Providing Financial Strategies for All Aspects of Your Life

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States District Court Eastern District of New York

Case 2:14-cv-05169-JMA-ARL Document 15 Filed 10/27/14 Page 1 of 42 PageID #: 122 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK MICHELLE F. HARTLEY, STEVEN TOMLINSON, individually and on behalf of all others similarly situated, and MARIA DEGENNERO, Civil Action No. Plaintiffs, AMENDED CLASS ACTION COMPLAINT FOR DAMAGES, vs. RESTITUTION AND INJUNCTIVE RELIEF WELLS FARGO & COMPANY; WACHOVIA SECURITIES FINANCIAL HOLDINGS, LLC; JURY TRIAL DEMAND and WELLS FARGO ADVISORS, LLC, all as successors in interest to Wachovia Securities, LLC, Defendants. Plaintiffs, individually and on behalf of all others similarly situated, by their attorneys, The Law Offices of Christopher Q. Davis, PLLC, alleges, upon personal knowledge and upon information and belief as to other matters, as follows: NATURE OF ACTION 1. This is a collective and class action brought by Individual and Lead Plaintiffs and Putative Class Representative Plaintiffs Michelle F. Hartley and Steven Tomlinson, Individual and Lead Plaintiff Maria DeGennero (together, the “Lead Plaintiffs” or “Named Plaintiffs”) and all putative plaintiffs (collectively, “Plaintiffs”), on their own behalf and on behalf of the proposed classes identified below. Plaintiffs and the Putative Class members were or are employed by Defendant Wells Fargo & Company, Defendant Wachovia Securities Financial Holdings, LLC, and Defendant Wells Fargo Advisors, LLC, as successor in interest to former 1 Case 2:14-cv-05169-JMA-ARL Document 15 Filed 10/27/14 Page 2 of 42 PageID #: 123 employer Wachovia Securities, LLC, (collectively, “Wells Fargo” or the “Defendants”). Plaintiffs were employed by Defendant Wells Fargo & Company in their registered broker- dealer, Wells Fargo Advisors, LLC, as Financial Advisors in the Private Client Group.1 2. -

2016 Annual Report (PDF)

Our Commitment WELLS FARGO & COMPANY ANNUAL REPORT 2016 2016 ANNUAL REPORT Contents 2 | Letter from Chairman of the Board 4 | Letter from Chief Executive Officer and President 14 | Demonstrating Our Commitment 14 | Homeownership: More than a dream 16 | Journey through retirement 18 | A prescription for caring 20 | Bringing bankers to the kitchen table 22 | A home for hope 24 | Building with smart technology 26 | Helping create affordable housing 28 | A future of efficient freight 30 | A bank for life 32 | Operating Committee and Other Corporate Officers 33 | Board of Directors 34 | 2016 Corporate Social Responsibility Performance 35 | 2016 Financial Report - Financial review - Controls and procedures - Financial statements - Report of independent registered public accounting firm 273 | Stock Performance 2 2016 ANNUAL REPORT Dear Fellow Shareholders, Since 1852, Wells Fargo has worked to earn customers’ trust We have enforced senior management accountability by meeting their financial needs and helping them succeed for the damage to Wells Fargo’s reputation through very financially, while maintaining the highest standards of significant compensation actions. The Board accepted integrity. That is why my fellow Board members and I were John Stumpf’s recommendation to forfeit all of his unvested deeply troubled that Wells Fargo violated that trust by equity of approximately $41 million prior to his retirement opening accounts for certain retail banking customers that as Chairman and CEO. The Board required Carrie Tolstedt, they did not request or in some cases even know about. the departed head of Community Banking, to forfeit all This behavior is unacceptable, not only to the Board but of her approximately $19 million of unvested equity. -

Our Firm and Understand Your Needs, Helps You Clarify Your Goals, and Takes the Safety and Security of Your Money and Investments Seriously

Our Firm and understand your needs, helps you clarify your goals, and takes the safety and security of your money and investments seriously. We will be fully invested in your success: Your Financial Advisor can help you stay on track to meet your goals through intelligent financial solutions, in-depth analysis of your investments, and regular feedback on your progress. We will be with you every step of the way: Your needs and goals will change over time. That’s why your Financial Advisor will be there to provide ongoing advice—along with the exceptional service you deserve— Home Office—St. Louis, MO through the ups and downs of markets and economic cycles. A heritage of client service Wells Fargo Advisors is one of the nation’s premier Areas of distinction financial-services firms. Represented by nearly 13,500 • Unique structure that combines the capabilities of a large, Financial Advisors in 5,000 U.S. locations, it was born out national firm with the best practices of several smaller, of Wells Fargo & Company’s 2009 acquisition of Wachovia esteemed firms Corporation.* • Dedicated to Financial Advisors and their relationships Wachovia Securities, LLC, which traced its roots to 1879, with clients grew over the years through mergers with some of the • Exceptional choice and flexibility for Financial Advisors industry’s most respected regional and national firms, and their clients through distinct business channels including the 2007 acquisition of A.G. Edwards, Inc., supported by established products, services, and by Wachovia Corporation. Throughout their histories, technology Wells Fargo Advisors’ predecessors were known for service based on trust and knowledge, and for corporate cultures Products and services that put client needs above all else. -

Court of Appeals STATE of NEW YORK

To Be Argued By: ROBERT J. GIUFFRA, JR., ESQ. Time Requested: 30 Minutes New York County Clerk’s Index No. 601475/09 Court of Appeals STATE OF NEW YORK ABN AMRO BANK N.V.;d BNP PARIBAS; CALYON; HSBC BANK USA, N.A.; KBC INVESTMENTS CAYMAN ISLANDS VLTD.; MERRILL LYNCH INTERNATIONAL; BANK OF AMERICA, N.A.; MORGAN STANLEY CAPITAL SERVICES INC.; NATIXIS; NATIXIS FINANCIAL PRODUCTS INC.; THE ROYAL BANK OF SCOTLAND PLC; SOCIÉTÉ GÉNÉRALE; UBS AG, LONDON BRANCH; and WACHOVIA BANK, N.A., Plaintiffs-Appellants, —and— BARCLAYS BANK PLC; CITIBANK, N.A.; CANADIAN IMPERIAL BANK OF COMMERCE; JPMORGAN CHASE BANK, N.A.; COÖPERATIEVE CENTRALE RAIFFEISEN-BOERENLEENBANK B.A., NEW YORK BRANCH; ROYAL BANK OF CANADA; SMBC CAPITAL MARKETS LIMITED, Plaintiffs, —against— MBIA INC., MBIA INSURANCE CORPORATION, and MBIA INSURANCE CORP. OF ILLINOIS, Defendants-Respondents. BRIEF FOR PLAINTIFFS-APPELLANTS ROBERT J. GIUFFRA, JR. MICHAEL T. TOMAINO, JR. BRIAN T. FRAWLEY JULIA M. JORDAN WILLIAM H. WAGENER JONATHAN C. SHAPIRO SULLIVAN & CROMWELL LLP 125 Broad Street New York, New York 10004 Telephone: (212) 558-4000 Facsimile: (212) 558-3588 Date Completed: March 16, 2011 Attorneys for Plaintiffs-Appellants STATEMENT PURSUANT TO § 500.1(F) OF THE RULES OF THE COURT OF APPEALS Plaintiff BNP Paribas states that it has over 1,000 subsidiaries and affiliates, which are too numerous to list, but states that its principal U.S. subsidiaries include Bank of the West; First Hawaiian Bank; BNP Pari bas Securities Corp.; BNP Paribas Prime Brokerage, Inc.; BNP Paribas Commodity Futures Inc.; Paribas North America, Inc. and BNP Paribas North America, Inc. -

As the Bad News and Advisor Departures Continue, Experts

Cover Story Client assets in the wealth group remain steady at $1.9 trillion. But the number of financial advisors as of June 30 is The Scandals’ Causes According 14,226 — down 860, or about 6%, from September 2016. That’s to CEO Tim Sloan when the fake-accounts scandal at its parent company resulted in a $185 million fine from the Consumer Financial Protection We had product sales goals that Bureau; an estimate of the number of unauthorized deposit sometimes resulted in behaviors and credit-card accounts opened since 2009 stood at as many and practices that did not serve as 3.5 million (as of August 2017). our customers’ or our team Will the bank’s latest rebranding and other corporate efforts members’ interests. And we were make a difference to its wealth business, and can Wells Fargo slow to see the harm they caused. stop the outflow of registered representatives? And what do the fake-accounts and other scandals at Wells Fargo mean for Second, despite our ongoing efforts to combat the broader wealth industry? Investment Advisor spoke with a these unacceptable bad practices and bad group of industry experts about these issues to gauge both the behaviors, they persisted, because we either When Will significance of the bank’s troubles and their resolution. minimized the problem, or we failed to see the problem for what it really was — something bigger By Janet Levaux Reputational Risks than we originally imagined. Wells Fargo, now subject to a Federal Reserve consent order Photo-illustration by that restricts its growth, was raked over the coals by Congress Third, we failed to acknowledge the role leadership Chris Nicholls in September 2016. -

Wells Fargo & Company Annual Report 2019

Wells Fargo & Company Annual Report 2019 Form 10-K (NYSE:WFC) Published: February 27th, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2018 Commission File Number 001‑2979 WELLS FARGO & COMPANY (Exact name of registrant as specified in its charter) Delaware No. 41-0449260 (State of incorporation) (I.R.S. Employer Identification No.) 420 Montgomery Street, San Francisco, California 94163 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: 1-866-878-5865 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange Title of Each Class on Which Registered Common Stock, par value $1-2/3 New York Stock Exchange (NYSE) 7.5% Non-Cumulative Perpetual Convertible Class A Preferred Stock, Series L NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series N NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series O NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series P NYSE Depositary Shares, each representing a 1/1000th interest in a share of 5.85% Fixed-to-Floating Rate Non-Cumulative Perpetual Class A Preferred Stock, Series Q NYSE Depositary Shares, each -

Wells Fargo Annual Report 2021

Wells Fargo Annual Report 2021 Form 10-K (NYSE:WFC) Published: February 23rd, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2020 Commission File Number 001-2979 WELLS FARGO & COMPANY (Exact name of registrant as specified in its charter) Delaware No. 41-0449260 (State of incorporation) (I.R.S. Employer Identification No.) 420 Montgomery Street, San Francisco, California 94104 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: 1-866-249-3302 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange Title of Each Class Trading Symbol on Which Registered Common Stock, par value $1-2/3 WFC NYSE 7.5% Non-Cumulative Perpetual Convertible Class A Preferred Stock, Series L WFC.PRL NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series N WFC.PRN NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series O WFC.PRO NYSE Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series P WFC.PRP NYSE Depositary Shares, each representing a 1/1000th interest in a share of 5.85% Fixed-to-Floating Rate Non-Cumulative Perpetual Class A Preferred Stock, Series Q WFC.PRQ NYSE -

Financial Industry Regulatory Authority Letter of Acceptance, Waiver and Consent No

FINANCIAL INDUSTRY REGULATORY AUTHORITY LETTER OF ACCEPTANCE, WAIVER AND CONSENT NO. 20090191139 TO: Department of Enforcement Financial Industry Regulatory Authority (“FfNRA”) RE: Wells Fargo Advisors, LLC, Wells Fargo Advisors Financial Network, LLC and Wells Fargo Investments, LLC (collectively “Wells Fargo,” “Respondent” or “the Firm”), CRDNos. 19616, 11025, 10582 Pursuant to FINRA Rule 9216 of FINRA’s Code of Procedure, Wells Fargo submits this Letter of Acceptance, Waiver and Consent (“AWC”) for the purpose of proposing a settlement of the alleged rule violations described below. This AWC is submitted on the condition that, if accepted, FINRA will not bring any future actions against Wells Fargo alleging violations based on the same factual findings described herein. I. ACCEPTANCE AND CONSENT A. Wells Fargo hereby accepts and consents, without admitting or denying the findings, and solely for the purposes of this proceeding and any other proceeding brought by or on behalf of FENRA, or to which FINRA is a party, prior to a hearing and without an adjudication of any issue of law or fact, to the entry of the following findings by FINRA: BACKGROUND Wells Fargo is the retail brokerage and wealth management affiliate of Wells Fargo & Company, headquartered in St. Louis, Missouri. On December 31, 2008, Wells Fargo & Company acquired Wachovia Corporation and its affiliated brokerage businesses, including Wachovia Securities. Wachovia Securities changed its name to Wells Fargo Advisors on May 1, 2009 and Wells Fargo Investments ceased doing business and merged into Wells Fargo Advisors on January 1,2011. Wells Fargo, a FINRA-regulated broker-dealer, currently has over 15,000 Financial Advisors, approximately six million active client accounts, 5,000 branch offices and over $1 trillion in client assets under management. -

Separately Managed Account Programs Disclosure

Wrap Fee Brochure for: Personalized Unified Managed Account Private Advisor Network Customized Portfolios 801 - 37967 Investment Advisory Services of Wells Fargo Advisors Revised June 2020 One North Jefferson, St. Louis, MO 63103 Phone (314) 875-3000 www.wellsfargoadvisors.com This brochure provides information about the qualifications and business practices of Wells Fargo Advisors and the Personalized Unified Managed Account, Private Advisor Network and Customized Portfolio Programs. This information should be considered before becoming a Client of one of these Programs. If you have any questions about the Programs or the contents of this brochure, please contact us at the telephone number above. This information has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. Additional information about Wells Fargo Advisors also is available on the SEC’s website at www.adviserinfo.sec.gov. The advisory services described in this brochure are not insured or otherwise protected by the U.S. Government, the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency, and involve risk, including the possible loss of principal. Investment and Insurance Products are: • Not Insured by the FDIC or Any Federal Government Agency • Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate • Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. -

Rebuilding Trust

Washington North Dakota Montana Minnesota Number of domestic locations by state Maine Wisconsin South Dakota Vt. Oregon Idaho N.H. Wyoming New York Michigan Massachusetts Iowa Nebraska Pennsylvania Rhode Island Illinois Indiana Ohio Nevada New Jersey Utah Colorado Connecticut Kansas W. Virginia Missouri Delaware Kentucky Virginia California Maryland Tennessee Oklahoma North Carolina Arkansas D.C. Arizona New Mexico South Carolina Mississippi Georgia Alabama Texas Louisiana Florida Alaska Hawaii Contents 2 | Letter from Chair of the Board 6 | Letter from Chief Executive Officer and President 18 | Rebuilding Trust 18 | Finding a forever home 20 | Making your phone a ‘control tower’ 22 | School expansion is an ‘odyssey’ 24 | It starts just by listening 26 | Growth at the grocery — and beyond 28 | Investments are a mother’s gift 30 | Small business, big impact 32 | Planting seeds for the next generation 34 | Operating Committee and Other Corporate Officers 35 | Board of Directors 36 | 2017 Corporate Social Responsibility Performance Highlights 37 | 2017 Financial Report - Financial review - Controls and procedures - Financial statements - Report of independent registered public accounting firm 279 | Stock Performance 1 Annual ReportAnnual Cover: In Florida, customer Alexandra Wilkinson, right, has a conversation about her finances with Personal Banker Nicole Allegretto. Learn more on 2017 page 24. Dear fellow shareholders, 2 Elizabeth A. Duke Chair, Board of Directors Wells Fargo & Company Annual Report Report Annual 2017 2017 I am honored to serve as chair of the board of directors of Wells Fargo, a company with a long history of success and a unique opportunity to learn from its challenges and become better, Many of the changes we made also reflected stronger, and more customer- the feedback we received as part of the focused than ever before. -

Financial Healthcare for Your Future. Financial Healthcare for Your Future. Investment and Insurance Products

Financial healthcare for your future. Financial healthcare for your future. Investment and Insurance Products: - Not FDIC-Insured - No Bank Guarantee - May Lose Value Our Vision We work with independent business owners No drug can be brought to market without its required trial phases. Our goal is to develop No trip should be taken without a map—and no family should begin and senior professionals in healthcare to plan a comprehensive its financial journey, especially across more than one generation, for their families’ unique financial challenges without some sort of comprehensive investment and estate plan. investment plan, No family plans to fail financially; it’s just that most families fail to plan. and opportunities throughout their lives. then guide you through Our goal is to help your family make a comprehensive investment plan, then guide you through the completion of that plan, that plan. year after year, with your other trusted advisors. 1 The Team Charles “Charlie” R. Huntington, Jr., CRPS Steven “Steve” G. Kraus Managing Director—Investment Officer Managing Director—Investment Officer I worked for Prudential Securities and Smith Barney A veteran with more than 25 years’ experience as a before joining Wells Fargo Advisors in 2009 to co-lead a team financial advisor, I worked for Prudential Securities and focused on personal investments for leaders in the Life Sciences Smith Barney before joining Wells Fargo Advisors in 2009. community. I co-lead our team, which includes supervising the money management and investment planning aspects of our prac- Bachelor’s degree in both Economics and Spanish from Lake Forest College, Illinois tice, while keeping my focus on helping our clients meet their lifetime goals. -

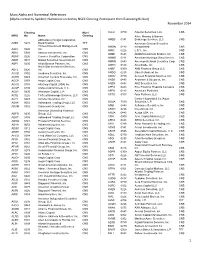

Alpha Sorted by Symbol; Numerical Sorted by NSCC Clearing Participant Then Executing Broker) November 2014

Muni Alpha and Numerical References (Alpha sorted by Symbol; Numerical sorted by NSCC Clearing Participant then Executing Broker) November 2014 Clearing Muni ALLU 0750 Alluvion Securities, LLC CNS MPID No. Name Clearing Allen, Mooney & Barnes ABN Amro Chicago Corporation AMBB 0141 Brokerage Services, LLC CNS AABT 5231 Bond Trading TFT American General Securities Thrivent Investment Management, AMGN 0443 Incorporated CNS AALC 0226 Inc. CNS AMIC 0226 L.S.Y., Inc. CNS ABAI 0309 Abacus Investments, Inc. CNS AMMI 0443 AM&M Investment Brokers, Inc. CNS ABAS 0226 Conover Securities Corporation CNS AMMS 0141 American Municipal Securities Inc. CNS ABLE 0031 Natixis Securities Americas LLC CNS AMNN 0443 American Network Securities Corp. CNS ABPI 0235 Allied Beacon Partners, Inc. CNS AMTD 0188 Ameritrade, Inc. CNS North Star Investment Services, ABYL 0226 Inc. CNS ANBF 0309 ANB Financial Group LLC CNS ACAD 0352 Academy Securities, Inc. CNS ANDG 0235 Garrett (Andrew) Inc. CNS ACBD 0443 American Century Brokerage, Inc. CNS ANOV 0750 Anovest Financial Services, Inc. CNS ACCP 0158 Aegis Capital Corp. CNS ANSR 0443 Anderson & Strudwick, Inc. CNS ACCU 0158 AltaCorp Capital (USA) Inc. CNS ANZS 0443 ANZ Securities, Inc. CNS ACGP 0235 Andes Capital Group, LLC CNS APEX 0443 Rice Financial Products Company CNS ACLP 0235 Alexander Capital, L.P. CNS APFS 0443 America's Portfolio's CNS ACSL 0226 FinTrust Brokerage Services, LLC CNS APTO 0103 Apto Partners, LLC CNS ACTI 0443 Activner Securities, Inc. CNS Cantor Fitzgerald & Co./Aqua ADAK 0052 Adirondack Trading Group, LLC CNS AQUA 7310 Securities, L.P. CNS ADAM 0352 Canaccord Genuity Inc. CNS ARBI 0443 Aufhauser Securities, Inc.