We Are One of the UK's Leading Providers of Wealth Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Activities – Inter Faith Week 2018

List of activities – Inter Faith Week 2018 This list contains information about all activities known to have taken place to mark Inter Faith Week 2018 in England, Northern Ireland and Wales. It has been compiled by the Inter Faith Network for the UK, which leads on the Week, based on information it listed on the www.interfaithweek.org website. A short illustrated report on the 2018 Week can be found at https://www.interfaithweek.org/resources/reports The list is ordered alphabetically by town, then within that chronologically by start date. ID: 1631 Date of activity: 19/11/2017 End date: 19/11/2017 Name of activity: Inter Faith Week Discussion and Display Organisation(s) holding the event: Acrrington Library Accrington Youth Group Short description: To mark Inter Faith Week, Accrington Youth Group is using its fortnightly meeting to discuss Inter Faith Week and strengthening inter faith relations, as well as increasing understanding between religious and non‐religious people. Location: St James' St, Accrington, BB5 1NQ Town: Accrington Categories: Youth event ID: 989 Date of activity: 09/11/2017 End date: 09/11/2017 Name of activity: The Alf Keeling Memorial Lecture: Science and Spirituality Organisation(s) holding the event: Altrincham Interfaith Group Short description: Altrincham Interfaith Group is holding the Alf Keeling Memorial Lecture on the theme of 'Science and Spirituality' to mark Inter Faith Week. The lecture will explore how modern scientific discovery relates to ancient Indian philosophy. The lecture will be delivered by Dr Girdari Lal Bhan, Hindu Representative at Greater Manchester Faith Community Leaders Group. Location: St Ambrose Preparatory School Hall, Wicker Town: Altrincham Lane, Hale Barns, WA15 0HE Categories: Conference/seminar/talk/workshop ID: 1632 Date of activity: 13/11/2017 End date: 17/11/2017 Name of activity: All Different, All Equal Organisation(s) holding the event: Audlem St. -

Leisure Opportunities 27Th June 2017 Issue

Find great staffTM leisure opportunities 27 JUNE - 10 JULY 2017 ISSUE 713 Daily news & jobs: www.leisureopportunities.co.uk Kent theme park loses Paramount brand London Resort Company involved but not one overarching Holdings (LRCH) – the studio leading the way. developer behind the Paramount “It doesn’t really change theme park in Kent – has anything. The branding is what announced a surprise split from will be shifting. The team, the the film studio, which was to consultants, the plans and the act as the masthead for the surveys are still working. It’s all multi-billion-pound attraction. on track from that side of things.” The £3.2bn London Paramount LRCH’s parent company, project was being lined up as Kuwaiti European Holding a major entertainment resort, Group (KEH), has invested with several rides and attractions £35m into the project so far. based on Paramount intellectual The opening date – scheduled property (IP) such as Star Trek, The for 2022 – has been pushed Godfather and Mission Impossible. back three times, with delays Those brands will no longer in securing land necessary to be used for the attraction, deliver the development. however, a LRCH spokesperson The project is still set to go ahead, though not under the Paramount banner Commenting on the confirmed that the project would company’s decision to halt the “still be going ahead” with its name changed with the BBC to use IP from Dr Who, Top Gear relationship, LRCH CEO Humphrey Percy to London Resort. Leisure Opportunities and Sherlock, as well as Aardman Animations, expressed his thanks to Paramount and added understands that LRCH is exploring new IPs to which created Wallace and Gromit. -

COVER June 08 9/6/08 4:34 Pm Page 1

COVER june 08 9/6/08 4:34 pm Page 1 THE LEADING TRADE MAGAZINE FOR UK SPORTS RETAILERS, MANUFACTURERS AND DISTRIBUTORS Sports www.sports-insight.co.uk £3.50 JUNE 2008 Insight THE OFFICIAL PUBLICATION OF THE FEDERATION OF SPORTS AND PLAY ASSOCIATIONS INSIDE THIS ISSUE SEE PAGE 23 TOUCH-SCREEN IN SEASON SILVER SERVERS INDUSTRY ANALYSIS TECHNOLOGY Focus on swimming, running, The pros and cons of hiring Will Beijing kick-start GB Changing the way people shop supports & school sports older workers swim sales? Hydro Ad - Shock Doctor:Layout 1 5/6/08 15:23 Page 1 Arena:Layout 1 5/6/08 16:38 Page 1 CONTENTS 9/6/08 4:49 pm Page 2 IN THIS ISSUE CONTENTS 06.08 ABC Certification Sports Insight working with Sports Insight has a current ABC certified circulation of 5,186 (audit period July 1, 2006 to June 30, 2007). The Audit Bureau of Circulations (ABC) is an independent audit watchdog that WIN a copy of ‘The verifies magazines’ circulation figures, providing Magic of The FA Cup’ accurate and comparable data for advertisers. triple DVD set. Visit ABC Certification demonstrates a media www.sports-insight.co.uk owner’s integrity, in their willingness to be audited for more information. and to conform to industry standards. COVER STORIES REGULARS 28 INDUSTRY ANALYSIS 06 NEWS Will Beijing kick-start GB swim sales? Latest headlines, key dates and events 30 SILVER SERVERS 13 KIT STOP The pros & cons of hiring older workers Essential stock for your shop 34 TOUCH-SCREEN TECHNOLOGY 18 FSPA FOCUS Changing the way people shop News from the Federation of Sports -

Con Su Victoria Del Sábado a Domicilio Sobre El Nodalia Rugby Valladolid

Boletín informativo de la Federación Española de Rugby Boletín nº 34 Temporada 2006/2007 13 de mayo de 2007 DIVISIÓN DE HONOR 2006/07. JORNADA 17ª Con el título de Liga resuelto, la lucha por la permanencia toma el máximo interés en la penúltima jornada MAGNERS LEAGUE Ospreys se lleva el Fiesta de rugby de Liga, y el CIC Penúltima jornada de título pese al esfuerzo español en Valladolid Rugby Valladolid. En la Liga de División de de los Cardiff Blues con la disputa de los el otro derbi de la Honor de rugby con Campeonatos de jornada, Getxo Artea el título ya decidido a El título de la Magners España y Torneos se juega la favor del Cetransa League se decidió a favor Nacionales de permanencia ante UEMC El Salvador que de The Ospreys tras categorías inferiores Spyro Bera Bera y el disputará su primer derrotar a los Borders con la guinda del Liceo Francés, en partido ante su Reivers y aprovechar la derbi pucelano entre descenso, visita al público después de la derrota de los Leinster el Cetransa El Kitmar Ordizia. consecución del irlandeses frente a Cardiff Salvador, campeón campeonato. Blues, también con P-2 opciones al título. P-18 CAMPEONATO INFANTIL GUINNESS PREMIERSHIP TORNEOS NACIONALES INFANTIL, ALEVIN, BENJAMIN Y PRE-BENJAMIN Valladolid vuelve a acoger Leicester nuevo campeón de la al futuro del rugby nacional Guinness Premiership Un año más los campos de Pepe Rojo de Valladolid Los Leicester Tigers acogerán a los más jóvenes del rugby nacional en el consiguieron su Campeonato de España infantil y los Torneos quinto título de la Nacionales Infantil, Alevín, Benjamín y Pre-benjamín Guinness Premiership en el que participarán 122 equipos de 40 clubes tras imponerse con diferentes con más 1800 niños jugando 294 claridad a Gloucester encuentros, acompañados por 26 árbitros, 6 por 44-16 con siete ensayos. -

Twenty Nineteen Annual Report & Financial Statements 2019 Annual Report & Financial Statements 2019 Page 1

Leicester Football Club Plc twenty nineteen Annual Report & Financial Statements 2019 Annual Report & Financial Statements 2019 Page 1 Contents Directors and Officers 2 Strategic Report 3 - Chairman’s Statement 3 - Business Review 4 Professional Advisers 6 Directors’ Report 7 Statement of Directors’ Responsibilities in respect of the Financial Statements 9 Independent Auditors’ Report to the Members of Leicester Football Club Plc 10 Consolidated Profit and Loss Account 15 Consolidated Statement of Comprehensive Income 15 Consolidated and Company Balance Sheets 16 Consolidated Statement of Changes in Equity 17 Company Statement of Changes in Equity 17 Consolidated Statement of Cash Flows 18 Notes 19 Annual Report & Financial Statements 2019 Page 2 Directors and Officers PETER TOM CBE SIMON COHEN Executive Chairman Chief Executive Officer Peter has been Chairman of the club for over 20 years, Tigers’ Head of Rugby Operations since 2005, Simon having made 130 appearances between 1963 and 1968. joined the board of directors in 2011 and was appointed He is a director of Premier Rugby Limited and Jacksons as Chief Executive Officer in January 2012. Previously a (CI) Limited. Peter’s previous roles include Executive sports lawyer and partner at James Chapman & Co in Chairman of Breedon Group plc and Chief Executive, Manchester, Simon represented the England Rugby team, (latterly Chairman) of Aggregate Industries. In 2006 he was awarded a CBE the Rugby Players’ Association and British and Irish Lions players. He also set for services to Business and Sport. He holds an Honorary Degree from up Rugbyclass, a nationwide rugby coaching company and was an agent for a De Montfort University and in 2018 was awarded an Honorary Degree by the number of England players, including Jonny Wilkinson. -

The Prima Tiger Cup – Season 2019/20 Entry Form

The Prima Tiger Cup – Season 2019/20 Entry Form The Prima Tiger Cup is inclusive of The Prima Tiger Cup, The Prima Tiger Bowl and The Prima Tiger Shield. The terms Cup, Bowl and Shield are used for historic and marketing purposes only. Please note that the last date for entries is 10 days before your selected festival. The Prima Tiger Cup is a free to enter contact based fun event open to all clubs at Under 10 level (RFU defined). The event takes part over 5 festivals covering the Tigers Academy DPP Region and beyond. Clubs are only allowed to enter one festival. Throughout the duration of these festivals the Tigers will be looking to identify clubs who demonstrate the true ethos of the game under our event criteria in keeping with the RFU Age Grade Rules and guidelines. Selected clubs from the festivals may also be invited to participate in a series of games to be held at a later date at the Tigers famous Welford Road Stadium. Please see below for this season’s area festival venues and dates. (1) Diss RFC – 6th October 2019 (2) Leicester Forest RFC – 13th October 2019 (3) Tamworth RFC – 27th October 2019 (4) Mellish RFC – 3rd November 2019 If you and your team would like to take part in this season’s Prima Tiger Cup, please complete below entry form and return to: Prima Tiger Cup, Leicester Tigers, Aylestone Road, Leicester, LE2 7TR or email [email protected]. (Preferred) Club name:…………………………………………………………………………………………………………………………………………………………. Contact name:………………………………………..…………….…………………. Tel No.:………………………………………….………………… Email address:…………………………………………………………………………………………………………………………………………………….. U9 contact name (for next season’s competition):……………………………..………………..……….……………………………………. -

Prospectus V

Our Undergraduate UN I prospectus V Open Days 2016 ER S I TY Saturday 9 July Focus on Medicine Day OF Friday 22 July LEICE Saturday 17 September ST Saturday 15 October ER UND ER Book a place online at G www.le.ac.uk/opendays R ADUAT E P R OSP EC TUS 2 0 1 7 @uniofleicester · /uniofleicester University of Leicester Student Recruitment University Road Leicester LE1 7RH UK This prospectus was printed by an t: +44 (0)116 252 2674 ISO14001 printer using vegetable- e: [email protected] based inks on an elementally www.le.ac.uk chlorine free FSC certified stock. LEICR L34 2 Your Your 4 Students’ Learning Union Your Your 4 Experience Leicester Open Days Experience There’s no better way of finding out more about the University of Leicester than coming to one of our Open Days. Your 16 Career Saturday You’ll be 9 July 2016 able to: Focus on Medicine Day • Find out all you can about courses from the people who teach them – it’s your Friday chance to quiz the tutors. • Have a look round the campus – check Your 22 July 2016 out our facilities and just get a feel for 3 Campus the place. Welcome 6 Saturday • Visit our accommodation to see where 2 you might like to live. September 2016 4 Your Learning Experience 17 • Experience a taster lecture. 16 Your Career Saturday 24 Your Students’ Union 15 Oc tober 2016 Top five 36 Your Campus questions to ask: 40 Your Accommodation 48 Your Sport What course modules are on offer and do 54 Your City Book a place 1 I get a choice? 60 Your Support online at What kind of careers support is there? www.le.ac.uk/opendays 2 68 Your International University 3 Can I have a year abroad or in industry? 72 Your Alumni Association What’s the cost of living like? e.g. -

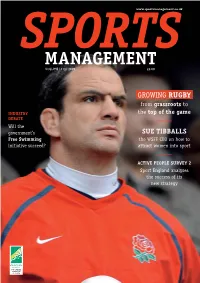

SM Digital Spreads Template.Indd

SPORTSwww.sportsmanagement.co.uk MANAGEMENT VOLUME 13 Q1 2009 £3.00 GROWING RUGBY from grassroots to INDUSTRY the top of the game DEBATE Will the government’s SUE TIBBALLS Free Swimming the WSFF CEO on how to initiative succeed? attract women into sport ACTIVE PEOPLE SURVEY 2 Sport England analyses the success of its new strategy THE OFFICIAL MAGAZINE OF SAPCA Boost your business EDITOR’S LETTER Harness the power of our total marketing package www.sportsmanagement.co.uk SPORTS MANAGEMENT Transforming lives VOLUME 13 Q1 2009 £3.00 GROWING RUGBY from grassroots to INDUSTRY the top of the game e’ve always known sport can transform the lives of young people who’ve lost their DEBATE Will the government’s SUE TIBBALLS way in life, or even more importantly, keep them on a positive course from the start. Free Swimming the WSFF CEO on how to initiative succeed? attract women into sport W However, with teenagers presenting increasing challenges to society, the power of ACTIVE PEOPLE SURVEY 2 Sport England analyses the success of its new strategy sport to support them has assumed new levels of importance and significance. SPORTS This is especially true today, when the major thrusts of sports policy are – understandably MANAGEMENT – towards excellence, in support of our London 2012 performance and legacy, and towards participation, as part of the vital healthy-living agenda. With two such powerful and well-funded policy threads in place, it’s important not to overlook the societal aspects of sport. Sports Management leads the industry in offering you a Rugby great Martin Johnson In this issue, we look at examples of best practice in sports mentoring (page 40) and highlight a range of initiatives including the Respect Athlete Mentoring Programme (RAMP), which assigns comprehensive range of marketing services which enable e-mail: please use contact’s elite athlete mentors to disaffected young people between the ages of 11 and 25. -

The Golden Ratio for Social Marketing

30/ 60/ 10: The Golden Ratio for Social Marketing February 2014 www.rallyverse.com @rallyverse In planning your social media content marketing strategy, what’s the right mix of content? Road Runner Stoneyford Furniture Catsfield P. O & Stores Treanors Solicitors Masterplay Leisure B. G Plating Quality Support Complete Care Services CENTRAL SECURITY Balgay Fee d Blends Bruce G Carrie Bainbridge Methodist Church S L Decorators Gomers Hotel Sue Ellis A Castle Guest House Dales Fitness Centre St. Boniface R. C Primary School Luscious C hinese Take Away Eastern Aids Support Triangle Kristine Glass Kromberg & Schubert Le Club Tricolore A Plus International Express Parcels Miss Vanity Fair Rose Heyworth Club Po lkadotfrog NPA Advertising Cockburn High School The Mosaic Room Broomhill Friery Club Metropolitan Chislehurst Motor Mowers Askrigg V. C School D. C Hunt Engineers Rod Brown E ngineering Hazara Traders Excel Ginger Gardens The Little Oyster Cafe Radio Decoding Centre Conlon Painting & Decorating Connies Coffee Shop Planet Scuba Aps Exterior Cleaning Z Fish Interpretor Czech & Slovak System Minds Morgan & Harding Red Leaf Restaurant Newton & Harrop Build G & T Frozen Foods Council on Tribunals Million Dollar Design A & D Minicoaches M. B Security Alarms & Electrical Iben Fluid Engineering Polly Howell Banco Sabadell Aquarius Water Softeners East Coast Removals Rosica Colin S. G. D Engineering Services Brackley House Aubergine 262 St. Marys College Independent Day School Arrow Vending Services Natural World Products Michael Turner Electrical Himley Cricket Club Pizz a & Kebab Hut Thirsty Work Water Coolers Concord Electrical & Plumbing Drs Lafferty T G, MacPhee W & Mcalindan Erskine Roofing Rusch Manufacturing Highland & Borders Pet Suppl ies Kevin Richens Marlynn Construction High Definition Studio A. -

Parliamentary Debates (Hansard)

Thursday Volume 551 18 October 2012 No. 51 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Thursday 18 October 2012 £5·00 © Parliamentary Copyright House of Commons 2012 This publication may be reproduced under the terms of the Open Parliament licence, which is published at www.parliament.uk/site-information/copyright/. 463 18 OCTOBER 2012 464 taxpayer. Why on earth would the Minister want to House of Commons swap that for the unmitigated disaster of the west coast tender? Is not that free-marketism gone mad? Thursday 18 October 2012 Mr McLoughlin: I draw on what the shadow Lord Chancellor, the right hon. Member for Tooting (Sadiq The House met at half-past Nine o’clock Khan), said when he was a Transport Minister: “The rail franchising system was examined by the National Audit Office last year, and was found to deliver good value for PRAYERS money” and “steadily improving” services. He continued: “Passenger numbers are at their highest levels since the 1940s,” [MR SPEAKER in the Chair] and “punctuality is more than 90 per cent.”—[Official Report, 1 July 2009; Vol. 495, c. 425-6.] Oral Answers to Questions I agree with what the right hon. Gentleman said then, and I think it is the right way forward. Miss Anne McIntosh (Thirsk and Malton) (Con): I TRANSPORT congratulate my right hon. Friend on continuing the policies of this Government as well as the last, but there The Secretary of State was asked— are lessons to be learned for both the east coast and the west coast franchise. Will he ensure that the product of Colne-Skipton Rail Link the east coast main line service will remain the premier service in the land? 1. -

Rocket-Round-Leicester-Trail-Map.Pdf

KE D L ESTO D A E N O H U R A A L N V L D E E A E R V T V S I A A R O I N Y R B B G R L I E O UE N K L E HE RMITA A V GE RO AD T A D ID S AV A D C W E T B H U R Birstall Golf Club C D H A A O A S R D T L O L R A I N T A S R N R I O B TEDWOR R A O D A Midland Co-Operative D Red Hill Allotments L Society TH O BORDER DR DRIVE GR IVE BORDER U SE EEN O L G C W A H SH E N AK B O MILLWOOD CLOSE Great Central O R Railway D A ESCENT O BIRSTOW CR FR O EE R HOLD U N ROAD G A M H O R AY UR W IDLESP R B BR O R O PER D SEVERANCE ROAD E A BI R R ST D OW AD R D O IV C R E RE EY L S RS C CE JE N N E SE E T CLO M U Y ND CHLE BO N T E Y P E V B V EL A I EAS G E T RAVE R RO H U A T D D N BO R ULE A E L G V L L I VAR A C T S N S D Y R G R BU A L N U D A I B O A C L Belgrave Cemetery D D O I R O S L M E L H A T T S R BELGRAVE BOULEVARD I B RED HILL WAY WATERMEAD WAY CASH MOR E V BEL GRA VE BOUL EVARD IEW ILL C D H IRC F E L EL R E ST EA D RO A Footbridge D WOODSTOCK ROAD E CE A K L E LOS P D L C ESTO LA D CK A E E N ELLIOTT O O M H U R A A N L ST V L D E D E PA E A E R E V R V T O V S OAD I I A U A R O I O R N Y T R B N E B D W G E N R L U I X E O UE V E N K N L E HE RMITA A V GE RO AD A A T A C ID E S D F AV I S V A D N L E A C R A R W E L E T C L T H B H T E U A Belgrave R A W Birstall Golf Club D N C H N H A E Rugby Club A O R T Outdoor Pursuits A S L R H D T L A O L E R A B U Centre I N T H R A S R N R I C O B A M T R A A S E D O R T DW W A Midland Co-Operative O O D O N O D Red Hill Allotments R R R L Society O MOTTI T A Y O O T H D BORDER A A S DR E -

Country City on Product 3Dlm

Country City on product 3dlm - lmic Name alb tirana Resurrection Cathedral alb tirana Clock Tower of Tirana alb tirana The Plaza Tirana alb tirana TEATRI OPERAS DHE BALETIT alb tirana Taivani Taiwan Center alb tirana Toptani Shopping Center alb tirana Muzeu Historik Kombetar and andorra_la_vella Sant Joan de Caselles and andorra_la_vella Rocòdrom - Caldea and andorra_la_vella Sant Martí de la Cortinada and andorra_la_vella Santa Coloma and andorra_la_vella Sant Esteve d'Andorra la Vella and andorra_la_vella La Casa de la Vall and andorra_la_vella La Noblesse du Temps aut bischofshofen Paul Ausserleitner Hill aut graz Graz Hauptbahnhof aut graz Stadthalle Graz aut graz Grazer Opernhaus aut graz Merkur Arena aut graz Kunsthaus Graz aut graz Universität Graz aut graz Technische Universität Graz aut graz Universität für Musik und darstellende Kunst Graz aut graz Mariatrost aut graz Mausoleum aut graz Vereinigte Bühnen Schauspielhaus Graz aut graz Heiligen Blut aut graz Landhaus aut graz Grazer Uhrturm aut graz Schloss Eggenberg aut graz Magistrat der Stadt Graz mit eigenem Statut aut graz Neue Galerie Graz aut graz Ruine Gösting aut graz Herz Jesu aut graz Murinsel aut graz Dom aut graz Herzogshof aut graz Paulustor aut graz Franciscan Church aut graz Holy Trinity Church aut graz Church of the Assumption am Leech aut graz Mariahilf aut graz Universalmuseum Joanneum, Museum im Palais aut graz Straßengel aut graz Kirche Hl. Kyrill und Method aut graz Kalvarienberg aut graz Pfarrkirche der Pfarre Graz-Kalvarienberg aut graz Glöckl Bräu aut innsbruck