PARAMOUNT GROUP, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PARAMOUNT GROUP, INC. (Exact Name of Registrant As Specified in Its Charter)

, UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended: December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from To Commission File Number: 001-36746 PARAMOUNT GROUP, INC. (Exact name of registrant as specified in its charter) Maryland 32-0439307 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 1633 Broadway, Suite 1801, New York, NY 10019 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 237-3100 Securities registered pursuant to section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock of Paramount Group, Inc., PGRE New York Stock Exchange $0.01 par value per share Securities registered pursuant to section 12(g) of the Act: Title of each class None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Paramount Group, Inc

Exhibit 99.2 SUPPLEMENTAL OPERATING AND FINANCIAL DATA FOR THE QUARTER ENDED MARCH 31, 2021 1633 Broadway 1301 Avenue of the Americas 31 West 52nd Street One Market Plaza 300 Mission Street Market Center FORWARD-LOOKING STATEMENTS This supplemental information contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by our use of the words “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects” and similar expressions that do not relate to historical matters. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and could materially affect actual results, performance or achievements. These factors include, without limitation, the negative impact of the coronavirus 2019 (COVID-19) global pandemic on the U.S., regional and global economies and our tenants' financial condition and results of operations, the ability to enter into new leases or renew leases on favorable terms, dependence on tenants’ financial condition, trends in the office real estate industry including telecommuting, flexible work schedules, open workplaces and teleconferencing, the uncertainties of real estate development, acquisition and disposition activity, the ability to effectively integrate acquisitions, the costs and availability of financing, the ability of our joint venture partners to satisfy their obligations, the effects of local, national and international economic and market conditions, the effects of acquisitions, dispositions and possible impairment charges on our operating results, regulatory changes, including changes to tax laws and regulations, and other risks and uncertainties detailed from time to time in our filings with the U.S. -

Commercial Mortgage Alert

JANUARY 15, 2016 Buyers Resigned to Holding B-Pieces 10 Years B-piece buyers have concluded that risk-retention regulations will be even more 6 REIT BOOKRUNNER RANKING onerous than initially believed. The rules, which will take effect Dec. 24, impose the requirement that buyers 9 GLOBAL CMBS ISSUANCE hold B-pieces for at least five years. But investors now say that the way the guide- 11 CMBS SPREAD PREDICTIONS lines are written, buyers will typically end up having to retain the bonds for the entire life of a conduit deal — at least 10 years. The realization is making it harder 2 Three Banks Backing SF Office Project for investment managers to attract capital for such purchases, which are vital for the operation of the commercial MBS market. 2 Paramount Eyes Refi at 2nd NY Tower That’s the latest in a series of worries resulting from ongoing analysis by CMBS 2 Mesa West Lends on Chicago Tower issuers and investors about how the long-planned regulations will affect the sector. “As we get closer to the compliance deadline and more people are thinking harder 4 Margin Plan for Agency Loans Dead about how they’re going to deal with risk retention, problems like this are going to See BUYERS on Page 10 4 Conduit Issuers Test Investor Demand 5 Loan on Midtown Tower Split 11 Ways Blackstone Taps 3 Lenders for BioMed Deal 5 Law Firm Not Finished Growing Blackstone has lined up $2 billion of floating-rate financing from three banks for BioMed Realty. 5 Morgan Stanley Seeks DC Office Loan its pending takeover of Citibank and MUFG Union Bank won the mandate for a $1.25 billion loan on 16 6 BofA Takes REIT Crown; Volume Up office and laboratory properties. -

Hudson Yards FGEIS

TABLE OF CONTENTS Chapter 8: Shadows ...............................................................................................8-1 A. INTRODUCTION..................................................................................................................8-1 1. ISSUES.................................................................................................................................8-1 2. PRINCIPAL CONCLUSIONS...................................................................................................8-1 3. METHODOLOGY ..................................................................................................................8-2 4. MAXIMUM SHADOW STUDY AREA.....................................................................................8-3 5. CRITERIA AND REGULATIONS ............................................................................................8-3 6. DATA SOURCES ..................................................................................................................8-4 7. SCREENING AND DETAILED ANALYSIS METHODOLOGIES .................................................8-4 B. EXISTING CONDITIONS ....................................................................................................8-5 1. STUDY AREA ......................................................................................................................8-5 2. OTHER STUDY AREAS (CORONA YARD) ............................................................................8-5 3. OPEN SPACES – EXISTING CONDITIONS -

Njit-Etd2014-011

Copyright Warning & Restrictions The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Under certain conditions specified in the law, libraries and archives are authorized to furnish a photocopy or other reproduction. One of these specified conditions is that the photocopy or reproduction is not to be “used for any purpose other than private study, scholarship, or research.” If a, user makes a request for, or later uses, a photocopy or reproduction for purposes in excess of “fair use” that user may be liable for copyright infringement, This institution reserves the right to refuse to accept a copying order if, in its judgment, fulfillment of the order would involve violation of copyright law. Please Note: The author retains the copyright while the New Jersey Institute of Technology reserves the right to distribute this thesis or dissertation Printing note: If you do not wish to print this page, then select “Pages from: first page # to: last page #” on the print dialog screen The Van Houten library has removed some of the personal information and all signatures from the approval page and biographical sketches of theses and dissertations in order to protect the identity of NJIT graduates and faculty. ABSTRACT IS THE PUBLIC INVITED? DESIGN, MANAGEMENT AND USE OF PRIVATELY OWNED PUBLIC SPACES IN NEW YORK CITY by Te-Sheng Huang Researchers in urban planning, urban design, landscape architecture and sociology often criticize the increasing privatization of public space in the US for limiting the diversity of uses and users. -

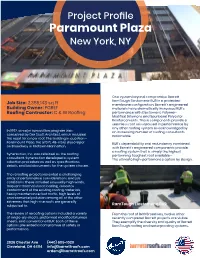

Paramount Plaza Project Profile

Project Profile Paramount Plaza New York, NY One system beyond compromise: Barrett RamTough Elastomeric BUR in a protected Job Size: 2,359,148 sq ft membrane configuration. Barrett’s engineered Building Owner: PGREF materials have dramatically increased BUR’s Roofing Contractor: C & W Roofing performance with Elastomeric Polymer- Modified Bitumens and Spunbond Polyester Reinforcements. These components provide a seamless roof unsurpassed in performance by any other roofing system as acknowledged by In 1992, a major renovation program was an increasing number of roofing consultants conceived by Der Scutt Architect, which included nationwide. the need for a new roof. The building in question— Paramount Plaza, the 670 ft, 48-story skyscraper BUR’s dependability and redundancy combined on Broadway in Midtown Manhattan. with Barrett’s engineered components provide a roofing system that is simply the highest Syneraction, Inc. was retained as the roofing performing, toughest roof available— consultant. Syneraction developed a system The ultimate high-performance option by design. selection procedure as well as specifications, details, and bid documents for the system chosen. The reroofing project presented a challenging array of performance considerations and job conditions: these included unusually high winds, frequent thermal shock loading, asbestos containment of the existing roofing materials, heavy maintenance foot traffic, high levels of environmental pollution among all of the other extremes that high-rise roofs are generally subjected to. RamTough Elastomeric BUR The review of reroofing options included a variety From the roof of 1633 Broadway, twelve other of single-ply sheets, preformed modified bitumen recently completed Barrett projects are visible. sheets, and conventional BUR. -

Robert Gorton Partner EXPERIENCE Robert Gorton Has Been Engaged

Robert Gorton Partner EXPERIENCE Robert Gorton has been engaged in Construction Management and Owner's Representation since 1972. He has been responsible for all aspects of the building development process as a senior executive. Through the 1970's Mr. Gorton worked with Tishman Realty and Construction developing his skills in estimating, purchasing, scheduling and project management. In early 1980 Mr. Gorton joined the newly formed construction management firm, Lehrer McGovern (Bovis), starting as a Project Manager and leaving in 1988as the Senior Vice President-Director of Domestic Operations. During his tenure, the firm had grown from a small New York City construction management firm of 10 employees to the fourth largest construction management firm in the country with over 1,200 employees. After leaving Lehrer McGovern, Mr. Gorton joined Edward J. Minskoff Equities, Inc., New York City Developer (EJME), as Senior Vice President/Construction. During his tenure at EJME, he was responsible for the commercial office building known as 1325 Avenue of the Americas, 101 Avenue of the Americas, a 412,000 sf commercial office building, and 712 Fifth Avenue, a 500,000 sf commercial office building. In 1994, Mr. Gorton founded Gorton Associates, Inc., a full service Project Management Consulting firm headquartered in New York City. Mr. Gorton has consulted on numerous renovation and new construction projects in New York City and throughout the East Coast, specializing in residential, commercial, tenant and retail spaces. REPRESENTATIVE ASSIGNMENTS . Metropolitan Museum of Art- Multiple Projects, New York, NY . Sotheby’s, New York, NY . Private Residence, Fifth Avenue, New York, NY . Columbia University, New York, NY . -

Repairs on the Verizon

GOTHAM GIGS FROM BOMBS TO BIKES Combat engineer puts the pieces back together CRAIN’S® NEW YORK BUSINESS PAGE 8 VOL. XXIX, NO. 2 WWW.CRAINSNEWYORK.COM JANUARY 14-20, 2013 PRICE: $3.00 Repairs on the CUOMO’S Verizon Telecom’s $1B worth of Sandy damage CASINO could offer silver lining for company FLIP BY MATTHEW FLAMM Nearly three months after Super- storm Sandy knocked out power in lower Manhattan, 160 Water St. is Governor does a ‘180,’ sending its own little ghost town, vacant since seawater filled its basement gambling lobbyists scrambling the night of Oct. 29. But the emptiness of the 24- story building means more than just BY CHRIS BRAGG the absence of tenants like the New York City Health and Hospitals A year ago, Gov. Andrew Cuomo made the centerpiece of his State of Corp. Sliced-off copper cables from the State address an ambitious plan to legalize casino gambling in New the Verizon phone system hang from the telecommunications York. A $4 billion convention center in Queens was to be built next to “frame room” walls, its floor still the Aqueduct racino, which seemed certain to become the city’s first puddled in water. When 160 Water full-fledged casino. In the 2013 iteration of the speech last week, the St. reopens next month, the frame governor reversed himself. He said casinos in the city would under- room will re- mine the goal of drawing Gotham’s 52 million tourists upstate. The main empty. first three gambling venues he eyes for the state now appear destined All the phone 300K for north of the metropolitan area. -

9 West 57Th Street

Space Report of Select Relocation Alternatives February 13, 2013 Looking for office space in New York City? Click here to contact us for a free customized report. Table of Contents 1. 250 WEST 55TH STREET 2. 9 WEST 57TH STREET 3. 681 FIFTH AVENUE 4. 712 FIFTH AVENUE 5. 717 FIFTH AVENUE 6. 745 FIFTH AVENUE 7. 540 MADISON AVENUE 8. 660 MADISON AVENUE 9. 1370 AVENUE OF THE AMERICAS 10. 888 SEVENTH AVENUE th 250 West 55 Street Location: BETWEEN BROADWAY AND EIGHTH AVENUE AVAILABLE SPACE Floor Rentable Area Asking Rental (in square feet) (per square foot) Multiple floors available in Roughly 24,000 rsf each $80’s - $90’s the base and tower of the building. COMMENTS: • Brand new LEED Gold construction. All floors feature oversized windows, 10’ finished ceilings, column free floorplates and minimal core penetrations. • Tower floors have incredible Southern, Western and Northern Views. ELECTRICITY: Submetered LANDLORD’S WORK: Build-to-suit POSSESSION: June 1, 2013 TERM: 10 years minimum BUILDING PROFILE OWNERSHIP: Boston Properties, Inc. YEAR BUILT: 2013 BUILDING AREA: 1,052,150 square feet NUMBER OF FLOORS: 38 250 West 55th Street Actual Photos and Renderings 250 West 55th Street Actual Photos and Renderings 250 West 55th Street Typical Core and Shell Plan – Tower Floors th 9 West 57 Street Solow Building Location: BETWEEN FIFTH & SIXTH AVENUES AVAILABLE SPACE Floor Rentable Area Asking Rental (in square feet) (per square foot) th th Entire 30 – 49 Approximately $165 - $200 31,000 rsf Each (divisible) COMMENTS: • Partial 30th – 49th Floors: Pricing reflects units to be built on the north side of the building with unobstructed views of Central Park. -

CPY Document

430 FEDERAL TRADE COMMISSION DECISIONS Complaint (;7 F. IK THE L'\TI' En OF A;\IERICAN HOME PRODUCTS CORPORATIOX Docket X o. 8318 BRISTOL- !YERS CmIP AXY, Docket 1'0. 8319 PLOl:GH, IXC. , Docket No. 8320 STERLIKG DRUG, INC., Docket No. 8321 ORDERS , OPINION , ETC. , IX REGARD '10 THE ALLEGED VIOLATION OF THE FEDERAL TRADE COl\BIISSION ACT Dockets 8318, 8819/8320 8321. Comp aint8 . Mar. 14, 1961- Deels-ions , Apr. , 1965 Order \vithdl'awing complaints against four major drug manufacturers which charged them witb false and misleading advertising of their analgesic preparations, rescinding earlier orders to submit special reports , and denying one respondent' s motion for prehearing discovery on grounds of ruootness. COMPLAINT 2 Pursnant to the provisions of the Federal Trade Commission Act and by virtue of the authority vested in it by said Act, the Federal Trade Commission , having reason to be1ieve that American Home Products Corporation , he.reinafter referred to LS respondent, has vio- lated the provisions of said Act, and it appearing to the Commission that a proceeding by it in respect thereof would be in the public interest, hereby issues its complaint stating its charges in that respect as follows: PAHAGRAPH 1. R.espondent American Home Products Corporation is a corporation organized, existing and doing business under and by virtue of the laws of the State of Delaware, with its principal offce and place of business located at 20 East 40th Street in the city of New York, State of New York. PAn. 2. Respondent is now , and for some time last past has been engaged in the sale and distribution of a preparation which comes within the classification of drugs as t.he term "drug" is defined in the Federal Trade Commission Act. -

United States Department of the Interior Minerals Management Service

CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 1 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 10th OCS Oil and Gas Lease Sale 00087 DEC/QUAL : 09-OCT-1962 Term Date : 09-OCT-1962 Regns : G 11th OCS Oil and Gas Lease Sale Zone 3 00100 DEC/QUAL : 28-APR-1964 Term Date : 28-APR-1964 Regns : G 12th OCS Oil and Gas Sale Zone 2 00118 DEC/QUAL : 01-JAN-1947 Term Date : 14-OCT-1968 Regns : G 1400 CORP. 00622 DEC/QUAL : 10-DEC-1980 Term Date : 22-APR-1982 Regns : P 145 OG HOLDINGS, LLC 03267 4514 Cole Ave. DEC/QUAL : 07-NOV-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 2 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 157 OG Holdings, LLC 03271 4514 Cole Avenue DEC/QUAL : 21-DEC-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG 1982 Drilling Program 00830 Box 6629 DEC/QUAL : 14-NOV-1983 San Antonio, TX 78209 Term Date : 19-JUL-1988 Regns : P 1986 STEA Limited Partnership I 01145 1221 Lamar, Suite 1600 DEC/QUAL : 19-JUN-1987 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-I STEA Limited Partnership 01253 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-VI STEA Limited Partnership 01252 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 3 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 1988-I TEAI Limited Partnership 01470 c/o Torch Energy Assoc. -

Bfm:978-1-56898-652-4/1.Pdf

Manhattan Skyscrapers Manhattan Skyscrapers REVISED AND EXPANDED EDITION Eric P. Nash PHOTOGRAPHS BY Norman McGrath INTRODUCTION BY Carol Willis PRINCETON ARCHITECTURAL PRESS NEW YORK PUBLISHED BY Princeton Architectural Press 37 East 7th Street New York, NY 10003 For a free catalog of books, call 1.800.722.6657 Visit our website at www.papress.com © 2005 Princeton Architectural Press All rights reserved Printed and bound in China 08 07 06 05 4 3 2 1 No part of this book may be used or reproduced in any manner without written permission from the publisher, except in the context of reviews. The publisher gratefully acknowledges all of the individuals and organizations that provided photographs for this publi- cation. Every effort has been made to contact the owners of copyright for the photographs herein. Any omissions will be corrected in subsequent printings. FIRST EDITION DESIGNER: Sara E. Stemen PROJECT EDITOR: Beth Harrison PHOTO RESEARCHERS: Eugenia Bell and Beth Harrison REVISED AND UPDATED EDITION PROJECT EDITOR: Clare Jacobson ASSISTANTS: John McGill, Lauren Nelson, and Dorothy Ball SPECIAL THANKS TO: Nettie Aljian, Nicola Bednarek, Janet Behning, Penny (Yuen Pik) Chu, Russell Fernandez, Jan Haux, Clare Jacobson, John King, Mark Lamster, Nancy Eklund Later, Linda Lee, Katharine Myers, Jane Sheinman, Scott Tennent, Jennifer Thompson, Paul G. Wagner, Joe Weston, and Deb Wood of Princeton Architectural Press —Kevin Lippert, Publisher LIBRARY OF CONGRESS CATALOGING-IN-PUBLICATION DATA Nash, Eric Peter. Manhattan skyscrapers / Eric P. Nash ; photographs by Norman McGrath ; introduction by Carol Willis.—Rev. and expanded ed. p. cm. Includes bibliographical references. ISBN 1-56898-545-2 (alk.