Finksburg Planning and Citizens Council

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States District Court for the District of Maryland : Lise L

Case 1:04-cv-02983-CCB Document 51 Filed 06/09/05 Page 1 of 5 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND : LISE L. LINTON, ET AL : : v. : Civil No. CCB-04-2983 : MICHAEL A. BRIAND, ET AL : ...o0o... MEMORANDUM Plaintiff, Lise Linton, instituted this suit in Frederick County Circuit Court with her husband, David Linton, claiming negligence and loss of consortium arising out of a car accident that occurred on August 10, 2003 on Maryland Route 140 in Frederick County, Maryland. The Lintons sued Michael Briand (“Briand”), the driver of the automobile, Donita Rockwell (“Rockwell”), Briand’s girlfriend and passenger in the car, and their own insurance company, Progressive Casualty Insurance Company (“Progressive”). The defendants removed the case to this court based on diversity jurisdiction. In an amended complaint, David Linton was dismissed as a plaintiff and named as a defendant. Due to her physical and emotional injuries, Lise Linton sued the defendants for $1,500,000 in compensatory damages, plus interest and costs of the suit. Both David Linton and Progressive filed a cross-claim against Briand and Rockwell for contribution and indemnification. Now pending before the court is defendant Rockwell’s motion for summary judgment as to all claims, cross-claims, and third party claims. This matter has been fully briefed and no hearing is necessary. See Local Rule 105.6. For the reasons stated below, Rockwell’s motion will be granted. BACKGROUND At the time of the automobile accident, Briand lived in Milford, New Hampshire and Rockwell Case 1:04-cv-02983-CCB Document 51 Filed 06/09/05 Page 2 of 5 lived in Cleveland, Ohio. -

Arterial Trip Length Characteristics

Arterial Trip Length Characteristics Stanley E. Young, Dennis So Ting Fong Arterial Trip Length Characteristics Stanley E. Young Traffax, Inc. Dennis So Ting Fong Traffax, Inc. SBIR Phase 3 Transportation Research Project Traffax, Inc. September 2, 2016 D1.5 Arterial Trip Length Characteristics* Deliverable Reference: *Formerly titled Accessibility Measures Report Sensor Fusion and MOE Development for Off-Line Project Name: Traffic Analysis of Real Time Data Contractor: Traffax Inc Contract Number: DTFH61-14-C-00035 Contract Term Start 9/4/2014 Contract Term End 9/4/2017 Key Personnel Stan Young, Darcy Bullock, Dennis So Ting Fong Recommended Citation Young, S. E., and D. S. T. Fong. Arterial Trip Length Characteristics. Purdue University, West Lafayette, Indiana, 2017. https://doi.org/10.5703/1288284316560 Acknowledgments This work was supported by Traffax/USDOT SBIR DTFH6114C00035. The contents of this paper reflect the views of the authors, who are responsible for the facts and the accuracy of the data presented herein, and do not necessarily reflect the official views or policies of the sponsoring organizations. These contents do not constitute a standard, specification, or regulation. Table of Contents 1 Introduction ........................................................................................................................................... 1 2 Approach ............................................................................................................................................... 4 3 Sample Data and Results...................................................................................................................... -

Fairground Village Center

EXCLUSIVE OFFERING FAIRGROUND VILLAGE CENTER WESTMINSTER, MD LOCATION OVERVIEW WINTER’S MILL HIGH SCHOOL 49,905 AADT | CROSSROADS SQUARE | 140 | 140 VILLAGE SHOPPING CENTER | 1 MILE MALCOM DRIVE DOWNTOWN WESTMINSTER 28,947 AADT | FAIRGROUND VILLAGE | Carroll Arthritis, P.A 140 VILLAGE ROAD 3,913 AADT | 140 VILLAGE RD CENTER | 1 MILE CARROLL HOSPITAL EDGE | FAIRGROUND VILLAGE CENTER EDGE | FAIRGROUND VILLAGE CENTER 2 3 LOCATION SUMMARY EMPLOYMENT DRIVERS York Chambersburg McConnellsburg Fort Loudon Westminster is a city in northern Maryland, a suburb of Balti- Fayetteville 30 83 Red Lion more, and is the seat of Carroll County. The city is an outlying Quarryville community within the Baltimore-Towson, MD MSA, which is Spring Grove 81 15 part of a greater Washington-Baltimore-Northern Virginia, West Virginia CSA. Mont Alto Gettysburg Mercersburg Westminster offers four primary highways that serve the city. The most prominent of these is Maryland Route 140, which McSherrystown Hanover follows an east-southeast to west-northwest alignment across Greencastle Oxford the area. To the southeast, MD 140 connects to Baltimore, Shrewbury while north-westward, it passes through Taneytown on its Carroll Valley 35 Miles Waynesboro Stewartstown way to Emmitsburg. Maryland Route 97 is the next most im- Littlestown New Freedom portant highway serving the city, providing the most direct Blue Ridge Summit route southward towards Washington, D.C. Two other pri- MARYLAND-PENNSYLVANIA LINE mary highways, Maryland Route 27 and Maryland Route 31 Sabillasville Emmitsburg 23 Miles provide connections to surrounding nearby towns. Maugansville 97 Westminster ranks #5 in the best places to live in Carroll Manchester Smithsburg Taneytown County according to Niche.com, due to it’s affordability, Hagerstown traffic free commutes, and location to major employment. -

February 19, 2019 (PDF)

MEETING SUMMARY Carroll County Planning and Zoning Commission February 19, 2019 Location: Carroll County Office Building Members Present: Richard Soisson, Chair Cynthia L. Cheatwood, Vice Chair (9:07 a.m.) Jeffrey A. Wothers Daniel E. Hoff Janice R. Kirkner, Alternate Ed Rothstein, Ex-officio Members Absent: Eugene A. Canale Alec Yeo Present with the Commission were the following persons: Lynda Eisenberg, Mary Lane, Arco Sen and Laura Bavetta, Department of Planning; Clay Black, Kierstin Eggerl and David Becraft, Development Review; Tom Devilbiss, Land and Resource Management and Jay Voight, Zoning Administrator were present. CALL TO ORDER/WELCOME Chair Soisson called the meeting to order at approximately 9:00 a.m. ESTABLISHMENT OF QUORUM Laura Bavetta took attendance and noted that five members of the Board were present and a quorum was in attendance. Ms. Cheatwood arrived at 9:07 a.m. and six members were present. PLEDGE OF ALLEGIANCE REVIEW AND APPROVAL OF AGENDA On motion of Mr. Wothers, seconded by Ms. Kirkner and carried, the Agenda was approved. REVIEW AND APPROVAL OF MINUTES On motion of Mr. Wothers, seconded by Ms. Kirkner and carried, the Minutes from the February 6, 2019 meeting were approved. PUBLIC COMMENTS There were no public comments. COMMISSION MEMBER REPORTS A. COMMISSION CHAIRMAN Chair Soisson reported that he approved South Carroll Gateway Industrial Park Lot 5, Roy’s Body Shop, South Carroll Photovoltaic Facility and Blue Ridge Horizons. B. EX-OFFICIO MEMBER Commissioner Rothstein did not have anything to report. Planning and Zoning Commission 2 February 19, 2019 Official Minutes C. OTHER COMMISSION MEMBERS Mr. -

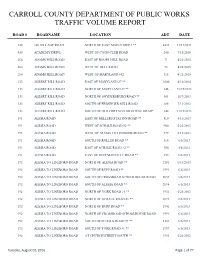

Traffic Volume Report

CARROLL COUNTY DEPARTMENT OF PUBLIC WORKS TRAFFIC VOLUME REPORT ROAD # ROADNAME LOCATION ADT DATE 344 140 VILLAGE ROAD NORTH OF EAST MAIN STREET ** 4433 11/17/2011 455 ACADEMY DRIVE WEST OF COON CLUB ROAD 240 7/18/2016 260 ADAMS MILL ROAD EAST OF ROOPS MILL ROAD 71 4/23/2015 260 ADAMS MILL ROAD WEST OF BELL ROAD 78 4/23/2015 260 ADAMS MILL ROAD WEST OF MARYLAND 852 315 4/23/2015 133 ALBERT RILL ROAD EAST OF MARYLAND 27 ** 1600 4/10/2014 133 ALBERT RILL ROAD NORTH OF MARYLAND 27 ** 346 11/15/2013 133 ALBERT RILL ROAD NORTH OF SNYDERSBURG ROAD ** 381 11/7/2013 133 ALBERT RILL ROAD SOUTH OF FRIDINGER MILL ROAD 186 7/11/2013 133 ALBERT RILL ROAD SOUTH OF OLD FORT SCHOOLHOUSE ROAD* 348 11/15/2013 191 ALESIA ROAD EAST OF MILLERS STATION ROAD ** 810 5/16/2013 191 ALESIA ROAD WEST OF SCHALK ROAD #2 ** 900 5/23/2013 191 ALESIA ROAD WEST OF ALESIA TO LINEBORO ROAD ** 779 6/13/2013 191 ALESIA ROAD SOUTH OF ROLLER ROAD ** 314 6/6/2013 191 ALESIA ROAD EAST OF SCHALK ROAD #2 ** 760 5/8/2013 191 ALESIA ROAD EAST OF HOFFMANVILLE ROAD ** 355 6/6/2013 192 ALESIA TO LINEBORO ROAD NORTH OF ALESIA ROAD ** 2181 6/13/2013 192 ALESIA TO LINEBORO ROAD SOUTH OF RUPP ROAD ** 1991 6/6/2013 192 ALESIA TO LINEBORO ROAD SOUTH OF CROSSROAD SCHOOLHOUSE ROAD 2057 6/6/2013 192 ALESIA TO LINEBORO ROAD SOUTH OF ALESIA ROAD ** 2694 6/6/2013 192 ALESIA TO LINEBORO ROAD NORTH OF YORK ROAD #1 ** 1952 5/23/2013 192 ALESIA TO LINEBORO ROAD NORTH OF SCHALK ROAD #1 ** 2073 6/6/2013 192 ALESIA TO LINEBORO ROAD NORTH OF RUPP ROAD ** 1941 6/6/2013 192 ALESIA TO LINEBORO ROAD NORTH -

Revised March 22, 2010

Revised March 22, 2010 CODE OF MARYLAND REGULATIONS Table of Contents Definitions Page 1 PERMITS AVAILABLE Page 2 TYPES OF PERMITS Page 2 BLANKET PERMIT Page 3 BOOK PERMIT Page 5 CONTAINERIZED CARGO PERMIT Page 7 SPECIAL HAULING PERMIT Page 7 SPECIAL VEHICLE PERMIT Page 9 FEES Page 10 DENIAL OF PERMIT – Conditions Page 13 SUSPENSION & REVOCATION OF PERMIT Page 14 FALSE STATEMENT IN APPLICATIONS Page 16 EXCEPTIONAL HAULING PERMIT Page 16 GENERAL CONDITIONS Page 17 DEFINTIONS Page 17 MISCELLANEOUS CONDITIONS Page 19 FAILURE TO COMPLY WITH REGULATIONS Page 19 COMBINATION OF VEHICLES Page 21 SELF-PROPELLED VEHICLES Page 23 COSTS AND DAMAGES Page 25 SAFETY Page 25 LIMITATIONS Page 28 MOVEMENT ON TOLL FACILITIES PROPERTY Page 29 HOURS OF MOVEMENT – GENERAL Page 30 EMERGENCY MOVEMENT Page 31 CONTINUOUS TRAVEL Page 33 SPECIFIC CONDITIONS Page 36 DEFINITIONS Page 36 VEHICLES OVER 45 TONS, OVER 60 TONS, Page 37 OVER 250 TONS STEEL RIMMED EQUIPMENT Page 38 ii TMS 9/9/10 ESCORT VEHICLES Page 39 SIGNING Page 39 ESCORTS – IN GENERAL Page 40 PRIVATE ESCORT – WHEN REQUIRED Page 40 PRIVATE ESCORT – EQUIPMENT AND Page 41 RESPONSIBILITIES ESCORTED VEHICLES – GENERAL Page 42 RESTRICTIONS POLICE ESCORT Page 43 CONTAINERIZED CARGO PERMITS Page 44 DEFINITIONS Page 44 PERMITS AVAILABLE Page 44 INDIVISIBLE LOAD DETERMINATION Page 45 ROUTES OF TRAVEL Page 45 AUTHORITY TO ISSUE PERMITS Page 55 PROCEDURES Page 55 FEES Page 55 DENIAL OF PERMIT Page 56 MISCELLANEOUS CONDITIONS Page 56 SUSPENSIONS Page 57 FALSE STATEMENT Page 58 COSTS AND DAMAGES Page 59 DIVISION OF BRIDGE DEVELOPMENT (SHA) WEIGHT, Page 60 AXLE CHARTS iii TMS 9/9/10 Title 11 DEPARTMENT OF TRANSPORTATION Subtitle 04 STATE HIGHWAYADMINISTRATION Chapter 01 Permits for Oversize and Overweight Vehicles Authority: Transportation Article, §§-103(b), 4-204, 4-205(f), 8-204(b)—(d), (i), 24-112, 24-113; Article 88B, §§1, 3, 14; Annotated Code of Maryland 11.04.01.01 .01 Definitions A. -

CARR-391 Meadow Brook Farm, (Sam Roop Farm, John Roop Farm)

CARR-391 Meadow Brook Farm, (Sam Roop Farm, John Roop Farm) Architectural Survey File This is the architectural survey file for this MIHP record. The survey file is organized reverse- chronological (that is, with the latest material on top). It contains all MIHP inventory forms, National Register nomination forms, determinations of eligibility (DOE) forms, and accompanying documentation such as photographs and maps. Users should be aware that additional undigitized material about this property may be found in on-site architectural reports, copies of HABS/HAER or other documentation, drawings, and the “vertical files” at the MHT Library in Crownsville. The vertical files may include newspaper clippings, field notes, draft versions of forms and architectural reports, photographs, maps, and drawings. Researchers who need a thorough understanding of this property should plan to visit the MHT Library as part of their research project; look at the MHT web site (mht.maryland.gov) for details about how to make an appointment. All material is property of the Maryland Historical Trust. Last Updated: 04-16-2004 INDIVIDUAL PROPERTY/DISTRICT MARYLAND HISTORICAL TROST INTERNAL NR-ELIGIBILITY REVIEW FORM Property/District Name: Survey Number: CARR- 3q/ Project: Westminster Bypass (MD 140) Agency: .::::S.:..:HA::..:..----------- Site visit by MHT Staff: _L no __ yes Name ------------ Date -------- Eligibility recommended _A__ Eligibility not recommended Criteria: __A Ls :Le __ D Considerations: __A __B __c __ D __E __F __G __None Justification for decision: (Use continuation sheet if necessary and attach map) Documentation on the property/district is presented in: Review and Compliance Files Prepared by: Rita Suffness. Cultural Resources Group Leader. -

In the United States District Court for the District of Maryland

Case 1:11-cv-00622-ELH Document 82 Filed 02/07/12 Page 1 of 61 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND MARK STRICKLAND, Plaintiff, v. Civil Action No.: ELH-11-00622 CARROLL COUNTY, MARYLAND et al., Defendants. MEMORANDUM OPINION Plaintiff Mark Strickland, who is self represented, filed suit1 against the State of Maryland (the “State”); Carroll County, Maryland (“Carroll County” or the “County”); Carroll County Sheriff Kenneth Tregoning; Carroll County Deputy Sheriff Jeffrey Miller; the Carroll County State’s Attorney’s Office (“SAO” or “Carroll County SAO”); Carroll County State’s Attorney Jerry Barnes; and several individual members of the Carroll County SAO: Allan Culver, Esquire; David Daggett, Esquire; Maria Oesterreicher, Esquire; and Arian Noma, Esquire.2 The forty-six page Complaint contains twenty-four counts, relating to civil rights violations allegedly committed against Strickland. Plaintiff seeks compensatory and punitive damages in excess of $2 billion, plus interest and costs. Complaint at page 41 ¶ 1 to page 46 ¶ 24. He also seeks “a preliminary and permanent injunction…preventing Defendants from further depriving Plaintiffs of their rights 1 I shall refer to plaintiff’s “Amended Complaint #1” (ECF 64), titled “Federal & State Civil Rights Violations And Intentional Torts,” as the “Complaint.” Because plaintiff is proceeding pro se, his filings have been “‘liberally construed’” and are “‘held to less stringent standards than formal pleadings drafted by lawyers.’” Erickson v. Pardus, 551 U.S. 89, 94 (2007) (citation omitted). 2 Defendants Barnes, Culver, Daggett, Noma, Oesterreicher, and the SAO are collectively referred to as the “SAO defendants.” Case 1:11-cv-00622-ELH Document 82 Filed 02/07/12 Page 2 of 61 under the Constitution and laws of the United States and the State of Maryland,” id. -

Council Packet 03 23 20.Pdf

AMENDED AGENDA CITY OF WESTMINSTER Mayor and Common Council Meeting Monday, March 23, 2020 at 7 pm https://www.facebook.com/westminstermd/ 1. CALL TO ORDER 2. APPROVAL OF MINUTES A) Mayor and Common Council Meeting of March 9, 2020 B) Closed Meeting of March 9, 2020 3. CONSENT CALENDAR A) Approval of February 2020 Departmental Operating Reports 4. REPORT FROM THE MAYOR 5. REPORTS FROM STANDING COMMITTEES A) Arts Council B) Economic and Community Development Committee C) Finance Committee D) Personnel Committee E) Public Safety Committee F) Public Works Committee G) Recreation and Parks Committee 6. COUNCIL COMMENTS AND DISCUSSION 7. UNFINISHED BUSINESS 1 8. NEW BUSINESS A) Approval – Parking Space License Agreement with the Board of Commissioners and the Carroll County Public Library – Ms. Matthews B) Approval - Police Mutual Aid Agreement regarding the Carroll County COVID-19 Pandemic 2020 Force – Chief Ledwell 9. DEPARTMENTAL REPORTS 10. CITIZEN COMMENTS 11. ADJOURNMENT 2 MINUTES CITY OF WESTMINSTER Mayor and Common Council Meeting Monday, March 9, 2020 at 7 pm CALL TO ORDER Elected Officials Present: Councilmember Chiavacci, Mayor Dominick, Councilmember Gilbert, President Pecoraro, and Councilmember Yingling. Staff Present: Safety and Risk Coordinator DeMay, Director of Community Planning and Development Depo, Deputy Director of Public Works Dick, Director of Recreation and Parks Gruber, Police Chief Ledwell, City Attorney Levan, City Administrator Matthews, Director of Finance and Administrative Services Palmer, Director of Housing Services Valenzisi, and City Clerk Visocsky. APPROVAL OF MINUTES President Pecoraro requested a motion to approve the following: • Mayor and Common Council Meeting minutes of February 24, 2020 • Closed Meeting minutes of February 24, 2020 Councilmember Yingling moved, seconded Councilmember Chiavacci, to approve the minutes of February 24, 2020. -

In the United States District Court for the District of Maryland

Case 1:10-cr-00532-RDB Document 117 Filed 08/05/11 Page 1 of 17 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND UNITED STATES OF AMERICA, * v. * Criminal No. RDB-10-0532 ULYSSES S. CURRIE, et al., * Defendants. * * * * * * * * * * * * * * MEMORANDUM OPINION Defendants Maryland State Senator Ulysses S. Currie (“Senator Currie”), William J. White (“White”), and R. Kevin Small (“Small”) move to dismiss the following charges against them: Conspiracy to violate the Travel Act, 18 U.S.C. § 1952, and the Hobbs Act, 18 U.S.C. § 1951 (Count One), violations of the Travel Act (Counts Two through Seven), and violations of the Hobbs Act, (Count Eight).1 Count One names Defendants Senator Currie, White and Small as co-conspirators, as well their former employer, Shoppers Food Warehouse, Corp. (“Shoppers”).2 Counts Two through Seven allege acts of bribery undertaken by Senator Currie with the assistance of White and Small pursuant to Senator Currie’s alleged corrupt relationship with Shoppers. Count Eight alleges that Senator Currie, aided and abetted by White and Small, obtained money by extortion under color of official right from Shoppers. The parties’ submissions have been reviewed and a hearing was held on July 25, 2011. For the reasons that follow, Defendants’ Motion to Dismiss (ECF No. 45) is DENIED. 1 On May 11, 2011, on a motion from the Government, Counts Nine through Sixteen were dismissed without prejudice. ECF No. 77. Defendants do not move to dismiss the remaining claims articulated in Counts Seventeen and Eighteen, which allege false statements by White and Senator Currie, respectively. -

Mayor and Board of Aldermen Resolution No: 17-23

, / THE CITY OF FREDERICK MAYOR AND BOARD OF ALDERMEN / RESOLUTION NO: 17-23 A RESOLUTION concerning The Frederick County Hazard Mitigation Plan WHEREAS, the Disaster Mitigation Act of 2000, as amended, requires that local governments, develop, adopt, and update natural hazard mitigation plans in order to receive certain federal assistance, and WHEREAS, a Hazard Mitigation Planning Committee (HMPC), composed of various county agencies and representatives from Frederick County, the City of Frederick and the towns of Brunswick, Burkittsville, Emmitsburg, Middletown, Mount Airy, Myersville, New Market, Rosemont, Thurmont, Woodsboro, and Walkersville was convened in order to study the risks from and vulnerabilities to natural hazards, and to make recommendations for mitigating the effects of such hazards on Frederick County and its municipalities; and WHEREAS, a request for proposals was issued to hire an experienced consulting firm to work with the HMPC to update the previous comprehensive hazard mitigation plan for Frederick County; and WHEREAS, the efforts of the HMPC members and the consulting firm of Dewberry, in consultation with members of the county's public, private and non-profit sectors, have resulted in an update of the Frederick County Hazard Mitigation Plan including the City of Frederick. NOW THEREFORE, BE IT RESOLVED by the Mayor and Board of Aldermen of the City of Frederick that the Frederick County Hazard Mitigation Plan dated May 2016 is hereby approved and adopted for the City of Frederick., A copy of the plan is attached to this resolution. ADOPTED AND APPROVED this 7th day of December, 2017. WITNESS: APPROVED FOR LEGAL SUFFICIENCY: City Attorney TABLE OF CONTENTS TABLE OF CONTENTS ................................................................................................................................. -

Appendix 3-1: HIRA Methodology & Reference Data

Appendix 3-1: HIRA Methodology & Reference Data A blend of quantitative factors extracted from the National Center for Environmental Information, local damage assessment data, and the 2018 Local Risk Perspective Survey, were used for the new 2018 Baltimore City Hazard Identification and Risk Assessment (HIRA). The following five (5) rating parameters were used to develop hazard risk ranking for the (15) identified sixteen hazards. Probability Probability means the likelihood of the hazard occurring and are defined in terms of general descriptors, (for example, unlikely, somewhat likely, likely, highly likely), historical frequencies, statistical probabilities, and/or hazard probability maps. Deaths Hazard related deaths correlate to the severity of impact to the community from any specific hazards. Injuries Hazard related injuries correlate to the severity of impact to the community from any specific hazards. Damages Hazard related damages include both property and crop damages and correlate to the severity of impact to the community from any specific hazards. Local Hazard Risk Perspective A local hazard risk perspective provides a basis for determining those hazards that are of concern to people who work and/or live in the planning area. Levels of concern are defined in terms of general descriptors, (for example, not concerned, somewhat concerned, concerned, very concerned). 1 Table 3-1 below provides the specific rating criteria used in this analysis. All rating criteria are equally weighted. HIRA results are presented in Table 3-2.