Hedge Fund Insider Trading Case in History

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Complaint Against Rajat K. Gupta and Raj Rajaratnam

George S. Canellos -,"-:-:-1 Attorney for Plaintiff . .. SECURITIES AND EXCHANGE COMMISsroNls New York Regional Office 3 World Financial Center, Suite 400 New York, NY 10281-1022 (212) 336-1100 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, Plaintiff, ..;against- COMPLAINT RAJAT K. GUPTA and RAJRAJARATNAM, ECFCASE Defendants. Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against defendants Rajat K. Gupta ("Gupta") and Raj Rajaratnam ("Rajaratnam" and . together with Gupta, the "Defendants"), alleges as follows: i I SUMMARY I I I 1. This matter concerns an extensive insider trading scheme conducted by II 'I . Gupta and Rajaratnam. On multiple occasions, Gupta disclosed material nonpublic I information that he obtained in the course ofhis duties las a member ofthe Boards of D~rectors ofThe GoldmanSachs Group, Inc~ ("Goldman Sachs") and The Procter & GambleCompany ("Procter & Gamble") to Rajaratnam, the founder and Managing I General Partner ofthe hedge fund investment manager named Galleon Management, LP I I ("Galleon"). Rajaratnam, in tum, either caused the Galleon hedge fullds that he managed· I i to trade on the basis ofmaterial nonpublic information, or passed the information on to . others at Galleon who caused other Galleon hedge funds to trade on the basis ofthe material nonpublic information. 2. Specifically, Gupta disclosed to Rajaratnam material nonpublic information concerning Berkshire Hathaway Inc's ("Berkshire") $5 billion investment in Goldman Sachs before it was publicly announced on September 23,2008. Gupta also provided to Rajaratnam material non-public information concerning Goldman Sachs's financial results for both the second and fourth quarters of2008. Rajaratnam caused the various. -

Bharara Wins a PR Victory After Bruising Newman Loss - Law360 Page 1 of 3

Bharara Wins A PR Victory After Bruising Newman Loss - Law360 Page 1 of 3 Portfolio Media. Inc. | 860 Broadway, 6th Floor | New York, NY 10003 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] Bharara Wins A PR Victory After Bruising Newman Loss By Ed Beeson Law360, New York (October 23, 2015, 9:42 PM ET) -- After losing his battle against an insider trading decision that cost him marquee convictions, U.S. Attorney Preet Bharara on Thursday was able to score public relations points when he announced he would exonerate six cooperating witnesses in a show that his office acts fairly, particularly to those who help the government out. Mere weeks after the Supreme Court refused to hear the government’s appeal of the blockbuster decision known as U.S. v. Newman, the top Manhattan federal prosecutor made a somewhat unexpected move when he released six people from guilty pleas they entered in connection with the Newman case and another matter brought against former hedge fund manager Michael Steinberg. Doing so enabled Bharara, who is known for his media savvy, to send a strong public message about how his office operates. “It does provide the U.S. attorney’s office with an opportunity, from a public relations perspective, to say, 'We did the right thing,'” said Michael Weinstein, chairman of the white collar defense and investigations practice at Cole Schotz Meisel Forman & Leonard PA and a former federal prosecutor. “From a PR standpoint, Preet can take advantage of this,” he said. Bharara said he made this move because after the Second Circuit overturned the insider trading convictions of former hedge fund managers Todd Newman and Anthony Chiasson and ultimately forced him to drop charges against Steinberg as well, it wouldn't have been “in the interests of justice" to maintain the guilty pleas of cooperators who were central to the government's prosecutions. -

Former Galleon Portfolio Manager Sentenced in Manhattan Federal Court for Insider Trading

UNITED STATES ATTORNEY’S OFFICE Southern District of New York U.S. ATTORNEY PREET BHARARA FOR IMMEDIATE RELEASE CONTACT: Ellen Davis, Jerika Richardson, Tuesday, June 26, 2012 Jennifer Queliz http://www.justice.gov/usao/nys (212) 637-2600 FORMER GALLEON PORTFOLIO MANAGER SENTENCED IN MANHATTAN FEDERAL COURT FOR INSIDER TRADING Preet Bharara, the United States Attorney for the Southern District of New York, announced that ADAM SMITH, a former portfolio manager of the communications fund at Galleon Group (“Galleon”), was sentenced today to two years of probation and ordered to forfeit $105,300 for his participation in an insider trading scheme in which SMITH provided material, nonpublic information (“Inside Information”) obtained from an investment banker at a financial institution and from other public company employees to Raj Rajaratnam, the head of Galleon. At various times, both he and Rajaratnam traded on the Inside Information. SMITH pled guilty in January 2011 to one count of conspiracy to commit securities fraud and one count of securities fraud. He was sentenced today in Manhattan federal court by U.S. District Judge Jed S. Rakoff. According to the Information, statements made during SMITH’s guilty plea proceeding, and SMITH’s testimony during the trial of Rajaratnam: From 2003 through 2009, SMITH executed and caused others to execute securities trades based on Inside Information that he obtained from certain insiders who violated fiduciary and other duties of trust and confidence. On multiple occasions, SMITH obtained Inside Information from an investment banker at a financial institution where he once worked. In 2005, while working as an analyst at Galleon, the investment banker told SMITH that Integrated Devices Technology Inc. -

Inside Mckinsey - FT.Com

Inside McKinsey - FT.com http://www.ft.com/intl/cms/s/2/0d506e0e-1583-11e1-b9b8-00144feabd... November 25, 2011 9:32 pm By Andrew Hill 'We will never forget it,' Dominic Barton, global managing director of McKinsey, speaking about the Rajat Gupta and Anil Kumar affairs hen 1,200 partners of McKinsey&Company – the elite of global consulting – arrived at the Gaylord National Hotel & Convention Center, outside Washington DC, early on the morning of March 15 this year, they found themselves where they least wanted to be: at the centre of a media firestorm. Up the east coast, in a Manhattan courtroom, an insider trading case was focusing attention on the links between key former employees of the world’s best-known, most prestigious, most self-consciously high-minded consulting firm and a corrupt hedge fund 1 of 13 27/11/2011 8:37 PM Inside McKinsey - FT.com http://www.ft.com/intl/cms/s/2/0d506e0e-1583-11e1-b9b8-00144feabd... boss. For outsiders, intrigued by and suspicious of the McKinsey mystique, it was an irresistible combination. For partners, most of whom had flown into Washington from their offices around the globe for the scheduled annual meeting, it was a public embarrassment, a private outrage – and even a potential threat to the future of “the Firm”, as McKinseyites call their employer. “You can’t underestimate the shock, the disbelief and anger there,” recalls one McKinsey veteran. As Dominic Barton, the Firm’s personable global managing director, brought the opening plenary session to order, the older partners were “completely ashen-faced”, the same person recalls. -

Rajat Gupta's Trial: the Case for Civil Charges

http://www.slate.com/articles/news_and_politics/jurisprudence/2012/05/rajat_gupta_s_trial_the_case_for_civil_charges_against_him_.html Rajat Gupta’s trial: The case for civil charges against him. By Harlan J. Protass | Posted Friday, May 18, 2012, at 8:00 AM ET | Posted Friday, May 18, 2012, at 8:00 AM ET Slate.com Take Their Money and Run The government should fine the hell out of Rajat Gupta instead of criminally prosecuting him. Rajat Gupta, former Goldman Sachs board member, leaves a Manhattan court after surrendering to federal authorities Oct. 26, 2011 in New York City Photograph by Spencer Platt/Getty Images. On Monday, former McKinsey & Company chief executive Rajat Gupta goes on trial for insider trading. Gupta is accused of sharing secrets about Goldman Sachs and Proctor & Gamble with Raj Rajaratnam, the former chief of hedge fund giant Galleon Group, who was convicted in October 2011 of the same crime. Gupta and Rajaratnam are the biggest names in the government’s 3-year-old crackdown on illegal trading on Wall Street. So far, prosecutors have convicted or elicited guilty pleas from more than 60 traders, hedge fund managers, and other professionals. Federal authorities said in February that they are investigating an additional 240 people for trading on inside information. About one half have been identified as “targets,” meaning that government agents believe they committed crimes and are building cases against them. Officials are so serious about their efforts that they even produced a public service announcement about fraud in the public markets. It features Michael Douglas, the Academy Award winning actor who played corrupt financier Gordon Gekko in the 1987 hit film Wall Street. -

Rajaratnam, Raj Verdict

United States Attorney Southern District of New York FOR IMMEDIATE RELEASE CONTACT: U.S. ATTORNEY'S OFFICE MAY 11, 2011 ELLEN DAVIS, CARLY SULLIVAN, JERIKA RICHARDSON, EDELI RIVERA PUBLIC INFORMATION OFFICE (212) 637-2600 HEDGE FUND BILLIONAIRE RAJ RAJARATNAM FOUND GUILTY IN MANHATTAN FEDERAL COURT OF INSIDER TRADING CHARGES Rajaratnam Convicted On 14 Counts For Illegal Stock Trades In Companies Including Goldman Sachs, Clearwire, Akamai, AMD, Intel, Polycom, and PeopleSupport PREET BHARARA, the United States Attorney for the Southern District of New York, announced that RAJ RAJARATNAM was found guilty today by a jury in Manhattan federal court of conspiracy and securities fraud crimes stemming from his involvement in the largest hedge fund insider trading scheme in history. RAJARATNAM was the Managing Member of Galleon Management, LLC ("Galleon"), the General Partner of Galleon Management, L.P., and a portfolio manager for Galleon Technology Offshore, Ltd., and certain accounts of Galleon Diversified Fund, Ltd. He was convicted after an eight-week trial before U.S. District Judge RICHARD J. HOLWELL. Manhattan U.S. Attorney PREET BHARARA stated: "Raj Rajaratnam, once a high-flying billionaire and hedge fund manager, is now a convicted felon, 14 times over. Rajaratnam was among the best and the brightest – one of the most educated, successful and privileged professionals in the country. Yet, like so many others recently, he let greed and corruption cause his undoing. The message today is clear -- there are rules and there are laws, and they apply to everyone, no matter who you are or how much money you have. Unlawful insider trading should be offensive to everyone who believes in, and relies on, the market. -

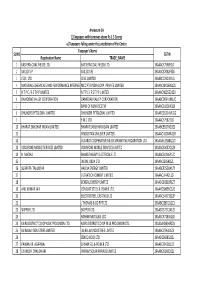

FINAL DISTRIBUTION.Xlsx

Annexure-1A 1)Taxpayers with turnover above Rs 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 EASTERN COAL FIELDS LTD. EASTERN COAL FIELDS LTD. 19AAACE7590E1ZI 2 SAIL (D.S.P) SAIL (D.S.P) 19AAACS7062F6Z6 3 CESC LTD. CESC LIMITED 19AABCC2903N1ZL 4 MATERIALS CHEMICALS AND PERFORMANCE INTERMEDIARIESMCC PTA PRIVATE INDIA CORP.LIMITED PRIVATE LIMITED 19AAACM9169K1ZU 5 N T P C / F S T P P LIMITED N T P C / F S T P P LIMITED 19AAACN0255D1ZV 6 DAMODAR VALLEY CORPORATION DAMODAR VALLEY CORPORATION 19AABCD0541M1ZO 7 BANK OF NOVA SCOTIA 19AAACB1536H1ZX 8 DHUNSERI PETGLOBAL LIMITED DHUNSERI PETGLOBAL LIMITED 19AAFCD5214M1ZG 9 E M C LTD 19AAACE7582J1Z7 10 BHARAT SANCHAR NIGAM LIMITED BHARAT SANCHAR NIGAM LIMITED 19AABCB5576G3ZG 11 HINDUSTAN UNILEVER LIMITED 19AAACH1004N1ZR 12 GUJARAT COOPERATIVE MILKS MARKETING FEDARATION LTD 19AAAAG5588Q1ZT 13 VODAFONE MOBILE SERVICES LIMITED VODAFONE MOBILE SERVICES LIMITED 19AAACS4457Q1ZN 14 N MADHU BHARAT HEAVY ELECTRICALS LTD 19AAACB4146P1ZC 15 JINDAL INDIA LTD 19AAACJ2054J1ZL 16 SUBRATA TALUKDAR HALDIA ENERGY LIMITED 19AABCR2530A1ZY 17 ULTRATECH CEMENT LIMITED 19AAACL6442L1Z7 18 BENGAL ENERGY LIMITED 19AADCB1581F1ZT 19 ANIL KUMAR JAIN CONCAST STEEL & POWER LTD.. 19AAHCS8656C1Z0 20 ELECTROSTEEL CASTINGS LTD 19AAACE4975B1ZP 21 J THOMAS & CO PVT LTD 19AABCJ2851Q1Z1 22 SKIPPER LTD. SKIPPER LTD. 19AADCS7272A1ZE 23 RASHMI METALIKS LTD 19AACCR7183E1Z6 24 KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. 19AAAAK8694F2Z6 25 JAI BALAJI INDUSTRIES LIMITED JAI BALAJI INDUSTRIES LIMITED 19AAACJ7961J1Z3 26 SENCO GOLD LTD. 19AADCS6985J1ZL 27 PAWAN KR. AGARWAL SHYAM SEL & POWER LTD. 19AAECS9421J1ZZ 28 GYANESH CHAUDHARY VIKRAM SOLAR PRIVATE LIMITED 19AABCI5168D1ZL 29 KARUNA MANAGEMENT SERVICES LIMITED 19AABCK1666L1Z7 30 SHIVANANDAN TOSHNIWAL AMBUJA CEMENTS LIMITED 19AAACG0569P1Z4 31 SHALIMAR HATCHERIES LIMITED SHALIMAR HATCHERIES LTD 19AADCS6537J1ZX 32 FIDDLE IRON & STEEL PVT. -

SEC Complaint

George S. Canellos -,"-:-:-1 Attorney for Plaintiff . .. SECURITIES AND EXCHANGE COMMISsroNls New York Regional Office 3 World Financial Center, Suite 400 New York, NY 10281-1022 (212) 336-1100 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, Plaintiff, ..;against- COMPLAINT RAJAT K. GUPTA and RAJRAJARATNAM, ECFCASE Defendants. Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against defendants Rajat K. Gupta ("Gupta") and Raj Rajaratnam ("Rajaratnam" and . together with Gupta, the "Defendants"), alleges as follows: i I SUMMARY I I I 1. This matter concerns an extensive insider trading scheme conducted by II 'I . Gupta and Rajaratnam. On multiple occasions, Gupta disclosed material nonpublic I information that he obtained in the course ofhis duties las a member ofthe Boards of D~rectors ofThe GoldmanSachs Group, Inc~ ("Goldman Sachs") and The Procter & GambleCompany ("Procter & Gamble") to Rajaratnam, the founder and Managing I General Partner ofthe hedge fund investment manager named Galleon Management, LP I I ("Galleon"). Rajaratnam, in tum, either caused the Galleon hedge fullds that he managed· I i to trade on the basis ofmaterial nonpublic information, or passed the information on to . others at Galleon who caused other Galleon hedge funds to trade on the basis ofthe material nonpublic information. 2. Specifically, Gupta disclosed to Rajaratnam material nonpublic information concerning Berkshire Hathaway Inc's ("Berkshire") $5 billion investment in Goldman Sachs before it was publicly announced on September 23,2008. Gupta also provided to Rajaratnam material non-public information concerning Goldman Sachs's financial results for both the second and fourth quarters of2008. Rajaratnam caused the various. -

Wall Street As Yossarian: the Other Effects of the Rajaratnam Insider Trading Conviction

WALL STREET AS YOSSARIAN: THE OTHER EFFECTS OF THE RAJARATNAM INSIDER TRADING CONVICTION J. Scott Colesanti* I. INTRODUCTION ―Without warning, the patient sat up in bed and shouted, „I see everything twice!‟‖1 And thus Yossarian, the war-weary bomber pilot of the masterful novel, Catch-22, was able to malinger in an Italian hospital even longer while nervous doctors attended to the strange malady of his neighbor.2 The storied literary diversion may highlight the good fortune of those evading government prosecution of financial crimes in 2011, a year that fulfilled the promise that observers of hedge fund discipline would similarly see things twice. To wit, in May 2011, a Manhattan jury convicted billionaire hedge fund entrepreneur Raj Rajaratnam of fourteen counts of conspiracy and securities fraud.3 Chief among these convictions was the crime of insider trading.4 The case punctuated two years of criminal actions based upon insider trading allegations by the U.S. Attorney for the Southern District of New York, who had called * J. Scott Colesanti is an Associate Professor of Legal Writing at the Maurice A. Deane School of Law at Hofstra University, where he has taught Securities Regulation every year since 2002. He has authored over twenty articles on the detection, prosecution, or punishment of securities fraud. His first Hofstra Law Review article was published in 2006, and his Expert Commentaries introduce the LexisNexis versions of such landmark securities law cases as United States v. O‟Hagan and SEC v. W.J. Howey & Co. Professor Colesanti is a former contributing co-editor to the Business Law Professor Blog, where over 100 of his posts appear. -

Hedge Fund Owner Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison

UNITED STATES ATTORNEY’S OFFICE Southern District of New York U.S. ATTORNEY PREET BHARARA FOR IMMEDIATE RELEASE CONTACT: Ellen Davis, Carly Sullivan, Thursday, October 13, 2011 Jerika Richardson http://www.justice.gov/usao/nys (212) 637-2600 HEDGE FUND FOUNDER RAJ RAJARATNAM SENTENCED IN MANHATTAN FEDERAL COURT TO 11 YEARS IN PRISON FOR INSIDER TRADING CRIMES Rajaratnam Receives Longest Prison Term In History For Insider Trading PREET BHARARA, the United States Attorney for the Southern District of New York, announced that RAJ RAJARATNAM was sentenced today in Manhattan federal court to 11 years in prison stemming from his involvement in the largest hedge fund insider trading scheme in history. RAJARATNAM was the Managing Member of Galleon Management, LLC ("Galleon"), the General Partner of Galleon Management, L.P., and a portfolio manager for Galleon Technology Offshore, Ltd., and certain accounts of Galleon Diversified Fund, Ltd. He was convicted on May 11, 2011, of all 14 counts of conspiracy and securities fraud with which he was charged, following an eight-week jury trial. RAJARATNAM was sentenced today by U.S. District Judge RICHARD J. HOLWELL. It is the longest sentence to be imposed for insider trading in history. Manhattan U.S. Attorney PREET BHARARA stated: "Two years ago, Raj Rajaratnam stood at the summit of Wall Street, commanding his own financial empire. Then he was arrested, tried, and convicted by a jury. Mr. Rajaratnam stood convicted 14 times over of felonies, his empire exposed as a web of fraud and corruption that entangled many. Today, Mr. Rajaratnam stood once more and faced justice which was meted out to him. -

Annual Report 2020

Our Purpose, Values and Principles CONTENT Chairman’s Statement ............................................................... 03 OUR PURPOSE Managing Director’s Statement ............................................... 04 We will provide branded products and services of Report of the Directors ............................................................. 05-48 superior quality and value that improve the lives of the Management Discussion & Analysis ....................................... 49-50 world’s consumers, now and for generations to come. Corporate Governance .............................................................. 51-68 NSUME R Auditors’ Report .......................................................................... 69-77 CO S Balance Sheet ............................................................................ 78 OUR VALUES Statement of Profit & Loss ....................................................... 79 Integrity Statement of Cash Flow ........................................................... 80-81 P Leadership E & Statement of Changes in Equity ............................................. 82 L G Ownership P Notes forming part of the Financial Statements ................ 83-129 B Passion for Winning O R E A P Ten Year Financial Highlights ................................................... 130 Trust N G D & S P OUR PRINCIPLES We show respect for all individuals. The interests of the Company and the individual are inseparable. We are strategically focused on our work. Innovation is the cornerstone of our -

Raj Rajaratnam

Raj Rajaratnam Raj Rajaratnam (Tamil : ரா Raj Rajaratnam ராஜரதின ; born June 15, 1957) is [1] a Sri Lankan American former hedge June 15, 1957 (age 57) fund manager and billionaire founder of Born Colombo , Dominion of Ceylon (now Sri the Galleon Group , a New York-based Lanka ) hedge fund management firm. [3][4] On October 16, 2009, he was arrested by the FBI on allegations of insider trading , Ethnicity Sri Lankan American which also caused the Galleon Group to close. [5] He stood trial in U.S. v American Rajaratnam (09 Cr. 01184) in the United Citizenship States District Court for the Southern District of New York , and on May 11, Alma mater Wharton School of Business (MBA ) 2011 was found guilty on all 14 counts of conspiracy and securities fraud. [6][7] On October 13, 2011, Rajaratnam was Occupation Hedge fund manager sentenced to 11 years in prison [8] and fined a criminal and civil penalty of over Net worth $1.8 billion (2009) [2] $150 million combined. [9] As of January 14, 2013 Rajaratnam is Spouse(s) Asha Pabla incarcerated at Federal Medical Center, Devens in Ayer, Massachusetts , an administrative facility housing male Children 3 offenders requiring specialized or long- term medical or mental health care. Rengan Rajaratnam Rajaratnam's release date is July 4, 2021. Relatives Ragakanthan Rajaratnam Background and career Rajaratnam is an ethnic Sri Lankan Tamil born in Colombo in the Dominion of Ceylon , present- day Sri Lanka. His father was the head of the Singer Sewing Machine Co. in South Asia. [10] According to the newspaper The Island , he attended S.