Appendix A: Case Firms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New Packaging Lines for United Biscuits

BETTER PLANT, BETTER PRODUCTIVITY, BETTER PROFIT FEBRUARY 2015 FOOD PROCESSING New packaging lines for United Biscuits How to save on energy costs The changing face of retail w w w . f p o n t h e n e t . n e t 33837837 - FPFP FFeb15eb15 EEdn.indddn.indd 1 229/01/20159/01/2015 112:552:55 DELIVERING THE SOLUTION Let’s prove it... The Spiroflow Test Centre is at the heart of everything we do. “ It’s in the Test Centre where we demonstrate the optimum conveyor, bulk bag discharger or filler for any food application. We like nothing more than finding the solution for a difficult ingredient. Proving that our equipment works, on the most challenging of particulate materials, enables customers to place their orders with confidence - knowing it’s the right solution. ” Terry Mason Test Centre Manager Flexible Screw Aero Mechanical Tubular Drag Conveyors Conveyors Conveyors Vacuum Bulk Bag Bulk Bag Conveyors Fillers Dischargers T: +44 (0) 1200 422525 E: [email protected] www.spiroflow.com 33837837 - FPFP FFeb15eb15 EEdn.indddn.indd 2 229/01/20159/01/2015 112:552:55 FOOD PROCESSING Contents February 2015 Vol 84 No 02 All change for retail? CASE STUDY VISION SYSTEMS 4 Dalco Food installs vegetarian 18 Inspection cure for drink processors dough mixture solution The problems at Tesco seemed insurmountable last year: an accounting ACRYLAMIDE scandal, falling prices and consumers QUESTIONS AND ANSWERS 20 The big debate turning away in their droves towards 6 New EHEDG section for UK and discount retailers. But January has seen Ireland HEATING + VENTILATION something of a turning point with new 22 Substantial payback for RHI CEO Dave Lewis implementing a series NEWS of strategic changes that have been 8 Fit to trade? warmly received by both the market and REGULATORY ISSUES industry. -

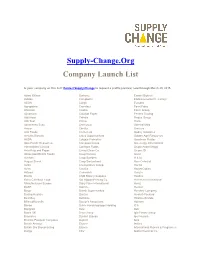

Supply-Change.Org Company Launch List

Supply-Change.Org Company Launch List Is your company on this list? Contact Supply Change to request a profile preview, now through March 25, 2015. Adani Wilmar Burberry Emami Biotech Adidas Campbell's Etablissements Fr. Colruyt AEON Cargill Eurostar Agropalma Carrefour Farm Frites Ahlstrom Casino Fazer Group Ajinomoto Catalyst Paper Ferrero Trading Aldi Nord Cefetra Findus Group Aldi Sud Cémoi Florin Almacenes Exito Cencosud General Mills Amcor Cérélia Ginsters Arla Foods Coca-Cola Godrej Industries Arnott's Biscuits Coles Supermarkets Golden Agri-Resources ASDA Colgate-Palmolive Goodman Fielder Asia Pacific Resources Compass Group Greenergy International International Limited ConAgra Foods Grupo André Maggi Asia Pulp and Paper Co-op Clean Co. Grupo JD Associated British Foods Coop Norway Gucci Auchan Coop Sweden H & M August Storck Coop Switzerland Hain Celestial Aviko Co-operative Group Haribo Avon CostCo HarperCollins Axfood Cranswick Harry's Barilla CSM Bakery Supplies Hasbro Barry Callebaut Food Dai Nippon Printing Co. Heineken International Manufacturers Europe Dairy Farm International Heinz BASF Danone Henkel Bayer Dansk Supermarked Hershey Company Beijing Hualian Danzer Hewlett-Packard Best Buy Delhaize Hillshire Brands BillerudKorsnäs Doctor's Associates Holmen Bimbo Dohle Handelsgruppe Holding ICA Bongrain Dow IGA Boots UK Drax Group Iglo Foods Group Brambles Dunkin' Brands Igor Novara Brioche Pasquier Cerqueux Dupont Ikea British Airways Ecover Inditex British Sky Broadcasting Elanco International Flavors & Fragrances Bunge -

Blackstone and Pai Partners Agree Sale of United Biscuits to Yildiz Holding

BLACKSTONE AND PAI PARTNERS AGREE SALE OF UNITED BISCUITS TO YILDIZ HOLDING London, 3 November 2014 - Private equity funds managed by Blackstone (“Blackstone”) and PAI Partners (“PAI”) announce the sale of United Biscuits (“UB” or “the Company”), a leading international manufacturer of biscuits, to Yildiz Holding ("Yildiz"). UB is a leading manufacturer and marketer of biscuits in the UK and second largest in the Netherlands, France, Belgium and Ireland. Among UB’s popular brand names are McVitie’s, Penguin, go ahead!, McVitie’s Jaffa Cakes, Jacob’s, Jacob’s Cream Crackers, Twiglets, Mini Cheddars and Carr's in the UK, and BN, Delacre, Verkade and Sultana in Continental Europe. UB owns and operates 16 manufacturing facilities of which seven are in the UK. Lionel Assant, European Head of Private Equity at Blackstone, said: "United Biscuits is a great business and has been an excellent investment for us. Yildiz is the best home for the company and will allow UB to fulfil its international growth ambitions. I would like to thank United Biscuits' management team for the way in which they have led the company and wish UB well under new ownership." Frédéric Stévenin, Partner at PAI Partners, commented: “United Biscuits is an iconic business with leading global brands. We are very proud to have been part of its development and wish everyone at the Company continued successes over the years ahead.” Commenting on the sale, Martin Glenn, CEO of United Biscuits, said: “We look forward to being part of Yildiz as we continue to fulfil our growth potential both in the UK and abroad where we are looking to expand our share of the biscuit and snacking markets and where there is huge potential for all our brands. -

The Changing Face of Economics and the Consequences for Industry

Fergus Carr 2505361 History and Theory The changing face of economics and the consequences for industry In this essay I am going to study the way in which a changing economy affects the architecture of industry. I am going to examine the change of use of the Peek Freans biscuit factory in Bermondsey from confectionary manufactory (use class B2) to offices and studios (use class B1). It is a fact that industrial units are redeveloped when the existing infrastructure becomes outdated or outmoded. However, I feel that there may be more to the redevelopment of the Bermondsey site than may meet the eye. Firstly I would like to address the question of classical economics, which relied upon the belief that “the pursuit of individual self interest produced the greatest possible economic benefits for society as a whole, through the power of the invisible hand”.1 This meant that the state would have a laissez-faire policy towards the regulation of industry. That it was the captains of Industry that provided capital for cultural and community projects such as art galleries, museums and more pertinently social housing, which gave rise to the creation and development of communities based entirely on the local industry, examples of which can be found In the chocolate company Cadbury’s model village Bourneville near Birmingham, tobacco company RJ Reynolds in Winston-Salem in the USA and Peek Freans “Biscuit Town” of Bermondsey in London, to name but a few of the most pertinent examples. When James Peek and his business partner George Hender Frean established the Peek Freans Company in 1857, they had anticipated Mr. -

Joint Release 5 December 2012 KP Snacks to Become Part of European Intersnack Group • United Biscuits Sells KP Snacks Busin

Joint Release 5 December 2012 KP Snacks to become part of European Intersnack Group • United Biscuits sells KP Snacks business – Combination with Intersnack perfect fit for growth • David Fish, UB Group Non Executive Chairman: "This deal ensures that the KP brands continue as part of a major European Snacks business” • Maarten Leerdam, Intersnack’s Executive Chairman: “We believe in the power of iconic, local hero brands, and we aim to leverage these strengths for further expansion.” Intersnack Group (“Intersnack”) and United Biscuits (“UB" - owned by Blackstone and PAI Partners), jointly, today announced that both parties have signed an agreement for Intersnack to acquire KP Snacks, UB’s snacks unit, from UB for an undisclosed sum. Intersnack and KP Snacks together will combine their unrivalled market expertise to further develop KP Snacks’ brands and explore new markets. The transaction is expected to close during the first quarter of 2013. KP Snacks is the number two snack manufacturer in the UK and famous for its iconic brands, including McCoy's, Hula Hoops, KP Nuts, Space Raiders, Nik Naks, Wheat Crunchies, Skips, Phileas Fogg, Discos, Roysters, Choc Dips, Brannigans, Frisps, KP Crisps, KP Mini Chips and Cheese Footballs. In addition to these brands, the transaction includes, among other assets, KP’s UK manufacturing facilities and a head office. UB will retain ownership of its baked bagged snack brands manufactured in its biscuit factories including Mini Cheddars and Twiglets. With an annual turnover of £280m (€346m), KP Snacks has shown consistent top and bottom line growth over the last five years. The company employs approximately 1,500 people. -

Sustainable Success

ÜLKER BİSKÜVİ ANNUAL REPORT 2018 ÜLKER BİSKÜVİ ÜLKER BİSKÜVİ ANNUAL REPORT 2018 REPORT ANNUAL Kısıklı Mahallesi Ferah Caddesi No: 1 34692 Büyük Çamlıca-Üsküdar / Istanbul - TURKEY Tel: +90 216 524 29 00 Faks: +90 216 316 43 44 www.ulker.com.tr www.ulkerbiskuvi.com.tr 100% recycled paper is used for the publication of this report. SUSTAINABLE SUCCESS... BISCUIT 9 Kat Rulokat, 9 Kat İnce Gofret, Ülker Deluxe, Çokoprens, Probis, Ülker Pötibör, Rondo, Canpare, Kat Tat, Altınbaşak, Çizi, İkram, Biskrem, Ülker Çubuk, Çiziviç, 9 Kat, Ülker Bebe Bisküvi, Hanımeller, Krispi, Ülker Çubuk Kraker, Ülker Susamlı Çubuk Kraker, Ülker Bebe Bisküvi, Saklıköy, Mc Vities, Dore, Haylayf, Taç Kraker CONTENTS 02 Key Financial Indicators 04 Sales Volume and Revenue Growth CHOCOLATE 04 Capital Structure Ülker Çikolatalı Gofret, Albeni, Metro, Çokonat, Dido, Laviva, Napoliten, Halley, 05 Ülker’s Share Hobby Krem, Hobby, Smartt Sürpriz Yumurta, Caramio, Cocostar, Çokomel, Performance on the BIST Çokomel Pofti, Godiva Masterpiece, Alpella Gofret, Ülker Cocostar, Ülker 06 About pladis 08 Ülker Bisküvi Production Finger Çikolata, Çokokrem, Piko, Çokomilk, Ülker Çikolata ÜLKER BİSKÜVİ Facilities 10 Message from the Chairman 12 Message from the CEO 14 Strategies CAKE 15 Current Economic 2018 REPORT ANNUAL Outlook, Global and 8 Kek, Pöti, Kekstra, O’lala Sufle, O’lala Bar, O’lala Waffle, Dankek Rulo Pasta, Dankek Çay Turkish Food Industries Saati, Smartt Sütkek, Çokokrem Pankek, Lokmalık, Alpella, Peki, O’lala Sufle Mini, Dankek 16 Production and Capacity Baton, Dankek -

Case No COMP/M.1920 - NABISCO / UNITED BISCUITS

EN Case No COMP/M.1920 - NABISCO / UNITED BISCUITS Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 05/05/2000 Also available in the CELEX database Document No 300M1920 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 5.05.2000 SG (2000) D/103526 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information MERGER PROCEDURE omitted has been replaced by ranges of figures or a ARTICLE 6(1)(b) DECISION general description. To the notifying party Dear Sirs, Subject: Case No COMP/M.1920 - Nabisco/United Biscuits Notification of 22.03.2000 pursuant to Article 4 of Council Regulation No 4064/89 1. On 22.03.2000, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EEC) No 4064/89 by which Nabisco Group Holdings Corporation ("Nabisco") acquires within the meaning of Article 3(1)(b) of the Council Regulation control of the whole of United Biscuits (Holdings) plc ("UB") and The Horizon Biscuit Company Ltd. (“ Horizon”) by way of a public bid originally announced on 17th December 1999 and by way of purchase of shares. 2. In the course of the proceedings, the parties submitted an undertaking in accordance with Article 6(2) of the Merger Regulation. -

United Biscuits Revolution 25 September 2002

United Biscuits Revolution 25 September 2002 22 United Biscuits has created an internal Stand up if you’ve never placed Hula Hoops on the ends of your fin- gers before eating them. Is there anyone in the country e-community to share who hasn’t? Even the Queen has probably done it. But United Bis- winning web cuits, the firm behind the snack and countless others, has been so strategies among its busy marketing some products online that its custo-mers’ fingers brands, Mark Vickery may be spending more time on their keyboards. The firm has two main operating categories: biscuits, of which (left) and Will Ursell McVitie’s is the top brand, and snacks, which KP heads. Between tell Caspar van Vark them, they own some of the UK’s most familiar products, including McCoy’s, Go Ahead! and Oreo. Some have advertised online but, until recently, the company took a piecemeal approach, with each brand doing its own thing. A wise strategy, perhaps, as a packet of biscuits does not necessarily have much in common with a bag of crisps when it comes to target markets. But it also makes Hula Hoops: Steve Threlfall site has attracted 86,000 visits sense to look at brands together and let their online strategies feed off each other. ed Biscuits’ online activities, with several major campaigns for Hula That’s precisely what United Biscuits decided to do some 12 Hoops and Penguin. The company also hired a three-strong agency months ago when it formed an ‘e-business community’, for which in- roster to handle digital campaigns: Wheel group’s Abel & Baker, Oys- formation systems director Mark Vickery has overall responsibility. -

Ülker Bisküvi Sanayi A.Ş Annual Report for the Period Between January 1 – December 31, 2017

ÜLKER BİSKÜVİ SANAYİ A.Ş ANNUAL REPORT FOR THE PERIOD BETWEEN JANUARY 1 – DECEMBER 31, 2017 KEY FINANCIAL INDICATORS In 2017, Ülker Bisküvi increased its sales by 14.7% and reached the all-time highest turnover level of its history with TL 4.8 billion. Summary Balance Sheet (TL) 2016 Restated 2017 Current Assets 3.599.182.282 4.796.550.026 Non-Current Assets 2.401.043.645 3.529.902.400 TOTAL LIABILITIES AND EQUITY 6.000.225.927 8.326.452.426 Current Liabilities 3.153.740.946 1.999.151.376 Non-Current Liabilities 1.247.463.757 3.631.397.896 Equity Attributable To Equity Holders’ of the Parent 1.399.603.255 2.427.359.715 Non-Controlling Interest 199.417.969 268.543.439 TOTAL LIABILITIES AND EQUITY 6.000.225.927 8.326.452.426 Summary P&L (TL) 2016 Restated 2017 Revenue 4.193.774.746 4.811.032.525 Gross Profit 1.074.049.647 1.276.935.898 Operating Profit 508.681.416 594.602.063 Net Profit (Equity Holders of the Parent) 272.663.250 383.153.137 Ratios 2016 Restated 2017 Gross Profit Margin (%) 25,6% 26,5% Net Margin (Equity Holders of the parent) 6,5% 8,0% Earning per Share (TL) 0,80 1,12 With effective and incessant cost management, Ülker Bisküvi continued its double digit growth in operating profit also in 2017, and increased its profit by 16.9% to TL 594.6 million. 2016 2017 Operating Profit (mn TL) 508,7 594,6 Equity Attributable To Equity Holders’ of the Parent (mn TL) 1.399,6 2.429,5 Net Profit (Equity Holders of the Parent, mn TL) 273 383 Net Profit Margin (Equity Holders of the Parent) 6,5% 8,0% EBITDA (mn TL) 575,3 701,4 EBITDA margin 13,7% 14,6% 1 SALES VOLUME AND INCOME GROWTH Continuing its successful performance also in 2017, Ülker Bisküvi reached a sales volume of 575 thousand tons, and increased its turnover to TL 4.8 billion. -

Thehrdirector INTERVIEW: Andrew Newall – Group HR Director, United Biscuits

theHRDIRECTOR THE ONLY INDEPENDENT HR STRATEGIC PUBLICATION IN THE UK MARCH 08 ISSUE 45 theHRDIRECTOR INTERVIEW: Andrew Newall – Group HR director, United Biscuits FORUM: PLANNING FOR THE FUTURE Thinking the unthinkable ETHICS IN THE WORKPLACE A necessity not a ‘nice to have’ CORPORATE MANSLAUGHTER ACT Avoiding the cost of complacency GLOBAL PAYROLL Bringing consistency out of complexity CASE STUDIES THIS MONTH Andrew McCallum – Head of Corporate Reputation, Centrica Alex Redgrave – Vice President, Head of Consulting, HOK Professor Richard Scase Arco Getty Images PLEASE NOTE: Henley Management College WE DO NOT SABMiller ACCEPT ANY PAID FOR OR SPONSORED EDITORIAL Pictured: Andrew Newall - Group HR director, United Biscuits DON’T MISS NEXT MONTH’S ISSUE WHERE WE LOOK AT: DIVERSITY & INCLUSION – REAPING THE BENEFITS; DEVELOPING DIRECTORS; DECISION MAKING; GRADUATES …AND MORE “cvmail is cost-effective, has halved our recruitment workload, and has been extremely easy to use.” Ashurst natural selection consultative and effective e-recruitment 020 7393 7693 [email protected] cvmail.net The Thomson trademark and Star Design are trademarks of Thomson Finance S.A. used herein under licence. www.thehrdirector.com CONTENTS theHRDIRECTOR CONTENTS MARCH 08 ISSUE 45 EDITOR’S WELCOME 5 theHRDIRECTOR INTERVIEW 8 This month we talk to Andrew Newall – Group HR director at United Biscuits. FORUM: PLANNING FOR THE FUTURE 12 PAST PERFORMANCE IS NO GUARANTEE OF FUTURE SUCCESS 14 p14 We find out how companies need to plan for the future in a way that takes into consideration our changing world. predicting future trends CASE STUDY SABMILLER 18 “and staying ahead of INTERVIEW PROFESSOR RICHARD SCASE 20 the game is key THE IMPACT OF TECHNOLOGICAL DEVELOPMENTS 22 In an increasingly virtual world, how will the UK workforce develop over the next 20 years? Kai Peters, chief executive, Ashridge Business School, examines the workforce of the future, what its needs will be and the implications for businesses. -

Valeo Foods/Jacob Fruitfield

DETERMINATION OF MERGER NOTIFICATION M/11/028 - Valeo Foods/Jacob Fruitfield Section 21 of the Competition Act 2002 Proposed acquisition by Valeo Foods Group Limited of sole control of Jacob Fruitfield Food Group Limited Dated 14 September 2011 Introduction 1. On 19 August 2011, in accordance with section 18 of the Competition Act 2002, the Competition Authority (“the Authority”) received a notification of a proposed acquisition whereby Valeo Foods Group Limited (“Valeo Foods”) would acquire sole control of Jacob Fruitfield Food Group Limited (“Jacob Fruitfield”). The Undertakings Involved The Acquirer 2. Valeo Foods is controlled by CapVest Equity Partners II, L.P. (“CapVest”). CapVest principally makes private equity investments in Western Europe. CapVest owns the Mater Private Hospital (“MPH”) and Drie Mollen International BV (“Drie Mollen”). 3. MPH is active in the provision of private healthcare in Ireland. Drie Mollen is a Swiss-based coffee company engaged in the production and sale of tea and coffee in six European countries under the United Coffee brand. Drie Mollen has a limited presence on the island of Ireland. 4. Valeo Foods is the holding company formed in 2010 to acquire the entire issued share capital of Maiden Acquisition Company Holdings and Origin Foods. The Competition Authority approved the acquisition of sole control of Valeo Foods by CapVest on 18 November 2010. 1 5. Valeo Foods is involved in the supply of various consumer goods products to the Irish retail sector. Valeo Foods’ business involves: • importing and distributing home-baking and cooking ingredients sold under the Shamrock brand; • importing and distributing Italian meals sold under the Roma brand; • milling, selling and distributing packaged flour; 1 M/10/031 – CapVest/Origin Foods/Maiden. -

ULKER Investor Presentation

Investor Presentation March 2018 Agenda Company Overview Domestic Operations International Operations Strategy Financial Highlights Appendix 2 Leader confectionery company in the region 3 Net Sales by Segment - 2017 Over 70+ years of experience in Turkey 9,3% 1,8% Producer of biscuits, chocolates, chocolate covered 42,4% products, crackers, wafers and cakes 46,5% Leader in Turkey with 36% market share as of 2017 Biscuit Chocolate Cake Non-Conf Extensive sales & distribution capabilities Net Sales by region - 2017 32% A gateway to the Middle East, Northern Africa and Central Asia 68% 41.5% - Free Float & 58.5% pladis and Ulker family members Domestic International EBITDA by region - 2017 Key figures – TL mn 2017 37% Sales Volume (Tonnes) 542.965 Net Sales 4.811 63% EBITDA 701.4 EBITDA Margin % 14.6% Domestic International 3 Continuous focus in value 4 Gathering all chocolate and cake businesses under Ülker Bisküvi Ülker Biskuvi acquired 30% minority and starting disposals of 6 non-core assets stake in Biskot Simplified traditional channel distribution SKU optimization in biscuits 502 SKUs vs. 330 SKUs in 2014 Cancellation of privileged shares and founder shares 2013 2012 2014 Free Float reached 40% after Yıldız Holding’s block sale New dividend policy – minimum 70% of distributable income Our restructuring history between 2012-2014 4 5 First phase of international acquisitions completed Hi Food (1) İstanbul Gıda FMC Hamle UI MENA IBC (2) (Egypt) (Export out of Turkey) (Saudi Arabia) (Kazakhstan) (Saudi Arabia and export (Saudi Arabia) of Saudi Arabia) March2016 June2016 March2017 December 2017 Stake: 100.0% Stake: 51.4% Stake: 55.0% Stake: 100.0% Stake: 100% 2017 Net Sales: USD c.167mn 2017 Net Sales: USD c.137 mn Stake: 100% 2017 Net Sales: USD c.52mn 2017 Net Sales: USD c.29.5mn 2017 Net Sales: USD c.50mn 2017 EBITDA: USD c.15 mn 2017 EBITDA : USD c.17.5 mn 2017 Net Sales: USD c.37mn 2017 EBITDA : USD c.4 mn 2017 EBITDA : USD c.