Ganesha Motors Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Combination Registration No. C-2020/04/740)

COMPETITION COMMISSION OF INDIA (Combination Registration No. C-2020/04/740) 04.06.2020 Notice u/s 6 (2) of the Competition Act, 2002 jointly filed by Peugeot S.A. and Fiat Chrysler Automobiles N.V. CORAM: Mr. Ashok Kumar Gupta Chairperson Ms. Sangeeta Verma Member Mr. Bhagwant Singh Bishnoi Member Order under Section 31(1) of the Competition Act, 2002 1. On 15.04.2020, the Competition Commission of India (Commission) received a notice under Section 6(2) of the Competition Act, 2002 (Act) jointly filed by Peugeot S.A. (PSA) and Fiat Chrysler Automobiles N.V. (FCA) (hereinafter, PSA and FCA are collectively referred to as “Parties”). 2. The proposed combination relates to the merger between PSA and FCA and upon completion of the Proposed Combination, PSA will be merged with and into FCA (Proposed Combination). The notice has been filed pursuant to Combination Agreement dated 17.12.2019. Combination Registration No. C-2020/04/740 3. In terms of regulation 14 of the Competition Commission of India (Procedure in regard to the transaction of business relating to Combinations) Regulations, 2011 (Combination Regulations), the Commission vide its email dated 04.05.2020, sought certain information /clarification(s) inter alia, relating to activities of the Parties; response to the same was received on 13.05.2020, after seeking extension of time by the Parties (Response). Further, certain clarification(s)/ information in relation to Response was sought from the Parties, reply to which were received on 28.05.2020. Additionally, Parties vide their email dated 02.06.2020 provided certain information/clarification(s) necessary for the purpose of assessment of the Proposed Combination. -

Automotive Research Association of India (ARAI)

48th ANNUAL REPORT 2017-2018 mpowering m obility thesafe and intelligent way The Automotive Research Association of India The Automotive Research Association of India ARAI Vision and Mission ARAI has a strong base of state-of-the-art technology equipment, Vision laboratory facilities and highly qualified and experienced personnel. With these assets, ARAI has goals, strategies and action plans to achieve the fullest customer satisfaction. These are:- (a) to compete in service with excellence (b) to obtain recognition and accreditation (c) to cover global market (d) to build commitment of all personnel (e) to develop team spirit and sense of belonging amongst all. ● ARAI has been providing various services to the Indian Automotive Mission Industry, in the areas of design & development and know-how for manufacture & testing of components / system to national / international standards. ARAI shall strive to achieve international recognition in these areas. ● ARAI shall seek valuable guidance and support from members, from time to time to achieve growth and stability. ● With the globalisation of economy and business, ARAI shall enlarge its scope of services to meet the requirements of automotive industries any where in the world. ● ARAI strongly believes that satisfaction of customer needs on continuing basis, is of prime importance to earn loyalty of customers. Therefore, emphasis shall be on meeting and exceeding customer needs through continuing quality improvement with active participation of employees and also customers. TOTAL INCOME th (Rs. in lakh) 48 ANNUAL REPORT 2017-2018 31408 ## 27507 # 23236 21441 19014 16890 14751 13079 10661 8744 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 Above Income is excluding Interest on earmarked fund transferred to respective fund and funds transferred from R & D reserve fund. -

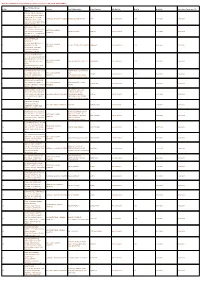

![S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD](https://docslib.b-cdn.net/cover/0659/s-no-aeo-registration-no-name-iec-code-1-inaaacv5657k1f186-gimatex-industries-pvt-ltd-0397062826-2-inaabct1122c1f181-tide-water-oil-co-india-ltd-4100659.webp)

S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD

S.No. AEO Registration No Name IEC CODE 1 INAAACV5657K1F186 GIMATEX INDUSTRIES PVT.LTD 0397062826 2 INAABCT1122C1F181 TIDE WATER OIL CO.[INDIA] LTD. 0296013633 3 INAABCV2801N1F180 VEER-O-METALS PRIVATE LIMITED 0799011029 4 INAABCE5852A1F187 EVERFLOW PETROFILS LTD. 0306015714 5 INAAACJ7650E1F184 JINDAL POLY FILMS LTD. 0588065781 6 INAACCB5512F1F180 BANOX EXIM PRIVATE LIMITED 0504086031 7 INAAACJ0474G1F189 JINDAL EXPORTS & IMPORTS PVT.LTD. 0588058173 8 INAAACS2679A1F182 SARITA HANDA EXPORTS PVT LTD 0501036636 9 INAABCS3931J1F183 SPIROTECH HEAT EXCHANGERS PVT. LTD. 0594045754 10 INAACCG7788C1F185 GRAND SLAM FITNESS PRIVATE LIMITED 0507001796 11 INAAACS3317D1F181 SUNRISE SPORTS (INDIA) PVT LTD 0594054451 12 INAABCV6922E1F185 VARDEEP PETRO CHEMICAL PRIVATE LIMITED 0403016827 13 INAAAFJ4032F1F181 JAIN METAL ROLLING MILLS 0488048397 14 INAADCP6204B1F185 P.A.R.K. FELTS (P) LTD 3306002801 15 INAAFCG2966D1F184 GREENLAM INDUSTRIES LIMITED. 1414002017 16 INAACCG6027C1F188 SIEMENS GAMESA RENEWABLE POWER PRIVATE LIMITED 0508033608 17 INAADCS5009B1F181 SUBRAMANY & CO (EXPORTS) PRIVATE LIMITED 3596001021 18 INAABCJ5937F1F180 JSK INDUSTRIES PVT. LTD., 0307076555 19 INAABCM9522F1F180 MAURIA UDYOG LTD 0588077186 20 INAAACS8793F1F189 SECO TOOLS INDIA PVT. LTD. 0389062375 21 INAAACT6305N1F185 J. K. PAPER LTD 3496003154 22 INAABCN0010F1F187 NELCAST LIMITED 0493027173 23 INAJCPM7016K1F186 FLOAT GLASS CENTRE 0404004075 24 INAAECT2086J1F184 TIRUBALA INTERNATIONAL PVT.LTD., 0605009058 25 INAAACW4857C1F184 WALTER TOOLS INDIA PVT.LTD 3103005946 26 INAASCS7221E1F187 -

Legendary Jeep® Brand Enters One of the World's Largest Automobile

Legendary Jeep® Brand Enters One of the World’s Largest Automobile Markets Jeep® Wrangler Unlimited, Jeep Grand Cherokee and Jeep Grand Cherokee SRT make their Indian debut at the 2016 Auto Expo in New Delhi Jeep brand sales in India to start in mid-2016 Introduction comes at a time of record worldwide sales for Jeep and continued global expansion New Delhi, February 3, 2016 – The growing international presence of the Jeep® brand marked another milestone today when the brand was introduced to India at the 2016 Auto Expo in New Delhi. With a line-up of three SUVs – Jeep Wrangler Unlimited, Jeep Grand Cherokee and the high- performance Jeep Grand Cherokee SRT – Jeep brand sales in India will start in mid-2016, a year that also marks the brand’s 75th anniversary. “Our aggressive expansion in international markets is one of the key drivers behind our current global sales momentum,” said Mike Manley, Head of Jeep Brand, FCA, and Chief Operating Officer (COO) of the Asia Pacific (APAC) Regional Operations Group. “Last year, we started local production in Brazil and China, and today, we are launching the Jeep brand in the fifth largest market in the world, India, setting the foundation for our future growth in this country.” The Jeep brand arrives in India at a time of record sales and continued expansion into markets outside its North American home. Jeep recorded sales of more than 1.2 million units worldwide in 2015 – the highest total in its 75-year history – setting a global sales record for the fourth consecutive year. -

State Wise Detail Report from 01/04/2018 to 31/03/2019 in Respect of IEM Part-B

State Wise Detail Report from 01/04/2018 to 31/03/2019 in respect of IEM Part-B. (NEW FORMAT) Name Of Undertaking / Sr. No. Location Item Of Manufacture Actual Capacity Ack No./Date Mem No Mem Date Production Commenced On Address MARUTHI ISPAT & ENERGY PVT.LIMITED,,RAMA TOWERS 2ND FLOOR,, 5-4-83, TSR 1 KURNOOL ,ANDHRA PRADESH WHRB CO-GENERATION 8 MW 472 10/07/2018 3303 19/11/2007 01/06/2018 CHAMBERS,, M.G. ROAD, RANIGANJ,, SECUNDERABAD, ANDHRA PRADESH,NU SRINI FOOD PARK PVT. LTD.,,H.NO.8-2-293/82/A/1154, CHITTOOR ,ANDHRA 2 PLOT NO.1154,ROAD NO.57, COLD STORAGE 5000 MT 789 27/11/2018 685 18/03/2009 09/07/2012 PRADESH JUBILEE HILLS,, HYDERABAD, ANDHRA PRADESH,NU PRAKASH FERROUS INDUSTRIES PVT.LTD.,,SURVEY NO. 27/1,, CHITTOOR ,ANDHRA 3 URANDUR VILLAGE, M.S.BILLETS,BILLETS, INGOTS 180000 MT 453 28/06/2018 1156 08/04/2011 07/12/2012 PRADESH SRIKALAHASTI MANDAL, CHITTOOR, ANDHRA PRADESH 517 640,NU AISAN AUTO PARTS INDIA PVT.LTD.,,KUNIO NAKASHIMA, GEE GEE PLAZA #1,FLAT #20, CHITTOOR ,ANDHRA 4 3RD FLOOR,WHEATCROFT PART OF MOTOR VEHICLES 241000 NOS. 423 15/06/2018 1294 01/06/2012 13/05/2014 PRADESH ROAD, NUNGAMBAKKAM,CHENNAI, TAMIL NADU 600 034,NU NHK SPRING INDIA LTD.,,PLOT SUSPENSION COIL SPRINGS NO. 31, SECTOR -3, IMT CHITTOOR ,ANDHRA FOR 5 11 NOS. 510 24/07/2018 1767 25/07/2012 25/03/2016 MANESAR,, GURGAON 122 PRADESH AUTOMOBILES,RAILWAYS 050, HARYANA, ,NU AND OTHER APPLICATIONS GREENPANEL INDUSTRIES LIMITED,MAKUM ROAD, PO CHITTOOR ,ANDHRA MEDIUM DENSITY FIBER 6 360000 CBM 540 17/08/2018 656 25/03/2013 01/07/2018 TINSUKIA, TINSUKIA,, ASSAM - PRADESH BOARD 786125., , ,NU PENNA CEMENT INDUSTRIES ORIDINARY PORTLAND LTD.,PLOT NO.705, LAKSHMI, CEMENT, PORTLAND 7 NIVAS, ROAD NO.3,BANJARA, NELLORE ,ANDHRA PRADESH POZZOLONA CEMENT, 2 MTPA 692 01/11/2018 2263 13/12/2013 28/03/2018 HILLS, HYDERABAD-500034., PORTLAND SLAG CEMENT, A.P., ,NU SIMILAR HYDRAULIC CEMENT AUROBINDO PHARMA LIMITED,PLOT NO.2, 8 NELLORE ,ANDHRA PRADESH TABLETS 3750 MLN.NOS. -

FCA Consent Decree January 10, 2019

Case 3:17-md-02777-EMC Document 484-1 Filed 01/10/19 Page 1 of 224 1 LEIGH P. RENDÉ (PA Bar No. 203452) JOSEPH W.C. WARREN (DC Bar No. 452913) 2 Environment and Natural Resources Division Environmental Enforcement Section P.O. Box 7611, Ben Franklin Station 3 Washington, DC 20044-7611 Telephone: (202) 514-1461 4 Email: [email protected] Email: [email protected] 5 Counsel for the United States 6 XAVIER BECERRA Attorney General of California 7 NICKLAS A. AKERS Senior Assistant Attorney General 8 JUDITH A. FIORENTINI (CA Bar No. 201747) Supervising Deputy Attorney General 9 JON F. WORM (CA Bar No. 248260) LAUREL M. CARNES (CA Bar No. 285690) Deputy Attorneys General 10 600 West Broadway, Suite 1800 San Diego, CA 92101 11 Telephone: (619) 738-9325 Email: [email protected] 12 Email: [email protected] Email: [email protected] 13 Counsel for the People of the State of California 14 UNITED STATES DISTRICT COURT 15 NORTHERN DISTRICT OF CALIFORNIA 16 SAN FRANCISCO DIVISION 17 IN RE: CHRYSLER-DODGE-JEEP No. 3:17-md-02777-EMC 18 ECODIESEL MARKETING, SALES PRACTICES, AND PRODUCTS CONSENT DECREE 19 LIABILITY LITIGATION Hon. Edward M. Chen 20 21 22 23 24 25 CONSENT DECREE 3:17-md-2777-EMC Case 3:17-md-02777-EMC Document 484-1 Filed 01/10/19 Page 2 of 224 1 UNITED STATES, 2 Plaintiff, 3 v. 4 FCA US LLC, 3:17-cv-3446-EMC 5 FIAT CHRYSLER AUTOMOBILES N.V., V.M. -

2017 Annual Report

2017 ANNUAL REPORT 2017 | ANNUAL REPORT 3 Table of contents Table of contents Board of Directors and Auditor ...................... 5 Consolidated Financial Statements at December 31, 2017 ................................ 135 Letter from the Chairman and the CEO ......... 7 Consolidated Income Statement ...................... 136 Consolidated Statement Board Report ................................................ 11 of Comprehensive Income/(Loss) ..................... 137 Certain Defined Terms ....................................... 12 Consolidated Statement of Financial Position ... 138 Selected Financial Data ..................................... 13 Consolidated Statement of Cash Flows ............ 139 Risk Factors ...................................................... 16 Consolidated Statement of Changes in Equity .. 140 Overview ........................................................... 32 Notes to the Consolidated Financial Statements .. 141 Our Business Plan ............................................. 34 Company Financial Statements ................ 233 Overview of Our Business .................................. 35 Income Statement ............................................ 234 Operating Results .............................................. 44 Statement of Financial Position ......................... 235 Subsequent Events and 2018 Guidance ............ 76 Notes to the Company Financial Statements .... 236 Other Information ............................................. 246 Major Shareholders .......................................... -

4/2 Wheeler DEALER LIST Across India-14 MAR 18

POST-GST AFD DEALER CONTACT DETAILS 14-03-2018 PLEASE CONTACT NEAREST DEPOT FOR POST-GST 4/2 WHEELER PRICES S.NO. LOCATION NAME OF PRINCIPLE COMPANY NAME OF DEALER ADDRESS CONTACT DETAILS M/S HONDA MOTORCYCLE & 9357440003 0163-4221101, 1 ABOHAR M/S MODERN MOTORS B-V-1148, THANA ROAD, ABOHAR-152116 SCOOTER INDIA (P) LTD 4500943 HANUMANGARH ROAD ,NEAR BAJAJI 2 ABOHAR M/S HYUNDAI MOTORS INDIA LTD M/S AMAN AUTO ZONE 9855267900 DHAM, ABOHAR-152116 10-59 1 PLOT NO 2 & 3, RAMNAGAR KHOJA 3 ADILABAD M/S ROYAL ENFIELD MOTORS LTD M/S ASHWIK MOTORS COLONY, DASNAPUR, MAVALA ADILABAD, 8297388779 TELANGANA- 504002. YAMUNA COMPLEX, M.C. ROAD, ADOOR - 4 ADOOR M/S ROYAL ENFIELD MOTORS LTD M/S YAMUNA AGENCIES 9562144401 691 523, KERALA NUTAN NAGAR, AGARTALA AIRPORT ROAD, 5 AGARTALA M/S ROYAL ENFIELD MOTORS LTD M/S XED MOTORCYCLES 8415951975 AGARTALA, TRIPURA - 799009 NEAR MANGO HOTEL, OPP BHAGWATI M/S FCA INDIA AUTOMOBILES PVT. 6 AGRA M/S KALYAN AUTOMART PRIVATE LIMITED DHABA SIKANDRA, BYE PASS ROAD, AGRA - AMIT SHARMA - 9837034507 LTD. 282007. KHASRA NO. 3529, SITUATED AT ABADI OF M/S HONDA MOTORCYCLE & MAUJA MATHURABANGER, MUHAL, 7 AGRA M/S BRAJESHWARI MOTORS PVT LTD MR VIKAS AGRAWAL - 9897288200 SCOOTER INDIA (P) LTD GAIRBANDAGAN,TEHSIL & DISTRICT- MATHURA UP-281001 KHASRA NO. 3529, SITUATED AT ABADI OF M/S HONDA MOTORCYCLE & MAUJA MATHURABANGER, MUHAL, 8 AGRA M/S BRAJESHWARI MOTORS PVT LTD MR VIKAS AGRAWAL - 9897288200 SCOOTER INDIA (P) LTD GAIRBANDAGAN,TEHSIL & DISTRICT- MATHURA UP-281001 PLOT NO F6, PHASE - 2, TRANS YAMUNA M/S HONDA MOTORCYCLE & 9 AGRA M/S MANGAL MOTORS PRIVATE LIMITED COLONY, AGRA -282006 DIST. -

28E99536f14744563029725ed3

For over 75 years, the Jeep Brand has been conquering lands and hearts alike. Its unwavering heritage and dedication to discovering the ® unknown stands tall even today. Indelibly linked to freedom, adventure, authenticity, and passion, these core values are embodied in every Jeep vehicle’s DNA. ® Introducing the Jeep Compass Trailhawk® – an SUV that combines these core ideals with the predatory dominance of a hawk. Built to ® dominate every challenging terrain, its Trail Rated® badge is an armation of the same capability and a sign of its worldwide o-roading SUPERIOR authority. Outfitted with coveted creature comforts and world-class 4x4 capability, your journey to owning the wild begins here. BY NATURE. Dual Zone Automatic Climate Control The Dual Zone Automatic Climate Control constantly adjusts air temperature inside the cabin to create separate customised environments providing excellent comfort for all passengers. Pure adventure outside. Pure luxury 17.78 cm (7) Premium Instrument Cluster A state-of-the-art, reconfigurable 17.78 cm (7) wide instrument cluster displays all the essential information, helping you feel inside. connected and secure. The Jeep Compass Trailhawk® has been built with the capability to go anywhere. Its ® cockpit and cabin are designed to keep you comfortable everywhere, on city roads and uneven terrain. To add to it, the sporty design, handpicked leather, plush seats, and sophisticated finishes take comfort and luxury to extraordinary heights. Engine Stop - Start System The Engine Stop - Start System ensures the engine intelligently turns o instantly when not in use and restarts automatically when needed. When going through heavy trac, this feature Plush Seats reduces the amount of time the engine stays idle, thereby Every aspect of the Trailhawk® interior is designed to give reducing fuel consumption and emissions. -

Fiat India Automobiles Private Limited

Fiat India Automobiles Private Limited September 27, 2018 Summary of rated instruments Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial Paper 500.0 625.0 [ICRA]A1+; Reaffirmed Fund-based – Cash Credit 625.0 500.0 [ICRA]AA- (Stable); Reaffirmed Fund-based – Term Loan 1,365.0 1,490.0 [ICRA]AA- (Stable); Reaffirmed [ICRA]AA- (Stable); Reaffirmed Non Fund-Based 10.0 10.0 [ICRA]A1+; Reaffirmed Total 2,500.0 2,625.0 *Instrument details are provided in Annexure-1 Rating action ICRA has reaffirmed the long-term rating of FIAT India Automobiles Private Limited (FIAPL) at [ICRA]AA- (pronounced ICRA double A minus)1 on the Rs. 1,490.0-crore2 (enhanced from Rs 1,365.0 crore) long-term loan and the Rs. 500.0-crore (reduced from Rs 625.0 crore) fund-based bank facilities. ICRA has also reaffirmed the long-term rating at [ICRA]AA- and reaffirmed short-term rating at [ICRA]A1+ (pronounced ICRA A one plus) for the Rs. 10.0-crore non-fund based limits of FIAPL. The outlook on the long-term rating is Stable. ICRA has reaffirmed the rating of [ICRA]A1+ for the Rs. 625.0-crore (enhanced from Rs. 500.0 crore) commercial paper programme of FIAPL. Rationale The ratings reaffirmation reflects FIAPL’s strong operational, managerial and financial support from its promoter group, TML (rated [ICRA]AA (Positive) and [ICRA]A1+) and FCA Italy SpA (FCA)3. ICRA notes the firm’s strategic importance for the promoter group (as sole manufacturer of JEEP and Fiat branded vehicles in India as well as Nexon compact utility vehicle for TML) and assured profits under take-or-pay agreement. -

Index More Information

Cambridge University Press 978-1-108-43379-2 — Making Cars in the New India Tom Barnes Index More Information Index 253 t Index Aathi hamizhar Peravai (ATP), 121 Bajaj Auto, 58–60, 123 AGC Automotive, 50 export share, 58–59 All-India Central Council of Trade Unions factories, 58 (AICCTU), 119 industrial conlict at, 124 All-India Trade Union Congress motorcycle and three-wheeler (AITUC), 114, 165 production volume, 59 American automotive OEMs, 18 regular workforce, 58 apprentices, 218 suppliers, 60 Apprenticeship Act, 101 Bellsonica, 45 Asahi India, 45 BharatBenz, 55, 57, 119 Ashok Leyland, 57 Bharatiya Janata Party (BJP), 165 Ashutosh Rubber, 53 Bharatiya Kamdar Ekta Sangh (BKES), Asia, auto-producing regions in, 37 128 auto assembly manufacturing, 9 Bharatiya Mazdoor Sangh (BMS), 165 auto-based global value chains, 15 Bharat Seats, 45 Automotive Components Manufacturers Bhargava, R.C., 197 Association of India (ACMA), 137 Bidi Workers Welfare Cess Act 1976, 100 automotive global production networks, BMW, 119 17–23 passenger cars and Sports Utility automotive manufacturers in NCR, Vehicles (SUVs), 1 149–158 Bosch India, 16, 69 average proportion of contract labour, BRIC (Brazil, Russia, India, China) 155–156 economies, auto manufacturing in, 10 female labour force participation, 156 Building and Other Construction Workers’ hiring and employment relations Welfare Cess Act 1996, 100 practices, 151 buyer-driven commodity chain, 12–13 wage rates, 156–158 Automotive Mission Plan 2006- 2016 Caparo Engineering India, 123 (AMP-1), 96 Caparo Maruti, -

Forrh; O'kz 2019&2020 Esa Fofhkuu Okgu Fuekzrkvksa }Kjk }Kjk Ykwp Fd

foRrh; o’kZ 2019&2020 esa fofHkUu okgu fuekZrkvksa }kjk }kjk ykWp fd;s x;s vuqeksfnu ekWMyksa okguksa dk fooj.k Ø0 okguksa dk fooj.k la0 E-rickshaw/-E-cart 1 ^^SAMRAT Chief-R03” Special Purpose Battery Operated Three Wheeler-E-cart, Goods Vehicle, 01 Seats. 2 DABANG” Special Purpose Battery Operated Three Wheeler-E-Rickshaw, Passenger Vehicle, 05 Seats. 3 G-ONE, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 4 ^^OGATA R1 DLX, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 5 ^^City Metro, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 6 Comfort F2F, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 7 M2J, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 8 Rajeev Auto, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 9 Treo Yaari HRT, Three Wheeler E-Rickshaw, 05 seats 10 Treo HRT, Electric Three Wheeler (Battery Operated Vehicle)-L5M, 04 seats 11 RAJHANS, Special Purpose Battery Operated Three Wheeler E-Rickshaw, 05 seats 12 ele Cargo, Special Purpose Battery Operated Three Wheeler E-Cart, 01 seats 13 BAAZ XL, Special Purpose Battery Operated Three Wheeler E-Cart, 01 seats Battery operated Three wheeler 14 NANDI-EV-PASSENGER CARRIER 4+1, Electric Three Wheeler Passenger Carrier-L5M, 05 Seats 15 Xero Li Ion, Two Wheeler BOV-L2, 02 seats 16 ZEAL, Two Wheeler Battery Operated Vehicle- L2, 02 seats M/s Hyundai Motor India Ltd. 17 Santro 1.1 MT Dlite, 5 Door-Passenger Car with Catalytic Converter-M1, (Petrol Engine), 05 seats,