ASEAN Investment Report 2015 Invest in ASEAN Infrastructure Investment and Connectivity ASEAN INVESTMENT REPORT 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agreements That Have Undermined Venezuelan Democracy Xxxxxxxxxxxxxxxxxxxxxxthe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements That Have Undermined Venezuelan Democracy

THE CHINA DEALS Agreements that have undermined Venezuelan democracy xxxxxxxxxxxxxxxxxxxxxxThe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements that have undermined Venezuelan democracy August 2020 1 I Transparencia Venezuela THE CHINA DEALS Agreements that have undermined Venezuelan democracy Credits Transparencia Venezuela Mercedes De Freitas Executive management Editorial management Christi Rangel Research Coordinator Drafting of the document María Fernanda Sojo Editorial Coordinator María Alejandra Domínguez Design and layout With the collaboration of: Antonella Del Vecchio Javier Molina Jarmi Indriago Sonielys Rojas 2 I Transparencia Venezuela Introduction 4 1 Political and institutional context 7 1.1 Rules of exchange in the bilateral relations between 12 Venezuela and China 2 Cash flows from China to Venezuela 16 2.1 Cash flows through loans 17 2.1.1 China-Venezuela Joint Fund and Large 17 Volume Long Term Fund 2.1.2 Miscellaneous loans from China 21 2.2 Foreign Direct Investment 23 3 Experience of joint ventures and failed projects 26 3.1 Sinovensa, S.A. 26 3.2 Yutong Venezuela bus assembly plant 30 3.3 Failed projects 32 4 Governance gaps 37 5 Lessons from experience 40 5.1 Assessment of results, profits and losses 43 of parties involved 6 Policy recommendations 47 Annex 1 52 List of Venezuelan institutions and officials in charge of negotiations with China Table of Contents Table Annex 2 60 List of unavailable public information Annex 3 61 List of companies and agencies from China in Venezuela linked to the agreements since 1999 THE CHINA DEALS Agreements that have undermined Venezuelan democracy The People’s Republic of China was regarded by the Chávez and Maduro administrations as Venezuela’s great partner with common interests, co-signatory of more than 500 agreements in the past 20 years, and provider of multimillion-dollar loans that have brought about huge debts to the South American country. -

AH16 Aboriginal and Torres Strait Islander Health

AH16 Aboriginal and Torres Strait Islander health www.racgp.org.au Healthy Profession. Healthy Australia. AH16 Aboriginal and Torres Strait Islander health Disclaimer The information set out in this publication is current at the date of first publication and is intended for use as a guide of a general nature only and may or may not be relevant to particular patients or circumstances. Nor is this publication exhaustive of the subject matter. Persons implementing any recommendations contained in this publication must exercise their own independent skill or judgement or seek appropriate professional advice relevant to their own particular circumstances when so doing. Compliance with any recommendations cannot of itself guarantee discharge of the duty of care owed to patients and others coming into contact with the health professional and the premises from which the health professional operates. Accordingly, The Royal Australian College of General Practitioners (RACGP) and its employees and agents shall have no liability (including without limitation liability by reason of negligence) to any users of the information contained in this publication for any loss or damage (consequential or otherwise), cost or expense incurred or arising by reason of any person using or relying on the information contained in this publication and whether caused by reason of any error, negligent act, omission or misrepresentation in the information. Recommended citation The Royal Australian College of General Practitioners. Curriculum for Australian General Practice 2016 – AH16 Aboriginal and Torres Strait Islander health. East Melbourne, Vic: RACGP, 2016. The Royal Australian College of General Practitioners 100 Wellington Parade East Melbourne, Victoria 3002 Australia Tel 03 8699 0510 Fax 03 9696 7511 www.racgp.org.au Published May 2016 © The Royal Australian College of General Practitioners We recognise the traditional custodians of the land and sea on which we work and live. -

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword 2018 marked the fifth year since International Import Exposition Municipal Commission of Commerce, President Xi Jinping first put forward (CIIE), China has deepened its ties releasing the Belt and Road Country the Belt and Road Initiative (BRI). The with partners about the globe in Investment Index Report series Initiative has transformed from a trade and economic development. to provide a rigorous framework strategic vision into practical action President Xi Jinping has reiterated at for evaluating the attractiveness during these remarkable five years. these events that countries should of investing in each BRI country. enhance cooperation to jointly build Based on extensive data collection There have been an increasing a community of common destiny and in-depth analysis, we evaluated number of participating countries for all mankind , and the Belt and BRI countries' (including key and expanding global cooperation Road Initiative is critical to realizing African nations) macroeconomic under the BRI framework, along with this grand vision. It will take joint attractiveness and risks, and identified China's growing global influence. By efforts and mutual understanding to key industries with high growth the end of 2018, China had signed overcome the challenges ahead. potential, to help Chinese enterprises BRI cooperation agreements with better understand each jurisdiction's 122 countries and 29 international Chinese investors face risks in the investment environment. organizations. According to the Big BRI countries, most of which are Data Report of the Belt and Road developing nations with relatively The Belt and Road Country (2018) published by the National underdeveloped transportation and Investment Index Report 2017 Information Center, public opinion telecommunication infrastructures. -

The Top 225 Global Contractors

The Top 225 International Contractors The Top 225 Global Contractors August 18, 2008 This annual issue ranks the 225 largest construction contracting firms from around the world. It also ranks the largest firms in a wide variety of market sectors and geographic markets: Building, Manufacturing, Power, Water, Industrial/Petroleum, Transportation, Hazardous Waste, Sewer/Waste and Telecommunications. In addition, readers will get insights from executives of these top firms about the markets and issues affecting the industry around the world. This and other ENR survey issues are used as reference tools throughout the industry. Companies are ranked according to construction revenue generated in 2007 in US$ millions. Main story: "Prices Soar in a Boom Market" Tables - The 2008 Top 225 International Contractors based on Contracting Revenue from Projects Outside Home Country (with description about how to use the tables) - The 2008 Top 225 Global Contractors based on Total Firm Contracting Revenue (with descriptions about how to use the tables) - The 2008 Top 225 At a Glance: Volume, Profitability, Professional Staff, Backlog, Market Analysis, International Regions - Top 10 by Market: Building, Manufacturing, Power, Water, Transportation, Hazardous Waste, Sewer/Waste, Telecommunications - Top 20 Non-US Firms in International Construction Management/Program Management Fees - Top 20 Non-US in Total CM/PM Fees - Top 10 By Region: Middle East, Asia, Africa, Latin America/Caribbean, Europe, U.S., Canada - How the Top 225 International Contractors Shared the 2007 Market - Where to Find The Top 225 International Contractors - Where to Find The Top 225 Global Contractors Web Only Supplements: "Subsidiaries By Rank"-includes in-depth listings of each firm's subsidiaries "Where the 2008 Top 225 Contractors Worked"-lists the countries in which these firms had work or offices during 2007. -

China's Supply-Side Structural Reforms: Progress and Outlook

China’s supply-side structural reforms: Progress and outlook A report by The Economist Intelligence Unit www.eiu.com The world leader in global business intelligence The Economist Intelligence Unit (The EIU) is the research and analysis division of The Economist Group, the sister company to The Economist newspaper. Created in 1946, we have 70 years’ experience in helping businesses, financial firms and governments to understand how the world is changing and how that creates opportunities to be seized and risks to be managed. Given that many of the issues facing the world have an international (if not global) dimension, The EIU is ideally positioned to be commentator, interpreter and forecaster on the phenomenon of globalisation as it gathers pace and impact. EIU subscription services The world’s leading organisations rely on our subscription services for data, analysis and forecasts to keep them informed about what is happening around the world. We specialise in: • Country Analysis: Access to regular, detailed country-specific economic and political forecasts, as well as assessments of the business and regulatory environments in different markets. • Risk Analysis: Our risk services identify actual and potential threats around the world and help our clients understand the implications for their organisations. • Industry Analysis: Five year forecasts, analysis of key themes and news analysis for six key industries in 60 major economies. These forecasts are based on the latest data and in-depth analysis of industry trends. EIU Consulting EIU Consulting is a bespoke service designed to provide solutions specific to our customers’ needs. We specialise in these key sectors: • Consumer Markets: Providing data-driven solutions for consumer-facing industries, we and our management consulting firm, EIU Canback, help clients to enter new markets and be successful in current markets. -

Pre-Feasibility Study on Yangon Circular Railway Modernization Project

32mm Republic of the Union of Myanmar Yangon Regional Government PROJECT FOR COMPREHENSIVE URBAN TRANSPORT PLAN OF THE GREATER YANGON (YUTRA) Pre-Feasibility Study on Yangon Circular Railway Modernization Project Final Report January 2015 Japan International Cooperation Agency (JICA) ALMEC Corporation Oriental Consultants Co., Ltd Nippon Koei Co., Ltd EI JR 14-208 The exchange rate used in the report is: US$ 1.00 = MMK 1,000.00 Project for Comprehensive Urban Transport Plan of the Greater Yangon (YUTRA) Pre-Feasibility Study on Yangon Circular Railway Modernization Project FINAL REPORT TABLE OF CONTENTS 1 UPPER PLANNING, COMPREHENSION OF THE CURRENT ISSUE 1.1 CURRENT SITUATION AND ISSUE OF TRANSPORT SECTOR IN THE GREATER YANGON .................. 1-1 1.1.1 GENERAL ............................................................................................................ 1-1 1.1.2 MAIN TRANSPORT COMPONENTS ......................................................................... 1-2 1.1.3 TRANSPORT DEMAND CHARACTERISTICS ............................................................. 1-9 1.2 CURRENT SITUATION AND ISSUE OF RAILWAY SECTOR IN THE GREATER YANGON ...................... 1-11 1.2.1 RAILWAY IN GREATER YANGON ........................................................................... 1-11 1.2.2 CURRENT SITUATION AND ISSUES ........................................................................ 1-13 1.3 COMPREHENSION OF THE CURRENT UPPER PLANNING AND POLICY OF RAILWAY SECTOR IN YANGON REGION .................................................................................................................... -

Australian Trade Commission (Austrade)

Page 2 of 45 Austrade Submission Productivity Commission Inquiry into public infrastructure and the ways to encourage private financing and funding for major infrastructure projects, including issues relating to the high cost and the long lead times associated with these projects. Closing date for submissions: 23 December 2013 Please note the information contained within is primarily based on information derived from ongoing engagement and discussions with international infrastructure companies, professional service providers to the infrastructure industry in Australia and Australian government agencies (both state and federal). Austrade is a government funded trade and investment promotion body and not an infrastructure specialist organisation. As such Austrade is not in a position to make claims regarding the veracity of the information contained but has sought to illustrate areas of commonality in the feedback received. 23rd December 2013 Page 3 of 45 TABLE OF CONTENTS TABLE OF CONTENTS ................................................................................................................................................. 3 EXECUTIVE SUMMARY ............................................................................................................................................... 4 CONTEXT / BACKGROUND ......................................................................................................................................... 5 Case Study One: Legacy Way Brisbane ................................................................................................................ -

Geotechnical Services

GGeeooAAlllliiaannccee CCoonnssuullttaannttss PPttee LLttdd WHO WE ARE GeoAlliance Consultants Pte Ltd is a specialist ground engineering consultancy established by a group of registered professional engineers in Singapore. Our team has wide hands-on experience in both design and supervision of civil engineering and geotechnical engineering works in Singapore and overseas. Our team members have been involved in projects on the MRT Northeast Line, MRT Circle Line, MRT Downtown Line and Marina Coastal Expressway, and Kim Chuan Sewerage Plant, Changi Outfall in each of their own capacities. Merging our skill sets, experience and resources, we endeavour to provide innovative technical solutions for geotechnical and underground space projects. WHY GeoAlliance Professional Engineers with PE(Civil), PE(Geo) and AC(Geo) registrations Experience with local building authority, international consultants and contractors “Can-do” attitude Innovative, cost-effective and practical solutions Efficient and excellent services Reliable business & project partner Potential integration with client’s team WHAT WE DO Our team has an extensive range of knowledge and experience. Professional services by GeoAlliance Consultants Pte Ltd can be provided at all stages of project implementation, including: Planning Analysis and Design Feasibility Studies Geotechnical Interpretative Studies Planning of Geotechnical Investigations Earth Retaining Structures (ERSS or Engineering Support for Project Tenders TERS) Preliminary Designs for Cost Estimates Geotechnical -

GIS Data Hub Data Collection Specification - Part 2

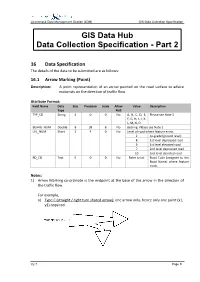

Licensing & Data Management Section (LDM) GIS Data Collection Specification GIS Data Hub Data Collection Specification - Part 2 16 Data Specification The details of the data to be submitted are as follows: 16.1 Arrow Marking (Point) Description: A point representation of an arrow painted on the road surface to advice motorists on the direction of traffic flow. Attribute Format: Field Name Data Size Precision Scale Allow Value Description Type Null TYP_CD String 4 0 0 No A, B, C, D, E, Please see Note 3 F, G, H, I, J, K, L, M, N, O BEARG_NUM Double 8 38 8 No Bearing. Please see Note 2 LVL_NUM Short 2 4 0 No Level of road where feature exists 2 At-grade (ground level) 8 1st level depressed road 9 1st level elevated road 7 2nd level depressed road 10 2nd level elevated road RD_CD Text 6 0 0 No Refer to list Road Code (assigned to the Road Name) where feature exists Notes: 1) Arrow Marking co-ordinate is the midpoint at the base of the arrow in the direction of the traffic flow. For example, a) Type C (straight / right turn shared arrow): one arrow only, hence only one point (x1, y1) required. V2.7 Page 9 Licensing & Data Management Section (LDM) GIS Data Collection Specification b) Types G (left converging arrow) & H (right converging arrow): two arrows, hence two points (x1, y1) and (x2, y2) are required. 2) The bearing should correspond with the bearing of each individual road. For example, if the bearing of the road is 97 degrees, then the bearing of arrow markings A is 97 degrees and the bearing of arrow markings B is 277 degrees respectively. -

USMC Fact Sheet

Hotels Nearby To Campus Thistle Hotel (www.thistle.com) Jalan Sungai Chat, 80100 Johor. Campus Address Distance : 20.7 km Tel: +607 - 222 9234 No 3, Persiaran Canselor 1, Kota Ilmu, Approx: 18mins EduCity@Iskandar, 79200 Nusajaya, Johor. Pariss Hotel (www.parisshotel.com.my) Tel: +607 - 560 2560 No 38, Jalan Bestari 7/2, Taman Nusa Bestari 81300 Skudai, Johor. Nearby Airports From Campus Distance: 10.3 km Tel: +607 - 232 8250 Senai International Airport, Johor. Approx: 10 mins Distance: 33km Tune Hotel (www.tunehotels.com) Changi International Airport, Singapore. Danga Bay, Lot PTB 22819, Distance: 60km Jalan Skudai, Mukim Bandar Johor, 80200 Johor. Distance: 17 km Tel: +607 - 2329010 Approx: 15 mins Car Hire Service Hotel Granada (www.htlgranada.com) Persona Berkat Solution Car Rental Jalan Indah 15/2 , Tel: +6016 - 410 6640 Taman Bukit Indah, 81200 Johor. Distance: 10.6km Tel: +607 - 231 8888 May Flower Car Rental Approx: 11 mins Tel: +607 - 224 1357 Traders Hotel Puteri Harbour Wahdah Car Rental (www.shangri-la.com/johor/traders/) Tel: +607 234 8645 Persiaran Puteri Selatan, Puteri Harbour, 79000 Nusajaya, Johor. Distance: 6.2 km Tel : +607-560 8888 Approx: 9mins Campus Address: No 3, Persiaran Canselor 1, Kota Ilmu, EduCity@Iskandar, 79200 Nusajaya, Johor. Tel: +607 - 560 2560 How To Get To Our Campus Taxi Service Driving Changi Airport To Campus From Kedah Taxi Azman : +6019-772 5048 Distance: 766 km Approx. 7 hours 43 mins * Please call and make your booking 3 days ahead From Penang Distance: 687km Approx. 7 hours From Ipoh Distance: 531km Approx. 5.5 hours Senai International Airport To Campus From Kuala Lumpur Purchase the taxi voucher from the airport, not Distance: 326km Approx. -

Causeway Link Buses Now Available from Mall of Medini to Singapore

5/5/2016 Causeway Link buses now available from Mall of Medini to Singapore | New Straits Times | Malaysia General Business Sports and Lifestyle News Causeway Link buses now available from Mall of Medini to Singapore BY CHUAH BEE KIM 16 MARCH 2016 @ 8:30 PM Tweet ISKANDAR PUTERI: Those who commute to Singapore can now head to the Mall of Medini to take the Causeway Link buses to the republic. Handal Indah Sdn Bhd executive director Rozlan A. Bakar said the mall has more than 1,000 parking spaces for commuters to park their cars before taking the buses to Singapore to work. Rozlan said there are 50 trips from the mall to the Sultan Abu Bakar Customs, Immigration and Quarantine Complex in the Second Link from as early as 5am, and daily services from the Sultan Iskandar CIQ Building to Singapore via the Causeway. A total of 1.1 million commuters use the Causeway Link buses daily to and from Singapore to Johor per month, which is about 36,000 commuters a day. On challenges faced by Handal Indah, Rozlan said the company has a shortage of bus drivers and the road conditions also cause buses to have a shorter lifespan and suffer breakdowns. "A total of 150 buses can head to Singapore in a day, and the same number come to Johor via Singapore," he told a Press conference here today. "However, we take steps to improve comfort for commuters and we upgrade on technology," he said. As for buses plying routes in the city, Rozlan said there are 200 buses for this and the waiting time is 20 minutes per bus. -

Behavioral Intention to Use Public Transport Based on Theory of Planned Behavior

MATEC Web of Conferences 47, 003 08 (2016) DOI: 10.1051/matecconf/201647003 08 C Owned by the authors, published by EDP Sciences, 2016 Behavioral Intention to Use Public Transport Based on Theory of Planned Behavior Kamarudin Ambak1,a, Kanesh Kumar Kasvar1, Basil David Daniel1, Joewono Prasetijo1 and Ahmad Raqib Abd Ghani1 1Smart Driving Research Center, Universiti Tun Hussein Onn Malaysia, 86400 Batu Pahat, Johor, Malaysia Abstract. An increase in population generates increasing in travel demand. In Malaysia, public transport become an important modes of transport that connection people. This paper presents behavioural intention to use public transport especially public bus based on Theory of Planned Behaviour (TPB). A questionnaire survey was conducted to identify factors that contribute and influence users to use public bus and to determine factor that most dominant using TPB model. A total of 282 questionnaires were distributed in selected area of Batu Pahat and Kluang. Correlation and regression analysis were used for this study. Results show that the Attitude toward public transport is the most dominant factor compared with Subjective Norm and Perceived Behavior Control that influencing users to use public bus. Majority respondents were agreed that they prefer to use public bus because it is cheap to travel and no other choices of other transfer modes. As for the recommendation, this study can be extended in future as part of strategic sustainable transportation system in Batu Pahat and Kluang areas. 1 Introduction Malaysia is one of the substantial developing nations in South East Asia. Transportation plays vital role in Malaysia economic contribution. Modern day busy lifestyles have increased the value of time.