Gupta V. New Silk Route Advisors, L.P., Et Al

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best Foot Forward

July/August 2011 • Issue 52 i n fo c u s parag saxena | new silk route Best foot forward March 2011 • Issue 48 Saxena: confident in future LP support New Silk Route gained a lot of unwanted publicity earlier this year when it emerged that one of its founders was being charged by the SEC in the Galleon insider trading scandal. But co-founder Parag Saxena says the growth capital firm has worked to move forward and remind LPs private equity is a team sport. By Christopher Witkowsky f the partners at New Silk Route needed evidence that the immediate task of formulating a cohesive message for LPs. firm’s limited partners were happy with the performance of the Suddenly, their job became not just about finding the best fund, a big vote of confidence came in May when close to 100 investments, but about reassuring and shoring up a base of LPs that Ipercent of LPs met a capital call. consisted of large institutions experienced in the asset class and The firm had for months been dealing with fallout related to not in the mood to deal with scandal, especially in an uncertain co-founder Rajat Gupta, who was caught up in a wide-ranging economic environment. insider trading investigation involving hedge fund giant Galleon At a recent meeting in the firm’s New York office Saxena Group. Gupta was accused in early March by the US Securities declines to discuss Gupta’s case in any detail, but says he and other and Exchange Commission of sharing confidential information to firm principals reached out to LPs when the SEC charges were Galleon’s founder Raj Rajaratnam, which the hedge fund executive made public. -

Inside Mckinsey - FT.Com

Inside McKinsey - FT.com http://www.ft.com/intl/cms/s/2/0d506e0e-1583-11e1-b9b8-00144feabd... November 25, 2011 9:32 pm By Andrew Hill 'We will never forget it,' Dominic Barton, global managing director of McKinsey, speaking about the Rajat Gupta and Anil Kumar affairs hen 1,200 partners of McKinsey&Company – the elite of global consulting – arrived at the Gaylord National Hotel & Convention Center, outside Washington DC, early on the morning of March 15 this year, they found themselves where they least wanted to be: at the centre of a media firestorm. Up the east coast, in a Manhattan courtroom, an insider trading case was focusing attention on the links between key former employees of the world’s best-known, most prestigious, most self-consciously high-minded consulting firm and a corrupt hedge fund 1 of 13 27/11/2011 8:37 PM Inside McKinsey - FT.com http://www.ft.com/intl/cms/s/2/0d506e0e-1583-11e1-b9b8-00144feabd... boss. For outsiders, intrigued by and suspicious of the McKinsey mystique, it was an irresistible combination. For partners, most of whom had flown into Washington from their offices around the globe for the scheduled annual meeting, it was a public embarrassment, a private outrage – and even a potential threat to the future of “the Firm”, as McKinseyites call their employer. “You can’t underestimate the shock, the disbelief and anger there,” recalls one McKinsey veteran. As Dominic Barton, the Firm’s personable global managing director, brought the opening plenary session to order, the older partners were “completely ashen-faced”, the same person recalls. -

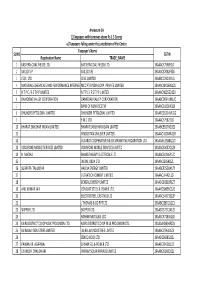

FINAL DISTRIBUTION.Xlsx

Annexure-1A 1)Taxpayers with turnover above Rs 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 EASTERN COAL FIELDS LTD. EASTERN COAL FIELDS LTD. 19AAACE7590E1ZI 2 SAIL (D.S.P) SAIL (D.S.P) 19AAACS7062F6Z6 3 CESC LTD. CESC LIMITED 19AABCC2903N1ZL 4 MATERIALS CHEMICALS AND PERFORMANCE INTERMEDIARIESMCC PTA PRIVATE INDIA CORP.LIMITED PRIVATE LIMITED 19AAACM9169K1ZU 5 N T P C / F S T P P LIMITED N T P C / F S T P P LIMITED 19AAACN0255D1ZV 6 DAMODAR VALLEY CORPORATION DAMODAR VALLEY CORPORATION 19AABCD0541M1ZO 7 BANK OF NOVA SCOTIA 19AAACB1536H1ZX 8 DHUNSERI PETGLOBAL LIMITED DHUNSERI PETGLOBAL LIMITED 19AAFCD5214M1ZG 9 E M C LTD 19AAACE7582J1Z7 10 BHARAT SANCHAR NIGAM LIMITED BHARAT SANCHAR NIGAM LIMITED 19AABCB5576G3ZG 11 HINDUSTAN UNILEVER LIMITED 19AAACH1004N1ZR 12 GUJARAT COOPERATIVE MILKS MARKETING FEDARATION LTD 19AAAAG5588Q1ZT 13 VODAFONE MOBILE SERVICES LIMITED VODAFONE MOBILE SERVICES LIMITED 19AAACS4457Q1ZN 14 N MADHU BHARAT HEAVY ELECTRICALS LTD 19AAACB4146P1ZC 15 JINDAL INDIA LTD 19AAACJ2054J1ZL 16 SUBRATA TALUKDAR HALDIA ENERGY LIMITED 19AABCR2530A1ZY 17 ULTRATECH CEMENT LIMITED 19AAACL6442L1Z7 18 BENGAL ENERGY LIMITED 19AADCB1581F1ZT 19 ANIL KUMAR JAIN CONCAST STEEL & POWER LTD.. 19AAHCS8656C1Z0 20 ELECTROSTEEL CASTINGS LTD 19AAACE4975B1ZP 21 J THOMAS & CO PVT LTD 19AABCJ2851Q1Z1 22 SKIPPER LTD. SKIPPER LTD. 19AADCS7272A1ZE 23 RASHMI METALIKS LTD 19AACCR7183E1Z6 24 KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. 19AAAAK8694F2Z6 25 JAI BALAJI INDUSTRIES LIMITED JAI BALAJI INDUSTRIES LIMITED 19AAACJ7961J1Z3 26 SENCO GOLD LTD. 19AADCS6985J1ZL 27 PAWAN KR. AGARWAL SHYAM SEL & POWER LTD. 19AAECS9421J1ZZ 28 GYANESH CHAUDHARY VIKRAM SOLAR PRIVATE LIMITED 19AABCI5168D1ZL 29 KARUNA MANAGEMENT SERVICES LIMITED 19AABCK1666L1Z7 30 SHIVANANDAN TOSHNIWAL AMBUJA CEMENTS LIMITED 19AAACG0569P1Z4 31 SHALIMAR HATCHERIES LIMITED SHALIMAR HATCHERIES LTD 19AADCS6537J1ZX 32 FIDDLE IRON & STEEL PVT. -

The New Silk Road

The World’s Global Islamic Finance News Provider 6th June 2012 RED (All Cap) 850 The New Silk Road 828.94 Economic focus is swinging from west to BRIC countries, as a result of that there is 825 east and as Europe and the US continue also spin off and growth opportunities in to struggle, new investment fl ows and neighboring countries as well. China, India, 798.09 800 trade ties develop. The historic trading they all have to move their goods around route from China to Europe, across south the world in order to be able to trade. So 775 and central Asia and the Middle East, is they have to move some of these through -3.86% once again growing in importance as trade these other countries as well. A lot of these between these regions grows in volume countries are also rich in natural resources 750 W T F S S M T and signifi cance. As these new economic and are energy rich, so what we have going realities take shape across an ancient on is a boom and a lot of potential for Powered by: IdealRatings® road with strong Muslim connections, countries from China all the way to Turkey. Volume 9 Issue 22 how can Islamic fi nance benefi t this new The Middle East is also a criticial component IFN Rapids .........................................................2 movement? of the trade that is going on there, and of the fi nancing that’s going on in that part of the Islamic Finance news .........................................5 world.” IFN Reports: Slowly but surely; Afghan Sukuk: A What is the silk route? The old silk road refers to an ancient band aid on a hemorrhage? ..................................13 network of interlinking trade routes that He explains that the new silk route covers a IFN Correspondents: Jordan; Iraq; South connected Asia with the Mediterranean far wider remit than just China, the Middle Africa; Tanzania .......................................... -

Hedge Fund Insider Trading Case in History

United States Attorney Southern District of New York FOR IMMEDIATE RELEASE CONTACT: U.S. ATTORNEY’S OFFICE OCTOBER 16, 2009 YUSILL SCRIBNER, REBEKAH CARMICHAEL, JANICE OH PUBLIC INFORMATION OFFICE (212) 637-2600 FBI JIM MARGOLIN, MONICA McLEAN PUBLIC INFORMATION OFFICE (212) 384-2720, 2715 MANHATTAN U.S. ATTORNEY CHARGES HEDGE FUND MANAGERS, FORTUNE 500 EXECUTIVES, AND MANAGEMENT CONSULTING DIRECTOR IN $20 MILLION INSIDER TRADING CASE PREET BHARARA, the United States Attorney for the Southern District of New York, and JOSEPH DEMAREST, JR., Assistant Director-in-Charge of the New York Office of the Federal Bureau of Investigation ("FBI"), today announced charges against six individuals arising out of their alleged involvement in the largest hedge fund insider trading case in history. The defendants include: RAJ RAJARATNAM, the Managing Member of Galleon Management, LLC ("Galleon"), and a portfolio manager for Galleon Technology Offshore, Ltd.; DANIELLE CHIESI, an employee of New Castle Funds, LLC ("New Castle"), formerly the equity hedge fund group of Bear Stearns Asset Management, Inc.; MARK KURLAND, a top executive at New Castle; RAJIV GOEL, a Director in Strategic Investments at Intel Capital, the investment arm of Intel Corporation ("Intel"); ANIL KUMAR, a Director at McKinsey & Company, Inc. ("McKinsey"), a global management consulting firm; and ROBERT MOFFAT, Senior Vice President and Group Executive at International Business Machines Corporation ("IBM"). All are charged with participating in insider trading schemes that together netted more than $20 million in illegal profits. This case represents the first time that court-authorized wiretaps have been used to target significant insider trading on Wall Street. All of the defendants were arrested this morning by agents of the FBI. -

Pe-Impact-2008.Pdf

Contents Executive Summary 1 Sectoral Opportunities 3 Special Article: Private Equity in Power 6 Case Study: GMR Group 8 Case Study: Suzlon Energy 10 Case Study: Noida Toll Bridge 12 Case Study: Pipavav Port 14 Case Study: Indraprastha Gas 16 Case Study: Bharti Airtel 18 Case Study: Ramky Group 20 Case Study: Gujarat State Petronet 22 Special Article: Private Equity in SEZs 24 Directory of Private Equity Firms 28 Sponsors’ Profiles 29 Supported by: Executive Summary PE Investments in Infrastructure 2006 - 07 By Value f India has an Achilles heel, it would have to be its infrastructure. With the economy powering ahead, Iindicators of that weakness - like congested ports and airports, potholed roads and power blackouts – are showing up. Experts say that poor infrastructure is already a drag on the economy by as much as PE Investments in Infrastructure 2006 - 07 1-2 % a year. By No. of Investments According to India’s Finance Minister, P. Chidambaram, the country needs an investment of USD 475 billion (about Rs. 19,000 billion) in infrastructure over the next five years to support the targeted 9% growth. Where is this capital going to come from? Given the need to prune the fiscal deficit, the government is restricted in the resources it can allocate. Last year, the government revised upwards its investment target in infrastructure by a mere 2% - from Rs. 10,890 billion to Rs. 11,100 billion - over the next five years. It doesn’t come as a surprise then that private investment in infrastructure projects is no longer a choice, but a necessity. -

Major Categories

AWARDS DINNER CEREMONY │ S eptember 23, 2010, India FINALIST TOP CONTENDERS ANNOUNCEMENT August 27, 2010 New York, NY: GOLD STANDARD of PERFORMANCE, the ASIA-PACIFIC M&A ATLAS AWARDS honors top deals, dealmakers and firms from the greater Asia Pacific including India, China, South East Asia, Far East and the Australia/Oceanic mergers, acquisitions, private equity and venture capital communities. HONORARY GUEST EVENING REMARKS by: Paul A. Folmsbee, Consul General American Consulate General, State Department of United States of America WINNERS are revealed for the first time at the awards gala ceremony held September 23, 2010. Nominees or their representatives must confirm “proof of attendance” for the WINNER SELECTION process and be in attendance at the awards gala ceremony to be honored. Selection criteria are based on transaction performance metrics such as deal novelty and structure; sector and markets, jurisdictional intricacies; professional leadership; brand strength; resourcefulness; and other criteria. ENQUIRIES, contact: Raj Kashyap, at [email protected] or +914.886.3085. CONGRATULATIONS to the TOP CONTENDER FINALISTS CIRCLE MAJOR AWARD CATEGORIES: (Winner Selection Policy: Nominees must confirm “proof of attendance” by September 12 for inclusion in the winner selection process. Winners are honored and presented with a trophy.) ASIA PACIFIC M&A DEAL of the YEAR │ above 500 million USD (Qualification: Transaction private equity or corporate; cross-border, domestic, any sector, below a billion USD in size) • AsiaInfo Holdings, Inc. merger with Linkage Technologies International Holdings Limited. The Hina Group, BofA Merrill Lynch, Barclays Capital • Doosan Heavy Industries & Construction acquisition of Skoda Power. Citigroup • CVC Capital Partners control acquisition in PT Matahari Putra Prima Tbk, CVC Asia • Fortis Healthcare strategic acquisition stake in Parkway Holdings Ltd from TPG Capital. -

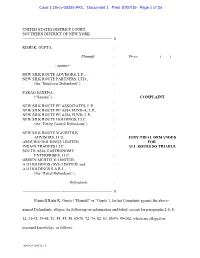

Gupta NSR COMPLAINT FINAL

Case 1:19-cv-09284-PKC Document 1 Filed 10/07/19 Page 1 of 34 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK --------------------------------------------------------------------- X RISHI K. GUPTA, : Plaintiff, : 19-cv-___________(____) - against - : NEW SILK ROUTE ADVISORS, L.P., : NEW SILK ROUTE PARTNERS, LTD., (the “Employer Defendants”) : PARAG SAXENA, : (“Saxena”) COMPLAINT : NEW SILK ROUTE PE ASSOCIATES, L.P., NEW SILK ROUTE PE ASIA FUND-A, L.P., : NEW SILK ROUTE PE ASIA FUND, L.P., NEW SILK ROUTE HOLDINGS, LLC, : (the “Entity Control Defendants”) : NEW SILK ROUTE MAURITIUS ADVISORS, LLC, : JURY TRIAL DEMANDED ARDUINO HOLDINGS LIMITED, FOR INGAIN TRADERS LLC, : ALL ISSUES SO TRIABLE SOUTH ASIA GASTRONOMY ENTERPRISES, LLC, : ORISEN MEDTECH LIMITED, A H HOLDINGS (BVI) LIMITED, and : A H HOLDINGS S.A.R.L., (the “Relief Defendants”), : Defendants. : --------------------------------------------------------------------- X Plaintiff Rishi K. Gupta (“Plaintiff” or “Gupta”), for his Complaint against the above- named Defendants, alleges the following on information and belief, except for paragraphs 2-6, 8, 12, 31-35, 39-48, 51, 54, 55, 58, 65-70, 72, 74, 82, 83, 85-94, 99-102, which are alleged on personal knowledge, as follows: {00076237.DOCX v 5} Case 1:19-cv-09284-PKC Document 1 Filed 10/07/19 Page 2 of 34 NATURE OF THE ACTION 1. This action is brought under the whistleblower protection provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, codified at Section 21F(6)(h) of the Securities Exchange Act of 1934, as amended, 15 U.S.C. § 78u-6(h) (“Dodd- Frank”). 2. Gupta was the chief compliance officer (“CCO”) and chief financial officer (“CFO”) of Defendant New Silk Route Advisors, LP (“NSR Advisors”), an investment advisor registered with the U.S. -

Annual Report 2020

Our Purpose, Values and Principles CONTENT Chairman’s Statement ............................................................... 03 OUR PURPOSE Managing Director’s Statement ............................................... 04 We will provide branded products and services of Report of the Directors ............................................................. 05-48 superior quality and value that improve the lives of the Management Discussion & Analysis ....................................... 49-50 world’s consumers, now and for generations to come. Corporate Governance .............................................................. 51-68 NSUME R Auditors’ Report .......................................................................... 69-77 CO S Balance Sheet ............................................................................ 78 OUR VALUES Statement of Profit & Loss ....................................................... 79 Integrity Statement of Cash Flow ........................................................... 80-81 P Leadership E & Statement of Changes in Equity ............................................. 82 L G Ownership P Notes forming part of the Financial Statements ................ 83-129 B Passion for Winning O R E A P Ten Year Financial Highlights ................................................... 130 Trust N G D & S P OUR PRINCIPLES We show respect for all individuals. The interests of the Company and the individual are inseparable. We are strategically focused on our work. Innovation is the cornerstone of our -

Raj Rajaratnam

Raj Rajaratnam Raj Rajaratnam (Tamil : ரா Raj Rajaratnam ராஜரதின ; born June 15, 1957) is [1] a Sri Lankan American former hedge June 15, 1957 (age 57) fund manager and billionaire founder of Born Colombo , Dominion of Ceylon (now Sri the Galleon Group , a New York-based Lanka ) hedge fund management firm. [3][4] On October 16, 2009, he was arrested by the FBI on allegations of insider trading , Ethnicity Sri Lankan American which also caused the Galleon Group to close. [5] He stood trial in U.S. v American Rajaratnam (09 Cr. 01184) in the United Citizenship States District Court for the Southern District of New York , and on May 11, Alma mater Wharton School of Business (MBA ) 2011 was found guilty on all 14 counts of conspiracy and securities fraud. [6][7] On October 13, 2011, Rajaratnam was Occupation Hedge fund manager sentenced to 11 years in prison [8] and fined a criminal and civil penalty of over Net worth $1.8 billion (2009) [2] $150 million combined. [9] As of January 14, 2013 Rajaratnam is Spouse(s) Asha Pabla incarcerated at Federal Medical Center, Devens in Ayer, Massachusetts , an administrative facility housing male Children 3 offenders requiring specialized or long- term medical or mental health care. Rengan Rajaratnam Rajaratnam's release date is July 4, 2021. Relatives Ragakanthan Rajaratnam Background and career Rajaratnam is an ethnic Sri Lankan Tamil born in Colombo in the Dominion of Ceylon , present- day Sri Lanka. His father was the head of the Singer Sewing Machine Co. in South Asia. [10] According to the newspaper The Island , he attended S. -

Government's Sentencing Memo in U.S. V. Gupta

Case 1:11-cr-00907-JSR Document 124 Filed 10/17/12 Page 1 of 13 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x : UNITED STATES OF AMERICA : : - v. - : S1 11 Cr. 907 (JSR) : RAJAT K. GUPTA, : : Defendant. : : - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x GOVERNMENT’S SENTENCING MEMORANDUM PREET BHARARA United States Attorney for the Southern District of New York Richard C. Tarlowe Assistant United States Attorney - Of Counsel - Case 1:11-cr-00907-JSR Document 124 Filed 10/17/12 Page 2 of 13 I. INTRODUCTION The Government submits this memorandum in connection with the sentencing of Rajat Gupta. Gupta was convicted after trial of one count of conspiracy to commit securities fraud and three counts of securities fraud in connection with an insider trading scheme in which Gupta provided material nonpublic information to Raj Rajaratnam in violation of Gupta’s fiduciary and other duties of confidentiality so that Rajaratnam could use the information for trading purposes. Gupta’s position on the Boards of Directors of Goldman Sachs and Procter & Gamble (“P&G”) gave him privileged access to sensitive and confidential information. Rather than use that information solely to serve the interests of the shareholders, as he was obligated to do, Gupta violated boardroom confidences and used the information he learned as a Director to help Rajaratnam and others at Galleon make millions of dollars in illegal profits. For the reasons discussed below, a significant term of imprisonment is necessary to reflect the seriousness of Gupta’s crimes and to deter other corporate insiders in similar positions of trust from stealing corporate secrets and engaging in a crime that has become far too common. -

SEC Complaint

David Rosenfeld Associate Regional Director Attorney for Plaintiff SECURITIES AND EXCHANGE COMMISSION New York Regional Office 3 World Financial Center, Suite 400 New York, New York 10281 (212) 336-0153 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, 09 Civ. 8811 Plaintiff, (JSR) -against- ECFCASE GALLEON MANAGEMENT, LP, AMENDED RAJ RAJARATNAM, COMPLAINT RAJIVGOEL, ANILKUMAR, JURY TRIAL DANIELLE CHIESI, DEMANDED MARK KURLAND, ROBERT MOFFAT, NEW CASTLE FUNDS LLC, ROOMY KHAN, DEEP SHAH, ALI T. FAR, CHOO-BENG LEE, . FAR & L~E LLC, SPHERIX CAPITAL LLC, ALIHARIRI, ZVIGOFFER, DAVID PLATE, GAUTHAM SHANKAR, SCHOTTENFELD GROUP LLC, STEVEN FORTUNA, and S2 CAPITAL MANAGEMENT, LP, Defendants. PlaintiffSecurities and Exchange Commission ("Commission") for its Complaint against defendants Galleon Management, LP ("Galleon"), Raj Rajaratnam ("Rajaratnam"), Rajiv Goel ("Goel"), Anil Kumar ("Kumar"), Danielle Chiesi ("Chiesi"), Mark Kurland ("Kurland"), Robert Moffat ("Moffat"), New Castle Funds LLC ("New Castle"), Roomy Khan ("Khan"), Deep Shah ("Shah"), Ali T. Far ("Far"), Choo-Beng Lee ("Lee"), Far & Lee LLC ("Far & Lee"), Spherix Capital LLC ("Spherix Capital"), Ali Hariri ("Hariri"), Zvi Goffer ("Goffer"), David Plate ("Plate"), Gautham Shankar ("Shankar"), Schottenfeld Group LLC ("Schottenfeld"), Steven Fortuna ("Fortuna"), and S2 Capital Management, LP ("S2 Capital"), alleges as follows: SUMMARY I. This case involves widespread and repeated insider trading at several hedge funds, including Galleon - a multi-billion dollar New York hedge fund complex founded and controlled by Rajaratnam - New Castle, Spherix Capital, and S2 Capital. The sources ofthe inside infonnation include Goel, a managing director at Intel Corporation ("Intel"), Kumar, a director at McKinsey & Co. ("McKinsey"), Moffat, a senior executive at IBM, as well as executives and consultants at other well known companies.