-surge/607750/; Whalen, Jeanne et al., Purell prices are spiking on Amazon, as sanitizer speculation becomes a cottage industry, THE WASHINGTON POST (Mar. -

To: Commission From: Jonathan Wayne, Executive Director Michael Dunn, Esq., Political Committee and Lobbyist Registrar Date: May 20, 2020 Re: Request by Mr

Commission Meeting 05/27/2020 STATE OF MAINE Agenda Item #2 COMMISSION ON GOVERNMENTAL ETHICS AND ELECTION PRACTICES 135 STATE HOUSE STATION AUGUSTA, MAINE 04333-0135 To: Commission From: Jonathan Wayne, Executive Director Michael Dunn, Esq., Political Committee and Lobbyist Registrar Date: May 20, 2020 Re: Request by Mr. John Jamieson to Investigate Polling by U.S. Senator Susan Collins Maine Election Law regulates funds, goods and services (e.g., polling) received by someone for the purpose of deciding whether to become a candidate for state office. If the person subsequently runs for office, the candidate must disclose the funds, goods and services as contributions in their first campaign finance report. They are subject to the same dollar amount limitations as contributions received after the individual becomes a candidate. The person must also disclose any payments made for the purpose of deciding whether to become a candidate. In 2017, U.S. Senator Susan Collins was giving consideration to running for Governor of Maine. Mr. John Jamieson of South Portland requests that the Commission investigate whether she received polling services that exceeded the $1,600 limitation applicable at that time. Sen. Collins responds that the polling was paid for by Collins for Senate (her U.S. Senate re-election committee) for a federal campaign purpose and she did not violate Maine Election Law. LEGAL REQUIREMENTS Standard for Opening a Requested Investigation The Election Law authorizes the Commission to receive requests for investigation and to conduct an investigation “if the reasons stated for the request show sufficient grounds for believing that a violation may have occurred”: A person may apply in writing to the commission requesting an investigation as described in subsection 1. -

Kane's Reign Ends Today

Steve Esack and Peter Hall Of The Morning Call 8/17/16 Kane's reign ends today HARRISBURG — Kathleen Kane charged into state government 1,381 days ago as a reformer unbound by the political establishment she railed against in her successful campaign to become the state's first woman elected attorney general. On Wednesday, she slinks away, leaving behind her once bright political future and a resignation letter after abusing the power voters entrusted in her as the state's top law enforcement officer. "I have been honored to serve the people of Pennsylvania and I wish them health and safety in all their days," Kane said Tuesday in a two-sentence resignation. The announcement came a day after a jury of six men and six women convicted her on two felony counts of perjury and seven lesser charges of lying and abusing her power about a grand jury secrets leak she orchestrated to embarrass a rival. It also came after Montgomery County Judge Wendy Demchick-Alloy set an Oct. 24 sentencing date for the Scranton-area Democrat. The state constitution says public officials must resign after being convicted of a crime, but state court rulings have pushed resignations back until sentencing. Kane negated that with her decision to quit after months of refusing to heed such advice from politicians. Kane lawyers vow appeal, but offer few details In a statement, Gov. Tom Wolf, a Democrat, said Kane is making the right call. "What has transpired with Attorney General Kane is unfortunate," Wolf said. "Her decision to resign is the right one, and will allow the people of Pennsylvania to finally move on." The Commonwealth Attorneys Act states that the first deputy slides into the attorney general's post if the elected or appointed official resigns or becomes incapacitated. -

Election Insight 2020

ELECTION INSIGHT 2020 “This isn’t about – yeah, it is about me, I guess, when you think about it.” – President Donald J. Trump Kenosha Wisconsin Regional Airport Election Eve. 1 • Election Insight 2020 Contents 04 … Election Results on One Page 06 … Biden Transition Team 10 … Potential Biden Administration 2 • Election Insight 2020 Election Results on One Page 3 • Election Insight 2020 DENTONS’ DEMOCRATS Election Results on One Page “The waiting is the hardest part.” Election results as of 1:15 pm November 11th – Tom Petty Top Line Biden declared by multiple news networks to be America’s next president. Biden’s Pennsylvania win puts him over 270. Georgia and North Carolina not yet called. Biden narrowly leads in GA while Trump leads in NC. Trump campaign seeks recounts in GA and Wisconsin and files multiple lawsuits seeking to overturn the election results in states where Biden has won. Two January 5, 2021 runoff elections in Georgia will determine Senate control. Senator Mitch McConnell will remain Majority Leader and divided government will continue, complicating the prospects for Biden’s legislative agenda, unless Democrats win both runoff s. Democrats retain their House majority but Republicans narrow the Democrats’ margin with a net pickup of six seats. Incumbents Losing Reelection • Sen. Doug Jones (D-AL) • Rep. Harley Rouda (D-CA-48) • Rep. Xochitl Torres Small (D-NM-3) • Sen. Martha McSally (R-AZ) • Rep. Debbie Mucarsel-Powell (D-FL-26) • Rep. Max Rose (D-NY-11) • Sen. Cory Gardner (R-CO) • Rep. Donna Shalala (D-FL-27) • Rep. Kendra Horn (D-OK-5) • Rep. -

3.24.20 Defense Production Act Letter

STATE OF WISCONSIN DEPARTMENT OF JUSTICE ⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯ Josh Kaul Room 114 East, State Capitol Attorney General PO Box 7857 Madison WI 53707-7857 (608) 266-1221 TTY 1-800-947-3529 March 24, 2020 SENT VIA EMAIL ONLY [email protected] [email protected] The President of the United States The White House 1600 Pennsylvania Avenue, N.W. Washington, DC 20500 Re: Shortage of critical supplies Dear Mr. President: We write regarding the immediate need across the country for vital support and to urge you to fully utilize the Defense Production Act to prioritize production of masks, respirators, and other critical items needed to fight the coronavirus pandemic. We are on the brink of catastrophic consequences resulting from the continued shortage of critical supplies. The federal government must act decisively now and use its sweeping authority to get as many needed supplies produced as soon as possible for distribution as quickly as possible. News reports from around the country have highlighted shortages in equipment and testing, with headlines like ‘At War with No Ammo’: Doctors Say Shortage of Protective Gear Is Dire1 and There Is a Shortage of Coronavirus Tests in Wisconsin, and Even Health Care Workers Are Having a Hard Time Getting One.2 Reports like these are consistent with our understanding of the supply shortages our jurisdictions and others across the country are facing or may soon face. 1 Andrew Jacobs et al., ‘At War with No Ammo’: Doctors Say Shortage of Protective Gear Is Dire, N.Y. Times (Mar. 19, 2020), http://www.nytimes.com/2020/03/19/health/coronavirus-masks-shortage.html.